444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany data center power market represents a critical infrastructure segment driving the nation’s digital transformation and technological advancement. As Europe’s largest economy continues to embrace digitalization, cloud computing, and Industry 4.0 initiatives, the demand for reliable, efficient, and sustainable data center power solutions has reached unprecedented levels. Germany’s strategic position as a technology hub in Central Europe, combined with its robust manufacturing base and commitment to renewable energy, creates a unique landscape for data center power infrastructure development.

Market dynamics in Germany reflect the country’s dual focus on technological innovation and environmental sustainability. The data center power market encompasses various components including uninterruptible power supply (UPS) systems, power distribution units (PDUs), generators, cooling systems, and energy management solutions. Industry growth is accelerating at a compound annual growth rate of 8.2%, driven by increasing digitalization across sectors, growing cloud adoption, and the expansion of edge computing infrastructure throughout German metropolitan areas.

Regional concentration remains significant in major urban centers such as Frankfurt, Berlin, Munich, and Hamburg, where approximately 75% of data center capacity is currently deployed. The Frankfurt metropolitan area alone accounts for nearly 40% of Germany’s data center infrastructure, establishing itself as a critical digital gateway between Europe and global markets. This concentration drives substantial investment in power infrastructure, backup systems, and energy-efficient technologies.

The Germany data center power market refers to the comprehensive ecosystem of electrical infrastructure, power management systems, and energy solutions specifically designed to support data center operations across German territories. This market encompasses all power-related components, services, and technologies required to ensure continuous, reliable, and efficient electrical supply to data processing facilities, server farms, and cloud computing infrastructure.

Power infrastructure components within this market include primary power distribution systems, backup power generation equipment, uninterruptible power supplies, power monitoring and management software, cooling system power requirements, and renewable energy integration solutions. The market also covers specialized services such as power system design, installation, maintenance, and optimization services tailored to meet the unique requirements of German data center operators.

Operational significance extends beyond basic power supply to encompass energy efficiency optimization, carbon footprint reduction, and compliance with Germany’s stringent environmental regulations. The market addresses critical aspects including power quality management, load balancing, redundancy planning, and integration with Germany’s evolving renewable energy grid infrastructure.

Germany’s data center power market demonstrates robust expansion driven by accelerating digital transformation initiatives across industries, increasing cloud service adoption, and growing demand for edge computing solutions. The market benefits from Germany’s position as Europe’s economic powerhouse and its commitment to sustainable technology infrastructure development.

Key growth drivers include the rapid expansion of hyperscale data centers, increasing enterprise cloud migration, and Germany’s ambitious renewable energy targets. The market experiences particularly strong demand from financial services, manufacturing, automotive, and telecommunications sectors, which collectively account for approximately 60% of data center power consumption in the region.

Technology evolution focuses heavily on energy efficiency improvements, with modern data center power systems achieving power usage effectiveness (PUE) ratios below 1.3 compared to legacy systems. Integration of artificial intelligence for power management, adoption of modular power architectures, and implementation of advanced cooling technologies represent key innovation areas driving market development.

Competitive landscape features both international technology leaders and specialized German engineering companies, creating a dynamic ecosystem that combines global expertise with local market knowledge. Strategic partnerships between power solution providers and renewable energy companies are becoming increasingly common as operators seek to meet sustainability objectives.

Market transformation in Germany’s data center power sector reflects broader trends toward sustainability, efficiency, and digital infrastructure resilience. Several critical insights shape current market dynamics and future development trajectories:

Digital transformation acceleration across German industries serves as the primary catalyst for data center power market expansion. The country’s Industry 4.0 initiative, combined with increasing adoption of Internet of Things (IoT) technologies, artificial intelligence, and machine learning applications, creates substantial demand for robust data processing infrastructure and corresponding power systems.

Cloud service proliferation drives significant investment in hyperscale data center facilities throughout Germany. Major cloud service providers continue expanding their German presence to serve local enterprises and comply with data sovereignty requirements. This expansion necessitates substantial power infrastructure investment, including redundant power systems, efficient cooling solutions, and renewable energy integration capabilities.

Regulatory environment in Germany increasingly favors sustainable technology solutions, creating market opportunities for energy-efficient power systems and renewable energy integration. The country’s commitment to carbon neutrality by 2045 drives data center operators to invest in clean energy solutions and advanced power management technologies that reduce environmental impact while maintaining operational reliability.

Economic digitalization across traditional German industries including automotive, manufacturing, and financial services generates substantial data processing requirements. These sectors demand high-availability power infrastructure to support mission-critical applications, driving investment in advanced UPS systems, redundant power architectures, and sophisticated monitoring solutions.

High capital investment requirements for advanced data center power infrastructure present significant barriers for smaller operators and new market entrants. The cost of implementing redundant power systems, renewable energy integration, and state-of-the-art cooling technologies requires substantial upfront investment, potentially limiting market participation to well-capitalized organizations.

Regulatory complexity surrounding energy efficiency standards, environmental compliance, and grid interconnection requirements creates operational challenges for data center developers. Navigating Germany’s comprehensive regulatory framework requires specialized expertise and can extend project timelines, increasing overall development costs and market entry barriers.

Grid infrastructure limitations in certain German regions constrain data center development and power system deployment. Areas with limited electrical grid capacity or reliability issues may require additional infrastructure investment, making some locations less attractive for large-scale data center development and limiting market expansion opportunities.

Skilled workforce shortage in specialized areas including power system engineering, renewable energy integration, and advanced cooling technologies creates operational challenges for market participants. The complexity of modern data center power systems requires highly trained technicians and engineers, and talent scarcity can limit growth potential and increase operational costs.

Renewable energy integration presents substantial opportunities for innovative power solution providers in the German market. As data center operators seek to meet ambitious sustainability targets, demand grows for solar power systems, wind energy integration, energy storage solutions, and smart grid connectivity that enables participation in renewable energy markets.

Edge computing expansion creates new market segments for distributed power solutions and micro data center technologies. The deployment of 5G networks, autonomous vehicle infrastructure, and IoT applications throughout German cities drives demand for localized data processing capabilities and corresponding power infrastructure in previously underserved locations.

Artificial intelligence adoption in power management systems offers opportunities for technology providers to develop advanced solutions that optimize energy consumption, predict maintenance requirements, and improve overall system efficiency. AI-driven power management can achieve efficiency improvements of 15-20% compared to traditional systems, creating compelling value propositions for data center operators.

Government incentive programs supporting digital infrastructure development and renewable energy adoption provide financial opportunities for market participants. Various federal and state programs offer subsidies, tax incentives, and grants for sustainable data center development, creating favorable conditions for investment in advanced power technologies.

Supply chain evolution in Germany’s data center power market reflects global trends toward localization and sustainability. German manufacturers increasingly focus on developing domestically produced power components, reducing dependence on international supply chains while supporting local economic development and ensuring supply security for critical infrastructure projects.

Technology convergence between traditional power systems and digital technologies creates new market dynamics and competitive landscapes. The integration of IoT sensors, cloud-based monitoring platforms, and predictive analytics transforms power infrastructure from passive systems into intelligent, self-optimizing networks that adapt to changing operational requirements.

Partnership strategies between power solution providers, renewable energy companies, and data center operators become increasingly important for market success. Collaborative approaches enable comprehensive solutions that address multiple customer requirements including power reliability, environmental sustainability, and operational efficiency within integrated service offerings.

Investment patterns show increasing focus on long-term sustainability and operational efficiency rather than purely cost-based decision making. Data center operators prioritize power solutions that offer superior total cost of ownership, environmental benefits, and future scalability, even when initial capital requirements are higher than traditional alternatives.

Comprehensive market analysis for Germany’s data center power market employs multiple research methodologies to ensure accuracy, reliability, and depth of insights. The research approach combines quantitative data analysis with qualitative industry expertise to provide a complete understanding of market dynamics, competitive landscapes, and future development trends.

Primary research activities include extensive interviews with industry executives, technology providers, data center operators, and regulatory officials throughout Germany. These discussions provide firsthand insights into market challenges, opportunities, and strategic priorities that shape investment decisions and technology adoption patterns across the sector.

Secondary research sources encompass industry reports, government publications, academic studies, and corporate financial disclosures from major market participants. This information provides quantitative foundations for market analysis while supporting trend identification and competitive positioning assessments throughout the German data center power ecosystem.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert review panels, and statistical analysis techniques. MarkWide Research employs rigorous quality control measures to verify all market data, growth projections, and industry insights before publication, maintaining high standards for research reliability and professional credibility.

Frankfurt metropolitan region dominates Germany’s data center power market, accounting for approximately 40% of national data center capacity and corresponding power infrastructure investment. The region’s strategic location as a financial hub, excellent connectivity to international networks, and robust electrical grid infrastructure make it the preferred location for hyperscale data centers and enterprise facilities.

Berlin-Brandenburg area represents the second-largest regional market, driven by government digitalization initiatives, growing technology sector presence, and increasing cloud service demand. The region benefits from competitive real estate costs, government support for digital infrastructure development, and access to renewable energy sources, attracting both domestic and international data center investments.

Munich and Bavaria demonstrate strong market growth supported by the region’s industrial base, automotive sector digitalization, and proximity to other European markets. The area’s focus on advanced manufacturing and Industry 4.0 applications creates substantial demand for edge computing infrastructure and distributed power solutions throughout the region.

Rhine-Ruhr metropolitan region including Düsseldorf, Cologne, and surrounding areas shows increasing data center development activity. The region’s industrial heritage, logistics infrastructure, and central European location attract data center operators seeking to serve both German and broader European markets with reliable, efficient power infrastructure solutions.

Market leadership in Germany’s data center power sector features a combination of international technology giants and specialized German engineering companies. This diverse competitive environment creates dynamic market conditions that drive innovation, competitive pricing, and comprehensive solution development across all market segments.

Competitive strategies increasingly focus on sustainability, energy efficiency, and comprehensive service offerings rather than purely product-based competition. Leading companies invest heavily in research and development, strategic partnerships, and local manufacturing capabilities to maintain market position and address evolving customer requirements.

By Component:

By Data Center Type:

By Power Rating:

UPS Systems segment represents the largest component category within Germany’s data center power market, driven by increasing reliability requirements and growing adoption of modular, scalable UPS architectures. Modern UPS systems achieve efficiency ratings exceeding 96% in online mode, significantly reducing operational costs while maintaining superior power protection capabilities.

Power Distribution Units experience rapid growth as data center operators seek granular monitoring and control capabilities. Intelligent PDUs with remote monitoring, automated switching, and predictive analytics features become standard requirements for modern facilities, enabling operators to optimize power consumption and prevent equipment failures.

Generator systems undergo significant transformation as operators seek alternatives to traditional diesel-powered backup solutions. Fuel cell systems, battery storage arrays, and hybrid backup architectures gain market share as data center operators prioritize environmental sustainability while maintaining operational reliability requirements.

Power monitoring software emerges as a critical growth category, with AI-driven analytics platforms enabling unprecedented visibility into power consumption patterns, efficiency optimization opportunities, and predictive maintenance scheduling. These solutions help German data centers achieve power usage effectiveness improvements of 10-15% through intelligent load management and system optimization.

Data Center Operators benefit from advanced power solutions that reduce operational costs, improve reliability, and support sustainability objectives. Modern power infrastructure enables operators to achieve superior uptime performance while minimizing energy consumption and environmental impact, creating competitive advantages in an increasingly demanding market environment.

Technology Providers gain access to a rapidly expanding market with strong growth prospects and increasing demand for innovative solutions. The German market’s focus on quality, reliability, and sustainability creates opportunities for premium products and services that command higher margins while building long-term customer relationships.

Enterprise Customers receive improved service reliability, reduced operational risks, and enhanced performance from their data center infrastructure investments. Advanced power management systems enable better resource utilization, predictable operational costs, and improved business continuity planning for mission-critical applications and services.

Government and Regulatory Bodies benefit from improved energy efficiency, reduced carbon emissions, and enhanced digital infrastructure resilience that supports broader economic development objectives. Sustainable data center power solutions contribute to Germany’s renewable energy goals while maintaining the reliable digital infrastructure necessary for continued economic growth.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration transforms power management capabilities throughout German data centers. AI-driven systems optimize energy consumption, predict equipment failures, and automatically adjust power distribution based on real-time demand patterns. These intelligent solutions achieve efficiency improvements of 12-18% while reducing operational complexity and maintenance requirements.

Modular Power Architecture gains widespread adoption as operators seek scalable, flexible infrastructure solutions. Modular UPS systems, containerized power solutions, and prefabricated electrical assemblies enable rapid deployment, simplified maintenance, and improved cost-effectiveness compared to traditional custom-built power infrastructure.

Renewable Energy Integration becomes standard practice for new data center developments throughout Germany. Solar power systems, wind energy connections, and energy storage solutions enable operators to reduce carbon footprints while achieving long-term cost stability through reduced dependence on grid electricity and fossil fuel backup systems.

Liquid Cooling Adoption accelerates as data centers deploy higher-density computing equipment and seek improved energy efficiency. Direct liquid cooling, immersion cooling, and hybrid cooling systems reduce overall power consumption while enabling higher rack densities and improved performance for AI and high-performance computing applications.

Edge Computing Expansion drives demand for distributed power solutions and micro data center technologies. The deployment of 5G networks, autonomous vehicle infrastructure, and industrial IoT applications creates new requirements for localized data processing capabilities and corresponding power infrastructure in urban and industrial environments.

Strategic partnerships between major cloud service providers and German renewable energy companies accelerate sustainable data center development. These collaborations enable large-scale renewable energy procurement, innovative power purchase agreements, and development of dedicated clean energy infrastructure supporting data center operations throughout Germany.

Technology innovations in battery storage systems and fuel cell technologies provide alternatives to traditional diesel backup generators. German data centers increasingly adopt lithium-ion battery systems, hydrogen fuel cells, and hybrid backup solutions that offer improved environmental performance while maintaining operational reliability requirements.

Regulatory developments including updated energy efficiency standards and carbon reporting requirements influence power system design and technology selection. New regulations promote adoption of advanced monitoring systems, renewable energy integration, and efficiency optimization technologies throughout the German data center sector.

Investment activities from international data center operators and infrastructure funds drive market expansion and technology advancement. Major investments in hyperscale facilities, edge computing infrastructure, and sustainable power solutions demonstrate strong confidence in Germany’s long-term market potential and regulatory environment.

Market participants should prioritize sustainability and energy efficiency in their strategic planning and product development activities. MarkWide Research analysis indicates that data center operators increasingly evaluate power solutions based on total environmental impact, long-term operational costs, and regulatory compliance rather than purely initial capital requirements.

Technology providers should invest in artificial intelligence capabilities, modular architectures, and renewable energy integration expertise to remain competitive in the evolving German market. Companies that develop comprehensive solutions addressing multiple customer requirements will achieve superior market positioning and customer loyalty compared to single-product providers.

Regional expansion strategies should focus on emerging markets outside traditional data center hubs, particularly areas with strong industrial bases, renewable energy resources, and government support for digital infrastructure development. Edge computing applications create new opportunities in previously underserved locations throughout Germany.

Partnership development with renewable energy companies, system integrators, and local engineering firms can provide competitive advantages and market access opportunities. Collaborative approaches enable comprehensive solution delivery while leveraging local expertise and established customer relationships throughout German markets.

Long-term growth prospects for Germany’s data center power market remain highly positive, supported by continued digital transformation, increasing cloud adoption, and expanding edge computing requirements. The market is projected to maintain robust growth rates exceeding 7% annually through the next decade, driven by both capacity expansion and technology advancement initiatives.

Technology evolution will focus increasingly on sustainability, efficiency, and intelligent automation. Next-generation power systems will integrate advanced AI capabilities, renewable energy sources, and predictive maintenance technologies to deliver superior performance while minimizing environmental impact and operational complexity for data center operators.

Market consolidation may occur as smaller players struggle to compete with comprehensive solution providers and well-capitalized international companies. However, specialized niche providers focusing on innovative technologies or specific market segments will continue to find opportunities for growth and differentiation within the evolving competitive landscape.

Regulatory influence will continue shaping market development through environmental standards, energy efficiency requirements, and sustainability mandates. MWR projections suggest that compliance-driven technology adoption will accelerate, creating opportunities for providers of advanced monitoring, renewable energy integration, and efficiency optimization solutions throughout the German market.

Germany’s data center power market represents a dynamic, rapidly evolving sector characterized by strong growth fundamentals, technological innovation, and increasing focus on sustainability. The market benefits from Germany’s position as Europe’s economic leader, its commitment to renewable energy, and its advanced industrial and technological capabilities that support continued digital infrastructure development.

Key success factors for market participants include embracing sustainability initiatives, investing in advanced technologies, and developing comprehensive solutions that address multiple customer requirements. The integration of artificial intelligence, renewable energy, and modular architectures will define competitive advantage in the evolving market landscape, while regulatory compliance and environmental performance become increasingly important selection criteria.

Future opportunities span multiple dimensions including edge computing expansion, renewable energy integration, and advanced power management technologies. Companies that successfully navigate the complex regulatory environment, develop strategic partnerships, and maintain focus on customer value creation will achieve superior market positioning and long-term growth in Germany’s expanding data center power market.

What is Data Center Power?

Data Center Power refers to the electrical power supply and management systems that support the operation of data centers, including servers, storage, and networking equipment. It encompasses various aspects such as power distribution, backup systems, and energy efficiency measures.

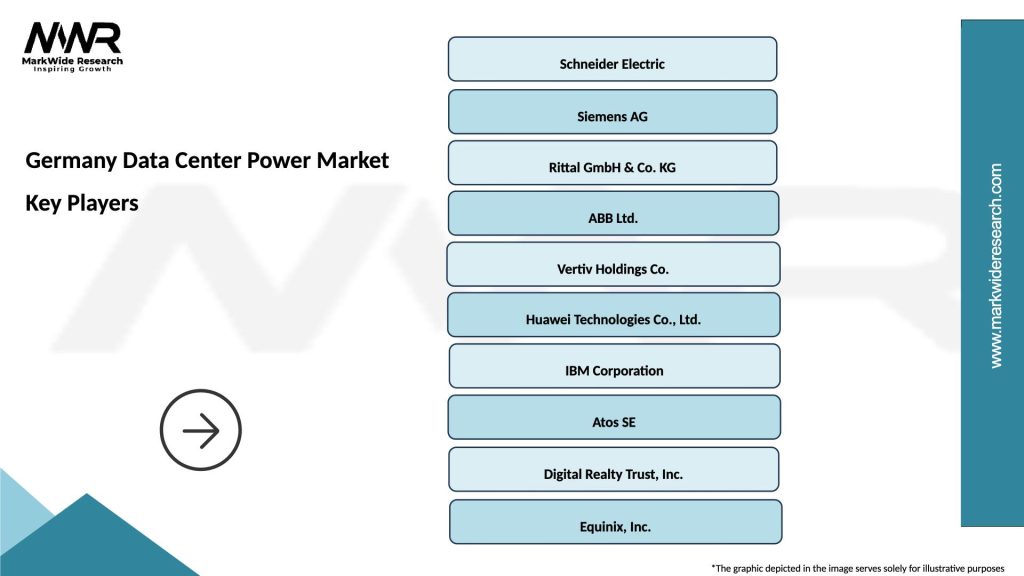

What are the key players in the Germany Data Center Power Market?

Key players in the Germany Data Center Power Market include companies like Siemens, Schneider Electric, and ABB, which provide power management solutions and infrastructure for data centers. These companies focus on energy efficiency and reliability, among others.

What are the growth factors driving the Germany Data Center Power Market?

The growth of the Germany Data Center Power Market is driven by the increasing demand for cloud computing, the rise of big data analytics, and the need for enhanced data security. Additionally, the push for energy-efficient solutions is also a significant factor.

What challenges does the Germany Data Center Power Market face?

Challenges in the Germany Data Center Power Market include the high costs associated with energy consumption and the complexity of integrating renewable energy sources. Additionally, regulatory compliance and the need for continuous upgrades pose significant hurdles.

What opportunities exist in the Germany Data Center Power Market?

Opportunities in the Germany Data Center Power Market include the development of innovative power management technologies and the increasing adoption of green data centers. The growing emphasis on sustainability and energy efficiency presents further avenues for growth.

What trends are shaping the Germany Data Center Power Market?

Trends in the Germany Data Center Power Market include the shift towards modular data center designs and the integration of artificial intelligence for power management. Additionally, there is a growing focus on renewable energy sources and energy-efficient technologies.

Germany Data Center Power Market

| Segmentation Details | Description |

|---|---|

| Type | UPS, Generators, Power Distribution Units, Cooling Systems |

| End User | Telecommunications, Cloud Service Providers, Financial Institutions, Government Agencies |

| Technology | DC Power, AC Power, Renewable Energy, Hybrid Systems |

| Capacity | Below 1 MW, 1-5 MW, 5-10 MW, Above 10 MW |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Data Center Power Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at