444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The GCC feed premix market represents a critical component of the region’s rapidly expanding livestock and aquaculture industries. Feed premixes serve as essential nutritional supplements that combine vitamins, minerals, amino acids, and other vital nutrients to enhance animal health and productivity. The Gulf Cooperation Council region, comprising Saudi Arabia, UAE, Qatar, Kuwait, Oman, and Bahrain, has witnessed remarkable growth in this sector driven by increasing meat consumption, government initiatives promoting food security, and rising awareness about animal nutrition.

Market dynamics in the GCC region reflect a growing emphasis on sustainable agriculture and livestock production. The feed premix industry has experienced significant expansion with adoption rates reaching 78% among commercial livestock operations across the region. This growth trajectory is supported by substantial investments in modern farming techniques and the implementation of advanced nutritional programs designed to optimize animal performance.

Regional demand patterns indicate strong market momentum, particularly in poultry and dairy sectors where premix utilization has become standard practice. The market demonstrates robust growth potential with increasing focus on feed efficiency, animal welfare standards, and the development of specialized premix formulations tailored to local climate conditions and livestock requirements.

The GCC feed premix market refers to the commercial sector encompassing the production, distribution, and utilization of concentrated nutritional supplements designed for animal feed applications across the Gulf Cooperation Council countries. These premixes contain carefully balanced combinations of essential nutrients that are added to base feed ingredients to create complete, nutritionally adequate animal diets.

Feed premixes typically consist of vitamins, minerals, amino acids, enzymes, probiotics, and other bioactive compounds that support optimal animal growth, reproduction, and immune function. The market encompasses various product categories including vitamin premixes, mineral premixes, amino acid premixes, and specialty formulations designed for specific animal species and production systems.

Commercial applications span across multiple livestock sectors including poultry, cattle, sheep, goats, camels, and aquaculture species. The market serves both large-scale commercial operations and smaller traditional farming enterprises, providing standardized nutritional solutions that enhance feed conversion efficiency and animal productivity while reducing production costs and environmental impact.

Strategic market analysis reveals the GCC feed premix market as a dynamic and rapidly evolving sector characterized by strong growth fundamentals and increasing technological sophistication. The market benefits from favorable demographic trends, rising disposable incomes, and growing consumer demand for high-quality animal protein products across the region.

Key growth drivers include government initiatives promoting food security, increasing livestock populations, and rising awareness about the importance of proper animal nutrition. The market has demonstrated resilience with consistent annual growth rates exceeding 6.5% over the past five years, supported by continuous innovation in premix formulations and delivery systems.

Competitive landscape features a mix of international and regional players offering comprehensive product portfolios and technical support services. Market leaders focus on developing customized solutions that address specific regional challenges including heat stress management, water quality issues, and local feed ingredient availability.

Future prospects remain highly positive with anticipated expansion driven by increasing meat consumption, growing aquaculture sector, and rising adoption of precision nutrition technologies. The market is expected to benefit from ongoing investments in livestock infrastructure and the implementation of advanced feed management systems across the region.

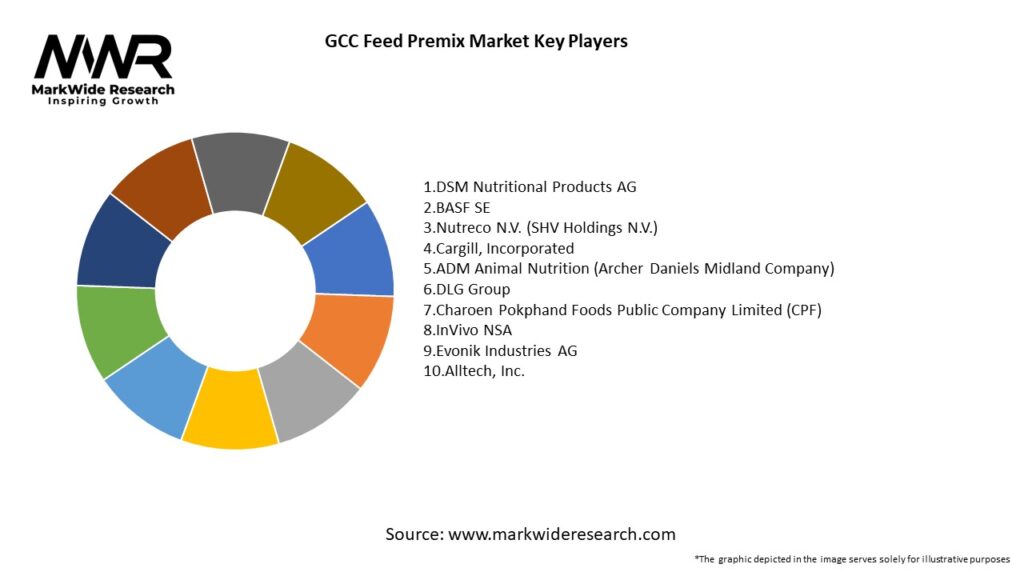

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Market intelligence reveals several critical insights that define the current state and future trajectory of the GCC feed premix market:

Primary growth catalysts propelling the GCC feed premix market include multiple interconnected factors that create a favorable environment for sustained expansion. The increasing focus on food security initiatives across Gulf nations has led to substantial investments in domestic livestock production capabilities, directly driving demand for high-quality feed supplements.

Population growth and rising urbanization throughout the region contribute significantly to increased meat and dairy consumption patterns. This demographic shift creates sustained demand pressure on livestock producers to enhance productivity and efficiency through improved nutrition programs. The growing middle class demonstrates increasing preference for premium animal protein products, encouraging producers to adopt advanced feeding strategies.

Government support programs play a crucial role in market development through subsidies, technical assistance, and infrastructure development initiatives. National food security strategies emphasize the importance of domestic livestock production, creating favorable policy environments that encourage premix adoption and technological advancement.

Climate adaptation requirements drive innovation in premix formulations designed to help animals cope with extreme heat conditions prevalent in the region. Specialized heat stress management premixes have become essential tools for maintaining animal productivity during challenging environmental conditions, creating new market opportunities for targeted nutritional solutions.

Significant challenges facing the GCC feed premix market include various factors that may limit growth potential and market penetration. High import dependency for raw materials creates vulnerability to global supply chain disruptions and price volatility, particularly affecting smaller market participants with limited purchasing power.

Regulatory complexity across different GCC countries creates compliance challenges for manufacturers and distributors operating in multiple markets. Varying standards and approval processes can delay product launches and increase operational costs, particularly for innovative formulations requiring extensive testing and documentation.

Traditional farming practices in certain segments of the livestock industry present resistance to modern nutrition programs. Some producers, particularly in rural areas, maintain preference for conventional feeding methods and may be hesitant to invest in premix technologies due to cost considerations or lack of technical knowledge.

Price sensitivity among cost-conscious producers creates pressure on premix manufacturers to balance product quality with affordability. Economic fluctuations and commodity price volatility can impact purchasing decisions, particularly during periods of reduced profitability in livestock operations.

Emerging opportunities in the GCC feed premix market present substantial potential for growth and innovation. The expanding aquaculture sector offers significant untapped potential, with fish and shrimp farming operations increasingly adopting specialized premix formulations to optimize growth rates and disease resistance.

Precision nutrition technologies create opportunities for developing customized premix solutions based on real-time animal performance data and environmental conditions. Integration of IoT sensors, data analytics, and artificial intelligence enables the creation of dynamic nutrition programs that adjust premix compositions based on specific farm conditions and production goals.

Organic and natural products represent a growing market segment driven by consumer preferences for sustainably produced animal products. Development of organic-certified premixes and natural alternatives to synthetic additives presents opportunities for premium positioning and higher profit margins.

Regional manufacturing expansion offers opportunities to reduce costs, improve supply chain reliability, and develop products specifically tailored to local market requirements. Establishing local production facilities can provide competitive advantages through reduced logistics costs and faster response to market demands.

Complex market dynamics shape the competitive landscape and growth patterns within the GCC feed premix market. Supply chain relationships between raw material suppliers, premix manufacturers, feed mills, and livestock producers create intricate value networks that influence pricing, product availability, and market access.

Technological advancement drives continuous evolution in premix formulations and delivery systems. Innovation in microencapsulation, slow-release technologies, and bioavailability enhancement creates opportunities for product differentiation and improved animal performance outcomes. Research and development investments focus on developing climate-adapted formulations and species-specific solutions.

Market consolidation trends reflect the increasing importance of scale economies and technical expertise in competitive positioning. Larger companies leverage their resources to invest in research facilities, quality control systems, and technical support services, while smaller players focus on niche markets and specialized applications.

Customer relationship management becomes increasingly important as producers seek comprehensive nutrition solutions rather than simple product transactions. Technical support services, training programs, and performance monitoring systems add value beyond the physical premix products, creating opportunities for long-term partnerships and customer loyalty.

Comprehensive research approach employed in analyzing the GCC feed premix market combines multiple data collection and analysis methodologies to ensure accuracy and reliability of market insights. Primary research activities include extensive interviews with industry stakeholders, including premix manufacturers, feed mill operators, livestock producers, and regulatory officials across all GCC countries.

Secondary research components encompass analysis of government statistics, industry reports, trade publications, and academic studies related to animal nutrition and livestock production in the Gulf region. Data validation processes involve cross-referencing multiple sources and conducting follow-up interviews to verify key findings and market trends.

Quantitative analysis utilizes statistical modeling techniques to project market trends and growth patterns based on historical data and identified market drivers. Market sizing methodologies consider production volumes, consumption patterns, import/export statistics, and pricing trends to develop comprehensive market assessments.

Qualitative insights are gathered through in-depth discussions with industry experts, technical specialists, and market participants to understand underlying market dynamics, competitive strategies, and future development prospects. This approach provides context for quantitative findings and helps identify emerging trends and opportunities.

Saudi Arabia dominates the regional market landscape, accounting for approximately 42% of total GCC premix consumption. The Kingdom’s large livestock population, government support for agricultural development, and substantial investments in modern farming infrastructure create a robust demand environment. Major poultry and dairy operations drive significant premix consumption, while emerging aquaculture projects present new growth opportunities.

United Arab Emirates serves as the regional hub for premix manufacturing and distribution, leveraging its strategic location and advanced logistics infrastructure. The UAE market demonstrates high adoption rates of premium and specialized premix products, with 85% of commercial operations utilizing advanced nutrition programs. Dubai and Abu Dhabi function as key import and re-export centers serving the broader GCC market.

Qatar shows strong market growth driven by food security initiatives and investments in domestic livestock production. The country’s focus on reducing import dependency has led to increased adoption of high-efficiency premix formulations designed to maximize local production capabilities. Government support programs encourage technology adoption and modern farming practices.

Kuwait demonstrates steady market development with growing emphasis on poultry and dairy sectors. The market benefits from increasing consumer awareness about food quality and safety, driving demand for premium animal products produced using advanced nutrition programs. Local distributors play important roles in market development and technical support services.

Oman and Bahrain represent smaller but growing markets with significant potential for expansion. Both countries focus on developing sustainable livestock production systems adapted to local environmental conditions, creating opportunities for specialized premix formulations and technical support services.

Market leadership in the GCC feed premix sector is characterized by a diverse mix of international corporations, regional manufacturers, and specialized suppliers offering comprehensive product portfolios and technical support services. The competitive environment emphasizes innovation, quality assurance, and customer relationship management as key differentiating factors.

Major international players leverage their global research and development capabilities to introduce advanced premix technologies and formulations specifically adapted to GCC market requirements:

Regional manufacturers play increasingly important roles by developing products tailored to local market conditions and providing competitive pricing structures. These companies often focus on specific market segments or geographic areas, building strong relationships with local feed mills and livestock producers.

Competitive strategies emphasize product differentiation through specialized formulations, comprehensive technical support services, and integrated nutrition management systems. Companies invest heavily in research and development to create innovative solutions addressing specific regional challenges such as heat stress management and water quality issues.

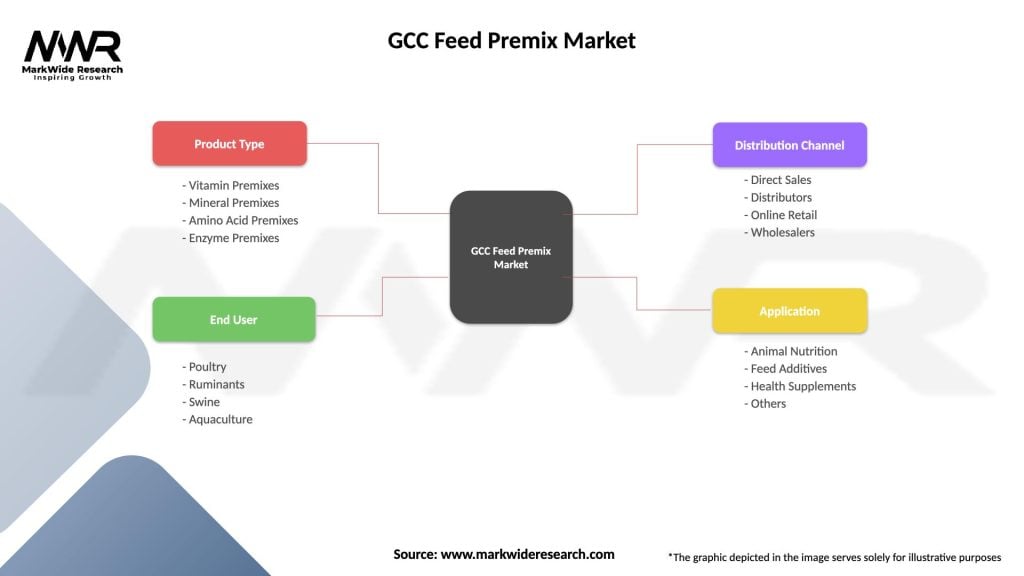

Product-based segmentation reveals distinct market categories with varying growth patterns and competitive dynamics:

By Product Type:

By Animal Type:

By Form:

Vitamin premixes maintain market leadership with consistent demand across all livestock sectors. These products address fundamental nutritional requirements and demonstrate stable consumption patterns regardless of economic fluctuations. Innovation focuses on improving vitamin stability, bioavailability, and cost-effectiveness through advanced manufacturing technologies.

Mineral premixes show strong growth driven by increasing awareness about the importance of trace element nutrition in animal performance. Regional soil deficiencies and water quality issues create specific mineral supplementation requirements, leading to development of customized formulations adapted to local conditions.

Amino acid premixes represent a high-growth category with annual expansion rates exceeding 8.5% driven by focus on protein efficiency and feed cost optimization. These products enable producers to reduce protein levels in base diets while maintaining animal performance, resulting in cost savings and environmental benefits.

Specialty premixes including enzymes, probiotics, and organic acids demonstrate the highest growth potential as producers seek advanced solutions for improving feed efficiency and animal health. These products command premium pricing and require technical expertise for proper implementation, creating opportunities for value-added services.

Aquaculture premixes emerge as the most dynamic category with specialized formulations for marine and freshwater species. Growing shrimp and fish farming operations drive demand for species-specific nutrition solutions that optimize growth rates, disease resistance, and product quality.

Livestock producers benefit significantly from premix adoption through improved animal performance, reduced mortality rates, and enhanced feed conversion efficiency. MarkWide Research analysis indicates that proper premix utilization can improve feed efficiency by 12-18% while reducing veterinary costs and production variability.

Feed manufacturers gain competitive advantages through offering complete nutrition solutions that differentiate their products in the marketplace. Premix integration enables feed mills to provide consistent quality, meet specific customer requirements, and develop premium product lines that command higher margins.

Premix suppliers benefit from growing market demand, opportunities for product innovation, and development of long-term customer relationships. The market provides platforms for introducing advanced technologies and building technical service capabilities that create sustainable competitive advantages.

Government stakeholders achieve food security objectives through supporting domestic livestock production efficiency and reducing import dependency for animal protein products. Premix adoption contributes to sustainable agriculture development and economic diversification goals across GCC countries.

Consumers benefit from improved food safety, consistent product quality, and potentially lower prices resulting from enhanced production efficiency. Advanced nutrition programs contribute to animal welfare improvements and sustainable production practices that align with growing consumer expectations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainable nutrition solutions represent a dominant trend driving product development and market positioning strategies. Manufacturers increasingly focus on developing environmentally friendly premix formulations that reduce nitrogen and phosphorus excretion while maintaining animal performance. This trend aligns with growing environmental awareness and regulatory pressures for sustainable livestock production practices.

Precision nutrition technologies gain momentum through integration of data analytics, sensors, and artificial intelligence in feed management systems. These technologies enable real-time optimization of premix formulations based on animal performance data, environmental conditions, and production goals, resulting in improved efficiency and reduced waste.

Natural and organic alternatives show increasing market acceptance as consumers demand sustainably produced animal products. Premix manufacturers develop formulations using natural sources of vitamins, minerals, and bioactive compounds while avoiding synthetic additives and growth promoters.

Species-specific formulations become more sophisticated as understanding of animal nutrition requirements advances. Customized premixes for different breeds, production stages, and environmental conditions enable producers to optimize performance while addressing specific challenges such as heat stress, disease pressure, and feed ingredient quality variations.

Digital integration transforms traditional premix marketing and distribution approaches through online platforms, mobile applications, and digital advisory services. These technologies improve customer engagement, provide technical support, and enable data-driven decision making in nutrition management programs.

Manufacturing capacity expansion initiatives across the region reflect growing market confidence and demand projections. Several major companies have announced plans to establish or expand production facilities in strategic GCC locations, aiming to reduce import dependency and improve supply chain efficiency.

Research and development investments focus on developing climate-adapted formulations specifically designed for Gulf region conditions. These initiatives address challenges such as extreme heat, high humidity, and water quality issues that affect animal performance and nutrition requirements.

Strategic partnerships between international premix manufacturers and local distributors strengthen market presence and technical support capabilities. These collaborations combine global expertise with local market knowledge to develop effective go-to-market strategies and customer service programs.

Regulatory harmonization efforts among GCC countries aim to streamline approval processes and create more efficient market access procedures. These initiatives reduce compliance costs and accelerate product launches across multiple markets within the region.

Technology adoption programs supported by government agencies and industry associations promote awareness and adoption of advanced nutrition technologies among livestock producers. Training programs, demonstration projects, and financial incentives encourage modernization of feeding practices and premix utilization.

Market entry strategies should prioritize building strong local partnerships and technical support capabilities to address the complex regulatory environment and diverse customer requirements across GCC countries. Companies entering the market should invest in understanding regional livestock production systems and developing relationships with key stakeholders including feed mills, large producers, and government agencies.

Product development focus should emphasize climate-adapted formulations and species-specific solutions that address unique challenges in the Gulf region. Innovation priorities should include heat stress management, water quality adaptation, and integration with local feed ingredients to create cost-effective and practical nutrition solutions.

Investment priorities should balance market development activities with long-term capacity building initiatives. MWR analysis suggests that companies achieving sustainable success invest heavily in technical support services, quality assurance systems, and customer education programs that build trust and loyalty in the marketplace.

Competitive positioning should emphasize value creation through comprehensive nutrition solutions rather than competing solely on price. Companies that combine high-quality products with technical expertise, customer support, and performance guarantees typically achieve stronger market positions and higher profitability.

Risk management strategies should address supply chain vulnerabilities through diversified sourcing, strategic inventory management, and development of alternative raw material sources. Companies should also invest in regulatory compliance systems and maintain flexibility to adapt to changing market conditions and customer requirements.

Long-term growth prospects for the GCC feed premix market remain highly positive, supported by fundamental demographic and economic trends that drive sustained demand for animal protein products. The market is expected to benefit from continued population growth, rising disposable incomes, and increasing consumer preferences for high-quality meat and dairy products.

Technology advancement will continue to drive market evolution through development of more sophisticated premix formulations and delivery systems. Integration of precision nutrition technologies, artificial intelligence, and data analytics will enable more efficient and sustainable livestock production systems that optimize resource utilization and environmental impact.

Market expansion into emerging segments, particularly aquaculture and organic production, presents significant growth opportunities over the forecast period. These sectors demonstrate strong growth potential with projected annual expansion rates exceeding 12% as production systems modernize and consumer preferences evolve.

Regional integration initiatives and infrastructure development projects will enhance market efficiency and reduce operational costs. Improved logistics networks, harmonized regulations, and increased local manufacturing capacity will create more competitive and resilient market structures that support sustained growth.

Sustainability focus will increasingly influence market development as environmental concerns and resource constraints drive adoption of more efficient production systems. Premix formulations that reduce environmental impact while maintaining animal performance will gain competitive advantages and market acceptance.

The GCC feed premix market represents a dynamic and rapidly evolving sector with strong fundamentals and significant growth potential. Market analysis reveals a complex landscape characterized by increasing sophistication in animal nutrition practices, growing emphasis on sustainability, and rising adoption of precision feeding technologies across the region.

Key success factors for market participants include developing deep understanding of local market conditions, building strong technical support capabilities, and maintaining focus on innovation and quality. Companies that effectively combine global expertise with regional market knowledge while providing comprehensive customer support services are positioned to achieve sustainable competitive advantages.

Future market development will be driven by continued expansion in livestock production, growing aquaculture sector, and increasing adoption of advanced nutrition technologies. The market offers substantial opportunities for companies willing to invest in long-term relationship building, product innovation, and technical service capabilities that create value for customers and stakeholders throughout the supply chain.

What is Feed Premix?

Feed premix refers to a concentrated mixture of vitamins, minerals, and other nutrients that are added to animal feed to enhance its nutritional value. It is commonly used in livestock, poultry, and aquaculture to promote growth and health.

What are the key players in the GCC Feed Premix Market?

Key players in the GCC Feed Premix Market include companies such as Cargill, ADM Animal Nutrition, and Alltech, which provide a range of feed premix solutions tailored for various livestock and poultry needs, among others.

What are the main drivers of growth in the GCC Feed Premix Market?

The growth of the GCC Feed Premix Market is driven by increasing demand for high-quality animal protein, rising livestock production, and advancements in animal nutrition technology. Additionally, the growing awareness of animal health and welfare contributes to market expansion.

What challenges does the GCC Feed Premix Market face?

The GCC Feed Premix Market faces challenges such as fluctuating raw material prices, regulatory compliance issues, and the need for continuous innovation to meet evolving consumer demands. These factors can impact production costs and market stability.

What opportunities exist in the GCC Feed Premix Market?

Opportunities in the GCC Feed Premix Market include the increasing adoption of organic and natural feed ingredients, the expansion of aquaculture, and the growing trend towards sustainable farming practices. These factors are likely to drive innovation and new product development.

What trends are shaping the GCC Feed Premix Market?

Trends in the GCC Feed Premix Market include the rising demand for customized feed solutions, the integration of technology in feed formulation, and a focus on enhancing feed efficiency. These trends are influencing how feed premixes are developed and marketed.

GCC Feed Premix Market

| Segmentation Details | Description |

|---|---|

| Product Type | Vitamin Premixes, Mineral Premixes, Amino Acid Premixes, Enzyme Premixes |

| End User | Poultry, Ruminants, Swine, Aquaculture |

| Distribution Channel | Direct Sales, Distributors, Online Retail, Wholesalers |

| Application | Animal Nutrition, Feed Additives, Health Supplements, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the GCC Feed Premix Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at