444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany automotive engine oil market represents one of Europe’s most sophisticated and technologically advanced lubricant sectors, driven by the country’s position as a global automotive manufacturing hub. Germany’s automotive industry, home to prestigious brands like BMW, Mercedes-Benz, Audi, and Volkswagen, demands premium-quality engine oils that meet stringent performance standards and environmental regulations. The market demonstrates robust growth potential, with industry analysts projecting a compound annual growth rate (CAGR) of 4.2% through the forecast period.

Market dynamics in Germany are significantly influenced by the country’s commitment to environmental sustainability and the ongoing transition toward electric mobility. Despite the growing electric vehicle segment, internal combustion engines continue to dominate the automotive landscape, maintaining strong demand for high-performance engine oils. The market benefits from Germany’s advanced automotive technology sector, which drives innovation in lubricant formulations and synthetic oil development.

Premium synthetic oils account for approximately 68% of the total market share, reflecting German consumers’ preference for high-quality products that offer superior engine protection and extended service intervals. The market is characterized by intense competition among international oil companies, specialty lubricant manufacturers, and automotive OEMs who produce their own branded engine oils.

The Germany automotive engine oil market refers to the comprehensive ecosystem encompassing the production, distribution, and consumption of lubricating oils specifically designed for automotive engines within the German territory. This market includes various oil types ranging from conventional mineral oils to advanced synthetic formulations, serving passenger cars, commercial vehicles, motorcycles, and specialty automotive applications.

Engine oils serve critical functions including lubrication of moving parts, heat dissipation, contaminant removal, and corrosion protection. In the German context, these products must comply with strict European Union regulations and German automotive standards, including ACEA specifications and OEM-specific requirements from major German automakers.

Market participants include global oil companies, specialty chemical manufacturers, automotive original equipment manufacturers, distributors, and retailers who collectively serve the diverse needs of German vehicle owners and fleet operators.

Germany’s automotive engine oil market demonstrates remarkable resilience and innovation, maintaining its position as Europe’s largest and most technologically advanced lubricant market. The sector benefits from strong domestic automotive production, high vehicle ownership rates, and sophisticated consumer preferences for premium products.

Key market drivers include the growing adoption of turbocharged engines, which require specialized high-performance oils, and increasing average vehicle age, leading to higher maintenance frequency. The market shows a clear shift toward synthetic and semi-synthetic formulations, with synthetic oils experiencing 6.8% annual growth compared to declining conventional oil segments.

Regulatory compliance remains a critical factor, with Euro 6 emission standards driving demand for low-viscosity, fuel-efficient engine oils. The market also responds to automotive industry trends including engine downsizing, extended drain intervals, and the integration of hybrid powertrains that require specialized lubricant solutions.

Competitive landscape features both global oil majors and specialized German companies, with market leadership determined by product innovation, distribution network strength, and OEM partnerships. The aftermarket segment represents approximately 72% of total volume, while OEM fill accounts for the remaining share.

Strategic market insights reveal several critical trends shaping Germany’s automotive engine oil landscape:

Primary market drivers propelling Germany’s automotive engine oil sector include several interconnected factors that create sustained demand growth and market evolution.

Automotive industry strength serves as the fundamental driver, with Germany maintaining its position as Europe’s largest vehicle producer. The presence of major automotive manufacturers creates consistent demand for both factory-fill oils and aftermarket products. Vehicle production volumes directly correlate with engine oil consumption, while the export-oriented nature of German automotive manufacturing extends market influence beyond domestic boundaries.

Advanced engine technologies increasingly require specialized lubricant formulations. Modern German vehicles feature sophisticated powertrains including turbocharged engines, direct injection systems, and hybrid configurations that demand high-performance oils. These technologies operate under more severe conditions, requiring oils with enhanced thermal stability, oxidation resistance, and deposit control capabilities.

Regulatory compliance requirements drive continuous product innovation and market growth. European emission standards, particularly Euro 6 and upcoming Euro 7 regulations, mandate the use of low-viscosity oils that support fuel economy improvements while maintaining engine protection. Environmental regulations also promote the adoption of synthetic oils that offer superior performance and reduced environmental impact.

Consumer awareness and preferences significantly influence market dynamics. German consumers demonstrate high automotive knowledge and willingness to invest in premium maintenance products. The growing understanding of engine oil’s role in vehicle performance, fuel economy, and longevity drives demand for high-quality synthetic formulations.

Market restraints present challenges that could potentially limit growth in Germany’s automotive engine oil sector, requiring strategic adaptation from industry participants.

Electric vehicle adoption represents the most significant long-term restraint, as the German government’s commitment to electromobility could reduce internal combustion engine vehicle sales. While the transition timeline extends over decades, increasing EV market penetration may gradually reduce engine oil demand. Current electric vehicle adoption rates of 12% for new car sales indicate the beginning of this transition.

Extended drain intervals paradoxically serve as both a market driver and restraint. While premium synthetic oils command higher prices, their ability to last longer between changes reduces overall consumption volume. Advanced oil formulations that support service intervals exceeding 25,000 kilometers directly impact replacement frequency and total market volume.

Economic volatility can affect consumer spending on premium automotive maintenance products. During economic downturns, consumers may defer maintenance or switch to lower-cost alternatives, impacting premium product segments that drive market profitability.

Raw material price fluctuations create cost pressures for manufacturers, particularly for synthetic base oils and advanced additive packages. Crude oil price volatility directly impacts production costs, while specialty chemical prices affect synthetic oil formulations. These cost pressures can limit market expansion and affect pricing strategies.

Regulatory complexity increases compliance costs and market entry barriers. The need to meet multiple OEM specifications, environmental standards, and performance requirements creates significant development and testing expenses that can limit innovation and market participation.

Significant market opportunities emerge from technological advancement, changing consumer preferences, and evolving automotive industry requirements in Germany’s engine oil sector.

Synthetic oil expansion presents substantial growth potential as consumers increasingly recognize the benefits of advanced formulations. The transition from conventional to synthetic oils offers opportunities for premium pricing and improved margins. Synthetic oil adoption rates continue growing at 8.5% annually, indicating strong market acceptance and future potential.

Specialty applications create niche market opportunities for high-performance and specialized engine oils. The growing popularity of performance vehicles, classic car restoration, and motorsports applications drives demand for specialized formulations. High-performance engine oils command premium pricing while serving dedicated customer segments.

Digital transformation opportunities include e-commerce expansion, digital marketing, and connected vehicle integration. Online sales channels provide direct consumer access while reducing distribution costs. Digital platforms enable better customer engagement, product education, and service scheduling integration.

Sustainability initiatives align with German environmental consciousness and regulatory trends. Opportunities exist for bio-based oils, recycled content formulations, and packaging innovations that reduce environmental impact. Sustainable product lines can differentiate brands and capture environmentally conscious consumers.

Commercial vehicle growth driven by e-commerce and logistics expansion creates opportunities for specialized heavy-duty engine oils. The growing commercial vehicle fleet requires products designed for severe service conditions and extended drain intervals.

Market dynamics in Germany’s automotive engine oil sector reflect complex interactions between technological advancement, regulatory requirements, consumer behavior, and competitive pressures that shape industry evolution.

Supply chain dynamics demonstrate increasing sophistication as manufacturers optimize distribution networks and inventory management. The integration of digital technologies enables better demand forecasting and supply chain efficiency. Just-in-time delivery systems reduce inventory costs while ensuring product availability across diverse market segments.

Competitive dynamics intensify as market participants pursue differentiation through product innovation, brand positioning, and service excellence. The market supports both global oil majors with comprehensive product portfolios and specialized companies focusing on niche applications. Market concentration shows the top five players controlling approximately 58% of market share, while numerous smaller participants serve specific segments.

Technology dynamics drive continuous product evolution as additive chemistry advances and base oil quality improves. The development of new viscosity grades, enhanced performance characteristics, and specialized formulations responds to evolving engine requirements. Research and development investments focus on meeting future emission standards and performance requirements.

Pricing dynamics reflect raw material costs, competitive pressures, and value perception among consumers. Premium synthetic oils maintain pricing power through demonstrated performance benefits, while conventional oils face price pressure from synthetic alternatives. Price elasticity varies significantly between market segments, with commercial users showing greater sensitivity than premium consumer segments.

Comprehensive research methodology employed in analyzing Germany’s automotive engine oil market combines quantitative data analysis with qualitative market insights to provide accurate and actionable intelligence.

Primary research encompasses extensive interviews with industry stakeholders including oil manufacturers, distributors, automotive service providers, and end consumers. Survey methodologies capture consumer preferences, purchasing behavior, and brand perception across different market segments. Expert interviews with automotive engineers, lubricant chemists, and industry executives provide technical insights and market trend analysis.

Secondary research utilizes industry reports, regulatory filings, automotive production statistics, and trade association data to establish market baselines and validate primary research findings. Data triangulation ensures accuracy by cross-referencing multiple sources and methodologies.

Market modeling employs statistical analysis techniques to project market trends, segment growth rates, and competitive dynamics. Regression analysis identifies key variables influencing market performance, while scenario modeling explores potential future developments under different assumptions.

Quality assurance processes include peer review, data validation, and continuous methodology refinement to maintain research accuracy and reliability. MarkWide Research standards ensure consistent application of proven research methodologies across all market analysis activities.

Regional analysis reveals distinct patterns and opportunities across Germany’s diverse automotive engine oil market, with significant variations in consumption patterns, distribution channels, and competitive dynamics.

North Rhine-Westphalia represents the largest regional market, accounting for approximately 23% of national consumption. This industrial heartland benefits from high vehicle density, extensive commercial vehicle operations, and strong automotive service infrastructure. The region’s economic strength supports premium product adoption and frequent vehicle maintenance.

Bavaria demonstrates strong market performance driven by automotive manufacturing concentration and affluent consumer base. Premium vehicle ownership rates exceed national averages, creating demand for high-performance engine oils. The region’s automotive industry presence, including BMW and Audi facilities, influences both OEM and aftermarket segments.

Baden-Württemberg shows sophisticated market characteristics reflecting its automotive engineering heritage. Mercedes-Benz and Porsche presence creates demand for specialized high-performance oils. The region demonstrates early adoption of advanced synthetic formulations and environmental consciousness in product selection.

Eastern German states exhibit growing market potential as economic development continues. While historically showing preference for value-oriented products, increasing prosperity drives gradual migration toward premium synthetic oils. Market growth rates in eastern regions exceed national averages at 5.8% annually.

Urban versus rural dynamics create distinct market characteristics. Urban areas show higher synthetic oil adoption, frequent service intervals, and premium brand preference. Rural regions maintain stronger relationships with local service providers and demonstrate greater price sensitivity while requiring specialized agricultural and commercial vehicle applications.

Competitive landscape in Germany’s automotive engine oil market features diverse participants ranging from global oil majors to specialized German companies, each pursuing distinct strategies for market success.

Competitive strategies emphasize product innovation, OEM partnerships, distribution network expansion, and brand differentiation. Market leaders maintain competitive advantages through comprehensive product portfolios, extensive retail networks, and strong relationships with automotive manufacturers and service providers.

Market segmentation analysis reveals distinct categories within Germany’s automotive engine oil market, each characterized by specific requirements, growth patterns, and competitive dynamics.

By Oil Type:

By Vehicle Type:

By Distribution Channel:

Category-wise analysis provides detailed insights into specific market segments within Germany’s automotive engine oil landscape, revealing unique characteristics and growth opportunities.

Synthetic Oil Category demonstrates the strongest growth trajectory, driven by German consumers’ preference for premium products and advanced engine requirements. Full synthetic oils command premium pricing while delivering superior performance in fuel economy, engine protection, and service life extension. This category benefits from OEM recommendations and increasing consumer awareness of long-term cost benefits.

Commercial Vehicle Category shows robust demand driven by Germany’s position as a European logistics hub. Heavy-duty engine oils require specialized formulations to handle severe operating conditions, extended service intervals, and diverse fuel types including biodiesel blends. This segment demonstrates strong loyalty to proven brands and technical support services.

Premium Performance Category serves high-end vehicles and motorsports applications, commanding the highest margins in the market. Racing oils and specialty formulations cater to performance enthusiasts and professional motorsports, requiring cutting-edge technology and proven track performance.

Eco-Friendly Category emerges as a growing segment responding to environmental consciousness and regulatory requirements. Low-viscosity oils supporting fuel economy improvements and reduced emissions align with German sustainability goals and automotive industry trends toward efficiency optimization.

Quick-Lube Category expands as consumers seek convenient service options. Fast oil change services require standardized products, efficient inventory management, and strong supplier relationships to maintain service speed and quality standards.

Industry participants and stakeholders in Germany’s automotive engine oil market realize significant benefits through strategic positioning and market participation.

Manufacturers benefit from Germany’s sophisticated market that rewards innovation and quality. The market supports premium pricing for advanced formulations while providing opportunities for long-term OEM partnerships. Technical expertise developed for German market requirements translates to competitive advantages in global markets.

Distributors and Retailers gain from stable demand patterns and strong consumer loyalty to proven brands. The market’s emphasis on quality over price creates opportunities for value-added services and technical support. Multi-channel distribution strategies enable market share expansion and customer relationship strengthening.

Automotive Service Providers benefit from consistent demand for professional oil change services and technical expertise. The complexity of modern engine requirements creates opportunities for specialized services and premium service pricing. Certified technician programs enhance service quality and customer confidence.

Consumers receive access to world-class engine oil products that enhance vehicle performance, reliability, and longevity. The competitive market ensures product innovation, competitive pricing, and extensive service network availability. Extended warranty protection and improved fuel economy provide tangible value benefits.

Automotive Manufacturers benefit from reliable lubricant supply chains and technical partnerships that support new engine development. Co-development programs with oil companies enable optimized engine-oil combinations that enhance vehicle performance and meet emission requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping Germany’s automotive engine oil sector reflect technological advancement, changing consumer preferences, and evolving industry requirements.

Synthetic Oil Dominance continues accelerating as consumers recognize superior performance benefits and total cost of ownership advantages. Premium synthetic formulations increasingly become the standard choice for new vehicles and quality-conscious consumers, driving market value growth despite stable volume trends.

OEM Specification Proliferation creates increasingly complex product requirements as automotive manufacturers develop proprietary oil specifications. Brand-specific approvals become critical for market access, requiring significant investment in product development and testing to meet diverse OEM requirements.

Environmental Sustainability gains prominence as consumers and regulators demand eco-friendly products. Bio-based oils, recycled content, and sustainable packaging initiatives respond to environmental consciousness while supporting corporate sustainability goals.

Digital Integration transforms customer engagement through online product selection tools, service scheduling platforms, and educational content. Connected vehicle integration enables predictive maintenance and automated service recommendations based on actual driving conditions.

Extended Service Intervals become standard as oil technology advances enable longer periods between changes. Service interval extensions to 25,000-30,000 kilometers reduce maintenance frequency while requiring higher-performance oil formulations.

Consolidation Trends affect both manufacturing and distribution as companies seek scale advantages and market efficiency. Strategic partnerships between oil companies and automotive service providers create integrated service offerings and improved customer experiences.

Recent industry developments demonstrate the dynamic nature of Germany’s automotive engine oil market and highlight strategic initiatives shaping future market evolution.

Product Innovation Initiatives focus on developing next-generation synthetic oils that meet increasingly stringent performance requirements. Advanced additive packages enhance fuel economy, reduce emissions, and extend service intervals while maintaining superior engine protection under severe operating conditions.

Strategic Partnership Formations between oil companies and automotive manufacturers create collaborative development programs for optimized engine-oil combinations. Co-engineering projects ensure lubricant formulations complement specific engine designs and performance requirements.

Distribution Network Expansion includes both physical infrastructure development and digital platform enhancement. Omnichannel strategies integrate online and offline customer touchpoints while improving service accessibility and customer convenience.

Sustainability Program Implementation addresses environmental concerns through product reformulation, packaging innovation, and supply chain optimization. Circular economy initiatives include used oil collection programs and recycled content integration in new products.

Technology Integration Projects leverage digital technologies for improved customer service, inventory management, and predictive maintenance capabilities. IoT integration enables real-time monitoring of oil condition and automated service scheduling.

Regulatory Compliance Preparations anticipate future emission standards and environmental regulations through proactive product development and testing programs. Euro 7 readiness initiatives ensure product portfolios meet upcoming regulatory requirements.

Strategic recommendations for market participants in Germany’s automotive engine oil sector emphasize adaptation to evolving market conditions and proactive positioning for future opportunities.

Product Portfolio Optimization should prioritize synthetic oil development while maintaining selective conventional oil offerings for price-sensitive segments. MarkWide Research analysis indicates that companies focusing on premium synthetic formulations achieve superior margin performance and market positioning.

Digital Transformation Investment becomes essential for competitive success as consumers increasingly expect online product information, purchasing options, and service integration. E-commerce capabilities should complement traditional distribution channels while providing enhanced customer experiences.

OEM Partnership Development requires strategic focus on building long-term relationships with German automotive manufacturers. Co-development programs create competitive advantages through exclusive specifications and preferred supplier status.

Sustainability Integration should encompass product development, packaging innovation, and supply chain optimization to meet growing environmental expectations. Environmental credentials increasingly influence purchasing decisions and brand perception.

Market Segmentation Strategy should recognize distinct requirements across passenger car, commercial vehicle, and specialty applications. Targeted product development and marketing approaches maximize effectiveness in specific market segments.

Geographic Expansion within Germany should consider regional variations in consumer preferences, distribution networks, and competitive dynamics. Regional customization enhances market penetration and customer satisfaction.

Future market outlook for Germany’s automotive engine oil sector indicates continued evolution driven by technological advancement, regulatory requirements, and changing mobility patterns.

Market growth projections suggest sustained expansion at a CAGR of 4.2% through the forecast period, driven primarily by synthetic oil adoption and premium product migration. While electric vehicle growth may impact long-term demand, the transition timeline provides substantial opportunities for market development and innovation.

Technology advancement will continue driving product evolution as additive chemistry improves and base oil quality advances. Next-generation synthetic oils will offer enhanced performance characteristics including improved fuel economy, extended service intervals, and superior engine protection under increasingly demanding operating conditions.

Regulatory evolution toward stricter emission standards will require continued product innovation and reformulation. Euro 7 implementation and potential future regulations will drive demand for specialized low-viscosity oils that support emission reduction while maintaining engine durability.

Market consolidation trends are expected to continue as companies seek scale advantages and operational efficiency. Strategic mergers and acquisitions may reshape competitive dynamics while creating opportunities for market share redistribution.

Digital integration will transform customer engagement and service delivery through connected vehicle technologies, predictive maintenance systems, and enhanced e-commerce platforms. Data analytics will enable personalized product recommendations and optimized service scheduling.

Sustainability initiatives will gain increasing importance as environmental consciousness grows and regulatory requirements expand. Circular economy principles will drive innovation in product formulation, packaging design, and end-of-life management.

Germany’s automotive engine oil market represents a sophisticated and dynamic sector characterized by premium product preferences, technological innovation, and strong competitive dynamics. The market benefits from Germany’s position as Europe’s automotive manufacturing leader while adapting to evolving consumer expectations and regulatory requirements.

Market fundamentals remain strong despite long-term challenges from electric vehicle adoption and extended service intervals. The ongoing transition toward synthetic oils, growing commercial vehicle segment, and emphasis on environmental sustainability create substantial opportunities for market participants who adapt strategically to changing conditions.

Success factors in this market include product innovation, OEM partnerships, distribution network strength, and brand differentiation. Companies that invest in synthetic oil development, digital transformation, and sustainability initiatives are best positioned to capitalize on emerging opportunities while maintaining competitive advantages.

Future market evolution will be shaped by the balance between traditional internal combustion engine requirements and emerging mobility trends. While electric vehicles represent a long-term challenge, the extended transition timeline provides opportunities for continued market development and value creation through premium product offerings and innovative service solutions.

What is Automotive Engine Oil?

Automotive engine oil is a lubricant used in internal combustion engines to reduce friction, protect against wear, and help maintain optimal operating temperatures. It plays a crucial role in enhancing engine performance and longevity.

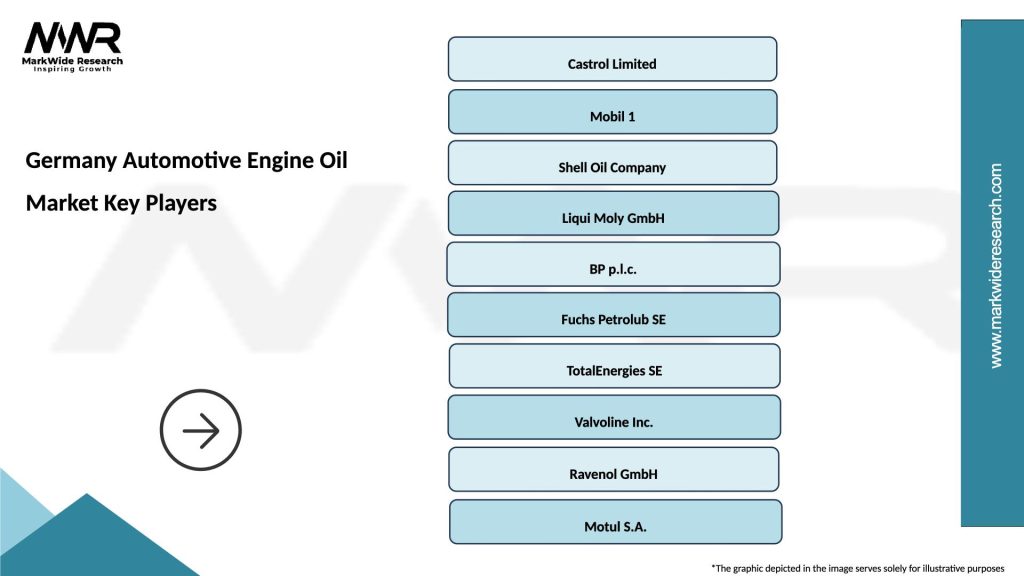

What are the key players in the Germany Automotive Engine Oil Market?

Key players in the Germany Automotive Engine Oil Market include companies like Castrol, Mobil, and TotalEnergies, which offer a range of engine oils for various vehicle types. These companies focus on innovation and quality to meet the demands of consumers and automotive manufacturers, among others.

What are the growth factors driving the Germany Automotive Engine Oil Market?

The growth of the Germany Automotive Engine Oil Market is driven by increasing vehicle production, rising consumer awareness about engine maintenance, and advancements in oil technology. Additionally, the trend towards higher performance and fuel-efficient engines is boosting demand for specialized engine oils.

What challenges does the Germany Automotive Engine Oil Market face?

The Germany Automotive Engine Oil Market faces challenges such as stringent environmental regulations and the growing popularity of electric vehicles, which reduce the demand for traditional engine oils. Additionally, fluctuating raw material prices can impact production costs.

What opportunities exist in the Germany Automotive Engine Oil Market?

Opportunities in the Germany Automotive Engine Oil Market include the development of synthetic and bio-based oils that cater to environmentally conscious consumers. Furthermore, the increasing trend of vehicle electrification presents a chance for companies to innovate and diversify their product offerings.

What trends are shaping the Germany Automotive Engine Oil Market?

Trends in the Germany Automotive Engine Oil Market include the shift towards high-performance and low-viscosity oils, as well as the growing demand for oils that enhance fuel efficiency. Additionally, there is a rising interest in sustainable and eco-friendly oil formulations.

Germany Automotive Engine Oil Market

| Segmentation Details | Description |

|---|---|

| Product Type | Synthetic, Semi-Synthetic, Mineral, Bio-Based |

| Vehicle Type | Passenger Cars, Commercial Vehicles, Motorcycles, Heavy-Duty Trucks |

| Grade | SAE 0W-20, SAE 5W-30, SAE 10W-40, SAE 15W-50 |

| End User | OEMs, Aftermarket Providers, Fleet Operators, Dealerships |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Automotive Engine Oil Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at