444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany beauty industry market represents one of Europe’s most sophisticated and dynamic consumer sectors, characterized by exceptional innovation, premium quality standards, and evolving consumer preferences. German consumers demonstrate increasing awareness of sustainable beauty practices, organic formulations, and personalized skincare solutions, driving significant transformation across traditional beauty categories. The market encompasses diverse segments including skincare, cosmetics, haircare, fragrances, and personal care products, with premium positioning and technological advancement serving as key differentiators.

Market dynamics indicate robust growth potential, with the industry experiencing a 6.2% annual growth rate driven by digital transformation, e-commerce expansion, and shifting demographic preferences. Sustainability initiatives have become paramount, with approximately 73% of German consumers actively seeking eco-friendly beauty products. The integration of advanced technologies, including artificial intelligence for personalized recommendations and augmented reality for virtual try-on experiences, continues reshaping the competitive landscape.

Regional distribution shows concentrated market activity in major metropolitan areas, with Berlin, Munich, Hamburg, and Frankfurt leading consumption patterns. The market demonstrates strong resilience against economic fluctuations, supported by consistent consumer spending on personal care essentials and premium beauty treatments. Innovation hubs throughout Germany foster collaboration between established multinational corporations and emerging beauty technology startups, creating a vibrant ecosystem for product development and market expansion.

The Germany beauty industry market refers to the comprehensive ecosystem encompassing manufacturing, distribution, retail, and consumption of cosmetic products, personal care items, skincare solutions, haircare treatments, fragrances, and beauty services within German borders. This market includes both domestic production capabilities and imported products, serving diverse consumer segments through multiple distribution channels including traditional retail, specialty beauty stores, department stores, pharmacies, and digital platforms.

Market scope extends beyond simple product transactions to include beauty services, professional treatments, wellness experiences, and educational initiatives that promote personal care awareness. The industry encompasses established multinational corporations, regional manufacturers, independent brands, and emerging startups, all contributing to a dynamic competitive environment. Consumer engagement patterns reflect sophisticated preferences for quality, efficacy, sustainability, and personalized experiences, distinguishing the German market from other European regions.

Regulatory framework ensures high safety standards and product quality through stringent testing requirements, ingredient transparency mandates, and environmental compliance measures. The market operates within European Union cosmetic regulations while maintaining additional German-specific standards that emphasize consumer protection and environmental responsibility.

Strategic analysis reveals the Germany beauty industry market as a mature yet rapidly evolving sector, driven by technological innovation, sustainability consciousness, and demographic shifts toward premium personal care experiences. Consumer behavior patterns demonstrate increasing preference for multifunctional products, clean beauty formulations, and personalized skincare regimens, creating opportunities for brands that can effectively address these sophisticated demands.

Market segmentation shows skincare products commanding the largest share, followed by haircare, color cosmetics, and fragrances, with each category experiencing distinct growth trajectories. The rise of men’s grooming products represents a significant growth opportunity, with male consumers showing 42% increased engagement in beauty and personal care routines over recent years. Digital transformation continues accelerating, with online sales channels capturing approximately 28% market share and growing rapidly.

Competitive landscape features both established international brands and innovative German companies, with market leadership determined by product quality, brand reputation, distribution efficiency, and digital marketing effectiveness. Sustainability initiatives have become essential differentiators, with consumers increasingly favoring brands demonstrating genuine environmental commitment through packaging innovation, ingredient sourcing, and manufacturing processes.

Consumer preferences in the German beauty market reflect sophisticated understanding of ingredient science, environmental impact, and personal wellness integration. Key insights reveal several transformative trends shaping market evolution:

Market intelligence indicates that German consumers demonstrate exceptional loyalty to brands that consistently deliver quality, innovation, and authentic brand values. Purchase decision factors include ingredient transparency, clinical testing results, sustainability credentials, and peer recommendations through digital platforms.

Primary growth drivers propelling the Germany beauty industry market include demographic shifts, technological advancement, and evolving lifestyle preferences that prioritize personal wellness and self-expression. Aging population dynamics create sustained demand for anti-aging skincare products, with consumers seeking scientifically-proven formulations that address specific skin concerns while maintaining natural appearance.

Digital transformation serves as a fundamental market driver, enabling personalized shopping experiences, virtual consultations, and direct brand engagement through social media platforms. E-commerce expansion facilitates access to international brands, niche products, and subscription services that deliver customized beauty solutions directly to consumers. The integration of artificial intelligence and machine learning technologies enhances product recommendations, skin analysis capabilities, and inventory management efficiency.

Sustainability consciousness drives innovation in product formulation, packaging design, and supply chain management, with consumers actively supporting brands that demonstrate environmental responsibility. Wellness trends position beauty products as essential components of holistic health routines, expanding market opportunities beyond traditional cosmetic applications. Social media influence continues shaping consumer preferences, with beauty influencers and user-generated content driving product discovery and brand awareness.

Economic stability in Germany supports consistent consumer spending on premium beauty products, while increasing disposable income enables experimentation with luxury brands and innovative treatments. Cultural shifts toward self-care and personal expression create opportunities for brands that can effectively communicate authentic brand stories and values.

Regulatory complexity presents significant challenges for beauty companies operating in the German market, with stringent safety testing requirements, ingredient restrictions, and labeling mandates increasing compliance costs and time-to-market delays. European Union regulations require extensive documentation and testing protocols that can be particularly burdensome for smaller brands and innovative formulations.

Market saturation in traditional beauty categories creates intense competition, making it difficult for new brands to establish market presence without significant marketing investments and unique value propositions. Consumer skepticism toward marketing claims requires brands to provide substantial scientific evidence and clinical testing results to support product efficacy statements.

Supply chain disruptions affect ingredient availability, manufacturing schedules, and distribution efficiency, particularly impacting brands dependent on international suppliers or specialized raw materials. Economic uncertainties can influence consumer spending patterns, with beauty products often considered discretionary purchases during economic downturns.

Sustainability expectations create operational challenges, as brands must balance environmental responsibility with product performance, cost considerations, and consumer convenience. Digital marketing complexity requires sophisticated strategies to navigate privacy regulations, algorithm changes, and evolving consumer engagement preferences across multiple platforms.

Emerging opportunities in the Germany beauty industry market center around technological innovation, demographic expansion, and sustainability leadership that can differentiate brands in competitive segments. Men’s beauty market represents substantial growth potential, with male consumers increasingly embracing skincare routines, grooming products, and color cosmetics, creating opportunities for targeted product development and marketing strategies.

Personalization technology offers significant opportunities for brands that can effectively leverage artificial intelligence, genetic testing, and skin analysis tools to create customized products and services. Subscription models provide recurring revenue streams while building customer loyalty through curated product selections and personalized recommendations.

Sustainable innovation creates competitive advantages for companies developing biodegradable formulations, refillable packaging systems, and carbon-neutral manufacturing processes. Professional partnerships with dermatologists, aestheticians, and wellness practitioners enable brands to establish credibility and access specialized distribution channels.

Digital-first strategies allow brands to build direct relationships with consumers, gather valuable data insights, and respond quickly to market trends without traditional retail intermediaries. International expansion opportunities exist for successful German brands to leverage their reputation for quality and innovation in global markets. Wellness integration enables beauty brands to expand into adjacent categories including supplements, aromatherapy, and mental health support products.

Complex market dynamics shape the Germany beauty industry through interconnected factors including consumer behavior evolution, technological advancement, regulatory changes, and competitive pressures. Supply and demand patterns reflect seasonal variations, with skincare products experiencing consistent year-round demand while color cosmetics show seasonal peaks during holiday periods and special events.

Price sensitivity varies significantly across consumer segments, with premium brands commanding loyalty among affluent consumers while value-conscious shoppers seek effective alternatives at accessible price points. Brand switching behavior has increased due to social media influence and easy access to product reviews, requiring companies to continuously innovate and maintain customer engagement.

Distribution channel evolution shows traditional retail maintaining importance while online channels capture increasing market share, with omnichannel strategies becoming essential for brand success. Inventory management challenges arise from seasonal demand fluctuations, product lifecycle variations, and the need to maintain fresh stock for time-sensitive formulations.

Innovation cycles have accelerated, with consumers expecting regular product updates, limited edition releases, and breakthrough formulations that address emerging skin concerns. Marketing effectiveness depends increasingly on authentic brand storytelling, influencer partnerships, and user-generated content that builds trust and community engagement. Competitive responses to market changes require agility in product development, pricing strategies, and marketing approaches.

Comprehensive research methodology employed for analyzing the Germany beauty industry market incorporates multiple data collection techniques, analytical frameworks, and validation processes to ensure accuracy and reliability of market insights. Primary research includes consumer surveys, industry expert interviews, retailer consultations, and focus group discussions that provide qualitative insights into market trends, consumer preferences, and competitive dynamics.

Secondary research encompasses analysis of industry reports, government statistics, trade association data, company financial statements, and regulatory documentation that supports quantitative market assessment. Data triangulation methods verify findings across multiple sources to ensure consistency and reliability of market projections and trend analysis.

Market segmentation analysis utilizes demographic data, purchasing behavior patterns, and product category performance metrics to identify growth opportunities and competitive positioning strategies. Competitive intelligence gathering includes monitoring brand activities, product launches, marketing campaigns, and strategic partnerships that influence market dynamics.

Statistical modeling techniques project market trends, growth trajectories, and scenario planning based on historical data patterns and identified market drivers. Quality assurance processes include peer review, data validation, and methodology verification to maintain research standards and analytical rigor throughout the study process.

Regional market distribution across Germany reveals distinct consumption patterns, demographic influences, and competitive dynamics that shape beauty industry performance in different geographic areas. Northern Germany demonstrates strong preference for sustainable beauty products and minimalist skincare routines, with cities like Hamburg and Bremen leading adoption of eco-friendly brands and refillable packaging systems.

Southern Germany shows higher consumption of premium beauty products and luxury brands, with Munich and Stuttgart consumers displaying willingness to invest in high-quality skincare and professional treatments. Western regions including North Rhine-Westphalia demonstrate diverse consumer preferences influenced by international cultural exposure and urban lifestyle trends.

Eastern Germany represents emerging market opportunities with growing consumer spending power and increasing interest in international beauty brands. Berlin market serves as a trendsetting hub for innovative beauty concepts, indie brands, and digital-first companies that influence national market trends. The capital city captures approximately 18% of national beauty spending despite representing a smaller population percentage.

Rural market segments show different purchasing patterns, with greater reliance on traditional retail channels and preference for established brands with proven efficacy. Regional preferences for specific product categories vary, with coastal areas showing higher sunscreen and protective skincare consumption, while urban centers drive color cosmetics and anti-pollution product demand. Distribution efficiency varies by region, with metropolitan areas benefiting from faster delivery times and broader product availability compared to rural locations.

Competitive landscape in the Germany beauty industry market features diverse players ranging from multinational corporations to innovative startups, each employing distinct strategies to capture market share and build consumer loyalty. Market leadership positions are established through brand recognition, product quality, distribution efficiency, and marketing effectiveness across multiple consumer touchpoints.

Emerging competitors include direct-to-consumer brands leveraging digital marketing, subscription services, and personalized product offerings to challenge established players. German beauty companies maintain competitive advantages through local market understanding, regulatory expertise, and consumer trust built over decades of market presence.

Competitive strategies focus on innovation, sustainability, digital transformation, and consumer engagement through multiple channels. Market consolidation continues as larger companies acquire innovative smaller brands to expand portfolio diversity and access emerging consumer segments.

Market segmentation analysis reveals distinct consumer groups, product categories, and distribution channels that define the Germany beauty industry market structure. Demographic segmentation identifies key consumer groups based on age, gender, income level, and lifestyle preferences that influence purchasing behavior and brand loyalty patterns.

By Product Category:

By Consumer Demographics:

By Distribution Channel:

Skincare category dominates the Germany beauty market with approximately 45% market share, driven by consumer awareness of skin health, anti-aging concerns, and preventive care approaches. Premium skincare products show particularly strong performance, with consumers willing to invest in scientifically-proven formulations that deliver visible results. Clean beauty trends within skincare emphasize natural ingredients, minimal processing, and transparent labeling that appeals to health-conscious consumers.

Haircare segment demonstrates steady growth through innovation in sulfate-free formulations, customized treatments, and professional-grade home products. Sustainable haircare gains traction with solid shampoo bars, refillable containers, and biodegradable formulations addressing environmental concerns. Men’s haircare represents a rapidly expanding subsegment with specialized products for male hair and scalp concerns.

Color cosmetics category experiences transformation through long-wearing formulations, skin-beneficial ingredients, and inclusive shade ranges that cater to diverse skin tones. Hybrid products combining makeup with skincare benefits appeal to time-conscious consumers seeking multifunctional solutions. Digital try-on technology enhances online color cosmetics shopping by enabling virtual product testing and shade matching.

Fragrance market shows resilience with niche perfumery gaining popularity alongside established designer brands. Personalized fragrances created through scent profiling and custom blending services attract consumers seeking unique olfactory experiences. Sustainable fragrance production emphasizes ethical ingredient sourcing and eco-friendly packaging solutions.

Industry participants in the Germany beauty market benefit from multiple opportunities for growth, innovation, and market expansion through strategic positioning and consumer-focused initiatives. Brand manufacturers gain access to sophisticated consumers who appreciate quality, innovation, and authentic brand values, enabling premium positioning and strong profit margins.

Retailers benefit from consistent consumer demand, high product turnover rates, and opportunities for cross-selling complementary products across beauty categories. Specialty beauty stores can differentiate through expert consultation services, exclusive product offerings, and personalized customer experiences that build loyalty and repeat purchases.

Technology providers find significant opportunities in developing solutions for personalized beauty recommendations, virtual try-on experiences, and supply chain optimization. Ingredient suppliers benefit from growing demand for innovative, sustainable, and scientifically-proven raw materials that enable product differentiation.

Consumers benefit from increased product variety, improved formulation quality, competitive pricing, and enhanced shopping experiences across multiple channels. Professional service providers including dermatologists, aestheticians, and beauty consultants can expand their practices through partnerships with beauty brands and technology platforms.

Investment opportunities exist for financial stakeholders interested in supporting innovative beauty companies, technology development, and market expansion initiatives. Regulatory compliance creates opportunities for consulting services, testing laboratories, and certification organizations that support industry standards and consumer safety.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends shaping the Germany beauty industry market reflect evolving consumer preferences, technological advancement, and societal shifts toward sustainability and personalization. Clean beauty movement continues gaining momentum, with consumers actively seeking products free from controversial ingredients, synthetic additives, and harmful chemicals that may impact long-term health.

Personalization revolution enables brands to offer customized products based on individual skin analysis, genetic testing, and lifestyle factors. MarkWide Research indicates that personalized beauty solutions show 35% higher customer satisfaction rates compared to standard formulations, driving investment in customization technology and data analytics capabilities.

Sustainable packaging innovation addresses environmental concerns through refillable containers, biodegradable materials, and zero-waste initiatives that resonate with environmentally conscious consumers. Gender-neutral beauty emerges as brands develop unisex products and marketing approaches that appeal to evolving gender identity concepts and inclusive beauty standards.

Technology integration includes artificial intelligence for product recommendations, augmented reality for virtual try-on experiences, and blockchain for ingredient traceability and authenticity verification. Wellness convergence positions beauty products as essential components of holistic health routines, incorporating stress-relief benefits, aromatherapy elements, and mental wellness support.

Social commerce leverages social media platforms for direct product sales, influencer partnerships, and user-generated content that drives brand awareness and consumer engagement. Subscription models provide recurring revenue streams while offering consumers convenience, personalization, and cost savings through curated product selections.

Recent industry developments demonstrate the dynamic nature of the Germany beauty market, with companies investing in innovation, sustainability, and digital transformation to maintain competitive advantages. Merger and acquisition activity continues as established companies acquire innovative startups and niche brands to expand portfolio diversity and access emerging consumer segments.

Sustainability initiatives include major brands committing to carbon-neutral operations, plastic-free packaging, and ethical ingredient sourcing that addresses growing environmental concerns. Digital platform launches enable brands to build direct consumer relationships, gather valuable data insights, and respond quickly to market trends without traditional retail intermediaries.

Research and development investments focus on breakthrough formulations, delivery systems, and active ingredients that provide superior efficacy and consumer benefits. Regulatory compliance improvements include enhanced safety testing protocols, ingredient transparency requirements, and environmental impact assessments that strengthen consumer confidence.

Partnership agreements between beauty brands and technology companies facilitate innovation in personalization tools, virtual consultation services, and supply chain optimization. International expansion strategies enable successful German brands to leverage their reputation for quality and innovation in global markets while accessing new consumer segments.

Professional collaborations with dermatologists, aestheticians, and wellness practitioners establish credibility and access specialized distribution channels that serve health-conscious consumers seeking expert-recommended products.

Strategic recommendations for success in the Germany beauty industry market emphasize innovation, sustainability, and consumer-centric approaches that build long-term competitive advantages. Brand differentiation requires authentic storytelling, unique value propositions, and consistent delivery of superior product quality that exceeds consumer expectations.

Digital transformation should prioritize omnichannel strategies that seamlessly integrate online and offline experiences, enabling consumers to discover, research, purchase, and receive support through their preferred channels. Investment in technology including artificial intelligence, augmented reality, and data analytics capabilities enables personalized experiences and operational efficiency improvements.

Sustainability leadership demands genuine commitment to environmental responsibility through product formulation, packaging innovation, supply chain optimization, and transparent communication about environmental impact. Consumer education initiatives build trust and loyalty by providing valuable information about ingredients, usage techniques, and product benefits.

Partnership strategies should focus on collaborations with complementary brands, technology providers, and professional service providers that enhance value propositions and expand market reach. Agile product development processes enable rapid response to market trends, consumer feedback, and competitive pressures while maintaining quality standards.

Market expansion opportunities exist in underserved segments including men’s beauty, senior consumers, and sustainable product categories that show strong growth potential. Data-driven decision making utilizing consumer insights, market analytics, and performance metrics enables optimized marketing strategies and resource allocation.

Future market projections for the Germany beauty industry indicate continued growth driven by innovation, demographic shifts, and evolving consumer preferences that prioritize quality, sustainability, and personalization. Market expansion is expected to accelerate with projected growth rates of 7.1% annually over the next five years, supported by increasing consumer awareness, disposable income growth, and digital channel development.

Technology integration will become increasingly sophisticated, with artificial intelligence enabling hyper-personalized product recommendations, virtual reality enhancing shopping experiences, and biotechnology advancing ingredient development. MWR analysis suggests that brands successfully leveraging technology integration will capture disproportionate market share growth compared to traditional approaches.

Sustainability requirements will intensify, with consumers expecting comprehensive environmental responsibility including carbon-neutral operations, circular economy principles, and regenerative ingredient sourcing. Regulatory evolution may introduce stricter environmental standards, ingredient restrictions, and transparency requirements that reshape industry practices.

Demographic trends including population aging, increasing male beauty engagement, and Generation Z market entry will create new opportunities for targeted product development and marketing strategies. Global expansion potential exists for successful German beauty brands to leverage their reputation for quality and innovation in international markets.

Market consolidation may continue as larger companies acquire innovative smaller brands, while direct-to-consumer models enable new entrants to challenge established players through digital-first strategies and authentic brand positioning.

The Germany beauty industry market represents a sophisticated and dynamic sector characterized by exceptional consumer awareness, stringent quality standards, and continuous innovation that positions it as a leading European beauty market. Market fundamentals remain strong, supported by economic stability, demographic diversity, and evolving consumer preferences that create sustained demand for high-quality beauty products and services.

Growth opportunities abound for companies that can effectively address consumer demands for sustainability, personalization, and authentic brand experiences while maintaining product quality and regulatory compliance. Digital transformation continues reshaping competitive dynamics, enabling new business models and direct consumer relationships that bypass traditional retail intermediaries.

Success factors include innovation leadership, sustainability commitment, consumer-centric approaches, and agile responses to market trends and competitive pressures. The market rewards brands that demonstrate genuine value creation through superior products, authentic brand storytelling, and consistent customer experiences across multiple touchpoints.

Future prospects indicate continued market expansion driven by technological advancement, demographic shifts, and increasing consumer sophistication that creates opportunities for both established players and innovative newcomers. The Germany beauty industry market will likely maintain its position as a trendsetting market that influences global beauty industry development through its emphasis on quality, innovation, and environmental responsibility.

What is Germany Beauty Industry?

The Germany Beauty Industry encompasses a wide range of products and services related to personal care, cosmetics, skincare, haircare, and fragrances. It includes both retail and professional segments, catering to diverse consumer needs and preferences.

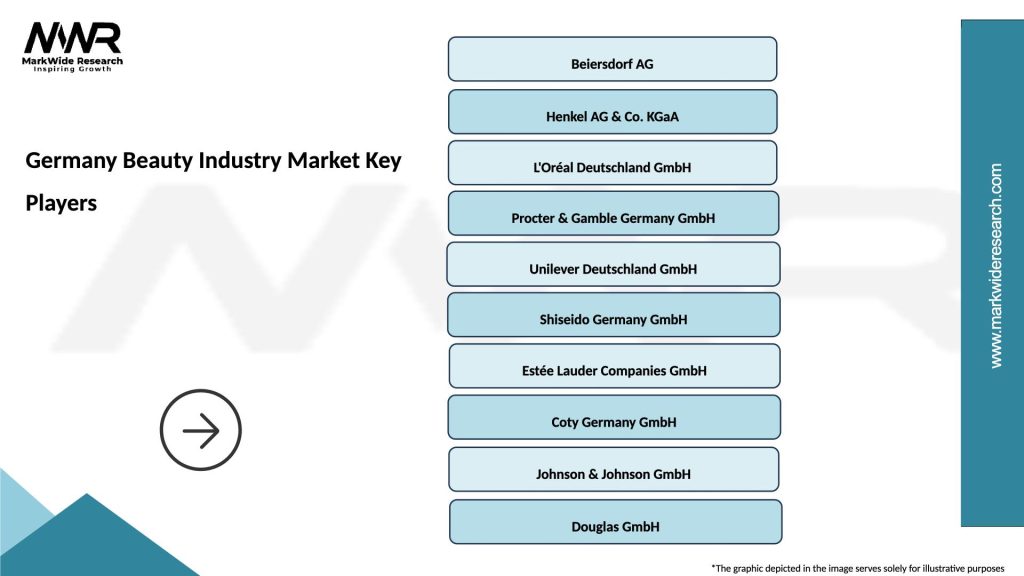

What are the key players in the Germany Beauty Industry Market?

Key players in the Germany Beauty Industry Market include companies like Beiersdorf AG, L’Oréal Deutschland GmbH, and Procter & Gamble Germany. These companies are known for their innovative products and strong market presence, among others.

What are the main drivers of growth in the Germany Beauty Industry Market?

The main drivers of growth in the Germany Beauty Industry Market include increasing consumer awareness of personal grooming, a rising demand for organic and natural beauty products, and the influence of social media on beauty trends. Additionally, the growing e-commerce sector is facilitating easier access to beauty products.

What challenges does the Germany Beauty Industry Market face?

The Germany Beauty Industry Market faces challenges such as intense competition among brands, regulatory compliance regarding product safety, and changing consumer preferences towards sustainability. These factors can impact market dynamics and brand loyalty.

What opportunities exist in the Germany Beauty Industry Market?

Opportunities in the Germany Beauty Industry Market include the expansion of vegan and cruelty-free product lines, the rise of personalized beauty solutions, and the potential for growth in male grooming products. These trends reflect evolving consumer demands and preferences.

What are the current trends in the Germany Beauty Industry Market?

Current trends in the Germany Beauty Industry Market include a focus on clean beauty, increased use of technology in product development, and the popularity of subscription services for beauty products. Additionally, there is a growing emphasis on inclusivity and diversity in marketing strategies.

Germany Beauty Industry Market

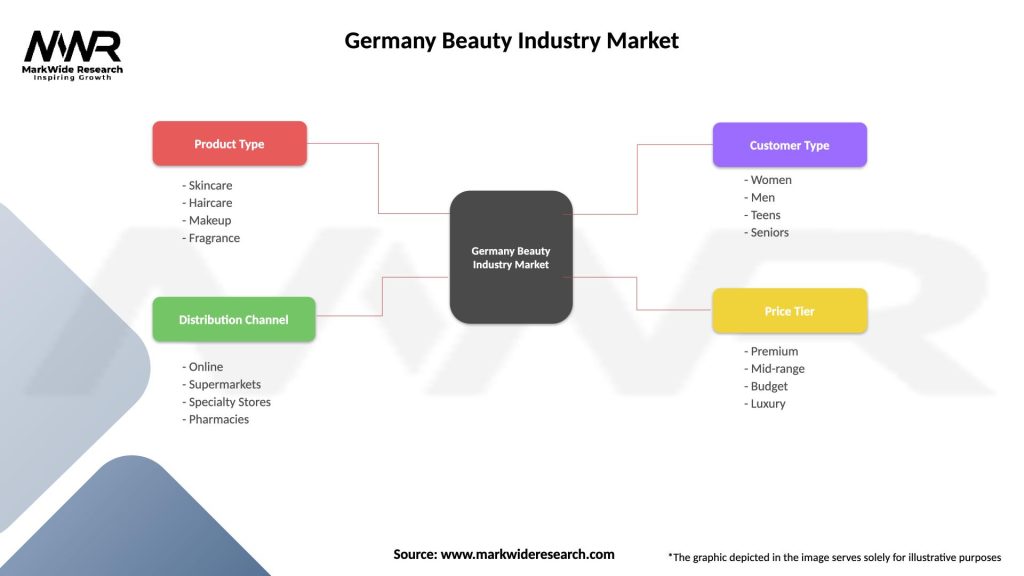

| Segmentation Details | Description |

|---|---|

| Product Type | Skincare, Haircare, Makeup, Fragrance |

| Distribution Channel | Online, Supermarkets, Specialty Stores, Pharmacies |

| Customer Type | Women, Men, Teens, Seniors |

| Price Tier | Premium, Mid-range, Budget, Luxury |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Beauty Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at