444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany blood glucose market represents a critical segment of the country’s healthcare technology landscape, driven by the increasing prevalence of diabetes and the growing emphasis on continuous glucose monitoring solutions. Germany’s healthcare system has embraced advanced blood glucose monitoring technologies, positioning the nation as a leading market for innovative diabetes management solutions in Europe. The market encompasses traditional blood glucose meters, continuous glucose monitoring systems, test strips, lancets, and emerging smart glucose monitoring devices.

Market dynamics indicate robust growth potential, with the German blood glucose monitoring sector experiencing a compound annual growth rate (CAGR) of 6.2% driven by technological advancements and increasing diabetes awareness. The integration of digital health solutions and telemedicine platforms has further accelerated market expansion, with continuous glucose monitoring adoption reaching approximately 28% among Type 1 diabetes patients in Germany. Healthcare digitization initiatives and government support for diabetes management programs continue to shape market development.

Regional distribution shows concentrated market activity in major metropolitan areas, with Bavaria, North Rhine-Westphalia, and Baden-Württemberg accounting for nearly 45% of total market demand. The market benefits from Germany’s robust healthcare infrastructure, comprehensive insurance coverage, and strong regulatory framework supporting medical device innovation and patient access to advanced glucose monitoring technologies.

The Germany blood glucose market refers to the comprehensive ecosystem of medical devices, technologies, and services designed for monitoring blood sugar levels among diabetic patients within the German healthcare system. This market encompasses traditional glucose meters, advanced continuous glucose monitoring systems, consumable supplies including test strips and lancets, and emerging digital health solutions that enable real-time glucose tracking and data management.

Blood glucose monitoring represents a fundamental component of diabetes management, enabling patients to make informed decisions about medication, diet, and lifestyle choices. In Germany’s context, the market includes both prescription and over-the-counter glucose monitoring solutions, supported by the country’s comprehensive healthcare coverage system and emphasis on preventive care approaches.

Market scope extends beyond traditional monitoring devices to include integrated digital platforms, smartphone applications, cloud-based data management systems, and artificial intelligence-powered analytics tools that enhance diabetes management outcomes. The German market particularly emphasizes precision medicine approaches and personalized diabetes care solutions.

Germany’s blood glucose market demonstrates exceptional growth momentum, driven by increasing diabetes prevalence, technological innovation, and supportive healthcare policies. The market has evolved from traditional fingerstick glucose meters to sophisticated continuous monitoring systems that provide real-time glucose data and trend analysis capabilities.

Key market drivers include the rising incidence of Type 1 and Type 2 diabetes, with diabetes prevalence rates reaching approximately 7.2% of the adult population in Germany. Technological advancement in glucose monitoring accuracy, user convenience, and data connectivity has significantly enhanced patient adoption rates and clinical outcomes.

Market segmentation reveals strong demand across multiple categories, with continuous glucose monitoring systems experiencing the highest growth rates, followed by smart glucose meters and integrated diabetes management platforms. The market benefits from Germany’s advanced healthcare infrastructure, comprehensive insurance coverage, and strong regulatory support for medical device innovation.

Competitive landscape features both established medical device manufacturers and emerging technology companies, creating a dynamic environment for innovation and market expansion. The integration of artificial intelligence, machine learning, and predictive analytics continues to drive market evolution and improve patient outcomes.

Strategic market analysis reveals several critical insights shaping the Germany blood glucose monitoring landscape:

Diabetes prevalence increase serves as the primary market driver, with Germany experiencing steady growth in both Type 1 and Type 2 diabetes cases. Demographic trends including population aging and lifestyle changes contribute to rising diabetes incidence rates, creating sustained demand for glucose monitoring solutions.

Technological advancement in glucose monitoring accuracy, convenience, and connectivity drives market expansion. Continuous glucose monitoring systems offer significant advantages over traditional fingerstick methods, including real-time glucose readings, trend alerts, and reduced testing frequency requirements. These technological improvements enhance patient compliance and clinical outcomes.

Healthcare digitization initiatives supported by the German government accelerate adoption of digital health solutions and connected medical devices. Electronic health records integration and telemedicine platforms create synergies with glucose monitoring technologies, improving care coordination and patient outcomes.

Insurance coverage expansion for advanced glucose monitoring technologies reduces patient cost barriers and increases accessibility. Statutory health insurance coverage for continuous glucose monitoring systems and digital health solutions supports market growth and patient adoption.

Clinical evidence demonstrating improved diabetes management outcomes with advanced glucose monitoring drives healthcare provider recommendations and patient adoption. Reduced hypoglycemic events and improved glycemic control associated with continuous monitoring systems support market expansion.

High implementation costs associated with advanced glucose monitoring systems create barriers for some patient segments and healthcare providers. Initial device costs and ongoing consumable expenses may limit adoption despite insurance coverage availability.

Technical complexity of advanced glucose monitoring systems may challenge some patients, particularly elderly users who require additional support and training. Digital literacy requirements for smartphone-connected devices and data management platforms can limit accessibility for certain patient populations.

Regulatory compliance requirements create development costs and time-to-market delays for new glucose monitoring technologies. CE marking processes and clinical validation requirements, while ensuring safety and efficacy, may slow innovation cycles and market entry for emerging solutions.

Data privacy concerns related to health information sharing and cloud-based storage may limit patient adoption of connected glucose monitoring devices. GDPR compliance requirements and data security considerations create additional complexity for digital health solutions.

Market saturation in traditional glucose monitoring segments may limit growth opportunities for established technologies. Competitive pressure from multiple device manufacturers creates pricing challenges and margin compression in mature market segments.

Artificial intelligence integration presents significant opportunities for enhanced glucose monitoring capabilities and predictive analytics. Machine learning algorithms can provide personalized insights, predict glucose trends, and optimize diabetes management strategies for individual patients.

Preventive care programs targeting pre-diabetes and at-risk populations create new market segments for glucose monitoring solutions. Population health management initiatives and workplace wellness programs offer expansion opportunities beyond traditional diabetes care.

Pediatric diabetes management represents an underserved market segment with specific needs for child-friendly glucose monitoring solutions. Family-centered care approaches and school-based diabetes management programs create opportunities for specialized products and services.

Integration with wearable devices and fitness trackers offers opportunities for comprehensive health monitoring solutions. Lifestyle integration and activity correlation with glucose patterns provide enhanced value propositions for health-conscious consumers.

Telemedicine expansion accelerated by recent healthcare trends creates opportunities for remote glucose monitoring and virtual diabetes care services. Digital therapeutics and app-based diabetes management solutions offer new revenue streams and patient engagement models.

Supply chain dynamics in the Germany blood glucose market reflect the complex interplay between device manufacturers, healthcare providers, insurance systems, and patients. Manufacturing capabilities within Germany and broader European Union support market stability and regulatory compliance.

Competitive dynamics feature intense competition among established medical device companies and emerging technology startups. Innovation cycles drive continuous product development and feature enhancement, with companies investing heavily in research and development to maintain market position.

Regulatory dynamics shaped by European Union medical device regulations and German healthcare policies influence market development and product approval timelines. Post-market surveillance requirements and quality management systems ensure ongoing safety and efficacy monitoring.

Reimbursement dynamics involving statutory health insurance negotiations and private insurance coverage decisions significantly impact market access and adoption rates. Health technology assessment processes evaluate clinical and economic benefits of new glucose monitoring technologies.

Patient behavior dynamics influenced by diabetes education, healthcare provider recommendations, and peer support networks affect adoption patterns and product preferences. Digital health literacy and technology comfort levels vary across patient demographics, influencing market segmentation strategies.

Comprehensive market research for the Germany blood glucose market employs multiple methodological approaches to ensure accuracy and reliability of findings. Primary research includes structured interviews with healthcare providers, diabetes specialists, patients, and industry stakeholders to gather firsthand insights into market trends and dynamics.

Secondary research encompasses analysis of published clinical studies, regulatory documents, industry reports, and healthcare statistics from authoritative sources including the German Diabetes Association and Federal Statistical Office. Market data validation through cross-referencing multiple sources ensures research reliability and accuracy.

Quantitative analysis utilizes statistical modeling and trend analysis to project market growth patterns and segment performance. Qualitative assessment incorporates expert opinions, stakeholder interviews, and case study analysis to provide contextual understanding of market dynamics.

Data collection methods include online surveys, telephone interviews, focus groups, and observational studies conducted across representative patient populations and healthcare settings. Sampling methodologies ensure geographic and demographic representation across Germany’s diverse healthcare landscape.

Analytical frameworks incorporate SWOT analysis, Porter’s Five Forces assessment, and competitive benchmarking to provide comprehensive market understanding. Forecasting models utilize historical data, current trends, and expert projections to develop realistic market growth scenarios.

Bavaria region demonstrates the strongest market presence, accounting for approximately 18% of national demand driven by advanced healthcare infrastructure, high diabetes prevalence, and strong economic conditions. Munich metropolitan area serves as a key market hub with concentration of healthcare providers and medical technology companies.

North Rhine-Westphalia represents the largest regional market by population, contributing nearly 22% of total market volume. Urban centers including Cologne, Düsseldorf, and Dortmund drive demand for advanced glucose monitoring solutions, supported by comprehensive healthcare networks and insurance coverage.

Baden-Württemberg region shows strong adoption rates for innovative glucose monitoring technologies, with Stuttgart and Karlsruhe areas leading in digital health solution implementation. The region’s technology-focused economy and high healthcare spending support premium product adoption.

Berlin-Brandenburg metropolitan region demonstrates growing market potential with increasing diabetes awareness and healthcare digitization initiatives. Academic medical centers and research institutions drive clinical adoption of advanced glucose monitoring systems.

Northern German states including Hamburg, Schleswig-Holstein, and Lower Saxony show steady market growth with emphasis on cost-effective glucose monitoring solutions. Rural healthcare delivery challenges create opportunities for telemedicine-integrated monitoring systems.

Market leadership in Germany’s blood glucose monitoring sector is characterized by both established medical device manufacturers and innovative technology companies driving market evolution:

Competitive strategies focus on technological innovation, clinical evidence generation, healthcare provider partnerships, and patient support programs. Market differentiation occurs through accuracy improvements, user convenience features, and integrated diabetes management platforms.

By Product Type:

By Technology:

By End User:

Continuous Glucose Monitoring segment demonstrates the highest growth potential with annual growth rates exceeding 12% driven by improved accuracy, convenience, and clinical outcomes. Sensor technology advancement and extended wear duration enhance patient adoption and satisfaction rates.

Traditional glucose meters maintain significant market share despite declining growth rates, particularly in cost-conscious segments and basic monitoring applications. Accuracy improvements and simplified operation continue to support market presence among specific patient populations.

Test strip category represents the largest consumable segment with recurring revenue potential and steady demand patterns. Compatibility requirements and accuracy standards drive brand loyalty and repeat purchasing behavior among patients.

Smart glucose monitoring devices with smartphone connectivity and data analytics capabilities show strong adoption among tech-savvy patients and younger demographics. Digital health integration and telemedicine compatibility enhance value propositions and market appeal.

Pediatric glucose monitoring solutions require specialized features including child-friendly designs, family sharing capabilities, and school-appropriate monitoring options. Caregiver involvement and safety considerations influence product development and market positioning strategies.

Healthcare Providers benefit from improved patient outcomes through enhanced glucose monitoring accuracy and real-time data access. Clinical decision support tools integrated with glucose monitoring systems enable more effective diabetes management and reduced complications.

Patients experience improved quality of life through convenient, accurate glucose monitoring solutions that reduce testing burden and provide actionable insights. Continuous monitoring systems eliminate frequent fingerstick requirements while providing comprehensive glucose trend information.

Insurance Systems realize cost savings through improved diabetes management outcomes, reduced hospitalizations, and prevention of costly complications. Preventive care approaches supported by advanced glucose monitoring reduce long-term healthcare expenditures.

Medical Device Manufacturers access growing market opportunities driven by technological innovation and increasing diabetes prevalence. Product differentiation through advanced features and clinical evidence creates competitive advantages and premium pricing opportunities.

Healthcare System benefits from improved resource utilization, reduced emergency interventions, and enhanced population health management capabilities. Digital health integration supports telemedicine initiatives and remote patient monitoring programs.

Strengths:

Weaknesses:

Opportunities:

Threats:

Continuous glucose monitoring adoption accelerates across all patient segments, driven by improved sensor accuracy, extended wear duration, and smartphone integration capabilities. Real-time glucose data and trend alerts provide significant advantages over traditional fingerstick methods.

Artificial intelligence integration transforms glucose monitoring from reactive measurement to predictive diabetes management. Machine learning algorithms analyze glucose patterns, lifestyle factors, and clinical data to provide personalized recommendations and early warning systems.

Digital health platform integration connects glucose monitoring devices with comprehensive diabetes management ecosystems including electronic health records, telemedicine platforms, and patient education resources. Data interoperability enhances care coordination and clinical decision-making.

Personalized medicine approaches utilize individual glucose patterns, genetic factors, and lifestyle data to optimize diabetes management strategies. Precision diabetes care improves outcomes while reducing treatment burden and healthcare costs.

Preventive care focus expands glucose monitoring applications beyond diabetes management to include pre-diabetes screening, metabolic health assessment, and wellness monitoring. Population health initiatives drive demand for accessible, cost-effective monitoring solutions.

Regulatory approvals for next-generation continuous glucose monitoring systems with improved accuracy and extended sensor life drive market innovation. CE marking achievements for innovative glucose monitoring technologies expand patient access to advanced solutions.

Strategic partnerships between medical device manufacturers and digital health companies accelerate development of integrated diabetes management platforms. Collaboration initiatives combine hardware expertise with software innovation to create comprehensive patient solutions.

Clinical evidence generation through large-scale studies demonstrates improved outcomes with advanced glucose monitoring technologies. Real-world evidence supports reimbursement decisions and healthcare provider adoption of innovative monitoring solutions.

Technology advancement in sensor miniaturization, accuracy improvement, and battery life extension enhances patient experience and adoption rates. Manufacturing innovation reduces production costs while maintaining quality standards and regulatory compliance.

Market expansion into new patient segments including pediatric diabetes, gestational diabetes, and pre-diabetes monitoring creates growth opportunities. Product portfolio diversification addresses specific needs of different patient populations and clinical applications.

MarkWide Research recommends that industry participants focus on artificial intelligence integration and predictive analytics capabilities to differentiate products in competitive markets. Investment in machine learning algorithms and data analytics platforms will create sustainable competitive advantages.

Strategic partnerships with healthcare providers, insurance companies, and digital health platforms should be prioritized to create comprehensive diabetes management ecosystems. Collaboration approaches will accelerate market penetration and improve patient outcomes.

Patient education initiatives and support programs are essential for successful adoption of advanced glucose monitoring technologies. Training programs and user support services will enhance patient satisfaction and long-term product loyalty.

Regulatory compliance and quality management systems require continuous investment to maintain market access and competitive positioning. Proactive regulatory strategies will facilitate faster market entry for innovative products.

Cost optimization through manufacturing efficiency and supply chain management will be crucial for maintaining profitability in competitive market segments. Value-based pricing strategies should emphasize clinical outcomes and total cost of care benefits.

Market growth trajectory indicates continued expansion driven by diabetes prevalence increases, technological innovation, and healthcare digitization trends. Long-term projections suggest sustained growth rates with continuous glucose monitoring systems leading market development.

Technology evolution toward non-invasive glucose monitoring, artificial intelligence integration, and comprehensive health monitoring platforms will reshape market dynamics. Innovation cycles are expected to accelerate with increased research and development investment.

Healthcare integration will deepen through electronic health record connectivity, telemedicine platform compatibility, and clinical decision support system integration. Interoperability standards will facilitate seamless data exchange and care coordination.

Patient empowerment trends will drive demand for user-friendly, informative glucose monitoring solutions that support self-management and lifestyle optimization. Consumer health focus will expand market applications beyond traditional diabetes care.

Regulatory environment evolution will balance innovation support with safety requirements, potentially streamlining approval processes for breakthrough technologies. MWR analysis indicates that adaptive regulatory frameworks will facilitate faster market access for innovative solutions while maintaining quality standards.

Germany’s blood glucose market represents a dynamic and rapidly evolving healthcare technology sector with significant growth potential driven by increasing diabetes prevalence, technological innovation, and supportive healthcare policies. The market’s transformation from traditional glucose meters to sophisticated continuous monitoring systems with artificial intelligence integration demonstrates the sector’s commitment to improving patient outcomes and diabetes management effectiveness.

Key success factors for market participants include technological innovation, clinical evidence generation, strategic partnerships, and patient-centered product development. The integration of digital health solutions, telemedicine capabilities, and predictive analytics creates opportunities for comprehensive diabetes management ecosystems that extend beyond traditional monitoring applications.

Future market development will be shaped by continued technological advancement, regulatory evolution, and changing patient expectations for convenient, accurate, and informative glucose monitoring solutions. The emphasis on preventive care, personalized medicine, and population health management will create new market segments and growth opportunities for innovative companies positioned to address evolving healthcare needs in Germany’s sophisticated medical technology landscape.

What is Blood Glucose?

Blood glucose refers to the concentration of glucose present in the blood, which is a critical factor in managing diabetes and other metabolic conditions. Monitoring blood glucose levels is essential for individuals with diabetes to maintain their health and prevent complications.

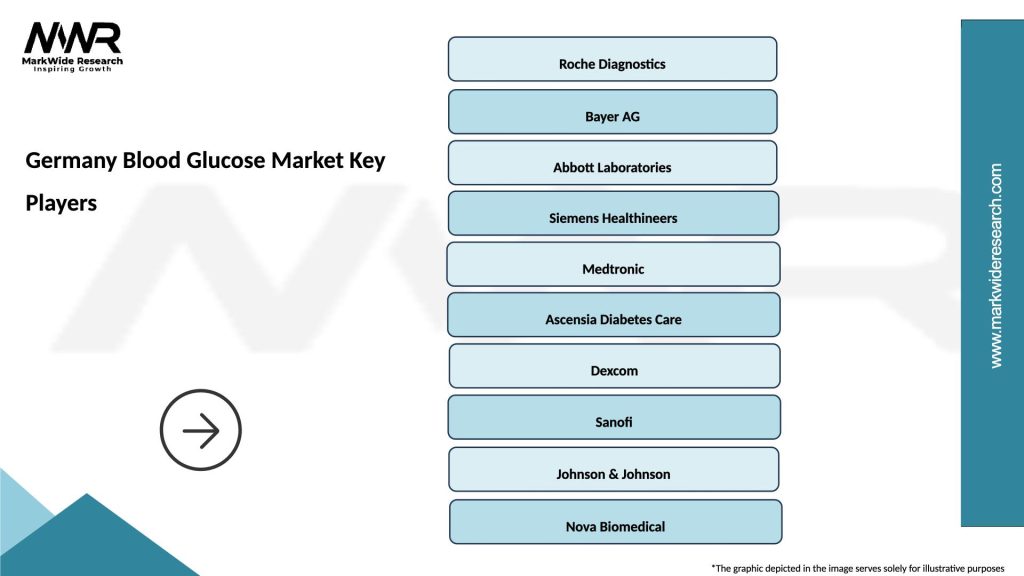

What are the key companies in the Germany Blood Glucose Market?

Key companies in the Germany Blood Glucose Market include Roche Diagnostics, Abbott Laboratories, and Ascensia Diabetes Care, among others. These companies are known for their innovative glucose monitoring devices and diabetes management solutions.

What are the growth factors driving the Germany Blood Glucose Market?

The growth of the Germany Blood Glucose Market is driven by the increasing prevalence of diabetes, advancements in glucose monitoring technology, and rising awareness about diabetes management. Additionally, government initiatives to promote health screenings contribute to market expansion.

What challenges does the Germany Blood Glucose Market face?

The Germany Blood Glucose Market faces challenges such as high costs associated with advanced glucose monitoring devices and regulatory hurdles for new product approvals. Furthermore, the market is impacted by the need for continuous innovation to meet consumer expectations.

What opportunities exist in the Germany Blood Glucose Market?

Opportunities in the Germany Blood Glucose Market include the development of smart glucose monitoring systems and integration with mobile health applications. There is also potential for growth in personalized diabetes management solutions tailored to individual patient needs.

What trends are shaping the Germany Blood Glucose Market?

Trends in the Germany Blood Glucose Market include the shift towards continuous glucose monitoring (CGM) systems and the increasing use of telehealth services for diabetes management. Additionally, there is a growing focus on user-friendly devices that enhance patient engagement and adherence.

Germany Blood Glucose Market

| Segmentation Details | Description |

|---|---|

| Product Type | Blood Glucose Meters, Test Strips, Lancets, Continuous Glucose Monitors |

| End User | Hospitals, Clinics, Homecare, Diabetes Centers |

| Technology | Enzymatic, Non-Enzymatic, Optical, Electrode-Based |

| Distribution Channel | Pharmacies, Online Retail, Hospitals, Supermarkets |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Blood Glucose Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at