444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The GCC industrial waste management market represents a rapidly evolving sector driven by stringent environmental regulations, growing industrial activities, and increasing awareness of sustainable waste disposal practices across the Gulf Cooperation Council region. Industrial waste management encompasses the collection, treatment, recycling, and disposal of waste generated by manufacturing facilities, oil and gas operations, petrochemical plants, and other industrial establishments throughout Saudi Arabia, UAE, Qatar, Kuwait, Oman, and Bahrain.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 6.8% driven by expanding industrial infrastructure and enhanced regulatory frameworks. The region’s commitment to Vision 2030 initiatives and circular economy principles has accelerated adoption of advanced waste management technologies, creating substantial opportunities for service providers and technology developers.

Key market characteristics include increasing demand for hazardous waste treatment services, growing emphasis on waste-to-energy solutions, and rising investments in recycling infrastructure. The market benefits from strong government support, with regulatory compliance rates improving by 45% over recent years as authorities implement stricter environmental standards and monitoring systems.

The GCC industrial waste management market refers to the comprehensive ecosystem of services, technologies, and infrastructure dedicated to handling industrial waste streams generated across the Gulf Cooperation Council countries. This market encompasses specialized collection systems, treatment facilities, recycling operations, and disposal services designed to manage various types of industrial waste including hazardous materials, chemical byproducts, manufacturing residues, and construction debris.

Industrial waste management involves systematic processes for identifying, segregating, collecting, transporting, treating, and disposing of waste materials in compliance with environmental regulations and safety standards. The market includes both public and private sector participants offering integrated solutions ranging from on-site waste handling to centralized treatment facilities and resource recovery operations.

Scope and definition extend beyond traditional disposal methods to encompass circular economy principles, emphasizing waste minimization, resource recovery, and environmental sustainability. Modern industrial waste management integrates advanced technologies including automated sorting systems, thermal treatment processes, biological treatment methods, and digital monitoring platforms to optimize efficiency and environmental outcomes.

Strategic market positioning reveals the GCC industrial waste management sector as a critical component of regional sustainable development initiatives, with growing emphasis on environmental compliance and resource efficiency. The market demonstrates strong fundamentals supported by expanding industrial base, increasing regulatory requirements, and rising environmental consciousness among stakeholders.

Growth trajectory analysis indicates sustained expansion driven by several key factors including industrial diversification efforts, infrastructure development projects, and implementation of stricter environmental standards. Waste generation rates continue increasing alongside industrial growth, with hazardous waste streams accounting for 35% of total industrial waste requiring specialized management solutions.

Investment landscape shows significant capital allocation toward advanced treatment technologies, facility expansion, and digital transformation initiatives. Public-private partnerships are emerging as preferred models for large-scale infrastructure development, while technology providers focus on developing region-specific solutions addressing local waste characteristics and regulatory requirements.

Competitive dynamics feature a mix of international waste management companies, regional service providers, and specialized technology vendors competing across different market segments. Market consolidation trends are evident as larger players acquire specialized capabilities and expand geographic coverage to serve multinational industrial clients effectively.

Primary market drivers encompass regulatory enforcement, industrial expansion, and sustainability mandates creating substantial demand for comprehensive waste management solutions across the GCC region:

Market segmentation insights reveal distinct opportunities across waste types, treatment methods, and end-user industries. Hazardous waste management represents the highest-value segment, while recyclable materials processing shows the fastest growth potential driven by circular economy initiatives and resource scarcity concerns.

Regulatory framework evolution serves as the primary catalyst for market expansion, with GCC governments implementing comprehensive environmental legislation requiring industrial facilities to adopt proper waste management practices. Environmental compliance mandates have increased significantly, with penalty enforcement rates rising by 60% for non-compliant facilities, creating strong incentives for proper waste management adoption.

Industrial sector diversification across the GCC region generates diverse waste streams requiring specialized management solutions. The expansion of manufacturing, pharmaceuticals, food processing, and technology sectors creates complex waste management challenges that drive demand for comprehensive service offerings and advanced treatment technologies.

Sustainability commitments by major corporations and government entities accelerate adoption of environmentally responsible waste management practices. Corporate sustainability programs increasingly prioritize waste reduction, recycling, and resource recovery as key performance indicators, driving investment in advanced waste management infrastructure and services.

Resource scarcity concerns motivate increased focus on waste-to-resource conversion technologies, creating opportunities for innovative treatment methods that recover valuable materials from industrial waste streams. Circular economy principles gain traction as organizations seek to minimize waste generation while maximizing resource utilization and economic value creation.

Public health awareness regarding environmental contamination risks drives stricter enforcement of waste management standards and increased investment in proper treatment facilities. Growing understanding of long-term environmental impacts creates political and social pressure for improved waste management practices across all industrial sectors.

High capital investment requirements for establishing comprehensive waste management facilities present significant barriers to market entry, particularly for smaller service providers and specialized treatment operations. Infrastructure development costs often require substantial upfront investments that may deter potential market participants and limit expansion of treatment capacity.

Technical complexity challenges associated with handling diverse industrial waste streams require specialized expertise and equipment that may not be readily available in all GCC markets. Skills shortage in environmental engineering and waste management technologies constrains market growth and increases operational costs for service providers.

Regulatory inconsistencies across different GCC countries create compliance challenges for multinational service providers and industrial clients operating in multiple jurisdictions. Harmonization gaps in environmental standards and permitting processes increase administrative burdens and operational complexity for market participants.

Limited treatment infrastructure in certain regions constrains market development and increases transportation costs for waste management services. Geographic concentration of treatment facilities in major industrial centers creates logistical challenges and cost inefficiencies for remote industrial operations.

Economic volatility in oil-dependent GCC economies can impact industrial activity levels and waste generation patterns, creating uncertainty for waste management service providers and affecting long-term investment planning and capacity development decisions.

Waste-to-energy development represents a significant growth opportunity as GCC countries seek alternative energy sources and sustainable waste disposal solutions. Energy recovery potential from industrial waste streams offers dual benefits of waste reduction and renewable energy generation, attracting government support and private investment.

Digital transformation initiatives create opportunities for technology providers to develop smart waste management solutions incorporating IoT sensors, data analytics, and automated monitoring systems. Industry 4.0 integration enables real-time waste tracking, predictive maintenance, and optimization of collection and treatment processes.

Circular economy implementation opens new markets for resource recovery and recycling services, with material recovery rates showing potential for improvement of up to 40% through advanced sorting and processing technologies. Secondary material markets develop as industries seek sustainable raw material alternatives.

Public-private partnerships offer opportunities for collaborative infrastructure development and service delivery models that leverage government support with private sector efficiency and innovation. Concession arrangements enable long-term revenue stability while sharing investment risks and operational responsibilities.

Regional integration potential exists for developing cross-border waste management networks that optimize treatment capacity utilization and enable economies of scale. Specialized treatment centers serving multiple countries can improve cost-effectiveness and technical capabilities for handling complex waste streams.

Supply-demand equilibrium in the GCC industrial waste management market reflects growing waste generation rates outpacing treatment capacity development, creating opportunities for capacity expansion and service enhancement. Treatment capacity utilization rates average 78% across the region, indicating strong demand fundamentals and potential for additional infrastructure investment.

Competitive intensity varies significantly across different market segments, with hazardous waste treatment showing higher barriers to entry and more concentrated market structure compared to general industrial waste collection and recycling services. Market consolidation trends emerge as larger players acquire specialized capabilities and expand service offerings.

Technology adoption patterns demonstrate increasing integration of advanced treatment methods and digital management systems, driven by regulatory requirements and operational efficiency objectives. Innovation cycles accelerate as companies invest in research and development to address specific regional waste management challenges and regulatory compliance needs.

Pricing dynamics reflect the balance between service quality, regulatory compliance, and cost competitiveness, with premium pricing for specialized hazardous waste treatment services and competitive pricing for standard waste collection and disposal services. Value-based pricing models gain acceptance for comprehensive waste management solutions.

Stakeholder relationships evolve toward long-term partnerships between waste generators and service providers, emphasizing collaborative approaches to waste minimization, treatment optimization, and environmental performance improvement. Service level agreements increasingly incorporate sustainability metrics and performance indicators.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the GCC industrial waste management market dynamics, trends, and growth prospects. Primary research activities include structured interviews with industry executives, government officials, and technology providers across all six GCC countries.

Secondary research components encompass analysis of government publications, industry reports, regulatory documents, and company financial statements to validate primary findings and provide comprehensive market context. Data triangulation methods ensure consistency and accuracy across different information sources and research approaches.

Market sizing methodology utilizes bottom-up and top-down approaches, analyzing waste generation patterns, treatment capacity data, and service provider revenues to develop comprehensive market assessments. Statistical modeling techniques project future market trends based on historical data patterns and identified growth drivers.

Competitive landscape analysis examines market share distribution, service offerings, geographic coverage, and strategic positioning of key market participants. SWOT analysis frameworks evaluate competitive strengths, weaknesses, opportunities, and threats for major industry players and market segments.

Quality assurance processes include peer review, expert validation, and cross-referencing with multiple data sources to ensure research accuracy and reliability. Continuous monitoring of market developments enables regular updates and refinements to research findings and market projections.

Saudi Arabia dominates the regional market with the largest industrial base and most comprehensive regulatory framework for waste management. Market share distribution shows Saudi Arabia accounting for 42% of regional waste management activity, driven by extensive petrochemical operations, manufacturing facilities, and major infrastructure development projects requiring specialized waste management services.

United Arab Emirates represents the second-largest market, characterized by diverse industrial sectors and advanced waste management infrastructure concentrated in Dubai and Abu Dhabi. Innovation leadership positions the UAE as a testing ground for new waste management technologies and sustainable disposal methods, with recycling rates reaching 25% of total industrial waste.

Qatar shows rapid market development driven by industrial diversification efforts and major construction projects related to infrastructure development. Investment concentration in advanced treatment facilities and waste-to-energy projects creates opportunities for technology providers and service companies specializing in complex waste streams.

Kuwait focuses on upgrading existing waste management infrastructure and implementing stricter environmental regulations for industrial facilities. Regulatory modernization drives demand for compliance-oriented waste management services and creates opportunities for international service providers with proven expertise.

Oman emphasizes sustainable waste management practices as part of broader environmental conservation initiatives, with particular focus on mining and industrial waste from resource extraction operations. Geographic challenges create opportunities for mobile treatment solutions and decentralized waste management approaches.

Bahrain leverages its strategic location and business-friendly environment to develop regional waste management service capabilities, focusing on serving multinational corporations with operations across multiple GCC countries. Hub development strategy positions Bahrain as a center for specialized waste treatment services.

Market leadership in the GCC industrial waste management sector features a combination of international waste management companies, regional service providers, and specialized technology vendors competing across different service segments and geographic markets.

Competitive strategies focus on technology differentiation, geographic expansion, and vertical integration to capture value across the waste management value chain. Strategic partnerships between international technology providers and local service companies enable market access while leveraging regional expertise and relationships.

Market positioning varies from full-service integrated providers offering end-to-end waste management solutions to specialized companies focusing on specific waste types or treatment technologies. Differentiation factors include regulatory compliance expertise, treatment technology capabilities, and geographic coverage across multiple GCC markets.

By Waste Type: The market segments into distinct categories based on waste characteristics and treatment requirements, with each segment presenting unique opportunities and challenges for service providers.

By Treatment Method: Different processing approaches address specific waste characteristics and regulatory requirements while optimizing resource recovery and environmental outcomes.

By End-User Industry: Different industrial sectors generate distinct waste profiles requiring tailored management approaches and specialized service capabilities.

Hazardous waste management represents the highest-value market segment, commanding premium pricing due to specialized treatment requirements and strict regulatory compliance standards. Treatment complexity and liability concerns create barriers to entry while ensuring stable margins for qualified service providers with appropriate licenses and capabilities.

Recycling and resource recovery shows the fastest growth potential as circular economy principles gain adoption across GCC industries. Material recovery operations benefit from rising commodity prices and increasing demand for sustainable raw materials, with recycling efficiency improvements of 30% achievable through advanced sorting technologies.

Waste-to-energy applications gain momentum as governments prioritize renewable energy development and sustainable waste disposal solutions. Energy recovery potential from industrial waste streams offers attractive returns on investment while addressing multiple policy objectives related to waste reduction and energy security.

Digital waste management emerges as a key differentiator, with IoT-enabled monitoring systems, predictive analytics, and automated reporting capabilities improving operational efficiency and regulatory compliance. Technology adoption rates accelerate as companies recognize the value of data-driven waste management optimization.

Specialized treatment services for unique waste streams create niche opportunities for companies with specific technical expertise and equipment capabilities. Custom treatment solutions command premium pricing while building long-term client relationships based on specialized knowledge and proven performance.

Industrial waste generators benefit from comprehensive waste management services that ensure regulatory compliance while minimizing operational disruption and environmental liability. Cost optimization through efficient waste handling and resource recovery creates direct economic value while supporting sustainability objectives and corporate reputation management.

Waste management service providers capitalize on growing market demand and regulatory requirements to build sustainable business models with recurring revenue streams. Operational efficiency gains through technology integration and process optimization improve profitability while enabling competitive pricing and service quality enhancement.

Technology vendors find expanding opportunities to deploy innovative solutions addressing specific regional challenges and regulatory requirements. Market penetration benefits from government support for environmental technology adoption and increasing industry awareness of advanced treatment capabilities and digital management systems.

Government authorities achieve environmental protection objectives while supporting economic development through proper waste management infrastructure and services. Regulatory compliance improves as industry adopts professional waste management practices, reducing environmental risks and public health concerns.

Local communities benefit from reduced environmental contamination and improved public health outcomes resulting from proper industrial waste management practices. Economic development opportunities emerge through job creation in the waste management sector and related environmental services industries.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as a dominant trend, with companies increasingly adopting circular economy principles and zero-waste objectives. Corporate sustainability commitments drive demand for comprehensive waste management solutions that minimize environmental impact while maximizing resource recovery and economic value creation.

Technology convergence accelerates as waste management companies integrate IoT sensors, artificial intelligence, and blockchain technologies to optimize operations and enhance transparency. Smart waste management systems enable real-time monitoring, predictive maintenance, and automated reporting capabilities that improve efficiency and regulatory compliance.

Regulatory harmonization trends emerge as GCC countries work toward standardizing environmental regulations and waste management requirements. Cross-border cooperation initiatives facilitate regional integration and enable economies of scale in treatment infrastructure development and service delivery.

Waste-to-resource transformation gains prominence as companies recognize the economic value of waste streams and invest in advanced recovery technologies. Resource recovery rates improve through implementation of sophisticated sorting and processing systems that extract valuable materials from complex waste streams.

Public-private collaboration expands as governments seek to leverage private sector expertise and investment capacity for waste management infrastructure development. Concession models and build-operate-transfer arrangements become preferred mechanisms for large-scale project implementation and long-term service delivery.

Infrastructure expansion accelerates across the GCC region with major investments in new treatment facilities, recycling centers, and waste-to-energy plants. Capacity additions focus on addressing treatment gaps for hazardous waste and developing advanced recovery capabilities for high-value materials and energy production.

Strategic partnerships form between international technology providers and regional service companies to combine global expertise with local market knowledge. Joint ventures enable technology transfer and capacity building while providing international companies with market access and regulatory compliance support.

Regulatory updates strengthen environmental protection standards and expand coverage of waste management requirements across different industrial sectors. Enforcement mechanisms improve through digital monitoring systems and increased inspection capabilities, driving higher compliance rates and service quality standards.

Innovation initiatives focus on developing region-specific solutions for challenging waste streams and extreme operating conditions. Research and development investments target advanced treatment technologies, energy recovery systems, and digital management platforms optimized for GCC market requirements.

Market consolidation continues as larger players acquire specialized capabilities and expand geographic coverage to serve multinational clients effectively. Acquisition activity focuses on companies with unique technologies, regulatory expertise, or strategic market positions in high-growth segments.

MarkWide Research recommends that market participants focus on developing comprehensive service offerings that address the full spectrum of industrial waste management requirements while maintaining flexibility to adapt to evolving regulatory and market conditions. Integrated service models provide competitive advantages through operational efficiency and client relationship strength.

Technology investment priorities should emphasize digital transformation capabilities that enable real-time monitoring, predictive analytics, and automated compliance reporting. Smart waste management systems differentiate service providers while improving operational efficiency and client value proposition through enhanced transparency and performance optimization.

Geographic expansion strategies should consider regional integration opportunities that leverage economies of scale while addressing local market requirements and regulatory compliance needs. Cross-border service capabilities enable serving multinational clients effectively while optimizing treatment capacity utilization across different markets.

Partnership development with technology providers, government agencies, and industrial clients creates opportunities for collaborative innovation and market development. Strategic alliances enable access to specialized capabilities, market knowledge, and investment resources necessary for sustainable growth and competitive positioning.

Sustainability positioning becomes increasingly important as clients prioritize environmental performance and circular economy principles. Value proposition development should emphasize resource recovery, environmental impact reduction, and long-term sustainability benefits alongside traditional waste management services.

Market expansion prospects remain robust through the forecast period, driven by continued industrial growth, strengthening regulatory frameworks, and increasing adoption of sustainable waste management practices. Growth acceleration is expected as circular economy initiatives gain momentum and waste-to-resource technologies achieve commercial viability at scale.

Technology evolution will continue transforming the industry landscape, with artificial intelligence, robotics, and advanced materials processing enabling more efficient and cost-effective waste management solutions. Innovation cycles accelerate as companies invest in research and development to address emerging challenges and capitalize on new opportunities.

Regulatory development trends toward greater standardization and stricter enforcement will drive continued market growth while raising barriers to entry for unqualified service providers. Compliance requirements become more sophisticated, creating opportunities for companies with advanced capabilities and proven track records.

Investment flows into the sector are expected to increase significantly as governments and private investors recognize the strategic importance of waste management infrastructure for sustainable development. Capital availability improves through green financing mechanisms and sustainability-focused investment funds targeting environmental infrastructure projects.

MWR projections indicate the market will experience sustained growth with compound annual growth rates exceeding 7% as demand fundamentals strengthen and new opportunities emerge in waste-to-energy, resource recovery, and digital waste management solutions. Market maturation will favor companies with comprehensive capabilities, strong regulatory compliance, and innovative technology platforms.

The GCC industrial waste management market presents compelling growth opportunities driven by expanding industrial activities, strengthening regulatory frameworks, and increasing emphasis on sustainable waste management practices across the region. Market fundamentals remain strong with growing waste generation rates, improving regulatory compliance requirements, and rising investment in advanced treatment infrastructure creating favorable conditions for sustained expansion.

Strategic positioning for success requires comprehensive service capabilities, technology integration, and strong regulatory compliance expertise to serve the diverse needs of industrial clients across different sectors and geographic markets. Innovation leadership in areas such as waste-to-energy, resource recovery, and digital management systems will differentiate successful market participants and drive long-term competitive advantages.

Future market development will be characterized by continued consolidation, technology advancement, and regional integration as the industry matures and adapts to evolving client requirements and regulatory standards. Sustainable growth strategies emphasizing circular economy principles, environmental performance, and stakeholder value creation will define successful companies in this dynamic and important market sector.

What is Industrial Waste Management?

Industrial Waste Management refers to the processes and practices involved in the collection, treatment, and disposal of waste generated by industrial activities. This includes hazardous and non-hazardous waste, recycling, and compliance with environmental regulations.

What are the key players in the GCC Industrial Waste Management Market?

Key players in the GCC Industrial Waste Management Market include Veolia, SUEZ, and Dulsco, which provide various waste management services such as collection, recycling, and treatment solutions, among others.

What are the main drivers of the GCC Industrial Waste Management Market?

The main drivers of the GCC Industrial Waste Management Market include increasing industrialization, stringent environmental regulations, and the growing emphasis on sustainable waste management practices. These factors are pushing industries to adopt more efficient waste management solutions.

What challenges does the GCC Industrial Waste Management Market face?

The GCC Industrial Waste Management Market faces challenges such as inadequate waste management infrastructure, high operational costs, and a lack of awareness regarding waste segregation and recycling among industries. These issues can hinder effective waste management practices.

What opportunities exist in the GCC Industrial Waste Management Market?

Opportunities in the GCC Industrial Waste Management Market include the development of advanced waste treatment technologies, increased investment in recycling facilities, and the potential for public-private partnerships to enhance waste management services. These factors can lead to improved sustainability outcomes.

What trends are shaping the GCC Industrial Waste Management Market?

Trends shaping the GCC Industrial Waste Management Market include the adoption of circular economy principles, increased automation in waste processing, and the integration of digital technologies for better waste tracking and management. These trends are driving innovation and efficiency in the sector.

GCC Industrial Waste Management Market

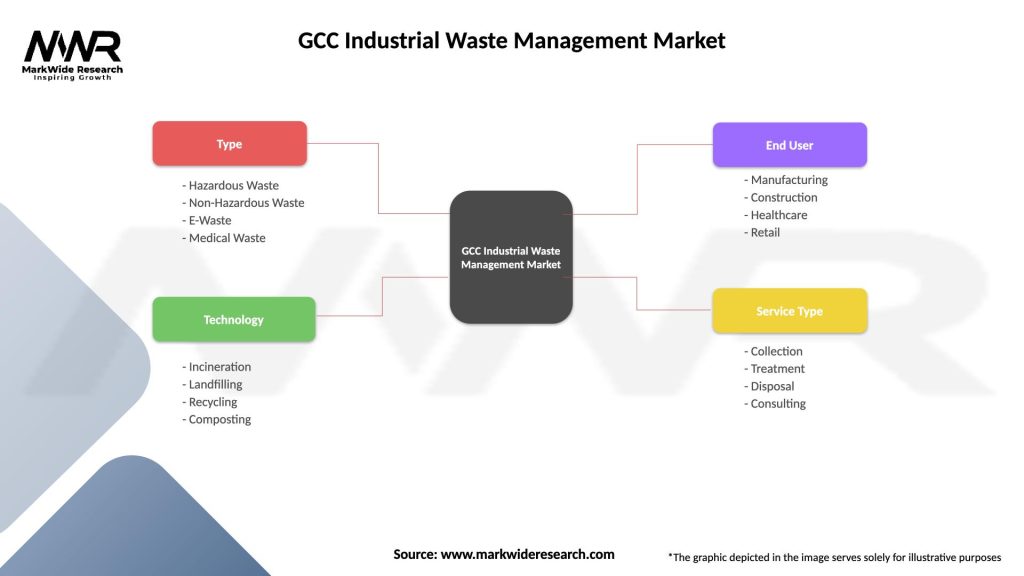

| Segmentation Details | Description |

|---|---|

| Type | Hazardous Waste, Non-Hazardous Waste, E-Waste, Medical Waste |

| Technology | Incineration, Landfilling, Recycling, Composting |

| End User | Manufacturing, Construction, Healthcare, Retail |

| Service Type | Collection, Treatment, Disposal, Consulting |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the GCC Industrial Waste Management Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at