444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The GCC perfume and fragrance market represents one of the most dynamic and culturally significant sectors in the Gulf Cooperation Council region, encompassing Saudi Arabia, UAE, Qatar, Kuwait, Bahrain, and Oman. This market demonstrates exceptional growth potential driven by deep-rooted cultural traditions, increasing disposable income, and evolving consumer preferences toward premium fragrance products. The region’s strategic position as a global hub for luxury goods and its rich heritage in perfumery create a unique market environment that attracts both international brands and local artisans.

Market dynamics in the GCC perfume and fragrance sector are characterized by a blend of traditional oud-based fragrances and contemporary Western-style perfumes. The market experiences robust expansion with a projected CAGR of 6.8% over the forecast period, reflecting strong consumer demand and increasing market penetration. Key growth drivers include rising urbanization, growing female workforce participation, and the region’s position as a luxury shopping destination for international tourists.

Regional preferences vary significantly across GCC countries, with Saudi Arabia and UAE leading market consumption due to their large populations and high purchasing power. The market showcases remarkable diversity in product offerings, ranging from traditional Arabic perfumes and oud to international designer fragrances and niche artisanal brands. This diversity caters to the sophisticated tastes of GCC consumers who demonstrate strong brand loyalty and willingness to invest in premium fragrance products.

The GCC perfume and fragrance market refers to the comprehensive ecosystem of fragrance products, including perfumes, colognes, essential oils, oud, and related aromatic products sold and consumed within the Gulf Cooperation Council countries. This market encompasses both traditional Arabic fragrances deeply rooted in regional culture and international fragrance brands catering to diverse consumer preferences across the six-nation bloc.

Market scope includes various product categories such as luxury perfumes, mass-market fragrances, traditional oud and bakhoor, essential oils, and fragrance accessories. The market serves multiple consumer segments including individual consumers, corporate gifting, hospitality industry, and religious institutions. Distribution channels range from traditional souks and specialized perfume shops to modern retail outlets, department stores, and increasingly popular e-commerce platforms.

Cultural significance plays a crucial role in defining this market, as fragrances hold deep cultural and religious importance in GCC societies. The market reflects the region’s appreciation for high-quality aromatic products, with consumers often viewing fragrances as essential lifestyle accessories rather than luxury items. This cultural foundation creates sustained demand and supports premium pricing strategies across various product segments.

The GCC perfume and fragrance market demonstrates exceptional resilience and growth potential, driven by strong cultural foundations and evolving consumer preferences. The market benefits from favorable demographic trends, including a young population with increasing disposable income and growing exposure to international lifestyle trends. Key market segments show varying growth patterns, with traditional Arabic fragrances maintaining steady demand while international brands experience rapid expansion.

Market leaders include both established international luxury brands and prominent regional players specializing in traditional Arabic perfumery. The competitive landscape features intense rivalry among premium brands, with companies investing heavily in product innovation, brand positioning, and retail expansion. Market penetration of online channels has accelerated significantly, with e-commerce adoption growing by 42% annually across the region.

Strategic opportunities emerge from several market trends, including increasing demand for personalized fragrances, growing interest in sustainable and natural ingredients, and expanding tourism industry. The market shows particular strength in the luxury segment, where consumers demonstrate willingness to pay premium prices for authentic, high-quality products. Regional economic diversification efforts and Vision 2030 initiatives in Saudi Arabia further support market expansion through increased consumer spending and tourism development.

Consumer behavior analysis reveals distinct purchasing patterns across GCC countries, with significant variations in brand preferences, price sensitivity, and product categories. The market demonstrates strong seasonal fluctuations, with peak demand during religious festivals, wedding seasons, and major shopping events. Understanding these patterns enables brands to optimize inventory management and marketing strategies for maximum market impact.

Cultural heritage serves as the primary market driver, with fragrances holding deep significance in GCC societies for personal grooming, religious practices, and social customs. This cultural foundation creates sustained demand that transcends economic cycles and supports premium pricing strategies. The tradition of gifting fragrances during special occasions and religious festivals generates consistent seasonal demand peaks throughout the year.

Economic prosperity across GCC countries enables consumers to invest in luxury fragrance products, with rising disposable income supporting market expansion. Government initiatives promoting economic diversification and tourism development create additional growth opportunities. The region’s strategic position as a global business hub attracts international visitors who contribute significantly to fragrance sales, particularly in duty-free and luxury retail segments.

Demographic advantages include a young, affluent population with increasing exposure to international lifestyle trends and brands. Growing female workforce participation expands the target market for women’s fragrances, while urbanization trends support modern retail channel development. Social media influence and celebrity endorsements drive brand awareness and product adoption among younger consumers, creating new market segments and consumption patterns.

Tourism growth significantly impacts market demand, with millions of international visitors seeking authentic Arabic fragrances and luxury perfumes as souvenirs and personal purchases. The hospitality industry’s expansion creates additional demand for signature scents and ambient fragrances. Major shopping festivals and events throughout the GCC region generate substantial fragrance sales, supported by attractive promotional offers and exclusive product launches.

Economic volatility related to oil price fluctuations can impact consumer spending on luxury items, including premium fragrances. While the market shows resilience, significant economic downturns may lead to temporary shifts toward more affordable product segments. Currency fluctuations affect import costs for international brands, potentially impacting pricing strategies and profit margins across the market.

Regulatory challenges include varying import regulations, taxation policies, and product certification requirements across different GCC countries. Compliance with Islamic principles regarding alcohol content in fragrances creates formulation constraints for some international brands. Intellectual property protection concerns affect brand investments and market entry strategies, particularly for luxury and niche fragrance companies.

Market saturation in certain premium segments creates intense competition and pressure on profit margins. The proliferation of counterfeit products poses significant challenges for authentic brands, requiring substantial investments in anti-counterfeiting measures and consumer education. Limited availability of skilled workforce in specialized areas such as perfumery and fragrance retail affects service quality and market development.

Supply chain complexities arise from dependence on imported raw materials and finished products, creating vulnerability to global supply disruptions. Climate conditions in the region can affect product storage and quality, requiring specialized logistics and warehousing solutions. Seasonal demand fluctuations create inventory management challenges, particularly for retailers carrying extensive product portfolios.

Digital transformation presents significant opportunities for market expansion through e-commerce platforms, social media marketing, and personalized customer experiences. The growing adoption of online shopping, accelerated by recent global events, creates new channels for brand engagement and sales growth. Virtual fragrance consultations and AI-powered recommendation systems offer innovative ways to enhance customer experience and drive sales conversion.

Sustainability trends create opportunities for brands focusing on natural ingredients, eco-friendly packaging, and ethical sourcing practices. Growing consumer awareness of environmental issues drives demand for sustainable fragrance options, creating market niches for innovative brands. The development of refillable packaging systems and concentrated fragrance formats addresses environmental concerns while offering cost advantages to consumers.

Customization demand opens opportunities for personalized fragrance services, bespoke perfume creation, and limited edition collections. The affluent GCC consumer base shows strong interest in exclusive, customized products that reflect individual preferences and status. Collaboration opportunities with local artisans and traditional perfumers can create unique product offerings that blend heritage with modern appeal.

Market expansion opportunities exist in underserved segments such as men’s grooming products, home fragrances, and therapeutic aromatherapy products. The growing wellness trend creates demand for fragrances with mood-enhancing and stress-relief properties. Corporate fragrance solutions for hospitality, retail, and office environments represent emerging market segments with substantial growth potential.

Supply and demand dynamics in the GCC perfume and fragrance market reflect complex interactions between cultural preferences, economic conditions, and global trends. Demand patterns show strong seasonal variations, with peak periods during religious festivals, wedding seasons, and major shopping events. Supply chain management requires careful coordination between international suppliers, local distributors, and retail partners to ensure product availability and quality maintenance.

Competitive dynamics feature intense rivalry among established international brands, emerging niche players, and traditional Arabic perfume houses. Market leaders invest heavily in brand building, retail expansion, and customer experience enhancement to maintain competitive advantages. Price competition remains limited in premium segments, where brand reputation and product quality drive purchasing decisions more than price considerations.

Innovation dynamics drive continuous product development, with brands introducing new fragrance compositions, packaging designs, and application formats. Technology integration enhances customer experience through virtual try-on solutions, fragrance profiling systems, and personalized recommendation engines. MarkWide Research indicates that innovation-focused brands achieve 15% higher customer retention rates compared to traditional approaches.

Distribution dynamics evolve rapidly with the expansion of modern retail formats, online platforms, and experiential retail concepts. Traditional channels such as souks and specialized perfume shops maintain importance for authentic Arabic fragrances, while international brands focus on premium department stores and flagship boutiques. Omnichannel strategies become increasingly important for reaching diverse consumer segments and providing seamless shopping experiences.

Primary research methodologies employed in analyzing the GCC perfume and fragrance market include comprehensive consumer surveys, in-depth interviews with industry stakeholders, and focus group discussions across major GCC cities. Data collection involves direct engagement with fragrance retailers, distributors, brand representatives, and end consumers to gather authentic market insights and validate market trends.

Secondary research incorporates analysis of industry reports, trade publications, government statistics, and company financial statements to establish market baselines and identify growth patterns. Competitive intelligence gathering includes monitoring of brand strategies, product launches, pricing policies, and marketing campaigns across the region. Import-export data analysis provides insights into market size, growth trends, and trade patterns.

Market segmentation analysis utilizes both demographic and psychographic variables to identify distinct consumer groups and their preferences. Geographic analysis considers cultural differences, economic conditions, and regulatory environments across different GCC countries. Product category analysis examines performance variations among different fragrance types, price segments, and distribution channels.

Validation processes include cross-referencing multiple data sources, expert consultations, and market reality checks to ensure accuracy and reliability of research findings. Trend analysis incorporates historical data patterns, current market conditions, and forward-looking indicators to develop comprehensive market projections. Quality assurance measures ensure research methodology adherence and data integrity throughout the analysis process.

Saudi Arabia represents the largest market within the GCC region, accounting for approximately 38% of total regional demand. The market benefits from a large population, high disposable income, and strong cultural affinity for premium fragrances. Vision 2030 initiatives promoting tourism and entertainment sectors create additional growth opportunities. The market shows particular strength in traditional Arabic fragrances and luxury international brands, with Riyadh and Jeddah serving as primary consumption centers.

United Arab Emirates holds the second-largest market position with 28% regional market share, driven by Dubai’s status as a global luxury shopping destination and Abu Dhabi’s growing affluence. The market benefits significantly from tourism, with international visitors contributing substantially to fragrance sales. UAE demonstrates the highest adoption rate of international luxury brands while maintaining strong demand for traditional oud and Arabic perfumes.

Qatar shows rapid market growth supported by high per capita income and increasing population. The market benefits from major international events and growing tourism industry. Qatari consumers demonstrate strong preference for premium and luxury fragrance products, with particular interest in exclusive and limited edition collections. The market shows 12% regional share with above-average growth rates.

Kuwait maintains a stable market position with 11% regional share, characterized by sophisticated consumer preferences and strong brand loyalty. The market shows resilience during economic fluctuations, supported by established retail infrastructure and consumer affluence. Kuwaiti consumers demonstrate particular interest in personalized fragrance services and bespoke perfume creation.

Bahrain and Oman together account for 11% of regional market share, showing steady growth supported by tourism development and increasing consumer sophistication. Both markets demonstrate growing interest in niche and artisanal fragrance brands, creating opportunities for specialized retailers and unique product offerings.

Market leadership in the GCC perfume and fragrance sector features a diverse mix of international luxury brands, regional specialists, and traditional Arabic perfume houses. Competition intensity varies across different market segments, with premium and luxury categories showing the most dynamic competitive environment. Brand differentiation strategies focus on heritage, quality, exclusivity, and customer experience rather than price competition.

Competitive strategies include retail expansion, digital transformation, product innovation, and customer experience enhancement. Leading brands invest heavily in flagship stores, exclusive collections, and personalized services to maintain competitive advantages. Strategic partnerships with local distributors and retailers enable international brands to navigate regional market complexities effectively.

By Product Type: The market segments into traditional Arabic fragrances including oud, bakhoor, and attar, representing deep cultural significance and sustained demand. International perfumes encompass luxury designer brands, mass-market fragrances, and niche artisanal products catering to diverse consumer preferences. Essential oils and aromatherapy products form a growing segment driven by wellness trends and natural product preferences.

By Gender: Women’s fragrances dominate market volume with sophisticated product offerings ranging from floral and oriental compositions to modern contemporary scents. Men’s fragrances show strong growth potential, particularly in premium and luxury segments. Unisex fragrances gain popularity among younger consumers seeking versatile and unique fragrance experiences.

By Price Range: Premium and luxury segments command the largest revenue share, reflecting consumer willingness to invest in high-quality fragrance products. Mass-market segments provide volume growth and market accessibility for price-conscious consumers. Ultra-luxury niche products serve affluent consumers seeking exclusive and rare fragrance experiences.

By Distribution Channel: Specialty fragrance stores maintain importance for traditional Arabic perfumes and personalized services. Department stores and luxury boutiques serve as primary channels for international brands. E-commerce platforms experience rapid growth, offering convenience and extensive product selection. Traditional souks and markets preserve cultural authenticity and tourist appeal.

By Application: Personal use represents the primary market segment, driven by daily grooming habits and lifestyle preferences. Gift market shows significant seasonal variations with peak demand during festivals and special occasions. Corporate and hospitality applications create specialized market niches with unique requirements and service expectations.

Traditional Arabic Fragrances maintain strong market position despite international brand expansion, with oud products commanding premium prices and loyal customer base. This category benefits from cultural authenticity, artisanal craftsmanship, and deep emotional connections with consumers. Market trends include modernization of traditional formulations, premium packaging innovations, and expansion into international markets.

Luxury International Brands experience robust growth driven by brand prestige, product quality, and sophisticated marketing strategies. This category shows particular strength in women’s fragrances and exclusive limited editions. Key success factors include retail presence in premium locations, celebrity endorsements, and innovative fragrance compositions that appeal to regional preferences.

Niche and Artisanal Fragrances represent the fastest-growing market segment, appealing to consumers seeking unique and exclusive fragrance experiences. This category benefits from personalization trends, sustainable practices, and storytelling marketing approaches. Growth drivers include increasing consumer sophistication, desire for individuality, and willingness to explore new fragrance territories.

Mass-Market Fragrances provide market accessibility and volume growth, particularly among younger consumers and price-conscious segments. This category focuses on trendy packaging, celebrity collaborations, and accessible pricing strategies. Distribution through modern retail channels and online platforms supports market expansion and brand awareness development.

Home and Ambient Fragrances emerge as a growing category driven by lifestyle trends and hospitality industry expansion. Products include reed diffusers, scented candles, and room sprays designed for residential and commercial applications. Market opportunities exist in luxury hotels, retail environments, and affluent residential segments seeking signature scent experiences.

Brand Manufacturers benefit from strong market demand, premium pricing opportunities, and cultural appreciation for quality fragrance products. The market offers excellent returns on investment for brands that understand regional preferences and invest in appropriate market entry strategies. Long-term growth prospects remain positive, supported by demographic trends and economic development across GCC countries.

Retailers and Distributors enjoy healthy profit margins, particularly in premium and luxury segments where brand exclusivity and customer service command premium pricing. The market provides opportunities for retail innovation, customer experience enhancement, and omnichannel strategy development. Strong seasonal demand patterns enable effective inventory management and promotional planning.

Consumers benefit from extensive product variety, competitive pricing in certain segments, and improving retail experiences. The market offers authentic traditional products alongside international luxury brands, providing choice and value across different price points. Growing online availability enhances shopping convenience and product accessibility.

Tourism Industry leverages the fragrance market as a key attraction for international visitors seeking authentic cultural experiences and luxury shopping opportunities. Fragrance retail contributes significantly to tourism revenue and enhances destination appeal. Duty-free operations benefit from high-margin fragrance sales and repeat customer visits.

Economic Development benefits from job creation in retail, distribution, and service sectors. The market supports small and medium enterprises, particularly in traditional perfumery and specialized retail segments. Foreign investment in retail infrastructure and brand development contributes to economic diversification efforts across GCC countries.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization Acceleration transforms the fragrance retail landscape with e-commerce platforms, virtual consultations, and AI-powered recommendation systems gaining prominence. Brands invest heavily in digital marketing, social media engagement, and online customer experience enhancement. Mobile commerce shows particularly strong growth, with consumers increasingly comfortable purchasing fragrances online after initial in-store experiences.

Sustainability Focus drives demand for natural ingredients, eco-friendly packaging, and ethical sourcing practices. Consumers show increasing awareness of environmental impact and prefer brands demonstrating genuine commitment to sustainability. Refillable packaging systems and concentrated fragrance formats gain popularity as environmentally conscious alternatives to traditional packaging.

Personalization Demand creates opportunities for bespoke fragrance services, custom blending, and limited edition collections. Affluent GCC consumers seek unique, personalized products that reflect individual preferences and status. Brands respond with fragrance profiling services, custom packaging options, and exclusive membership programs offering personalized experiences.

Wellness Integration connects fragrances with mood enhancement, stress relief, and aromatherapy benefits. Consumers increasingly view fragrances as wellness products rather than purely aesthetic accessories. This trend creates opportunities for therapeutic fragrance lines, meditation-focused scents, and products targeting specific emotional states or wellness goals.

Heritage Revival sees renewed interest in traditional Arabic perfumery techniques, authentic oud products, and artisanal craftsmanship. Modern consumers appreciate the cultural significance and artisanal quality of traditional fragrances while seeking contemporary presentations and accessibility. This trend supports premium positioning for authentic traditional products and creates opportunities for heritage brand storytelling.

Retail Innovation includes flagship store openings, experiential retail concepts, and omnichannel strategy implementations across major GCC cities. Leading brands invest in immersive retail experiences featuring fragrance bars, personalization services, and cultural storytelling elements. Pop-up stores and temporary installations create buzz and test new market concepts before permanent expansion.

Product Launches focus on region-specific formulations, limited edition collections, and collaborations with local artisans or celebrities. International brands develop GCC-exclusive products that incorporate regional preferences for oud, rose, and amber notes. Traditional perfume houses modernize their offerings with contemporary packaging and marketing while maintaining authentic formulations.

Technology Integration encompasses virtual reality fragrance experiences, AI-powered scent matching, and blockchain authentication systems for luxury products. Smart packaging solutions provide product information, authenticity verification, and personalized recommendations through mobile applications. Technology enhances both customer experience and operational efficiency across the value chain.

Strategic Partnerships between international brands and local distributors, retailers, and cultural institutions strengthen market presence and cultural authenticity. Collaborations with luxury hotels, airlines, and tourism boards create unique marketing opportunities and brand exposure. Educational partnerships with perfumery schools and cultural centers support industry development and talent cultivation.

Sustainability Initiatives include carbon-neutral shipping, sustainable packaging programs, and ethical sourcing certifications. Brands implement comprehensive sustainability strategies covering ingredient sourcing, manufacturing processes, and end-of-life product management. These initiatives respond to growing consumer awareness and regulatory requirements while supporting long-term brand positioning.

Market Entry Strategies should prioritize cultural understanding, local partnerships, and gradual market penetration rather than aggressive expansion approaches. MarkWide Research recommends that international brands invest in cultural education and local market research before launching products. Successful market entry requires authentic engagement with regional preferences, traditions, and consumer behaviors.

Product Development Focus should emphasize regional preference integration, quality excellence, and authentic storytelling. Brands should develop GCC-specific formulations that incorporate beloved regional ingredients while maintaining international quality standards. Innovation should balance tradition with modernity, creating products that honor cultural heritage while appealing to contemporary consumers.

Digital Strategy Implementation requires comprehensive omnichannel approaches combining online presence with physical retail experiences. Brands should invest in sophisticated e-commerce platforms, social media engagement, and digital marketing capabilities. Mobile-first strategies become increasingly important as smartphone penetration and mobile commerce adoption continue expanding across the region.

Sustainability Integration should become a core business strategy rather than a marketing add-on, with genuine commitment to environmental and social responsibility. Brands should implement comprehensive sustainability programs covering the entire value chain from ingredient sourcing to packaging disposal. Transparency and authenticity in sustainability claims become crucial for maintaining consumer trust and brand credibility.

Customer Experience Enhancement should focus on personalization, exclusivity, and cultural sensitivity to differentiate brands in competitive markets. Investment in staff training, service excellence, and customer relationship management creates sustainable competitive advantages. Brands should develop loyalty programs and exclusive services that recognize and reward customer preferences and cultural values.

Growth Projections indicate continued market expansion driven by demographic trends, economic development, and cultural factors supporting fragrance consumption. The market expects to maintain robust growth rates with projected CAGR of 6.8% over the next five years, supported by increasing consumer sophistication and market premiumization trends. Regional economic diversification efforts and tourism development initiatives create additional growth catalysts.

Technology Integration will accelerate with artificial intelligence, augmented reality, and blockchain technologies transforming customer experiences and operational efficiency. Virtual fragrance consultation services, AI-powered recommendation engines, and blockchain authentication systems become standard industry practices. Technology adoption will enable more personalized customer experiences while improving supply chain transparency and product authenticity verification.

Market Evolution toward sustainability, personalization, and cultural authenticity will reshape competitive dynamics and consumer expectations. Brands that successfully balance tradition with innovation while demonstrating genuine commitment to sustainability and cultural sensitivity will achieve competitive advantages. The market will likely see increased consolidation among smaller players while niche and artisanal brands find growing opportunities in specialized segments.

Consumer Sophistication will continue increasing, driving demand for higher quality products, authentic experiences, and personalized services. Younger consumers will bring different preferences and shopping behaviors, requiring brands to adapt marketing strategies and product offerings. The growing female workforce and changing social dynamics will create new market segments and consumption patterns requiring strategic responses from industry participants.

Regional Integration efforts may create more harmonized regulatory environments and facilitate cross-border trade and marketing initiatives. Economic cooperation and tourism development programs will support market growth and create opportunities for regional brand expansion. The success of major international events and tourism initiatives will significantly impact market development and international brand interest in the region.

The GCC perfume and fragrance market represents a unique and dynamic sector characterized by strong cultural foundations, economic prosperity, and evolving consumer preferences. The market demonstrates exceptional resilience and growth potential, supported by deep-rooted cultural appreciation for fragrances, increasing disposable income, and strategic position as a global luxury destination. Key success factors include understanding regional preferences, investing in quality and authenticity, and developing comprehensive customer experience strategies.

Market opportunities abound for brands that can successfully navigate cultural complexities while delivering authentic, high-quality products and services. The digital transformation trend creates new channels for customer engagement and market expansion, while sustainability focus opens opportunities for innovative brands committed to environmental and social responsibility. Personalization demand and wellness integration trends provide additional avenues for market differentiation and premium positioning.

Strategic recommendations emphasize the importance of cultural sensitivity, quality excellence, and long-term commitment to market development. Successful brands will balance respect for traditional preferences with innovation and modernization, creating products and experiences that honor cultural heritage while appealing to contemporary consumers. Investment in local partnerships, retail infrastructure, and customer relationship management will prove crucial for sustainable market success in this culturally rich and economically vibrant region.

What is Perfume and Fragrance?

Perfume and Fragrance refers to aromatic compounds used to create pleasant scents in various products, including personal care items, household goods, and cosmetics. This category encompasses a wide range of products, from luxury perfumes to everyday scented items.

What are the key players in the GCC Perfume and Fragrance Market?

Key players in the GCC Perfume and Fragrance Market include companies like Al Haramain Perfumes, Ajmal Perfumes, and Swiss Arabian Perfumes. These companies are known for their diverse product offerings and strong market presence in the region, among others.

What are the growth factors driving the GCC Perfume and Fragrance Market?

The growth of the GCC Perfume and Fragrance Market is driven by increasing consumer demand for luxury and niche fragrances, rising disposable incomes, and a growing interest in personal grooming and self-care. Additionally, cultural factors and gifting traditions in the region further enhance market growth.

What challenges does the GCC Perfume and Fragrance Market face?

The GCC Perfume and Fragrance Market faces challenges such as intense competition among brands, fluctuating raw material prices, and changing consumer preferences. These factors can impact profitability and market stability.

What opportunities exist in the GCC Perfume and Fragrance Market?

Opportunities in the GCC Perfume and Fragrance Market include the expansion of e-commerce platforms, increasing interest in sustainable and natural fragrances, and the potential for product innovation. Brands can leverage these trends to capture new consumer segments.

What trends are shaping the GCC Perfume and Fragrance Market?

Trends shaping the GCC Perfume and Fragrance Market include the rise of personalized fragrances, the popularity of unisex scents, and the incorporation of technology in fragrance development. These trends reflect changing consumer preferences and the desire for unique scent experiences.

GCC Perfume and Fragrance Market

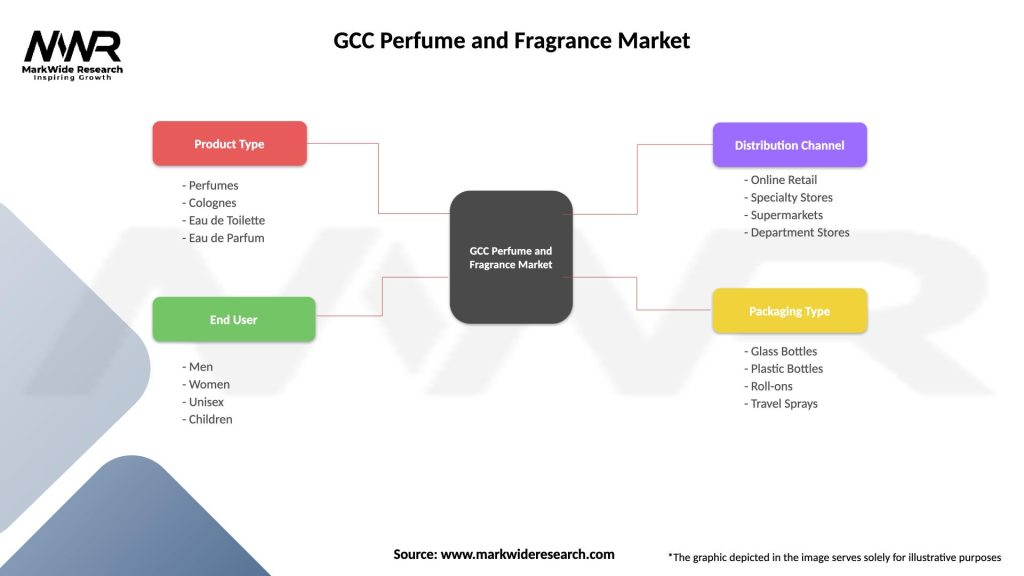

| Segmentation Details | Description |

|---|---|

| Product Type | Perfumes, Colognes, Eau de Toilette, Eau de Parfum |

| End User | Men, Women, Unisex, Children |

| Distribution Channel | Online Retail, Specialty Stores, Supermarkets, Department Stores |

| Packaging Type | Glass Bottles, Plastic Bottles, Roll-ons, Travel Sprays |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the GCC Perfume and Fragrance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at