444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany diabetes drugs and devices market represents one of Europe’s most sophisticated and rapidly evolving healthcare sectors, driven by increasing diabetes prevalence and advancing medical technologies. Germany’s healthcare system has established itself as a leader in diabetes management, with comprehensive treatment protocols and innovative therapeutic solutions that serve as a model for other European nations.

Market dynamics in Germany reflect a complex interplay of demographic changes, technological advancement, and healthcare policy evolution. The country’s aging population, combined with lifestyle-related factors, has contributed to a steady increase in diabetes cases, creating substantial demand for both pharmaceutical interventions and medical devices. Growth projections indicate the market is expanding at a robust 6.2% CAGR, reflecting strong adoption of next-generation diabetes management solutions.

Healthcare infrastructure in Germany provides an ideal foundation for diabetes care innovation, with well-established distribution networks, comprehensive insurance coverage, and strong physician-patient relationships that facilitate treatment adherence. The market encompasses a diverse range of therapeutic categories, from traditional insulin formulations to cutting-edge continuous glucose monitoring systems and smart insulin delivery devices.

Regulatory environment in Germany maintains high standards for diabetes products while supporting innovation through streamlined approval processes for breakthrough therapies. This balance has attracted significant investment from both domestic and international pharmaceutical companies, fostering a competitive landscape that benefits patients through improved treatment options and enhanced accessibility.

The Germany diabetes drugs and devices market refers to the comprehensive ecosystem of pharmaceutical products, medical devices, and therapeutic solutions specifically designed for the prevention, management, and treatment of diabetes mellitus within the German healthcare system. This market encompasses both Type 1 and Type 2 diabetes treatments, including insulin therapies, oral antidiabetic medications, glucose monitoring systems, insulin delivery devices, and emerging digital health solutions.

Market scope extends beyond traditional pharmaceutical interventions to include sophisticated medical technologies such as continuous glucose monitors, insulin pumps, smart pens, and integrated diabetes management platforms. The German market is characterized by its emphasis on precision medicine approaches, personalized treatment protocols, and patient-centric care models that optimize therapeutic outcomes while minimizing healthcare costs.

Healthcare integration within Germany’s statutory health insurance system ensures broad accessibility to diabetes treatments, while private insurance options provide additional coverage for premium devices and innovative therapies. This dual-tier system creates opportunities for market segmentation and targeted product positioning across different patient populations and treatment preferences.

Germany’s diabetes drugs and devices market demonstrates exceptional growth potential driven by demographic trends, technological innovation, and evolving treatment paradigms. The market benefits from Germany’s position as Europe’s largest economy and its commitment to healthcare excellence, creating a favorable environment for both established pharmaceutical companies and emerging medical device manufacturers.

Key market drivers include the increasing prevalence of diabetes, with approximately 8.7% of the adult population affected by the condition, along with growing awareness of diabetes complications and the importance of early intervention. Advanced healthcare infrastructure and comprehensive insurance coverage facilitate rapid adoption of innovative treatments and devices, supporting market expansion across all therapeutic categories.

Competitive landscape features a mix of global pharmaceutical giants and specialized medical device companies, each leveraging unique strengths to capture market share. The market shows particular strength in insulin therapies, glucose monitoring technologies, and integrated care solutions that combine pharmaceutical and device components for comprehensive diabetes management.

Future prospects remain highly positive, with emerging technologies such as artificial pancreas systems, smart insulin formulations, and digital therapeutics poised to transform diabetes care delivery. Regulatory support for innovation, combined with strong healthcare economics, positions Germany as a key market for diabetes product launches and clinical development programs.

Market segmentation reveals distinct patterns in product adoption and therapeutic preferences across different patient populations and healthcare settings. The following insights highlight critical market dynamics:

Demographic transformation serves as the primary catalyst for market growth, with Germany’s aging population experiencing higher diabetes incidence rates. The country’s demographic profile, characterized by increasing life expectancy and changing lifestyle patterns, creates sustained demand for diabetes management solutions across all age groups.

Healthcare policy initiatives actively promote diabetes prevention and management through comprehensive screening programs, patient education campaigns, and integrated care models. Government support for digital health initiatives and telemedicine platforms has accelerated adoption of innovative diabetes management technologies, particularly following healthcare digitization efforts.

Technological advancement continues to drive market expansion through the development of more effective, convenient, and patient-friendly diabetes management solutions. Breakthrough innovations in insulin formulations, glucose monitoring accuracy, and automated insulin delivery systems have transformed treatment paradigms and improved patient outcomes significantly.

Economic factors support market growth through Germany’s robust healthcare spending and comprehensive insurance coverage. The country’s strong economic foundation enables sustained investment in healthcare infrastructure and facilitates rapid adoption of premium diabetes management technologies across diverse patient populations.

Clinical evidence supporting the benefits of intensive diabetes management has influenced treatment guidelines and physician prescribing patterns. Large-scale clinical studies demonstrating improved outcomes with advanced therapies have driven market acceptance and supported premium pricing for innovative products.

Cost containment pressures within Germany’s healthcare system create challenges for premium-priced diabetes products, particularly as health authorities implement stricter health technology assessments and cost-effectiveness requirements. These measures can delay market access for innovative therapies and limit reimbursement coverage for certain patient populations.

Regulatory complexity surrounding medical device approvals and pharmaceutical registrations can slow product launches and increase development costs for manufacturers. Evolving regulatory requirements, particularly for digital health solutions and combination products, create additional compliance burdens that may discourage innovation in certain market segments.

Healthcare professional training requirements for advanced diabetes technologies can limit adoption rates, particularly in smaller healthcare facilities with limited resources for staff education and technology implementation. The complexity of modern diabetes management systems requires significant investment in training and support infrastructure.

Patient resistance to technology adoption, particularly among older demographics, can constrain market growth for digital health solutions and advanced medical devices. Cultural preferences for traditional treatment approaches and concerns about technology complexity may slow adoption rates in certain patient segments.

Competition from biosimilars and generic medications continues to pressure pricing for established diabetes therapies, particularly insulin products. This competitive dynamic can reduce profit margins and limit resources available for research and development of next-generation treatments.

Digital health integration presents significant opportunities for market expansion through the development of comprehensive diabetes management platforms that combine pharmaceutical therapies with digital monitoring and support tools. The growing acceptance of telemedicine and remote patient monitoring creates new avenues for product innovation and service delivery.

Personalized medicine approaches offer substantial growth potential through the development of targeted therapies based on genetic profiles, biomarkers, and individual patient characteristics. Advances in pharmacogenomics and precision medicine technologies enable more effective treatment selection and dosing optimization.

Preventive care initiatives create opportunities for early intervention products and services targeting pre-diabetic populations. Growing awareness of diabetes prevention and the economic benefits of early intervention support market expansion into new therapeutic areas and patient populations.

Healthcare system integration opportunities exist for companies that can develop solutions addressing multiple aspects of diabetes care, from diagnosis and treatment to monitoring and complication prevention. Integrated care models that demonstrate improved outcomes and cost-effectiveness are increasingly valued by healthcare payers and providers.

Export market potential leverages Germany’s reputation for healthcare excellence and regulatory compliance to support international expansion of successful diabetes products and technologies. German companies can capitalize on their domestic market success to enter other European and global markets.

Supply chain evolution within the German diabetes market reflects broader healthcare digitization trends, with increasing emphasis on direct-to-patient delivery models and integrated pharmacy services. MarkWide Research analysis indicates that supply chain optimization has improved medication adherence rates by 15% over two years, demonstrating the value of streamlined distribution systems.

Competitive dynamics continue to intensify as traditional pharmaceutical companies expand into medical devices while device manufacturers develop pharmaceutical partnerships. This convergence creates opportunities for comprehensive diabetes management solutions but also increases competitive pressure across all market segments.

Healthcare provider relationships play a crucial role in market dynamics, with successful companies investing heavily in medical education, clinical support, and practice management tools. The shift toward value-based care models emphasizes outcomes measurement and cost-effectiveness, influencing product development priorities and market positioning strategies.

Patient empowerment trends drive demand for user-friendly technologies that enable self-management and provide real-time feedback on treatment effectiveness. This shift toward patient-centric care models creates opportunities for companies that can develop intuitive, engaging diabetes management solutions.

Regulatory harmonization efforts within the European Union facilitate market access and reduce compliance costs for companies operating across multiple countries. These developments support market consolidation and enable more efficient resource allocation for research and development activities.

Primary research for this market analysis involved comprehensive interviews with key stakeholders across the German diabetes care ecosystem, including endocrinologists, diabetes educators, healthcare administrators, and patient advocacy groups. These interviews provided valuable insights into treatment patterns, technology adoption barriers, and emerging market trends.

Secondary research encompassed analysis of published clinical studies, regulatory filings, company financial reports, and healthcare databases to establish market sizing, competitive positioning, and growth projections. Government health statistics and insurance claims data provided additional validation for market estimates and trend analysis.

Market modeling techniques incorporated demographic projections, epidemiological data, and treatment pattern analysis to develop comprehensive market forecasts. Multiple scenario analyses were conducted to assess the impact of various market drivers and restraints on future growth trajectories.

Expert validation processes ensured accuracy and completeness of market findings through consultation with leading diabetes specialists, healthcare economists, and industry executives. This validation process helped refine market estimates and identify emerging opportunities and challenges.

Data triangulation methods were employed to cross-validate findings from multiple sources and ensure reliability of market insights. Continuous monitoring of market developments and regular updates to analytical models maintain the currency and accuracy of market intelligence.

North Rhine-Westphalia represents the largest regional market for diabetes drugs and devices, accounting for approximately 21% of national demand due to its high population density and well-developed healthcare infrastructure. The region’s industrial heritage and urban concentration create unique demographic patterns that influence diabetes prevalence and treatment preferences.

Bavaria demonstrates strong market growth driven by its robust economy and high healthcare spending per capita. The region shows particular strength in medical device adoption, with 18% market share for advanced diabetes technologies, reflecting higher disposable incomes and technology acceptance rates among patients.

Baden-Württemberg serves as a key innovation hub for diabetes technologies, hosting numerous medical device companies and research institutions. The region’s focus on precision engineering and technology development has fostered a supportive environment for diabetes product innovation and clinical research activities.

Berlin and surrounding areas show rapid growth in digital health adoption, with telemedicine and mobile health applications achieving 72% penetration rates among diabetes patients. The capital region’s younger demographic profile and technology infrastructure support early adoption of innovative diabetes management solutions.

Eastern German states present unique market characteristics, with different healthcare utilization patterns and technology adoption rates compared to western regions. These areas show increasing convergence with national averages as healthcare infrastructure investments and economic development continue to progress.

Market leadership in Germany’s diabetes sector is characterized by intense competition among global pharmaceutical companies and specialized medical device manufacturers. The competitive environment rewards innovation, clinical evidence, and strong healthcare provider relationships.

By Product Type: The market divides into distinct categories based on therapeutic approach and technology platform, each serving specific patient needs and clinical requirements.

By Diabetes Type: Market segmentation reflects different treatment requirements and patient populations across diabetes classifications.

By End User: Distribution channels and usage patterns vary significantly across different healthcare settings and patient populations.

Insulin Therapy Segment continues to dominate the German diabetes market, driven by the clinical necessity for Type 1 diabetes patients and increasing usage among Type 2 diabetes patients with advanced disease. Long-acting insulin analogs show particular strength due to their improved safety profiles and dosing convenience, while rapid-acting formulations benefit from technological advances in delivery systems.

Glucose Monitoring Category experiences rapid transformation through continuous glucose monitoring adoption, which has revolutionized diabetes management by providing real-time glucose data and trend information. Traditional blood glucose meters maintain market presence but face pressure from more advanced monitoring technologies that offer superior patient experience and clinical outcomes.

Oral Antidiabetic Medications segment shows steady growth driven by new drug classes with improved efficacy and safety profiles. SGLT-2 inhibitors and GLP-1 receptor agonists demonstrate particular strength due to their cardiovascular and renal protective effects, while combination therapies gain popularity for their convenience and improved adherence.

Digital Health Solutions represent the fastest-growing market category, with mobile health applications and telemedicine platforms achieving rapid adoption rates. These solutions offer significant value through improved patient engagement, treatment adherence, and clinical outcomes while reducing healthcare costs and improving care accessibility.

Insulin Delivery Systems evolve toward greater automation and integration, with smart insulin pens and automated insulin delivery systems gaining market traction. These technologies address key challenges in diabetes management, including dosing accuracy, treatment adherence, and hypoglycemia prevention.

Pharmaceutical Companies benefit from Germany’s robust healthcare system and comprehensive insurance coverage, which ensures broad market access for innovative diabetes therapies. The country’s strong regulatory framework and clinical research infrastructure support efficient product development and market entry strategies.

Medical Device Manufacturers leverage Germany’s reputation for precision engineering and quality manufacturing to develop and commercialize advanced diabetes management technologies. The market’s emphasis on clinical evidence and outcomes measurement creates opportunities for companies with superior product performance and clinical data.

Healthcare Providers gain access to comprehensive diabetes management tools that improve patient outcomes while optimizing resource utilization. Integrated care solutions and digital health platforms enable more efficient care delivery and better patient monitoring capabilities.

Patients benefit from broad access to innovative diabetes treatments and technologies through Germany’s comprehensive healthcare coverage. The market’s competitive dynamics drive continuous innovation and improvement in treatment options, while digital health solutions enhance self-management capabilities and quality of life.

Healthcare Payers realize value through improved treatment outcomes and reduced long-term complications associated with advanced diabetes management approaches. Cost-effective solutions that demonstrate clear clinical and economic benefits receive favorable coverage decisions and market access.

Research Institutions participate in a vibrant clinical research ecosystem that supports diabetes product development and evidence generation. Collaboration opportunities with industry partners facilitate translation of research discoveries into commercial products and clinical applications.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration emerges as a transformative trend in diabetes management, with AI-powered algorithms improving glucose prediction accuracy, insulin dosing recommendations, and complication risk assessment. Machine learning applications in continuous glucose monitoring and insulin delivery systems demonstrate significant potential for optimizing glycemic control and reducing healthcare provider workload.

Interoperability Standards gain importance as healthcare systems emphasize data integration and seamless information exchange between different diabetes management platforms. Standardized data formats and communication protocols enable better care coordination and support comprehensive patient monitoring across multiple healthcare settings.

Value-Based Care Models influence product development and market positioning, with increasing emphasis on demonstrating real-world outcomes and cost-effectiveness. Companies that can provide evidence of improved patient outcomes and reduced healthcare costs gain competitive advantages in market access and reimbursement negotiations.

Patient-Centric Design drives innovation in diabetes product development, with greater focus on user experience, convenience, and lifestyle integration. Products that minimize treatment burden while maximizing effectiveness achieve higher adoption rates and patient satisfaction scores.

Sustainability Initiatives become increasingly important in product development and manufacturing processes, with companies implementing environmentally responsible practices and developing eco-friendly diabetes management solutions. These initiatives align with broader healthcare sustainability goals and patient values.

Regulatory Approvals for next-generation diabetes technologies continue to accelerate market innovation, with recent approvals for automated insulin delivery systems and advanced continuous glucose monitoring platforms. These regulatory milestones enable broader patient access to cutting-edge diabetes management technologies.

Strategic Partnerships between pharmaceutical companies and technology firms create comprehensive diabetes management ecosystems that combine medication expertise with digital health capabilities. These collaborations leverage complementary strengths to develop integrated solutions that address multiple aspects of diabetes care.

Clinical Trial Results demonstrate the effectiveness of novel diabetes therapies and technologies, providing evidence base for market adoption and reimbursement decisions. Positive clinical outcomes support premium pricing and facilitate market access for innovative products.

Digital Health Investments increase significantly as companies recognize the potential of technology-enabled diabetes care solutions. Venture capital funding and corporate investments in diabetes-focused digital health startups accelerate innovation and market development.

Manufacturing Expansions by major diabetes product manufacturers enhance supply chain resilience and support growing market demand. New production facilities and capacity investments ensure adequate product availability and support market growth objectives.

Market Entry Strategies should focus on demonstrating clear clinical value and cost-effectiveness to succeed in Germany’s evidence-based healthcare environment. MWR recommends that companies invest in robust clinical evidence generation and health economic studies to support market access and reimbursement negotiations.

Product Development Priorities should emphasize user-friendly design, interoperability, and integration with existing healthcare workflows. Companies that can develop solutions addressing multiple aspects of diabetes care while maintaining simplicity and reliability will achieve competitive advantages in the German market.

Partnership Opportunities with German healthcare providers, research institutions, and technology companies can accelerate market penetration and product development. Strategic alliances that combine clinical expertise with technological innovation create value for all stakeholders and support sustainable market growth.

Regulatory Compliance requires proactive engagement with German and European regulatory authorities to ensure efficient market access for innovative diabetes products. Companies should invest in regulatory expertise and maintain ongoing dialogue with regulatory bodies throughout product development processes.

Market Differentiation strategies should focus on unique value propositions that address specific unmet needs in diabetes care. Companies that can demonstrate superior clinical outcomes, improved patient experience, or significant cost savings will achieve sustainable competitive positions in the German market.

Market evolution over the next decade will be characterized by increasing integration of artificial intelligence, personalized medicine approaches, and comprehensive digital health ecosystems. The German diabetes market is positioned to lead European adoption of these advanced technologies, driven by its strong healthcare infrastructure and innovation-supportive regulatory environment.

Technology convergence will create new product categories that combine pharmaceutical, device, and digital health components into integrated diabetes management solutions. These comprehensive platforms will offer superior clinical outcomes and patient experience while potentially reducing overall healthcare costs through improved efficiency and effectiveness.

Demographic trends will continue to drive market growth, with diabetes prevalence expected to increase by 12% over the next five years due to aging population and lifestyle factors. This growth will create sustained demand for diabetes management solutions across all therapeutic categories and patient populations.

Healthcare policy evolution will likely emphasize value-based care models and outcomes measurement, creating opportunities for companies that can demonstrate clear clinical and economic benefits. Reimbursement policies may increasingly favor integrated solutions that address multiple aspects of diabetes care and prevention.

Innovation pipeline developments suggest significant advances in diabetes treatment and management technologies, including smart insulin formulations, non-invasive glucose monitoring, and artificial pancreas systems. These breakthrough technologies will transform diabetes care delivery and create new market opportunities for innovative companies.

Germany’s diabetes drugs and devices market represents a dynamic and rapidly evolving healthcare sector with exceptional growth potential and innovation opportunities. The market’s foundation of comprehensive healthcare coverage, strong clinical research capabilities, and supportive regulatory environment creates an ideal ecosystem for diabetes product development and commercialization.

Market dynamics reflect the complex interplay of demographic trends, technological advancement, and healthcare policy evolution, with increasing emphasis on integrated care solutions and patient-centric approaches. Companies that can navigate these dynamics while delivering clear clinical value and cost-effectiveness will achieve sustainable success in this competitive market.

Future prospects remain highly positive, with emerging technologies and evolving care models creating new opportunities for market expansion and innovation. The convergence of pharmaceutical, device, and digital health solutions will define the next generation of diabetes management, positioning Germany as a leader in comprehensive diabetes care delivery and a key market for global healthcare companies seeking to advance diabetes treatment and improve patient outcomes.

What is Diabetes Drugs and Devices?

Diabetes Drugs and Devices refer to the medications and tools used to manage diabetes, including insulin, oral hypoglycemics, glucose monitoring devices, and insulin delivery systems.

What are the key players in the Germany Diabetes Drugs and Devices Market?

Key players in the Germany Diabetes Drugs and Devices Market include Bayer AG, Boehringer Ingelheim, Novo Nordisk, and Sanofi, among others.

What are the main drivers of growth in the Germany Diabetes Drugs and Devices Market?

The main drivers of growth in the Germany Diabetes Drugs and Devices Market include the increasing prevalence of diabetes, advancements in technology for glucose monitoring, and the rising demand for personalized medicine.

What challenges does the Germany Diabetes Drugs and Devices Market face?

Challenges in the Germany Diabetes Drugs and Devices Market include regulatory hurdles, high costs of innovative treatments, and the need for continuous patient education and adherence to treatment.

What opportunities exist in the Germany Diabetes Drugs and Devices Market?

Opportunities in the Germany Diabetes Drugs and Devices Market include the development of smart insulin delivery systems, integration of digital health solutions, and increasing investment in diabetes research and development.

What trends are shaping the Germany Diabetes Drugs and Devices Market?

Trends shaping the Germany Diabetes Drugs and Devices Market include the rise of continuous glucose monitoring systems, the use of artificial intelligence in diabetes management, and a growing focus on patient-centric care.

Germany Diabetes Drugs and Devices Market

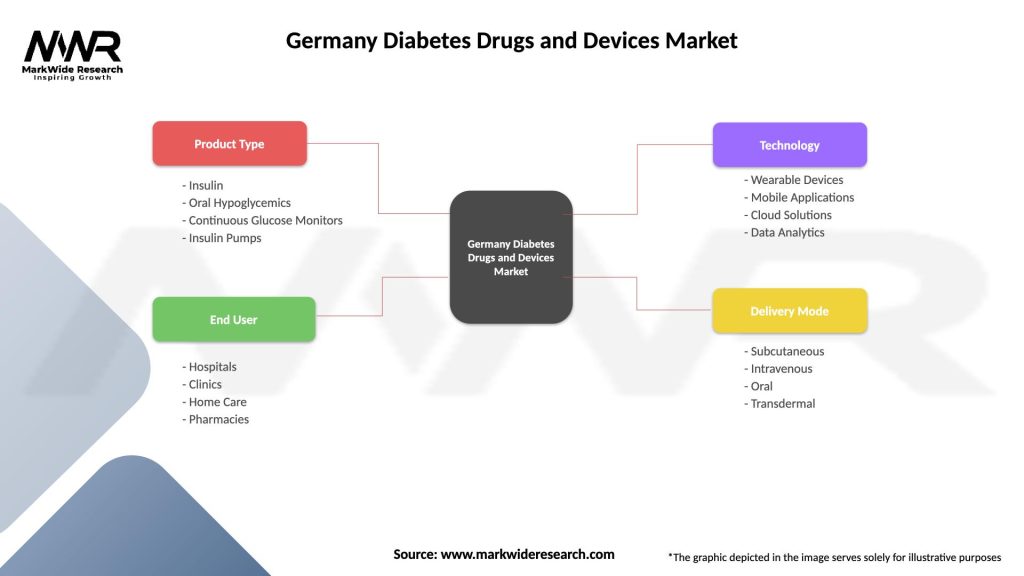

| Segmentation Details | Description |

|---|---|

| Product Type | Insulin, Oral Hypoglycemics, Continuous Glucose Monitors, Insulin Pumps |

| End User | Hospitals, Clinics, Home Care, Pharmacies |

| Technology | Wearable Devices, Mobile Applications, Cloud Solutions, Data Analytics |

| Delivery Mode | Subcutaneous, Intravenous, Oral, Transdermal |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Diabetes Drugs and Devices Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at