444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The GCC drone pilot training market represents a rapidly expanding sector within the broader unmanned aerial vehicle (UAV) industry across Gulf Cooperation Council countries. This specialized training market encompasses comprehensive educational programs, certification courses, and professional development initiatives designed to meet the growing demand for qualified drone operators throughout the region. Market dynamics indicate substantial growth driven by increasing commercial applications, regulatory compliance requirements, and technological advancement in drone operations.

Regional expansion across the GCC has been particularly notable, with countries like the United Arab Emirates, Saudi Arabia, and Qatar leading adoption rates. The market demonstrates significant growth potential with training programs experiencing increased enrollment rates of approximately 35% annually across major training institutions. Commercial applications spanning construction, oil and gas, agriculture, and logistics sectors continue driving demand for certified drone pilots throughout the Gulf region.

Training methodologies have evolved to incorporate advanced simulation technologies, hands-on flight experience, and comprehensive regulatory education. The market encompasses various training formats including online courses, classroom instruction, and practical flight training programs. Certification standards align with international aviation authorities while meeting specific GCC regulatory requirements, ensuring graduates possess necessary skills for professional drone operations.

The GCC drone pilot training market refers to the comprehensive ecosystem of educational institutions, training programs, and certification services dedicated to preparing individuals for professional unmanned aerial vehicle operations across Gulf Cooperation Council member states. This market encompasses specialized curricula covering flight operations, safety protocols, regulatory compliance, and technical maintenance skills required for commercial drone piloting careers.

Training programs within this market typically include theoretical knowledge components covering aerodynamics, weather patterns, airspace regulations, and emergency procedures. Practical elements involve hands-on flight training using various drone platforms, simulation exercises, and real-world scenario practice. Certification pathways lead to recognized credentials enabling graduates to operate drones professionally across multiple industries including construction, media production, surveying, and emergency services.

Market participants include aviation academies, technical institutes, private training organizations, and government-sponsored educational programs. These entities collaborate with regulatory authorities, drone manufacturers, and industry employers to ensure training standards meet evolving market demands and technological requirements throughout the GCC region.

Strategic analysis reveals the GCC drone pilot training market experiencing unprecedented growth driven by expanding commercial applications and regulatory mandates requiring certified operators. The market benefits from strong government support for drone technology adoption, substantial infrastructure investments, and growing recognition of UAV applications across traditional industries. Training enrollment has increased significantly, with specialized programs reporting capacity utilization rates exceeding 80% consistently across major GCC markets.

Market segmentation demonstrates diverse training categories including basic pilot certification, advanced commercial operations, specialized industry applications, and instructor certification programs. The commercial sector represents the largest training demand segment, followed by government and military applications. Technology integration within training programs has advanced considerably, incorporating virtual reality simulation, advanced flight management systems, and real-time data analysis capabilities.

Competitive landscape features established aviation training institutions expanding into drone education alongside emerging specialized drone training academies. International partnerships with leading drone manufacturers and training organizations enhance program quality and certification recognition. Future projections indicate sustained growth momentum supported by expanding commercial drone adoption and evolving regulatory frameworks requiring enhanced pilot qualifications.

Primary market drivers include expanding commercial drone applications across construction, oil and gas, agriculture, and logistics sectors throughout the GCC region. Regulatory developments mandating certified operators for commercial drone operations have significantly increased training demand. Government initiatives promoting drone technology adoption and smart city development projects create substantial opportunities for trained drone pilots.

Commercial expansion across multiple industries represents the primary driver for GCC drone pilot training market growth. Construction companies increasingly utilize drones for site surveying, progress monitoring, and safety inspections, creating substantial demand for certified operators. Oil and gas sector adoption of drone technology for pipeline inspection, facility monitoring, and emergency response operations requires specialized pilot training programs.

Government initiatives promoting smart city development and digital transformation create significant opportunities for drone applications. National vision programs across GCC countries emphasize technology adoption and innovation, supporting drone industry growth. Regulatory frameworks requiring certified operators for commercial drone operations mandate professional training, driving consistent market demand.

Infrastructure development projects throughout the GCC region utilize drone technology for planning, monitoring, and quality control purposes. Large-scale construction projects, urban development initiatives, and transportation infrastructure expansion create ongoing demand for qualified drone pilots. Economic diversification efforts across GCC economies emphasize technology sectors, supporting drone industry development and associated training requirements.

Technological advancement in drone capabilities necessitates enhanced pilot training programs covering advanced flight systems, data collection techniques, and specialized applications. Integration of artificial intelligence, autonomous flight capabilities, and sophisticated sensor systems requires comprehensive operator education and certification programs.

High training costs associated with comprehensive drone pilot certification programs present barriers for individual participants and smaller organizations. Advanced training equipment, specialized facilities, and expert instructors contribute to elevated program expenses. Limited training capacity at established institutions creates bottlenecks during peak demand periods, potentially constraining market growth.

Regulatory complexity across different GCC countries creates challenges for training standardization and certification recognition. Varying national aviation authority requirements and approval processes complicate program development and student mobility. Technology evolution requires continuous curriculum updates and instructor training, increasing operational costs for training providers.

Skills shortage among qualified instructors limits training program expansion capabilities. Experienced drone pilots with teaching qualifications remain scarce, constraining institutional capacity growth. Competition from international training programs and online certification courses creates pricing pressure on local training providers.

Economic fluctuations affecting construction and infrastructure sectors can impact training demand from commercial employers. Reduced project activity during economic downturns may decrease corporate training investments and individual career development spending.

Emerging applications in agriculture, environmental monitoring, and emergency services create new training market segments with specialized curriculum requirements. Agricultural drone operations for crop monitoring, precision spraying, and livestock management represent significant growth opportunities. Smart city initiatives across GCC countries generate demand for drone pilots trained in urban operations, traffic monitoring, and public safety applications.

International partnerships with leading drone manufacturers and global training organizations offer opportunities for program enhancement and certification recognition. Collaborative arrangements with technology companies provide access to advanced training equipment and curriculum development resources. Corporate training programs customized for specific industries and applications represent high-value market segments.

Online training platforms and hybrid learning models expand market reach while reducing operational costs. Digital training components combined with practical flight experience offer flexible learning options for working professionals. Government contracts for training public sector employees and military personnel provide stable revenue streams for training providers.

Regional expansion opportunities exist for established training providers to develop programs across multiple GCC countries. Standardized certification programs recognized throughout the region enhance student value propositions and institutional competitiveness.

Supply and demand dynamics within the GCC drone pilot training market demonstrate strong growth momentum driven by expanding commercial applications and regulatory requirements. Training capacity has increased substantially, with new institutions and program expansions meeting growing enrollment demand. Market equilibrium shows healthy balance between training supply and employment opportunities for certified pilots.

Competitive dynamics feature established aviation training institutions competing with specialized drone training academies and international providers. Market differentiation occurs through program quality, certification recognition, employment placement rates, and specialized industry focus. Pricing strategies vary significantly based on program comprehensiveness, duration, and included certifications.

Technology integration drives continuous market evolution as training programs incorporate advanced simulation systems, virtual reality platforms, and sophisticated drone technologies. MarkWide Research analysis indicates that institutions investing in advanced training technologies achieve 45% higher student satisfaction rates compared to traditional programs.

Regulatory influence significantly impacts market dynamics through certification requirements, operational standards, and safety protocols. Changes in aviation authority regulations create immediate effects on training curriculum and certification processes throughout the region.

Comprehensive analysis of the GCC drone pilot training market employs multiple research methodologies including primary data collection, secondary source analysis, and industry expert consultations. Research scope encompasses all six GCC member countries with detailed examination of training institutions, regulatory frameworks, and market participants.

Primary research involves structured interviews with training institution administrators, certified drone pilots, industry employers, and regulatory officials. Survey data collection from current students and recent graduates provides insights into program effectiveness, career outcomes, and market satisfaction levels. Focus group discussions with industry stakeholders explore emerging trends and future requirements.

Secondary research incorporates analysis of government publications, industry reports, academic studies, and regulatory documentation. Market data compilation includes enrollment statistics, certification rates, employment outcomes, and industry growth indicators. Quantitative analysis utilizes statistical modeling to project market trends and identify growth patterns.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert review, and statistical verification. Market projections incorporate scenario analysis considering various economic and regulatory factors affecting future development.

United Arab Emirates leads the GCC drone pilot training market with the most developed infrastructure and highest enrollment rates. Dubai and Abu Dhabi host multiple training institutions offering comprehensive certification programs. The UAE demonstrates 42% market share within the regional training market, supported by strong government initiatives and commercial drone adoption.

Saudi Arabia represents the fastest-growing training market segment, driven by Vision 2030 initiatives and massive infrastructure development projects. Training capacity expansion includes new institutions and program development across major cities. Government support for technology education and economic diversification creates favorable conditions for market growth.

Qatar focuses on specialized training programs supporting World Cup infrastructure projects and ongoing urban development initiatives. Training institutions emphasize construction and event management applications. Market concentration in Doha provides centralized training access for the national market.

Kuwait, Bahrain, and Oman demonstrate emerging market characteristics with developing training infrastructure and growing commercial applications. These markets show combined growth rates exceeding regional averages as drone adoption accelerates across various sectors. Cross-border recognition of certifications enhances regional market integration and student mobility.

Market leadership features established aviation training institutions expanding into drone education alongside specialized UAV training academies. Competition intensifies as institutions develop comprehensive programs covering multiple certification levels and industry applications.

Competitive strategies include program differentiation through specialized industry focus, advanced technology integration, and strong employment placement services. International partnerships enhance program credibility and certification recognition. Market positioning varies from comprehensive aviation education providers to specialized drone training academies targeting specific market segments.

Innovation leadership emerges through adoption of virtual reality training systems, advanced simulation platforms, and integrated learning management systems. Institutions investing in technology advancement demonstrate superior student outcomes and market competitiveness.

By Training Type: The market segments into basic pilot certification, advanced commercial operations, specialized industry applications, and instructor certification programs. Basic certification represents the largest segment, while specialized industry training shows the highest growth rates.

By Application Sector: Training programs target construction and infrastructure, oil and gas, agriculture, media and entertainment, emergency services, and government applications. Construction sector training dominates current demand, representing approximately 38% of total enrollment.

By Training Format: Market segmentation includes classroom-based programs, online courses, hybrid learning models, and intensive boot camps. Hybrid programs combining online theory with practical flight training demonstrate highest completion rates and student satisfaction.

By Certification Level: Programs range from recreational pilot licenses to advanced commercial certifications and specialized endorsements. Commercial certification programs generate the highest revenue per student and demonstrate strongest employment outcomes.

By Duration: Training programs vary from short-term certification courses lasting several weeks to comprehensive programs extending over multiple months. Intensive programs show 92% completion rates compared to extended programs with 78% completion rates.

Commercial Training Programs represent the largest market category, driven by regulatory requirements and expanding business applications. These programs emphasize safety protocols, regulatory compliance, and professional operation standards. Employment outcomes for commercial certification graduates exceed 85% placement rates within six months of completion.

Specialized Industry Training shows the highest growth potential with programs tailored for specific sectors including construction, agriculture, and emergency services. Customized curricula address unique operational requirements and safety considerations for each industry vertical. Premium pricing for specialized programs generates higher revenue per student.

Instructor Certification Programs address growing demand for qualified training personnel as market expansion continues. These advanced programs require significant flight experience and teaching qualifications. Instructor shortage creates opportunities for premium pricing and strong employment prospects.

Government Training Contracts provide stable revenue streams for training institutions while supporting public sector drone adoption. Programs include law enforcement, emergency response, and infrastructure monitoring applications. Contract duration typically spans multiple years with guaranteed enrollment levels.

Training Institutions benefit from expanding market demand, premium pricing opportunities, and government support for technology education. Diversification into drone training provides new revenue streams and enhanced institutional reputation. Partnership opportunities with drone manufacturers and employers create additional value propositions.

Students and Trainees gain access to emerging career opportunities with strong employment prospects and competitive compensation. Certification programs provide portable credentials recognized across GCC countries and internationally. Career advancement potential includes progression to specialized roles and training instruction positions.

Employers and Industries access qualified drone pilots meeting regulatory requirements and operational standards. Training partnerships ensure customized skill development aligned with specific business needs. Operational efficiency improvements through professional drone operations generate substantial return on training investments.

Government Stakeholders achieve technology adoption objectives while supporting economic diversification and job creation. Professional training standards enhance aviation safety and regulatory compliance. Strategic initiatives benefit from qualified personnel supporting smart city and infrastructure development projects.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology Integration drives significant transformation in training methodologies with virtual reality simulation, advanced flight management systems, and real-time data analysis becoming standard components. Training institutions investing in cutting-edge technology demonstrate superior student outcomes and market competitiveness. Simulation platforms enable safe training environments for complex scenarios and emergency procedures.

Specialization Trend shows training programs increasingly focusing on specific industry applications rather than general pilot certification. Specialized curricula for construction, agriculture, oil and gas, and emergency services create differentiated market positioning. Industry partnerships enhance program relevance and employment outcomes for graduates.

Hybrid Learning Models combine online theoretical components with practical flight training to optimize learning effectiveness and operational efficiency. Digital platforms enable flexible scheduling while maintaining hands-on experience requirements. MWR analysis indicates hybrid programs achieve 15% higher completion rates compared to traditional classroom-only formats.

International Standardization efforts focus on developing regionally recognized certifications accepted across GCC countries and internationally. Standardized programs enhance student mobility and employment opportunities while simplifying regulatory compliance for training providers.

Regulatory Advancement across GCC countries includes updated aviation authority guidelines for drone operations and pilot certification requirements. New regulations mandate professional certification for commercial operations while establishing clear operational standards. Harmonization efforts work toward regional consistency in certification requirements and operational procedures.

Infrastructure Investment in training facilities includes new aviation academies, expanded existing programs, and advanced technology platforms. Government funding supports institutional development while private investment drives specialized training center establishment. Facility expansion addresses growing enrollment demand and capacity constraints.

Technology Partnerships between training institutions and drone manufacturers provide access to latest equipment and curriculum development resources. Collaborative arrangements ensure training programs remain current with technological advancement. Equipment sponsorship programs reduce institutional costs while enhancing training quality.

Employment Integration initiatives connect training programs directly with employer needs through job placement services, internship programs, and career development support. Industry partnerships create clear pathways from certification to employment in professional drone operations.

Market Entry Strategy for new training providers should focus on specialized niche markets rather than competing directly with established comprehensive programs. Targeting specific industries or advanced certification levels provides differentiation opportunities. Partnership development with employers and technology providers enhances program credibility and student value propositions.

Technology Investment priorities should emphasize simulation systems, virtual reality platforms, and integrated learning management systems. Advanced training technology demonstrates institutional commitment to quality while improving learning outcomes. ROI analysis indicates technology investments generate positive returns through higher enrollment and premium pricing capabilities.

Regional Expansion opportunities exist for successful training providers to establish operations across multiple GCC countries. Standardized programs with local adaptation create scalable business models. Regulatory compliance across different jurisdictions requires careful planning and local partnerships.

Quality Differentiation through instructor expertise, employment placement rates, and industry recognition creates competitive advantages in increasingly crowded markets. Continuous improvement in curriculum development and student services maintains market leadership positions.

Market expansion projections indicate continued strong growth driven by expanding commercial applications and regulatory requirements throughout the GCC region. Training demand is expected to grow at rates exceeding 25% annually over the next five years, supported by infrastructure development and technology adoption initiatives.

Technology evolution will continue driving curriculum updates and training methodology advancement. Integration of artificial intelligence, autonomous systems, and advanced sensor technologies requires enhanced pilot education programs. Training complexity increases as drone capabilities expand and operational requirements become more sophisticated.

Industry maturation will lead to increased standardization, quality certification, and professional recognition for drone pilot careers. MarkWide Research projects that professional drone pilots will achieve salary parity with traditional aviation careers within the next decade, enhancing career attractiveness and training demand.

Regional integration efforts will create unified certification standards and enhanced mobility for trained pilots across GCC countries. Standardized programs and mutual recognition agreements will strengthen the regional market while improving efficiency for training providers and students alike.

The GCC drone pilot training market demonstrates exceptional growth potential driven by expanding commercial applications, regulatory requirements, and strong government support for technology adoption. Market dynamics favor continued expansion as industries across the region recognize the operational benefits of professional drone operations. Training institutions that invest in advanced technology, specialized programs, and industry partnerships will capture the greatest opportunities in this evolving market.

Strategic positioning through quality differentiation, employment integration, and regional expansion creates sustainable competitive advantages. The market’s evolution toward specialization and technology integration requires continuous adaptation and investment from training providers. Future success depends on maintaining program relevance, regulatory compliance, and strong industry connections while delivering measurable career outcomes for graduates throughout the dynamic GCC drone pilot training market.

What is Drone Pilot Training?

Drone Pilot Training refers to the education and certification processes that individuals undergo to operate drones safely and effectively. This training encompasses various aspects, including flight operations, safety protocols, and regulatory compliance.

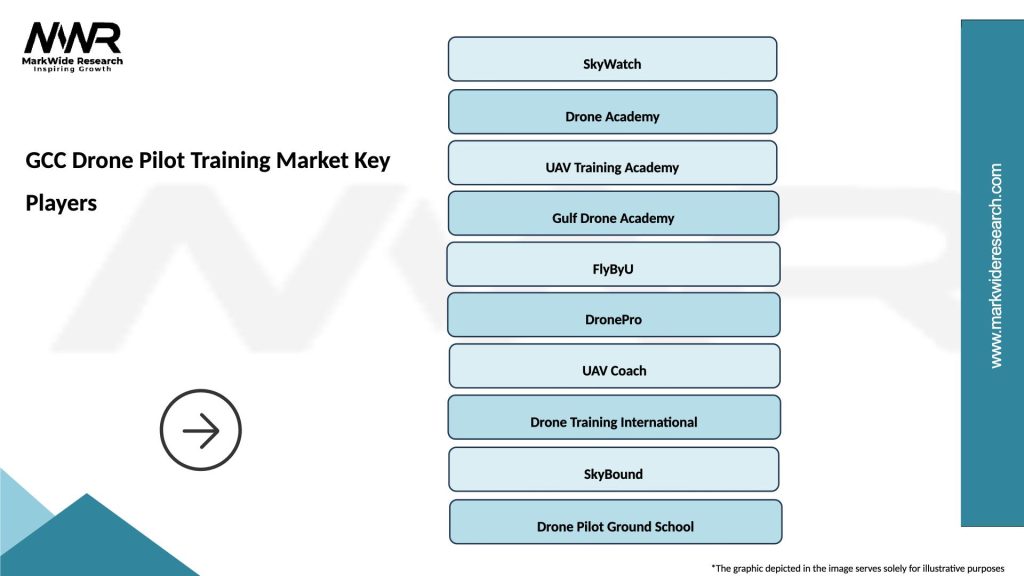

What are the key players in the GCC Drone Pilot Training Market?

Key players in the GCC Drone Pilot Training Market include companies like Falcon Aviation Academy, Skyborne Airline Academy, and Drone Academy, among others. These organizations provide specialized training programs tailored to different sectors such as agriculture, surveillance, and logistics.

What are the growth factors driving the GCC Drone Pilot Training Market?

The growth of the GCC Drone Pilot Training Market is driven by the increasing adoption of drones in various industries, such as agriculture for crop monitoring, construction for site surveying, and emergency services for disaster response. Additionally, the rising demand for skilled drone operators is contributing to market expansion.

What challenges does the GCC Drone Pilot Training Market face?

The GCC Drone Pilot Training Market faces challenges such as regulatory hurdles, the need for standardized training programs, and the rapid pace of technological advancements. These factors can complicate the training process and affect the consistency of pilot qualifications.

What opportunities exist in the GCC Drone Pilot Training Market?

Opportunities in the GCC Drone Pilot Training Market include the potential for partnerships with technology firms to enhance training methodologies and the expansion of training programs to cover emerging applications like drone delivery services and aerial photography. The growing interest in drone technology among various sectors also presents new avenues for training.

What trends are shaping the GCC Drone Pilot Training Market?

Trends shaping the GCC Drone Pilot Training Market include the integration of virtual reality and simulation technologies in training programs, the emphasis on regulatory compliance, and the increasing focus on safety and risk management. These trends are enhancing the effectiveness and accessibility of drone pilot training.

GCC Drone Pilot Training Market

| Segmentation Details | Description |

|---|---|

| Product Type | Basic Training, Advanced Training, Certification Programs, Online Courses |

| End User | Aviation Schools, Government Agencies, Private Companies, Hobbyists |

| Technology | Fixed-Wing Drones, Multi-Rotor Drones, Hybrid Drones, FPV Drones |

| Application | Aerial Photography, Surveying, Agriculture, Search & Rescue |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the GCC Drone Pilot Training Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at