444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The GCC perfume market has witnessed significant growth in recent years, driven by the region’s increasing disposable income, rising consumer preferences for luxury fragrances, and a booming tourism industry. Perfumes hold a special place in the culture and traditions of the Gulf Cooperation Council (GCC) countries, which include Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates (UAE). The market is characterized by a wide range of local and international perfume brands, catering to diverse consumer preferences and tastes.

Meaning

The GCC perfume market refers to the industry involved in the manufacturing, distribution, and sale of perfumes in the Gulf Cooperation Council countries. It encompasses various categories of fragrances, including eau de parfum, eau de toilette, cologne, and attar. Perfumes are considered a luxury product in the region, symbolizing elegance, sophistication, and personal style. The market represents a significant segment of the overall beauty and personal care industry in the GCC.

Executive Summary

The GCC perfume market has experienced robust growth in recent years, driven by factors such as increasing disposable income, a growing population, and the region’s strong cultural affinity for perfumes. The market is characterized by intense competition among both local and international perfume brands, each striving to capture a larger market share. Key market players are focusing on product innovation, marketing strategies, and expanding their distribution networks to gain a competitive edge.

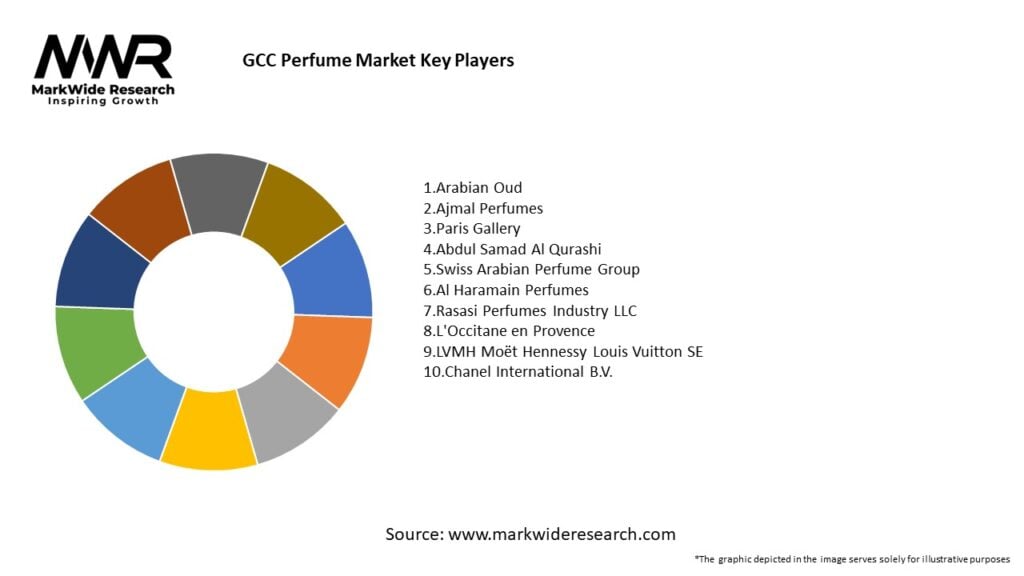

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The GCC perfume market is characterized by intense competition, continuous product innovation, and evolving consumer preferences. Key market dynamics include:

Regional Analysis

The GCC perfume market can be analyzed at the individual country level as well as from a regional perspective. The key countries in the GCC region include:

Competitive Landscape

Leading Companies in the GCC Perfume Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The GCC perfume market can be segmented based on various factors:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The GCC perfume market, like many other industries, faced challenges due to the COVID-19 pandemic. The pandemic caused disruptions in the supply chain, temporary store closures, and reduced consumer spending. However, as the situation improved and restrictions eased, the market showed signs of recovery.

The pandemic prompted a shift in consumer preferences, with a greater emphasis on personal hygiene and wellness. This led to increased demand for hand sanitizers, antibacterial soaps, and fragrances with antimicrobial properties. Perfume brands responded by introducing products that aligned with the evolving consumer needs.

Online sales and e-commerce platforms became crucial during the pandemic, allowing consumers to shop for perfumes from the safety of their homes. Perfume brands invested in digital marketing strategies and improved their online presence to adapt to changing consumer behavior.

The pandemic also highlighted the importance of sustainability and eco-friendly practices. Consumers demonstrated an increased interest in natural and organic fragrances, as well as environmentally conscious packaging. Perfume brands incorporated sustainable initiatives into their operations to meet the shifting consumer expectations.

Key Industry Developments

Analyst Suggestions

Future Outlook

The GCC perfume market is expected to continue its growth trajectory in the coming years. Factors such as increasing disposable income, a young population, and a strong cultural affinity for perfumes will drive market expansion. The demand for niche fragrances, personalized experiences, and sustainable products will shape the future trends in the industry.

Perfume brands that adapt to the changing consumer preferences, invest in digital marketing, and prioritize sustainability will be well-positioned to succeed. Continued innovation, strategic collaborations, and an enhanced focus on e-commerce channels will further propel the growth of the GCC perfume market.

Conclusion

The GCC perfume market is a vibrant and dynamic industry driven by cultural traditions, rising disposable income, and a growing consumer base. The market offers opportunities for both local and international perfume brands to thrive and expand their presence in the region. However, challenges such as counterfeit products, stringent regulations, and economic uncertainties need to be addressed.

To succeed in the market, perfume brands should prioritize product innovation, customization, and differentiation. They should also leverage digital platforms, collaborate with influencers, and enhance their sustainability efforts. By understanding and adapting to the evolving consumer preferences, perfume brands can position themselves for long-term growth and success in the GCC perfume market.

What is the GCC perfume?

The GCC perfume refers to fragrances produced and sold within the Gulf Cooperation Council region, which includes countries like Saudi Arabia, UAE, Qatar, Kuwait, Oman, and Bahrain. This market is characterized by a rich cultural heritage and a strong demand for luxury and traditional scents.

Who are the major players in the GCC perfume market?

Major companies in the GCC perfume market include Abdul Samad Al Qurashi, Ajmal Perfumes, Al Haramain Perfumes, and Swiss Arabian Perfumes, among others.

What are the key drivers of growth in the GCC perfume market?

The growth of the GCC perfume market is driven by factors such as increasing disposable income, a rising population with a strong affinity for luxury goods, and the cultural significance of perfumes in the region. Additionally, the expansion of retail channels enhances accessibility for consumers.

What challenges does the GCC perfume market face?

The GCC perfume market faces challenges such as intense competition among brands, fluctuating raw material prices, and the need for continuous innovation to meet changing consumer preferences. Regulatory compliance regarding product safety and labeling also poses challenges for manufacturers.

What opportunities exist in the GCC perfume market?

Opportunities in the GCC perfume market include the growing trend of personalized fragrances, the rise of e-commerce platforms for fragrance sales, and increasing interest in sustainable and natural ingredients. These trends present avenues for brands to differentiate themselves and capture new consumer segments.

What trends are shaping the GCC perfume market?

Current trends in the GCC perfume market include a shift towards niche and artisanal fragrances, the incorporation of technology in scent personalization, and a focus on eco-friendly packaging. Additionally, the influence of social media on consumer choices is becoming increasingly significant.

GCC Perfume Market

| Segmentation | Details |

|---|---|

| Product Type | Premium Perfumes, Mass Perfumes |

| Distribution Channel | Specialty Stores, Department Stores, Online Retailers |

| Region | Saudi Arabia, United Arab Emirates, Qatar, Oman, Bahrain, Kuwait |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the GCC Perfume Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at