444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany Combined Heat & Power market represents one of Europe’s most sophisticated and rapidly evolving energy infrastructure sectors, driven by the country’s ambitious energy transition goals and commitment to sustainable power generation. Combined Heat and Power (CHP) systems have emerged as a cornerstone technology in Germany’s energy landscape, offering exceptional efficiency rates of up to 90% overall efficiency compared to traditional separate heat and power generation methods.

Germany’s CHP market has experienced remarkable growth momentum, with installations expanding at a compound annual growth rate (CAGR) of 8.2% over recent years. This growth trajectory reflects the nation’s strategic focus on decentralized energy production and the integration of renewable energy sources into existing power infrastructure. The market encompasses diverse applications ranging from industrial manufacturing facilities to residential district heating systems, each contributing to Germany’s broader energy security objectives.

Market dynamics indicate strong government support through favorable regulatory frameworks, including the Combined Heat and Power Act (KWKG), which provides substantial incentives for CHP deployment. The technology’s ability to simultaneously generate electricity and useful heat makes it particularly attractive for energy-intensive industries and urban heating networks. Regional distribution shows concentrated adoption in industrial centers across North Rhine-Westphalia, Bavaria, and Baden-Württemberg, where manufacturing demand drives consistent baseload requirements.

The Germany Combined Heat & Power market refers to the comprehensive ecosystem of technologies, services, and infrastructure dedicated to the simultaneous generation of electricity and thermal energy from a single fuel source within German territory. CHP systems, also known as cogeneration systems, capture and utilize waste heat that would otherwise be lost in conventional power generation processes, achieving remarkable efficiency improvements.

These integrated systems operate on the fundamental principle of energy cascade utilization, where primary energy sources such as natural gas, biomass, biogas, or renewable fuels are converted into both electrical power and useful heat through advanced thermodynamic cycles. The technology encompasses various configurations including gas turbines, steam turbines, reciprocating engines, and fuel cells, each optimized for specific applications and capacity requirements.

Market scope extends beyond mere equipment supply to include comprehensive project development, engineering services, maintenance contracts, and energy management solutions. The definition encompasses both traditional fossil fuel-based systems and innovative renewable-powered installations that align with Germany’s Energiewende (energy transition) strategy. Stakeholder participation includes equipment manufacturers, project developers, energy service companies, utilities, and end-users across industrial, commercial, and residential sectors.

Germany’s Combined Heat & Power market stands as a pivotal component of the nation’s energy transformation strategy, demonstrating exceptional resilience and growth potential amid evolving regulatory landscapes and technological innovations. The market has established itself as a leader in European CHP deployment, with over 50,000 installations currently operational across diverse sectors and applications.

Key market drivers include stringent carbon emission reduction targets, rising energy costs, and increasing demand for energy security and independence. The industrial sector accounts for approximately 65% of total CHP capacity, with chemical, steel, and paper industries leading adoption rates. Technological advancement continues to enhance system efficiency and reduce operational costs, particularly in micro-CHP applications for residential and small commercial users.

Government initiatives through the KWKG framework provide substantial financial incentives, including feed-in tariffs and investment grants that significantly improve project economics. The market benefits from Germany’s well-developed gas infrastructure and growing renewable gas production capabilities. Future prospects remain highly favorable, with projected growth rates of 7.5% annually driven by industrial modernization, district heating expansion, and integration with renewable energy systems.

Strategic market analysis reveals several critical insights that define Germany’s CHP landscape and future development trajectory. The market demonstrates remarkable diversity in both technology applications and end-user segments, creating multiple growth opportunities across various economic sectors.

Germany’s CHP market benefits from a convergence of powerful driving forces that create sustained demand growth and investment opportunities across multiple sectors. These drivers reflect both policy initiatives and fundamental economic advantages that position CHP technology as essential infrastructure for Germany’s energy future.

Regulatory support through the Combined Heat and Power Act provides comprehensive incentives including capacity payments, electricity feed-in bonuses, and investment grants that significantly enhance project viability. The legislation mandates efficiency improvements and carbon reduction targets that favor CHP deployment over conventional generation methods. Carbon pricing mechanisms under the EU Emissions Trading System create additional economic advantages for high-efficiency CHP installations.

Energy security concerns drive demand for decentralized power generation capabilities that reduce dependence on imported electricity and enhance grid resilience. Industrial users particularly value the energy independence and cost predictability that CHP systems provide, especially during periods of volatile energy markets. Grid stability requirements create opportunities for CHP plants to provide essential system services while generating revenue through capacity markets.

Environmental objectives align perfectly with CHP technology’s inherent efficiency advantages, supporting Germany’s commitment to achieve carbon neutrality by 2045. The technology enables significant reductions in primary energy consumption and greenhouse gas emissions compared to separate heat and power generation. Circular economy principles promote waste heat recovery and biomass utilization through advanced CHP applications.

Despite strong fundamentals, Germany’s CHP market faces several significant challenges that may constrain growth potential and limit deployment in certain applications. These restraints require careful consideration by market participants and policymakers to ensure continued market development.

High capital costs represent the primary barrier to CHP adoption, particularly for smaller commercial and residential applications where project economics may not justify initial investments. Complex regulatory frameworks create administrative burdens and uncertainty that can delay project development and increase transaction costs. The intricate interplay between federal and state regulations often complicates permitting processes and grid connection procedures.

Technical challenges include integration complexities with existing heating and electrical systems, particularly in retrofit applications where space constraints and infrastructure limitations may limit feasible configurations. Maintenance requirements for CHP systems typically exceed those of conventional heating systems, requiring specialized technical expertise and potentially higher operational costs.

Market competition from alternative technologies, including heat pumps, renewable heating systems, and energy storage solutions, creates pressure on CHP market share in certain applications. Natural gas price volatility affects the economic attractiveness of gas-fired CHP systems, while concerns about long-term gas availability may influence investment decisions. Grid integration challenges can arise in areas with high renewable energy penetration, where CHP output may conflict with variable renewable generation patterns.

Germany’s CHP market presents numerous compelling opportunities for growth and innovation, driven by evolving energy system requirements and technological advancement. These opportunities span across traditional applications and emerging market segments that promise substantial expansion potential.

Industrial modernization creates significant opportunities as manufacturing facilities upgrade aging infrastructure and seek improved energy efficiency. The transition toward Industry 4.0 principles emphasizes integrated energy systems that can provide both process requirements and grid services. Hydrogen production applications offer promising new markets where CHP systems can provide both electricity and heat for electrolysis processes while utilizing waste heat for facility operations.

District heating expansion represents a major growth opportunity, particularly in urban areas seeking to reduce carbon emissions from building heating. Fourth-generation district heating networks operating at lower temperatures create ideal conditions for CHP integration with renewable heat sources. Seasonal thermal storage technologies enable CHP systems to serve heating demands year-round while maintaining electrical generation capabilities.

Renewable gas integration opens new possibilities for CHP systems to utilize biomethane, synthetic gases, and hydrogen blends, supporting both renewable energy targets and grid stability requirements. Power-to-gas applications create synergies between CHP plants and renewable energy systems, enabling long-term energy storage and sector coupling. Carbon capture utilization technologies may enable CHP plants to contribute to negative emissions while maintaining economic viability.

The interplay of technological, economic, and regulatory forces shapes Germany’s CHP market dynamics, creating a complex but favorable environment for continued growth and innovation. Market evolution reflects broader energy system transformation trends while maintaining focus on efficiency and reliability.

Technology convergence drives integration between CHP systems and complementary technologies including energy storage, heat pumps, and renewable generation assets. This convergence creates hybrid energy systems that optimize performance across multiple operating conditions and revenue streams. Digitalization trends enable advanced control strategies and predictive maintenance approaches that enhance system reliability and reduce operational costs.

Economic dynamics show increasing competitiveness of CHP technology as conventional energy costs rise and carbon pricing mechanisms strengthen. Financing innovations including energy service contracts and performance guarantees reduce barriers to adoption while transferring operational risks to specialized providers. Market liberalization creates opportunities for CHP operators to participate in competitive electricity markets and provide ancillary services.

Regulatory evolution continues to favor high-efficiency technologies through updated building codes, emission standards, and renewable energy requirements. European integration influences German CHP markets through cross-border electricity trading and harmonized technical standards. Local energy communities create new business models where CHP systems serve as anchor assets for distributed energy networks.

Comprehensive market analysis of Germany’s Combined Heat & Power sector employs rigorous research methodologies that combine quantitative data analysis with qualitative industry insights to provide accurate and actionable market intelligence. The research approach integrates multiple data sources and analytical techniques to ensure reliability and completeness.

Primary research activities include structured interviews with industry executives, technology providers, project developers, and end-users across various market segments. Survey methodologies capture quantitative data on market trends, technology preferences, and investment plans from representative samples of market participants. Expert consultations with technical specialists and policy experts provide insights into regulatory developments and technological advancement trajectories.

Secondary research incorporates analysis of government statistics, industry reports, academic publications, and regulatory documents to establish market baselines and identify emerging trends. Database analysis utilizes comprehensive project databases and installation records to track market development patterns and regional variations. Competitive intelligence activities monitor company strategies, product developments, and market positioning across the value chain.

Analytical frameworks employ statistical modeling techniques to project market growth scenarios and assess the impact of various driving factors. Scenario analysis evaluates potential market outcomes under different regulatory and economic conditions. Validation processes ensure data accuracy through cross-referencing multiple sources and expert review procedures.

Germany’s CHP market exhibits distinct regional characteristics that reflect local industrial concentrations, energy infrastructure development, and policy implementation variations across federal states. Regional distribution shows significant concentration in industrial heartlands while emerging opportunities develop in urban centers and rural areas.

North Rhine-Westphalia dominates the German CHP landscape, accounting for approximately 35% of total installed capacity due to its concentration of energy-intensive industries including steel, chemicals, and manufacturing. The region benefits from well-developed gas infrastructure and strong industrial demand for process heat and electricity. Industrial clusters in the Ruhr area and Rhine valley create ideal conditions for large-scale CHP deployment and district heating networks.

Bavaria represents the second-largest regional market with 18% market share, driven by diverse industrial sectors and strong support for renewable energy integration. The state’s emphasis on biomass CHP systems aligns with abundant agricultural resources and environmental objectives. Munich and Nuremberg metropolitan areas lead urban CHP adoption through district heating expansion and commercial building applications.

Baden-Württemberg contributes 15% of national CHP capacity, reflecting the region’s advanced manufacturing sector and innovation focus. The state’s automotive and machinery industries drive demand for reliable industrial energy systems. Stuttgart region demonstrates leadership in micro-CHP applications and fuel cell technology development.

Northern states including Lower Saxony, Schleswig-Holstein, and Hamburg collectively represent 20% of market activity, with growing emphasis on renewable gas utilization and offshore wind integration. Port cities develop CHP applications for maritime industries and logistics facilities.

Germany’s CHP market features a diverse competitive environment with established international players, specialized German companies, and emerging technology providers competing across various market segments and applications. The competitive landscape reflects both technological diversity and regional market dynamics.

Market competition intensifies across technology segments as companies develop specialized solutions for specific applications and customer requirements. Innovation focus emphasizes efficiency improvements, emissions reduction, and integration capabilities with renewable energy systems.

Germany’s CHP market demonstrates clear segmentation patterns across multiple dimensions including technology type, capacity range, fuel source, and end-user applications. This segmentation creates distinct market dynamics and competitive environments within the broader CHP ecosystem.

By Technology:

By Capacity Range:

By Fuel Type:

Industrial CHP applications represent the most mature and established market category, with manufacturing facilities utilizing systems primarily for process heat and electricity generation. Chemical industries lead adoption rates due to consistent thermal and electrical demands that align perfectly with CHP operational characteristics. These installations typically achieve overall efficiency rates exceeding 85% while providing essential grid services during peak demand periods.

District heating CHP systems serve urban and suburban communities through centralized thermal networks that distribute heat to residential and commercial buildings. Fourth-generation networks operating at lower temperatures create opportunities for renewable heat integration and improved overall system efficiency. Municipal utilities increasingly invest in CHP-based district heating to meet carbon reduction targets while maintaining service reliability.

Commercial building applications focus on hotels, hospitals, shopping centers, and office complexes where simultaneous heat and electricity demands create favorable economics for CHP deployment. Energy service companies often develop these projects through performance contracts that guarantee energy cost savings. Building automation systems optimize CHP operation to match varying load patterns throughout daily and seasonal cycles.

Residential micro-CHP represents an emerging category with significant growth potential as technology costs decline and performance improves. Fuel cell systems lead this segment with exceptional electrical efficiency and minimal maintenance requirements. Government incentives support residential adoption through investment grants and favorable electricity feed-in tariffs.

Industry participants across Germany’s CHP value chain realize substantial benefits that extend beyond traditional energy cost savings to include operational advantages, revenue diversification, and strategic positioning for future energy system evolution.

End-users benefit from significant reductions in overall energy costs through improved efficiency and reduced grid electricity purchases. Industrial facilities achieve greater energy security and independence while maintaining precise control over power quality and thermal supply parameters. Operational flexibility enables facilities to optimize energy consumption patterns and participate in demand response programs that generate additional revenue streams.

Equipment manufacturers capitalize on growing market demand while developing advanced technologies that command premium pricing. Service providers establish long-term customer relationships through maintenance contracts and performance guarantees that create predictable revenue streams. Project developers benefit from favorable regulatory frameworks and financing conditions that support profitable project development.

Utilities and grid operators gain access to distributed generation resources that enhance grid stability and reduce transmission constraints. CHP plants provide valuable ancillary services including frequency regulation, voltage support, and backup power capabilities. Environmental benefits support corporate sustainability objectives while contributing to national carbon reduction targets.

Local communities benefit from job creation in manufacturing, installation, and maintenance activities while enjoying improved energy security and reduced environmental impacts. Economic development opportunities arise from industrial competitiveness improvements and attraction of energy-intensive businesses.

Strengths:

Weaknesses:

Opportunities:

Threats:

Germany’s CHP market experiences several transformative trends that reshape technology applications, business models, and market dynamics. These trends reflect broader energy system evolution while creating new opportunities for innovation and growth.

Renewable gas integration emerges as a dominant trend with increasing utilization of biomethane, synthetic gases, and hydrogen blends in CHP applications. Power-to-gas technologies create synergies between renewable electricity generation and CHP systems, enabling long-term energy storage and sector coupling. Biogas upgrading facilities increasingly connect to CHP installations, creating integrated waste-to-energy solutions.

Digitalization and automation transform CHP operations through advanced control systems, predictive maintenance, and remote monitoring capabilities. Artificial intelligence applications optimize system performance while reducing operational costs and improving reliability. Internet of Things (IoT) integration enables real-time performance monitoring and automated response to changing operating conditions.

Hybrid energy systems combine CHP technology with complementary assets including thermal storage, heat pumps, and renewable generation to create optimized energy solutions. Sector coupling applications integrate electricity, heating, and transportation sectors through innovative CHP configurations. Virtual power plants aggregate multiple CHP units to provide grid services and participate in electricity markets.

Circular economy principles drive development of CHP systems that utilize waste materials, recover waste heat, and support industrial symbiosis applications. Carbon capture and utilization technologies may enable CHP plants to achieve negative emissions while maintaining economic viability.

Recent industry developments demonstrate accelerating innovation and market expansion across Germany’s CHP sector, with significant investments in technology advancement and project deployment creating momentum for continued growth.

Technology breakthroughs in fuel cell CHP systems achieve improved durability and reduced costs, making residential applications increasingly viable. Hydrogen-ready engines enable CHP systems to utilize varying hydrogen concentrations while maintaining performance and reliability. Advanced materials improve system efficiency and extend operational lifespans while reducing maintenance requirements.

Policy developments include updates to the Combined Heat and Power Act that extend support mechanisms and introduce new incentives for renewable gas utilization. Building energy codes increasingly favor high-efficiency technologies including CHP systems in new construction and major renovations. Carbon pricing mechanisms strengthen economic advantages for CHP technology compared to conventional alternatives.

Market consolidation activities include strategic acquisitions and partnerships that strengthen technology portfolios and expand market reach. International expansion efforts by German companies leverage domestic expertise to capture opportunities in emerging markets. Research collaborations between industry and academic institutions accelerate technology development and commercialization timelines.

Infrastructure investments in gas networks, district heating systems, and electrical grid upgrades support expanded CHP deployment. Financing innovations including green bonds and sustainability-linked loans improve access to capital for CHP projects.

Market participants should focus on strategic positioning to capitalize on emerging opportunities while addressing evolving challenges in Germany’s dynamic CHP market environment. MarkWide Research analysis indicates several key strategic priorities for sustained success.

Technology diversification represents a critical success factor as market demand shifts toward renewable fuel compatibility and hybrid system configurations. Companies should invest in hydrogen-ready technologies and develop capabilities for biogas and synthetic fuel applications. Digital integration capabilities become essential for competitive differentiation and customer value creation.

Market segment focus should emphasize high-growth applications including district heating, industrial modernization, and micro-CHP residential markets. Service model innovation through energy-as-a-service contracts and performance guarantees can reduce customer barriers while creating recurring revenue streams. Partnership strategies with utilities, energy service companies, and system integrators expand market reach and capabilities.

Regulatory engagement remains crucial for influencing policy development and ensuring favorable market conditions. International expansion leveraging German expertise and technology leadership can diversify revenue sources and reduce domestic market dependence. Sustainability positioning through carbon-neutral technologies and circular economy applications aligns with long-term market trends.

Investment priorities should emphasize research and development, manufacturing capacity expansion, and service network development to support growing market demand. Talent acquisition in digital technologies and renewable energy systems ensures organizational capabilities match market evolution.

Germany’s CHP market demonstrates exceptional long-term growth prospects driven by energy transition requirements, technological advancement, and supportive policy frameworks that position the sector for sustained expansion through 2030 and beyond. Market projections indicate continued robust growth with annual expansion rates of 7.5% expected over the next decade.

Technology evolution will emphasize renewable fuel compatibility, improved efficiency, and enhanced grid integration capabilities. Hydrogen CHP systems are projected to achieve commercial viability by 2028, creating new market segments and applications. Fuel cell technology costs are expected to decline by 40% by 2030, enabling widespread residential adoption and commercial building applications.

Market expansion will be driven by industrial modernization, district heating network development, and integration with renewable energy systems. MarkWide Research projects that renewable gas utilization in CHP applications will increase to 25% of total fuel consumption by 2030. Micro-CHP installations are expected to grow at 12% annually as technology costs decline and performance improves.

Policy support will continue through updated regulatory frameworks that emphasize carbon reduction and energy efficiency objectives. European integration will create additional opportunities through cross-border electricity trading and harmonized technical standards. Investment flows into CHP technology and infrastructure are projected to accelerate as sustainability objectives drive capital allocation decisions.

Competitive dynamics will intensify as new entrants and alternative technologies compete for market share, driving continued innovation and cost reduction. Market consolidation may accelerate as companies seek scale advantages and technology portfolios to serve diverse customer requirements.

Germany’s Combined Heat & Power market represents a cornerstone technology sector within the nation’s comprehensive energy transformation strategy, demonstrating remarkable resilience, innovation capacity, and growth potential that positions it as a global leader in efficient energy generation. The market’s evolution from traditional industrial applications to diverse, integrated energy solutions reflects both technological advancement and strategic policy support that creates sustainable competitive advantages.

Market fundamentals remain exceptionally strong, supported by robust regulatory frameworks, substantial industrial demand, and increasing recognition of CHP technology’s essential role in achieving carbon neutrality objectives. The convergence of digitalization, renewable energy integration, and circular economy principles creates multiple growth vectors that extend well beyond traditional market boundaries. Stakeholder benefits encompass economic, environmental, and strategic advantages that justify continued investment and market development.

Future prospects indicate sustained expansion driven by technology innovation, market diversification, and policy evolution that maintains Germany’s leadership position while creating export opportunities for domestic expertise. The successful integration of renewable fuels, advanced control systems, and hybrid configurations will determine long-term market success and contribution to national energy security objectives. Germany’s CHP market stands poised to play an increasingly vital role in the country’s sustainable energy future while serving as a model for global energy system transformation.

What is Combined Heat & Power?

Combined Heat & Power (CHP) refers to a technology that simultaneously generates electricity and useful heat from the same energy source. This process increases energy efficiency and can be applied in various sectors, including residential, commercial, and industrial applications.

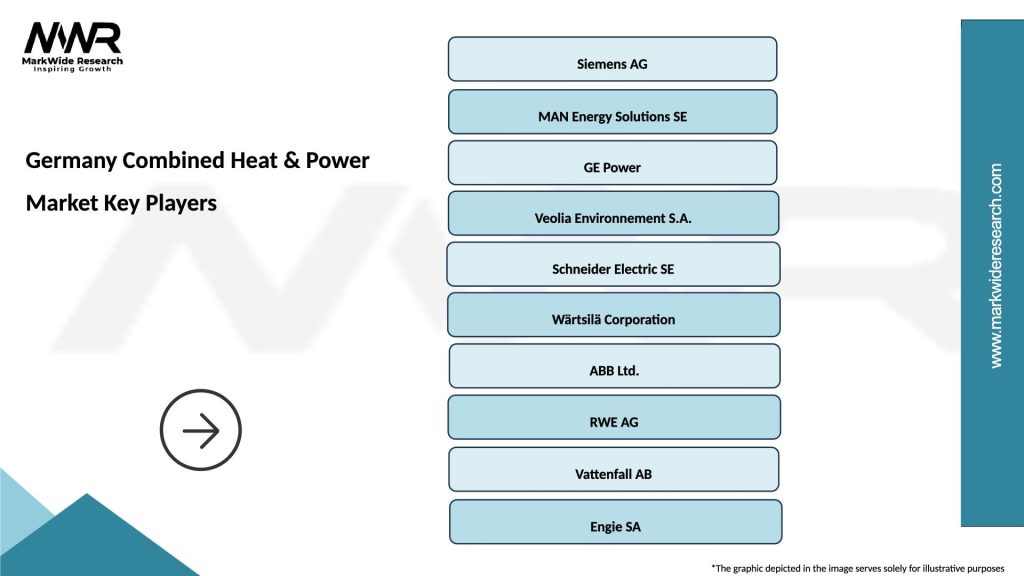

What are the key players in the Germany Combined Heat & Power Market?

Key players in the Germany Combined Heat & Power Market include Siemens AG, MAN Energy Solutions, and Bosch Thermotechnology, among others. These companies are involved in the development and deployment of CHP systems across various sectors.

What are the growth factors driving the Germany Combined Heat & Power Market?

The growth of the Germany Combined Heat & Power Market is driven by increasing energy efficiency demands, rising energy costs, and government incentives for renewable energy integration. Additionally, the push for reducing carbon emissions is encouraging the adoption of CHP technologies.

What challenges does the Germany Combined Heat & Power Market face?

The Germany Combined Heat & Power Market faces challenges such as high initial investment costs and regulatory complexities. Additionally, competition from alternative energy sources can hinder market growth.

What opportunities exist in the Germany Combined Heat & Power Market?

Opportunities in the Germany Combined Heat & Power Market include advancements in technology that enhance efficiency and reduce costs. Furthermore, the increasing focus on sustainability and energy independence presents significant growth potential for CHP systems.

What trends are shaping the Germany Combined Heat & Power Market?

Trends in the Germany Combined Heat & Power Market include the integration of smart grid technologies and the use of renewable energy sources in CHP systems. Additionally, there is a growing emphasis on decentralized energy production and energy storage solutions.

Germany Combined Heat & Power Market

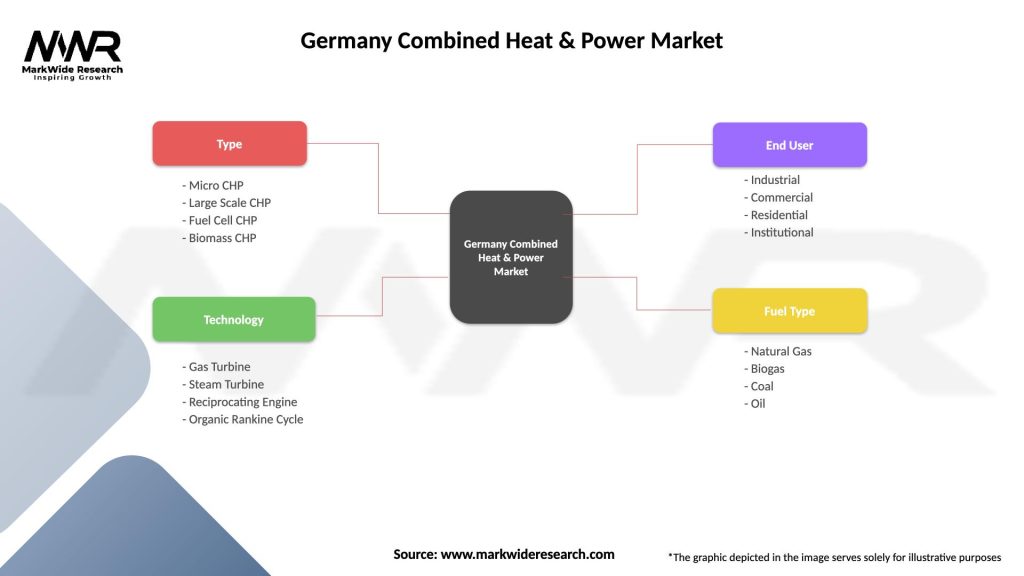

| Segmentation Details | Description |

|---|---|

| Type | Micro CHP, Large Scale CHP, Fuel Cell CHP, Biomass CHP |

| Technology | Gas Turbine, Steam Turbine, Reciprocating Engine, Organic Rankine Cycle |

| End User | Industrial, Commercial, Residential, Institutional |

| Fuel Type | Natural Gas, Biogas, Coal, Oil |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Combined Heat & Power Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at