444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The GCC portable air conditioners market represents a rapidly expanding segment within the region’s cooling solutions industry, driven by extreme climatic conditions and evolving consumer preferences. This dynamic market encompasses countries including Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Bahrain, and Oman, where temperatures frequently exceed comfortable indoor levels throughout extended periods of the year.

Market dynamics in the GCC region are characterized by unique environmental challenges, with summer temperatures often reaching above 45°C (113°F) in many areas. The portable air conditioning segment has experienced remarkable growth, with adoption rates increasing by 12.5% annually across residential and commercial applications. This growth trajectory reflects the region’s commitment to energy-efficient cooling solutions and the increasing demand for flexible, mobile climate control systems.

Regional characteristics significantly influence market development, as the GCC’s harsh desert climate creates year-round demand for cooling solutions. The market benefits from strong economic foundations built on oil revenues, enabling substantial investments in modern infrastructure and advanced cooling technologies. Additionally, the region’s growing expatriate population and expanding tourism sector contribute to sustained demand for portable cooling solutions.

Technology advancement plays a crucial role in market evolution, with manufacturers introducing energy-efficient models featuring smart connectivity and enhanced cooling capacity. The integration of IoT capabilities and mobile app controls has increased consumer interest, particularly among tech-savvy demographics in urban centers like Dubai, Doha, and Riyadh.

The GCC portable air conditioners market refers to the comprehensive ecosystem of mobile cooling devices designed for temporary or flexible climate control applications across the Gulf Cooperation Council region. These units provide localized cooling solutions without requiring permanent installation, making them ideal for various residential, commercial, and industrial applications where traditional HVAC systems may be impractical or insufficient.

Portable air conditioners in the GCC context encompass single-hose and dual-hose systems, evaporative coolers, and advanced inverter-driven units specifically engineered to handle extreme ambient temperatures. These devices typically feature wheels for mobility, self-contained refrigeration systems, and exhaust mechanisms that can be temporarily connected to windows or wall openings.

Market scope includes various capacity ranges from compact personal units suitable for small spaces to industrial-grade portable systems capable of cooling large areas. The definition extends to both consumer-grade products sold through retail channels and commercial-grade equipment utilized in construction sites, temporary facilities, and emergency cooling applications throughout the GCC region.

Strategic market positioning reveals the GCC portable air conditioners market as a high-growth segment benefiting from unique regional advantages and challenging climatic conditions. The market demonstrates robust expansion driven by urbanization trends, infrastructure development, and increasing consumer awareness of energy-efficient cooling solutions.

Key growth drivers include the region’s extreme temperatures, rapid construction activity, and growing preference for flexible cooling solutions. The market benefits from strong purchasing power across GCC countries, with consumer spending on home appliances increasing by 8.3% annually. Additionally, government initiatives promoting energy efficiency have accelerated adoption of advanced portable cooling technologies.

Market segmentation reveals diverse applications spanning residential apartments, commercial offices, construction sites, and hospitality venues. The residential segment dominates market share, accounting for approximately 65% of total demand, while commercial applications show the fastest growth rate due to expanding business activities and infrastructure projects.

Competitive landscape features both international brands and regional distributors, with market leaders focusing on product innovation, energy efficiency, and after-sales service quality. The market structure supports healthy competition while maintaining premium pricing for advanced features and superior cooling performance in extreme conditions.

Primary market insights reveal several critical factors shaping the GCC portable air conditioners landscape:

Climatic conditions serve as the primary market driver, with the GCC region experiencing some of the world’s most extreme summer temperatures. Average summer temperatures consistently exceed 40°C across most GCC countries, creating essential demand for supplementary cooling solutions. This climatic reality ensures year-round market activity, with peak demand periods extending from April through October.

Urbanization trends significantly contribute to market growth, as expanding cities and new residential developments create demand for flexible cooling solutions. Rapid population growth, particularly in UAE and Saudi Arabia, drives construction of apartments and commercial spaces where portable air conditioners provide immediate cooling relief before permanent HVAC installation or as supplementary systems.

Energy efficiency initiatives promoted by GCC governments encourage adoption of modern portable air conditioning technologies. National energy conservation programs and building efficiency standards create market opportunities for advanced units featuring inverter technology and smart controls. These initiatives often include rebates or incentives for energy-efficient appliances, stimulating consumer demand.

Economic prosperity across GCC countries supports consumer spending on comfort appliances, with disposable income levels enabling premium product purchases. The region’s strong economic foundation, built on energy exports and diversification initiatives, maintains robust consumer confidence and willingness to invest in quality cooling solutions.

Construction industry growth creates substantial demand for temporary cooling solutions at job sites, particularly during summer months when outdoor work becomes challenging. Large infrastructure projects, residential developments, and commercial construction require portable cooling for worker comfort and equipment protection, driving commercial segment growth.

High electricity costs in certain GCC markets create consumer hesitation regarding portable air conditioner usage, particularly for older, less efficient models. While some GCC countries maintain subsidized electricity rates, others have implemented market-based pricing that makes energy consumption a significant consideration for consumers evaluating portable cooling options.

Installation complexity associated with exhaust hose placement and window modifications can deter some consumers, particularly in rental properties where permanent modifications are restricted. This challenge is especially relevant in high-rise apartments and commercial buildings where window access may be limited or building management policies restrict external modifications.

Noise concerns related to portable air conditioner operation can limit adoption in residential settings, particularly in densely populated urban areas where noise regulations are strictly enforced. Consumer complaints about operational noise levels have influenced purchasing decisions, especially for bedroom and study room applications.

Seasonal demand fluctuations create inventory management challenges for retailers and distributors, requiring significant capital investment in stock during off-peak periods. This seasonality can strain smaller retailers’ cash flow and create supply chain complexities during peak demand periods.

Competition from central systems poses ongoing challenges, as many new constructions incorporate comprehensive HVAC solutions that reduce demand for portable alternatives. The preference for integrated cooling systems in premium residential and commercial developments can limit market expansion in certain segments.

Smart technology integration presents significant opportunities for market expansion, with IoT-enabled portable air conditioners offering remote monitoring, energy optimization, and predictive maintenance capabilities. The GCC region’s high smartphone penetration rate of 78% creates favorable conditions for smart appliance adoption, particularly among younger demographics seeking connected home solutions.

Energy efficiency advancement opportunities exist through development of units specifically designed for extreme GCC climates, featuring enhanced insulation, variable-speed compressors, and advanced refrigerants. Manufacturers can capitalize on government energy efficiency programs and consumer environmental consciousness to promote premium, eco-friendly models.

Commercial sector expansion offers substantial growth potential, particularly in construction, events, and hospitality industries. The region’s ambitious infrastructure projects, including EXPO preparations, mega-city developments, and tourism facility expansion, create sustained demand for high-capacity portable cooling solutions.

Rental market development represents an emerging opportunity, as temporary cooling needs for events, construction projects, and seasonal businesses create demand for equipment rental services. This model reduces capital investment barriers and provides flexible solutions for varying capacity requirements.

Regional manufacturing opportunities exist for establishing local assembly or manufacturing facilities, reducing import costs and delivery times while supporting government economic diversification initiatives. Local production can also enable customization for specific regional requirements and climate conditions.

Supply chain dynamics in the GCC portable air conditioners market reflect the region’s position as an import-dependent market with strong distribution networks. Major international manufacturers typically establish regional distribution centers in UAE or Saudi Arabia, leveraging these countries’ advanced logistics infrastructure to serve the broader GCC market efficiently.

Pricing dynamics demonstrate premium positioning compared to global averages, justified by extreme operating conditions and specialized features required for GCC climates. Market prices reflect import duties, distribution costs, and the premium consumers pay for reliable performance in challenging environmental conditions. Seasonal pricing fluctuations occur, with peak-season premiums of 15-20% common during high-demand periods.

Technology adoption patterns show rapid acceptance of advanced features, with inverter technology adoption growing by 18% annually as consumers recognize long-term energy savings benefits. Smart connectivity features gain traction particularly in UAE and Qatar, where tech-savvy consumers drive demand for app-controlled and IoT-integrated units.

Distribution channel evolution reflects changing consumer preferences, with online sales growing significantly while traditional retail maintains strong presence. E-commerce platforms capture approximately 25% market share in UAE and Saudi Arabia, while specialized appliance retailers remain dominant in other GCC countries where consumers prefer hands-on product evaluation.

Regulatory dynamics increasingly influence market development, with energy efficiency standards and environmental regulations shaping product specifications and market entry requirements. Government initiatives promoting sustainable cooling solutions create opportunities for advanced technologies while potentially restricting older, less efficient models.

Primary research methodology employed comprehensive data collection through structured interviews with industry stakeholders, including manufacturers, distributors, retailers, and end-users across all GCC countries. This approach ensured representative sampling from diverse market segments and geographic regions, providing authentic insights into market dynamics and consumer behavior patterns.

Secondary research integration incorporated analysis of government statistics, industry reports, trade publications, and company financial statements to validate primary findings and establish market context. This methodology included examination of import/export data, building permit statistics, and energy consumption patterns to understand market drivers and growth trajectories.

Market sizing approach utilized bottom-up methodology, analyzing sales data from major distributors and retailers to establish market parameters and growth trends. This approach incorporated seasonal adjustment factors and regional variations to ensure accurate market representation across diverse GCC markets.

Competitive analysis framework examined market share distribution, pricing strategies, product positioning, and distribution channel effectiveness through systematic evaluation of major market participants. This analysis included assessment of brand recognition, customer satisfaction levels, and market penetration strategies across different GCC countries.

Data validation processes employed triangulation techniques, cross-referencing multiple data sources to ensure accuracy and reliability of market insights. Regular validation checks with industry experts and statistical analysis of data consistency supported the research methodology’s credibility and analytical rigor.

Saudi Arabia dominates the GCC portable air conditioners market, accounting for approximately 35% of regional demand due to its large population, extensive construction activity, and extreme summer temperatures. The kingdom’s Vision 2030 initiatives drive infrastructure development, creating sustained demand for temporary cooling solutions in construction and commercial applications.

United Arab Emirates represents the second-largest market with 28% regional share, characterized by high consumer spending power and strong preference for premium, technologically advanced products. Dubai and Abu Dhabi lead adoption of smart-enabled portable air conditioners, while the country’s robust retail infrastructure supports diverse distribution channels.

Qatar demonstrates rapid market growth driven by ongoing infrastructure projects and high per-capita income levels. The country’s compact geography enables efficient distribution networks, while government energy efficiency initiatives promote adoption of advanced cooling technologies. Market share reaches approximately 12% of regional demand.

Kuwait maintains steady market presence with focus on residential applications, as extreme summer temperatures create essential demand for supplementary cooling solutions. The market benefits from strong consumer purchasing power and established appliance retail networks, contributing 11% to regional market volume.

Bahrain and Oman represent emerging markets with growing adoption rates, particularly in commercial and hospitality sectors. These countries show increasing consumer awareness of portable cooling benefits, with combined market share reaching 14% of regional demand and demonstrating consistent growth potential.

Market leadership in the GCC portable air conditioners sector features a mix of international brands and regional distributors, each leveraging distinct competitive advantages to capture market share and build customer loyalty.

Competitive strategies emphasize product differentiation through energy efficiency, smart connectivity, and specialized features for extreme climate conditions. Market leaders invest heavily in local service networks, recognizing that after-sales support significantly influences customer satisfaction and brand loyalty in the GCC market.

Distribution partnerships play crucial roles in competitive positioning, with successful brands establishing exclusive or preferred relationships with major appliance retailers across GCC countries. These partnerships often include marketing support, training programs, and inventory financing arrangements.

By Capacity Range:

By Technology Type:

By Application:

Residential category dominates market demand, driven by apartment living trends and consumer preference for flexible cooling solutions. This segment shows strong growth in energy-efficient models as consumers become increasingly conscious of electricity costs and environmental impact. Smart-enabled units gain traction particularly among younger demographics seeking connected home solutions.

Commercial category demonstrates fastest growth rate, fueled by expanding business activities and construction projects across GCC countries. Office buildings, retail spaces, and hospitality venues increasingly rely on portable air conditioners for zone cooling and temporary applications. This segment shows willingness to pay premium prices for reliable performance and advanced features.

Industrial applications require specialized units capable of operating in challenging environments with dust, high ambient temperatures, and continuous operation demands. Construction sites represent the largest industrial sub-segment, requiring robust units that can withstand harsh conditions while providing essential worker comfort and equipment protection.

Institutional segment shows steady growth as schools, hospitals, and government facilities utilize portable air conditioners for specific cooling needs. This category emphasizes reliability, energy efficiency, and quiet operation, with purchasing decisions often influenced by long-term operational costs and maintenance requirements.

Rental market category emerges as significant opportunity, serving temporary events, construction projects, and seasonal businesses. This segment requires durable, high-capacity units designed for frequent transportation and varied operating conditions, creating demand for specialized commercial-grade equipment.

Manufacturers benefit from strong market demand driven by climatic necessity and growing consumer awareness of portable cooling solutions. The GCC market offers premium pricing opportunities due to extreme operating conditions and consumer willingness to invest in quality products. Additionally, government energy efficiency initiatives create opportunities for advanced technology adoption and product differentiation.

Distributors and retailers enjoy healthy profit margins and consistent demand patterns, particularly during peak cooling seasons. The market’s import-dependent nature creates opportunities for exclusive distribution agreements and value-added services such as installation and maintenance support. Strong consumer purchasing power supports premium product positioning and comprehensive service offerings.

End-users gain access to flexible cooling solutions that complement existing HVAC systems or provide temporary relief in challenging situations. Portable air conditioners offer installation convenience, energy efficiency improvements, and zone cooling capabilities that enhance comfort while potentially reducing overall cooling costs through targeted application.

Service providers benefit from growing demand for installation, maintenance, and repair services as the installed base expands. The technical complexity of modern portable air conditioners creates opportunities for specialized service businesses offering preventive maintenance, emergency repair, and system optimization services.

Government stakeholders achieve energy efficiency objectives through promotion of advanced portable cooling technologies, supporting national sustainability goals while maintaining citizen comfort standards. The market’s growth contributes to economic diversification efforts and creates employment opportunities in retail, service, and distribution sectors.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart connectivity integration represents the most significant trend, with WiFi-enabled portable air conditioners gaining rapid adoption across GCC markets. Consumers increasingly demand mobile app controls, remote monitoring capabilities, and integration with smart home ecosystems. This trend particularly resonates with younger demographics and tech-savvy consumers in urban centers.

Energy efficiency optimization drives product development as manufacturers introduce inverter technology, variable-speed compressors, and advanced refrigerants specifically designed for extreme climate conditions. Government energy conservation initiatives and rising electricity costs in some GCC countries accelerate adoption of high-efficiency models.

Aesthetic design enhancement becomes increasingly important as portable air conditioners transition from purely functional appliances to design elements that complement modern interior spaces. Manufacturers focus on sleek profiles, premium finishes, and noise reduction to appeal to style-conscious consumers.

Commercial application expansion shows strong growth as businesses recognize portable air conditioners’ flexibility for zone cooling, temporary installations, and emergency backup applications. This trend particularly benefits construction, events, and hospitality industries requiring adaptable cooling solutions.

Rental service development emerges as significant trend, with specialized companies offering portable air conditioner rental for events, construction projects, and seasonal businesses. This model reduces capital investment barriers and provides flexible capacity management for varying cooling requirements.

Technology advancement initiatives by major manufacturers focus on developing units specifically engineered for GCC climate conditions, featuring enhanced heat exchangers, corrosion-resistant components, and improved dust filtration systems. These developments address unique regional challenges while improving reliability and performance.

Distribution network expansion continues across GCC countries, with international brands establishing dedicated service centers and authorized dealer networks. Recent developments include online sales platform integration and same-day delivery services in major urban centers, improving customer accessibility and satisfaction.

Energy efficiency certification programs launched by GCC governments create new market dynamics, with energy star ratings and efficiency labels influencing consumer purchasing decisions. These programs often include rebate incentives for high-efficiency models, stimulating demand for advanced technologies.

Smart home integration partnerships between portable air conditioner manufacturers and home automation companies enable seamless connectivity with popular smart home platforms. These collaborations expand market reach and appeal to consumers seeking comprehensive connected home solutions.

Sustainability initiatives by leading manufacturers include development of eco-friendly refrigerants, recyclable components, and energy-efficient operation modes. These developments align with regional environmental goals and appeal to environmentally conscious consumers across GCC markets.

MarkWide Research recommends that market participants focus on energy efficiency and smart technology integration to capitalize on evolving consumer preferences and government initiatives. Companies should prioritize development of units specifically designed for extreme GCC climate conditions while incorporating IoT capabilities and mobile connectivity features.

Distribution strategy optimization should emphasize omnichannel approaches, combining traditional retail presence with robust online platforms and specialized service networks. Companies should invest in local service capabilities and inventory management systems to address seasonal demand fluctuations effectively.

Product portfolio diversification across capacity ranges and application segments can help manufacturers capture broader market opportunities while reducing dependence on single market segments. Focus on commercial and industrial applications offers growth potential beyond traditional residential markets.

Partnership development with local distributors, service providers, and smart home technology companies can enhance market penetration and customer satisfaction. Strategic alliances should focus on improving after-sales support, technical expertise, and market reach across diverse GCC countries.

Sustainability positioning becomes increasingly important as environmental consciousness grows among consumers and government regulations evolve. Companies should emphasize energy efficiency, eco-friendly refrigerants, and recyclable components in marketing and product development strategies.

Market growth trajectory indicates continued expansion driven by sustained demand from extreme climate conditions, ongoing urbanization, and infrastructure development across GCC countries. The market is projected to maintain robust growth rates of 9.2% annually over the next five years, supported by economic prosperity and technological advancement.

Technology evolution will likely focus on artificial intelligence integration, predictive maintenance capabilities, and enhanced energy efficiency through advanced compressor technologies and smart controls. MWR analysis suggests that AI-enabled units could capture 30% market share within the next decade as consumers embrace automated climate control solutions.

Market consolidation may occur as smaller players struggle to compete with established brands offering comprehensive product portfolios and extensive service networks. This consolidation could benefit market leaders while creating opportunities for specialized niche players focusing on specific applications or technologies.

Regulatory development will likely introduce stricter energy efficiency standards and environmental requirements, potentially accelerating adoption of advanced technologies while phasing out older, less efficient models. These changes could create short-term market disruption but ultimately benefit innovative manufacturers.

Regional manufacturing opportunities may emerge as GCC countries pursue economic diversification and supply chain localization strategies. Local production facilities could reduce costs, improve supply chain resilience, and enable customization for specific regional requirements and climate conditions.

The GCC portable air conditioners market represents a dynamic and essential segment within the region’s cooling solutions industry, characterized by strong growth fundamentals and evolving consumer preferences. Extreme climatic conditions ensure consistent demand while economic prosperity supports premium product positioning and advanced technology adoption.

Market opportunities abound through smart technology integration, energy efficiency advancement, and commercial application expansion. The region’s high smartphone penetration and tech-savvy consumer base create favorable conditions for IoT-enabled portable air conditioners, while ongoing infrastructure development drives commercial segment growth.

Success factors for market participants include focus on energy efficiency, comprehensive service networks, and product differentiation through advanced features designed for extreme climate conditions. Companies that effectively balance innovation, reliability, and customer service are positioned to capture significant market share in this expanding sector.

Future prospects remain highly positive, with sustained growth expected through continued urbanization, infrastructure development, and technological advancement. The market’s evolution toward smart, energy-efficient solutions aligns with regional sustainability goals while meeting essential consumer cooling needs in one of the world’s most challenging climate environments.

What is Portable Air Conditioners?

Portable air conditioners are self-contained units that can be moved from room to room, providing cooling without the need for permanent installation. They are commonly used in residential and commercial settings for temporary cooling solutions.

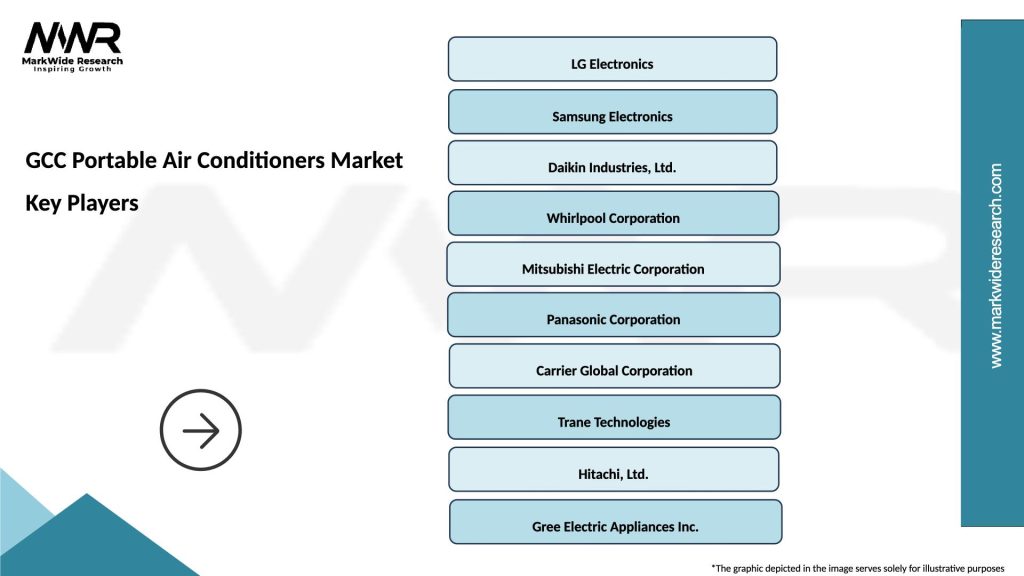

What are the key players in the GCC Portable Air Conditioners Market?

Key players in the GCC Portable Air Conditioners Market include companies like LG Electronics, Daikin Industries, and Midea Group, which offer a range of portable cooling solutions for various applications, among others.

What are the main drivers of the GCC Portable Air Conditioners Market?

The main drivers of the GCC Portable Air Conditioners Market include increasing temperatures in the region, rising demand for energy-efficient cooling solutions, and the growing trend of remote work, which boosts the need for flexible cooling options.

What challenges does the GCC Portable Air Conditioners Market face?

Challenges in the GCC Portable Air Conditioners Market include high energy consumption of some models, competition from fixed air conditioning systems, and regulatory pressures regarding energy efficiency and environmental impact.

What opportunities exist in the GCC Portable Air Conditioners Market?

Opportunities in the GCC Portable Air Conditioners Market include the development of smart portable air conditioners with IoT capabilities, increasing consumer awareness of energy-efficient products, and the potential for growth in the rental market for portable cooling solutions.

What trends are shaping the GCC Portable Air Conditioners Market?

Trends shaping the GCC Portable Air Conditioners Market include the rise of eco-friendly refrigerants, advancements in portable air conditioning technology, and a growing preference for multifunctional units that also provide heating and dehumidification.

GCC Portable Air Conditioners Market

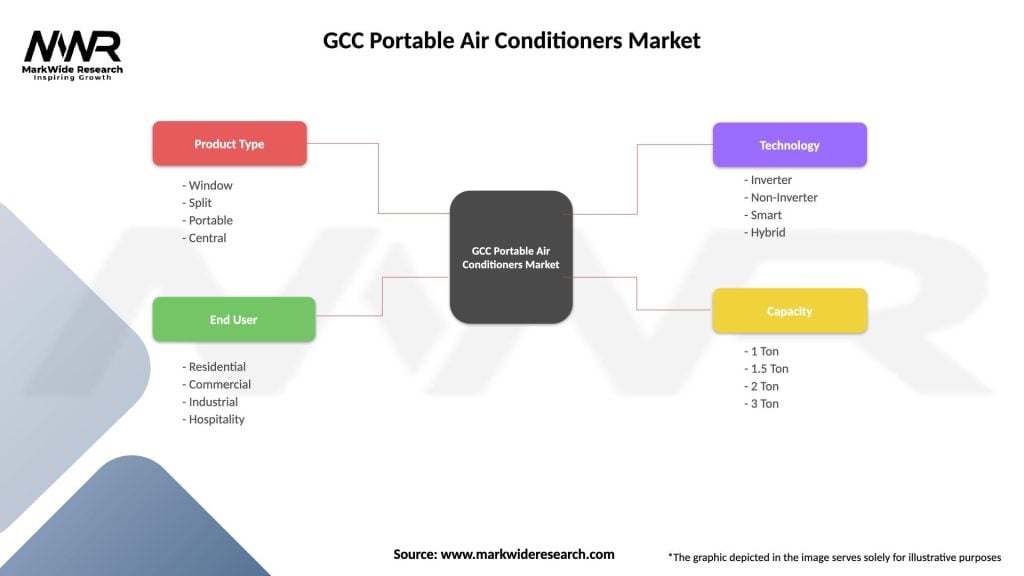

| Segmentation Details | Description |

|---|---|

| Product Type | Window, Split, Portable, Central |

| End User | Residential, Commercial, Industrial, Hospitality |

| Technology | Inverter, Non-Inverter, Smart, Hybrid |

| Capacity | 1 Ton, 1.5 Ton, 2 Ton, 3 Ton |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the GCC Portable Air Conditioners Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at