444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The GCC prefabricated building market represents a transformative segment within the regional construction industry, characterized by rapid technological advancement and increasing adoption across multiple sectors. This dynamic market encompasses the production, distribution, and installation of prefabricated construction components throughout the Gulf Cooperation Council countries, including Saudi Arabia, UAE, Qatar, Kuwait, Oman, and Bahrain.

Market dynamics indicate substantial growth momentum driven by government infrastructure initiatives, urbanization trends, and the region’s commitment to sustainable construction practices. The market demonstrates a compound annual growth rate (CAGR) of 8.2%, reflecting strong demand for efficient construction solutions that address the region’s ambitious development projects and housing requirements.

Regional characteristics show that the UAE and Saudi Arabia dominate market activity, accounting for approximately 68% of total market share due to their extensive infrastructure development programs and smart city initiatives. The market’s evolution reflects a strategic shift toward modular construction methodologies that offer enhanced speed, quality control, and cost-effectiveness compared to traditional building approaches.

Technology integration plays a crucial role in market advancement, with manufacturers increasingly adopting advanced manufacturing techniques, digital design tools, and automated production processes. This technological evolution supports the delivery of high-quality prefabricated solutions that meet stringent regional building codes and environmental standards while addressing the growing demand for sustainable construction alternatives.

The GCC prefabricated building market refers to the comprehensive ecosystem encompassing the design, manufacturing, transportation, and assembly of building components that are produced off-site in controlled factory environments before being transported to construction sites for final assembly and installation.

Prefabricated construction involves the systematic production of building elements including walls, floors, roofs, and entire structural modules using standardized manufacturing processes that ensure consistent quality, dimensional accuracy, and material optimization. This approach represents a fundamental departure from traditional on-site construction methodologies, offering enhanced efficiency and reduced construction timelines.

Market scope encompasses various prefabrication technologies including modular construction, panelized systems, pre-engineered buildings, and hybrid approaches that combine multiple prefabrication techniques. The market serves diverse applications ranging from residential housing and commercial buildings to industrial facilities and infrastructure projects across the GCC region.

Value proposition centers on delivering superior construction outcomes through improved quality control, reduced waste generation, enhanced safety standards, and accelerated project delivery schedules. The market addresses critical regional challenges including skilled labor shortages, extreme weather conditions, and the need for sustainable construction practices that align with national vision programs and environmental objectives.

Strategic positioning of the GCC prefabricated building market reflects its emergence as a cornerstone technology for addressing the region’s ambitious infrastructure development goals and urbanization requirements. The market demonstrates robust growth trajectory supported by government initiatives, private sector investment, and increasing recognition of prefabrication benefits among construction stakeholders.

Market segmentation reveals diverse application areas with residential construction representing the largest segment, followed by commercial and industrial applications. The market shows strong adoption rates across different building types, with modular housing projects experiencing 45% growth in adoption rates as governments prioritize affordable housing initiatives and rapid urban development.

Competitive landscape features a mix of international manufacturers, regional specialists, and emerging local players who contribute to market dynamism through technological innovation, capacity expansion, and strategic partnerships. Market leaders focus on developing region-specific solutions that address local climate conditions, building codes, and cultural preferences while maintaining cost competitiveness.

Future outlook indicates continued market expansion driven by mega-project developments, smart city initiatives, and the region’s commitment to economic diversification. The market benefits from supportive regulatory frameworks, infrastructure investments, and growing awareness of prefabrication advantages among developers, contractors, and end-users seeking efficient construction solutions.

Market intelligence reveals several critical insights that shape the GCC prefabricated building market’s development trajectory and competitive dynamics:

Strategic implications suggest that market participants must focus on technological innovation, quality assurance, and customer relationship management to maintain competitive advantages in this rapidly evolving market environment.

Government initiatives serve as primary market drivers, with national vision programs across GCC countries emphasizing infrastructure development, housing provision, and economic diversification. These strategic frameworks create substantial demand for efficient construction solutions that can deliver projects within accelerated timelines while meeting quality and sustainability requirements.

Urbanization trends generate continuous demand for residential and commercial construction projects, with rapid population growth and urban expansion requiring innovative construction approaches. The region’s demographic dynamics, including young populations and increasing urban migration, create sustained demand for affordable housing solutions that prefabricated construction can efficiently address.

Labor market dynamics significantly influence market growth, as skilled construction labor shortages drive adoption of prefabricated solutions that require fewer on-site workers and specialized skills. This factor becomes particularly relevant given regional efforts to reduce dependence on expatriate labor while improving construction productivity and safety standards.

Climate considerations favor prefabricated construction due to the region’s extreme weather conditions that can disrupt traditional construction activities. Factory-based production environments provide controlled manufacturing conditions that ensure consistent quality regardless of external weather factors, while reducing on-site construction exposure to harsh environmental conditions.

Sustainability requirements increasingly drive market adoption as governments and private developers prioritize environmentally responsible construction practices. Prefabricated construction offers inherent sustainability advantages including reduced material waste, improved energy efficiency, and lower environmental impact compared to traditional construction methods.

Initial capital requirements represent significant market restraints, as prefabricated construction requires substantial upfront investments in manufacturing facilities, equipment, and technology systems. These capital barriers can limit market entry for smaller players and require careful financial planning for established manufacturers seeking capacity expansion.

Transportation challenges pose logistical constraints due to the size and weight of prefabricated components, requiring specialized transportation equipment and careful route planning. Regional infrastructure limitations and cross-border transportation complexities can increase delivery costs and project timelines, particularly for large-scale modular components.

Design limitations may restrict architectural flexibility compared to traditional construction methods, potentially limiting market appeal for projects requiring unique or complex designs. While manufacturing capabilities continue advancing, certain architectural features and customization requirements may remain challenging to achieve through prefabricated approaches.

Market perception challenges persist among some stakeholders who associate prefabricated construction with lower quality or limited design options. Overcoming these perceptions requires continuous education, demonstration projects, and quality assurance initiatives that showcase the capabilities and benefits of modern prefabricated construction technologies.

Regulatory complexity can create market barriers when building codes and approval processes are not fully adapted to prefabricated construction methods. Navigating different regulatory requirements across GCC countries and ensuring compliance with local standards may require additional time and resources for market participants.

Smart city development presents substantial market opportunities as GCC countries invest heavily in intelligent urban infrastructure that requires innovative construction approaches. These projects demand integrated building systems that can accommodate advanced technologies while meeting accelerated delivery schedules, creating ideal conditions for prefabricated construction adoption.

Affordable housing initiatives represent significant growth opportunities, with governments across the region implementing large-scale housing programs that require cost-effective and rapidly deployable construction solutions. Prefabricated construction’s ability to deliver standardized housing units at scale aligns perfectly with these program requirements while maintaining quality standards.

Industrial facility development offers expanding opportunities as economic diversification efforts drive demand for manufacturing facilities, logistics centers, and specialized industrial buildings. These projects often feature standardized design requirements that are well-suited to prefabricated construction approaches, enabling faster facility deployment and operational readiness.

Sustainability mandates create market opportunities as environmental regulations become more stringent and green building certifications gain importance. Prefabricated construction’s inherent sustainability advantages position it favorably for projects seeking LEED certification or other environmental performance standards.

Technology integration opportunities emerge from the convergence of prefabricated construction with digital technologies including IoT, artificial intelligence, and advanced materials. These technological combinations enable the development of smart prefabricated buildings that offer enhanced functionality and operational efficiency.

Supply chain evolution demonstrates increasing sophistication as manufacturers develop integrated supply networks that optimize material sourcing, production scheduling, and delivery logistics. This evolution supports improved cost efficiency and delivery reliability while enabling manufacturers to respond more effectively to market demand fluctuations and project-specific requirements.

Competitive intensity continues increasing as new market entrants challenge established players through technological innovation, competitive pricing, and specialized service offerings. This dynamic environment drives continuous improvement in product quality, manufacturing efficiency, and customer service standards across the market.

Customer sophistication grows as developers, contractors, and end-users become more knowledgeable about prefabricated construction benefits and applications. This trend leads to more informed purchasing decisions and higher expectations for product quality, customization capabilities, and project support services.

Regulatory evolution shows positive trends as governments modernize building codes and approval processes to better accommodate prefabricated construction methods. These regulatory improvements reduce market barriers and enable faster project approvals, supporting overall market growth and adoption rates.

Innovation cycles accelerate as manufacturers invest in research and development to create next-generation prefabricated solutions that address emerging market needs. According to MarkWide Research analysis, innovation investments have increased by 35% annually as companies seek competitive differentiation through technological advancement.

Data collection employs comprehensive primary and secondary research methodologies to ensure accurate market analysis and reliable insights. Primary research includes structured interviews with industry executives, manufacturers, developers, and government officials across all GCC countries to gather firsthand market intelligence and validate secondary research findings.

Market analysis utilizes quantitative and qualitative research techniques including statistical analysis, trend identification, and comparative assessment of market segments and regional variations. This multi-faceted approach ensures comprehensive understanding of market dynamics, competitive positioning, and growth opportunities.

Industry validation involves consultation with technical experts, industry associations, and regulatory bodies to verify market data accuracy and ensure research findings reflect current market realities. This validation process includes review of manufacturing capabilities, project case studies, and regulatory framework analysis.

Forecasting methodology combines historical data analysis with forward-looking indicators including government spending plans, demographic trends, and economic development projections. This approach enables reliable market projections that account for both cyclical factors and long-term structural changes affecting the prefabricated building market.

Quality assurance protocols ensure research reliability through multiple data verification steps, cross-referencing of information sources, and peer review processes. These measures maintain high standards for data accuracy and analytical rigor throughout the research process.

Saudi Arabia leads the regional market with approximately 42% market share, driven by Vision 2030 initiatives and massive infrastructure development projects including NEOM, The Red Sea Project, and extensive housing programs. The kingdom’s commitment to economic diversification and urban development creates substantial demand for efficient construction solutions across residential, commercial, and industrial sectors.

United Arab Emirates represents the second-largest market segment with 26% market share, characterized by advanced adoption of prefabricated construction technologies and supportive regulatory frameworks. Dubai and Abu Dhabi lead market development through smart city initiatives, sustainable building requirements, and world-class infrastructure projects that showcase prefabricated construction capabilities.

Qatar demonstrates strong market growth potential with 15% market share, supported by National Vision 2030 and continued infrastructure development following FIFA World Cup investments. The country’s focus on sustainable development and efficient construction methods aligns well with prefabricated construction advantages, creating opportunities for market expansion.

Kuwait accounts for 8% market share with growing interest in prefabricated solutions for residential and commercial projects. Government housing programs and urban development initiatives drive market demand, while private sector adoption increases as awareness of prefabrication benefits grows among local developers and contractors.

Oman and Bahrain collectively represent 9% market share with emerging opportunities in residential construction and industrial facility development. These markets show increasing adoption of prefabricated construction as governments prioritize efficient infrastructure development and sustainable building practices within their economic development strategies.

Market leadership features a diverse mix of international manufacturers, regional specialists, and emerging local players who contribute to competitive dynamics through different strategic approaches and market positioning strategies.

Strategic positioning varies among competitors, with some focusing on technological innovation, others emphasizing cost leadership, and several pursuing niche market specialization. Market leaders invest heavily in manufacturing capacity expansion, technology upgrades, and regional market development to maintain competitive advantages.

By Technology:

By Application:

By Material:

Residential segment dominates market activity with strong growth driven by government housing initiatives and private residential development projects. This segment benefits from standardization opportunities that enable economies of scale while meeting diverse housing requirements across different income levels and lifestyle preferences.

Commercial construction shows increasing adoption of prefabricated solutions as developers recognize time-to-market advantages and quality consistency benefits. Office buildings, retail centers, and hospitality projects increasingly utilize modular construction approaches that reduce construction timelines while maintaining high-quality standards and design flexibility.

Industrial applications represent a mature segment with established adoption of pre-engineered building systems that offer cost-effective solutions for manufacturing facilities, warehouses, and logistics centers. This segment emphasizes functional efficiency and rapid deployment capabilities that support industrial development and economic diversification initiatives.

Infrastructure projects emerge as a growing segment as governments seek efficient delivery methods for educational facilities, healthcare buildings, and public infrastructure. These projects often require specialized design solutions that meet stringent regulatory requirements while delivering enhanced functionality and operational efficiency.

Technology integration across all segments drives demand for smart building capabilities, energy efficiency features, and advanced building systems that enhance occupant comfort and operational performance. This trend creates opportunities for manufacturers to differentiate their offerings through value-added technologies and integrated building solutions.

Manufacturers benefit from scalable production systems that enable efficient capacity utilization and consistent product quality. Factory-based production environments provide controlled manufacturing conditions that optimize material usage, reduce waste, and ensure dimensional accuracy while enabling flexible production scheduling to meet varying market demands.

Developers and contractors gain significant advantages through reduced construction timelines, improved project predictability, and enhanced quality control. Prefabricated construction enables parallel processing of site preparation and component manufacturing, reducing overall project duration while minimizing weather-related delays and on-site construction risks.

End users receive superior building performance through consistent quality standards, improved energy efficiency, and reduced maintenance requirements. Prefabricated buildings often demonstrate enhanced durability and operational efficiency compared to traditional construction, resulting in lower lifecycle costs and improved occupant satisfaction.

Government stakeholders achieve policy objectives more effectively through accelerated infrastructure delivery, improved construction safety standards, and enhanced sustainability outcomes. Prefabricated construction supports economic development goals by enabling faster project completion and more efficient resource utilization across public sector construction programs.

Financial institutions benefit from reduced project risks and improved loan performance due to prefabricated construction’s predictable timelines and quality outcomes. The reduced construction risk profile enables more favorable financing terms and improved project bankability for developers and contractors utilizing prefabricated construction approaches.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation reshapes the prefabricated building market through integration of Building Information Modeling (BIM), automated manufacturing systems, and digital project management platforms. These technologies enable enhanced design precision, improved manufacturing efficiency, and better project coordination throughout the construction process.

Sustainability focus intensifies as environmental considerations become central to construction decision-making processes. Manufacturers increasingly emphasize eco-friendly materials, energy-efficient designs, and circular economy principles that minimize environmental impact while meeting stringent green building certification requirements.

Mass customization emerges as a key trend enabling manufacturers to offer personalized solutions while maintaining production efficiency. Advanced manufacturing systems support flexible production processes that accommodate varying design requirements without sacrificing the cost and time advantages of prefabricated construction.

Smart building integration drives demand for prefabricated solutions that incorporate Internet of Things (IoT) technologies, automated building systems, and advanced monitoring capabilities. This trend creates opportunities for manufacturers to develop intelligent building modules that enhance operational efficiency and occupant experience.

Supply chain localization gains importance as manufacturers establish regional production facilities and supplier networks to reduce transportation costs and improve delivery reliability. This trend supports market responsiveness while creating local employment opportunities and reducing environmental impact from long-distance transportation.

Manufacturing capacity expansion accelerates across the region as established players and new entrants invest in production facilities to meet growing market demand. Recent facility openings in Saudi Arabia and UAE demonstrate industry confidence in long-term market growth prospects and commitment to serving regional construction requirements.

Technology partnerships between prefabricated building manufacturers and technology companies drive innovation in smart building systems, automated manufacturing processes, and digital design tools. These collaborations enable the development of next-generation solutions that combine construction efficiency with advanced building functionality.

Regulatory modernization initiatives across GCC countries update building codes and approval processes to better accommodate prefabricated construction methods. These regulatory improvements reduce market barriers and enable faster project approvals, supporting overall market growth and adoption rates.

Sustainability certifications become increasingly important as manufacturers pursue international environmental standards and green building certifications. These initiatives demonstrate commitment to environmental responsibility while meeting growing market demand for sustainable construction solutions.

Skills development programs address workforce requirements through training initiatives that develop technical expertise in prefabricated construction methods. Industry associations and educational institutions collaborate to create specialized training programs that support market growth and ensure quality standards.

Market entry strategies should focus on establishing strong local partnerships and understanding regional regulatory requirements before committing to significant capital investments. New market entrants benefit from collaborating with established developers and contractors to demonstrate product capabilities and build market credibility through successful project deliveries.

Technology investment priorities should emphasize digital design tools, automated manufacturing systems, and quality control technologies that enhance production efficiency and product consistency. MWR analysis indicates that companies investing in advanced manufacturing technologies achieve 23% higher productivity compared to traditional production approaches.

Customer education initiatives prove essential for market development, as many stakeholders remain unfamiliar with prefabricated construction benefits and applications. Manufacturers should invest in demonstration projects, case studies, and educational programs that showcase successful implementations and address common misconceptions about prefabricated construction quality and capabilities.

Supply chain optimization becomes critical for maintaining cost competitiveness and delivery reliability in the growing market. Companies should develop integrated supplier networks, establish strategic material partnerships, and implement advanced logistics systems that ensure efficient component delivery to construction sites.

Sustainability positioning offers significant competitive advantages as environmental considerations become increasingly important in construction decision-making. Manufacturers should pursue green building certifications, develop eco-friendly product lines, and communicate environmental benefits effectively to environmentally conscious customers and regulatory stakeholders.

Market expansion prospects remain highly positive with continued government infrastructure investments, urbanization trends, and increasing recognition of prefabricated construction benefits driving sustained demand growth. The market is projected to maintain robust growth momentum with a CAGR of 8.2% through the forecast period, supported by mega-project developments and smart city initiatives across the region.

Technology evolution will continue reshaping the market through integration of artificial intelligence, robotics, and advanced materials that enhance manufacturing capabilities and product performance. These technological advances enable the development of more sophisticated prefabricated solutions that address complex architectural requirements while maintaining cost and time advantages.

Market maturation indicates increasing sophistication among customers, suppliers, and regulatory frameworks that support broader adoption of prefabricated construction methods. This maturation process creates opportunities for specialized applications, premium product segments, and value-added services that differentiate market participants.

Regional integration trends suggest increasing standardization of building codes, quality standards, and approval processes across GCC countries, facilitating cross-border market expansion and economies of scale. This integration supports regional manufacturing strategies and enables more efficient resource allocation across different national markets.

Sustainability imperatives will increasingly influence market development as environmental regulations become more stringent and green building requirements expand. The market’s inherent sustainability advantages position it favorably for continued growth in an increasingly environmentally conscious construction industry that prioritizes resource efficiency and environmental responsibility.

The GCC prefabricated building market represents a dynamic and rapidly evolving sector that addresses critical regional construction challenges through innovative manufacturing approaches and advanced building technologies. Market growth momentum remains strong, supported by government infrastructure initiatives, urbanization trends, and increasing recognition of prefabricated construction benefits among industry stakeholders.

Strategic opportunities abound for manufacturers, developers, and investors who understand regional market dynamics and position themselves effectively to capitalize on emerging trends including smart city development, affordable housing initiatives, and sustainability mandates. The market’s evolution toward greater technological sophistication and broader application scope creates multiple pathways for growth and differentiation.

Success factors in this market include technological innovation, quality assurance, customer education, and strategic partnerships that enable effective market penetration and sustainable competitive advantages. Companies that invest in advanced manufacturing capabilities, develop strong regional presence, and maintain focus on customer needs will be best positioned to capture market opportunities and achieve long-term success in the expanding GCC prefabricated building market.

What is Prefabricated Building?

Prefabricated buildings are structures that are manufactured off-site in advance, typically in standard sections that can be easily shipped and assembled. They are commonly used in residential, commercial, and industrial applications due to their efficiency and cost-effectiveness.

What are the key players in the GCC Prefabricated Building Market?

Key players in the GCC Prefabricated Building Market include companies like Algeco, Katerra, and Modular Space, which specialize in modular construction and prefabricated solutions. These companies are known for their innovative designs and sustainable building practices, among others.

What are the growth factors driving the GCC Prefabricated Building Market?

The growth of the GCC Prefabricated Building Market is driven by factors such as the increasing demand for affordable housing, rapid urbanization, and the need for sustainable construction methods. Additionally, government initiatives promoting infrastructure development contribute to market expansion.

What challenges does the GCC Prefabricated Building Market face?

Challenges in the GCC Prefabricated Building Market include regulatory hurdles, the need for skilled labor, and potential resistance from traditional construction methods. These factors can hinder the adoption of prefabricated solutions in some regions.

What opportunities exist in the GCC Prefabricated Building Market?

The GCC Prefabricated Building Market presents opportunities in sectors such as healthcare, education, and hospitality, where rapid construction is essential. Additionally, advancements in technology and materials can lead to innovative prefabricated solutions.

What trends are shaping the GCC Prefabricated Building Market?

Trends in the GCC Prefabricated Building Market include the increasing use of sustainable materials, the integration of smart technology in building designs, and a shift towards modular construction methods. These trends reflect a growing emphasis on efficiency and environmental responsibility.

GCC Prefabricated Building Market

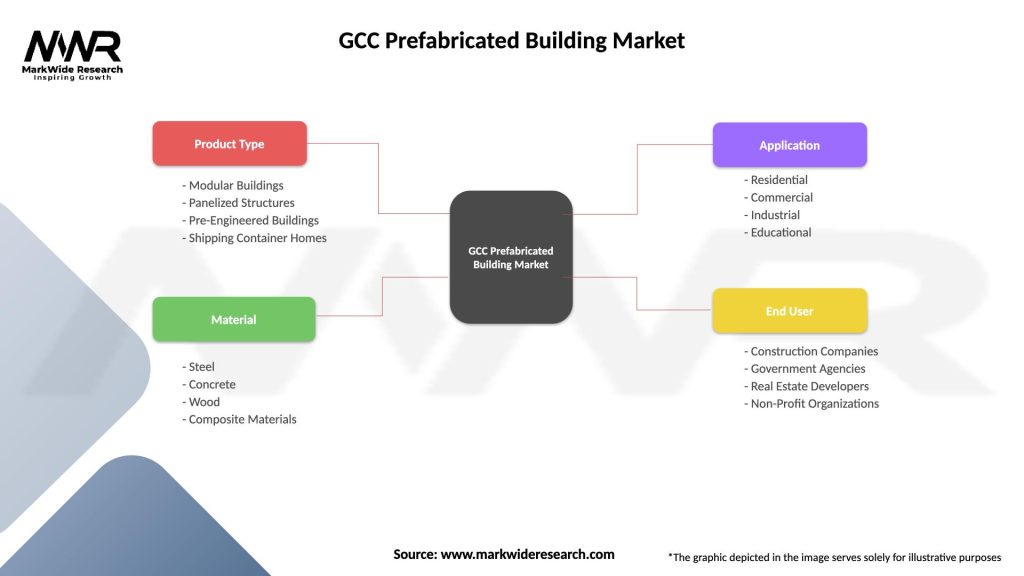

| Segmentation Details | Description |

|---|---|

| Product Type | Modular Buildings, Panelized Structures, Pre-Engineered Buildings, Shipping Container Homes |

| Material | Steel, Concrete, Wood, Composite Materials |

| Application | Residential, Commercial, Industrial, Educational |

| End User | Construction Companies, Government Agencies, Real Estate Developers, Non-Profit Organizations |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the GCC Prefabricated Building Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at