444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The GCC dishwasher market represents a rapidly evolving segment within the region’s home appliance industry, driven by changing lifestyle patterns, urbanization trends, and increasing disposable income levels. Gulf Cooperation Council countries including Saudi Arabia, UAE, Qatar, Kuwait, Oman, and Bahrain are experiencing significant transformation in household appliance adoption, with dishwashers becoming increasingly popular among modern consumers seeking convenience and efficiency in their daily routines.

Market dynamics indicate substantial growth potential as the region witnesses a shift from traditional dishwashing methods to automated solutions. The market is characterized by growing demand for energy-efficient models, smart connectivity features, and compact designs suitable for regional housing preferences. Consumer preferences are evolving toward premium appliances that offer superior cleaning performance while maintaining water and energy conservation standards.

Regional adoption rates vary significantly across GCC countries, with UAE and Saudi Arabia leading in market penetration at approximately 35% and 28% respectively. The market demonstrates strong growth momentum with projected expansion rates of 8.2% CAGR over the forecast period, supported by increasing new residential construction, rising awareness of hygiene standards, and growing preference for time-saving household solutions.

The GCC dishwasher market refers to the comprehensive ecosystem encompassing the manufacturing, distribution, sales, and servicing of automatic dishwashing appliances across the six Gulf Cooperation Council member states. This market includes various dishwasher categories ranging from built-in and freestanding models to compact and portable units designed to meet diverse consumer needs and kitchen configurations prevalent in the region.

Market scope extends beyond traditional appliance sales to include related services such as installation, maintenance, spare parts distribution, and extended warranty programs. The market encompasses both residential and commercial segments, with residential applications dominating demand patterns. Technology integration plays a crucial role, featuring smart connectivity, energy efficiency ratings, and specialized wash cycles adapted to regional water quality and cultural preferences.

Consumer segments within this market include expatriate communities, affluent local families, hospitality establishments, and commercial food service operations. The market reflects broader socioeconomic trends including urbanization, women’s workforce participation, and evolving lifestyle preferences that prioritize convenience and efficiency in household management.

Strategic analysis reveals the GCC dishwasher market as a high-growth segment within the region’s appliance industry, characterized by increasing consumer acceptance and technological advancement. The market benefits from favorable demographic trends, rising disposable incomes, and changing lifestyle patterns that favor automated household solutions over traditional manual dishwashing methods.

Key growth drivers include rapid urbanization across GCC countries, increasing number of dual-income households, and growing awareness of water conservation benefits offered by modern dishwashers. The market demonstrates strong potential with penetration rates expected to reach 45% by 2028, driven by new residential developments and replacement demand from existing users.

Market challenges encompass cultural adaptation barriers, initial cost considerations, and infrastructure requirements for proper installation and operation. However, these challenges are being addressed through targeted marketing campaigns, flexible financing options, and improved after-sales service networks. Competitive landscape features both international brands and regional distributors competing on product features, pricing strategies, and service quality.

Future prospects indicate sustained growth supported by government initiatives promoting energy efficiency, increasing focus on smart home technologies, and expanding retail infrastructure across the region. The market is positioned for continued expansion as consumer preferences evolve toward premium appliances offering enhanced functionality and environmental benefits.

Consumer behavior analysis reveals distinct patterns in dishwasher adoption across different GCC markets, with significant variations based on cultural factors, housing types, and income levels. The following insights provide comprehensive understanding of market dynamics:

Lifestyle transformation across GCC countries serves as the primary catalyst for dishwasher market growth, with urbanization and modernization trends fundamentally altering household management approaches. The increasing participation of women in the workforce creates demand for time-saving appliances that reduce domestic workload and enable better work-life balance.

Economic prosperity in the region supports higher disposable income levels, enabling consumers to invest in premium household appliances. Government initiatives promoting economic diversification and private sector growth contribute to sustained income growth, particularly among middle and upper-middle-class segments that represent the core target market for dishwashers.

Infrastructure development including new residential projects, commercial complexes, and hospitality facilities creates substantial demand for modern appliances. The ongoing construction boom across major GCC cities necessitates equipping new properties with contemporary amenities, including built-in dishwashers as standard features in premium developments.

Environmental awareness drives consumer preference for water and energy-efficient appliances. Modern dishwashers offer significant water savings compared to manual washing, appealing to environmentally conscious consumers and aligning with regional sustainability initiatives. Water conservation benefits become particularly relevant given the region’s arid climate and water scarcity concerns.

Cultural evolution toward convenience-oriented lifestyles influences appliance adoption patterns. Younger generations, particularly those with international exposure, demonstrate greater acceptance of automated household solutions. Social media influence and lifestyle aspirations promoted through digital platforms further accelerate market acceptance.

Cultural barriers represent significant challenges in certain market segments, where traditional dishwashing methods remain deeply ingrained in household practices. Some consumers express concerns about appliance reliability, maintenance requirements, and the perceived complexity of operating automated dishwashing systems compared to familiar manual methods.

Initial investment costs create adoption barriers, particularly for budget-conscious consumers and first-time buyers. Premium dishwasher models with advanced features command substantial price premiums, while installation costs, electrical modifications, and plumbing requirements add to the total ownership expense. Financing constraints limit market penetration among lower-income segments.

Infrastructure limitations in older residential buildings pose installation challenges, requiring significant modifications to accommodate built-in dishwasher units. Many existing kitchens lack proper electrical connections, water supply configurations, and drainage systems necessary for optimal dishwasher operation. Retrofitting costs can exceed appliance prices in some cases.

Service network gaps in smaller GCC cities and remote areas create concerns about maintenance accessibility and spare parts availability. Consumers worry about long-term support, particularly for imported brands with limited local service presence. Technical expertise shortages for installation and repair services further compound these concerns.

Water quality issues in certain regions affect dishwasher performance and longevity, requiring additional water treatment systems or specialized detergents. Hard water conditions can reduce appliance lifespan and cleaning effectiveness, creating additional operational costs and maintenance requirements that deter potential buyers.

Smart home integration presents substantial growth opportunities as GCC consumers increasingly adopt connected home technologies. Dishwashers with IoT capabilities, mobile app control, and integration with home automation systems appeal to tech-savvy consumers seeking comprehensive smart home solutions. Voice control compatibility with popular virtual assistants enhances user convenience and market appeal.

Sustainable technology advancement offers opportunities for manufacturers to differentiate products through enhanced energy efficiency, water conservation features, and eco-friendly materials. Government sustainability initiatives and green building standards create favorable conditions for energy-efficient appliances, potentially including incentives and rebates for qualifying models.

Commercial sector expansion provides significant growth potential as the region’s hospitality, food service, and healthcare industries continue expanding. Hotels, restaurants, hospitals, and catering businesses require reliable dishwashing solutions, creating opportunities for specialized commercial-grade products and service contracts. Franchise restaurant growth particularly drives standardized equipment procurement.

Emerging market segments including compact living spaces, vacation homes, and serviced apartments create demand for specialized dishwasher configurations. Developers increasingly include dishwashers as standard amenities in premium residential projects, creating bulk procurement opportunities and long-term service contracts.

E-commerce growth enables manufacturers and retailers to reach broader consumer bases through online sales channels. Digital marketing strategies, virtual demonstrations, and home delivery services reduce traditional retail barriers while providing detailed product information and customer reviews that influence purchase decisions.

Supply chain evolution significantly impacts market dynamics as manufacturers adapt distribution strategies to serve diverse GCC markets effectively. Regional distribution centers, local assembly operations, and strategic partnerships with established retailers create competitive advantages while reducing logistics costs and delivery times. Inventory management becomes crucial given seasonal demand fluctuations and varying market preferences across different countries.

Competitive intensity increases as both established international brands and emerging regional players compete for market share. Price competition intensifies in mid-range segments while premium brands focus on feature differentiation and service quality. Brand positioning strategies emphasize reliability, energy efficiency, and local service support to address consumer concerns and preferences.

Regulatory landscape influences market dynamics through energy efficiency standards, safety requirements, and import regulations. Harmonized GCC standards facilitate regional trade while ensuring product quality and consumer protection. Compliance requirements create barriers for low-quality imports while supporting established brands with robust quality assurance systems.

Technology integration drives market evolution as manufacturers incorporate advanced features including sensor-based wash cycles, artificial intelligence optimization, and predictive maintenance capabilities. Innovation cycles accelerate as companies compete to offer the latest technologies while maintaining reliability and ease of use that appeal to regional consumers.

Consumer education initiatives by manufacturers and retailers help overcome adoption barriers through demonstration programs, trial offers, and comprehensive after-sales support. Market development activities focus on highlighting water and energy savings, time convenience benefits, and superior cleaning performance compared to manual dishwashing methods.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the GCC dishwasher market. Primary research includes extensive consumer surveys, retailer interviews, and manufacturer consultations across all six GCC countries to capture diverse market perspectives and regional variations in consumer behavior and preferences.

Data collection methods encompass both quantitative and qualitative approaches, including structured questionnaires, focus group discussions, and in-depth interviews with industry stakeholders. Consumer surveys target representative samples across different demographic segments, income levels, and geographic locations to ensure comprehensive market understanding.

Secondary research incorporates analysis of industry reports, trade statistics, government publications, and company financial statements to validate primary findings and provide historical context. Market intelligence gathering includes monitoring of competitor activities, pricing strategies, and product launch patterns across the region.

Statistical analysis employs advanced analytical techniques to identify market trends, growth patterns, and correlation factors affecting consumer adoption rates. Forecasting models integrate multiple variables including economic indicators, demographic trends, and historical sales data to project future market development scenarios.

Quality assurance measures include data validation, cross-verification of sources, and peer review processes to ensure research accuracy and reliability. Continuous monitoring of market developments enables regular updates and refinements to research findings and market projections.

Saudi Arabia represents the largest market within the GCC region, accounting for approximately 42% of total dishwasher sales volume. The kingdom’s Vision 2030 initiatives promoting lifestyle improvements and women’s workforce participation drive market growth. Urban centers including Riyadh, Jeddah, and Dammam show highest adoption rates, while rural areas present significant growth opportunities as infrastructure development progresses.

United Arab Emirates demonstrates the highest market penetration rates at 35% of households, driven by diverse expatriate population and premium lifestyle preferences. Dubai and Abu Dhabi lead in luxury appliance adoption, while northern emirates show growing demand for mid-range models. Commercial sector growth in hospitality and food service industries creates additional demand for specialized dishwashing solutions.

Qatar exhibits strong growth potential supported by ongoing infrastructure development and rising household incomes. The market shows preference for premium European brands, with energy efficiency becoming increasingly important due to government sustainability initiatives. World Cup legacy projects continue driving commercial appliance demand in hospitality and food service sectors.

Kuwait presents a mature market with steady growth patterns, characterized by brand loyalty and preference for established manufacturers. Replacement demand comprises significant market share as early adopters upgrade to newer models with enhanced features. Government housing projects create opportunities for bulk procurement and standardized installations.

Bahrain shows growing market acceptance despite smaller market size, with increasing focus on compact and space-efficient models suitable for apartment living. Financial sector growth supports higher disposable incomes among target consumer segments, while tourism industry expansion drives commercial demand.

Oman represents an emerging market with substantial growth potential as economic diversification efforts progress. Infrastructure development in major cities creates demand for modern appliances, while government initiatives promoting energy efficiency support market expansion for qualified products.

Market leadership is distributed among several international brands, each employing distinct strategies to capture market share and build consumer loyalty. The competitive environment emphasizes product quality, service reliability, and adaptation to regional preferences and requirements.

Competitive strategies include localized marketing campaigns, extended warranty programs, and partnerships with major retailers and developers. Service differentiation becomes crucial as brands compete on installation quality, maintenance responsiveness, and spare parts availability across the region.

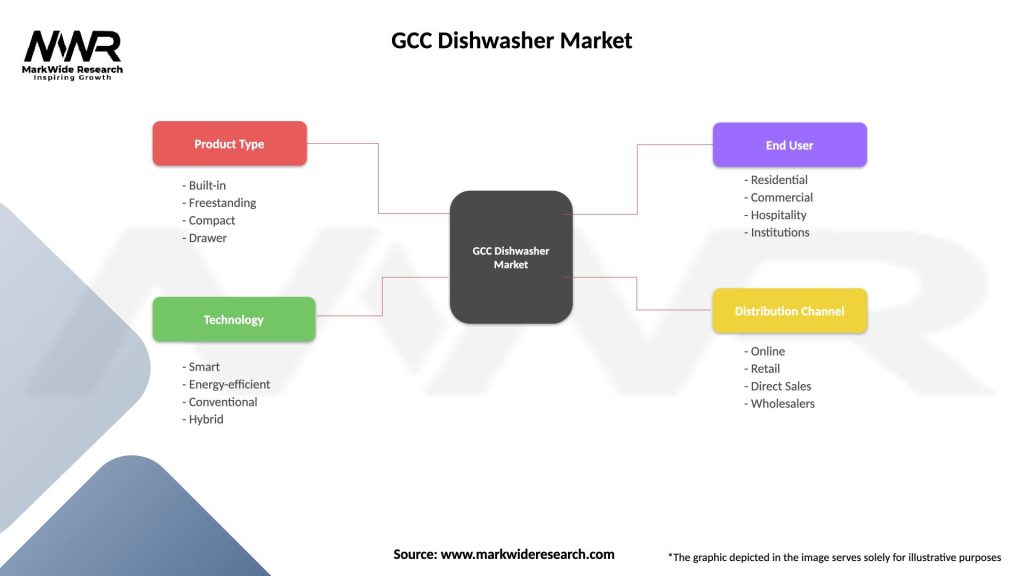

By Product Type: The market segments into distinct categories based on design and installation requirements, each serving specific consumer needs and kitchen configurations prevalent across GCC markets.

By Capacity: Consumer preferences vary based on household size, entertaining patterns, and kitchen space availability, creating distinct market segments with specific feature requirements.

By End User: Market applications span residential and commercial sectors, each with distinct requirements for performance, durability, and service support.

Premium Segment Analysis: High-end dishwashers priced above regional averages demonstrate strong growth momentum, driven by affluent consumers seeking advanced features and superior performance. This segment emphasizes smart connectivity, energy efficiency ratings, and premium materials that justify higher price points. European brands dominate this category with German manufacturers leading in reliability perception and build quality.

Mid-range Market Dynamics: The largest segment by volume focuses on balancing features with affordability, targeting middle-class consumers seeking reliable performance without premium pricing. Value proposition becomes critical as brands compete on essential features, warranty coverage, and service accessibility. This segment shows highest growth potential as market penetration increases across GCC countries.

Entry-level Opportunities: Budget-conscious consumers and first-time buyers drive demand for basic models offering core dishwashing functionality at accessible price points. Compact designs and simplified operation appeal to consumers transitioning from manual dishwashing methods. This segment requires focused marketing on convenience benefits and long-term cost savings.

Smart Technology Integration: Connected dishwashers with Wi-Fi capability and mobile app control represent the fastest-growing category, appealing to tech-savvy consumers and smart home enthusiasts. IoT features including remote monitoring, cycle customization, and maintenance alerts justify premium pricing while enhancing user experience and convenience.

Energy Efficiency Focus: Environmental consciousness and utility cost concerns drive preference for energy-efficient models with superior ratings. Water conservation features become particularly relevant in the water-scarce GCC region, with modern dishwashers offering significant savings compared to manual washing methods. Government incentives and green building standards further support this category growth.

Manufacturers benefit from expanding market opportunities as GCC countries experience continued economic growth and lifestyle modernization. The region offers attractive profit margins, growing consumer base, and relatively less saturated market conditions compared to mature markets. Brand building opportunities exist for companies willing to invest in local service networks and consumer education initiatives.

Retailers and Distributors gain from increasing consumer interest and expanding product categories that enhance store traffic and average transaction values. Service revenue streams from installation, maintenance, and extended warranties provide recurring income opportunities beyond initial appliance sales. Strategic partnerships with developers and contractors create bulk sales channels.

Consumers enjoy significant lifestyle improvements through time savings, superior cleaning performance, and water conservation benefits. Health advantages include better hygiene standards and reduced exposure to harsh cleaning chemicals. Long-term cost benefits emerge through water and energy savings, particularly with efficient models and proper usage patterns.

Real Estate Developers can differentiate properties by including dishwashers as standard amenities, appealing to modern buyers and tenants seeking convenience features. Property values benefit from modern appliance packages that enhance overall appeal and marketability of residential projects.

Service Providers including installation specialists, maintenance technicians, and parts suppliers benefit from growing installed base requiring ongoing support. Training opportunities exist for local technicians as manufacturers invest in service network development to support market expansion.

Government Stakeholders achieve sustainability objectives through promoting energy-efficient appliances that reduce overall energy consumption and water usage. Economic benefits include job creation in retail, service, and distribution sectors while supporting broader economic diversification goals.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart Technology Integration represents the most significant trend reshaping the dishwasher market, with manufacturers incorporating Wi-Fi connectivity, mobile app control, and artificial intelligence optimization. Voice control compatibility with popular virtual assistants enhances user convenience while predictive maintenance features reduce service calls and extend appliance lifespan.

Sustainability Focus drives product development toward enhanced energy efficiency, water conservation, and eco-friendly materials. Energy Star certification becomes increasingly important as consumers seek appliances that reduce utility costs and environmental impact. Manufacturers invest in developing models that exceed regional efficiency standards while maintaining superior cleaning performance.

Compact Design Innovation addresses space constraints in modern GCC housing, with manufacturers developing slimline models and drawer configurations that maximize functionality while minimizing kitchen footprint. Flexible installation options enable integration into diverse kitchen layouts and existing cabinetry configurations.

Premium Feature Democratization brings advanced capabilities previously reserved for luxury models to mid-range segments, including sensor-based wash cycles, adjustable racks, and specialized cleaning programs. Value engineering enables manufacturers to offer enhanced features at accessible price points, expanding market appeal.

Service Excellence Emphasis becomes a key differentiator as brands compete on installation quality, maintenance responsiveness, and customer support. Extended warranty programs and comprehensive service packages address consumer concerns about long-term reliability and support availability.

Customization and Personalization trends include adjustable interior configurations, specialized wash cycles for regional cuisine requirements, and aesthetic options that complement diverse kitchen designs. Cultural adaptation features address specific cleaning needs and usage patterns prevalent in GCC households.

Manufacturing Localization initiatives by major brands include establishing regional assembly facilities and distribution centers to reduce costs and improve supply chain efficiency. Local partnerships with established distributors and service providers enhance market penetration while providing better customer support across diverse GCC markets.

Retail Channel Expansion encompasses both traditional appliance stores and modern retail formats including hypermarkets, specialty chains, and online platforms. Showroom investments by manufacturers and retailers provide consumers with hands-on experience and professional consultation services that facilitate purchase decisions.

Technology Partnerships between appliance manufacturers and smart home platform providers create integrated solutions that appeal to tech-savvy consumers. IoT ecosystem integration enables dishwashers to communicate with other connected appliances and home management systems for optimized performance and user convenience.

Sustainability Initiatives include development of more efficient models, recycling programs for old appliances, and partnerships with utility companies to promote energy conservation. Green certification programs help consumers identify environmentally responsible products while supporting manufacturer differentiation strategies.

Service Network Development involves training local technicians, establishing spare parts distribution systems, and implementing customer service standards that meet regional expectations. Digital service platforms enable remote diagnostics, appointment scheduling, and customer communication that enhance service quality and efficiency.

Market Education Campaigns by industry associations and leading manufacturers focus on demonstrating dishwasher benefits, addressing cultural concerns, and promoting proper usage practices. Consumer awareness programs highlight water and energy savings, time convenience, and superior hygiene benefits compared to manual dishwashing methods.

Market Entry Strategies for new participants should focus on identifying underserved segments and geographic areas with growth potential. MarkWide Research analysis indicates that smaller GCC cities and mid-range price segments offer attractive opportunities for brands willing to invest in local market development and consumer education initiatives.

Product Development Priorities should emphasize energy efficiency, compact designs, and smart connectivity features that align with regional consumer preferences and infrastructure constraints. Cultural adaptation including specialized wash cycles and aesthetic options that complement local kitchen designs can provide competitive advantages in this diverse market.

Distribution Channel Optimization requires balancing traditional retail partnerships with emerging online platforms and direct-to-consumer sales models. Service capability development becomes crucial for long-term success, requiring investments in local technician training and spare parts distribution networks.

Pricing Strategy Considerations should account for varying income levels and price sensitivity across different GCC markets and consumer segments. Flexible financing options and trade-in programs can help overcome initial cost barriers while building brand loyalty and market share.

Marketing Communication should address cultural concerns while highlighting practical benefits including time savings, water conservation, and superior cleaning performance. Demonstration programs and trial offers can help overcome adoption barriers by providing hands-on experience with dishwasher benefits.

Partnership Development with real estate developers, kitchen designers, and home improvement retailers creates opportunities for bulk sales and integrated marketing approaches. Commercial sector focus on hospitality and food service industries provides additional growth channels with different requirements and decision-making processes.

Market expansion prospects remain highly favorable as GCC countries continue economic diversification efforts and lifestyle modernization trends. Demographic shifts including urbanization, women’s workforce participation, and generational changes support sustained growth in dishwasher adoption rates across the region. MWR projections indicate continued market expansion with penetration rates potentially reaching 52% by 2030.

Technology evolution will drive next-generation products featuring enhanced artificial intelligence, improved energy efficiency, and seamless smart home integration. Innovation cycles accelerate as manufacturers compete to offer cutting-edge features while maintaining reliability and ease of use that appeal to regional consumers seeking convenience and performance.

Sustainability initiatives will become increasingly important as governments implement stricter energy efficiency standards and consumers prioritize environmental responsibility. Water conservation features gain particular relevance in the water-scarce GCC region, with advanced models offering significant savings compared to traditional dishwashing methods.

Market maturation in leading countries like UAE and Saudi Arabia will shift focus toward replacement demand and premium segment growth, while emerging markets in Oman and Bahrain present opportunities for initial market development. Commercial sector expansion continues driven by tourism industry growth and food service sector development across the region.

Service excellence becomes a key competitive differentiator as market matures, with successful brands investing in comprehensive support networks, extended warranty programs, and customer satisfaction initiatives. Digital transformation of service delivery through remote diagnostics and predictive maintenance enhances customer experience while reducing operational costs.

The GCC dishwasher market represents a dynamic and rapidly evolving segment within the region’s appliance industry, characterized by strong growth potential, increasing consumer acceptance, and continuous technological advancement. Market fundamentals remain robust, supported by favorable demographic trends, rising disposable incomes, and lifestyle changes that prioritize convenience and efficiency in household management.

Strategic opportunities exist for manufacturers, retailers, and service providers willing to invest in market development, consumer education, and local infrastructure. Success factors include product adaptation to regional preferences, competitive pricing strategies, comprehensive service networks, and effective marketing communication that addresses cultural considerations while highlighting practical benefits.

Future growth prospects appear highly favorable as the market transitions from early adoption to mainstream acceptance across GCC countries. Continued economic development, infrastructure expansion, and generational shifts support sustained market expansion, while technological innovations in smart connectivity and energy efficiency create new value propositions for consumers seeking modern appliance solutions.

Market participants who understand regional dynamics, invest in local capabilities, and maintain focus on customer satisfaction are well-positioned to capitalize on the substantial opportunities presented by this expanding market. The GCC dishwasher market offers attractive long-term prospects for stakeholders committed to serving this diverse and growing consumer base with quality products and reliable service support.

What is a Dishwasher?

A dishwasher is a home appliance designed to clean dishes, utensils, and cookware automatically. It uses water, detergent, and a combination of spray arms to remove food particles and sanitize items, making it a convenient solution for households and commercial kitchens.

What are the key players in the GCC Dishwasher Market?

Key players in the GCC Dishwasher Market include companies like Bosch, LG Electronics, and Whirlpool, which offer a range of models catering to different consumer needs. These companies focus on innovation and energy efficiency to enhance user experience, among others.

What are the growth factors driving the GCC Dishwasher Market?

The GCC Dishwasher Market is driven by factors such as increasing urbanization, rising disposable incomes, and a growing preference for convenience in household chores. Additionally, the expansion of the hospitality sector is contributing to higher demand for commercial dishwashers.

What challenges does the GCC Dishwasher Market face?

Challenges in the GCC Dishwasher Market include high initial costs and the need for regular maintenance. Furthermore, cultural preferences for handwashing dishes in some households can limit market penetration.

What opportunities exist in the GCC Dishwasher Market?

Opportunities in the GCC Dishwasher Market include the introduction of smart dishwashers with IoT capabilities and energy-efficient models. Additionally, increasing awareness of hygiene and sanitation is likely to boost demand for dishwashers in both residential and commercial sectors.

What trends are shaping the GCC Dishwasher Market?

Trends in the GCC Dishwasher Market include a shift towards compact and portable models suitable for smaller living spaces. There is also a growing emphasis on sustainability, with manufacturers focusing on eco-friendly materials and energy-efficient technologies.

GCC Dishwasher Market

| Segmentation Details | Description |

|---|---|

| Product Type | Built-in, Freestanding, Compact, Drawer |

| Technology | Smart, Energy-efficient, Conventional, Hybrid |

| End User | Residential, Commercial, Hospitality, Institutions |

| Distribution Channel | Online, Retail, Direct Sales, Wholesalers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the GCC Dishwasher Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at