444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The GCC event management market represents a dynamic and rapidly evolving sector that encompasses comprehensive planning, coordination, and execution of diverse events across the Gulf Cooperation Council region. Market dynamics indicate substantial growth driven by increasing corporate activities, government initiatives, and rising consumer spending on experiential events. The region’s strategic position as a global business hub has positioned the event management industry as a critical component of economic diversification efforts.

Regional expansion has been particularly pronounced in the United Arab Emirates, Saudi Arabia, and Qatar, where mega-events and international conferences have become integral to national development strategies. The market demonstrates robust growth potential with increasing adoption of technology-driven solutions and sustainable event practices. Industry participants are leveraging advanced digital platforms to enhance attendee experiences and streamline operational efficiency.

Market penetration across various sectors including corporate events, weddings, exhibitions, and entertainment shows reflects the region’s cultural diversity and economic prosperity. The integration of innovative technologies such as virtual reality, artificial intelligence, and mobile applications has transformed traditional event management approaches, creating new opportunities for service providers and stakeholders.

The GCC event management market refers to the comprehensive ecosystem of professional services dedicated to planning, organizing, and executing various types of events across the Gulf Cooperation Council countries. This market encompasses strategic planning, venue selection, vendor coordination, logistics management, marketing, and post-event analysis for corporate conferences, trade exhibitions, cultural festivals, private celebrations, and government-sponsored events.

Professional event management involves the systematic application of project management principles to create memorable experiences while achieving specific business objectives. The market includes specialized service providers who offer end-to-end solutions ranging from concept development to execution, incorporating elements such as audio-visual production, catering coordination, security management, and attendee engagement strategies.

Market participants utilize advanced technologies and industry best practices to deliver seamless events that align with client expectations and regional cultural sensitivities. The sector has evolved to encompass hybrid event formats that combine physical and virtual elements, reflecting changing consumer preferences and technological capabilities in the post-pandemic landscape.

Strategic analysis reveals that the GCC event management market is experiencing unprecedented transformation driven by economic diversification initiatives and increasing investment in tourism and hospitality sectors. Key market drivers include rising corporate spending on marketing events, government support for mega-events, and growing consumer preference for experiential entertainment options.

Technology integration has emerged as a critical differentiator, with 65% of event organizers now incorporating digital solutions to enhance attendee engagement and operational efficiency. The market benefits from strong infrastructure development, favorable government policies, and increasing international business activities across the region.

Competitive dynamics are characterized by the presence of both international event management companies and local specialists who understand regional cultural nuances. The market demonstrates significant resilience with rapid adaptation to changing circumstances and evolving client requirements, particularly in the areas of health and safety protocols and sustainable event practices.

Future prospects remain highly positive, supported by major upcoming events, continued economic growth, and increasing recognition of events as powerful marketing and networking tools. The integration of sustainable practices and advanced technologies positions the market for continued expansion and innovation.

Market intelligence reveals several critical insights that define the current landscape and future trajectory of the GCC event management sector:

Economic diversification initiatives across GCC countries have created substantial demand for professional event management services as governments and private sector organizations seek to establish their regions as global business and tourism destinations. Vision 2030 programs and similar national development strategies have prioritized event hosting capabilities as key economic drivers.

Corporate expansion in the region has generated increased demand for professional conferences, product launches, and networking events. International companies establishing regional headquarters require sophisticated event management services to support their business development and stakeholder engagement activities. The growing startup ecosystem has also contributed to demand for specialized events and pitch competitions.

Tourism development strategies have positioned events as critical attractions for international visitors, creating opportunities for large-scale festivals, cultural celebrations, and entertainment events. The integration of sports tourism through major sporting events has further expanded market opportunities and demonstrated the region’s event hosting capabilities.

Technology advancement has enabled more sophisticated event experiences while improving operational efficiency and cost-effectiveness. The adoption of digital marketing strategies and social media integration has expanded event reach and engagement possibilities, creating new revenue streams and marketing opportunities for event organizers.

Regulatory complexity across different GCC countries can create challenges for event organizers, particularly for cross-border events or international conferences requiring multiple permits and compliance with varying local regulations. Cultural sensitivities and religious considerations require careful planning and may limit certain types of events or entertainment options.

Seasonal limitations due to extreme weather conditions during summer months can restrict outdoor events and impact venue availability, creating capacity constraints during peak seasons. The concentration of events during cooler months leads to resource competition and increased costs for venues, vendors, and specialized equipment.

Talent shortage in specialized event management skills, particularly in areas such as technical production, project management, and multilingual coordination, can limit service quality and capacity expansion. The need for continuous training and professional development adds operational costs and complexity for service providers.

Economic volatility related to oil price fluctuations can impact corporate spending on events and government investment in large-scale projects. Budget constraints during economic downturns may lead to event cancellations or significant scope reductions, affecting market stability and growth projections.

Mega-event hosting opportunities, including international sporting events, cultural festivals, and business summits, present significant growth potential for the GCC event management market. These large-scale events require comprehensive planning and coordination services, creating substantial revenue opportunities for qualified service providers.

Digital transformation initiatives offer opportunities to develop innovative event technologies, virtual reality experiences, and hybrid event platforms that can serve both regional and international markets. The growing demand for data analytics and attendee insights creates opportunities for specialized service offerings and technology partnerships.

Sustainable event management represents an emerging opportunity as organizations increasingly prioritize environmental responsibility and social impact. Service providers who develop expertise in green event practices and sustainable supply chain management can differentiate themselves and access new market segments.

Regional integration initiatives and increased cooperation among GCC countries create opportunities for multi-country event tours, regional conferences, and collaborative cultural celebrations. The development of specialized niche markets such as medical conferences, educational summits, and industry-specific trade shows offers potential for service specialization and premium pricing.

Competitive intensity in the GCC event management market has increased significantly as both international and local players compete for market share. Service differentiation has become critical, with companies focusing on specialized expertise, technology integration, and cultural competency to maintain competitive advantages.

Client expectations have evolved substantially, with increased demand for measurable outcomes, detailed analytics, and comprehensive post-event reporting. The shift toward experience-driven events has required service providers to develop new capabilities in audience engagement, interactive technologies, and personalized experiences.

Supply chain dynamics have become more complex with the need for diverse vendor networks, international supplier relationships, and flexible logistics solutions. The importance of risk management has increased, requiring comprehensive contingency planning and insurance coverage for various event scenarios.

Innovation cycles have accelerated with rapid adoption of new technologies and changing consumer preferences. Event management companies must continuously invest in technology upgrades and staff training to remain competitive and meet evolving client requirements in an increasingly sophisticated market environment.

Comprehensive market analysis was conducted using a multi-faceted research approach that combines primary and secondary research methodologies to ensure accurate and reliable market insights. Primary research included structured interviews with industry executives, event management professionals, venue operators, and key stakeholders across all GCC countries.

Secondary research encompassed analysis of industry reports, government publications, trade association data, and company financial statements to establish market trends and competitive dynamics. Quantitative analysis was performed using statistical modeling techniques to project market growth patterns and identify key performance indicators.

Data validation processes included cross-referencing multiple sources, expert consultation, and market participant feedback to ensure accuracy and reliability of findings. Regional analysis was conducted through country-specific research and local market expert consultations to capture unique market characteristics and opportunities.

Market segmentation analysis utilized both top-down and bottom-up approaches to identify market size, growth potential, and competitive positioning across different event categories and service segments. The research methodology ensures comprehensive coverage of market dynamics and provides reliable insights for strategic decision-making.

United Arab Emirates leads the GCC event management market with approximately 35% market share, driven by Dubai’s position as a global business hub and Abu Dhabi’s focus on cultural and sporting events. The country benefits from world-class infrastructure, international connectivity, and a diverse expatriate population that supports various event categories.

Saudi Arabia represents the fastest-growing market segment with significant government investment in entertainment and tourism sectors as part of Vision 2030 initiatives. The kingdom’s focus on mega-events, cultural festivals, and business conferences has created substantial opportunities for event management service providers.

Qatar maintains a strong market position with specialized focus on high-profile international events and luxury experiences. The country’s investment in infrastructure and commitment to hosting major sporting and cultural events has established it as a premium event destination in the region.

Kuwait, Bahrain, and Oman represent emerging markets with growing potential driven by economic diversification efforts and increasing corporate activities. These markets offer opportunities for specialized service providers and niche event categories, particularly in the areas of cultural events and business conferences.

Market leadership is distributed among several key players who have established strong regional presence and specialized expertise across different event categories:

Competitive strategies focus on technology integration, specialized expertise development, and strategic partnerships with venues, vendors, and international event management companies. Market participants are increasingly investing in digital capabilities and sustainable event practices to differentiate their service offerings.

By Event Type:

By Service Category:

By Client Segment:

Corporate Events dominate the market with consistent demand driven by business expansion and international corporate presence in the region. These events typically require sophisticated logistics and professional presentation standards, creating opportunities for premium service providers with specialized expertise in business event management.

Wedding and Social Events represent a high-growth segment with increasing spending on luxury celebrations and cultural ceremonies. The market benefits from cultural diversity in the region, creating demand for specialized services that can accommodate various traditions and preferences while maintaining high service standards.

Entertainment Events have gained significant momentum with government support for cultural development and tourism promotion. These events require specialized technical expertise and often involve international artists and performers, creating opportunities for companies with global networks and production capabilities.

Exhibition and Trade Shows continue to grow with increasing business activities and industry specialization. These events require comprehensive logistics coordination and often involve multiple stakeholders, creating opportunities for service providers with strong vendor networks and project management capabilities.

Service Providers benefit from diverse revenue streams, recurring client relationships, and opportunities for service expansion across multiple event categories. The market offers scalability potential with the ability to serve both local and international clients while developing specialized expertise in high-demand areas.

Venue Operators gain from increased utilization rates, premium pricing opportunities, and long-term partnerships with event management companies. The growing market provides consistent demand for various venue types and creates opportunities for facility upgrades and specialized service offerings.

Technology Vendors benefit from increasing demand for digital solutions, virtual event platforms, and innovative technologies that enhance attendee experiences. The market offers opportunities for technology integration and development of region-specific solutions that address local market requirements.

Government Stakeholders gain from economic diversification, tourism development, and international recognition through successful event hosting. The sector contributes to job creation, skills development, and positioning of GCC countries as preferred destinations for international events and conferences.

Strengths:

Weaknesses:

Opportunities:

Threats:

Hybrid Event Integration has emerged as a dominant trend with 72% of event organizers now incorporating both physical and virtual elements to maximize reach and engagement. This approach enables broader audience participation while maintaining the personal connection of in-person events.

Sustainability Focus has become increasingly important with event organizers implementing eco-friendly practices, waste reduction strategies, and carbon footprint minimization. Green certification programs and sustainable vendor selection have become standard requirements for many corporate and government events.

Personalization Technology is transforming attendee experiences through AI-powered recommendations, customized agendas, and targeted networking opportunities. Data analytics enable event organizers to create more relevant and engaging experiences while providing valuable insights for future event planning.

Cultural Integration has become a key differentiator with successful events incorporating local traditions, cuisine, and entertainment while maintaining international appeal. This trend reflects the region’s commitment to showcasing cultural heritage while embracing global business practices.

Health and Safety Protocols have been permanently integrated into event planning processes, with enhanced sanitation measures, crowd management strategies, and health monitoring systems becoming standard practice across all event categories.

Technology Partnerships between event management companies and technology providers have accelerated, creating innovative solutions for virtual reality experiences, mobile applications, and real-time analytics. These collaborations enable enhanced service offerings and improved operational efficiency.

Government Initiatives across GCC countries have established specialized event development agencies and provided funding support for major international events. Regulatory streamlining efforts have simplified permit processes and reduced bureaucratic barriers for event organizers.

Infrastructure Investments in new venues, transportation systems, and accommodation facilities have expanded the region’s event hosting capacity. Smart venue technologies and sustainable building practices have become standard features in new facility developments.

Professional Development Programs have been established to address talent shortages and improve service quality standards. Industry certifications and specialized training programs have enhanced professional capabilities and created career advancement opportunities.

International Partnerships with global event management companies have brought international expertise and best practices to the regional market. These collaborations have enabled knowledge transfer and capacity building while expanding service capabilities.

MarkWide Research analysis indicates that event management companies should prioritize technology integration and sustainable practices to maintain competitive advantages in the evolving market landscape. Investment in digital capabilities and staff training will be critical for long-term success and market positioning.

Strategic partnerships with international service providers and technology companies can enhance service offerings and expand market reach. Companies should focus on developing specialized expertise in high-growth segments such as hybrid events and sustainable event management.

Market expansion strategies should consider regional integration opportunities and cross-border event planning capabilities. Cultural competency and multilingual capabilities will become increasingly important as the market becomes more diverse and international.

Risk management strategies should be enhanced to address economic volatility, regulatory changes, and operational challenges. Companies should develop flexible business models that can adapt to changing market conditions and client requirements.

Innovation investment in emerging technologies and service delivery methods will be essential for maintaining market leadership and meeting evolving client expectations. Continuous learning and adaptation will be key success factors in the dynamic market environment.

Market prospects for the GCC event management sector remain highly positive with continued growth expected across all major segments. Government support for tourism and entertainment sectors, combined with increasing corporate activities, will drive sustained demand for professional event management services.

Technology evolution will continue to transform the industry with artificial intelligence, virtual reality, and advanced analytics becoming standard tools for event planning and execution. MWR projections indicate that technology-enabled services will represent an increasing share of market revenue.

Sustainability requirements will become more stringent with clients increasingly demanding environmentally responsible event solutions. Service providers who develop expertise in sustainable practices will gain competitive advantages and access to premium market segments.

Regional integration initiatives will create opportunities for multi-country events and collaborative projects among GCC nations. The development of standardized regulations and simplified cross-border procedures will facilitate market expansion and operational efficiency.

Professional development and talent acquisition will remain critical challenges requiring continued investment in training programs and international recruitment. The establishment of industry standards and certification programs will enhance service quality and professional recognition.

The GCC event management market represents a dynamic and rapidly evolving sector with substantial growth potential driven by economic diversification, government support, and increasing demand for professional event services. Market fundamentals remain strong with diverse revenue streams, expanding client base, and continuous innovation in service delivery methods.

Strategic opportunities exist for service providers who can effectively integrate technology, develop specialized expertise, and adapt to changing market requirements. The emphasis on sustainable practices and cultural integration will create new competitive advantages and market differentiation opportunities.

Future success will depend on the ability to navigate regulatory complexities, manage operational challenges, and continuously invest in professional development and technology advancement. The market’s resilience and adaptability position it well for continued growth and expansion in the coming years.

What is Event Management?

Event management refers to the process of planning, organizing, and executing events such as conferences, weddings, and corporate gatherings. It involves various aspects including venue selection, logistics, and coordination of activities to ensure a successful event.

What are the key players in the GCC Event Management Market?

Key players in the GCC Event Management Market include companies like Informa, MCI Group, and dmg events, which specialize in organizing large-scale events and exhibitions. These companies provide comprehensive services that cater to various sectors, including corporate, entertainment, and cultural events, among others.

What are the main drivers of growth in the GCC Event Management Market?

The growth of the GCC Event Management Market is driven by factors such as increasing corporate events, a rise in tourism, and government initiatives to promote cultural and entertainment events. Additionally, the growing demand for professional event planning services is contributing to market expansion.

What challenges does the GCC Event Management Market face?

The GCC Event Management Market faces challenges such as fluctuating economic conditions, competition from alternative entertainment options, and regulatory hurdles. These factors can impact event planning and execution, making it essential for companies to adapt to changing market dynamics.

What opportunities exist in the GCC Event Management Market?

Opportunities in the GCC Event Management Market include the potential for virtual and hybrid events, which have gained popularity due to technological advancements. Additionally, the increasing focus on sustainability in event planning presents avenues for innovative practices and eco-friendly solutions.

What trends are shaping the GCC Event Management Market?

Trends in the GCC Event Management Market include the integration of technology such as event management software and mobile applications, as well as a growing emphasis on personalized experiences for attendees. Furthermore, the rise of experiential marketing is influencing how events are designed and executed.

GCC Event Management Market

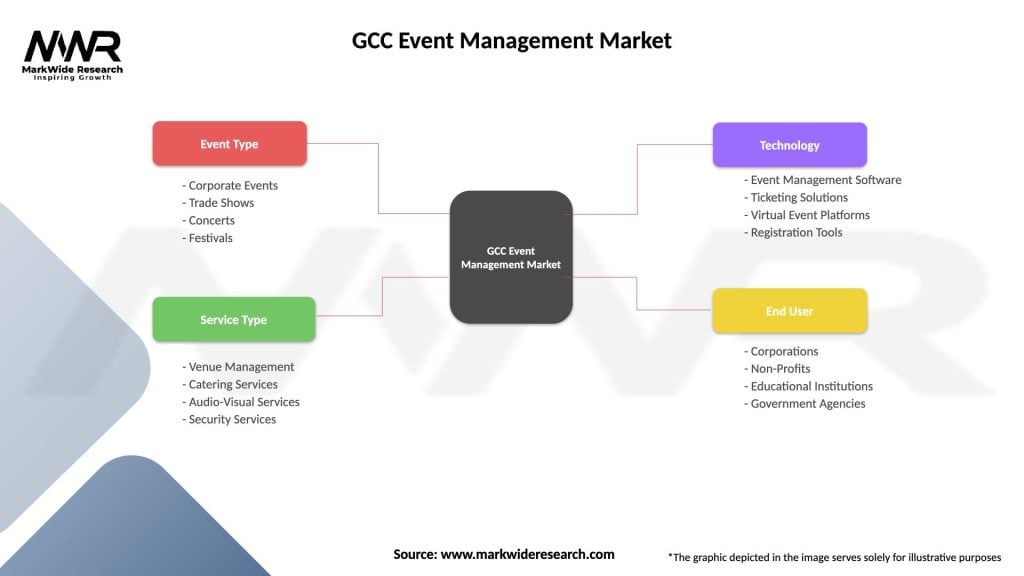

| Segmentation Details | Description |

|---|---|

| Event Type | Corporate Events, Trade Shows, Concerts, Festivals |

| Service Type | Venue Management, Catering Services, Audio-Visual Services, Security Services |

| Technology | Event Management Software, Ticketing Solutions, Virtual Event Platforms, Registration Tools |

| End User | Corporations, Non-Profits, Educational Institutions, Government Agencies |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the GCC Event Management Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at