444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The genetic testing market in Europe represents one of the most rapidly expanding healthcare segments, driven by increasing awareness of personalized medicine and preventive healthcare approaches. European countries are witnessing unprecedented growth in genetic testing adoption, with healthcare systems increasingly integrating these advanced diagnostic tools into routine medical practice. The market encompasses various testing methodologies including diagnostic testing, predictive testing, carrier testing, and pharmacogenomic testing.

Market dynamics indicate robust expansion across multiple European regions, with Western European countries leading adoption rates at approximately 42% market penetration. The integration of genetic testing into national healthcare frameworks has accelerated significantly, particularly in countries like Germany, United Kingdom, France, and Netherlands. Technological advancements in next-generation sequencing and reduced testing costs have made genetic testing more accessible to broader patient populations.

Healthcare providers across Europe are increasingly recognizing the value of genetic testing in early disease detection and treatment optimization. The market growth trajectory shows consistent expansion with projected CAGR of 11.2% through the forecast period, driven by rising prevalence of genetic disorders and increasing investment in precision medicine initiatives.

The genetic testing market in Europe refers to the comprehensive ecosystem of diagnostic services, technologies, and healthcare solutions that analyze human DNA to identify genetic variations, mutations, and predispositions to various diseases. Genetic testing encompasses laboratory procedures that examine chromosomes, genes, or proteins to detect genetic disorders, assess disease risk, and guide treatment decisions.

European genetic testing includes multiple categories such as clinical genetic testing performed in healthcare settings, direct-to-consumer testing available through commercial providers, and research-based testing conducted in academic institutions. The market covers various testing methodologies including molecular genetic tests, chromosomal genetic tests, and biochemical genetic tests.

Market scope extends across numerous applications including oncology testing, reproductive health screening, cardiovascular disease assessment, neurological disorder detection, and pharmacogenomic analysis. The European market operates within stringent regulatory frameworks ensuring testing accuracy, patient privacy, and ethical standards in genetic information handling.

European genetic testing market demonstrates exceptional growth momentum, establishing itself as a cornerstone of modern healthcare delivery across the continent. Market expansion is primarily driven by increasing healthcare expenditure, growing awareness of genetic disorders, and supportive government policies promoting precision medicine initiatives.

Key market segments show varying growth patterns, with oncology genetic testing representing the largest application segment, accounting for approximately 38% market share. Reproductive health testing follows as the second-largest segment, driven by increasing maternal age and growing awareness of genetic screening benefits. Pharmacogenomic testing emerges as the fastest-growing segment with projected CAGR of 14.7%.

Regional distribution reveals Western Europe maintaining market leadership, while Eastern European countries demonstrate accelerating adoption rates. Technological innovations in sequencing technologies and bioinformatics continue to drive market evolution, making genetic testing more accurate, faster, and cost-effective.

Competitive landscape features established multinational corporations alongside emerging biotechnology companies, creating a dynamic ecosystem of innovation and market competition. Strategic partnerships between healthcare providers, technology companies, and research institutions are reshaping market dynamics and accelerating service delivery improvements.

Market intelligence reveals several critical insights shaping the European genetic testing landscape:

Market trends indicate sustained growth across all major testing categories, with particular strength in cancer genetics and rare disease testing. Healthcare providers are increasingly adopting genetic testing as a standard diagnostic tool, supported by improving reimbursement policies across European countries.

Primary growth drivers propelling the European genetic testing market include multiple interconnected factors creating favorable market conditions:

Healthcare transformation toward value-based care models emphasizes genetic testing’s role in improving patient outcomes while reducing long-term healthcare costs. Pharmaceutical companies increasingly rely on genetic testing for drug development and patient stratification in clinical trials.

Consumer awareness campaigns and educational initiatives have significantly increased public understanding of genetic testing benefits, creating sustained demand growth across diverse patient populations.

Market challenges present obstacles to genetic testing market expansion across Europe, requiring strategic solutions from industry stakeholders:

Healthcare provider education remains insufficient in some regions, limiting optimal utilization of genetic testing capabilities. Laboratory standardization challenges affect testing quality consistency across different European markets.

Market fragmentation due to varying national healthcare policies creates operational complexities for companies seeking pan-European market presence.

Emerging opportunities in the European genetic testing market present substantial growth potential for industry participants:

Market expansion into Eastern European countries presents significant growth opportunities as healthcare systems modernize and genetic testing awareness increases. Public-private partnerships offer pathways for accelerated market development and improved patient access.

Technology convergence with digital health platforms, wearable devices, and electronic health records creates opportunities for comprehensive health management solutions incorporating genetic insights.

Market dynamics in the European genetic testing sector reflect complex interactions between technological advancement, regulatory evolution, and changing healthcare paradigms. Supply-side factors include continuous innovation in sequencing technologies, expanding laboratory capabilities, and growing service provider networks across European countries.

Demand-side dynamics are driven by increasing patient awareness, healthcare provider adoption, and supportive reimbursement policies. MarkWide Research analysis indicates that market equilibrium is shifting toward increased testing accessibility with approximately 23% annual growth in testing volume across major European markets.

Competitive dynamics feature intense innovation competition among established players and emerging biotechnology companies. Market consolidation trends include strategic acquisitions and partnerships aimed at expanding testing capabilities and geographic reach.

Regulatory dynamics continue evolving with European Medicines Agency and national regulatory bodies developing comprehensive frameworks for genetic testing oversight. Technology adoption cycles show accelerating integration of next-generation sequencing and artificial intelligence in testing workflows.

Economic dynamics reflect improving cost-effectiveness of genetic testing, with healthcare systems recognizing long-term economic benefits of early disease detection and personalized treatment approaches.

Research approach for European genetic testing market analysis employs comprehensive mixed-methodology framework combining quantitative and qualitative research techniques. Primary research includes extensive interviews with healthcare providers, laboratory directors, genetic counselors, and industry executives across major European markets.

Secondary research encompasses analysis of published studies, regulatory filings, company reports, and healthcare statistics from authoritative sources including European Centre for Disease Prevention and Control, national health ministries, and academic institutions.

Data collection methodology incorporates multiple validation techniques ensuring research accuracy and reliability:

Market modeling utilizes advanced statistical techniques and forecasting algorithms to project market trends and growth trajectories. Data triangulation methods ensure research findings accuracy through cross-validation of multiple data sources.

Regional market distribution across Europe reveals distinct patterns of genetic testing adoption and growth potential:

Western Europe maintains market leadership with Germany representing the largest national market, accounting for approximately 28% regional market share. German healthcare system integration of genetic testing in oncology and rare disease diagnosis drives substantial market activity. United Kingdom follows with strong market presence supported by National Health Service genetic testing programs and robust research infrastructure.

France demonstrates significant market growth with expanding pharmacogenomic testing adoption and increasing integration of genetic screening in preventive healthcare protocols. Netherlands and Switzerland show high per-capita testing rates driven by advanced healthcare systems and strong patient awareness.

Southern Europe markets including Italy, Spain, and Portugal exhibit accelerating growth with improving healthcare infrastructure and increasing genetic testing accessibility. Italy shows particular strength in cancer genetic testing with approximately 19% market share in the regional oncology testing segment.

Eastern Europe represents the fastest-growing regional segment with Poland, Czech Republic, and Hungary leading adoption rates. Market penetration in Eastern European countries reaches approximately 15% with substantial growth potential as healthcare modernization continues.

Nordic countries including Sweden, Norway, and Denmark demonstrate high testing adoption rates supported by comprehensive healthcare systems and strong government support for precision medicine initiatives.

Competitive environment in the European genetic testing market features diverse participants ranging from multinational corporations to specialized biotechnology companies:

Market competition intensifies through continuous innovation in testing technologies, expansion of service offerings, and strategic partnerships with healthcare providers. Competitive strategies focus on improving testing accuracy, reducing turnaround times, and expanding geographic coverage across European markets.

Emerging competitors include specialized genetic testing companies and biotechnology startups developing innovative testing methodologies and artificial intelligence-powered analysis platforms.

Market segmentation analysis reveals distinct categories driving European genetic testing market growth:

By Technology:

By Application:

By End User:

Oncology genetic testing represents the most mature and largest market category, driven by increasing cancer incidence and growing adoption of precision oncology approaches. Tumor profiling and hereditary cancer testing show particularly strong growth with healthcare providers increasingly utilizing genetic information for treatment selection.

Reproductive health testing demonstrates consistent growth driven by increasing maternal age and growing awareness of genetic screening benefits. Non-invasive prenatal testing (NIPT) shows exceptional adoption rates with approximately 31% annual growth across European markets.

Pharmacogenomic testing emerges as the fastest-growing category with healthcare systems recognizing the value of genetic-guided medication selection. Drug-gene interaction testing shows particular promise in psychiatry, cardiology, and pain management applications.

Rare disease testing represents a specialized but important market category with growing recognition of genetic testing’s role in rare disorder diagnosis. Whole exome sequencing and whole genome sequencing are increasingly utilized for comprehensive rare disease evaluation.

Cardiovascular genetic testing shows expanding applications in familial hypercholesterolemia screening and cardiomyopathy evaluation, supported by clinical guidelines promoting genetic testing adoption.

Healthcare providers benefit significantly from genetic testing integration through improved diagnostic accuracy, enhanced treatment selection, and better patient outcomes. Clinical decision-making becomes more precise with genetic information enabling personalized treatment approaches and risk stratification.

Patients experience substantial benefits including early disease detection, personalized treatment options, and informed healthcare decision-making. Preventive healthcare opportunities increase through genetic risk assessment and targeted screening programs.

Healthcare systems realize long-term economic benefits through reduced healthcare costs, improved treatment efficiency, and better resource allocation. MWR analysis indicates potential healthcare cost savings of approximately 18% through genetic testing-guided treatment optimization.

Pharmaceutical companies benefit from genetic testing through improved drug development processes, enhanced clinical trial design, and better patient stratification. Companion diagnostics development creates new revenue opportunities and improves drug efficacy.

Laboratory service providers experience business growth through expanding testing volumes, premium pricing for specialized tests, and opportunities for service differentiation. Technology providers benefit from increasing demand for advanced sequencing platforms and analysis software.

Research institutions gain access to valuable genetic data for advancing scientific understanding and developing new therapeutic approaches. Collaborative opportunities increase between academic institutions and commercial organizations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends shaping the European genetic testing market landscape include several transformative developments:

Technology convergence trends include integration of genetic testing with electronic health records, clinical decision support systems, and population health management platforms. Data analytics advancement enables more sophisticated genetic risk modeling and personalized healthcare recommendations.

Market consolidation trends feature strategic partnerships between technology providers, healthcare organizations, and pharmaceutical companies to create comprehensive genetic testing ecosystems.

Recent industry developments demonstrate accelerating innovation and market expansion across the European genetic testing sector:

Investment activities show substantial funding for genetic testing companies and technology development programs. Public-private partnerships are accelerating genetic testing implementation in population health initiatives.

International collaborations between European institutions and global partners are advancing genetic testing research and clinical applications.

Strategic recommendations for market participants include focused approaches to capitalize on emerging opportunities and address market challenges:

Market entry strategies should focus on establishing strong local partnerships and understanding regional regulatory requirements. Innovation priorities should emphasize improving testing accessibility, reducing costs, and enhancing clinical utility.

Long-term success requires continuous investment in research and development, maintaining technological leadership, and building comprehensive service ecosystems that address diverse customer needs across European markets.

Future market trajectory for European genetic testing indicates sustained growth with expanding applications and improving accessibility. Market evolution will be driven by continued technological advancement, increasing healthcare integration, and growing patient awareness of genetic testing benefits.

Technology development trends suggest continued improvement in testing accuracy, speed, and cost-effectiveness. Artificial intelligence integration will enhance genetic data interpretation and clinical decision support capabilities. Point-of-care testing solutions will expand testing accessibility and enable rapid clinical decision-making.

Healthcare system integration will deepen with genetic testing becoming standard practice across multiple medical specialties. Preventive healthcare emphasis will drive population-based genetic screening programs and risk assessment initiatives.

Regulatory environment will continue evolving to support innovation while ensuring patient safety and data protection. Reimbursement policies are expected to expand coverage for genetic testing applications with demonstrated clinical utility.

Market growth projections indicate continued expansion with projected CAGR of 11.8% through the next five years. MarkWide Research forecasts suggest particularly strong growth in pharmacogenomic testing and rare disease applications.

Emerging applications in mental health genetics, infectious disease susceptibility, and aging-related disorders will create new market opportunities and expand the addressable patient population.

The European genetic testing market represents a dynamic and rapidly expanding healthcare sector with substantial growth potential across multiple applications and geographic regions. Market fundamentals remain strong, supported by advancing technology, increasing healthcare integration, and growing recognition of genetic testing’s clinical value.

Key success factors for market participants include maintaining technological leadership, ensuring regulatory compliance, and developing comprehensive service offerings that address diverse customer needs. Strategic focus on emerging applications such as pharmacogenomics and rare disease testing will be critical for capturing growth opportunities.

Market challenges including regulatory complexity and reimbursement inconsistencies require strategic approaches and continued industry collaboration. Innovation investment in artificial intelligence, point-of-care testing, and data analytics will drive competitive differentiation and market expansion.

Long-term outlook remains highly positive with genetic testing becoming increasingly integral to European healthcare delivery. Market participants positioned with strong technological capabilities, comprehensive service offerings, and strategic partnerships are well-positioned to capitalize on sustained market growth and expanding clinical applications across the European genetic testing landscape.

What is Genetic Test?

Genetic testing refers to a variety of techniques used to analyze genes, chromosomes, and proteins to identify genetic disorders or predispositions. It plays a crucial role in personalized medicine, allowing for tailored treatment plans based on an individual’s genetic makeup.

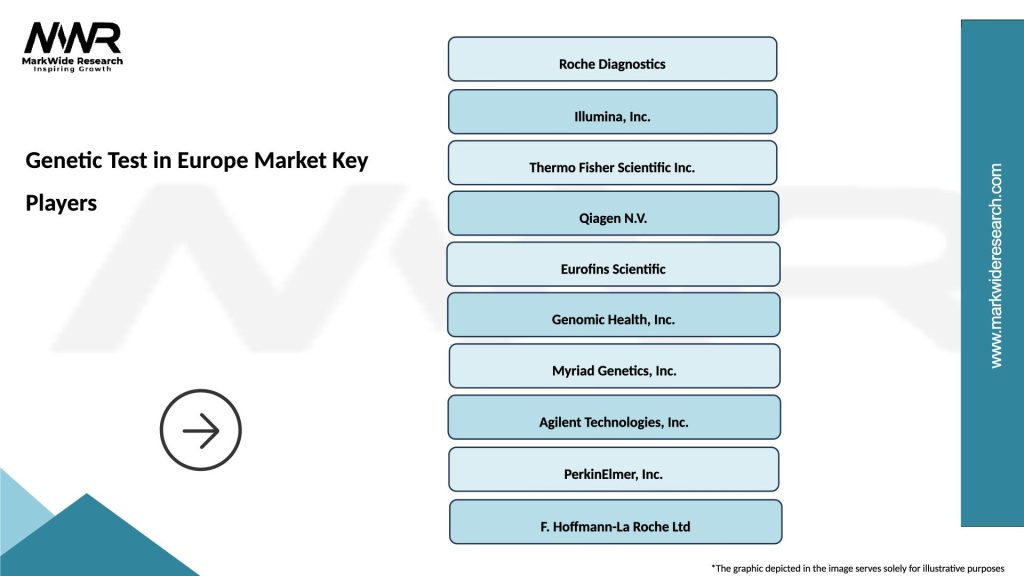

What are the key players in the Genetic Test in Europe Market?

Key players in the Genetic Test in Europe Market include companies like Roche, Illumina, and QIAGEN, which are known for their innovative testing solutions and technologies. These companies focus on various applications such as oncology, prenatal testing, and hereditary disease screening, among others.

What are the growth factors driving the Genetic Test in Europe Market?

The Genetic Test in Europe Market is driven by factors such as the increasing prevalence of genetic disorders, advancements in genomic technologies, and a growing emphasis on personalized medicine. Additionally, rising awareness among consumers about genetic testing benefits contributes to market growth.

What challenges does the Genetic Test in Europe Market face?

Challenges in the Genetic Test in Europe Market include regulatory hurdles, ethical concerns regarding genetic data privacy, and the high costs associated with advanced testing technologies. These factors can hinder market expansion and consumer adoption.

What opportunities exist in the Genetic Test in Europe Market?

Opportunities in the Genetic Test in Europe Market include the development of new testing technologies, increasing partnerships between biotech firms and healthcare providers, and the expansion of direct-to-consumer genetic testing services. These trends can enhance accessibility and innovation in genetic testing.

What trends are shaping the Genetic Test in Europe Market?

Trends shaping the Genetic Test in Europe Market include the rise of next-generation sequencing, the integration of artificial intelligence in data analysis, and a growing focus on preventive healthcare. These innovations are transforming how genetic information is utilized in clinical settings.

Genetic Test in Europe Market

| Segmentation Details | Description |

|---|---|

| Product Type | Diagnostic Tests, Predictive Tests, Carrier Tests, Prenatal Tests |

| Technology | Next-Generation Sequencing, Polymerase Chain Reaction, Microarray Analysis, Sanger Sequencing |

| End User | Hospitals, Research Laboratories, Diagnostic Centers, Academic Institutions |

| Application | Oncology, Rare Diseases, Cardiovascular Disorders, Neurological Disorders |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Genetic Test in Europe Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at