444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The GCC fitness ring market represents a rapidly evolving segment within the broader fitness technology landscape across the Gulf Cooperation Council region. Fitness rings have emerged as innovative wearable devices that combine traditional fitness tracking with gamification elements, creating an engaging exercise experience for users of all ages. The market encompasses various types of fitness rings, from simple activity trackers to sophisticated devices integrated with gaming consoles and mobile applications.

Market dynamics in the GCC region reflect the growing emphasis on health and wellness, particularly following increased awareness of lifestyle-related health issues. The adoption rate has shown remarkable growth, with fitness ring penetration increasing by 34% year-over-year across major GCC markets. Countries like the UAE, Saudi Arabia, and Qatar are leading the charge in embracing these innovative fitness solutions, driven by government initiatives promoting active lifestyles and digital wellness programs.

Consumer behavior patterns indicate a strong preference for technology-integrated fitness solutions that offer convenience and entertainment value. The market has witnessed significant diversification, with products ranging from basic motion-sensing rings to advanced devices featuring heart rate monitoring, sleep tracking, and social connectivity features. Regional adoption rates vary, with urban centers showing 65% higher adoption compared to rural areas, reflecting infrastructure readiness and consumer purchasing power.

The GCC fitness ring market refers to the commercial ecosystem encompassing the development, distribution, and consumption of ring-shaped wearable fitness devices across the six Gulf Cooperation Council member states. These innovative devices typically feature motion sensors, connectivity capabilities, and software integration designed to track physical activity, encourage exercise participation, and provide health-related insights to users.

Fitness rings distinguish themselves from traditional wearable fitness devices through their unique form factor and specialized functionality. Unlike smartwatches or fitness bands, these rings are designed to be held and manipulated during exercise routines, often incorporating resistance training elements and motion-based gaming experiences. The devices typically connect to gaming consoles, smartphones, or dedicated applications to provide interactive workout sessions and progress tracking.

Market scope extends beyond hardware sales to include associated software, subscription services, and complementary accessories. The ecosystem encompasses various stakeholders including device manufacturers, software developers, fitness content creators, and retail distribution networks. Integration capabilities with existing fitness platforms and health monitoring systems have become crucial differentiating factors in this competitive landscape.

Strategic market positioning reveals the GCC fitness ring market as a high-growth segment within the regional fitness technology sector. The market demonstrates strong momentum driven by increasing health consciousness, government wellness initiatives, and the growing popularity of home-based fitness solutions. Consumer adoption patterns show particular strength among younger demographics and tech-savvy fitness enthusiasts.

Key market characteristics include rapid technological advancement, diverse product offerings, and strong integration with digital fitness ecosystems. The market benefits from favorable demographic trends, including a young population base and increasing disposable income levels across GCC countries. Distribution channels have evolved to include both traditional retail and e-commerce platforms, with online sales showing 42% growth in recent periods.

Competitive landscape features a mix of international technology companies and emerging regional players. Market leaders focus on innovation, user experience, and ecosystem integration to maintain competitive advantages. Product differentiation occurs through features such as battery life, sensor accuracy, software compatibility, and content library depth. The market shows strong potential for continued expansion as fitness technology adoption accelerates across the region.

Primary market drivers include the increasing prevalence of sedentary lifestyles, growing awareness of fitness benefits, and the appeal of gamified exercise experiences. The market benefits from strong government support for health and wellness initiatives across GCC countries, creating favorable conditions for fitness technology adoption.

Consumer preference analysis reveals several key insights:

Technology trends shaping the market include improved sensor accuracy, enhanced battery life, and advanced software algorithms for personalized fitness recommendations. Integration capabilities with smart home systems and health platforms are becoming increasingly important for market success.

Health consciousness surge represents the primary catalyst driving fitness ring adoption across the GCC region. Rising awareness of lifestyle-related health issues, including obesity and cardiovascular diseases, has motivated consumers to seek convenient and engaging fitness solutions. Government health initiatives and public awareness campaigns have amplified this trend, creating a supportive environment for fitness technology adoption.

Digital transformation in the fitness industry has accelerated the acceptance of technology-integrated exercise solutions. Consumers increasingly expect their fitness devices to offer connectivity, data tracking, and personalized experiences. The COVID-19 pandemic further accelerated this trend by highlighting the importance of home-based fitness solutions and contactless exercise options.

Demographic advantages in the GCC region provide strong market support. The young population base, with 68% of residents under 35 years, demonstrates high receptivity to innovative fitness technologies. Additionally, increasing disposable income levels and urbanization trends create favorable conditions for premium fitness product adoption.

Gaming culture integration has emerged as a significant driver, particularly among younger demographics. The popularity of gaming consoles and mobile gaming in the region creates natural synergies with fitness ring products that incorporate gaming elements. This convergence of entertainment and fitness appeals to consumers seeking engaging exercise experiences.

Price sensitivity remains a significant constraint for market expansion, particularly in price-conscious consumer segments. While premium products offer advanced features, the cost barrier limits accessibility for broader market penetration. Economic fluctuations and varying income levels across different GCC markets create challenges for uniform pricing strategies.

Cultural considerations influence adoption patterns in certain market segments. Traditional exercise preferences and cultural attitudes toward fitness technology may limit acceptance in some demographic groups. Gender-specific preferences and cultural norms regarding fitness activities require careful consideration in product development and marketing strategies.

Technical limitations of current fitness ring technologies present adoption barriers. Issues such as battery life, sensor accuracy, and connectivity reliability can impact user satisfaction and long-term engagement. Compatibility challenges with existing devices and platforms may discourage potential users who prefer integrated technology ecosystems.

Market education requirements represent an ongoing challenge, as many consumers remain unfamiliar with fitness ring benefits and functionality. The need for comprehensive user education and demonstration programs increases marketing costs and extends adoption timelines. Skepticism regarding effectiveness compared to traditional exercise methods requires ongoing market education efforts.

Government wellness initiatives across GCC countries present substantial opportunities for market expansion. National health strategies emphasizing preventive healthcare and active lifestyles create supportive policy environments for fitness technology adoption. Public-private partnerships in health and wellness sectors offer potential collaboration opportunities for market players.

Corporate wellness programs represent an emerging opportunity segment. Companies increasingly recognize the benefits of employee fitness programs for productivity and healthcare cost management. B2B market potential includes corporate bulk purchases, wellness program integration, and employee incentive programs incorporating fitness ring technology.

Healthcare integration opportunities exist through partnerships with medical institutions and healthcare providers. Fitness rings can serve as valuable tools for rehabilitation programs, chronic disease management, and preventive healthcare initiatives. Medical endorsement and clinical validation could significantly enhance market credibility and adoption rates.

Educational sector adoption presents opportunities for youth market development. Schools and universities seeking innovative physical education solutions may adopt fitness ring technologies for student engagement and health promotion. Curriculum integration possibilities could establish long-term user habits and brand loyalty among young consumers.

Supply chain evolution reflects the market’s maturation, with established distribution networks and retail partnerships across major GCC markets. E-commerce growth has transformed distribution strategies, with online platforms accounting for 47% of total sales in recent periods. This shift enables broader market reach and direct consumer engagement opportunities.

Innovation cycles in the fitness ring market demonstrate rapid technological advancement and product iteration. Manufacturers continuously enhance features, improve user interfaces, and expand compatibility options to maintain competitive positions. Research and development investments focus on sensor technology, battery efficiency, and software algorithm improvements.

Consumer engagement patterns show strong initial adoption followed by varying long-term usage rates. User retention strategies have become critical for market success, with companies investing in content development, community building, and gamification enhancements. Subscription service models are emerging as important revenue streams beyond hardware sales.

Regulatory landscape continues to evolve as governments develop frameworks for fitness technology and health data management. Privacy regulations and data protection requirements influence product development and market entry strategies. Compliance with regional standards and certification requirements affects market access and consumer confidence.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable market insights. Primary research included extensive consumer surveys, industry expert interviews, and retailer feedback collection across all six GCC countries. Survey participants represented diverse demographic segments, ensuring comprehensive market perspective coverage.

Secondary research incorporated analysis of industry reports, government publications, trade association data, and company financial statements. Market data validation occurred through cross-referencing multiple sources and conducting follow-up verification interviews with key industry stakeholders. MarkWide Research analysts utilized proprietary databases and industry connections to access exclusive market intelligence.

Quantitative analysis methods included statistical modeling, trend analysis, and market sizing calculations based on available data points. Qualitative assessment incorporated expert opinions, consumer behavior analysis, and competitive landscape evaluation. Data collection spanned multiple time periods to identify trends and validate market projections.

Regional analysis methodology ensured comprehensive coverage of all GCC markets while accounting for country-specific variations in consumer behavior, regulatory environments, and market conditions. Cultural sensitivity considerations influenced research design and data interpretation to ensure accurate market representation across diverse regional markets.

United Arab Emirates leads the GCC fitness ring market with the highest adoption rates and most developed distribution infrastructure. Dubai and Abu Dhabi serve as primary market centers, benefiting from high disposable incomes, tech-savvy populations, and strong retail presence. The UAE accounts for approximately 35% of regional market share, driven by favorable demographics and government wellness initiatives.

Saudi Arabia represents the largest potential market due to its population size and ongoing economic diversification efforts. Vision 2030 initiatives emphasizing health and wellness create supportive conditions for fitness technology adoption. Major cities including Riyadh, Jeddah, and Dammam show strong growth potential, with market penetration currently at 28% of regional total.

Qatar demonstrates high per-capita adoption rates, reflecting strong purchasing power and government emphasis on health and fitness. World Cup legacy infrastructure and continued sports development initiatives support market growth. The country shows 15% regional market share despite its smaller population base.

Kuwait, Bahrain, and Oman collectively represent emerging opportunities with growing consumer interest and improving retail infrastructure. These markets show 22% combined regional share with significant growth potential as awareness and availability increase. Market development strategies focus on education, demonstration, and localized marketing approaches to drive adoption in these developing markets.

Market leadership is currently distributed among several key players, each bringing unique strengths and market positioning strategies. The competitive environment features both established technology companies and emerging fitness-focused brands competing for market share through innovation and customer experience differentiation.

Leading market participants include:

Competitive strategies emphasize product differentiation through feature enhancement, ecosystem integration, and user experience optimization. Price competition occurs primarily in the mid-market segment, while premium brands focus on advanced functionality and build quality. Partnership strategies with fitness content providers and healthcare organizations provide competitive advantages.

Market entry barriers include technology development requirements, distribution network establishment, and brand recognition building. Innovation pace remains high, with companies investing significantly in research and development to maintain competitive positions and address evolving consumer preferences.

By Product Type:

By Price Range:

By Distribution Channel:

By End User:

Gaming-integrated fitness rings dominate the market with the highest consumer adoption rates and engagement levels. These products benefit from established gaming ecosystems and proven user retention strategies. Content library depth and regular updates significantly influence consumer satisfaction and long-term usage patterns.

Standalone fitness trackers appeal to health-conscious consumers seeking dedicated fitness solutions without gaming elements. This segment shows steady growth among older demographics and serious fitness enthusiasts who prefer focused functionality over entertainment features. Health data accuracy and professional fitness program integration drive adoption in this category.

Smart ring technology represents the premium market segment with advanced health monitoring capabilities including heart rate tracking, sleep analysis, and stress monitoring. Healthcare integration potential makes this category attractive for medical applications and chronic disease management programs.

Resistance training rings cater to strength training enthusiasts and professional fitness applications. This category shows strong growth potential as consumers seek comprehensive home gym solutions. Durability requirements and resistance level customization are key success factors in this segment.

Price segment analysis reveals that mid-range products achieve the highest sales volumes, balancing features and affordability effectively. Premium segment growth is driven by early adopters and tech enthusiasts, while budget segments enable market expansion into price-sensitive consumer groups.

Manufacturers benefit from growing market demand and opportunities for product innovation and differentiation. The expanding market enables economies of scale in production and distribution while supporting premium pricing for advanced features. Brand building opportunities exist through association with health and wellness trends.

Retailers gain access to high-margin products with strong consumer interest and repeat purchase potential. Cross-selling opportunities exist with complementary fitness products and accessories. The market’s growth trajectory supports inventory investment and dedicated retail space allocation.

Consumers benefit from improved health outcomes, convenient exercise solutions, and engaging fitness experiences. Cost-effectiveness compared to gym memberships and personal training services provides long-term value. Flexibility in workout timing and location addresses common fitness barriers.

Healthcare providers can leverage fitness ring technology for patient monitoring, rehabilitation programs, and preventive healthcare initiatives. Data collection capabilities support evidence-based treatment decisions and patient progress tracking. Remote monitoring possibilities reduce healthcare delivery costs while improving patient outcomes.

Government stakeholders benefit from supporting public health objectives and reducing healthcare system burdens. Economic development opportunities exist through technology sector growth and job creation. Social benefits include improved population health and reduced lifestyle-related disease prevalence.

Strengths:

Weaknesses:

Opportunities:

Threats:

Gamification evolution continues to shape product development with increasingly sophisticated gaming elements and social features. Virtual reality integration and augmented reality experiences are emerging as next-generation features that enhance user engagement and exercise effectiveness.

Artificial intelligence integration enables personalized workout recommendations, progress tracking, and adaptive difficulty adjustment. Machine learning algorithms analyze user behavior patterns to optimize exercise routines and improve long-term engagement rates. This trend shows 73% consumer interest in AI-powered fitness features.

Ecosystem connectivity has become crucial for market success, with consumers expecting seamless integration across devices and platforms. Smart home integration allows fitness rings to connect with home automation systems, creating comprehensive wellness environments.

Sustainability focus influences product development and marketing strategies as environmentally conscious consumers seek eco-friendly fitness solutions. Recyclable materials and energy-efficient designs are becoming important differentiating factors in purchasing decisions.

Subscription service models are gaining traction as companies seek recurring revenue streams beyond hardware sales. Content subscriptions offering new workouts, challenges, and features provide ongoing value to users while supporting business sustainability.

Product launches have accelerated with major technology companies introducing innovative fitness ring solutions targeting different market segments. Feature enhancements focus on improved sensor accuracy, extended battery life, and enhanced software capabilities to address user feedback and competitive pressures.

Strategic partnerships between technology companies and fitness content providers have expanded product ecosystems and user engagement opportunities. MarkWide Research analysis indicates that partnership strategies contribute to 23% higher user retention rates compared to standalone product offerings.

Distribution expansion efforts have improved product availability across GCC markets through new retail partnerships and e-commerce platform integration. Localization initiatives include Arabic language support, culturally appropriate content, and region-specific marketing campaigns.

Investment activity in the fitness technology sector has increased, supporting innovation and market expansion efforts. Venture capital funding for fitness ring startups and related technologies demonstrates investor confidence in market growth potential.

Regulatory developments include new health data protection guidelines and fitness device certification requirements that influence product development and market entry strategies. Compliance initiatives ensure consumer protection while supporting market credibility and trust.

Market entry strategies should prioritize consumer education and demonstration programs to address awareness barriers and showcase product benefits effectively. Retail partnerships with established electronics and fitness retailers provide credibility and market access advantages for new entrants.

Product development focus should emphasize user experience optimization, battery life improvement, and ecosystem integration capabilities. Cultural sensitivity in product design and marketing approaches will be crucial for success across diverse GCC markets.

Pricing strategies must balance feature differentiation with market accessibility to maximize adoption across different consumer segments. Value proposition communication should emphasize long-term health benefits and cost-effectiveness compared to alternative fitness solutions.

Distribution channel optimization should leverage both online and offline channels to reach different consumer preferences and shopping behaviors. E-commerce capabilities are essential for market reach and direct consumer engagement opportunities.

Partnership development with healthcare providers, corporate wellness programs, and educational institutions can expand market applications and create sustainable growth opportunities. Content partnerships enhance product value and user engagement while supporting differentiation strategies.

Market trajectory indicates continued strong growth driven by increasing health consciousness, technology advancement, and supportive demographic trends. MWR projections suggest the market will experience robust expansion with compound annual growth rates exceeding 12% over the next five years.

Technology evolution will focus on enhanced sensor capabilities, improved artificial intelligence integration, and expanded ecosystem connectivity. Next-generation features may include biometric authentication, advanced health monitoring, and virtual coaching capabilities that further differentiate products and enhance user value.

Market maturation will likely result in increased competition, product standardization, and price optimization across different segments. Consolidation activities may occur as smaller players seek partnerships or acquisition opportunities with larger technology companies.

Regional expansion opportunities exist as market awareness increases and distribution infrastructure develops in underserved areas. Government wellness initiatives will continue supporting market growth through policy frameworks and public health programs.

Innovation focus will shift toward personalization, medical applications, and integration with broader health ecosystems. Healthcare partnerships and clinical validation studies will become increasingly important for premium market positioning and medical market penetration.

The GCC fitness ring market represents a dynamic and rapidly evolving segment within the regional fitness technology landscape. Strong market fundamentals including favorable demographics, increasing health consciousness, and government wellness support create excellent conditions for continued growth and innovation.

Market opportunities extend across multiple segments and applications, from individual consumer fitness to corporate wellness programs and healthcare integration. Technology advancement continues to drive product differentiation and user experience enhancement, supporting premium positioning and market expansion strategies.

Success factors for market participants include consumer education, product innovation, ecosystem integration, and strategic partnerships. Cultural sensitivity and regional market adaptation will be crucial for maximizing adoption across diverse GCC consumer segments.

The future outlook remains highly positive, with continued growth expected across all major market segments and geographic regions. Investment in innovation, distribution infrastructure, and consumer engagement will determine competitive positioning and long-term market success in this promising and rapidly expanding market.

What is Fitness Ring?

Fitness Rings are wearable devices designed to monitor various health metrics such as heart rate, activity levels, and sleep patterns. They are increasingly popular among fitness enthusiasts and health-conscious individuals in the GCC region.

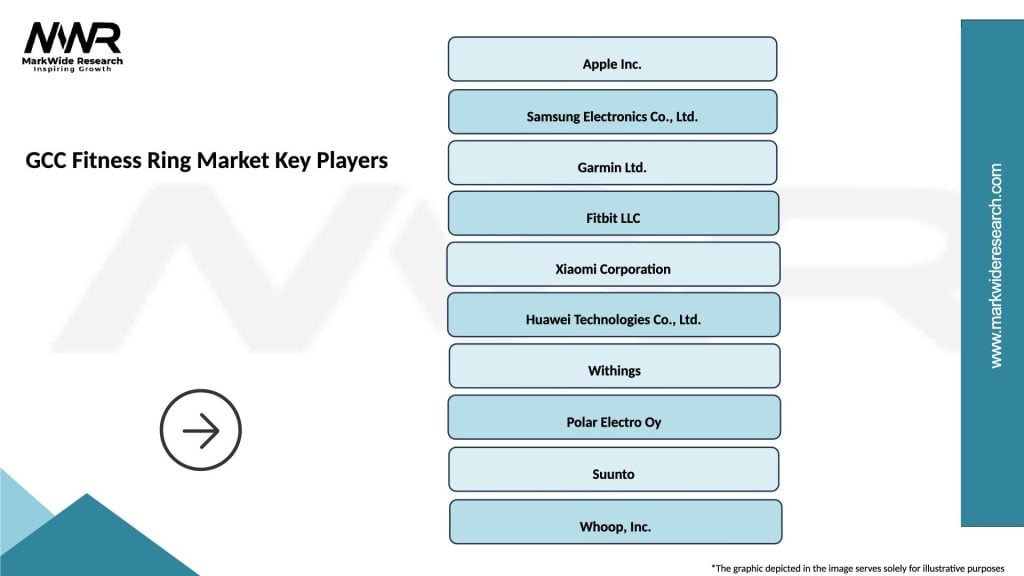

What are the key players in the GCC Fitness Ring Market?

Key players in the GCC Fitness Ring Market include Fitbit, Garmin, Xiaomi, and Apple, which offer a range of fitness tracking devices with advanced features. These companies are competing to innovate and capture market share in the growing health and wellness sector.

What are the main drivers of growth in the GCC Fitness Ring Market?

The growth of the GCC Fitness Ring Market is driven by increasing health awareness, rising disposable incomes, and a growing trend towards fitness and wellness. Additionally, the integration of advanced technology in fitness rings enhances user experience and engagement.

What challenges does the GCC Fitness Ring Market face?

The GCC Fitness Ring Market faces challenges such as data privacy concerns and the high cost of advanced fitness tracking devices. Additionally, competition from alternative fitness solutions can impact market growth.

What opportunities exist in the GCC Fitness Ring Market?

Opportunities in the GCC Fitness Ring Market include the potential for partnerships with health organizations and the expansion of product features such as personalized health insights. The increasing popularity of fitness apps also presents avenues for growth.

What trends are shaping the GCC Fitness Ring Market?

Trends in the GCC Fitness Ring Market include the rise of smart wearables with integrated health monitoring features and the growing focus on holistic health management. Additionally, sustainability in product design is becoming increasingly important to consumers.

GCC Fitness Ring Market

| Segmentation Details | Description |

|---|---|

| Product Type | Smart Rings, Fitness Trackers, Health Monitors, Sleep Trackers |

| Technology | Bluetooth, NFC, GPS, Heart Rate Monitoring |

| End User | Fitness Enthusiasts, Health-Conscious Individuals, Athletes, Casual Users |

| Distribution Channel | Online Retail, Specialty Stores, Fitness Centers, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the GCC Fitness Ring Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at