444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The GCC labeling market represents a dynamic and rapidly expanding sector within the broader packaging and identification industry across the Gulf Cooperation Council region. This market encompasses diverse labeling solutions including adhesive labels, pressure-sensitive labels, shrink sleeves, and in-mold labels that serve critical functions across multiple industries. Market dynamics indicate robust growth driven by increasing consumer goods production, stringent regulatory requirements, and rising demand for product traceability and brand differentiation.

Regional expansion across the GCC countries has been particularly pronounced, with the labeling market experiencing significant adoption rates of 12.5% annually in key sectors such as food and beverage, pharmaceuticals, and personal care products. The market’s growth trajectory reflects the region’s economic diversification efforts and increasing manufacturing capabilities, positioning labeling solutions as essential components in modern supply chain management and consumer engagement strategies.

Technology integration has emerged as a defining characteristic of the GCC labeling landscape, with smart labeling solutions and digital printing technologies gaining substantial market penetration. The adoption of advanced labeling systems has improved operational efficiency by approximately 35% across major manufacturing facilities, while simultaneously enhancing product authentication and consumer interaction capabilities through innovative features such as QR codes and NFC-enabled labels.

The GCC labeling market refers to the comprehensive ecosystem of labeling products, technologies, and services utilized across the Gulf Cooperation Council countries for product identification, branding, regulatory compliance, and consumer communication purposes. This market encompasses traditional paper-based labels, advanced synthetic materials, digital printing solutions, and smart labeling technologies that enable product traceability and enhanced consumer engagement throughout various industry verticals.

Labeling solutions within this market serve multiple critical functions including brand recognition, regulatory compliance, supply chain management, and consumer safety information dissemination. The market includes various label types such as pressure-sensitive labels, wet-glue labels, shrink sleeves, stretch sleeves, and in-mold labels, each designed to meet specific application requirements and environmental conditions prevalent in the GCC region’s diverse industrial landscape.

Market scope extends beyond traditional labeling applications to include innovative solutions such as tamper-evident labels, security labels, and interactive labels that incorporate digital technologies. These advanced labeling solutions enable manufacturers and brands to establish direct communication channels with consumers while ensuring product authenticity and supply chain integrity across the region’s expanding retail and distribution networks.

Strategic market positioning of the GCC labeling sector demonstrates exceptional growth potential driven by regional economic diversification initiatives and increasing consumer goods manufacturing. The market has established itself as a critical component of the region’s packaging industry, with labeling solutions experiencing widespread adoption across food and beverage, pharmaceutical, cosmetic, and industrial sectors. Growth acceleration has been particularly notable in sustainable labeling materials, with eco-friendly options capturing approximately 28% of new product launches.

Technology advancement represents a key differentiator in the current market landscape, with digital printing technologies and smart labeling solutions driving innovation and operational efficiency improvements. The integration of Industry 4.0 principles has enabled manufacturers to achieve greater customization capabilities while reducing production lead times and enhancing quality control processes. Digital transformation initiatives have resulted in productivity improvements of up to 42% among leading labeling solution providers.

Market consolidation trends indicate increasing collaboration between international labeling technology providers and regional manufacturers, creating opportunities for knowledge transfer and capacity expansion. This collaborative approach has facilitated the development of specialized labeling solutions tailored to the unique requirements of GCC markets, including extreme temperature resistance, humidity tolerance, and multilingual labeling capabilities that address the region’s diverse consumer demographics.

Industry transformation within the GCC labeling market reflects broader regional trends toward manufacturing excellence and supply chain optimization. Key insights reveal several critical factors shaping market development:

Economic diversification initiatives across GCC countries have emerged as primary drivers of labeling market expansion, with governments actively promoting manufacturing sector development and reducing dependence on oil revenues. These strategic initiatives have resulted in substantial investments in industrial infrastructure and manufacturing capabilities, creating increased demand for comprehensive labeling solutions across emerging production facilities and established manufacturing operations.

Consumer goods expansion represents another significant driver, with the region experiencing robust growth in food and beverage production, pharmaceutical manufacturing, and personal care product development. The expanding consumer base, coupled with increasing disposable income levels, has driven demand for premium product presentation and sophisticated labeling solutions that enhance brand recognition and consumer appeal. Market penetration of international brands has further accelerated demand for high-quality labeling technologies.

Regulatory requirements have become increasingly stringent across GCC countries, particularly in pharmaceutical and food sectors, necessitating comprehensive labeling solutions that ensure compliance with safety standards and traceability requirements. These regulatory drivers have created substantial opportunities for advanced labeling technologies that incorporate security features, tamper-evident capabilities, and comprehensive product information management systems.

Technology adoption has accelerated significantly, with manufacturers recognizing the competitive advantages of advanced labeling solutions in terms of operational efficiency, quality control, and consumer engagement. The integration of digital technologies has enabled real-time production monitoring, reduced waste generation, and improved customization capabilities, driving widespread adoption across various industry sectors.

Cost considerations represent significant restraints for many potential adopters of advanced labeling technologies, particularly smaller manufacturers and emerging businesses with limited capital resources. The initial investment requirements for sophisticated labeling equipment and digital printing systems can be substantial, creating barriers to market entry and technology adoption. Economic pressures have intensified these challenges, with some organizations deferring labeling system upgrades due to budget constraints and uncertain market conditions.

Technical complexity associated with advanced labeling solutions has created implementation challenges for organizations lacking specialized technical expertise. The integration of smart labeling technologies, digital printing systems, and automated application equipment requires comprehensive training programs and ongoing technical support, which can strain organizational resources and extend implementation timelines. Skills shortage in specialized labeling technologies has further complicated adoption efforts across the region.

Supply chain dependencies have emerged as notable constraints, with many advanced labeling materials and equipment requiring importation from international suppliers. These dependencies can result in extended lead times, currency fluctuation impacts, and potential supply disruptions that affect production planning and operational continuity. Logistics challenges have been particularly pronounced during periods of global supply chain disruption.

Environmental regulations and sustainability requirements have created additional compliance burdens for labeling solution providers, necessitating investments in eco-friendly materials and production processes. While these requirements drive innovation, they also increase operational costs and complexity, particularly for organizations transitioning from traditional labeling approaches to sustainable alternatives.

Sustainable labeling solutions present exceptional opportunities for market expansion, with increasing environmental consciousness driving demand for recyclable, biodegradable, and compostable labeling materials. The development of innovative sustainable materials and production processes has created opportunities for differentiation and premium positioning within the market. Green initiatives across GCC countries have established favorable regulatory environments for sustainable labeling technologies, with adoption rates reaching 31% among environmentally conscious brands.

Smart labeling technologies offer substantial growth potential through integration of IoT capabilities, blockchain authentication, and interactive consumer engagement features. These advanced solutions enable enhanced product traceability, anti-counterfeiting measures, and direct consumer communication channels that create additional value propositions for brands and manufacturers. Digital transformation initiatives across the region have created receptive market conditions for innovative labeling technologies.

E-commerce expansion has generated significant opportunities for specialized labeling solutions designed for direct-to-consumer shipping and online retail applications. The growing e-commerce sector requires labeling solutions that withstand shipping conditions while maintaining visual appeal and providing comprehensive product information. Online retail growth has increased demand for tamper-evident labels and security features that ensure product integrity during distribution.

Healthcare sector growth presents substantial opportunities for pharmaceutical labeling solutions, medical device labeling, and healthcare product identification systems. The expanding healthcare infrastructure across GCC countries has created demand for specialized labeling solutions that meet stringent regulatory requirements while ensuring patient safety and product traceability throughout complex supply chains.

Competitive landscape within the GCC labeling market demonstrates increasing consolidation among major players while simultaneously creating opportunities for specialized niche providers. Market dynamics reflect a balance between established international suppliers and emerging regional manufacturers, with collaboration and partnership strategies becoming increasingly common. Strategic alliances have enabled technology transfer and capacity expansion, resulting in improved service capabilities and reduced dependency on international suppliers.

Innovation cycles have accelerated significantly, with new labeling technologies and materials being introduced at unprecedented rates. The rapid pace of innovation has created both opportunities and challenges for market participants, requiring continuous investment in research and development while managing technology transition risks. Product lifecycle compression has intensified competitive pressures while creating opportunities for early adopters of emerging technologies.

Customer expectations have evolved substantially, with increasing demands for customization, rapid turnaround times, and comprehensive service support. These changing expectations have driven market participants to develop more flexible production capabilities and enhanced customer service offerings. Service integration has become a key differentiator, with successful providers offering comprehensive solutions that extend beyond basic labeling products to include design services, technical support, and supply chain management.

Regional integration efforts across GCC countries have facilitated market expansion and standardization initiatives, creating opportunities for economies of scale and improved operational efficiency. The harmonization of regulatory requirements and trade facilitation measures has reduced barriers to cross-border business development and enabled more efficient resource allocation across the region.

Comprehensive market analysis was conducted through multi-phase research methodology combining primary and secondary research approaches to ensure accuracy and reliability of market insights. The research framework incorporated quantitative data collection, qualitative analysis, and expert interviews to develop a holistic understanding of market dynamics, competitive landscape, and growth opportunities within the GCC labeling sector.

Primary research activities included structured interviews with industry executives, technology providers, end-users, and regulatory officials across all GCC countries. Survey methodologies were employed to gather quantitative data regarding market preferences, adoption patterns, and investment intentions. Field research was conducted at major manufacturing facilities and trade exhibitions to observe market trends and technological developments firsthand.

Secondary research encompassed comprehensive analysis of industry reports, regulatory documents, trade statistics, and company financial statements to establish market baselines and validate primary research findings. Data triangulation techniques were employed to ensure consistency and accuracy across multiple information sources, while statistical analysis methods were used to identify significant trends and correlations within the collected data.

Expert validation processes involved consultation with industry specialists, academic researchers, and technology experts to verify research findings and ensure comprehensive coverage of market dynamics. The research methodology incorporated continuous monitoring of market developments and regular updates to maintain currency and relevance of insights throughout the analysis period.

Saudi Arabia dominates the GCC labeling market landscape, accounting for approximately 38% of regional demand due to its extensive manufacturing base and large consumer market. The kingdom’s Vision 2030 initiatives have accelerated industrial development and created substantial opportunities for labeling solution providers. Manufacturing expansion across food processing, pharmaceutical production, and petrochemical sectors has driven consistent demand growth for advanced labeling technologies and materials.

United Arab Emirates represents the second-largest market segment, with Dubai and Abu Dhabi serving as major distribution hubs for labeling products and technologies throughout the region. The UAE’s strategic position as a trade gateway has attracted international labeling technology providers and created a competitive marketplace for innovative solutions. Free zone development has facilitated technology transfer and established the UAE as a regional center for labeling industry expertise.

Qatar has emerged as a high-growth market segment, driven by infrastructure development projects and expanding consumer goods sectors. The country’s focus on food security and local production capabilities has created demand for comprehensive labeling solutions that support domestic manufacturing initiatives. Economic diversification efforts have resulted in increased investment in packaging and labeling technologies across multiple industry sectors.

Kuwait, Oman, and Bahrain collectively represent emerging market opportunities with distinct characteristics and growth drivers. Kuwait’s petrochemical industry has created demand for specialized industrial labeling solutions, while Oman’s tourism and food processing sectors drive consumer goods labeling requirements. Bahrain’s position as a financial center has attracted international brands requiring premium labeling solutions for luxury and high-value products.

Market leadership within the GCC labeling sector is characterized by a combination of international technology providers and regional manufacturing specialists. The competitive landscape demonstrates increasing collaboration between global suppliers and local partners to address unique regional requirements and market conditions.

Strategic positioning among competitive players reflects diverse approaches to market development, with some organizations focusing on technology leadership while others emphasize cost competitiveness and local market expertise. Partnership strategies have become increasingly common, enabling international providers to access regional markets while local manufacturers gain access to advanced technologies and global best practices.

Technology-based segmentation reveals distinct market categories with varying growth trajectories and application requirements:

Application-based segmentation demonstrates diverse end-user requirements and growth patterns:

Material-based segmentation reflects evolving sustainability requirements and performance specifications:

Food and Beverage Labeling represents the most dynamic category within the GCC market, driven by expanding local production capabilities and increasing consumer demand for premium products. This category has experienced significant innovation in terms of sustainable materials, interactive labeling technologies, and enhanced visual appeal. Regulatory compliance requirements have intensified demand for comprehensive nutritional labeling and multilingual information display, creating opportunities for specialized labeling solutions.

Pharmaceutical Labeling demonstrates exceptional growth potential due to expanding healthcare infrastructure and increasing local pharmaceutical manufacturing. This category requires specialized materials and printing technologies that ensure durability, tamper-evidence, and regulatory compliance throughout complex supply chains. Serialization requirements have driven adoption of advanced printing technologies and track-and-trace capabilities, with implementation rates reaching 67% among major pharmaceutical manufacturers.

Personal Care and Cosmetics labeling has evolved significantly toward premium presentation and interactive consumer engagement features. This category emphasizes aesthetic appeal, tactile experiences, and brand differentiation through innovative materials and finishing techniques. Luxury positioning has driven demand for specialized labeling solutions that incorporate metallic effects, embossing, and premium substrates.

Industrial and Chemical labeling focuses on durability, safety information display, and harsh environment resistance. This category requires specialized materials that maintain readability and adhesion under extreme temperature conditions, chemical exposure, and outdoor weathering. Safety compliance has become increasingly critical, with demand for hazard communication labels and GHS-compliant identification systems growing substantially.

Manufacturers benefit significantly from advanced labeling solutions through improved operational efficiency, enhanced quality control, and reduced production costs. Modern labeling systems enable automated application processes, real-time quality monitoring, and flexible production scheduling that optimize manufacturing operations. Productivity improvements of up to 45% have been documented among manufacturers implementing integrated labeling solutions.

Brand owners gain substantial advantages through enhanced product differentiation, improved consumer engagement, and strengthened brand protection capabilities. Advanced labeling technologies enable sophisticated design execution, interactive consumer experiences, and anti-counterfeiting measures that protect brand integrity. Consumer response rates to interactive labeling features have increased by approximately 23% compared to traditional labeling approaches.

Retailers benefit from improved inventory management, enhanced product presentation, and streamlined supply chain operations through advanced labeling solutions. Smart labeling technologies enable automated inventory tracking, dynamic pricing capabilities, and enhanced customer information access. Operational efficiency improvements in retail environments have reached significant levels through implementation of intelligent labeling systems.

Consumers experience enhanced product information access, improved safety assurance, and interactive brand engagement opportunities through advanced labeling technologies. Modern labeling solutions provide comprehensive product information, authentication capabilities, and direct communication channels with manufacturers. Consumer satisfaction with product information accessibility has improved substantially through implementation of comprehensive labeling solutions.

Regulatory authorities benefit from improved compliance monitoring, enhanced product traceability, and strengthened consumer protection capabilities through advanced labeling requirements. Modern labeling technologies enable comprehensive supply chain visibility and automated compliance verification processes that support regulatory oversight objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainable labeling solutions have emerged as the dominant trend shaping market development, with increasing emphasis on recyclable materials, biodegradable substrates, and environmentally responsible production processes. This trend reflects growing environmental consciousness among consumers and regulatory pressure for sustainable packaging solutions. Adoption rates for sustainable labeling materials have increased by 34% over recent periods, indicating strong market acceptance and continued growth potential.

Smart labeling technologies represent another significant trend, with integration of QR codes, NFC chips, and RFID capabilities becoming increasingly common across various application sectors. These technologies enable enhanced consumer engagement, product authentication, and supply chain traceability that create additional value propositions for brands and manufacturers. Interactive labeling adoption has accelerated particularly in premium consumer goods and pharmaceutical applications.

Digital printing advancement has revolutionized labeling production capabilities, enabling short-run customization, variable data printing, and rapid prototyping that support agile manufacturing approaches. This trend has democratized access to high-quality labeling solutions while reducing minimum order quantities and lead times. Digital printing penetration has reached significant levels across commercial labeling operations.

Automation integration continues to drive efficiency improvements in labeling application processes, with automated systems becoming standard in high-volume manufacturing operations. This trend reflects broader Industry 4.0 adoption and emphasis on operational excellence through technology integration. Automated labeling systems have demonstrated substantial productivity improvements while reducing labor costs and improving quality consistency.

Customization demand has intensified across all market segments, with increasing requirements for personalized labeling solutions, limited edition designs, and localized content that addresses diverse consumer preferences. This trend has driven adoption of flexible production technologies and enhanced design capabilities among labeling solution providers.

Technology partnerships between international labeling equipment manufacturers and regional system integrators have accelerated market development and technology transfer. These collaborations have resulted in localized support capabilities, customized solutions development, and enhanced service offerings that address specific regional requirements. Partnership initiatives have facilitated knowledge transfer and capacity building across the GCC labeling ecosystem.

Sustainability initiatives have gained momentum across the industry, with major labeling solution providers investing in eco-friendly materials development and circular economy principles. These developments include recyclable label materials, biodegradable adhesives, and sustainable production processes that address environmental concerns while maintaining performance standards. Green technology adoption has become a key differentiator in competitive positioning.

Regulatory harmonization efforts across GCC countries have simplified compliance requirements and facilitated cross-border trade in labeling products and services. These developments have reduced regulatory complexity while maintaining safety and quality standards, creating opportunities for regional market expansion and standardization initiatives.

Investment expansion in labeling manufacturing capabilities has accelerated across the region, with several major projects announced for local production facilities and technology centers. These investments reflect growing confidence in regional market potential and strategic positioning for long-term growth opportunities.

Digital transformation initiatives have revolutionized labeling design, production, and application processes through integration of advanced software systems, automated workflows, and data analytics capabilities. These developments have improved operational efficiency while enabling new service offerings and customer engagement models.

Strategic positioning recommendations emphasize the importance of developing comprehensive sustainability strategies that address environmental concerns while maintaining operational efficiency and cost competitiveness. MarkWide Research analysis indicates that organizations implementing robust sustainability initiatives achieve superior market positioning and customer loyalty compared to traditional approaches.

Technology investment priorities should focus on digital printing capabilities, automation systems, and smart labeling technologies that enable operational excellence and enhanced customer value propositions. Organizations should develop phased implementation strategies that balance technology advancement with financial constraints and operational continuity requirements.

Market expansion strategies should emphasize regional collaboration and partnership development to leverage local market knowledge while accessing international technology and expertise. Successful market participants should develop comprehensive service offerings that extend beyond basic labeling products to include design services, technical support, and supply chain management capabilities.

Talent development initiatives represent critical success factors for long-term market participation, with organizations needing to invest in technical training programs and knowledge transfer initiatives. The development of local expertise in advanced labeling technologies will reduce dependence on international support while improving customer service capabilities.

Customer engagement strategies should emphasize collaborative relationships and consultative approaches that address specific customer requirements while providing ongoing technical support and innovation guidance. Organizations should develop comprehensive understanding of customer operations and strategic objectives to provide optimal labeling solutions.

Market evolution projections indicate continued robust growth driven by economic diversification initiatives, increasing manufacturing capabilities, and rising consumer goods demand across GCC countries. The labeling market is expected to experience sustained expansion with growth rates of approximately 8.7% annually over the forecast period, supported by technology advancement and increasing adoption of premium labeling solutions.

Technology integration will accelerate significantly, with smart labeling solutions, artificial intelligence applications, and IoT connectivity becoming standard features across various application sectors. MWR projections suggest that intelligent labeling technologies will capture substantial market share as organizations recognize the competitive advantages of enhanced traceability and consumer engagement capabilities.

Sustainability transformation will reshape market dynamics substantially, with eco-friendly labeling solutions becoming mandatory rather than optional across many application sectors. Regulatory requirements and consumer preferences will drive widespread adoption of sustainable materials and production processes, creating opportunities for innovative solution providers while challenging traditional approaches.

Regional integration efforts will facilitate market consolidation and standardization initiatives that improve operational efficiency while reducing complexity for multi-country operations. Harmonized regulatory frameworks and trade facilitation measures will enable more efficient resource allocation and technology deployment across the region.

Innovation acceleration will continue through increased research and development investments, technology partnerships, and collaborative initiatives between international providers and regional manufacturers. These developments will result in specialized solutions that address unique regional requirements while incorporating global best practices and advanced technologies.

The GCC labeling market represents a dynamic and rapidly evolving sector with exceptional growth potential driven by economic diversification, technological advancement, and increasing consumer goods demand. Market analysis reveals robust fundamentals supported by government initiatives, infrastructure development, and rising manufacturing capabilities across the region. Strategic opportunities exist for organizations that can effectively combine international expertise with local market knowledge while addressing sustainability requirements and technology integration challenges.

Success factors in this market emphasize the importance of comprehensive solution offerings, technological innovation, and collaborative partnerships that address diverse customer requirements while maintaining operational excellence. The market’s evolution toward sustainable solutions and smart technologies creates opportunities for differentiation and premium positioning, while regulatory harmonization efforts facilitate regional expansion and standardization initiatives.

Future market development will be characterized by continued technology integration, sustainability transformation, and increasing customization requirements that demand flexible and responsive solution providers. Organizations that can successfully navigate these trends while maintaining cost competitiveness and service excellence will be well-positioned to capitalize on the substantial growth opportunities within the GCC labeling market.

What is GCC Labeling?

GCC Labeling refers to the regulations and standards governing the labeling of products in the Gulf Cooperation Council region, ensuring that consumers receive accurate information about the products they purchase.

What are the key players in the GCC Labeling Market?

Key players in the GCC Labeling Market include Avery Dennison, Brady Corporation, and CCL Industries, which provide a range of labeling solutions for various industries, including food and beverage, pharmaceuticals, and consumer goods, among others.

What are the main drivers of growth in the GCC Labeling Market?

The main drivers of growth in the GCC Labeling Market include the increasing demand for packaged goods, the rise in e-commerce, and the need for compliance with regulatory standards in labeling.

What challenges does the GCC Labeling Market face?

The GCC Labeling Market faces challenges such as stringent regulatory requirements, the need for continuous innovation in labeling technologies, and competition from alternative packaging solutions.

What opportunities exist in the GCC Labeling Market?

Opportunities in the GCC Labeling Market include the expansion of the food and beverage sector, the growth of sustainable labeling solutions, and advancements in digital printing technologies that enhance customization.

What trends are shaping the GCC Labeling Market?

Trends shaping the GCC Labeling Market include the increasing focus on eco-friendly materials, the integration of smart labeling technologies, and the growing importance of transparency in product information.

GCC Labeling Market

| Segmentation Details | Description |

|---|---|

| Product Type | Pressure Sensitive Labels, Shrink Sleeves, In-Mold Labels, Wrap-Around Labels |

| End User | Food & Beverage, Pharmaceuticals, Cosmetics, Electronics |

| Technology | Digital Printing, Flexographic Printing, Gravure Printing, Offset Printing |

| Application | Branding, Product Information, Safety Labels, Promotional Labels |

Please note: The segmentation can be entirely customized to align with our client’s needs.

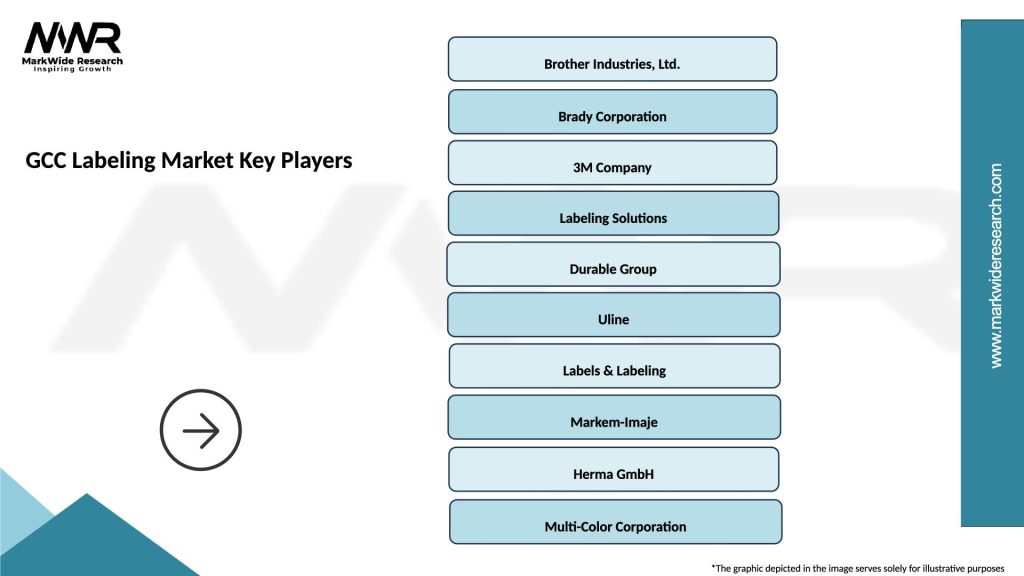

Leading companies in the GCC Labeling Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at