444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

Data analytics in banking has emerged as a transformative force, reshaping the way financial institutions operate, make decisions, and interact with customers. With the proliferation of digital technologies and the exponential growth of data, banks in Germany are leveraging advanced analytics to gain deeper insights into customer behavior, enhance risk management practices, and drive operational efficiency. Data analytics solutions enable banks to extract actionable intelligence from vast amounts of structured and unstructured data, enabling them to personalize services, detect fraud, optimize processes, and improve decision-making.

Meaning

Data analytics in banking refers to the process of collecting, processing, analyzing, and interpreting large volumes of data to derive valuable insights and inform strategic decisions within financial institutions. By harnessing the power of data, banks can gain a deeper understanding of customer preferences, identify emerging trends, mitigate risks, and drive innovation across various business functions, including marketing, sales, risk management, compliance, and operations. Data analytics encompasses a wide range of techniques, including descriptive, diagnostic, predictive, and prescriptive analytics, as well as machine learning and artificial intelligence (AI) algorithms, to unlock the full potential of data and drive competitive advantage in the banking industry.

Executive Summary

The adoption of data analytics in banking is rapidly accelerating in Germany, driven by factors such as increasing competition, changing customer expectations, regulatory pressures, and technological advancements. Banks are investing heavily in data analytics capabilities to gain a competitive edge, enhance customer experiences, and optimize business performance. Key areas of focus include customer segmentation and targeting, product customization, risk modeling, fraud detection, regulatory compliance, and operational efficiency. By leveraging data analytics, banks in Germany can unlock new revenue streams, reduce costs, mitigate risks, and improve overall business outcomes in an increasingly digital and data-driven landscape.

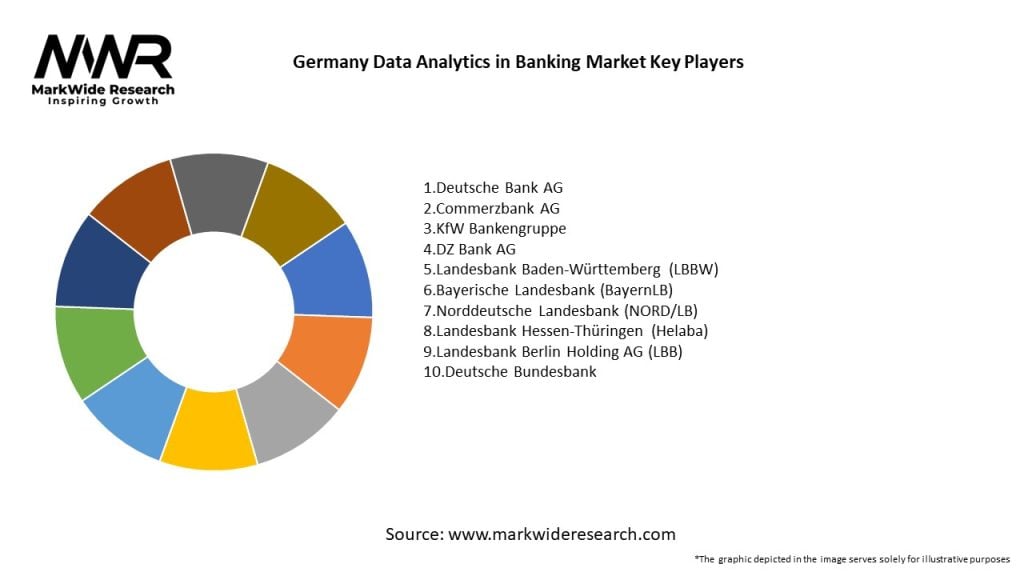

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The German data analytics in banking market is characterized by rapid technological advancements, evolving customer preferences, regulatory pressures, and competitive dynamics. Banks are increasingly investing in data analytics capabilities to drive digital innovation, improve operational efficiency, and enhance customer engagement. However, challenges such as data privacy concerns, talent shortages, and legacy infrastructure constraints pose barriers to adoption and implementation. Moving forward, banks must navigate these dynamics by prioritizing investments in talent, technology, and partnerships to capitalize on emerging opportunities and address evolving market demands.

Regional Analysis

The adoption of data analytics in banking varies across regions in Germany, with major financial centers such as Frankfurt, Munich, and Berlin leading the way in innovation and investment. Frankfurt, as the financial capital of Germany, is home to many multinational banks and financial institutions that are at the forefront of data analytics adoption. Munich, with its vibrant startup ecosystem and strong technology talent pool, is emerging as a hub for fintech innovation and collaboration in data analytics. Berlin, known for its dynamic entrepreneurial culture and thriving tech scene, is attracting a growing number of fintech startups and digital banks that are leveraging data analytics to disrupt the traditional banking industry.

Competitive Landscape

Leading Companies in the Germany Data Analytics in Banking Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The German data analytics in banking market can be segmented based on various factors, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has accelerated the adoption of data analytics in banking, as banks seek to navigate unprecedented challenges, mitigate risks, and support customers in a rapidly changing environment. Key impacts of Covid-19 on the German data analytics in banking market include:

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for data analytics in banking in Germany is highly promising, with continued investments, innovations, and regulatory developments driving market growth and adoption. Banks will increasingly leverage data analytics to gain competitive advantage, enhance customer experiences, manage risks, and drive operational efficiency in an evolving digital and data-driven landscape. Key trends shaping the future of data analytics in banking include AI-powered insights, open banking innovation, real-time decision-making, and ethical AI and responsible data use practices. By embracing these trends and addressing challenges such as talent shortages, data privacy concerns, and legacy infrastructure constraints, banks in Germany can capitalize on emerging opportunities and lead the industry towards a more data-driven and customer-centric future.

Conclusion

Data analytics has emerged as a game-changer for the banking industry in Germany, enabling banks to unlock the full potential of data to drive innovation, competitiveness, and growth. By harnessing advanced analytics techniques and technologies, banks can gain deeper insights into customer behaviors, mitigate risks, optimize operations, and deliver personalized experiences that meet the evolving needs and expectations of customers in a digital-first world. Despite challenges such as data quality issues, talent shortages, and regulatory complexities, the future of data analytics in banking in Germany is bright, with continued investments, collaborations, and innovations driving industry-wide transformation and value creation. By staying agile, innovative, and customer-focused, banks can leverage data analytics to thrive in a rapidly changing and increasingly competitive landscape, shaping the future of banking in Germany and beyond.

What is Data Analytics in Banking?

Data Analytics in Banking refers to the use of advanced analytical techniques and tools to analyze data generated within the banking sector. This includes customer data, transaction records, and market trends to enhance decision-making, risk management, and customer service.

What are the key players in the Germany Data Analytics in Banking Market?

Key players in the Germany Data Analytics in Banking Market include SAP, SAS Institute, and FICO, which provide various analytics solutions tailored for financial institutions. These companies focus on improving operational efficiency and customer insights, among others.

What are the main drivers of growth in the Germany Data Analytics in Banking Market?

The main drivers of growth in the Germany Data Analytics in Banking Market include the increasing demand for personalized banking services, the need for enhanced risk management, and the growing volume of data generated by digital banking transactions.

What challenges does the Germany Data Analytics in Banking Market face?

Challenges in the Germany Data Analytics in Banking Market include data privacy concerns, regulatory compliance issues, and the integration of legacy systems with modern analytics tools. These factors can hinder the effective implementation of data analytics strategies.

What opportunities exist in the Germany Data Analytics in Banking Market?

Opportunities in the Germany Data Analytics in Banking Market include the potential for leveraging artificial intelligence and machine learning to enhance predictive analytics, as well as the growing trend of open banking, which allows for better data sharing and collaboration among financial institutions.

What trends are shaping the Germany Data Analytics in Banking Market?

Trends shaping the Germany Data Analytics in Banking Market include the increasing adoption of cloud-based analytics solutions, the rise of real-time data processing, and the focus on customer-centric analytics to improve user experience and engagement.

Germany Data Analytics in Banking Market

| Segmentation Details | Description |

|---|---|

| Application | Fraud Detection, Risk Management, Customer Segmentation, Predictive Analytics |

| Technology | Machine Learning, Big Data, Cloud Computing, Data Visualization |

| End User | Commercial Banks, Investment Banks, Credit Unions, Online Banks |

| Service Type | Consulting, Implementation, Managed Services, Support Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Germany Data Analytics in Banking Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at