444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany cold logistics market represents a critical component of the nation’s supply chain infrastructure, facilitating the temperature-controlled storage and transportation of perishable goods across diverse industries. Germany’s position as Europe’s largest economy and a major food processing hub has established it as a leading market for cold chain solutions, with the sector experiencing robust growth driven by increasing consumer demand for fresh and frozen products.

Market dynamics in Germany’s cold logistics sector are characterized by technological advancement, regulatory compliance, and sustainability initiatives. The market encompasses various temperature ranges from chilled storage at 2-8°C to deep-freeze facilities operating at -25°C or below, serving pharmaceutical, food and beverage, chemical, and agricultural sectors. Growth rates in the sector have consistently outpaced traditional logistics, with the market expanding at a compound annual growth rate of 6.2% over recent years.

Infrastructure development across Germany has been substantial, with major logistics hubs in Hamburg, Munich, Frankfurt, and Berlin driving market expansion. The integration of advanced technologies including IoT sensors, automated storage systems, and predictive analytics has enhanced operational efficiency by approximately 35% in leading facilities. MarkWide Research analysis indicates that Germany accounts for nearly 28% of the European cold logistics market share, reflecting its strategic importance in regional supply chains.

The Germany cold logistics market refers to the comprehensive ecosystem of temperature-controlled storage, transportation, and distribution services that maintain product integrity throughout the supply chain for temperature-sensitive goods. This specialized logistics segment ensures that perishable products maintain their quality, safety, and efficacy from production facilities to end consumers through controlled temperature environments.

Cold logistics encompasses multiple interconnected components including refrigerated warehousing, cold storage facilities, temperature-controlled transportation vehicles, monitoring systems, and specialized handling equipment. The market serves critical functions in preserving pharmaceutical products, fresh produce, dairy items, frozen foods, chemicals, and biotechnology products that require specific temperature conditions to maintain their properties and prevent spoilage.

Temperature zones within Germany’s cold logistics infrastructure typically include ambient controlled environments, chilled storage for fresh products, frozen storage for long-term preservation, and ultra-low temperature facilities for specialized pharmaceutical and biotechnology applications. The market’s significance extends beyond simple storage, encompassing value-added services such as quality control, inventory management, order fulfillment, and last-mile delivery solutions.

Germany’s cold logistics market demonstrates exceptional resilience and growth potential, driven by evolving consumer preferences, regulatory requirements, and technological innovations. The sector has emerged as a cornerstone of the country’s logistics infrastructure, supporting diverse industries while adapting to changing market demands and sustainability imperatives.

Key performance indicators reveal strong market fundamentals, with capacity utilization rates reaching 87% across major facilities and investment in automation technologies increasing by 42% annually. The market benefits from Germany’s strategic geographic position, advanced transportation networks, and robust regulatory framework that ensures high standards for temperature-sensitive product handling.

Market segmentation shows balanced growth across pharmaceutical cold chain services, food and beverage logistics, and specialty chemical storage. The pharmaceutical segment has experienced particularly strong expansion, growing at 8.4% annually, driven by increased vaccine distribution requirements and biotechnology product development. Sustainability initiatives have become increasingly important, with energy-efficient facilities and carbon-neutral transportation options gaining market traction.

Future prospects remain highly favorable, with market participants investing heavily in digital transformation, automation, and sustainable technologies. The integration of artificial intelligence, blockchain technology, and advanced monitoring systems is expected to drive operational efficiency improvements and enhance service quality across the cold logistics value chain.

Strategic insights into Germany’s cold logistics market reveal several critical trends shaping industry development and competitive dynamics:

Primary growth drivers propelling Germany’s cold logistics market include demographic shifts, regulatory changes, and evolving consumer behavior patterns that collectively create sustained demand for temperature-controlled logistics services.

Consumer demand evolution represents a fundamental market driver, with German consumers increasingly prioritizing fresh, organic, and premium food products that require sophisticated cold chain management. The rise of health-conscious consumption patterns has expanded demand for fresh produce, dairy products, and prepared meals, all requiring reliable temperature-controlled distribution networks.

Pharmaceutical industry expansion serves as another critical driver, particularly following increased vaccine distribution requirements and growing biotechnology sector development. The need for specialized storage conditions, including ultra-low temperature capabilities and validated cold chain processes, has created substantial market opportunities for specialized service providers.

E-commerce growth has fundamentally transformed cold logistics requirements, with online grocery sales and meal kit delivery services demanding flexible, scalable cold chain solutions. Last-mile delivery capabilities for temperature-sensitive products have become essential competitive differentiators for logistics service providers.

Regulatory compliance requirements continue driving market development, with stringent food safety standards, pharmaceutical regulations, and environmental guidelines necessitating advanced cold storage and transportation capabilities. These regulatory frameworks ensure high service standards while creating barriers to entry that benefit established market participants.

Significant challenges facing Germany’s cold logistics market include operational complexities, cost pressures, and regulatory compliance requirements that can limit market accessibility and profitability for some participants.

High capital requirements represent a primary market restraint, as cold storage facilities and refrigerated transportation equipment require substantial initial investments. The specialized nature of cold logistics infrastructure, including advanced refrigeration systems, monitoring equipment, and backup power systems, creates significant financial barriers for new market entrants.

Energy costs constitute an ongoing operational challenge, with refrigeration systems consuming substantial electricity and contributing to operational expenses. Rising energy prices and carbon taxation policies have increased operational costs, particularly for facilities operating at ultra-low temperatures required for pharmaceutical and biotechnology products.

Skilled labor shortage affects market growth, as cold logistics operations require specialized technical expertise for equipment maintenance, quality control, and regulatory compliance. The complexity of modern cold storage systems and stringent safety requirements necessitate ongoing training and certification programs that can strain human resources.

Regulatory complexity presents operational challenges, with multiple regulatory frameworks governing food safety, pharmaceutical storage, environmental compliance, and worker safety. Maintaining compliance across diverse regulatory requirements increases operational complexity and administrative costs for market participants.

Emerging opportunities in Germany’s cold logistics market span technological innovation, market expansion, and service diversification areas that present significant growth potential for forward-thinking market participants.

Digital transformation initiatives offer substantial opportunities for operational optimization and service enhancement. Implementation of artificial intelligence, machine learning, and predictive analytics can improve demand forecasting, optimize routing, and enhance preventive maintenance programs, creating competitive advantages for early adopters.

Sustainability solutions represent growing market opportunities, with increasing demand for carbon-neutral cold logistics services and energy-efficient facilities. Investment in renewable energy systems, alternative refrigerants, and sustainable packaging solutions can differentiate service providers while meeting corporate sustainability requirements.

Pharmaceutical cold chain expansion presents significant growth opportunities, particularly in specialized storage for cell and gene therapies, personalized medicines, and advanced biotechnology products requiring ultra-low temperature storage and validated distribution processes.

Regional market development offers expansion opportunities beyond major metropolitan areas, with secondary cities and rural regions requiring improved cold logistics infrastructure to support local food production and distribution networks. MWR analysis suggests that regional market penetration could increase overall market capacity by 23% over the next five years.

Complex market dynamics shape Germany’s cold logistics sector through interconnected factors including technological advancement, regulatory evolution, competitive pressures, and changing customer expectations that collectively influence market development trajectories.

Supply and demand balance in the German cold logistics market reflects strong underlying demand growth outpacing capacity expansion in certain segments, particularly pharmaceutical cold storage and last-mile delivery services. This dynamic has supported pricing stability while encouraging investment in new capacity and service capabilities.

Competitive intensity varies across market segments, with established players maintaining strong positions in traditional cold storage while new entrants focus on specialized services and technology-enabled solutions. Market consolidation trends have emerged as larger players acquire specialized service providers to expand service portfolios and geographic coverage.

Technology adoption rates continue accelerating, with digital solutions becoming essential for competitive positioning. Advanced warehouse management systems, real-time monitoring capabilities, and automated handling equipment have become standard requirements rather than competitive differentiators, raising the baseline for market participation.

Customer relationship dynamics have evolved toward long-term partnerships and integrated service agreements, with clients seeking comprehensive cold chain solutions rather than individual services. This trend has encouraged market participants to develop broader service capabilities and invest in customer-specific infrastructure.

Comprehensive research methodology employed for analyzing Germany’s cold logistics market incorporates multiple data sources, analytical techniques, and validation processes to ensure accuracy and reliability of market insights and projections.

Primary research activities included structured interviews with industry executives, facility managers, and technology providers across the cold logistics value chain. Survey data collection from market participants provided quantitative insights into operational performance, investment priorities, and market outlook perspectives.

Secondary research sources encompassed industry publications, regulatory filings, company annual reports, and trade association data to establish market baselines and validate primary research findings. Government statistics, customs data, and economic indicators provided macroeconomic context for market analysis.

Data validation processes included cross-referencing multiple sources, expert review panels, and statistical analysis to ensure data accuracy and consistency. Market sizing methodologies employed bottom-up and top-down approaches to validate market estimates and growth projections.

Analytical frameworks incorporated Porter’s Five Forces analysis, SWOT assessment, and competitive positioning analysis to provide comprehensive market understanding. Trend analysis and scenario modeling supported development of market forecasts and strategic recommendations for industry participants.

Regional distribution of Germany’s cold logistics market reflects the country’s economic geography, with major metropolitan areas and industrial centers driving demand while rural regions present emerging opportunities for market expansion.

North Rhine-Westphalia represents the largest regional market, accounting for approximately 24% of national cold storage capacity, driven by its dense population, industrial concentration, and proximity to major European markets. The region’s extensive transportation infrastructure and port access through the Rhine River system support robust cold logistics operations.

Bavaria constitutes another significant market region, with 18% market share, benefiting from strong pharmaceutical and biotechnology industries centered around Munich and Nuremberg. The region’s agricultural production and food processing sectors create substantial demand for cold storage and distribution services.

Hamburg and surrounding areas serve as critical logistics hubs, with the port of Hamburg facilitating international cold chain operations and distribution throughout Northern Europe. The region’s strategic position supports approximately 15% of Germany’s cold logistics capacity, with particular strength in seafood and international food product distribution.

Frankfurt region benefits from its position as a major transportation hub, with Frankfurt Airport serving as a critical node for pharmaceutical cold chain operations and time-sensitive temperature-controlled shipments. The region’s logistics infrastructure supports efficient distribution to major European markets.

Emerging regional markets in Eastern Germany present growth opportunities, with improving infrastructure and economic development creating demand for modern cold logistics facilities. These regions offer cost advantages and strategic positioning for serving Eastern European markets.

Germany’s cold logistics market features a diverse competitive landscape encompassing international logistics giants, specialized cold storage providers, and technology-focused service companies competing across various market segments and service categories.

Competitive strategies focus on technology integration, service specialization, and geographic expansion to capture market share and enhance customer relationships. Market leaders invest heavily in automation, sustainability initiatives, and digital platforms to differentiate their service offerings.

Market segmentation of Germany’s cold logistics sector reveals distinct categories based on temperature requirements, industry applications, and service types that serve diverse customer needs and operational requirements.

By Temperature Range:

By Industry Application:

By Service Type:

Food and beverage logistics represents the largest category within Germany’s cold logistics market, driven by consumer demand for fresh products and the country’s position as a major food processing hub. This segment benefits from stable demand patterns and established distribution networks, with growth supported by premium product trends and organic food consumption.

Pharmaceutical cold chain services constitute the fastest-growing category, experiencing expansion rates of 8.4% annually due to increased vaccine distribution, biotechnology product development, and stringent regulatory requirements. This segment commands premium pricing due to specialized handling requirements and validation processes.

E-commerce fulfillment has emerged as a significant growth category, with online grocery and meal kit services driving demand for flexible cold storage solutions and last-mile delivery capabilities. This segment requires innovative approaches to temperature control and customer service integration.

International trade facilitation represents an important category leveraging Germany’s strategic position in European markets. Cold storage facilities supporting import/export operations and customs-bonded storage provide critical infrastructure for international food and pharmaceutical trade.

Specialty chemicals and industrial products constitute a niche but profitable category requiring specialized handling capabilities and regulatory compliance. This segment benefits from Germany’s strong chemical industry and advanced manufacturing base.

Industry participants in Germany’s cold logistics market realize substantial benefits through operational efficiency improvements, market expansion opportunities, and enhanced service capabilities that strengthen competitive positioning and financial performance.

Operational efficiency gains result from advanced technology implementation, with automated systems reducing labor costs by approximately 30% while improving accuracy and throughput. Energy management systems and predictive maintenance programs further enhance operational performance and reduce total cost of ownership.

Market expansion opportunities enable participants to diversify service portfolios and geographic coverage, reducing dependence on individual market segments while capturing growth in emerging areas such as pharmaceutical logistics and e-commerce fulfillment.

Customer relationship benefits include long-term contracts, integrated service agreements, and strategic partnerships that provide revenue stability and growth opportunities. Value-added services create additional revenue streams while strengthening customer loyalty and switching costs.

Stakeholder advantages extend to suppliers, customers, and communities through improved supply chain reliability, enhanced product quality, and economic development contributions. MarkWide Research indicates that modern cold logistics facilities generate approximately 40% more local economic impact compared to traditional warehouse operations.

Investment returns for facility owners and operators benefit from strong demand fundamentals, stable cash flows, and asset appreciation potential. The specialized nature of cold storage infrastructure creates barriers to entry that support sustainable competitive advantages and pricing power.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation integration represents a dominant trend transforming Germany’s cold logistics market, with robotic systems, automated storage and retrieval solutions, and artificial intelligence optimizing warehouse operations and reducing labor dependency. These technologies improve accuracy, speed, and cost-effectiveness while addressing skilled labor shortages.

Sustainability focus has become increasingly important, with market participants investing in energy-efficient refrigeration systems, renewable energy sources, and carbon-neutral transportation options. Environmental regulations and corporate sustainability commitments drive adoption of natural refrigerants and green building standards.

Digital connectivity through IoT sensors, blockchain technology, and cloud-based platforms enables real-time monitoring, predictive maintenance, and supply chain transparency. These digital solutions enhance quality control, reduce waste, and improve customer service capabilities.

Pharmaceutical specialization continues expanding, with facilities developing ultra-low temperature capabilities, validated processes, and specialized handling procedures for biotechnology products. This trend creates premium service opportunities and higher-margin business segments.

Last-mile innovation addresses e-commerce growth through mobile cold storage units, micro-fulfillment centers, and alternative delivery methods maintaining temperature control throughout the final delivery process. These solutions support online grocery and meal kit services.

Consolidation activity in the market includes mergers, acquisitions, and strategic partnerships as companies seek scale advantages, expanded service capabilities, and geographic coverage. This trend creates larger, more integrated service providers with comprehensive cold chain solutions.

Recent industry developments in Germany’s cold logistics market reflect ongoing transformation through technology adoption, capacity expansion, and strategic initiatives that reshape competitive dynamics and service capabilities.

Facility expansions have accelerated across major metropolitan areas, with several large-scale cold storage developments adding substantial capacity to meet growing demand. These projects incorporate advanced automation, energy-efficient systems, and multi-temperature capabilities to serve diverse customer requirements.

Technology partnerships between logistics providers and technology companies have resulted in innovative solutions for temperature monitoring, predictive analytics, and automated handling systems. These collaborations enhance operational efficiency and service quality while reducing costs.

Sustainability initiatives include major investments in solar power systems, natural refrigerant adoption, and carbon-neutral transportation fleets. Several market leaders have committed to achieving net-zero emissions by 2030, driving industry-wide environmental improvements.

Pharmaceutical certifications and specialized facility developments have expanded to meet growing vaccine distribution and biotechnology storage requirements. These developments include GDP-certified facilities and ultra-low temperature storage capabilities.

Strategic acquisitions have consolidated market positions and expanded service portfolios, with larger players acquiring specialized service providers and regional operators to enhance geographic coverage and technical capabilities.

Strategic recommendations for Germany’s cold logistics market participants focus on technology adoption, service differentiation, and operational optimization to maintain competitive advantages and capture growth opportunities in evolving market conditions.

Technology investment priorities should emphasize automation, digital monitoring systems, and predictive analytics to improve operational efficiency and service quality. Early adoption of emerging technologies can create sustainable competitive advantages and operational cost reductions.

Service specialization strategies recommend focusing on high-value segments such as pharmaceutical logistics, e-commerce fulfillment, or sustainability-focused services where premium pricing and customer loyalty opportunities exist. Developing deep expertise in specialized areas can differentiate service providers.

Geographic expansion considerations suggest evaluating opportunities in secondary markets and regional areas where cold logistics infrastructure remains underdeveloped. These markets may offer lower competition and higher growth potential compared to saturated metropolitan areas.

Partnership development with technology providers, customers, and complementary service companies can enhance capabilities while sharing investment risks and costs. Strategic alliances can accelerate market entry and capability development.

Sustainability integration should become a core business strategy rather than a compliance requirement, with investments in renewable energy, efficient systems, and carbon-neutral operations creating competitive advantages and meeting customer expectations.

Future prospects for Germany’s cold logistics market remain highly positive, with sustained growth expected across multiple segments driven by demographic trends, technological advancement, and evolving consumer preferences that support long-term market expansion.

Growth projections indicate continued market expansion at a compound annual growth rate of 6.8% over the next five years, with pharmaceutical cold chain services and e-commerce fulfillment leading growth rates. Market capacity is expected to increase by 45% during this period to meet expanding demand.

Technology evolution will continue transforming market operations through artificial intelligence, robotics, and advanced monitoring systems that improve efficiency, reduce costs, and enhance service quality. Digital transformation initiatives are expected to become standard requirements for competitive participation.

Sustainability requirements will intensify, with environmental regulations and customer expectations driving adoption of carbon-neutral operations, renewable energy systems, and circular economy principles. These trends will create both challenges and opportunities for market participants.

Market consolidation is likely to continue, with larger players acquiring specialized service providers and regional operators to achieve scale advantages and expanded service capabilities. This trend may reduce the number of independent operators while creating more comprehensive service providers.

International expansion opportunities may emerge as German cold logistics companies leverage their expertise and technology capabilities to serve Eastern European and other international markets, creating additional growth avenues beyond domestic operations.

Germany’s cold logistics market represents a dynamic and rapidly evolving sector that plays a critical role in the country’s supply chain infrastructure and economic development. The market demonstrates strong fundamentals driven by diverse industry demand, technological innovation, and strategic geographic positioning that support sustained growth prospects.

Key success factors for market participants include technology adoption, operational efficiency, service specialization, and sustainability integration that create competitive advantages and customer value. The market rewards companies that invest in advanced capabilities while maintaining high service standards and regulatory compliance.

Future opportunities span multiple dimensions including pharmaceutical cold chain expansion, e-commerce fulfillment growth, regional market development, and international expansion that provide diverse pathways for market participants to achieve growth objectives and enhance market positions.

The Germany cold logistics market is well-positioned to continue its growth trajectory, supported by strong underlying demand, technological advancement, and strategic infrastructure investments that reinforce its position as a leading European cold chain hub serving diverse industries and customer segments with excellence and innovation.

What is Cold Logistics?

Cold logistics refers to the transportation and storage of temperature-sensitive goods, such as perishable food items, pharmaceuticals, and chemicals, that require specific temperature conditions to maintain their quality and safety.

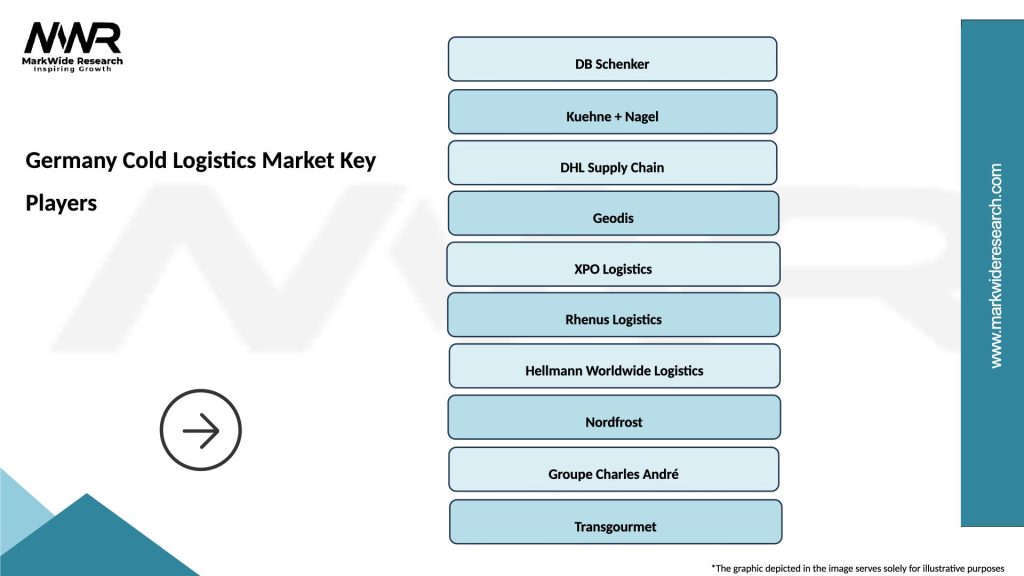

What are the key players in the Germany Cold Logistics Market?

Key players in the Germany Cold Logistics Market include companies like DHL Supply Chain, Kuehne + Nagel, and DB Schenker, which provide specialized cold chain solutions for various industries, among others.

What are the main drivers of growth in the Germany Cold Logistics Market?

The main drivers of growth in the Germany Cold Logistics Market include the increasing demand for fresh food products, the rise in e-commerce for perishable goods, and stringent regulations regarding food safety and quality.

What challenges does the Germany Cold Logistics Market face?

Challenges in the Germany Cold Logistics Market include high operational costs, the complexity of maintaining temperature control during transportation, and the need for advanced technology to monitor and manage cold chain processes.

What opportunities exist in the Germany Cold Logistics Market?

Opportunities in the Germany Cold Logistics Market include the expansion of online grocery shopping, advancements in refrigeration technology, and the growing demand for temperature-controlled pharmaceuticals.

What trends are shaping the Germany Cold Logistics Market?

Trends shaping the Germany Cold Logistics Market include the adoption of IoT for real-time tracking, increased focus on sustainability in logistics operations, and the integration of automation in cold storage facilities.

Germany Cold Logistics Market

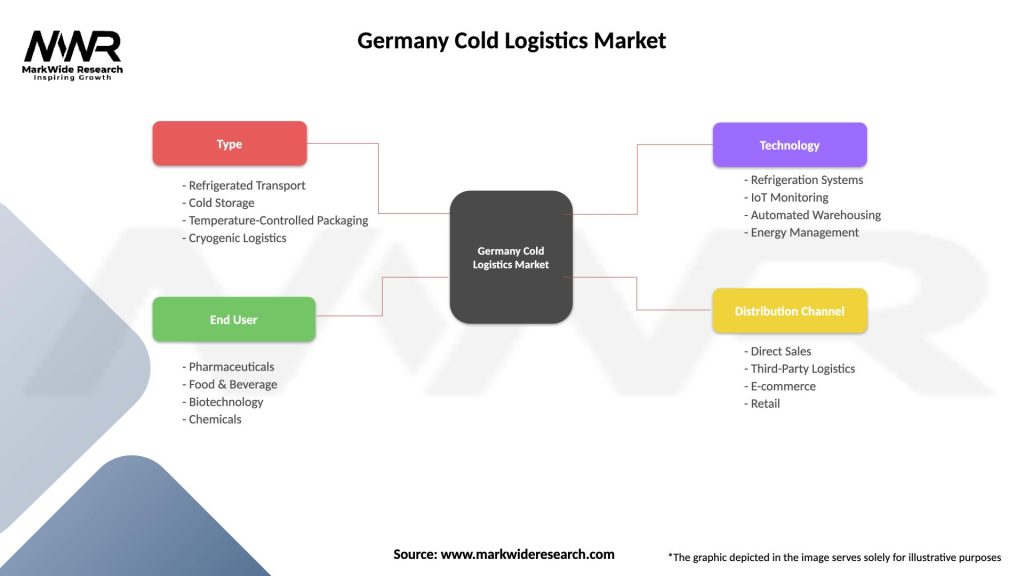

| Segmentation Details | Description |

|---|---|

| Type | Refrigerated Transport, Cold Storage, Temperature-Controlled Packaging, Cryogenic Logistics |

| End User | Pharmaceuticals, Food & Beverage, Biotechnology, Chemicals |

| Technology | Refrigeration Systems, IoT Monitoring, Automated Warehousing, Energy Management |

| Distribution Channel | Direct Sales, Third-Party Logistics, E-commerce, Retail |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Cold Logistics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at