444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The GCC Secondhand Luxury Goods Market refers to the buying and selling of pre-owned luxury products in the Gulf Cooperation Council (GCC) countries, including Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates (UAE). This market has gained significant traction in recent years, driven by changing consumer preferences, the desire for unique and sustainable products, and the growing popularity of online platforms for buying and selling secondhand items.

Meaning

The GCC Secondhand Luxury Goods Market encompasses a wide range of products, including designer clothing, handbags, shoes, accessories, watches, jewelry, and more. These goods are typically of high quality and come from renowned luxury brands such as Chanel, Gucci, Louis Vuitton, and Rolex, among others. The market offers an opportunity for consumers to own luxury items at a fraction of the original price, making it an attractive alternative to buying brand new products.

Executive Summary

The GCC Secondhand Luxury Goods Market has witnessed substantial growth in recent years, driven by several factors. The market provides an avenue for consumers to indulge in luxury without breaking the bank, as pre-owned items are often available at significantly lower prices compared to their new counterparts. Additionally, the market caters to the increasing demand for sustainable and eco-friendly consumption practices, as buying secondhand reduces waste and extends the lifespan of luxury products.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Increasing E-commerce Growth: Online platforms dedicated to the resale of luxury items are becoming increasingly popular in the GCC, driving the growth of the secondhand luxury goods market.

Sustainability and Conscious Consumption: Consumers in the GCC are increasingly drawn to sustainable and eco-friendly purchasing options, making secondhand luxury goods an attractive alternative to new products.

Growth in Young Consumer Demographics: The growing population of young, affluent consumers in the GCC, who are digitally connected and value sustainability, is propelling the demand for secondhand luxury goods.

Rise in Luxury Goods Awareness: A greater focus on luxury goods authenticity, coupled with advancements in technology that help validate the legitimacy of items, is boosting consumer confidence in purchasing pre-owned luxury items.

Market Drivers

The GCC Secondhand Luxury Goods Market is primarily driven by the following factors:

Increased Digital Adoption: The rise of online platforms and mobile apps for the sale of pre-owned luxury goods is making it easier for consumers to access a wide range of products.

Sustainability Trends: Growing awareness of the environmental impact of consumerism is encouraging consumers to adopt a more sustainable approach to shopping, with many choosing secondhand goods to reduce waste and promote recycling.

High Disposable Income: The GCC region boasts a high per capita income, enabling consumers to afford luxury items while also seeking cost-effective alternatives like secondhand products.

Changing Consumer Behavior: A shift in consumer behavior, particularly among the younger demographic, is influencing the demand for secondhand luxury items as they seek affordable yet authentic luxury products.

Thrive in Digital Platforms: The availability of digital platforms that authenticate, buy, and sell secondhand luxury items has made it easier for consumers to access high-quality pre-owned goods with confidence.

Market Restraints

Despite its growth potential, the GCC Secondhand Luxury Goods Market faces several challenges:

Authenticity Concerns: Despite technological advancements, the issue of counterfeit luxury goods remains a significant barrier, as consumers seek guarantees about the authenticity and quality of secondhand products.

Cultural Preferences: Some GCC consumers still view secondhand products as less desirable than new luxury items, especially in markets where brand new products are more commonly associated with status.

Limited Awareness: In certain segments of the population, there is still limited awareness about the availability and benefits of secondhand luxury goods, especially in less digitally engaged demographics.

Lack of Standardized Regulations: The lack of standardized regulations regarding the resale of luxury items can create challenges for businesses and consumers regarding quality control, warranty, and pricing transparency.

Market Opportunities

The GCC Secondhand Luxury Goods Market presents several opportunities for growth:

Expansion of E-commerce Platforms: The growing popularity of online resale platforms presents an opportunity for companies to expand their reach and capture a larger portion of the market by offering a seamless digital experience.

Luxury Consignment Stores: With increasing demand for pre-owned luxury items, there is an opportunity for physical consignment stores to thrive in high-income areas within the GCC region.

Sustainability Partnerships: Businesses can tap into the increasing demand for sustainable products by creating partnerships with environmental organizations or developing green initiatives to attract eco-conscious consumers.

Luxury Rental Services: The growing demand for short-term luxury items (such as for special events) could lead to the development of luxury goods rental services, which would complement the secondhand market.

Market Dynamics

The GCC Secondhand Luxury Goods Market is influenced by several dynamic factors:

Shifting Demographics: The region’s younger, tech-savvy consumers are increasingly embracing the secondhand luxury market, using digital platforms to buy and sell pre-owned goods.

Economic Cycles: While high disposable income in the GCC supports the luxury market, fluctuations in oil prices and regional economic instability can affect the demand for non-essential luxury items, including secondhand goods.

Cultural Shifts: A growing cultural shift towards sustainability and conscious consumerism is leading more consumers to consider secondhand products as a viable option for luxury shopping.

Technological Advancements: The integration of artificial intelligence (AI), blockchain, and digital authentication systems is enabling greater transparency and trust in the resale of luxury goods, enhancing the overall market ecosystem.

Regional Analysis

The GCC Secondhand Luxury Goods Market is characterized by diverse trends across various countries:

UAE: The UAE, especially Dubai, is one of the largest markets for secondhand luxury goods in the GCC region. With its status as a global luxury hub and a large expatriate population, the demand for pre-owned luxury items is significant.

Saudi Arabia: Saudi Arabia has seen a rise in secondhand luxury goods due to the younger population, growing online platforms, and increasing awareness of the benefits of sustainable shopping.

Qatar and Kuwait: Qatar and Kuwait are also experiencing growth in the demand for secondhand luxury products, particularly as consumers in these markets become more aware of the value of pre-owned items and more comfortable with online shopping.

Bahrain and Oman: While smaller markets compared to the UAE and Saudi Arabia, Bahrain and Oman are also witnessing an increase in demand for secondhand luxury goods, particularly as online platforms expand their reach in these regions.

Competitive Landscape

Leading Companies in the GCC Secondhand Luxury Goods Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

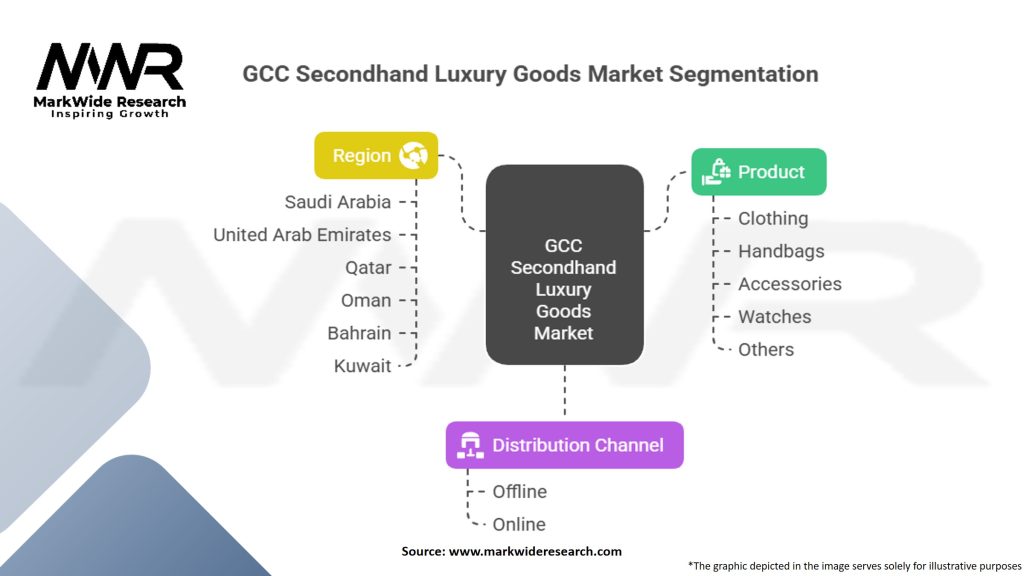

Segmentation

The GCC Secondhand Luxury Goods Market can be segmented based on various factors:

Product Type: Handbags, Watches, Jewelry, Clothing, Shoes, Accessories.

Platform Type: Online Resale Platforms, Physical Consignment Stores, Auction Platforms.

End-User: Individual Consumers, Retailers, Online Resellers.

Category-wise Insights

Each category offers unique growth potential:

Handbags: High-demand secondhand luxury handbags from top brands like Chanel, Louis Vuitton, and Hermes are popular in the GCC market due to their value retention and fashion appeal.

Watches: Luxury watches, especially limited edition or vintage models, are increasingly being bought and sold in the secondhand market in the GCC region.

Key Benefits for Industry Participants and Stakeholders

The GCC Secondhand Luxury Goods Market offers key benefits for participants:

High Profit Margins: Luxury goods retain high value even when resold, allowing sellers to earn significant profits on pre-owned items.

Sustainability and Recycling: The resale of luxury items promotes sustainability and the circular economy, which is increasingly valued by consumers in the GCC region.

SWOT Analysis

Strengths:

High demand for luxury products in the GCC.

Growing acceptance of secondhand goods in the region.

Weaknesses:

Potential stigma around buying secondhand luxury goods.

Challenges related to product authenticity and quality.

Opportunities:

Expanding digital platforms for wider reach.

Increased demand for luxury rental services.

Threats:

Competition from counterfeit goods.

Economic instability affecting luxury spending.

Market Key Trends

Key trends shaping the GCC Secondhand Luxury Goods Market include:

E-commerce Growth: The rapid growth of online resale platforms is revolutionizing how consumers buy and sell secondhand luxury goods in the GCC region.

Consumer Education: Increasing awareness about the benefits of secondhand luxury shopping is helping to dispel myths and expand market acceptance.

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the GCC Secondhand Luxury Goods Market. While the initial lockdowns and economic uncertainties temporarily slowed down the market, the shift towards online shopping and the increased focus on sustainable consumption practices have contributed to its recovery and growth in the post-pandemic era.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the GCC Secondhand Luxury Goods Market appears promising, with continued growth expected. Increasing consumer acceptance, advancements in authentication technologies, the rise of online platforms, and collaborations with luxury brands are likely to fuel market expansion in the coming years.

Conclusion

The GCC Secondhand Luxury Goods Market offers consumers the opportunity to indulge in luxury at affordable prices while promoting sustainability and unique shopping experiences. Despite challenges such as counterfeit products and limited availability, the market is poised for growth driven by evolving consumer preferences, digital transformation, and partnerships with luxury brands. By addressing these challenges and capitalizing on opportunities, industry participants and stakeholders can capitalize on the growing demand for secondhand luxury goods in the GCC region.

What is the GCC secondhand luxury goods market?

The GCC secondhand luxury goods market refers to the trade of pre-owned high-end products, including fashion items, accessories, and watches, within the Gulf Cooperation Council region. This market has gained traction due to increasing consumer interest in sustainable fashion and the desire for luxury items at more accessible prices.

Who are the key players in the GCC secondhand luxury goods market?

Key players in the GCC secondhand luxury goods market include companies like The Luxury Closet, Vestiaire Collective, and Reebonz, which specialize in the resale of luxury items. These companies leverage online platforms to reach a broader audience and enhance customer experience, among others.

What are the main drivers of growth in the GCC secondhand luxury goods market?

The main drivers of growth in the GCC secondhand luxury goods market include the rising awareness of sustainability among consumers, the increasing acceptance of pre-owned luxury items, and the expansion of online resale platforms. Additionally, changing consumer behaviors towards luxury spending are contributing to this growth.

What challenges does the GCC secondhand luxury goods market face?

Challenges in the GCC secondhand luxury goods market include concerns over authenticity and quality of products, as well as competition from traditional luxury retailers. Additionally, regulatory issues related to the resale of luxury goods can pose challenges for market players.

What opportunities exist in the GCC secondhand luxury goods market?

Opportunities in the GCC secondhand luxury goods market include the potential for growth in online sales channels and the increasing demand for sustainable luxury options. Furthermore, collaborations with luxury brands for certified resale programs can enhance market credibility.

What trends are shaping the GCC secondhand luxury goods market?

Trends shaping the GCC secondhand luxury goods market include the rise of digital platforms for resale, the popularity of luxury rental services, and a growing focus on sustainability. Additionally, social media influences consumer purchasing decisions, driving interest in pre-owned luxury items.

GCC Secondhand Luxury Goods Market

| Segmentation Details | Description |

|---|---|

| Product | Clothing, Handbags, Accessories, Watches, Others |

| Distribution Channel | Offline, Online |

| Region | Saudi Arabia, United Arab Emirates, Qatar, Oman, Bahrain, Kuwait |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the GCC Secondhand Luxury Goods Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at