444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The GEO satellite market represents a critical segment of the global space industry, encompassing satellites positioned in geostationary Earth orbit approximately 35,786 kilometers above the Earth’s equator. These satellites maintain a fixed position relative to Earth’s surface, making them ideal for telecommunications, broadcasting, weather monitoring, and defense applications. The market has experienced substantial growth driven by increasing demand for high-speed internet connectivity, expanding broadcasting services, and growing government investments in space-based infrastructure.

Market dynamics indicate robust expansion across multiple sectors, with telecommunications operators and government agencies leading adoption rates. The integration of advanced technologies such as high-throughput satellites (HTS) and electric propulsion systems has enhanced satellite capabilities while reducing operational costs. Regional markets show varying growth patterns, with North America and Asia-Pacific demonstrating particularly strong demand for GEO satellite services.

Industry transformation continues as traditional satellite operators adapt to evolving customer requirements and emerging technologies. The market benefits from increasing digitalization trends, expanding internet penetration in developing regions, and growing demand for reliable communication infrastructure. MarkWide Research analysis suggests that technological advancements and strategic partnerships are reshaping competitive dynamics within the sector.

The GEO satellite market refers to the commercial and government sector focused on the development, manufacturing, launch, and operation of satellites positioned in geostationary Earth orbit. These satellites orbit Earth at the same rotational speed as the planet, appearing stationary from ground-based perspectives and enabling continuous coverage of specific geographic regions.

Geostationary satellites serve multiple critical functions including telecommunications relay, television and radio broadcasting, internet services, weather monitoring, and military communications. The market encompasses satellite manufacturers, launch service providers, ground equipment suppliers, and satellite operators who provide end-user services. Key characteristics include 24-hour orbital periods, fixed geographic coverage areas, and the ability to provide uninterrupted communication links between ground stations.

Strategic positioning within the GEO satellite market reflects the sector’s fundamental role in global communications infrastructure. The market demonstrates resilience despite emerging competition from low Earth orbit (LEO) constellation projects, maintaining advantages in specific applications requiring continuous regional coverage. Growth drivers include expanding broadband demand in underserved regions, increasing government space budgets, and technological innovations improving satellite performance and cost-effectiveness.

Market segmentation reveals diverse applications spanning commercial telecommunications, government and military communications, broadcasting services, and scientific research. The sector benefits from established ground infrastructure and proven operational models, while adapting to incorporate next-generation technologies such as software-defined satellites and advanced beam-forming capabilities.

Competitive landscape features established aerospace companies, emerging commercial operators, and government agencies investing in sovereign space capabilities. The market shows approximately 15% growth in satellite capacity utilization across key regions, driven by increasing data consumption and expanding digital services.

Fundamental market insights reveal several critical trends shaping the GEO satellite industry’s evolution:

Primary market drivers propelling GEO satellite industry growth encompass technological, economic, and social factors creating sustained demand for satellite-based services. The increasing global demand for high-speed internet connectivity, particularly in remote and underserved regions, represents a fundamental growth catalyst. Telecommunications operators rely on GEO satellites to extend network coverage where terrestrial infrastructure remains economically unfeasible.

Government investments in space-based capabilities continue driving market expansion, with defense agencies requiring secure, reliable communication systems for military operations and national security applications. The growing importance of weather monitoring and climate research has increased demand for meteorological satellites, while disaster management applications require continuous Earth observation capabilities.

Broadcasting industry evolution maintains strong demand for GEO satellite capacity, with direct-to-home television services and radio broadcasting requiring wide-area coverage. The emergence of ultra-high-definition content and streaming services has increased bandwidth requirements, driving demand for high-throughput satellite technologies. Commercial aviation and maritime industries increasingly depend on satellite communications for passenger connectivity and operational communications.

Significant market restraints challenge GEO satellite industry growth, including high capital requirements for satellite development, manufacturing, and launch operations. The substantial upfront investments required for satellite projects create barriers for new market entrants and limit expansion opportunities for existing operators. Launch costs remain a critical constraint despite recent reductions in launch service pricing.

Regulatory complexities across international markets create operational challenges for satellite operators, with frequency coordination requirements and orbital slot allocations limiting deployment flexibility. The increasing congestion in geostationary orbit positions constrains available orbital slots, while space debris concerns raise operational risks and insurance costs.

Competition from alternative technologies presents ongoing challenges, particularly from LEO satellite constellations offering lower latency services and terrestrial fiber networks expanding into previously satellite-dependent markets. The long development cycles for GEO satellites, typically spanning 3-5 years from design to launch, limit operators’ ability to respond rapidly to changing market conditions.

Emerging market opportunities within the GEO satellite sector reflect evolving customer requirements and technological capabilities. The expanding Internet of Things (IoT) ecosystem creates demand for satellite connectivity solutions supporting remote monitoring applications across agriculture, energy, and transportation sectors. Smart city initiatives in developing regions present opportunities for satellite-based connectivity and data services.

5G network deployment creates opportunities for satellite operators to provide backhaul services and extend cellular coverage to remote areas. The integration of satellite and terrestrial networks enables seamless connectivity solutions, while edge computing applications require distributed satellite infrastructure. Climate monitoring and environmental research applications drive demand for specialized Earth observation satellites.

Commercial space exploration and lunar missions create new market segments for satellite communication services, while asteroid mining and space manufacturing initiatives require reliable communication links. The growing space tourism industry presents opportunities for passenger communication services and safety applications.

Complex market dynamics shape the GEO satellite industry’s competitive landscape and growth trajectory. The interplay between established satellite operators and emerging commercial space companies creates dynamic competitive pressures while driving innovation and cost reduction initiatives. Technology convergence between satellite and terrestrial networks enables new service models and revenue opportunities.

Supply chain considerations significantly impact market dynamics, with semiconductor shortages and specialized component availability affecting satellite manufacturing schedules. The consolidation of satellite manufacturing capabilities among major aerospace companies influences pricing and delivery timelines. Launch service availability and pricing directly impact satellite deployment strategies and operational costs.

Customer behavior evolution reflects changing expectations for satellite services, with demand for flexible, scalable solutions replacing traditional fixed-capacity models. The shift toward managed services and satellite-as-a-service offerings transforms revenue models and customer relationships. Regulatory developments continue influencing market dynamics through spectrum allocation decisions and orbital debris mitigation requirements.

Comprehensive research methodology employed in analyzing the GEO satellite market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research includes interviews with industry executives, satellite operators, equipment manufacturers, and government officials involved in space policy development. Secondary research encompasses analysis of industry reports, regulatory filings, financial statements, and technical publications.

Market sizing methodologies utilize bottom-up and top-down approaches, analyzing satellite capacity utilization rates, service pricing trends, and regional demand patterns. The research incorporates quantitative analysis of satellite launches, orbital slot allocations, and frequency assignments to assess market capacity and growth potential. Competitive analysis examines market share distributions, technology capabilities, and strategic positioning of key industry participants.

Data validation processes include cross-referencing multiple sources, expert interviews, and statistical analysis to ensure research accuracy. The methodology incorporates scenario analysis and sensitivity testing to account for market uncertainties and alternative development paths.

North American markets demonstrate strong demand for GEO satellite services, driven by established telecommunications infrastructure and significant government space investments. The region maintains approximately 40% market share in global satellite services revenue, supported by major satellite operators and aerospace manufacturers. United States government agencies represent substantial customers for satellite communications and Earth observation services.

European markets show steady growth with emphasis on sovereign space capabilities and commercial satellite services. The region benefits from coordinated space policies through the European Space Agency and strong industrial capabilities. Asia-Pacific regions exhibit the highest growth rates, with emerging economies investing in satellite infrastructure to support economic development and connectivity requirements.

Latin American markets present significant opportunities for satellite services, particularly in remote regions lacking terrestrial infrastructure. The region shows growing adoption rates of satellite-based internet and broadcasting services. Middle East and Africa demonstrate increasing demand for satellite communications supporting oil and gas operations, government communications, and broadcasting services.

Competitive dynamics within the GEO satellite market reflect the presence of established aerospace companies, commercial satellite operators, and emerging space technology firms. The market features both horizontal and vertical integration strategies as companies seek to control multiple aspects of the satellite value chain.

Strategic partnerships and joint ventures characterize competitive relationships, with companies collaborating on technology development while competing for market share. The industry shows increasing consolidation as operators seek scale advantages and cost synergies.

Market segmentation analysis reveals diverse applications and customer segments within the GEO satellite industry. By Application: telecommunications services represent the largest segment, followed by broadcasting, government and military communications, and Earth observation applications. Each segment demonstrates distinct growth patterns and customer requirements.

By Service Type: the market divides into satellite manufacturing, launch services, ground equipment, and satellite operations. Manufacturing services include satellite design, component integration, and testing services. Launch services encompass vehicle procurement, mission planning, and orbital insertion operations.

By End User: commercial customers including telecommunications operators, broadcasters, and internet service providers represent significant market segments. Government customers include defense agencies, civilian space organizations, and research institutions. The market also serves specialized sectors including maritime, aviation, and energy industries requiring reliable satellite communications.

Telecommunications category maintains the largest market share within GEO satellite applications, driven by global demand for internet connectivity and voice services. This segment benefits from increasing data consumption and expanding broadband requirements in underserved regions. High-throughput satellites enable more efficient spectrum utilization and improved service economics.

Broadcasting applications continue demonstrating stability despite competition from internet-based streaming services. Direct-to-home television services rely on GEO satellites for wide-area coverage, while radio broadcasting maintains steady demand. Ultra-high-definition content drives bandwidth requirements and satellite capacity utilization.

Government and defense applications show consistent growth supported by increasing space budgets and national security requirements. Military communications demand secure, reliable satellite links for global operations. Weather monitoring and Earth observation applications support climate research and disaster management initiatives.

Satellite operators benefit from stable revenue streams through long-term capacity agreements and diverse customer bases. The GEO satellite model provides predictable coverage areas and established ground infrastructure, reducing operational complexity. Economies of scale in satellite operations enable competitive service pricing and improved profitability.

Equipment manufacturers gain from recurring satellite replacement cycles and technology upgrade opportunities. The standardization of satellite platforms reduces development costs while enabling customization for specific applications. Launch service providers benefit from predictable demand patterns and established launch windows for GEO missions.

End customers receive reliable, wide-area coverage with proven technology and established service models. GEO satellites provide consistent service quality and simplified ground equipment requirements. Government agencies benefit from sovereign space capabilities and secure communication channels for national security applications.

Strengths:

Weaknesses:

Opportunities:

Threats:

Software-defined satellites represent a transformative trend enabling flexible payload reconfiguration and service adaptation throughout satellite lifespans. This technology allows operators to modify coverage areas, frequency allocations, and service characteristics based on changing market demands. Electric propulsion systems are becoming standard for GEO satellites, reducing launch mass requirements and extending operational lifespans.

High-throughput satellite technology continues evolving with advanced beam-forming capabilities and frequency reuse techniques improving spectral efficiency. The integration of artificial intelligence and machine learning enables autonomous satellite operations and predictive maintenance capabilities. MWR analysis indicates that these technological trends are driving significant performance improvements across the satellite industry.

Hybrid network architectures combining GEO satellites with LEO constellations and terrestrial networks create comprehensive connectivity solutions. The trend toward satellite-as-a-service models transforms traditional capacity leasing arrangements into managed service offerings. Environmental sustainability initiatives focus on end-of-life satellite disposal and orbital debris mitigation strategies.

Recent industry developments highlight the dynamic nature of the GEO satellite market and ongoing technological evolution. Major satellite operators have announced next-generation satellite programs incorporating advanced propulsion systems and flexible payload architectures. Manufacturing innovations include standardized satellite platforms reducing development costs and delivery timelines.

Strategic partnerships between satellite operators and cloud service providers create new market opportunities for edge computing and content delivery applications. Government agencies continue investing in sovereign satellite capabilities, driving demand for domestic manufacturing and launch services. Regulatory developments include updated orbital debris mitigation guidelines and spectrum allocation decisions affecting future satellite deployments.

Technology demonstrations showcase advanced satellite capabilities including optical inter-satellite links and autonomous operations systems. The industry shows increasing focus on cybersecurity measures protecting satellite communications and ground infrastructure. Commercial space initiatives expand market opportunities beyond traditional telecommunications and broadcasting applications.

Strategic recommendations for GEO satellite market participants emphasize the importance of technology innovation and market diversification. Companies should invest in next-generation satellite technologies including software-defined payloads and electric propulsion systems to maintain competitive advantages. Portfolio diversification across multiple market segments reduces dependency on traditional telecommunications applications.

Partnership strategies with terrestrial network operators and cloud service providers create opportunities for integrated service offerings and expanded market reach. Companies should focus on developing flexible service models accommodating changing customer requirements and market conditions. Operational efficiency improvements through automation and artificial intelligence reduce costs and improve service reliability.

Market expansion into emerging regions presents growth opportunities, requiring adaptation of service offerings and business models to local market conditions. Companies should maintain focus on regulatory compliance and international coordination requirements while pursuing global market opportunities. Sustainability initiatives addressing environmental concerns enhance corporate reputation and regulatory compliance.

Future market prospects for the GEO satellite industry reflect continued growth driven by expanding global connectivity requirements and technological innovations. The market is expected to maintain steady expansion with projected growth rates supported by emerging applications and geographic market development. Technology evolution will continue enhancing satellite capabilities while reducing operational costs.

Integration trends between satellite and terrestrial networks will create comprehensive connectivity solutions addressing diverse customer requirements. The development of lunar and deep space communication networks presents new market opportunities extending beyond traditional Earth-based applications. MarkWide Research projections indicate that the industry will adapt successfully to competitive pressures while maintaining core market positions.

Regulatory evolution will continue shaping market development through spectrum allocation decisions and orbital coordination requirements. The industry’s focus on sustainability and space debris mitigation will influence future satellite designs and operational practices. Commercial space expansion creates additional market segments requiring reliable satellite communication services.

The GEO satellite market demonstrates resilience and adaptability in an evolving space industry landscape, maintaining critical roles in global communications infrastructure while embracing technological innovations. Despite competitive pressures from alternative technologies, GEO satellites continue providing unique advantages in wide-area coverage applications and established service models. Market fundamentals remain strong with diverse customer segments and expanding applications driving sustained demand.

Strategic positioning for market success requires balancing traditional strengths with innovative capabilities addressing emerging customer requirements. The industry’s evolution toward software-defined satellites, hybrid networks, and sustainable operations positions GEO satellites for continued relevance in the global space economy. Future growth prospects reflect the fundamental importance of satellite communications in an increasingly connected world, with GEO satellites maintaining essential roles in telecommunications, broadcasting, and specialized applications requiring continuous regional coverage.

What is GEO Satellite?

GEO Satellite refers to a type of satellite that orbits the Earth at a geostationary orbit, approximately thirty-six thousand kilometers above the equator. These satellites are commonly used for telecommunications, weather monitoring, and broadcasting services.

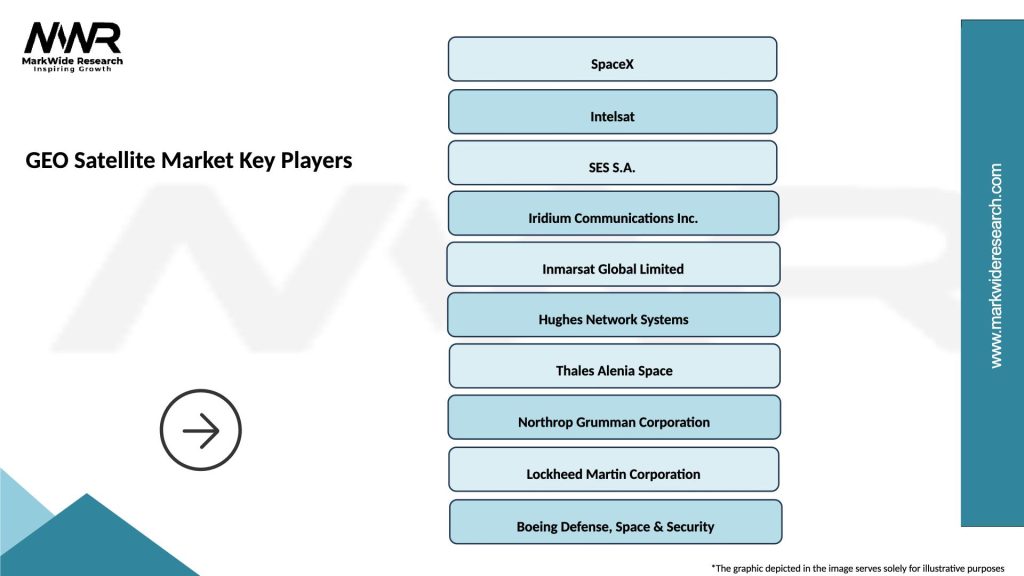

What are the key players in the GEO Satellite Market?

Key players in the GEO Satellite Market include companies like Intelsat, SES S.A., and Eutelsat, which provide satellite communication services and infrastructure. These companies are involved in various applications such as broadband internet, television broadcasting, and data transmission, among others.

What are the growth factors driving the GEO Satellite Market?

The GEO Satellite Market is driven by increasing demand for high-speed internet connectivity, the expansion of satellite-based communication services, and advancements in satellite technology. Additionally, the growing need for reliable weather forecasting and disaster management solutions contributes to market growth.

What challenges does the GEO Satellite Market face?

The GEO Satellite Market faces challenges such as high launch costs, limited bandwidth availability, and regulatory hurdles. Additionally, competition from low Earth orbit (LEO) satellite systems poses a significant challenge to traditional GEO satellite operators.

What opportunities exist in the GEO Satellite Market?

Opportunities in the GEO Satellite Market include the potential for new applications in Internet of Things (IoT) connectivity, enhanced global communication networks, and partnerships with emerging technology firms. The increasing focus on satellite-based solutions for remote areas also presents significant growth potential.

What trends are shaping the GEO Satellite Market?

Trends in the GEO Satellite Market include the integration of artificial intelligence for satellite operations, the development of more efficient satellite designs, and the rise of hybrid satellite systems that combine GEO and LEO capabilities. These innovations aim to improve service delivery and reduce operational costs.

GEO Satellite Market

| Segmentation Details | Description |

|---|---|

| Product Type | Communication Satellites, Earth Observation Satellites, Navigation Satellites, Scientific Satellites |

| Technology | Geostationary Orbit, Low Earth Orbit, Medium Earth Orbit, Hybrid Systems |

| End User | Government, Commercial, Military, Research Institutions |

| Application | Telecommunications, Weather Monitoring, Disaster Management, Environmental Monitoring |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the GEO Satellite Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at