444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The GCC international express service market represents a dynamic and rapidly evolving sector within the broader logistics and transportation industry across the Gulf Cooperation Council region. This market encompasses comprehensive express delivery services that facilitate cross-border shipments, e-commerce fulfillment, and business-to-business logistics solutions throughout Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Bahrain, and Oman. The regional market has experienced remarkable transformation driven by digital commerce expansion, increased trade activities, and growing consumer expectations for faster delivery services.

Market dynamics indicate substantial growth momentum, with the sector expanding at a compound annual growth rate of 8.2% over the recent forecast period. This growth trajectory reflects the region’s strategic position as a global trade hub, enhanced infrastructure investments, and the proliferation of e-commerce platforms. The market encompasses various service categories including same-day delivery, next-day express, international courier services, and specialized logistics solutions for industries such as healthcare, automotive, and technology.

Regional integration initiatives and free trade agreements have significantly boosted cross-border express services, while the ongoing digital transformation across GCC countries has created new opportunities for innovative delivery solutions. The market benefits from substantial government investments in transportation infrastructure, smart city initiatives, and logistics zones that enhance operational efficiency and service capabilities.

The GCC international express service market refers to the comprehensive ecosystem of time-sensitive delivery and logistics services that operate across Gulf Cooperation Council countries, facilitating rapid transportation of documents, parcels, and goods through integrated networks of air, land, and sea transportation modes.

Express services in this context encompass door-to-door delivery solutions, customs clearance facilitation, real-time tracking capabilities, and value-added services such as cash-on-delivery, insurance coverage, and specialized handling for sensitive or high-value items. These services cater to diverse customer segments including individual consumers, small and medium enterprises, multinational corporations, and government entities requiring reliable and efficient cross-border logistics solutions.

International express specifically denotes services that cross national boundaries within the GCC region and extend to global destinations, leveraging strategic partnerships, hub-and-spoke networks, and advanced technology platforms to ensure seamless connectivity and operational excellence across multiple jurisdictions and regulatory environments.

Strategic analysis of the GCC international express service market reveals a sector characterized by robust growth potential, technological innovation, and increasing market sophistication. The market has demonstrated resilience and adaptability, particularly during challenging economic periods, by diversifying service offerings and enhancing operational capabilities to meet evolving customer demands.

Key market drivers include the rapid expansion of e-commerce activities, which account for approximately 42% of express service volume growth, along with increased business-to-business trade facilitated by regional economic diversification initiatives. The market benefits from substantial infrastructure investments, including the development of world-class airports, logistics parks, and digital customs platforms that streamline cross-border operations.

Competitive landscape features a mix of global express service providers, regional logistics companies, and emerging technology-driven startups that collectively contribute to market innovation and service enhancement. The sector has witnessed significant consolidation activities and strategic partnerships aimed at expanding geographic coverage, improving service quality, and achieving operational efficiencies.

Future prospects remain highly favorable, supported by continued economic growth, population expansion, urbanization trends, and the ongoing digital transformation across GCC countries. The market is expected to benefit from emerging technologies such as artificial intelligence, Internet of Things, and autonomous delivery systems that promise to revolutionize service delivery and operational efficiency.

Market intelligence reveals several critical insights that define the current state and future trajectory of the GCC international express service market. These insights provide valuable perspective on market dynamics, competitive positioning, and growth opportunities across the region.

Economic diversification initiatives across GCC countries have created substantial momentum for international express services, as governments actively promote non-oil sectors including manufacturing, technology, tourism, and financial services. These diversification efforts have generated increased trade volumes, cross-border business activities, and demand for reliable logistics solutions that support economic transformation objectives.

E-commerce expansion represents the most significant driver of market growth, with online retail platforms experiencing unprecedented adoption rates across the region. The proliferation of digital marketplaces, mobile commerce applications, and cross-border shopping platforms has created substantial demand for express delivery services capable of handling diverse product categories, multiple delivery options, and complex fulfillment requirements.

Infrastructure development programs have substantially enhanced the region’s logistics capabilities through investments in airports, seaports, road networks, and specialized logistics zones. These infrastructure improvements have reduced transit times, improved service reliability, and enabled express service providers to offer more competitive pricing and enhanced service quality to customers across various market segments.

Digital transformation initiatives have revolutionized customer expectations and service delivery models, with consumers and businesses demanding real-time visibility, flexible delivery options, and seamless integration with digital platforms. This technological evolution has driven express service providers to invest heavily in advanced tracking systems, mobile applications, and automated sorting facilities that enhance operational efficiency and customer satisfaction.

Regulatory complexity across multiple jurisdictions presents ongoing challenges for international express service providers, as they must navigate varying customs procedures, documentation requirements, and compliance standards across different GCC countries and international destinations. These regulatory variations can create operational inefficiencies, increase compliance costs, and potentially delay service delivery times.

Infrastructure limitations in certain areas, particularly last-mile delivery networks in remote or rapidly developing urban areas, can constrain service expansion and quality. While major cities benefit from excellent infrastructure, some regions still face challenges related to address standardization, road accessibility, and delivery point identification that impact service efficiency and customer satisfaction.

Cost pressures from fuel price volatility, labor costs, and technology investments continue to challenge profitability margins across the express service sector. Service providers must balance competitive pricing expectations with the need to maintain service quality and invest in operational improvements, creating ongoing tension between market competitiveness and financial sustainability.

Security concerns related to cross-border shipments, customs clearance procedures, and cargo screening requirements can create operational delays and additional compliance costs. Enhanced security measures, while necessary for safety and regulatory compliance, can impact service speed and operational efficiency, particularly for time-sensitive express deliveries.

Technology integration presents substantial opportunities for market expansion and service enhancement, particularly through the adoption of artificial intelligence, machine learning, and Internet of Things solutions that can optimize routing, predict demand patterns, and improve operational efficiency. These technological advances enable express service providers to offer more personalized services, reduce operational costs, and enhance customer experience across all touchpoints.

Sustainability initiatives create new market segments and competitive advantages for providers who can offer environmentally responsible delivery solutions. Growing corporate and consumer awareness of environmental impact has created demand for carbon-neutral delivery options, electric vehicle fleets, and sustainable packaging solutions that align with broader sustainability objectives across the region.

Healthcare logistics represents a rapidly expanding opportunity segment, driven by increased demand for pharmaceutical distribution, medical device delivery, and temperature-controlled transportation services. The growing healthcare sector across GCC countries, combined with aging populations and increased health awareness, creates substantial demand for specialized express services that meet stringent regulatory and quality requirements.

Cross-border e-commerce expansion offers significant growth potential as regional consumers increasingly purchase products from international online retailers. This trend creates opportunities for express service providers to develop specialized cross-border fulfillment services, customs clearance solutions, and last-mile delivery networks that facilitate seamless international shopping experiences.

Competitive intensity within the GCC international express service market has increased significantly as global logistics giants, regional players, and technology-driven startups compete for market share across various service segments. This competitive environment has driven continuous innovation, service enhancement, and pricing optimization that ultimately benefits customers through improved service quality and expanded delivery options.

Customer behavior evolution reflects changing expectations for delivery speed, service flexibility, and digital integration. Modern consumers and businesses expect real-time tracking, multiple delivery options, easy returns processing, and seamless integration with e-commerce platforms. These evolving expectations drive continuous service innovation and technology investment across the express service sector.

Operational efficiency improvements through automation, artificial intelligence, and advanced logistics management systems have enabled service providers to handle increased volumes while maintaining service quality and competitive pricing. According to MarkWide Research analysis, operational efficiency gains have improved delivery performance by 31% over the past two years.

Strategic partnerships between express service providers, e-commerce platforms, retailers, and technology companies have created integrated service ecosystems that enhance customer value and operational efficiency. These collaborative relationships enable service providers to expand their geographic reach, enhance service capabilities, and access new customer segments through strategic alliances and joint ventures.

Comprehensive analysis of the GCC international express service market employs a multi-faceted research approach that combines primary data collection, secondary research, and industry expert insights to provide accurate and actionable market intelligence. The research methodology ensures data accuracy, market representation, and analytical depth across all market segments and geographic regions.

Primary research activities include structured interviews with industry executives, customer surveys, and operational assessments conducted across major express service providers, logistics companies, and end-user organizations throughout the GCC region. These primary research efforts provide direct insights into market trends, competitive dynamics, operational challenges, and growth opportunities from key stakeholders.

Secondary research encompasses analysis of industry reports, government publications, trade association data, and corporate financial statements to validate primary research findings and provide comprehensive market context. This secondary research ensures broad market coverage and enables trend analysis across multiple time periods and market cycles.

Data validation processes include cross-referencing multiple data sources, statistical analysis of research findings, and expert review of analytical conclusions to ensure research accuracy and reliability. The validation methodology incorporates feedback from industry experts, academic researchers, and market participants to enhance the credibility and usefulness of research outcomes.

Saudi Arabia represents the largest segment of the GCC international express service market, accounting for approximately 35% of regional market share, driven by its substantial population, economic diversification initiatives, and growing e-commerce sector. The kingdom’s Vision 2030 program has accelerated infrastructure development and created new opportunities for express service providers across multiple industry sectors.

United Arab Emirates maintains a strong market position with 28% regional market share, benefiting from its strategic location as a regional trade hub, world-class infrastructure, and highly developed e-commerce ecosystem. Dubai and Abu Dhabi serve as major logistics centers that facilitate express services throughout the region and internationally.

Qatar demonstrates robust growth potential despite its smaller market size, with express services benefiting from ongoing infrastructure development, population growth, and increased business activity related to major events and economic diversification initiatives. The country’s focus on technology and innovation creates opportunities for advanced express service solutions.

Kuwait and Bahrain represent mature markets with steady growth trajectories, while Oman shows increasing potential as infrastructure development and economic diversification efforts create new opportunities for express service expansion. Each country presents unique market characteristics and growth drivers that influence service provider strategies and operational approaches.

Market leadership within the GCC international express service sector features a diverse mix of global logistics companies, regional service providers, and emerging technology-driven platforms that compete across various service segments and geographic markets. The competitive environment continues to evolve as companies adapt to changing customer expectations and market dynamics.

Competitive strategies focus on technology investment, service diversification, geographic expansion, and strategic partnerships that enhance market position and customer value. Companies increasingly emphasize sustainability initiatives, digital integration, and specialized service offerings to differentiate their market positioning and capture growth opportunities.

Service type segmentation reveals distinct market categories that address different customer needs and operational requirements across the GCC international express service market. Each segment demonstrates unique growth patterns, competitive dynamics, and customer preferences that influence service provider strategies and market development approaches.

By Service Type:

By End User:

Document express services continue to represent a stable market segment despite digital transformation trends, as legal documents, contracts, and official paperwork still require physical delivery for regulatory compliance and business requirements. This segment benefits from consistent demand and premium pricing for time-sensitive legal and business documentation.

Parcel express services have experienced dramatic growth driven by e-commerce expansion, with online retail shipments now representing the largest volume category within the express service market. This segment demonstrates strong growth potential as regional e-commerce adoption continues to accelerate across all GCC countries.

Specialized express services for industries such as healthcare, automotive, and technology have emerged as high-value market segments that require specialized handling, temperature control, and regulatory compliance. These services command premium pricing and offer opportunities for service differentiation and customer loyalty development.

Cross-border express services benefit from regional trade integration and international business expansion, with intra-GCC shipments representing a particularly strong growth segment. These services require sophisticated customs clearance capabilities and multi-country operational expertise that create competitive barriers and customer switching costs.

Service providers benefit from substantial growth opportunities driven by regional economic expansion, e-commerce development, and infrastructure investment that create favorable market conditions for business expansion and profitability improvement. The market offers multiple revenue streams through service diversification and value-added offerings that enhance customer relationships and financial performance.

Customers gain access to increasingly sophisticated express service options that provide greater convenience, reliability, and value through competitive pricing, enhanced service quality, and innovative delivery solutions. The expanding market creates more choices and better service levels across all customer segments and geographic regions.

Economic development benefits include job creation, infrastructure utilization, and trade facilitation that support broader economic growth objectives across GCC countries. The express service sector contributes to economic diversification efforts by enabling new business models, supporting entrepreneurship, and facilitating international trade relationships.

Technology advancement opportunities emerge through industry investment in logistics technology, automation systems, and digital platforms that drive innovation and create spillover benefits for other economic sectors. These technological developments enhance regional competitiveness and support smart city initiatives across GCC countries.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation continues to reshape the express service landscape through mobile applications, artificial intelligence, and Internet of Things integration that enhance customer experience and operational efficiency. Service providers increasingly invest in digital platforms that provide real-time tracking, predictive analytics, and automated customer service capabilities.

Sustainability initiatives have gained significant momentum as companies and consumers prioritize environmental responsibility in logistics operations. Express service providers are implementing electric vehicle fleets, carbon offset programs, and sustainable packaging solutions that align with broader environmental objectives and customer expectations.

Last-mile innovation focuses on solving the final delivery challenge through autonomous vehicles, drone delivery systems, and smart locker networks that improve delivery efficiency and customer convenience. These innovations address urban congestion challenges and provide flexible delivery options that meet evolving customer preferences.

Cross-border facilitation improvements through digital customs platforms, trade agreement implementation, and regulatory harmonization efforts have streamlined international express services and reduced delivery times. MWR data indicates that customs clearance times have improved by 26% over the past year across major GCC trade routes.

Infrastructure investments across GCC countries have significantly enhanced express service capabilities through airport expansions, logistics park development, and smart city initiatives that improve operational efficiency and service quality. These investments create long-term competitive advantages for the region and support continued market growth.

Strategic partnerships between express service providers, e-commerce platforms, and technology companies have created integrated service ecosystems that enhance customer value and operational efficiency. These collaborative relationships enable service innovation, geographic expansion, and access to new customer segments through shared resources and expertise.

Regulatory reforms aimed at trade facilitation, customs modernization, and business environment improvement have reduced operational barriers and enhanced market attractiveness for international express service providers. These reforms support economic diversification objectives and improve regional competitiveness in global logistics markets.

Technology adoption initiatives including artificial intelligence implementation, blockchain integration, and automated sorting systems have revolutionized operational capabilities and customer service quality across the express service sector. These technological advances enable service providers to handle increased volumes while maintaining service quality and competitive pricing.

Market participants should prioritize technology investment and digital transformation initiatives that enhance operational efficiency, customer experience, and competitive positioning in an increasingly sophisticated market environment. Companies that successfully integrate advanced technologies will gain significant competitive advantages and market share growth opportunities.

Service diversification strategies should focus on high-value segments such as healthcare logistics, e-commerce fulfillment, and specialized industrial services that offer premium pricing and customer loyalty benefits. These specialized services create competitive differentiation and reduce vulnerability to price-based competition in commodity service segments.

Sustainability integration should become a core strategic priority as environmental awareness increases among customers and regulatory requirements evolve. Companies that proactively implement green logistics solutions will benefit from enhanced brand reputation, customer preference, and regulatory compliance advantages.

Partnership development with e-commerce platforms, technology providers, and regional businesses can accelerate market expansion and service innovation while sharing investment costs and operational risks. Strategic alliances enable companies to access new markets, technologies, and customer segments more efficiently than independent expansion efforts.

Long-term growth prospects for the GCC international express service market remain highly favorable, supported by continued economic diversification, population growth, urbanization trends, and technology adoption across the region. The market is expected to benefit from ongoing infrastructure development, regulatory improvements, and increasing integration with global logistics networks.

Technology evolution will continue to drive market transformation through artificial intelligence, autonomous delivery systems, and advanced analytics that enhance service capabilities and operational efficiency. These technological advances will enable new service models, improve customer experience, and create competitive advantages for innovative service providers.

Market consolidation trends are likely to continue as companies seek scale advantages, geographic expansion, and technology capabilities through mergers, acquisitions, and strategic partnerships. This consolidation will create larger, more capable service providers while potentially reducing competitive intensity in certain market segments.

Regulatory harmonization efforts across GCC countries will facilitate cross-border express services and reduce operational complexity for international service providers. According to MarkWide Research projections, regulatory improvements could enhance cross-border delivery efficiency by 18% over the next three years, creating substantial value for customers and service providers alike.

The GCC international express service market represents a dynamic and rapidly evolving sector with substantial growth potential driven by economic diversification, e-commerce expansion, and technological innovation across the Gulf Cooperation Council region. The market benefits from strategic geographic positioning, world-class infrastructure, and supportive government policies that create favorable conditions for continued expansion and development.

Key success factors for market participants include technology investment, service innovation, sustainability integration, and strategic partnership development that enhance competitive positioning and customer value. Companies that successfully navigate regulatory complexity, operational challenges, and competitive pressures will capture significant growth opportunities in this expanding market.

Future market development will be shaped by continued digital transformation, sustainability initiatives, and regional integration efforts that enhance service capabilities and operational efficiency. The market outlook remains positive, supported by strong economic fundamentals, infrastructure investment, and evolving customer expectations that drive continuous innovation and service enhancement across the express service sector.

What is GCC International Express Service?

GCC International Express Service refers to expedited shipping solutions that facilitate the swift movement of goods across borders within the Gulf Cooperation Council region. This service is essential for businesses needing timely delivery of products, documents, and packages to various destinations.

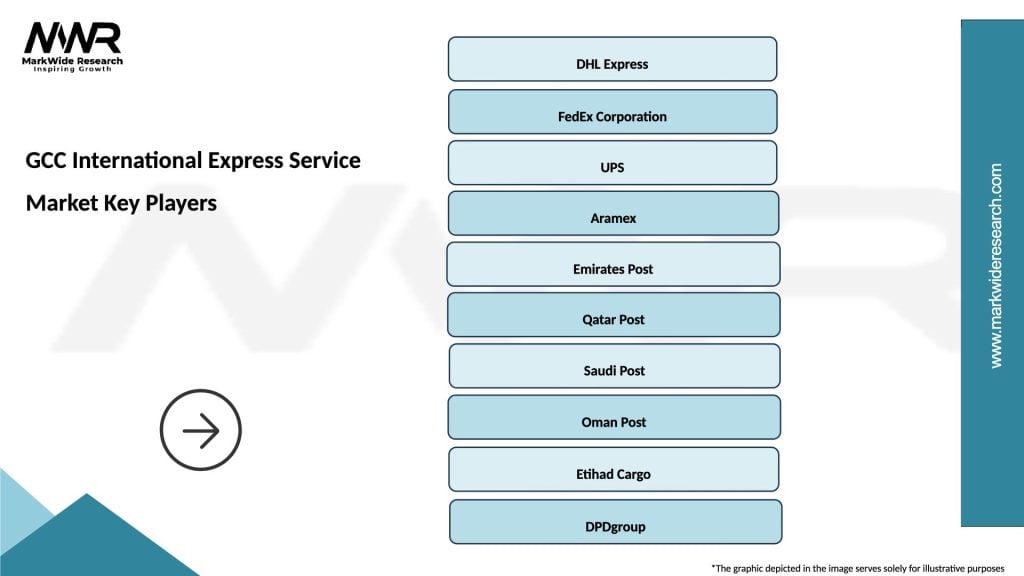

What are the key players in the GCC International Express Service Market?

Key players in the GCC International Express Service Market include DHL, FedEx, and Aramex, which provide a range of logistics and express delivery solutions tailored to the needs of businesses and consumers in the region, among others.

What are the growth factors driving the GCC International Express Service Market?

The growth of the GCC International Express Service Market is driven by increasing e-commerce activities, rising demand for fast delivery services, and the expansion of trade agreements among GCC countries. Additionally, advancements in logistics technology are enhancing service efficiency.

What challenges does the GCC International Express Service Market face?

The GCC International Express Service Market faces challenges such as regulatory complexities, customs delays, and competition from local delivery services. These factors can impact the efficiency and reliability of express services in the region.

What opportunities exist in the GCC International Express Service Market?

Opportunities in the GCC International Express Service Market include the growth of cross-border e-commerce, the potential for partnerships with local businesses, and the increasing demand for specialized logistics services. These factors can lead to innovative service offerings.

What trends are shaping the GCC International Express Service Market?

Trends shaping the GCC International Express Service Market include the rise of same-day delivery options, the integration of technology for tracking and management, and a focus on sustainability in logistics practices. These trends are influencing how services are designed and delivered.

GCC International Express Service Market

| Segmentation Details | Description |

|---|---|

| Service Type | Same-Day Delivery, Next-Day Delivery, Scheduled Delivery, Standard Delivery |

| Customer Type | Retailers, E-Commerce Platforms, Corporates, Individual Consumers |

| Delivery Mode | Air Freight, Ground Transport, Sea Freight, Multimodal Transport |

| Packaging Type | Boxed, Palletized, Crated, Envelope |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the GCC International Express Service Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at