444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany cloud computing market represents one of Europe’s most dynamic and rapidly evolving technology sectors, driven by accelerating digital transformation initiatives across industries. German enterprises are increasingly adopting cloud-based solutions to enhance operational efficiency, reduce infrastructure costs, and improve scalability. The market encompasses a comprehensive range of services including Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS), with growing emphasis on hybrid and multi-cloud architectures.

Market dynamics indicate robust growth momentum, with the sector experiencing a compound annual growth rate (CAGR) of 12.8% as organizations prioritize cloud migration strategies. Key drivers include stringent data protection regulations, increasing demand for remote work solutions, and the need for advanced analytics capabilities. The market benefits from Germany’s strong industrial base, particularly in automotive, manufacturing, and financial services sectors, which are actively embracing cloud technologies to maintain competitive advantages.

Regional leadership in cloud adoption is evident across major metropolitan areas including Berlin, Munich, Frankfurt, and Hamburg, where technology hubs and data centers are concentrated. Public cloud adoption has reached approximately 68% penetration rate among German enterprises, while private cloud implementations continue to grow due to data sovereignty concerns and regulatory compliance requirements.

The Germany cloud computing market refers to the comprehensive ecosystem of cloud-based services, infrastructure, and solutions deployed across German enterprises and organizations. This market encompasses the delivery of computing resources, applications, and data storage services through internet-connected networks, enabling businesses to access scalable technology solutions without maintaining physical infrastructure.

Cloud computing in the German context involves three primary service models: Infrastructure as a Service providing virtualized computing resources, Platform as a Service offering development and deployment environments, and Software as a Service delivering applications through web browsers. Deployment models include public clouds operated by third-party providers, private clouds dedicated to single organizations, and hybrid clouds combining both approaches.

Market significance extends beyond technology adoption to encompass economic transformation, regulatory compliance, and competitive positioning within the European Union. German organizations leverage cloud computing to achieve digital sovereignty, enhance data security, and comply with regulations such as the General Data Protection Regulation (GDPR) while maintaining operational flexibility and innovation capabilities.

Germany’s cloud computing landscape demonstrates exceptional growth potential driven by comprehensive digital transformation strategies across public and private sectors. The market exhibits strong momentum with enterprise adoption rates increasing by 15.2% annually as organizations recognize cloud computing’s strategic importance for business continuity, scalability, and innovation.

Key market characteristics include predominant adoption of hybrid cloud architectures, emphasis on data sovereignty and regulatory compliance, and growing investment in edge computing capabilities. Industry verticals such as manufacturing, automotive, healthcare, and financial services lead cloud adoption initiatives, leveraging advanced analytics, artificial intelligence, and machine learning capabilities to drive operational excellence.

Competitive dynamics feature a mix of global cloud providers and regional specialists, with increasing focus on German data residency requirements and localized support services. Market evolution is characterized by shift toward multi-cloud strategies, containerization adoption, and integration of emerging technologies including Internet of Things (IoT) and blockchain solutions.

Future prospects indicate sustained growth momentum supported by government digitalization initiatives, Industry 4.0 implementation, and increasing demand for cloud-native applications. Strategic investments in data center infrastructure, edge computing networks, and cybersecurity capabilities position Germany as a leading European cloud computing hub.

Strategic market insights reveal fundamental shifts in how German organizations approach technology infrastructure and digital transformation. MarkWide Research analysis indicates several critical trends shaping market evolution and competitive positioning.

Digital transformation imperatives serve as the primary catalyst driving Germany’s cloud computing market expansion. German enterprises recognize cloud computing as essential infrastructure for maintaining competitiveness in increasingly digital business environments. Organizations across industries are modernizing legacy systems, implementing data-driven decision-making processes, and enhancing customer experiences through cloud-enabled technologies.

Cost optimization pressures motivate organizations to adopt cloud solutions that reduce capital expenditure requirements and operational overhead. Traditional IT infrastructure maintenance costs, including hardware procurement, software licensing, and technical support, create significant financial burdens that cloud computing addresses through scalable, pay-as-you-use models.

Remote work acceleration following global pandemic impacts has fundamentally altered workplace dynamics and technology requirements. Cloud-based collaboration tools, virtual desktop infrastructure, and distributed computing capabilities enable German organizations to maintain productivity and business continuity regardless of physical location constraints.

Regulatory compliance requirements drive cloud adoption as organizations seek solutions that simplify adherence to complex data protection, financial reporting, and industry-specific regulations. Cloud providers offering German data residency, comprehensive audit trails, and automated compliance reporting capabilities gain competitive advantages in the market.

Innovation acceleration through cloud computing enables German companies to rapidly deploy new applications, experiment with emerging technologies, and scale successful initiatives without significant infrastructure investments. Development agility and time-to-market improvements become critical competitive differentiators across industries.

Data sovereignty concerns represent significant barriers to cloud adoption among German organizations prioritizing data control and regulatory compliance. Strict data protection requirements under GDPR and national regulations create hesitation regarding public cloud deployments, particularly for sensitive business information and personal data processing.

Security apprehensions persist despite advances in cloud security technologies, with organizations expressing concerns about data breaches, unauthorized access, and cyber attacks. Legacy security mindsets and risk-averse corporate cultures slow cloud migration initiatives, particularly in highly regulated industries such as banking and healthcare.

Skills shortage challenges limit organizations’ ability to effectively implement and manage cloud computing solutions. Technical expertise gaps in cloud architecture, security management, and DevOps practices create implementation delays and increase dependency on external consultants and managed services providers.

Integration complexity with existing IT infrastructure and business applications creates technical and operational challenges that organizations must address during cloud migration projects. Legacy system dependencies and data migration requirements often result in extended implementation timelines and increased costs.

Vendor lock-in concerns influence cloud provider selection decisions as organizations seek to maintain flexibility and avoid dependency on single technology platforms. Interoperability limitations and proprietary technologies can restrict future migration options and increase long-term costs.

Industry 4.0 initiatives present substantial growth opportunities for cloud computing providers serving Germany’s manufacturing sector. Smart factory implementations require scalable computing resources, real-time data processing capabilities, and advanced analytics platforms that cloud solutions can efficiently deliver.

Government digitalization programs create significant market expansion opportunities as public sector organizations modernize IT infrastructure and citizen services. Digital government initiatives require secure, compliant cloud platforms that can support large-scale data processing and citizen-facing applications.

Edge computing deployment opportunities emerge from increasing demand for low-latency applications, IoT implementations, and distributed computing architectures. 5G network rollouts enable new use cases requiring edge computing capabilities that complement traditional cloud services.

Artificial intelligence and machine learning adoption creates demand for specialized cloud platforms offering GPU computing, data lake storage, and pre-built AI services. German enterprises seeking competitive advantages through data analytics and automation represent significant growth opportunities for cloud providers.

Sustainability initiatives drive demand for energy-efficient cloud solutions that help organizations reduce carbon footprints and achieve environmental goals. Green cloud computing offerings powered by renewable energy sources align with Germany’s environmental commitments and corporate sustainability objectives.

Competitive intensity continues escalating as global cloud providers expand German operations while regional specialists strengthen market positions through localized offerings and compliance expertise. Market dynamics reflect ongoing consolidation trends, strategic partnerships, and technology innovation cycles that reshape competitive landscapes.

Pricing pressures intensify as cloud providers compete for enterprise customers through aggressive pricing strategies, bundled service offerings, and flexible contract terms. Cost optimization becomes increasingly important as organizations evaluate total cost of ownership across different cloud deployment models and provider options.

Technology evolution drives continuous market transformation through emerging capabilities including serverless computing, containerization, and quantum computing services. Innovation cycles accelerate as providers invest heavily in research and development to maintain competitive differentiation and market leadership positions.

Customer expectations evolve toward demanding higher service levels, enhanced security capabilities, and seamless integration with existing business processes. Service quality and customer support become critical differentiators as organizations evaluate long-term cloud partnerships.

Regulatory landscape changes influence market dynamics through evolving data protection requirements, cybersecurity mandates, and digital sovereignty initiatives. Compliance capabilities increasingly determine provider selection decisions and market positioning strategies.

Comprehensive market analysis employs multi-faceted research approaches combining primary and secondary data sources to ensure accuracy and reliability of market insights. Research methodology incorporates quantitative analysis, qualitative assessments, and industry expert consultations to provide holistic market understanding.

Primary research activities include structured interviews with cloud computing executives, IT decision-makers, and technology vendors across various industry verticals. Survey methodologies capture market trends, adoption patterns, and future investment intentions through statistically significant sample sizes representing diverse organizational profiles.

Secondary research sources encompass industry reports, government publications, regulatory filings, and technology vendor documentation to validate primary findings and provide historical context. Data triangulation ensures research accuracy through cross-verification of information from multiple independent sources.

Market modeling techniques utilize advanced statistical methods, trend analysis, and forecasting algorithms to project market growth trajectories and identify emerging opportunities. Scenario analysis evaluates potential market developments under different economic and regulatory conditions.

Quality assurance processes include peer review, expert validation, and continuous monitoring of market developments to maintain research relevance and accuracy throughout the analysis period.

North Rhine-Westphalia leads Germany’s cloud computing adoption with 28% market share, driven by concentrated industrial activity, major metropolitan areas, and established technology infrastructure. Düsseldorf and Cologne serve as primary cloud computing hubs with significant data center investments and enterprise customer concentrations.

Bavaria represents the second-largest regional market with 22% market share, benefiting from Munich’s technology sector strength and automotive industry cloud adoption. Regional advantages include proximity to major European markets, strong research institutions, and government support for digitalization initiatives.

Baden-Württemberg accounts for 18% market share with Stuttgart serving as a key automotive and manufacturing cloud computing center. Industry concentration in advanced manufacturing, automotive, and engineering sectors drives demand for specialized cloud solutions supporting Industry 4.0 implementations.

Berlin-Brandenburg captures 15% market share as Germany’s startup and technology innovation hub, with growing cloud adoption among emerging companies and established enterprises. Government presence and public sector digitalization initiatives contribute to regional market growth.

Hesse maintains 12% market share with Frankfurt’s financial services sector driving cloud adoption for trading platforms, risk management, and regulatory compliance applications. Data center infrastructure concentration supports regional cloud computing growth and international connectivity.

Remaining regions collectively represent 5% market share with growing adoption rates as cloud infrastructure expands beyond major metropolitan areas to serve distributed enterprise operations and regional businesses.

Market leadership reflects intense competition among global cloud providers and specialized regional players, each offering distinct value propositions tailored to German market requirements. Competitive positioning emphasizes data sovereignty, regulatory compliance, and localized support capabilities.

Competitive strategies focus on differentiation through specialized industry solutions, enhanced security capabilities, and comprehensive compliance support. Market consolidation continues through strategic acquisitions and partnerships aimed at expanding service portfolios and geographic coverage.

Service model segmentation reveals distinct market dynamics across Infrastructure as a Service, Platform as a Service, and Software as a Service categories, each addressing specific customer requirements and use cases.

By Service Type:

By Deployment Model:

By Organization Size:

Manufacturing sector leads cloud adoption with comprehensive Industry 4.0 implementations leveraging IoT integration, predictive analytics, and supply chain optimization. Automotive companies particularly embrace cloud computing for connected vehicle platforms, autonomous driving development, and manufacturing process optimization.

Financial services demonstrate strong cloud growth driven by digital banking initiatives, regulatory compliance requirements, and customer experience enhancement. Banking institutions prioritize hybrid cloud architectures that balance innovation capabilities with stringent security and regulatory requirements.

Healthcare organizations increasingly adopt cloud solutions for electronic health records, telemedicine platforms, and medical research applications. Data privacy concerns and regulatory compliance drive preference for private and hybrid cloud deployments with German data residency guarantees.

Retail and e-commerce sectors leverage cloud computing for omnichannel customer experiences, inventory management, and data analytics. Digital transformation initiatives focus on personalization, supply chain optimization, and mobile commerce capabilities.

Government and public sector adoption accelerates through digitalization programs aimed at improving citizen services and operational efficiency. Cloud-first policies encourage migration to secure, compliant cloud platforms while maintaining data sovereignty requirements.

Education institutions embrace cloud computing for remote learning platforms, research computing, and administrative systems. Digital learning initiatives drive demand for scalable, collaborative cloud solutions supporting diverse educational requirements.

Cost optimization represents the primary benefit driving cloud adoption as organizations reduce capital expenditure requirements and operational overhead through scalable, pay-as-you-use models. Financial flexibility enables businesses to align technology costs with actual usage patterns and business growth trajectories.

Scalability advantages allow organizations to rapidly adjust computing resources based on demand fluctuations without infrastructure constraints. Elastic scaling capabilities support business growth, seasonal variations, and unexpected workload spikes through automated resource provisioning.

Innovation acceleration through cloud computing enables rapid deployment of new applications, experimentation with emerging technologies, and faster time-to-market for digital initiatives. Development agility improves competitive positioning and customer responsiveness across industries.

Enhanced security capabilities provided by cloud providers often exceed internal IT security resources through specialized expertise, advanced threat detection, and continuous monitoring. Compliance support simplifies adherence to regulatory requirements through automated reporting and audit capabilities.

Business continuity improvements result from cloud computing’s inherent redundancy, disaster recovery capabilities, and geographic distribution. Operational resilience ensures minimal downtime and rapid recovery from disruptions affecting business operations.

Global accessibility enables distributed teams and international operations through consistent application access and data availability. Remote work support facilitates flexible working arrangements and business continuity during challenging circumstances.

Strengths:

Weaknesses:

Opportunities:

Threats:

Hybrid cloud architecture adoption accelerates as German organizations seek to balance flexibility with data control requirements. Multi-cloud strategies become increasingly popular for avoiding vendor lock-in while optimizing performance across different workloads and applications.

Edge computing integration expands rapidly to support low-latency applications, IoT implementations, and distributed computing requirements. 5G network deployment enables new use cases requiring edge computing capabilities that complement traditional centralized cloud services.

Artificial intelligence and machine learning integration becomes standard across cloud platforms, enabling advanced analytics, automation, and intelligent decision-making capabilities. AI-powered cloud services drive competitive differentiation and business value creation.

Containerization and microservices adoption increases as organizations modernize applications for cloud-native architectures. DevOps practices become essential for managing complex, distributed cloud environments and accelerating development cycles.

Sustainability focus drives demand for energy-efficient cloud solutions powered by renewable energy sources. Green cloud computing initiatives align with Germany’s environmental commitments and corporate sustainability objectives.

Zero-trust security models gain adoption as organizations implement comprehensive security frameworks for cloud environments. Identity and access management becomes critical for protecting distributed cloud resources and data.

Major cloud providers continue expanding German data center presence to address data sovereignty requirements and improve service performance. Infrastructure investments focus on edge computing capabilities, renewable energy integration, and advanced security features.

Strategic partnerships between global cloud providers and German system integrators strengthen local market presence and customer support capabilities. Collaboration initiatives combine international technology expertise with regional market knowledge and compliance understanding.

Government initiatives promote cloud adoption through digital transformation programs, regulatory frameworks, and public sector modernization projects. GAIA-X project aims to establish European cloud infrastructure standards and data sovereignty principles.

Industry consolidation continues through acquisitions and mergers aimed at expanding service portfolios, customer bases, and geographic coverage. Market concentration increases as smaller providers seek partnerships or acquisition opportunities.

Technology innovations focus on quantum computing services, advanced AI capabilities, and autonomous cloud management systems. Research investments drive next-generation cloud computing capabilities and competitive differentiation.

Regulatory developments influence market dynamics through evolving data protection requirements, cybersecurity mandates, and digital sovereignty initiatives. Compliance frameworks become increasingly important for market access and customer trust.

Cloud providers should prioritize German data residency capabilities and comprehensive compliance support to address market-specific requirements. Localization strategies including regional data centers, German-speaking support, and local partnerships enhance competitive positioning and customer trust.

Enterprise customers should develop comprehensive cloud strategies that balance innovation capabilities with regulatory compliance and data sovereignty requirements. Multi-cloud approaches provide flexibility while avoiding vendor lock-in and optimizing performance across different workloads.

Investment focus should emphasize edge computing capabilities, artificial intelligence integration, and sustainability initiatives to capture emerging market opportunities. MWR analysis suggests that organizations investing in these areas will achieve competitive advantages and market leadership positions.

Skills development initiatives are essential for addressing cloud computing expertise gaps and enabling successful implementation projects. Training programs and certification initiatives should focus on cloud architecture, security management, and DevOps practices.

Security investments must remain priority considerations as organizations expand cloud adoption and face evolving cyber threats. Zero-trust architectures and comprehensive identity management systems provide essential protection for distributed cloud environments.

Partnership strategies should leverage complementary capabilities and market expertise to enhance service offerings and customer reach. Ecosystem development through strategic alliances creates competitive advantages and accelerates market growth.

Long-term growth prospects remain highly positive as German organizations continue digital transformation initiatives and embrace cloud-first strategies. Market evolution will be characterized by increasing sophistication in cloud architectures, enhanced security capabilities, and deeper integration with emerging technologies.

Technology advancement will drive new use cases and market opportunities through quantum computing services, advanced AI capabilities, and autonomous cloud management systems. Innovation cycles will accelerate as providers invest heavily in research and development to maintain competitive differentiation.

Regulatory landscape evolution will continue influencing market dynamics through data sovereignty requirements, cybersecurity mandates, and environmental regulations. Compliance capabilities will become increasingly important for market success and customer trust.

Industry transformation will accelerate as cloud computing becomes integral to business operations across all sectors. Digital-native companies will gain competitive advantages while traditional organizations must adapt or risk market position erosion.

Sustainability initiatives will drive demand for environmentally responsible cloud solutions powered by renewable energy sources. Green cloud computing will become standard practice rather than competitive differentiator as environmental concerns intensify.

Market consolidation will continue as smaller providers seek partnerships or acquisition opportunities while major players expand through strategic investments and geographic expansion. Competitive dynamics will favor providers offering comprehensive solutions, strong compliance capabilities, and superior customer support.

Germany’s cloud computing market represents a dynamic and rapidly evolving technology sector with substantial growth potential driven by digital transformation imperatives, regulatory compliance requirements, and innovation acceleration needs. Market fundamentals remain strong with increasing enterprise adoption rates, expanding service portfolios, and growing investment in cloud infrastructure and capabilities.

Key success factors for market participants include comprehensive compliance support, German data residency capabilities, and specialized industry solutions that address specific customer requirements. Competitive positioning will increasingly depend on ability to balance innovation with regulatory compliance while providing superior customer experiences and support.

Future market development will be shaped by emerging technologies, evolving regulatory frameworks, and changing customer expectations as cloud computing becomes integral to business operations across all industries. Organizations that successfully navigate these dynamics while maintaining focus on security, compliance, and customer value will achieve sustained competitive advantages in Germany’s expanding cloud computing market.

What is Cloud Computing?

Cloud computing refers to the delivery of computing services over the internet, including storage, processing, and software. It enables businesses to access technology resources on-demand without the need for physical infrastructure.

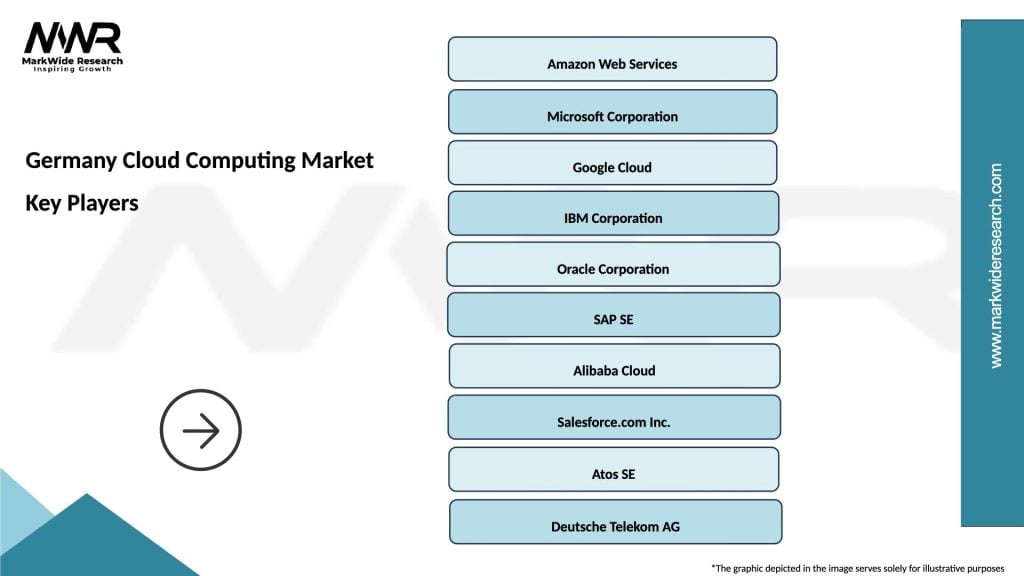

What are the key players in the Germany Cloud Computing Market?

Key players in the Germany Cloud Computing Market include SAP, Deutsche Telekom, and Amazon Web Services, among others. These companies provide a range of cloud services, including infrastructure as a service (IaaS) and software as a service (SaaS).

What are the main drivers of growth in the Germany Cloud Computing Market?

The main drivers of growth in the Germany Cloud Computing Market include the increasing demand for scalable IT solutions, the rise of remote work, and the need for enhanced data security. Businesses are increasingly adopting cloud solutions to improve efficiency and reduce costs.

What challenges does the Germany Cloud Computing Market face?

The Germany Cloud Computing Market faces challenges such as data privacy concerns, regulatory compliance issues, and the complexity of cloud migration. Companies must navigate these challenges to successfully implement cloud solutions.

What opportunities exist in the Germany Cloud Computing Market?

Opportunities in the Germany Cloud Computing Market include the growth of artificial intelligence and machine learning applications, the expansion of hybrid cloud solutions, and the increasing adoption of cloud services by small and medium-sized enterprises. These trends are expected to drive innovation and investment.

What trends are shaping the Germany Cloud Computing Market?

Trends shaping the Germany Cloud Computing Market include the shift towards multi-cloud strategies, the integration of edge computing, and the focus on sustainability in cloud operations. These trends are influencing how businesses leverage cloud technologies.

Germany Cloud Computing Market

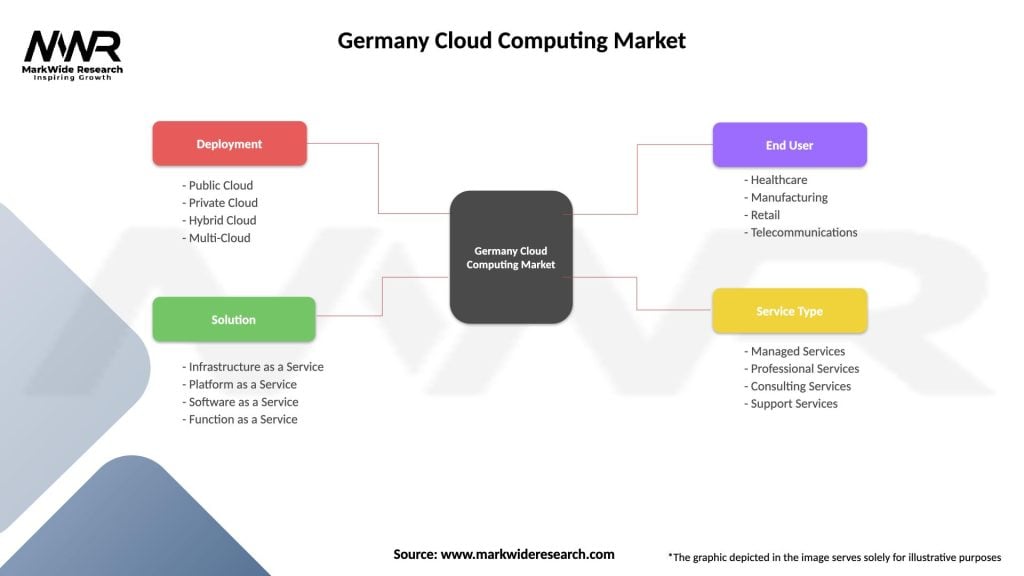

| Segmentation Details | Description |

|---|---|

| Deployment | Public Cloud, Private Cloud, Hybrid Cloud, Multi-Cloud |

| Solution | Infrastructure as a Service, Platform as a Service, Software as a Service, Function as a Service |

| End User | Healthcare, Manufacturing, Retail, Telecommunications |

| Service Type | Managed Services, Professional Services, Consulting Services, Support Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Cloud Computing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at