444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany data center storage market represents one of Europe’s most dynamic and rapidly evolving technology sectors, driven by the country’s position as a leading digital economy and manufacturing hub. Germany’s data center infrastructure has experienced unprecedented growth, with storage capacity expanding at a compound annual growth rate (CAGR) of 12.8% over recent years. This remarkable expansion reflects the nation’s commitment to digital transformation, cloud adoption, and Industry 4.0 initiatives across various sectors.

Digital transformation initiatives across German enterprises have fundamentally reshaped storage requirements, with organizations increasingly demanding high-performance, scalable, and energy-efficient storage solutions. The market encompasses diverse storage technologies including solid-state drives (SSDs), hard disk drives (HDDs), hybrid storage systems, and emerging non-volatile memory express (NVMe) solutions. German data centers are experiencing a significant shift toward flash-based storage systems, which now account for approximately 68% of new storage deployments in enterprise data centers.

Hyperscale data centers and colocation facilities represent the fastest-growing segments within Germany’s storage landscape, driven by increasing demand from cloud service providers, content delivery networks, and enterprise customers seeking scalable infrastructure solutions. The market benefits from Germany’s strategic location in Central Europe, robust telecommunications infrastructure, and stringent data protection regulations that enhance trust and reliability for international businesses.

The Germany data center storage market refers to the comprehensive ecosystem of storage hardware, software, and services deployed within data center facilities across Germany to store, manage, and retrieve digital information for various applications and workloads. This market encompasses traditional storage arrays, software-defined storage solutions, cloud storage platforms, and emerging technologies designed to meet the evolving needs of German enterprises, government organizations, and service providers.

Data center storage systems in Germany serve critical functions including data backup and recovery, disaster recovery, content distribution, application hosting, and real-time data processing for industries ranging from automotive and manufacturing to financial services and healthcare. The market includes both primary storage solutions for active workloads and secondary storage systems for archival and compliance purposes, reflecting Germany’s strict regulatory requirements and business continuity standards.

Germany’s data center storage market stands at the forefront of European digital infrastructure development, characterized by robust growth, technological innovation, and increasing adoption of next-generation storage technologies. The market demonstrates strong momentum driven by digital transformation initiatives, cloud migration strategies, and the growing importance of data analytics and artificial intelligence applications across German industries.

Key market dynamics include the accelerating shift from traditional spinning disk storage to all-flash arrays, with flash storage adoption rates reaching 72% among German enterprises for primary workloads. The integration of artificial intelligence and machine learning capabilities into storage management systems has emerged as a critical differentiator, enabling predictive analytics, automated tiering, and intelligent data placement strategies.

Sustainability considerations play an increasingly important role in storage procurement decisions, with German organizations prioritizing energy-efficient storage solutions that align with the country’s environmental goals. The market benefits from strong government support for digitalization initiatives and substantial investments in renewable energy infrastructure that power modern data center facilities.

Strategic market insights reveal several transformative trends shaping Germany’s data center storage landscape:

Digital transformation initiatives across German industries serve as the primary catalyst for data center storage market expansion. Organizations are modernizing their IT infrastructure to support cloud-native applications, big data analytics, and artificial intelligence workloads that demand high-performance, scalable storage solutions. The German government’s digitalization strategy and Industry 4.0 initiatives further accelerate storage technology adoption across manufacturing, automotive, and industrial sectors.

Data volume growth represents another fundamental driver, with German organizations generating and storing increasingly large amounts of structured and unstructured data. The proliferation of Internet of Things (IoT) devices, connected manufacturing systems, and digital customer interactions creates exponential data growth that requires scalable storage infrastructure. Real-time analytics requirements drive demand for high-performance storage systems capable of supporting low-latency data access and processing.

Regulatory compliance requirements significantly influence storage technology adoption in Germany. Organizations must implement storage solutions that support data sovereignty requirements, audit trails, and long-term data retention policies mandated by various industry regulations. The need for disaster recovery capabilities and business continuity planning drives investment in redundant storage systems and geographically distributed backup solutions.

Cloud adoption strategies continue to reshape storage requirements, with German enterprises implementing hybrid and multi-cloud architectures that require seamless data mobility and consistent storage management across diverse environments. The growing importance of edge computing creates new storage requirements for distributed applications and real-time data processing at network edges.

High implementation costs represent a significant barrier to storage technology adoption, particularly for small and medium-sized enterprises seeking to modernize their data center infrastructure. The substantial capital investment required for enterprise-grade storage systems, including hardware, software licenses, and professional services, can strain IT budgets and delay technology refresh cycles.

Technical complexity associated with modern storage architectures poses challenges for organizations lacking specialized expertise in storage management and administration. The integration of software-defined storage, hyper-converged infrastructure, and cloud-native storage solutions requires significant technical knowledge and ongoing training investments that many organizations struggle to provide.

Data security concerns continue to influence storage technology adoption decisions, with organizations expressing caution about migrating sensitive data to cloud-based storage platforms or implementing new storage technologies without comprehensive security validation. The complexity of multi-cloud security management and data encryption requirements creates additional implementation challenges.

Legacy system integration challenges limit the pace of storage modernization, as organizations must maintain compatibility with existing applications and workflows while implementing new storage technologies. The need to support legacy protocols and traditional backup systems can complicate storage architecture design and increase implementation costs.

Artificial intelligence and machine learning applications present substantial growth opportunities for advanced storage solutions optimized for AI workloads and high-performance computing environments. German organizations increasingly recognize the strategic value of AI-driven insights, creating demand for storage systems capable of supporting parallel processing, large dataset management, and real-time model training requirements.

Edge computing expansion creates new market opportunities for distributed storage solutions that support autonomous vehicles, smart manufacturing, and IoT applications requiring low-latency data access and processing. The development of 5G networks and edge data centers drives demand for compact, high-performance storage systems optimized for edge deployment scenarios.

Sustainability initiatives offer opportunities for energy-efficient storage technologies that align with Germany’s environmental goals and corporate sustainability commitments. Organizations increasingly prioritize green data center solutions that reduce power consumption, cooling requirements, and environmental impact while maintaining high performance and reliability standards.

Industry-specific solutions present growth opportunities for specialized storage platforms designed for sectors such as automotive manufacturing, financial services, healthcare, and media and entertainment. These vertical markets require storage solutions with specific performance characteristics, compliance capabilities, and integration features tailored to industry requirements.

Technology evolution drives continuous transformation in Germany’s data center storage market, with emerging technologies such as Storage Class Memory (SCM), computational storage, and DNA-based storage promising to revolutionize data storage capabilities. The integration of artificial intelligence into storage management platforms enables predictive analytics, automated optimization, and intelligent data placement strategies that improve efficiency by approximately 35%.

Competitive dynamics intensify as traditional storage vendors compete with cloud service providers, software-defined storage specialists, and emerging technology companies offering innovative storage solutions. The market experiences consolidation through strategic acquisitions and partnerships that combine complementary technologies and expand market reach.

Customer expectations continue to evolve, with organizations demanding storage solutions that provide cloud-like simplicity, pay-as-you-grow pricing models, and seamless scalability without compromising performance or security. The shift toward consumption-based pricing models reflects changing customer preferences for operational expenditure over capital investment approaches.

Ecosystem partnerships become increasingly important as storage vendors collaborate with cloud providers, system integrators, and technology partners to deliver comprehensive solutions that address complex customer requirements. These partnerships enable integrated offerings that combine storage hardware, management software, and professional services.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Germany’s data center storage market dynamics. Primary research activities include structured interviews with storage technology vendors, data center operators, enterprise IT decision-makers, and industry experts to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, vendor financial statements, technology specifications, and regulatory documents to validate primary research findings and provide comprehensive market context. Quantitative analysis includes statistical modeling of market trends, growth projections, and technology adoption patterns based on historical data and industry benchmarks.

Market segmentation analysis examines storage technology categories, deployment models, industry verticals, and customer segments to identify growth opportunities and competitive dynamics. Competitive intelligence activities include vendor positioning analysis, product portfolio assessment, and strategic initiative evaluation to understand market leadership and innovation trends.

Data validation processes ensure research accuracy through cross-verification of findings across multiple sources, expert review panels, and statistical validation techniques. The research methodology incorporates both qualitative insights and quantitative metrics to provide a balanced perspective on market dynamics and future trends.

Bavaria and Baden-Württemberg represent the largest regional markets for data center storage in Germany, driven by high concentrations of automotive manufacturers, technology companies, and research institutions that generate substantial data storage requirements. These regions account for approximately 42% of total storage capacity deployments, reflecting their economic importance and digital infrastructure investments.

North Rhine-Westphalia emerges as a significant growth region, benefiting from its industrial heritage, strategic location, and substantial investments in digital transformation initiatives. The region’s focus on smart manufacturing and Industry 4.0 applications drives demand for high-performance storage solutions that support real-time data processing and analytics workloads.

Berlin and Brandenburg demonstrate strong growth potential driven by the capital region’s concentration of government agencies, startups, and technology companies requiring modern data center infrastructure. The region benefits from favorable government policies supporting digitalization and substantial investments in renewable energy infrastructure.

Hamburg and surrounding areas show increasing storage market activity driven by the region’s importance as a logistics hub, media center, and financial services location. The growing importance of e-commerce and digital logistics creates substantial data storage requirements that drive market growth in this region.

Market leadership in Germany’s data center storage sector reflects a diverse ecosystem of international technology vendors, specialized storage companies, and emerging solution providers competing across various market segments and customer categories.

Technology-based segmentation reveals distinct market dynamics across different storage technology categories:

By Storage Technology:

By Deployment Model:

By Organization Size:

Primary Storage Systems represent the largest market category, encompassing high-performance storage arrays that support mission-critical applications, databases, and real-time workloads. This category experiences strong growth driven by digital transformation initiatives and increasing demand for low-latency storage solutions that enable responsive user experiences and efficient business operations.

Secondary Storage Solutions focus on backup, archival, and disaster recovery applications that require cost-effective, scalable storage capacity. German organizations increasingly adopt cloud-integrated backup solutions that provide off-site data protection while maintaining local recovery capabilities for business continuity requirements.

Object Storage Platforms gain traction for unstructured data management, content distribution, and big data analytics applications. These solutions provide web-scale storage capabilities that support modern application architectures and enable organizations to extract value from large datasets through advanced analytics and machine learning applications.

Converged Infrastructure solutions integrate storage, compute, and networking components into unified platforms that simplify data center management and reduce operational complexity. Hyper-converged infrastructure adoption reaches approximately 34% among German enterprises seeking simplified IT operations and improved resource utilization.

Technology vendors benefit from Germany’s robust digital economy, substantial IT investment levels, and strong demand for innovative storage solutions. The market provides opportunities for revenue growth, technology innovation, and strategic partnerships that expand market reach and enhance competitive positioning in the European market.

Data center operators gain advantages through access to advanced storage technologies that improve operational efficiency, energy consumption, and service quality for their customers. Modern storage solutions enable operators to offer differentiated services, improved performance, and enhanced reliability that attract and retain enterprise customers.

Enterprise customers realize significant benefits including improved application performance, reduced operational costs, enhanced data protection, and increased business agility through modern storage infrastructure investments. Organizations achieve faster time-to-market for new services and improved competitive positioning through data-driven insights and analytics capabilities.

System integrators and service providers benefit from growing demand for storage implementation, migration, and management services. The complexity of modern storage environments creates opportunities for professional services, managed services, and consulting engagements that generate recurring revenue streams and strengthen customer relationships.

Strengths:

Weaknesses:

Opportunities:

Threats:

Flash storage adoption continues to accelerate across German data centers, with organizations migrating from traditional spinning disk storage to solid-state storage systems that provide superior performance, reliability, and energy efficiency. The declining cost of NAND flash memory makes all-flash arrays increasingly attractive for a broader range of applications and workloads.

Artificial intelligence integration transforms storage management through predictive analytics, automated optimization, and intelligent data placement capabilities that improve system efficiency and reduce operational overhead. Machine learning algorithms enable storage systems to automatically adapt to changing workload patterns and optimize performance without manual intervention.

Container storage solutions gain prominence as German organizations adopt containerized applications and microservices architectures that require persistent storage optimized for modern application deployment models. Kubernetes-native storage solutions provide the flexibility and scalability required for cloud-native application development.

Multi-cloud storage strategies become mainstream as organizations implement hybrid cloud architectures that span multiple cloud providers and on-premises infrastructure. This trend drives demand for storage solutions that provide seamless data mobility and consistent management across diverse environments.

Sustainability initiatives increasingly influence storage technology selection, with organizations prioritizing energy-efficient solutions that reduce power consumption and environmental impact. Green data center certifications and carbon footprint reduction goals drive adoption of environmentally responsible storage technologies.

Strategic acquisitions reshape the competitive landscape as major storage vendors acquire specialized technology companies to enhance their product portfolios and expand market capabilities. Recent consolidation activities focus on artificial intelligence, data management software, and cloud-native storage technologies that address evolving customer requirements.

Partnership agreements between storage vendors and cloud service providers create integrated solutions that combine on-premises storage capabilities with cloud services. These partnerships enable hybrid cloud deployments and provide customers with seamless data mobility between private and public cloud environments.

Technology innovations include the development of computational storage solutions that integrate processing capabilities directly into storage devices, reducing data movement and improving application performance. Storage Class Memory technologies bridge the gap between traditional storage and memory, enabling new application architectures and use cases.

Regulatory developments continue to influence storage market dynamics, with evolving data protection requirements and digital sovereignty initiatives affecting storage deployment strategies and vendor selection criteria. MarkWide Research analysis indicates that regulatory compliance considerations influence approximately 78% of storage procurement decisions among German enterprises.

Storage vendors should focus on developing integrated solutions that combine storage hardware, management software, and cloud services to address the growing demand for simplified, consumption-based storage models. Investment in artificial intelligence capabilities and automation features will differentiate offerings and provide competitive advantages in the evolving market landscape.

Enterprise customers are advised to develop comprehensive storage strategies that align with their digital transformation objectives and support both current and future application requirements. Organizations should prioritize scalable solutions that provide flexibility for changing business needs and enable seamless integration with cloud services.

Data center operators should invest in next-generation storage infrastructure that supports emerging technologies such as artificial intelligence, edge computing, and 5G applications. Focus on energy-efficient solutions and sustainable practices will become increasingly important for competitive differentiation and regulatory compliance.

System integrators should develop specialized expertise in modern storage technologies and cloud integration to capitalize on growing demand for professional services and managed solutions. Investment in training and certification programs will be essential for maintaining competitive positioning in the evolving market.

Long-term growth prospects for Germany’s data center storage market remain highly positive, driven by continued digital transformation initiatives, emerging technology adoption, and increasing data generation across all sectors of the economy. MarkWide Research projects that the market will maintain robust growth momentum with a projected CAGR of 11.2% through the next five years, reflecting strong underlying demand drivers and technological innovation.

Technology evolution will continue to reshape the storage landscape, with artificial intelligence, machine learning, and advanced analytics becoming integral components of storage management platforms. The integration of quantum computing and neuromorphic processing technologies may create new storage requirements and opportunities for innovative solutions.

Edge computing expansion will drive demand for distributed storage solutions that support autonomous systems, smart cities, and industrial IoT applications requiring low-latency data access and processing. The deployment of 5G networks will enable new use cases and applications that require high-performance storage at network edges.

Sustainability considerations will become increasingly important, with organizations prioritizing carbon-neutral data centers and environmentally responsible storage technologies. The development of renewable energy-powered data centers and circular economy approaches to hardware lifecycle management will influence future market dynamics and competitive positioning.

Germany’s data center storage market represents a dynamic and rapidly evolving sector that plays a critical role in the country’s digital transformation journey and economic competitiveness. The market demonstrates strong growth momentum driven by digital transformation initiatives, cloud adoption strategies, and increasing demand for high-performance storage solutions across diverse industry sectors.

Key success factors for market participants include investment in innovative technologies, development of integrated solutions, and focus on customer-centric approaches that address evolving business requirements. The shift toward flash-based storage, artificial intelligence integration, and hybrid cloud architectures creates substantial opportunities for vendors that can deliver comprehensive, scalable solutions.

Future market development will be shaped by emerging technologies, regulatory requirements, and sustainability considerations that influence storage technology selection and deployment strategies. Organizations that proactively adapt to these trends and invest in modern storage infrastructure will be well-positioned to capitalize on the substantial growth opportunities in Germany’s data center storage market over the coming years.

What is Data Center Storage?

Data Center Storage refers to the systems and technologies used to store and manage data in data centers. This includes various storage solutions such as SAN, NAS, and cloud storage, which are essential for handling large volumes of data efficiently.

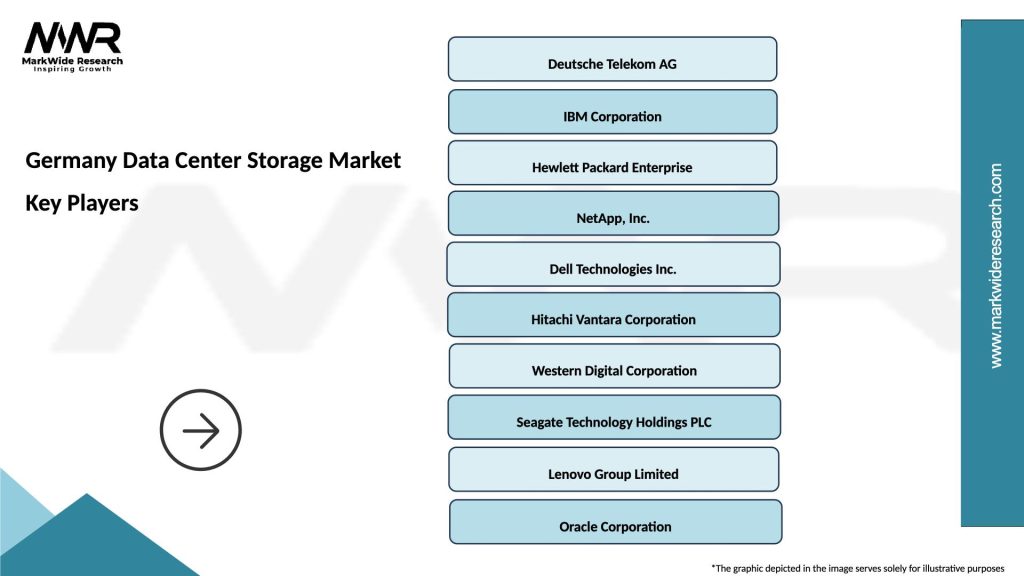

What are the key players in the Germany Data Center Storage Market?

Key players in the Germany Data Center Storage Market include companies like Dell Technologies, IBM, and NetApp, which provide a range of storage solutions and services. These companies are known for their innovative technologies and robust infrastructure, among others.

What are the main drivers of growth in the Germany Data Center Storage Market?

The main drivers of growth in the Germany Data Center Storage Market include the increasing demand for data storage due to digital transformation, the rise of cloud computing, and the need for enhanced data security. Additionally, the growing adoption of big data analytics is fueling the market.

What challenges does the Germany Data Center Storage Market face?

The Germany Data Center Storage Market faces challenges such as high operational costs, data security concerns, and the complexity of managing hybrid storage environments. These factors can hinder the adoption of new storage technologies.

What opportunities exist in the Germany Data Center Storage Market?

Opportunities in the Germany Data Center Storage Market include the growing trend of edge computing, advancements in storage technologies like NVMe, and the increasing need for scalable storage solutions. These trends present avenues for innovation and investment.

What trends are shaping the Germany Data Center Storage Market?

Trends shaping the Germany Data Center Storage Market include the shift towards cloud-based storage solutions, the integration of AI and machine learning for data management, and the emphasis on sustainability in data center operations. These trends are influencing how companies approach data storage.

Germany Data Center Storage Market

| Segmentation Details | Description |

|---|---|

| Product Type | Direct Attached Storage, Network Attached Storage, Storage Area Network, Cloud Storage |

| Technology | Flash Storage, Hard Disk Drive, Hybrid Storage, Object Storage |

| End User | Telecommunications, BFSI, Government, Healthcare |

| Deployment | On-Premises, Off-Premises, Hybrid, Multi-Cloud |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Data Center Storage Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at