444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The GCC (Gulf Cooperation Council) industrial gas market is a thriving sector that plays a vital role in various industries across the region. Industrial gases, such as nitrogen, oxygen, hydrogen, argon, and carbon dioxide, are used in a wide range of applications, including oil and gas, healthcare, chemicals, food and beverage, and electronics. This market overview provides valuable insights into the GCC industrial gas market, its growth prospects, key market drivers and restraints, opportunities, and regional analysis.

Meaning

The GCC industrial gas market refers to the demand, supply, and trade of industrial gases in the Gulf Cooperation Council countries, including Saudi Arabia, United Arab Emirates, Kuwait, Qatar, Bahrain, and Oman. Industrial gases are produced and distributed by specialized companies and are essential for various industrial processes, such as welding, cutting, packaging, and refrigeration. These gases are supplied in different forms, including compressed gas cylinders, liquid containers, and pipeline networks.

Executive Summary

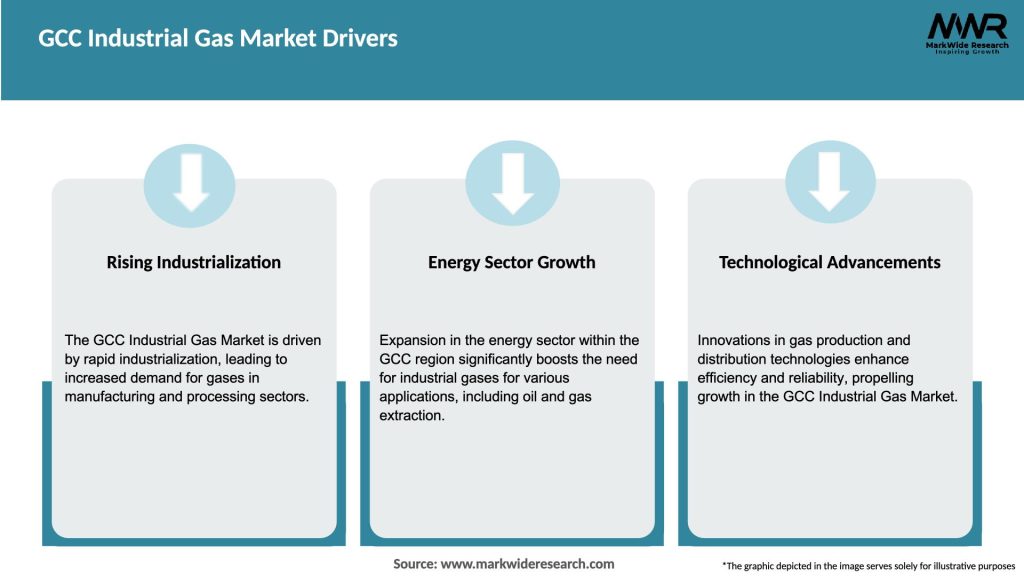

The GCC industrial gas market has experienced significant growth in recent years, driven by the expansion of key industries, infrastructure development, and increasing investments in research and development. The market offers lucrative opportunities for industrial gas suppliers and manufacturers to cater to the growing demand from sectors such as oil and gas, healthcare, and manufacturing. However, the market also faces challenges related to regulatory frameworks, fluctuating gas prices, and environmental concerns.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The GCC industrial gas market is characterized by intense competition among key players, including multinational corporations and local suppliers. Market dynamics are influenced by factors such as technological advancements, mergers and acquisitions, pricing strategies, and collaborations with end-use industries. The market is highly responsive to changes in the economic and political landscape, as well as evolving customer preferences and environmental regulations.

Regional Analysis

The GCC industrial gas market can be segmented into countries, namely Saudi Arabia, United Arab Emirates, Kuwait, Qatar, Bahrain, and Oman. Saudi Arabia holds the largest market share, driven by its strong presence in the oil and gas industry and large-scale industrial projects. The United Arab Emirates follows closely, with significant demand coming from diverse sectors such as construction, manufacturing, and healthcare. Other GCC countries also contribute to the market growth, driven by infrastructure investments and industrial diversification initiatives.

Competitive Landscape

Leading Companies in the GCC Industrial Gas Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

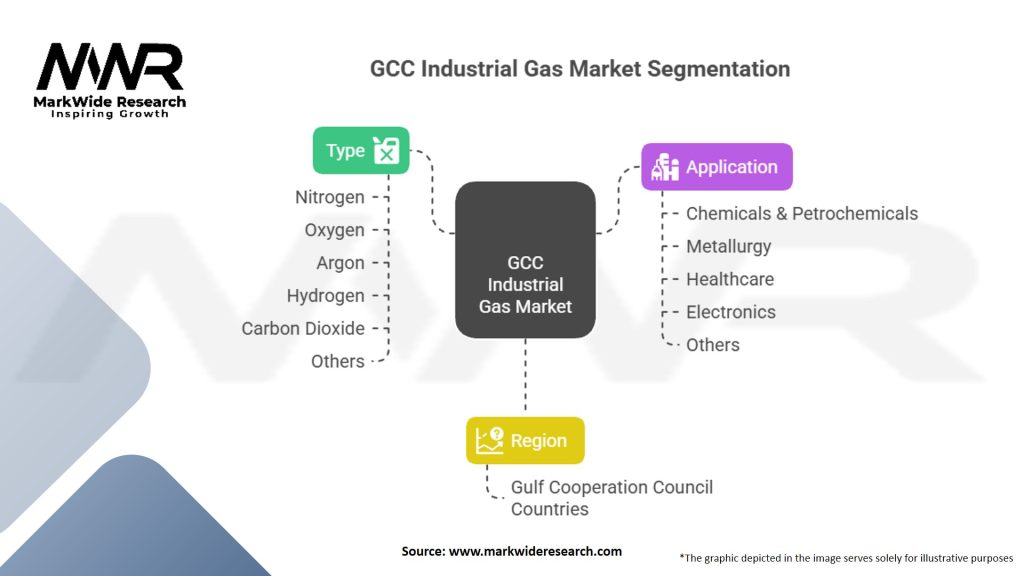

Segmentation

The GCC industrial gas market can be segmented based on gas type, distribution mode, and end-use industry. Gas types include nitrogen, oxygen, hydrogen, argon, carbon dioxide, and others. Distribution modes include cylinders and packaged gases, bulk delivery, and pipeline networks. End-use industries encompass oil and gas, healthcare, chemicals, food and beverage, electronics, and others.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a significant impact on the GCC industrial gas market. The temporary shutdown of industries, travel restrictions, and disruptions in the supply chain affected the demand and supply of industrial gases. However, the healthcare sector witnessed a surge in demand for medical gases, especially oxygen, during the pandemic. The market has shown resilience and adaptability, with companies implementing safety measures and adjusting their operations to meet the evolving needs of industries during the crisis.

Key Industry Developments

Analyst Suggestions

Future Outlook

The GCC industrial gas market is expected to witness steady growth in the coming years, driven by the region’s economic diversification initiatives, infrastructure development, and increasing demand from key industries. The expansion of the healthcare sector, the adoption of specialty gases in advanced manufacturing processes, and the focus on sustainable practices will shape the future of the market. Continuous investments in research and development and strategic collaborations are essential to stay competitive and capture growth opportunities.

Conclusion

The GCC industrial gas market is a dynamic and growing sector that serves as a critical enabler for various industries in the region. The demand for industrial gases continues to rise due to expanding infrastructure projects, economic diversification efforts, and advancements in technology. Market participants should focus on catering to the evolving needs of industries, investing in sustainable practices, and leveraging technological innovations to maintain a competitive edge in this flourishing market.

What is Industrial Gas?

Industrial gas refers to gases that are produced for use in industrial applications, including manufacturing, chemical processing, and energy production. Common types include oxygen, nitrogen, hydrogen, and argon, which are utilized across various sectors such as healthcare, food processing, and metal fabrication.

What are the key players in the GCC Industrial Gas Market?

Key players in the GCC Industrial Gas Market include Air Products, Linde, and Gulf Cryo, which provide a range of industrial gases for various applications. These companies are involved in the production and distribution of gases used in sectors like oil and gas, healthcare, and manufacturing, among others.

What are the growth factors driving the GCC Industrial Gas Market?

The GCC Industrial Gas Market is driven by factors such as the increasing demand for industrial gases in the oil and gas sector, the growth of the manufacturing industry, and advancements in technology that enhance gas production and distribution efficiency. Additionally, the rising focus on sustainable practices is also contributing to market growth.

What challenges does the GCC Industrial Gas Market face?

Challenges in the GCC Industrial Gas Market include fluctuating raw material prices, regulatory compliance issues, and the need for significant capital investment in infrastructure. These factors can impact the operational efficiency and profitability of companies within the market.

What opportunities exist in the GCC Industrial Gas Market?

Opportunities in the GCC Industrial Gas Market include the expansion of renewable energy projects, the increasing adoption of industrial gases in emerging sectors, and the potential for technological innovations in gas production and storage. These factors can lead to new applications and increased market penetration.

What trends are shaping the GCC Industrial Gas Market?

Trends in the GCC Industrial Gas Market include a growing emphasis on sustainability and environmental responsibility, the integration of digital technologies for better supply chain management, and the development of specialized gases for niche applications. These trends are influencing how companies operate and compete in the market.

GCC Industrial Gas Market

| Segmentation Details | Details |

|---|---|

| Type | Nitrogen, Oxygen, Argon, Hydrogen, Carbon Dioxide, Others |

| Application | Chemicals & Petrochemicals, Metallurgy, Healthcare, Electronics, Others |

| Region | Gulf Cooperation Council (GCC) Countries |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the GCC Industrial Gas Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at