444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany agricultural tractor machinery market stands as one of Europe’s most sophisticated and technologically advanced agricultural equipment sectors. Germany’s agricultural sector has consistently demonstrated remarkable resilience and innovation, with tractor machinery serving as the backbone of modern farming operations across the country. The market encompasses a comprehensive range of agricultural tractors, from compact utility models to high-horsepower field tractors designed for large-scale farming operations.

Market dynamics in Germany reflect the country’s commitment to sustainable agriculture and precision farming technologies. The sector has experienced steady growth, with adoption rates of advanced tractor technologies reaching 78% among commercial farming operations. German farmers increasingly prioritize fuel efficiency, environmental compliance, and digital integration in their machinery selection processes.

Regional distribution shows significant concentration in Bavaria, Lower Saxony, and North Rhine-Westphalia, which collectively account for approximately 65% of total tractor sales. The market benefits from Germany’s strong manufacturing base, with several global tractor manufacturers maintaining production facilities and research centers within the country. Technological advancement remains a key differentiator, with GPS-guided systems, automated steering, and IoT connectivity becoming standard features in premium tractor segments.

The Germany agricultural tractor machinery market refers to the comprehensive ecosystem encompassing the manufacturing, distribution, sales, and servicing of agricultural tractors and related machinery within German borders. This market includes various tractor categories ranging from compact tractors under 40 horsepower to high-performance tractors exceeding 300 horsepower, along with specialized attachments and implements.

Agricultural tractor machinery represents mechanized equipment designed to provide power and traction for agricultural tasks including plowing, planting, cultivating, harvesting, and material handling. In the German context, this market extends beyond basic tractor units to encompass precision agriculture technologies, autonomous farming systems, and integrated digital platforms that optimize farm productivity and sustainability.

Market scope includes both domestic production and imports, covering new equipment sales, used machinery transactions, rental services, and aftermarket parts and services. The definition encompasses traditional diesel-powered tractors as well as emerging alternative fuel technologies including electric, hybrid, and hydrogen-powered agricultural machinery that align with Germany’s environmental objectives.

Germany’s agricultural tractor machinery market demonstrates robust performance characterized by technological innovation, sustainability focus, and strong domestic demand. The market benefits from Germany’s position as a leading agricultural producer within the European Union and its commitment to modernizing farming practices through advanced machinery adoption.

Key market drivers include increasing farm consolidation, growing emphasis on precision agriculture, and stringent environmental regulations promoting cleaner technologies. The sector shows particular strength in high-horsepower tractor segments, with tractors above 100 horsepower representing 42% of total unit sales. Digital transformation initiatives have accelerated adoption of smart farming technologies, creating new opportunities for connected tractor systems.

Competitive landscape features a mix of global manufacturers and specialized German companies, with market leadership distributed among established brands known for quality and innovation. The market faces challenges from supply chain disruptions and component shortages, but maintains resilience through strong aftermarket services and flexible manufacturing capabilities. Future growth prospects remain positive, supported by government incentives for sustainable farming practices and continued investment in agricultural modernization.

Strategic insights reveal several critical trends shaping Germany’s agricultural tractor machinery market. The following key insights provide comprehensive understanding of market dynamics:

Market maturity in Germany creates opportunities for value-added services and premium technology features rather than simple volume growth. Customer expectations continue evolving toward integrated solutions that combine machinery, software, and services into comprehensive farming systems.

Primary market drivers propelling Germany’s agricultural tractor machinery sector reflect broader agricultural modernization trends and specific German market characteristics. Farm efficiency requirements top the list of driving factors, as German farmers face increasing pressure to optimize productivity while managing labor shortages and rising operational costs.

Technological advancement serves as a fundamental driver, with farmers increasingly adopting precision agriculture technologies to maximize yields and minimize resource consumption. The integration of GPS systems, variable rate technology, and automated guidance systems has become essential for competitive farming operations. Environmental regulations significantly influence purchasing decisions, with emissions standards driving demand for cleaner, more efficient tractor technologies.

Government support programs provide substantial momentum through subsidies and incentives for sustainable farming equipment. The German government’s commitment to carbon neutrality creates favorable conditions for electric and hybrid tractor adoption. Farm consolidation trends drive demand for larger, more capable machinery as agricultural operations scale up to improve efficiency and competitiveness.

Labor market challenges accelerate automation adoption, with skilled agricultural workers becoming increasingly scarce. This shortage drives investment in autonomous and semi-autonomous tractor systems that reduce dependency on manual labor while maintaining operational efficiency.

Significant market restraints challenge growth in Germany’s agricultural tractor machinery sector, requiring strategic responses from manufacturers and dealers. High capital costs represent the primary barrier, particularly for smaller farming operations that struggle to justify investments in advanced machinery given uncertain commodity prices and profit margins.

Supply chain disruptions continue affecting the market, with semiconductor shortages and component availability issues delaying deliveries and increasing costs. These challenges have been particularly acute for technologically advanced tractors that rely heavily on electronic systems and digital components. Economic uncertainty related to global events and trade relationships creates hesitation among farmers considering major equipment purchases.

Regulatory complexity poses challenges as manufacturers must navigate evolving emissions standards, safety requirements, and digital privacy regulations. The transition to new emission standards requires significant research and development investments while potentially obsoleting existing inventory. Market saturation in certain segments limits growth opportunities, particularly in traditional tractor categories where replacement cycles extend due to improved durability and reliability.

Skills gaps in both farming operations and service networks constrain adoption of advanced technologies. Many farmers require extensive training to effectively utilize sophisticated tractor systems, while service technicians need specialized knowledge to maintain and repair complex electronic systems.

Emerging opportunities in Germany’s agricultural tractor machinery market present significant potential for growth and innovation. Electric and hybrid tractor technologies represent the most promising opportunity, with government incentives and environmental consciousness driving early adoption among progressive farmers. The transition to alternative powertrains creates opportunities for both established manufacturers and new market entrants.

Precision agriculture expansion offers substantial growth potential as farmers seek to optimize resource utilization and maximize yields. Advanced sensor technologies, artificial intelligence, and machine learning applications create opportunities for value-added services and subscription-based business models. Data analytics services present new revenue streams as farmers increasingly value insights derived from machinery-generated data.

Autonomous farming systems represent a transformative opportunity, with fully autonomous tractors expected to revolutionize agricultural operations. Early market entry in autonomous technologies could provide competitive advantages for manufacturers willing to invest in research and development. Service digitization creates opportunities to enhance customer relationships through predictive maintenance, remote diagnostics, and digital support platforms.

Export potential remains strong given Germany’s reputation for high-quality agricultural machinery. Expanding into emerging markets and developing specialized equipment for specific crop types or farming conditions could drive growth beyond domestic boundaries.

Complex market dynamics shape Germany’s agricultural tractor machinery sector through interconnected forces affecting supply, demand, and competitive positioning. Technological evolution continues accelerating, with manufacturers investing heavily in research and development to maintain competitive advantages. The pace of innovation creates both opportunities and challenges as companies balance current product lines with future technology investments.

Customer behavior patterns show increasing sophistication, with farmers conducting extensive research and seeking comprehensive solutions rather than standalone products. This trend favors manufacturers offering integrated systems and comprehensive support services. Seasonal demand fluctuations require careful inventory management and production planning, with peak sales periods coinciding with specific agricultural seasons.

Competitive intensity remains high as established manufacturers face pressure from both traditional competitors and new entrants focusing on electric or autonomous technologies. Price competition in commodity segments contrasts with premium pricing opportunities in advanced technology categories. Supply chain resilience has become crucial following recent disruptions, with manufacturers diversifying supplier networks and increasing inventory buffers.

Regulatory evolution continues influencing market dynamics through emissions standards, safety requirements, and digital regulations. Manufacturers must anticipate regulatory changes and invest in compliance capabilities while maintaining profitability and competitiveness.

Comprehensive research methodology employed in analyzing Germany’s agricultural tractor machinery market combines quantitative and qualitative approaches to ensure accurate and actionable insights. Primary research includes extensive interviews with key industry stakeholders including manufacturers, dealers, farmers, and industry associations to gather firsthand perspectives on market trends and challenges.

Secondary research encompasses analysis of industry reports, government statistics, trade publications, and company financial statements to establish market baselines and validate primary findings. Data triangulation methods ensure accuracy by cross-referencing multiple sources and identifying consistent patterns across different data sets.

Market segmentation analysis utilizes both top-down and bottom-up approaches to accurately size different market segments and identify growth opportunities. Statistical modeling techniques help project future market trends based on historical data and identified driving factors. Competitive intelligence gathering includes analysis of manufacturer strategies, product portfolios, and market positioning to understand competitive dynamics.

Regional analysis incorporates state-level data and regional agricultural statistics to identify geographic variations and opportunities. Technology assessment includes evaluation of emerging technologies and their potential market impact through expert interviews and patent analysis. Quality assurance processes ensure data accuracy and reliability throughout the research process.

Regional distribution across Germany reveals distinct patterns reflecting agricultural characteristics, farm sizes, and crop specializations. Bavaria leads the market with approximately 28% of total tractor sales, driven by diverse agricultural operations including dairy farming, crop production, and specialty agriculture. The region’s strong agricultural tradition and relatively fragmented farm structure support demand across all tractor categories.

Lower Saxony represents the second-largest market, accounting for 22% of national sales, with emphasis on large-scale crop production and livestock operations. The region’s flat terrain and larger average farm sizes favor high-horsepower tractors and specialized equipment. North Rhine-Westphalia contributes 15% of market volume, with diverse agricultural activities and strong industrial agriculture presence.

Eastern German states including Brandenburg, Mecklenburg-Vorpommern, and Saxony-Anhalt show rapid growth in tractor adoption, benefiting from farm modernization and consolidation following reunification. These regions favor large-scale, high-efficiency equipment suitable for extensive agricultural operations. Baden-Württemberg demonstrates strong demand for precision agriculture technologies and premium tractor features, reflecting the region’s focus on high-value crop production.

Regional preferences vary significantly, with southern regions favoring versatile tractors suitable for diverse farming operations, while northern and eastern regions prioritize high-capacity equipment for large-scale production. Service network density influences purchasing decisions, with manufacturers maintaining strong regional presence to support customers effectively.

Competitive landscape in Germany’s agricultural tractor machinery market features a diverse mix of global manufacturers, European specialists, and domestic companies competing across multiple segments. Market leadership is distributed among several key players, each with distinct strengths and market positioning strategies.

Competitive strategies emphasize technology differentiation, service excellence, and comprehensive customer solutions. Innovation leadership remains crucial, with companies investing heavily in autonomous systems, electric powertrains, and precision agriculture technologies. Strategic partnerships with technology companies and agricultural service providers enhance competitive positioning and market reach.

Market segmentation in Germany’s agricultural tractor machinery sector reflects diverse customer needs, applications, and technological requirements. Horsepower-based segmentation represents the primary classification method, with distinct customer preferences and use cases across different power categories.

By Horsepower Range:

By Application:

By Technology Level:

Category-specific analysis reveals distinct trends and opportunities across different tractor segments in the German market. High-horsepower tractors above 200 HP show the strongest growth momentum, driven by farm consolidation and efficiency requirements. These tractors incorporate the latest technology features and command premium pricing, making them attractive for manufacturers despite lower unit volumes.

Mid-range tractors in the 100-200 HP category represent the largest volume segment, serving diverse commercial farming operations. This category shows increasing adoption of precision agriculture technologies, with variable rate application systems present in 72% of new sales. Utility tractors in the 40-100 HP range maintain steady demand from medium-sized farms and specialized agricultural operations.

Compact tractors under 40 HP serve niche markets including small farms, municipalities, and landscaping operations. While volume growth remains limited, this segment offers opportunities for electric powertrains and specialized attachments. Specialty tractors designed for vineyards, orchards, and greenhouse operations show strong growth potential as German agriculture diversifies into high-value crops.

Technology categories demonstrate clear migration toward advanced and smart tractor systems. Basic tractors face declining demand as farmers prioritize efficiency and data capabilities. Smart tractors with IoT connectivity and data analytics represent the fastest-growing category, appealing to tech-savvy farmers seeking operational optimization.

Industry participants in Germany’s agricultural tractor machinery market enjoy numerous benefits from the sector’s maturity, technological advancement, and strong customer base. Manufacturers benefit from Germany’s reputation for engineering excellence and quality, enabling premium pricing and strong brand positioning in global markets.

Dealers and distributors enjoy stable revenue streams from both new equipment sales and aftermarket services. The market’s emphasis on service quality creates opportunities for long-term customer relationships and recurring revenue through maintenance contracts and parts sales. Technology providers find receptive customers willing to invest in advanced systems that improve productivity and sustainability.

Farmers benefit from access to world-class agricultural machinery that enhances productivity, reduces labor requirements, and improves environmental performance. Government stakeholders achieve agricultural policy objectives through advanced machinery adoption that supports sustainable farming practices and rural economic development.

Financial institutions find attractive lending opportunities in agricultural equipment financing, supported by strong collateral values and established customer relationships. Research institutions benefit from collaboration opportunities with manufacturers developing next-generation agricultural technologies. Service providers enjoy growing demand for specialized maintenance, training, and consulting services as equipment complexity increases.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends reshaping Germany’s agricultural tractor machinery market reflect broader technological evolution and changing agricultural practices. Electrification emerges as the most significant trend, with manufacturers developing electric and hybrid tractor systems to meet environmental regulations and customer sustainability goals.

Autonomous operation represents another major trend, with semi-autonomous and fully autonomous tractors gaining acceptance among progressive farmers. These systems promise to address labor shortages while improving operational efficiency and precision. Data-driven farming continues expanding, with tractors serving as mobile data collection platforms that enable precision agriculture and predictive analytics.

Connectivity integration has become standard, with IoT-enabled tractors providing real-time monitoring, remote diagnostics, and fleet management capabilities. Sustainability focus drives demand for fuel-efficient technologies and alternative powertrains that reduce environmental impact. Service digitization transforms customer relationships through digital platforms, predictive maintenance, and remote support capabilities.

Customization trends show farmers seeking tractors tailored to specific applications and regional requirements. Subscription models and equipment-as-a-service offerings gain traction as farmers seek flexible access to advanced technologies without large capital investments. Integration platforms that combine multiple agricultural systems and data sources become increasingly valuable for comprehensive farm management.

Recent industry developments highlight the dynamic nature of Germany’s agricultural tractor machinery market and ongoing transformation initiatives. Major manufacturers have announced significant investments in electric tractor development, with several companies planning commercial launches of battery-powered agricultural tractors within the next few years.

Strategic partnerships between traditional tractor manufacturers and technology companies accelerate innovation in autonomous systems and artificial intelligence applications. These collaborations combine agricultural expertise with cutting-edge technology capabilities to develop next-generation farming solutions. Government initiatives supporting sustainable agriculture have increased funding for research and development in clean tractor technologies.

Market consolidation continues with acquisitions and mergers aimed at strengthening technology capabilities and market positions. Digital platform launches by major manufacturers create comprehensive ecosystems connecting tractors, implements, and farm management systems. Service expansion initiatives focus on predictive maintenance, remote diagnostics, and data analytics services that enhance customer value propositions.

Research breakthroughs in battery technology, hydrogen fuel cells, and autonomous navigation systems promise to revolutionize agricultural machinery capabilities. Regulatory developments including updated emissions standards and safety requirements drive continuous product evolution and compliance investments.

Strategic recommendations for stakeholders in Germany’s agricultural tractor machinery market emphasize adaptation to technological change and evolving customer needs. MarkWide Research analysis suggests manufacturers should prioritize investment in electric and autonomous tractor technologies to maintain competitive positioning in the evolving market landscape.

Manufacturers should develop comprehensive digital service platforms that extend beyond traditional equipment sales to include data analytics, predictive maintenance, and farm management solutions. This approach creates recurring revenue streams and strengthens customer relationships. Dealers must invest in technician training and diagnostic equipment to support increasingly sophisticated tractor systems.

Market entry strategies for new participants should focus on niche segments or disruptive technologies rather than competing directly with established players in traditional categories. Partnership approaches can provide faster market access and technology development capabilities than independent development efforts.

Customer engagement strategies should emphasize total cost of ownership and productivity benefits rather than initial purchase price, particularly for advanced technology systems. Sustainability positioning becomes increasingly important as environmental regulations and customer preferences drive demand for cleaner technologies. Regional customization of products and services can capture specific market opportunities and customer preferences across different German agricultural regions.

Future prospects for Germany’s agricultural tractor machinery market remain positive despite challenges from economic uncertainty and supply chain disruptions. MWR projects continued growth driven by technological advancement, sustainability requirements, and ongoing agricultural modernization initiatives. The market is expected to experience steady growth rates of 4-6% annually over the next five years.

Technology evolution will accelerate, with electric tractors expected to capture 15-20% market share by 2030 as battery technology improves and charging infrastructure expands. Autonomous systems will transition from experimental to commercial applications, initially in controlled environments before expanding to general field operations.

Market structure may evolve toward service-oriented business models as manufacturers seek recurring revenue streams and customers demand comprehensive solutions. Digital integration will deepen, with tractors becoming integral components of connected farm ecosystems that optimize entire agricultural operations.

Regulatory environment will continue driving innovation in clean technologies and safety systems. International expansion opportunities remain strong for German manufacturers leveraging technology leadership and quality reputation in emerging markets. Consolidation trends may accelerate as companies seek scale advantages and technology capabilities necessary for future competition.

Germany’s agricultural tractor machinery market represents a mature yet dynamic sector characterized by technological innovation, sustainability focus, and strong customer sophistication. The market benefits from Germany’s agricultural heritage, engineering excellence, and commitment to environmental stewardship, creating favorable conditions for continued growth and development.

Key success factors include technology leadership, service excellence, and adaptation to evolving customer needs. Manufacturers that invest in electric powertrains, autonomous systems, and digital services are best positioned for future success. Market opportunities exist across multiple dimensions, from premium technology segments to emerging export markets seeking German quality and innovation.

Challenges including supply chain disruptions, regulatory complexity, and economic uncertainty require strategic responses and operational flexibility. However, the market’s fundamental strengths in technology, quality, and customer relationships provide resilience against short-term disruptions. Future growth will likely emphasize value-added services, sustainability solutions, and integrated farming systems rather than simple volume expansion.

Strategic positioning for long-term success requires balancing current market needs with future technology investments. Companies that successfully navigate this transition while maintaining service excellence and customer relationships will capture the greatest opportunities in Germany’s evolving agricultural tractor machinery market.

What is Agricultural Tractor Machinery?

Agricultural Tractor Machinery refers to the various types of tractors and related equipment used in farming and agricultural practices. These machines are essential for tasks such as plowing, planting, and harvesting crops.

What are the key players in the Germany Agricultural Tractor Machinery Market?

Key players in the Germany Agricultural Tractor Machinery Market include companies like John Deere, AGCO Corporation, and Claas. These companies are known for their innovative machinery and extensive product lines, catering to various agricultural needs.

What are the main drivers of the Germany Agricultural Tractor Machinery Market?

The main drivers of the Germany Agricultural Tractor Machinery Market include the increasing demand for efficient farming practices, advancements in technology, and the need for sustainable agricultural solutions. These factors contribute to the growth of modern agricultural machinery.

What challenges does the Germany Agricultural Tractor Machinery Market face?

The Germany Agricultural Tractor Machinery Market faces challenges such as high initial investment costs, regulatory compliance, and the need for skilled operators. These factors can hinder the adoption of new technologies and machinery in the agricultural sector.

What opportunities exist in the Germany Agricultural Tractor Machinery Market?

Opportunities in the Germany Agricultural Tractor Machinery Market include the development of smart farming technologies, increased automation, and the growing trend of precision agriculture. These innovations can enhance productivity and sustainability in farming.

What trends are shaping the Germany Agricultural Tractor Machinery Market?

Trends shaping the Germany Agricultural Tractor Machinery Market include the rise of electric and hybrid tractors, the integration of IoT technology for better farm management, and a focus on environmentally friendly practices. These trends are driving the evolution of agricultural machinery.

Germany Agricultural Tractor Machinery Market

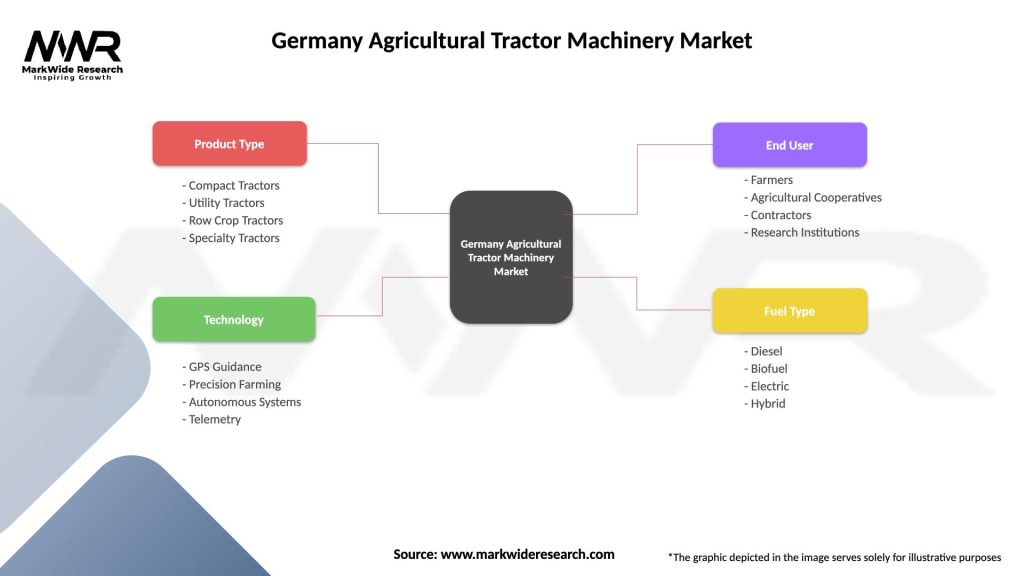

| Segmentation Details | Description |

|---|---|

| Product Type | Compact Tractors, Utility Tractors, Row Crop Tractors, Specialty Tractors |

| Technology | GPS Guidance, Precision Farming, Autonomous Systems, Telemetry |

| End User | Farmers, Agricultural Cooperatives, Contractors, Research Institutions |

| Fuel Type | Diesel, Biofuel, Electric, Hybrid |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany Agricultural Tractor Machinery Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at