444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The GCC mutual fund market represents a dynamic and rapidly evolving financial services sector across the Gulf Cooperation Council region, encompassing Saudi Arabia, UAE, Kuwait, Qatar, Bahrain, and Oman. This market has experienced substantial transformation over the past decade, driven by increasing investor sophistication, regulatory reforms, and growing demand for diversified investment solutions. The region’s mutual fund industry serves as a crucial bridge between retail investors and capital markets, offering professionally managed investment vehicles that cater to various risk appetites and investment objectives.

Market dynamics in the GCC mutual fund sector reflect the broader economic diversification efforts across Gulf nations, with funds increasingly focusing on sectors beyond traditional oil and gas investments. The market demonstrates robust growth potential, with industry analysts projecting a compound annual growth rate of 8.2% over the forecast period. This expansion is supported by favorable demographic trends, including a young and increasingly affluent population, alongside government initiatives promoting financial market development and foreign investment attraction.

Investment preferences within the GCC mutual fund market show a notable shift toward Islamic finance-compliant products, with Sharia-compliant funds capturing approximately 45% of total market share. This trend reflects the region’s cultural values and religious considerations, creating unique opportunities for fund managers specializing in Islamic investment principles. Additionally, the market benefits from increasing institutional investor participation and growing cross-border investment flows within the GCC region.

The GCC mutual fund market refers to the collective investment scheme industry operating across the six Gulf Cooperation Council member states, where pooled investor funds are professionally managed and invested in diversified portfolios of securities, real estate, commodities, and other financial instruments to generate returns while spreading investment risk across multiple assets and markets.

Mutual funds in the GCC context serve multiple functions within the regional financial ecosystem. They provide retail and institutional investors with access to professional fund management expertise, diversified investment portfolios, and exposure to both domestic and international markets. These investment vehicles operate under regulatory frameworks established by each GCC country’s capital market authority, ensuring investor protection and market integrity while promoting financial market development.

The market encompasses various fund types including equity funds, fixed-income funds, money market funds, balanced funds, and specialized sector-specific funds. Additionally, the GCC mutual fund market features a significant proportion of Islamic investment funds that comply with Sharia principles, avoiding investments in prohibited sectors such as conventional banking, alcohol, gambling, and tobacco while emphasizing profit-and-loss sharing arrangements.

The GCC mutual fund market stands at a pivotal juncture, characterized by accelerating growth, regulatory modernization, and increasing investor sophistication. The market benefits from strong macroeconomic fundamentals across Gulf nations, including substantial sovereign wealth accumulation, ongoing economic diversification initiatives, and favorable demographic trends supporting long-term investment demand.

Key market drivers include the region’s Vision 2030 initiatives, particularly Saudi Arabia’s comprehensive economic transformation program, which has catalyzed significant capital market reforms and attracted international fund managers. The UAE’s position as a regional financial hub continues to strengthen, with Dubai and Abu Dhabi serving as key centers for mutual fund operations and cross-border investment activities.

Regulatory developments across GCC countries have created more favorable operating environments for mutual fund companies, with streamlined licensing procedures, enhanced investor protection measures, and improved market transparency. These reforms have attracted international asset management firms to establish regional operations, increasing competition and driving product innovation within the market.

Investment trends show growing demand for ESG-compliant funds, technology sector exposure, and alternative investment strategies. The market demonstrates resilience despite global economic uncertainties, supported by strong domestic liquidity conditions and continued government support for financial market development across the region.

Strategic market insights reveal several critical trends shaping the GCC mutual fund landscape. The following key observations provide comprehensive understanding of market dynamics:

Economic diversification initiatives across GCC countries serve as primary catalysts for mutual fund market growth. Government-led transformation programs, particularly Saudi Arabia’s Vision 2030 and UAE’s economic diversification strategy, are creating new investment opportunities and driving demand for professional asset management services. These initiatives include massive infrastructure projects, technology sector development, and tourism industry expansion, all requiring sophisticated financing and investment solutions.

Demographic advantages significantly support market expansion, with the GCC region featuring a young, educated, and increasingly affluent population. Rising disposable incomes, growing financial literacy, and changing investment preferences among millennials and Gen Z investors are driving demand for mutual fund products. The region’s expatriate population also contributes to market growth, seeking investment vehicles for wealth accumulation and retirement planning.

Regulatory reforms have created more attractive operating environments for mutual fund companies. Capital market authorities across GCC countries have implemented investor-friendly regulations, streamlined fund licensing procedures, and enhanced market transparency measures. These reforms have attracted international asset managers while encouraging domestic financial institutions to expand their mutual fund offerings.

Technological advancement is revolutionizing fund distribution and investor engagement. Digital platforms, robo-advisory services, and mobile applications are making mutual fund investments more accessible to retail investors. Fintech integration is reducing operational costs while improving customer experience and portfolio management efficiency across the market.

Regulatory fragmentation across GCC countries creates operational complexities for mutual fund companies seeking regional expansion. Despite harmonization efforts, significant differences in licensing requirements, investment restrictions, and reporting standards persist between jurisdictions. These regulatory disparities increase compliance costs and limit economies of scale for fund managers operating across multiple GCC markets.

Limited investor education remains a significant challenge, particularly among retail investors who may lack comprehensive understanding of mutual fund risks and benefits. Traditional investment preferences favoring real estate and bank deposits continue to compete with mutual fund products. Cultural factors and risk aversion among certain investor segments also constrain market penetration rates.

Market concentration in certain GCC countries limits diversification opportunities and increases systemic risks. Heavy dependence on oil and gas sectors in some regional economies creates volatility that affects mutual fund performance. Additionally, limited depth in local capital markets restricts investment options for domestically focused funds.

Operational challenges include talent shortages in specialized areas such as Islamic finance, alternative investments, and risk management. High operational costs associated with regulatory compliance and technology infrastructure development also pressure fund profitability, particularly for smaller asset management firms seeking to establish market presence.

Islamic finance expansion presents substantial growth opportunities, with Sharia-compliant mutual funds experiencing increasing demand from both regional and international investors. The GCC’s position as a global Islamic finance hub creates competitive advantages for fund managers specializing in Islamic investment principles. Growing international recognition of Islamic finance standards opens opportunities for cross-border fund distribution and investment.

ESG investing trends align well with regional sustainability initiatives and Vision 2030 programs across GCC countries. Environmental, social, and governance-focused funds can capitalize on government commitments to renewable energy, social development, and corporate governance improvements. International investors seeking ESG exposure in emerging markets view the GCC as an attractive destination.

Technology sector growth across the region creates opportunities for specialized technology funds and venture capital-style investment vehicles. Government support for fintech development, artificial intelligence initiatives, and smart city projects generates demand for funds focusing on innovation and technology investments.

Infrastructure investment opportunities abound as GCC countries implement massive development projects including transportation networks, renewable energy facilities, and urban development initiatives. Infrastructure-focused mutual funds can provide retail and institutional investors with exposure to these long-term growth themes while supporting regional economic development objectives.

Competitive dynamics within the GCC mutual fund market reflect a balance between established regional players and international entrants seeking market share. Local banks and financial institutions maintain strong distribution advantages through extensive branch networks and existing customer relationships. However, international asset managers bring sophisticated investment expertise and global market access that appeals to institutional investors and high-net-worth individuals.

Product innovation cycles are accelerating as fund managers respond to evolving investor preferences and market conditions. The introduction of exchange-traded funds (ETFs), alternative investment strategies, and thematic funds targeting specific sectors or investment themes demonstrates market maturation. Fund managers are also developing hybrid products combining conventional and Islamic investment approaches to broaden market appeal.

Distribution channel evolution shows significant shifts toward digital platforms and direct-to-investor sales models. Traditional bank-based distribution remains important, but online platforms and robo-advisory services are gaining market share, particularly among younger investors. This evolution is driving changes in fee structures and investor relationship management approaches across the industry.

Market cyclicality reflects broader economic conditions and oil price fluctuations that significantly impact GCC economies. Fund performance and investor sentiment demonstrate correlation with regional economic cycles, though diversification efforts are gradually reducing this sensitivity. Cross-border investment flows and international fund offerings are helping to moderate market volatility and provide more stable return profiles.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the GCC mutual fund market. Primary research involves extensive interviews with fund managers, regulatory officials, institutional investors, and industry experts across all six GCC countries. These interviews provide qualitative insights into market trends, challenges, and opportunities that quantitative data alone cannot capture.

Secondary research incorporates analysis of regulatory filings, fund prospectuses, annual reports, and financial statements from major mutual fund companies operating in the region. Capital market authority publications, central bank reports, and government economic data provide macroeconomic context and regulatory framework analysis essential for comprehensive market understanding.

Quantitative analysis utilizes fund performance data, asset flow information, and market share statistics to identify trends and patterns in investor behavior and fund manager performance. Statistical modeling techniques help project future market developments and assess the impact of various economic scenarios on mutual fund market growth.

Cross-validation processes ensure data accuracy and reliability through triangulation of multiple information sources. Industry expert validation and peer review processes enhance the credibility and usefulness of research findings for market participants and stakeholders seeking strategic insights into GCC mutual fund market dynamics.

Saudi Arabia dominates the GCC mutual fund market, accounting for approximately 42% of regional assets under management. The Kingdom’s Vision 2030 program has catalyzed significant capital market reforms, including the introduction of new fund categories and relaxation of foreign investment restrictions. The Saudi Stock Exchange (Tadawul) modernization and MSCI emerging market inclusion have attracted international fund managers and increased investor interest in Saudi-focused mutual funds.

United Arab Emirates serves as the regional financial hub, hosting numerous international asset management firms and offering sophisticated fund products. Dubai and Abu Dhabi’s strategic positions facilitate cross-border investment flows and provide access to international markets. The UAE mutual fund market benefits from regulatory flexibility and strong institutional investor presence, capturing approximately 28% of regional market share.

Kuwait maintains a mature mutual fund market with strong institutional participation from pension funds and insurance companies. The Kuwait Stock Exchange upgrade to emerging market status has enhanced international investor interest. Kuwaiti mutual funds demonstrate strong performance in regional equity investments and Islamic finance products, representing about 15% of GCC market assets.

Qatar leverages its substantial sovereign wealth and World Cup 2022 infrastructure investments to drive mutual fund market growth. The Qatar Stock Exchange development and foreign ownership limit increases have attracted international fund managers. Qatari funds focus heavily on infrastructure, real estate, and energy sector investments, comprising approximately 8% of regional market share.

Bahrain and Oman represent smaller but growing mutual fund markets, together accounting for the remaining 7% of regional assets. Bahrain’s position as an Islamic finance center supports specialized fund offerings, while Oman’s economic diversification efforts create opportunities for sector-specific investment funds targeting tourism, logistics, and manufacturing industries.

Market leadership in the GCC mutual fund sector reflects a combination of regional banking giants and international asset management firms. The competitive landscape demonstrates increasing consolidation as larger players acquire smaller fund managers to achieve economies of scale and expand product offerings.

Competitive strategies focus on product differentiation, distribution channel expansion, and technology adoption to enhance investor experience and operational efficiency. Many firms are investing heavily in digital platforms and robo-advisory services to capture younger investor segments while maintaining traditional relationship-based approaches for institutional clients.

By Fund Type: The GCC mutual fund market demonstrates diverse segmentation reflecting varying investor preferences and risk appetites across the region.

By Investor Type: Market segmentation reveals distinct patterns in investment behavior and product preferences.

Islamic Mutual Funds represent the fastest-growing category within the GCC market, driven by strong cultural alignment and increasing international demand for Sharia-compliant investment products. These funds avoid interest-based investments and prohibited sectors while emphasizing profit-and-loss sharing arrangements. Performance metrics show Islamic funds achieving competitive returns while maintaining religious compliance, attracting both regional and international investors seeking ethical investment alternatives.

Technology Sector Funds are experiencing rapid growth as GCC countries invest heavily in digital transformation and innovation initiatives. These specialized funds provide exposure to regional fintech companies, e-commerce platforms, and technology infrastructure projects. Government support for smart city developments and artificial intelligence initiatives creates substantial investment opportunities for technology-focused mutual funds.

Real Estate Investment Funds capitalize on ongoing urban development and infrastructure projects across the GCC region. These funds provide retail investors with access to commercial real estate investments and development projects that would otherwise require substantial capital commitments. The category benefits from government initiatives promoting real estate market development and foreign investment attraction.

ESG-Focused Funds align with regional sustainability commitments and Vision 2030 environmental objectives. These funds integrate environmental, social, and governance criteria into investment decisions while targeting companies contributing to sustainable development goals. Growing international investor interest in ESG investing creates opportunities for GCC-based funds meeting global sustainability standards.

For Investors: The GCC mutual fund market provides numerous advantages including professional fund management, diversified investment exposure, and access to regional and international markets. Retail investors benefit from lower minimum investment requirements compared to direct market participation, while institutional investors gain access to specialized investment strategies and alternative asset classes.

For Fund Managers: The expanding GCC market offers significant business opportunities including growing asset bases, fee income generation, and regional expansion possibilities. Regulatory improvements and market development initiatives create favorable operating environments for both domestic and international asset management firms.

For Regulators: Mutual fund market development supports broader capital market objectives including increased market depth, improved price discovery, and enhanced financial system stability. Growing institutional investor participation contributes to market maturation and reduced volatility in regional stock markets.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation is revolutionizing mutual fund distribution and investor engagement across the GCC region. Robo-advisory platforms, mobile applications, and online investment portals are making fund investments more accessible to retail investors while reducing operational costs for fund managers. MarkWide Research analysis indicates that digital channels now account for approximately 30% of new fund subscriptions in major GCC markets.

ESG integration represents a significant trend as GCC mutual funds incorporate environmental, social, and governance criteria into investment processes. This trend aligns with regional sustainability commitments and attracts international investors seeking responsible investment opportunities. Fund managers are developing ESG frameworks and reporting standards to meet growing investor demand for sustainable investment products.

Cross-border investment within the GCC region is increasing as regulatory barriers decrease and market integration progresses. Mutual funds are expanding their investment mandates to include regional opportunities, providing investors with broader diversification and growth potential. This trend supports economic integration objectives while creating economies of scale for fund managers.

Alternative investment strategies are gaining popularity as investors seek enhanced returns and portfolio diversification. Private equity-style funds, real estate investment trusts, and commodity-focused funds are expanding within the mutual fund framework, providing retail investors with access to previously institutional-only investment strategies.

Fee compression continues as competitive pressures intensify and investors become more cost-conscious. Fund managers are reducing management fees while seeking operational efficiencies to maintain profitability. This trend benefits investors through lower investment costs while challenging fund managers to demonstrate value through superior performance and service quality.

Regulatory harmonization efforts across GCC countries are progressing with initiatives to standardize fund licensing, reporting requirements, and investor protection measures. These developments facilitate regional fund distribution and reduce compliance costs for asset managers operating across multiple jurisdictions. Recent agreements on mutual recognition of fund licenses represent significant progress toward integrated regional markets.

Technology infrastructure investments by fund managers and regulatory authorities are enhancing market efficiency and investor access. Implementation of blockchain technology for fund administration, artificial intelligence for investment research, and cloud-based systems for operational management are transforming industry operations and reducing costs.

International partnerships between GCC fund managers and global asset management firms are increasing, bringing international expertise and investment strategies to regional markets. These collaborations enhance product offerings while providing local firms with access to global distribution networks and institutional investor relationships.

Sustainable finance initiatives are gaining momentum as GCC governments promote green bonds, renewable energy investments, and sustainable development projects. Mutual funds are developing specialized products targeting these themes while contributing to regional sustainability objectives and attracting ESG-focused international investors.

Talent development programs are addressing skill shortages through partnerships with international educational institutions and professional certification programs. These initiatives aim to build local expertise in fund management, Islamic finance, and alternative investments while reducing dependence on expatriate professionals.

Strategic positioning recommendations for mutual fund companies operating in the GCC market emphasize the importance of developing comprehensive digital strategies while maintaining strong traditional distribution relationships. Fund managers should invest in technology platforms that enhance investor experience and operational efficiency while preserving personal relationships that remain crucial in regional business culture.

Product development should focus on innovative solutions addressing specific regional needs and investor preferences. This includes developing hybrid Islamic-conventional products, ESG-integrated funds, and thematic investments aligned with Vision 2030 initiatives. Fund managers should also consider alternative investment strategies that provide diversification benefits and enhanced return potential for sophisticated investors.

Regulatory compliance strategies should anticipate continued harmonization efforts across GCC countries while maintaining flexibility to adapt to jurisdiction-specific requirements. Establishing robust compliance frameworks and maintaining strong relationships with regulatory authorities will be essential for successful regional expansion and operational efficiency.

Talent acquisition and development should prioritize building local expertise in specialized areas such as Islamic finance, alternative investments, and ESG integration. Partnerships with educational institutions and professional development programs can help address skill shortages while building sustainable competitive advantages in key market segments.

Distribution channel optimization should balance digital innovation with traditional relationship-based approaches. Fund managers should develop omnichannel strategies that leverage technology for efficiency while maintaining personal service quality that differentiates their offerings in competitive markets.

Long-term growth prospects for the GCC mutual fund market remain highly positive, supported by favorable demographic trends, ongoing economic diversification, and continued regulatory improvements. MWR projections indicate the market will experience sustained expansion over the next decade, driven by increasing investor sophistication and growing demand for professional asset management services.

Technology integration will continue transforming market operations, with artificial intelligence, blockchain, and digital platforms becoming standard components of fund management and distribution. These technological advances will improve operational efficiency, reduce costs, and enhance investor experience while creating new opportunities for innovative fund products and services.

Regional integration efforts are expected to accelerate, creating larger, more efficient markets for mutual fund operations. Regulatory harmonization and cross-border investment facilitation will enable fund managers to achieve greater economies of scale while providing investors with enhanced diversification opportunities across the GCC region.

Sustainable investing will become increasingly important as ESG considerations integrate into mainstream investment processes. The GCC mutual fund market is well-positioned to capitalize on this trend through its Islamic finance expertise and alignment with regional sustainability commitments, attracting both domestic and international ESG-focused investors.

Market maturation will bring increased competition, product sophistication, and investor education. This evolution will benefit investors through improved product choices and lower costs while challenging fund managers to demonstrate clear value propositions and superior performance in increasingly competitive markets.

The GCC mutual fund market represents a compelling growth opportunity within the global asset management industry, characterized by strong fundamentals, supportive regulatory environments, and favorable demographic trends. The market’s unique combination of Islamic finance expertise, economic diversification initiatives, and strategic geographic positioning creates distinctive competitive advantages for both regional and international fund managers.

Key success factors for market participants include developing comprehensive digital strategies, maintaining strong regulatory compliance frameworks, and building specialized expertise in Islamic finance and ESG investing. The ongoing transformation of GCC economies through Vision 2030 initiatives provides substantial opportunities for innovative fund products targeting infrastructure, technology, and sustainable development themes.

Market challenges including regulatory fragmentation, talent shortages, and competitive pressures require strategic responses and continued investment in operational capabilities. However, the overall trajectory remains highly positive, with sustained growth expected across all major GCC markets as investor sophistication increases and regulatory frameworks continue evolving to support market development and international integration.

What is Mutual Fund?

A mutual fund is an investment vehicle that pools money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. It allows individual investors to access a professionally managed investment strategy.

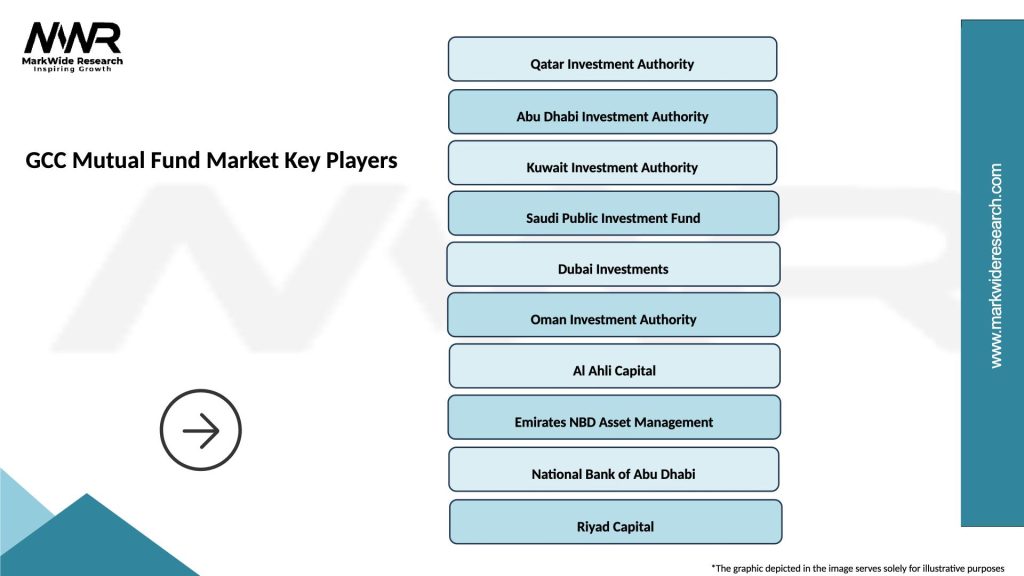

What are the key players in the GCC Mutual Fund Market?

Key players in the GCC Mutual Fund Market include companies like Qatar Investment Authority, Abu Dhabi Investment Authority, and Saudi Arabian Monetary Authority, among others.

What are the growth factors driving the GCC Mutual Fund Market?

The growth of the GCC Mutual Fund Market is driven by increasing investor awareness, a growing middle class, and favorable regulatory frameworks that encourage investment in mutual funds.

What challenges does the GCC Mutual Fund Market face?

Challenges in the GCC Mutual Fund Market include market volatility, regulatory changes, and competition from alternative investment options that may deter investors.

What opportunities exist in the GCC Mutual Fund Market?

Opportunities in the GCC Mutual Fund Market include the potential for increased foreign investment, the introduction of new fund products, and the growing trend of sustainable investing among investors.

What trends are shaping the GCC Mutual Fund Market?

Trends in the GCC Mutual Fund Market include the rise of digital platforms for fund management, increased focus on ESG (Environmental, Social, and Governance) criteria, and the growing popularity of index funds and ETFs among investors.

GCC Mutual Fund Market

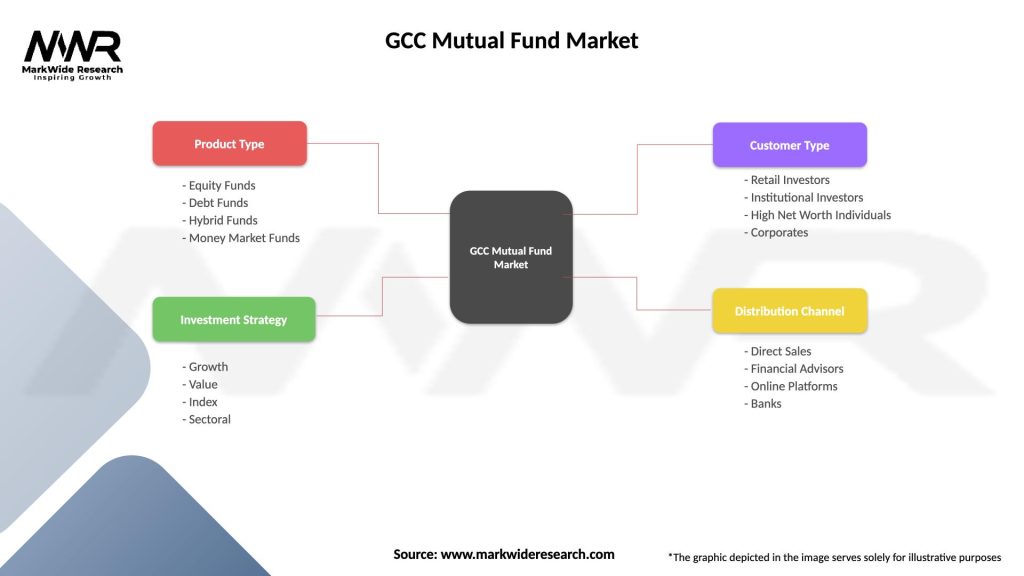

| Segmentation Details | Description |

|---|---|

| Product Type | Equity Funds, Debt Funds, Hybrid Funds, Money Market Funds |

| Investment Strategy | Growth, Value, Index, Sectoral |

| Customer Type | Retail Investors, Institutional Investors, High Net Worth Individuals, Corporates |

| Distribution Channel | Direct Sales, Financial Advisors, Online Platforms, Banks |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the GCC Mutual Fund Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at