444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The GCC firefighting foam market represents a critical component of the region’s fire safety infrastructure, experiencing substantial growth driven by increasing industrial activities and stringent safety regulations. The Gulf Cooperation Council countries, including Saudi Arabia, UAE, Qatar, Kuwait, Bahrain, and Oman, are witnessing unprecedented expansion in their petrochemical, oil and gas, and construction sectors, creating significant demand for advanced firefighting foam solutions.

Market dynamics indicate that the region’s focus on industrial diversification and infrastructure development is propelling the adoption of sophisticated fire suppression systems. The GCC’s strategic position as a global energy hub necessitates robust fire safety measures, particularly in high-risk environments such as refineries, chemical plants, and offshore platforms. Firefighting foam technology has evolved considerably, with manufacturers developing environmentally friendly formulations that maintain superior fire suppression capabilities while addressing environmental concerns.

Regional growth patterns show that the market is expanding at a compound annual growth rate of 6.2%, driven by increasing investments in industrial safety infrastructure and growing awareness of fire hazards in various sectors. The adoption of advanced foam concentrates and delivery systems is particularly notable in the petrochemical industry, where fire risks are inherently high and regulatory compliance is mandatory.

The GCC firefighting foam market refers to the comprehensive ecosystem of fire suppression products, technologies, and services specifically designed to combat liquid fuel fires and other hazardous fire scenarios across the Gulf Cooperation Council region. This market encompasses various types of foam concentrates, delivery systems, and associated equipment used in industrial, commercial, and municipal fire protection applications.

Firefighting foam operates by creating a blanket over burning liquids, effectively separating the fuel from oxygen and suppressing vapor formation. The technology involves specialized chemical formulations that expand when mixed with water and air, creating a stable foam layer that provides superior fire suppression compared to water alone. Modern foam systems incorporate advanced surfactants and additives that enhance their effectiveness while reducing environmental impact.

The market includes several categories of foam products, including aqueous film-forming foam (AFFF), alcohol-resistant foam, protein-based foam, and synthetic foam concentrates. Each type serves specific applications and fire scenarios, with selection depending on factors such as fuel type, environmental conditions, and regulatory requirements. Delivery mechanisms range from portable foam generators to sophisticated fixed installation systems integrated into industrial facilities.

Strategic analysis of the GCC firefighting foam market reveals a dynamic landscape characterized by technological innovation, regulatory evolution, and increasing industrial safety awareness. The region’s commitment to diversifying its economy beyond oil dependency has led to substantial investments in manufacturing, petrochemicals, and infrastructure development, all of which require comprehensive fire protection systems.

Key market drivers include the expansion of industrial facilities, implementation of stringent fire safety regulations, and growing adoption of environmentally sustainable foam formulations. The market is witnessing a shift toward fluorine-free foam alternatives, driven by environmental regulations and corporate sustainability initiatives. This transition represents both a challenge and opportunity for market participants.

Competitive dynamics show that international manufacturers are establishing stronger regional presence through partnerships and local distribution networks. The market benefits from increasing government investments in emergency response capabilities and industrial safety infrastructure. Technology advancement is evident in the development of more effective foam concentrates that require lower application rates while maintaining superior fire suppression performance.

Regional variations exist across GCC countries, with Saudi Arabia and UAE leading in market size due to their extensive industrial base, while Qatar and Kuwait show strong growth in specialized applications related to their energy sectors. The market outlook remains positive, supported by ongoing infrastructure projects and increasing focus on occupational safety standards.

Market intelligence reveals several critical insights that shape the GCC firefighting foam landscape. The region’s unique industrial profile, dominated by oil and gas operations, creates specific requirements for fire suppression systems that can handle hydrocarbon fires effectively.

Industrial expansion across the GCC region serves as the primary catalyst for firefighting foam market growth. The ongoing development of new petrochemical complexes, refineries, and manufacturing facilities creates substantial demand for comprehensive fire protection systems. Government initiatives supporting economic diversification have led to increased industrial activity, particularly in sectors with elevated fire risks.

Regulatory enforcement has intensified significantly, with authorities implementing stricter fire safety standards and mandatory compliance requirements. The adoption of international safety standards, including NFPA and API guidelines, has created a more structured approach to fire protection system design and implementation. Insurance requirements also drive demand, as coverage providers mandate specific fire suppression capabilities for high-risk facilities.

Technological advancement in foam formulations and delivery systems continues to drive market evolution. Manufacturers are developing more effective concentrates that provide superior fire suppression performance while addressing environmental concerns. Smart foam systems incorporating IoT connectivity and automated monitoring capabilities are gaining traction among technologically advanced facilities.

Safety awareness has increased dramatically following several high-profile industrial incidents globally. Organizations are investing more heavily in comprehensive fire protection systems, including advanced foam suppression capabilities. Corporate responsibility initiatives emphasize worker safety and environmental protection, driving adoption of more sophisticated fire suppression technologies.

Environmental concerns represent a significant challenge for the firefighting foam market, particularly regarding traditional AFFF formulations containing per- and polyfluoroalkyl substances (PFAS). Regulatory restrictions on fluorinated foam products are increasing across the region, creating uncertainty for end-users and suppliers. Compliance costs associated with transitioning to alternative formulations can be substantial for existing installations.

High implementation costs pose barriers for smaller industrial facilities and organizations with limited capital budgets. The initial investment required for comprehensive foam systems, including storage tanks, proportioning equipment, and delivery infrastructure, can be prohibitive. Maintenance expenses add to the total cost of ownership, requiring specialized expertise and regular system testing.

Technical complexity in system design and operation requires specialized knowledge that may not be readily available in all markets. The need for proper training and certification adds to implementation challenges, particularly for organizations without extensive fire safety experience. Integration difficulties with existing fire protection infrastructure can complicate upgrade projects.

Supply chain constraints occasionally impact product availability and pricing, particularly for specialized foam concentrates and equipment components. The reliance on international suppliers for certain products creates vulnerability to global supply disruptions. Quality variations among different suppliers can affect system performance and reliability.

Sustainable technology development presents significant opportunities for innovation in fluorine-free foam formulations. The growing demand for environmentally friendly alternatives creates market space for manufacturers who can develop effective PFAS-free products. Green building initiatives and sustainability certifications increasingly favor eco-friendly fire suppression systems.

Digital integration opportunities exist in developing smart foam systems with advanced monitoring and control capabilities. IoT-enabled systems can provide real-time performance data, predictive maintenance alerts, and automated response protocols. Data analytics applications can optimize foam system performance and reduce operational costs.

Training and certification services represent a growing market segment as organizations seek to ensure proper system operation and regulatory compliance. Professional development programs for fire safety personnel create additional revenue streams for market participants. Consulting services for system design and optimization are increasingly valued by end-users.

Regional manufacturing opportunities exist for establishing local production facilities to serve the GCC market more effectively. Local manufacturing can reduce costs, improve supply chain reliability, and provide better customer support. Partnership opportunities with regional distributors and service providers can enhance market penetration.

Supply and demand dynamics in the GCC firefighting foam market are influenced by cyclical industrial investment patterns and regulatory changes. The market experiences periods of accelerated growth during major industrial development phases, followed by consolidation periods focused on system optimization and maintenance. Demand patterns vary significantly between different industry sectors and geographic regions within the GCC.

Competitive pressures are intensifying as international manufacturers establish stronger regional presence and local companies develop enhanced capabilities. Price competition is balanced by quality requirements and technical support needs, creating opportunities for differentiation through superior products and services. Innovation cycles are accelerating as manufacturers respond to environmental regulations and performance requirements.

Regulatory dynamics continue to evolve, with authorities implementing more stringent environmental and safety standards. The transition away from PFAS-containing foams is creating market disruption while opening opportunities for alternative technologies. Compliance timelines vary across different jurisdictions, creating complex implementation challenges for multinational organizations.

Technology adoption rates vary significantly across different market segments, with large industrial facilities typically leading in advanced system implementation. Smaller organizations often lag in adoption due to cost constraints and limited technical expertise. Market maturation is evident in increasing focus on system optimization and lifecycle management rather than just initial installation.

Comprehensive market analysis was conducted using multiple research approaches to ensure accuracy and reliability of findings. Primary research involved extensive interviews with industry stakeholders, including foam manufacturers, distributors, end-users, and regulatory officials across all GCC countries. Secondary research incorporated analysis of industry reports, regulatory documents, and company financial statements.

Data collection methods included structured surveys of key market participants, in-depth interviews with industry experts, and analysis of import/export statistics for foam products and equipment. Market sizing was validated through multiple approaches, including top-down analysis based on industrial capacity and bottom-up assessment of individual market segments. Quality assurance procedures ensured data accuracy and consistency across different sources.

Regional analysis was conducted through country-specific research, accounting for local market conditions, regulatory environments, and industrial characteristics. Cross-validation of findings was performed through triangulation of different data sources and methodologies. Trend analysis incorporated historical data spanning five years to identify patterns and project future developments.

Expert validation was conducted through review panels comprising industry professionals, regulatory specialists, and technical experts. Findings were tested against known market conditions and validated through comparison with related market segments. Continuous monitoring ensures ongoing accuracy of market intelligence and identification of emerging trends.

Saudi Arabia dominates the GCC firefighting foam market, accounting for approximately 40% of regional demand, driven by its extensive petrochemical industry and ongoing industrial diversification initiatives. The kingdom’s Vision 2030 program has accelerated investments in new industrial facilities, creating substantial demand for advanced fire protection systems. NEOM and other megaprojects are incorporating state-of-the-art fire suppression technologies from the design phase.

United Arab Emirates represents the second-largest market, with strong demand from both industrial and commercial sectors. Dubai’s position as a regional business hub and Abu Dhabi’s industrial development have created diverse market opportunities. Free zone developments and logistics facilities are increasingly adopting sophisticated foam systems to meet international safety standards.

Qatar shows robust growth driven by LNG facilities and infrastructure development related to major sporting events and economic diversification. The country’s focus on industrial safety and environmental protection has led to adoption of advanced foam technologies. Industrial cities and petrochemical complexes represent key demand centers.

Kuwait maintains steady demand primarily from oil and gas operations, with increasing focus on refinery upgrades and petrochemical expansion. The country’s industrial safety regulations have become more stringent, driving adoption of modern foam systems. Port facilities and storage terminals represent growing market segments.

Bahrain and Oman represent smaller but growing markets, with Bahrain focusing on aluminum production and financial services infrastructure, while Oman emphasizes oil and gas operations and industrial diversification. Both countries are implementing enhanced safety standards that support foam market growth.

Market leadership is shared among several international manufacturers who have established strong regional presence through local partnerships and distribution networks. The competitive environment is characterized by ongoing innovation in foam formulations and delivery systems, with companies investing heavily in research and development to meet evolving market requirements.

Competitive strategies focus on product differentiation through advanced formulations, comprehensive service offerings, and strong technical support. Companies are investing in local manufacturing capabilities and regional research facilities to better serve GCC market requirements. Strategic partnerships with local distributors and engineering firms are common approaches to market penetration.

Product type segmentation reveals distinct market preferences based on application requirements and regulatory considerations. The market encompasses various foam concentrate types, each serving specific fire suppression needs and industrial applications.

By Foam Type:

By Application:

By End-User:

Industrial applications dominate the GCC firefighting foam market, with petrochemical and oil and gas facilities representing the largest consumption categories. These facilities require specialized foam systems capable of handling large-scale hydrocarbon fires and meeting stringent safety regulations. System complexity in industrial applications often involves integrated fire detection, alarm, and suppression systems with automated foam delivery capabilities.

Aviation sector requirements focus on rapid fire suppression capabilities for aircraft rescue and firefighting operations. Airport facilities require specialized foam vehicles and fixed installation systems designed for aviation fuel fires. Performance standards in aviation applications are particularly stringent, requiring foam products that meet international aviation safety specifications.

Marine applications present unique challenges related to saltwater environments and space constraints aboard vessels. Port facilities require large-capacity foam systems for cargo handling areas and fuel storage facilities. Offshore platforms represent specialized applications requiring compact, reliable foam systems capable of operating in harsh marine environments.

Commercial building applications are growing as building codes increasingly require foam suppression systems in high-risk areas such as parking garages, mechanical rooms, and storage areas. Integration requirements with building management systems and fire alarm networks add complexity to commercial installations.

Emergency services applications focus on mobile foam delivery systems and training requirements for fire department personnel. Municipal fire departments are investing in specialized foam equipment and training programs to enhance their capability to handle industrial and transportation-related incidents.

Enhanced safety performance represents the primary benefit for end-users implementing advanced foam suppression systems. Modern foam technologies provide superior fire suppression capabilities compared to traditional water-based systems, particularly for liquid fuel fires. Risk reduction translates directly into lower insurance premiums and reduced potential for catastrophic losses.

Regulatory compliance benefits include meeting mandatory fire safety standards and avoiding potential penalties or operational restrictions. Comprehensive foam systems help organizations demonstrate due diligence in fire safety management and environmental protection. Certification advantages support international business operations and supply chain requirements.

Operational efficiency improvements result from automated foam systems that reduce response time and manual intervention requirements during fire incidents. Advanced monitoring capabilities provide real-time system status information and predictive maintenance alerts. Integration capabilities with existing safety systems enhance overall facility protection.

Environmental benefits are increasingly important as organizations adopt fluorine-free foam alternatives and implement sustainable fire protection practices. Modern foam systems often require lower application rates, reducing water usage and environmental impact. Waste reduction through improved system efficiency supports corporate sustainability goals.

Economic advantages include reduced fire damage potential, lower insurance costs, and improved operational continuity. Professional maintenance programs extend system life and ensure reliable performance. Training benefits enhance personnel capabilities and career development opportunities in fire safety management.

Strengths:

Weaknesses:

Opportunities:

Threats:

Environmental sustainability has emerged as the dominant trend shaping the GCC firefighting foam market. The transition away from PFAS-containing foams is accelerating, driven by regulatory pressure and corporate environmental responsibility initiatives. Fluorine-free alternatives are gaining market acceptance as their performance characteristics improve and cost differentials narrow.

Digital transformation is revolutionizing foam system monitoring and management capabilities. IoT-enabled systems provide real-time performance data, automated testing protocols, and predictive maintenance alerts. Smart integration with building management systems and emergency response networks enhances overall safety system effectiveness.

Customization trends reflect increasing demand for application-specific foam formulations and delivery systems. Manufacturers are developing specialized products for unique industrial processes and environmental conditions. Modular system designs allow for flexible installation and future expansion capabilities.

Training emphasis has intensified as organizations recognize the importance of proper foam system operation and maintenance. Professional certification programs and hands-on training facilities are expanding across the region. Simulation technologies are being incorporated into training programs to provide realistic experience without actual fire risks.

Service integration trends show increasing demand for comprehensive service packages including design, installation, maintenance, and training. End-users prefer single-source solutions that ensure system reliability and regulatory compliance. Performance guarantees and outcome-based service contracts are becoming more common.

Regulatory evolution continues to shape market development, with several GCC countries implementing updated fire safety codes that mandate foam suppression systems in specific applications. Environmental regulations are becoming more stringent, particularly regarding PFAS-containing products, driving innovation in alternative formulations.

Technology advancement has accelerated, with manufacturers introducing new fluorine-free foam concentrates that match or exceed the performance of traditional AFFF products. Delivery system innovations include more efficient proportioning equipment and automated monitoring capabilities that reduce maintenance requirements.

Market consolidation activities have increased as larger manufacturers acquire specialized foam companies to expand their product portfolios and regional capabilities. Strategic partnerships between international manufacturers and local distributors are becoming more sophisticated, often including technology transfer and training components.

Investment activities in regional manufacturing facilities have increased, with several companies announcing plans to establish production capabilities within the GCC. Research and development investments are focusing on region-specific formulations that address local climate and application conditions.

Certification programs have expanded significantly, with international training organizations establishing regional facilities and local partnerships. Professional development initiatives are creating career pathways for fire safety specialists and foam system technicians.

Strategic positioning recommendations for market participants emphasize the importance of developing comprehensive environmental compliance strategies. Companies should invest in fluorine-free foam technology development and establish clear transition timelines for PFAS-containing products. MarkWide Research analysis indicates that early movers in sustainable foam technology will gain significant competitive advantages.

Market entry strategies should focus on building strong local partnerships and establishing regional service capabilities. International manufacturers should consider joint ventures or acquisitions to gain market access and local expertise. Distribution network development is critical for success in the fragmented GCC market.

Product development priorities should address the growing demand for smart foam systems with integrated monitoring and control capabilities. Investment in IoT technology and data analytics capabilities will differentiate products in an increasingly competitive market. Customization capabilities for specific industrial applications represent important growth opportunities.

Service expansion recommendations include developing comprehensive training programs and certification services. Organizations that can provide complete solutions including design, installation, maintenance, and training will capture greater market share. Digital service platforms can enhance customer engagement and system performance monitoring.

Risk management strategies should address supply chain vulnerabilities and regulatory compliance requirements. Companies should diversify supplier networks and establish regional inventory capabilities to ensure product availability. Regulatory monitoring systems are essential for anticipating and responding to changing compliance requirements.

Market trajectory for the GCC firefighting foam market remains positive, supported by continued industrial development and increasing safety awareness. The transition to environmentally sustainable foam products will create both challenges and opportunities for market participants. Growth projections indicate sustained expansion driven by new industrial projects and system upgrade requirements.

Technology evolution will continue to focus on environmental sustainability and performance optimization. Fluorine-free foam formulations are expected to achieve performance parity with traditional products within the next few years. Smart system integration will become standard in new installations, providing enhanced monitoring and control capabilities.

Regulatory development will likely accelerate the phase-out of PFAS-containing foams, creating market opportunities for alternative technologies. MWR projections suggest that environmental compliance will become a primary differentiator among foam suppliers. International harmonization of standards may simplify compliance requirements across GCC countries.

Market structure evolution may include increased consolidation as companies seek to achieve scale advantages and comprehensive service capabilities. Regional manufacturing development will likely accelerate, reducing dependence on international supply chains. Innovation investment will focus on developing products specifically designed for GCC climate and application conditions.

End-user trends indicate growing sophistication in foam system selection and operation. Organizations are increasingly viewing foam systems as integrated components of comprehensive safety management programs rather than standalone fire suppression equipment. Performance expectations continue to rise as users demand greater reliability, environmental compliance, and operational efficiency.

The GCC firefighting foam market represents a dynamic and evolving sector driven by industrial growth, regulatory development, and technological innovation. The region’s strategic importance as a global energy hub creates sustained demand for advanced fire suppression capabilities, while environmental concerns are reshaping product development priorities and market dynamics.

Market fundamentals remain strong, supported by ongoing industrial development, infrastructure investment, and increasing safety awareness. The transition to environmentally sustainable foam products presents both challenges and opportunities, requiring market participants to balance performance requirements with environmental compliance. Technology advancement in fluorine-free formulations and smart system integration will define competitive success in the coming years.

Strategic success in this market requires comprehensive understanding of regional requirements, strong local partnerships, and commitment to innovation in sustainable technologies. Companies that can provide integrated solutions combining advanced products, comprehensive services, and technical expertise will capture the greatest market opportunities. The future outlook remains positive for organizations positioned to navigate the evolving regulatory landscape while meeting the sophisticated fire protection needs of the GCC’s diverse industrial base.

What is Firefighting Foam?

Firefighting foam is a specialized fire suppression agent that is used to extinguish flammable liquid fires. It works by forming a blanket over the fuel surface, preventing oxygen from reaching the flames and cooling the fire.

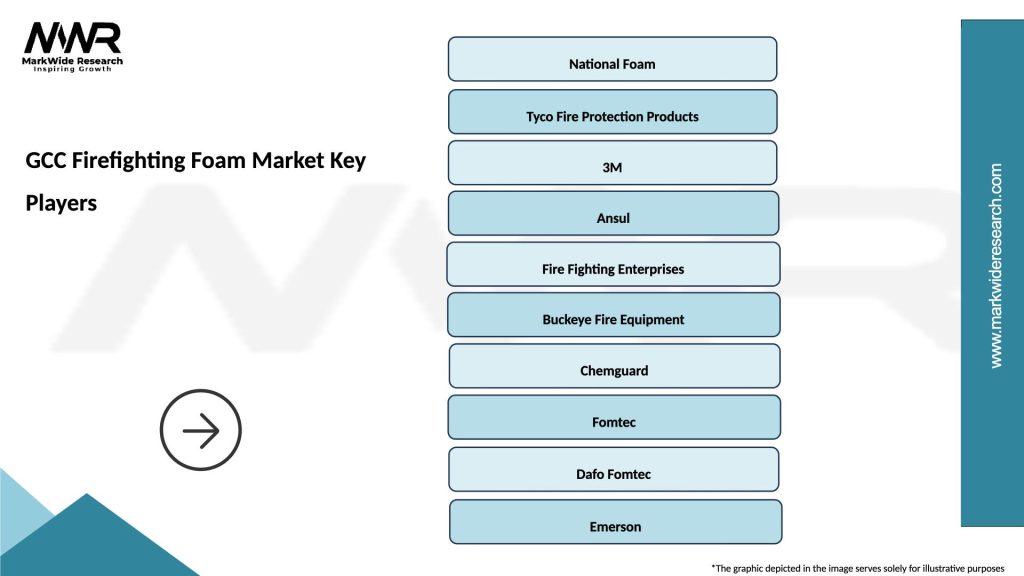

What are the key players in the GCC Firefighting Foam Market?

Key players in the GCC Firefighting Foam Market include companies such as Tyco Fire Protection Products, National Foam, and 3M, which are known for their innovative firefighting solutions and extensive product lines, among others.

What are the main drivers of the GCC Firefighting Foam Market?

The GCC Firefighting Foam Market is driven by increasing industrialization, stringent fire safety regulations, and the growing demand for effective fire suppression systems in sectors like oil and gas, aviation, and manufacturing.

What challenges does the GCC Firefighting Foam Market face?

Challenges in the GCC Firefighting Foam Market include environmental concerns regarding the use of certain foam chemicals, regulatory compliance issues, and the high costs associated with advanced firefighting technologies.

What opportunities exist in the GCC Firefighting Foam Market?

Opportunities in the GCC Firefighting Foam Market include the development of eco-friendly foam formulations, advancements in firefighting technology, and the expansion of fire safety regulations across various industries.

What trends are shaping the GCC Firefighting Foam Market?

Trends in the GCC Firefighting Foam Market include the increasing adoption of fluorine-free foams, innovations in foam application techniques, and a growing focus on sustainability and environmental impact in firefighting practices.

GCC Firefighting Foam Market

| Segmentation Details | Description |

|---|---|

| Product Type | Aqueous Film-Forming Foam, Protein Foam, Fluorine-Free Foam, Alcohol-Resistant Foam |

| Application | Aviation, Marine, Industrial, Residential |

| End User | Fire Departments, Oil & Gas, Manufacturing, Military |

| Distribution Channel | Direct Sales, Online Retail, Distributors, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the GCC Firefighting Foam Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at