444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany compact dishwasher market represents a dynamic and rapidly evolving segment within the country’s home appliance industry. Compact dishwashers have gained significant traction among German consumers, particularly in urban areas where space optimization is crucial. The market is experiencing robust growth driven by changing lifestyle patterns, increasing urbanization, and growing awareness of water and energy efficiency.

German households are increasingly adopting compact dishwashing solutions as an alternative to traditional full-size models. The market demonstrates strong momentum with a projected CAGR of 6.2% over the forecast period. Space-constrained living conditions in major German cities like Berlin, Munich, and Hamburg have created substantial demand for these efficient appliances.

Consumer preferences in Germany show a marked shift toward premium compact dishwashers that offer advanced features while maintaining minimal footprint. The market encompasses various product categories including countertop models, built-in compact units, and portable dishwashers. Energy efficiency ratings play a crucial role in purchasing decisions, with approximately 78% of German consumers prioritizing A+++ rated appliances.

Market penetration varies significantly across different regions within Germany, with urban areas showing higher adoption rates compared to rural regions. The growing trend of single-person households and young professionals living in apartments has contributed to the market’s expansion. Sustainability concerns and government initiatives promoting energy-efficient appliances further support market growth.

The Germany compact dishwasher market refers to the commercial ecosystem encompassing the manufacturing, distribution, and retail of space-efficient dishwashing appliances specifically designed for German consumers with limited kitchen space while maintaining high cleaning performance and energy efficiency standards.

Compact dishwashers are specialized appliances designed to fit into smaller spaces while providing effective dishwashing capabilities. These units typically accommodate 6-8 place settings compared to 12-16 place settings in standard dishwashers. German engineering standards ensure these appliances meet stringent quality and efficiency requirements.

Market definition includes various product types such as countertop dishwashers, slimline built-in models, and portable units. The segment focuses on appliances with widths ranging from 45cm to 55cm, significantly smaller than conventional 60cm models. Technology integration includes smart connectivity features, multiple wash programs, and advanced water filtration systems.

Consumer demographics primarily include urban dwellers, young professionals, small families, and elderly consumers seeking convenient dishwashing solutions. The market also serves the growing segment of micro-apartments and studio living spaces that have become increasingly common in German metropolitan areas.

Market dynamics in the Germany compact dishwasher sector reveal strong growth potential driven by urbanization trends and evolving consumer lifestyles. The market benefits from Germany’s position as a leading European economy with high disposable income levels and strong environmental consciousness among consumers.

Key growth drivers include the increasing number of single-person households, which account for approximately 42% of German households, and the rising popularity of compact living solutions. Technological advancements in dishwasher design have enabled manufacturers to pack full-size functionality into smaller form factors without compromising performance.

Competitive landscape features both established German appliance manufacturers and international brands competing for market share. Premium positioning strategies focus on energy efficiency, smart features, and superior build quality. Distribution channels include traditional retail stores, online platforms, and specialized appliance retailers.

Market challenges include higher per-unit costs compared to standard dishwashers and consumer education regarding the benefits of compact models. However, growing environmental awareness and government incentives for energy-efficient appliances create favorable market conditions. Future prospects remain positive with continued urbanization and changing demographic patterns supporting sustained growth.

Consumer behavior analysis reveals distinct preferences among German buyers for compact dishwashers. The following insights highlight critical market characteristics:

Market segmentation shows distinct preferences across different consumer groups. Young professionals prioritize smart features and energy efficiency, while elderly consumers focus on ease of use and reliability. Regional variations exist with northern German cities showing higher adoption rates compared to southern regions.

Urbanization trends represent the primary driver for Germany’s compact dishwasher market growth. Major German cities continue experiencing population growth, leading to increased demand for space-efficient appliances. Housing density in urban areas necessitates compact solutions that don’t compromise functionality.

Demographic shifts significantly influence market dynamics. The growing number of single-person households and small families creates ideal conditions for compact dishwasher adoption. Lifestyle changes among younger generations who prioritize convenience and efficiency further support market expansion.

Environmental consciousness drives consumer preference for energy and water-efficient appliances. German government initiatives promoting sustainable living and energy conservation create favorable conditions for compact dishwashers with superior efficiency ratings. Utility cost concerns motivate consumers to invest in appliances that reduce long-term operating expenses.

Technological advancements enable manufacturers to offer full-featured dishwashers in compact formats. Innovations in pump technology, water circulation systems, and smart controls make compact models increasingly attractive. Design improvements address previous limitations while maintaining space-saving benefits.

Real estate trends toward smaller living spaces and micro-apartments create sustained demand for compact appliances. Rental market dynamics in German cities often favor tenants who can provide their own appliances, increasing demand for portable and easily installable compact dishwashers.

Higher unit costs compared to standard dishwashers present a significant market restraint. Compact dishwashers typically command premium pricing due to specialized engineering and smaller production volumes. Cost-conscious consumers may opt for traditional models or delay purchases due to price sensitivity.

Limited capacity concerns affect consumer adoption, particularly among families who require larger dishwashing capacity. Perception issues regarding cleaning effectiveness and cycle times compared to full-size models create hesitation among potential buyers.

Installation challenges in older German buildings with limited plumbing flexibility can restrict market growth. Rental property limitations where tenants cannot modify kitchen installations present additional barriers to market expansion.

Consumer awareness gaps regarding the benefits and capabilities of modern compact dishwashers limit market penetration. Traditional preferences for full-size appliances among certain demographic segments slow adoption rates.

Competition from alternative solutions such as hand washing or dishwashing services in urban areas provides alternatives to appliance ownership. Maintenance concerns and service availability for specialized compact models may deter some consumers from making purchases.

Smart home integration presents substantial opportunities for compact dishwasher manufacturers. Growing adoption of IoT technologies in German households creates demand for connected appliances with remote monitoring and control capabilities.

Sustainability trends offer opportunities for manufacturers to develop ultra-efficient models that exceed current energy standards. Water conservation features and eco-friendly materials can differentiate products in the environmentally conscious German market.

Rental market expansion creates opportunities for portable and easily installable compact dishwashers. Student housing and young professional segments represent untapped markets with specific needs for flexible appliance solutions.

Design innovation opportunities exist for creating aesthetically appealing compact dishwashers that complement modern German kitchen designs. Customization options for different installation scenarios can expand market reach.

Service model innovations such as appliance-as-a-service or rental programs could address cost concerns while expanding market access. Partnership opportunities with kitchen designers, real estate developers, and furniture retailers can create new distribution channels.

Supply chain dynamics in the Germany compact dishwasher market reflect the country’s strong manufacturing base and efficient distribution networks. Local production capabilities provide advantages in terms of quality control, customization, and reduced transportation costs.

Demand patterns show seasonal variations with higher sales during spring and summer months when consumers undertake kitchen renovations. Economic cycles influence purchasing decisions, with premium compact dishwashers showing resilience during economic downturns due to their value proposition.

Technology adoption rates vary across different consumer segments, with younger demographics embracing smart features more readily. Price elasticity analysis indicates that German consumers are willing to pay premiums for superior energy efficiency and build quality.

Regulatory environment supports market growth through energy efficiency standards and environmental regulations. EU directives on appliance efficiency create minimum performance requirements that benefit high-quality compact dishwasher manufacturers.

Market maturity levels differ across regions, with urban markets showing higher penetration rates. Growth potential remains significant in suburban and rural areas as awareness increases and product availability improves.

Primary research methodologies employed in analyzing the Germany compact dishwasher market include comprehensive consumer surveys, retailer interviews, and manufacturer consultations. Data collection processes encompass both quantitative and qualitative research approaches to ensure comprehensive market understanding.

Consumer surveys conducted across major German cities provide insights into purchasing behavior, brand preferences, and satisfaction levels. Sample sizes of over 2,000 respondents ensure statistical significance and regional representation.

Secondary research incorporates industry reports, government statistics, and trade association data to validate primary findings. Market intelligence gathering includes analysis of competitor strategies, pricing trends, and technological developments.

Data validation processes ensure accuracy and reliability of market insights. Cross-referencing multiple data sources and expert opinions provides comprehensive market perspective.

Analytical frameworks include market sizing models, growth projections, and competitive positioning analysis. Statistical methods ensure robust data interpretation and meaningful market insights.

Northern Germany demonstrates the highest adoption rates for compact dishwashers, with cities like Hamburg and Bremen showing strong market penetration. Urban density and higher disposable incomes contribute to market leadership in this region.

Western Germany including North Rhine-Westphalia and Hesse shows steady growth driven by industrial centers and university towns. Student populations and young professionals create sustained demand for compact appliance solutions.

Southern Germany markets in Bavaria and Baden-Württemberg exhibit growing interest in premium compact dishwashers. Economic prosperity in these regions supports higher-end product adoption with approximately 35% market share for premium models.

Eastern Germany represents an emerging market with significant growth potential. Urban renewal projects and modernization of housing stock create opportunities for compact dishwasher integration.

Berlin market deserves special attention due to its unique characteristics as a major metropolitan area with diverse housing types. Rental market dominance influences product preferences toward portable and easily installable models.

Market leadership in Germany’s compact dishwasher sector includes both domestic and international manufacturers competing across different price segments and feature categories.

Competitive strategies focus on differentiation through energy efficiency, smart features, and design innovation. Brand positioning emphasizes German engineering quality and long-term reliability to appeal to local consumer preferences.

Product type segmentation reveals distinct market categories with varying growth patterns and consumer preferences:

By Installation Type:

By Capacity:

By Price Range:

Countertop dishwashers represent the fastest-growing category with approximately 28% annual growth driven by rental market demand and student housing applications. Portability features and easy installation make these models particularly attractive to mobile demographics.

Built-in compact models maintain market leadership with strong demand from homeowners undertaking kitchen renovations. Integration capabilities with modern kitchen designs drive premium pricing and higher profit margins for manufacturers.

Smart-enabled dishwashers show increasing adoption rates among tech-savvy German consumers. Connectivity features including smartphone apps and voice control integration command price premiums and enhance brand differentiation.

Energy-efficient models with A+++ ratings dominate sales across all categories. Environmental consciousness among German consumers drives preference for models with superior efficiency ratings and water conservation features.

Noise-reduction technology becomes increasingly important in compact models due to apartment living conditions. Quiet operation features below 44 dB are becoming standard expectations rather than premium features.

Manufacturers benefit from growing market demand and opportunities for premium positioning. Innovation focus on compact solutions allows for differentiation and higher profit margins compared to standard appliance categories.

Retailers gain from expanding product categories and higher-margin compact dishwasher sales. Specialized knowledge requirements create opportunities for value-added services and customer consultation.

Consumers benefit from space-efficient solutions that don’t compromise functionality. Energy savings and water conservation provide long-term cost benefits while supporting environmental goals.

Real estate developers can enhance property appeal by incorporating compact dishwasher-ready kitchen designs. Modern amenities increase rental and sale values in competitive urban markets.

Service providers benefit from specialized maintenance and installation opportunities. Technical expertise in compact dishwasher systems creates new revenue streams and customer relationships.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart connectivity emerges as a dominant trend with manufacturers integrating IoT capabilities into compact dishwashers. Smartphone control and remote monitoring features appeal to tech-savvy German consumers seeking convenience and efficiency.

Sustainability focus drives development of ultra-efficient models that exceed current energy standards. Water recycling systems and eco-friendly materials become standard features rather than premium options.

Design aesthetics gain importance as compact dishwashers become visible elements in open kitchen designs. Color options and sleek finishes allow integration with modern German kitchen styles.

Flexible installation solutions address diverse housing situations in German cities. Modular designs and adaptable mounting systems enable installation in various kitchen configurations.

Noise reduction technology advances to meet apartment living requirements. Ultra-quiet operation below 40 dB becomes a key differentiator in the compact dishwasher segment.

Technology partnerships between appliance manufacturers and smart home platform providers accelerate innovation in connected compact dishwashers. Integration capabilities with popular German smart home systems enhance market appeal.

Manufacturing investments in compact dishwasher production facilities demonstrate industry confidence in market growth. Automation improvements help reduce production costs while maintaining quality standards.

Retail channel expansion includes specialized compact appliance showrooms and enhanced online presence. Virtual reality demonstrations help consumers understand space-saving benefits and installation options.

Service network development addresses maintenance and support needs for compact dishwasher owners. Specialized technician training ensures proper installation and service quality.

Sustainability initiatives include recycling programs for old appliances and development of more environmentally friendly manufacturing processes. Circular economy principles guide product design and lifecycle management.

MarkWide Research recommends that manufacturers focus on developing ultra-compact models specifically designed for German micro-apartments and student housing. Customization options for different installation scenarios can expand market reach significantly.

Investment priorities should emphasize smart connectivity features and energy efficiency improvements. Consumer education campaigns highlighting the benefits of compact dishwashers can accelerate market adoption rates.

Distribution strategy optimization should include partnerships with furniture retailers and kitchen designers. Demonstration programs in retail locations can help overcome consumer hesitation about compact dishwasher capabilities.

Product development should focus on noise reduction and water efficiency improvements. Modular designs that accommodate various kitchen configurations can differentiate products in competitive markets.

Market expansion opportunities exist in suburban and rural areas through targeted marketing and improved distribution networks. Financing options can address price sensitivity concerns among cost-conscious consumers.

Market growth projections indicate sustained expansion with compact dishwashers gaining approximately 15% market share of the total German dishwasher market by 2028. Urbanization trends and demographic shifts support continued demand growth.

Technology evolution will focus on artificial intelligence integration and predictive maintenance capabilities. Machine learning algorithms will optimize wash cycles based on load types and user preferences.

Sustainability requirements will drive development of even more efficient models with potential 50% water reduction compared to current standards. Renewable energy integration may become standard in premium models.

Market consolidation may occur as smaller manufacturers struggle to compete with established brands. Innovation partnerships between appliance manufacturers and technology companies will accelerate product development.

Consumer adoption will accelerate as awareness increases and product availability improves. MWR analysis suggests that compact dishwashers will become mainstream appliances in German urban households within the next five years.

Germany’s compact dishwasher market presents significant growth opportunities driven by urbanization, changing demographics, and evolving consumer preferences. The market benefits from strong German engineering capabilities, environmental consciousness, and increasing demand for space-efficient appliances.

Key success factors include energy efficiency, smart connectivity, and design innovation that addresses specific German consumer needs. Market challenges such as higher costs and limited awareness can be overcome through targeted strategies and consumer education.

Future prospects remain highly positive with sustained growth expected across all market segments. Technology advancement and sustainability trends will continue driving innovation and market expansion. The compact dishwasher market is positioned to become an integral part of Germany’s evolving appliance landscape, offering manufacturers and stakeholders substantial opportunities for growth and profitability.

What is Compact Dishwasher?

A compact dishwasher is a smaller, space-efficient version of a traditional dishwasher, designed to fit in smaller kitchens or apartments. These appliances typically offer similar functionalities as standard dishwashers but are optimized for limited space.

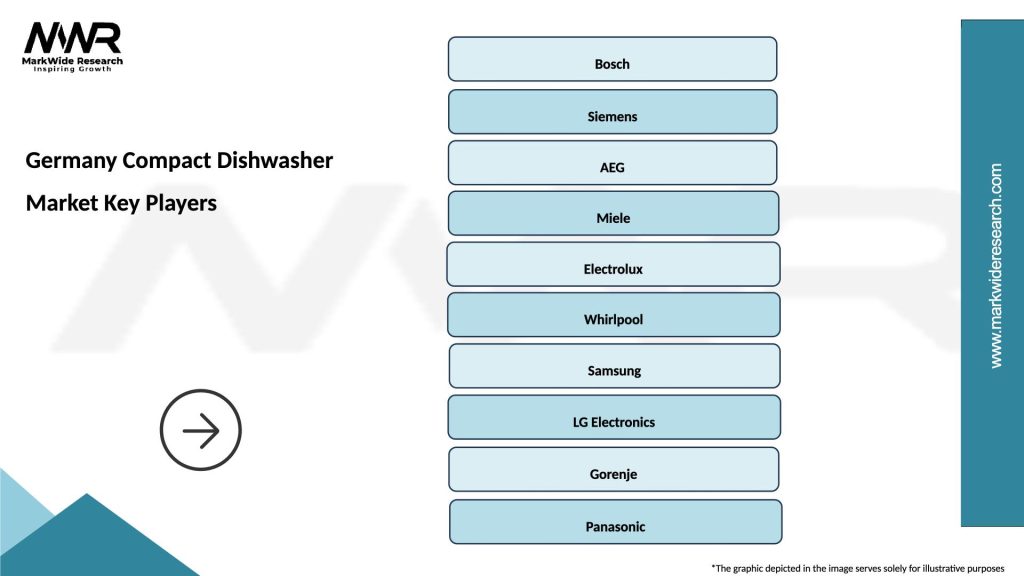

What are the key players in the Germany Compact Dishwasher Market?

Key players in the Germany Compact Dishwasher Market include Bosch, Siemens, and Miele, which are known for their innovative designs and energy-efficient models. Other notable companies include AEG and Beko, among others.

What are the growth factors driving the Germany Compact Dishwasher Market?

The growth of the Germany Compact Dishwasher Market is driven by increasing urbanization, the rise in small households, and a growing preference for energy-efficient appliances. Additionally, the trend towards modern kitchen designs is boosting demand for compact dishwashers.

What challenges does the Germany Compact Dishwasher Market face?

Challenges in the Germany Compact Dishwasher Market include intense competition among manufacturers and the need for continuous innovation to meet consumer preferences. Additionally, price sensitivity among consumers can impact sales.

What opportunities exist in the Germany Compact Dishwasher Market?

Opportunities in the Germany Compact Dishwasher Market include the potential for smart technology integration and the growing demand for eco-friendly appliances. As consumers become more environmentally conscious, manufacturers can capitalize on this trend by offering sustainable options.

What trends are shaping the Germany Compact Dishwasher Market?

Trends in the Germany Compact Dishwasher Market include the increasing popularity of built-in models and the incorporation of advanced features such as Wi-Fi connectivity and energy-saving modes. Additionally, there is a rising interest in stylish designs that complement modern kitchen aesthetics.

Germany Compact Dishwasher Market

| Segmentation Details | Description |

|---|---|

| Product Type | Built-in, Freestanding, Portable, Countertop |

| End User | Households, Restaurants, Cafés, Hotels |

| Technology | Smart, Energy-efficient, Conventional, Hybrid |

| Distribution Channel | Online, Retail Stores, Wholesalers, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Compact Dishwasher Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at