444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The GCC digital printing market represents one of the most dynamic and rapidly evolving sectors within the Gulf Cooperation Council region’s technology landscape. This comprehensive market encompasses advanced printing technologies, including inkjet, laser, and thermal printing solutions across various applications ranging from commercial printing to packaging and textiles. The region’s strategic position as a global business hub, combined with increasing digitalization initiatives and growing demand for customized printing solutions, has positioned the GCC digital printing market for substantial expansion.

Market dynamics in the GCC region are characterized by robust technological adoption, with digital printing experiencing a compound annual growth rate of 8.2% across key market segments. The United Arab Emirates and Saudi Arabia lead market penetration, accounting for approximately 65% of regional digital printing adoption. This growth trajectory reflects the region’s commitment to diversifying economies away from traditional oil-based industries toward technology-driven sectors.

Regional infrastructure development and government initiatives supporting digital transformation have created favorable conditions for market expansion. The integration of Industry 4.0 principles and smart manufacturing concepts has accelerated demand for sophisticated digital printing solutions across commercial, industrial, and consumer applications throughout the GCC region.

The GCC digital printing market refers to the comprehensive ecosystem of digital printing technologies, equipment, consumables, and services operating within the Gulf Cooperation Council member states, including the United Arab Emirates, Saudi Arabia, Qatar, Kuwait, Bahrain, and Oman. This market encompasses various digital printing methodologies that utilize electronic files to produce printed materials without traditional printing plates or lengthy setup processes.

Digital printing technology enables on-demand production, variable data printing, and customization capabilities that traditional offset printing cannot efficiently deliver. The market includes hardware components such as digital presses, wide-format printers, and desktop printing systems, alongside software solutions, inks, substrates, and comprehensive service offerings that support the complete digital printing workflow.

Market scope extends across multiple industry verticals, including commercial printing, packaging, textiles, signage, labels, and specialty applications. The GCC region’s unique position as a global trade hub and its rapid economic diversification initiatives have created distinct market characteristics that differentiate it from other regional digital printing markets worldwide.

Strategic market analysis reveals that the GCC digital printing market is experiencing unprecedented transformation driven by technological innovation, changing consumer preferences, and regional economic diversification strategies. The market demonstrates strong fundamentals with consistent growth across all major segments, supported by increasing adoption of digital technologies and growing demand for personalized printing solutions.

Key market drivers include rapid urbanization, expanding e-commerce activities, and government initiatives promoting digital transformation across various industries. The region’s young, tech-savvy population has contributed to 42% increased demand for customized and on-demand printing services, particularly in retail, marketing, and packaging applications.

Technological advancement remains a critical factor, with innovations in print quality, speed, and substrate compatibility driving market evolution. The integration of artificial intelligence, automation, and cloud-based printing solutions has enhanced operational efficiency and reduced production costs, making digital printing increasingly attractive to businesses across the GCC region.

Market segmentation analysis indicates strong performance across commercial printing, packaging, and textile applications, with emerging opportunities in industrial printing and specialty applications. Regional market leaders continue investing in advanced technologies and expanding service capabilities to capture growing market opportunities.

Market intelligence reveals several critical insights that define the current and future trajectory of the GCC digital printing market:

Economic diversification initiatives across GCC countries serve as primary catalysts for digital printing market expansion. Government programs promoting non-oil economic activities have created favorable conditions for technology adoption and business growth in the printing sector. These initiatives include substantial investments in digital infrastructure, technology parks, and innovation centers that support digital printing businesses.

E-commerce growth throughout the region has generated unprecedented demand for packaging and marketing materials, driving digital printing adoption. The rapid expansion of online retail platforms requires flexible, responsive printing solutions capable of handling variable order volumes and customization requirements that traditional printing methods cannot efficiently address.

Urbanization trends and population growth across major GCC cities have increased demand for commercial printing services, signage, and marketing materials. The region’s young demographic profile, with 68% of the population under 35 years, demonstrates strong preference for customized and digitally-produced products across various applications.

Technological advancement in digital printing equipment has improved quality, speed, and cost-effectiveness, making digital solutions increasingly competitive with traditional printing methods. Innovations in inkjet technology, color management, and substrate compatibility have expanded application possibilities and market opportunities.

Sustainability concerns and environmental regulations are driving adoption of digital printing solutions that offer reduced waste, lower energy consumption, and more efficient resource utilization compared to conventional printing processes. This trend aligns with regional sustainability initiatives and corporate environmental responsibility programs.

High initial investment requirements for advanced digital printing equipment present significant barriers for small and medium-sized enterprises seeking to enter or expand within the market. The substantial capital expenditure needed for professional-grade digital printing systems, combined with ongoing maintenance and consumable costs, can limit market accessibility for smaller operators.

Technical skill requirements for operating sophisticated digital printing equipment create workforce challenges across the region. The shortage of qualified technicians and operators with specialized digital printing expertise can constrain business growth and operational efficiency for companies investing in advanced printing technologies.

Substrate limitations continue to restrict digital printing applications in certain market segments. While technology improvements have expanded substrate compatibility, some specialized materials and applications still require traditional printing methods, limiting digital printing market penetration in specific niches.

Competition from traditional printing methods remains significant, particularly for large-volume applications where offset printing maintains cost advantages. Established relationships between businesses and traditional printing providers can create resistance to digital printing adoption despite technological advantages.

Economic volatility related to oil price fluctuations can impact business investment decisions and overall market growth in the GCC region. Economic uncertainty may cause businesses to delay capital investments in new printing technologies, affecting market expansion rates.

Industrial printing applications represent substantial untapped opportunities within the GCC digital printing market. The region’s growing manufacturing sector requires advanced printing solutions for product marking, labeling, and traceability applications that digital printing technologies can efficiently address.

Textile printing expansion offers significant growth potential, particularly in fashion, home décor, and specialty textile applications. The region’s position as a global fashion hub and growing textile manufacturing capabilities create favorable conditions for digital textile printing market development.

3D printing integration presents emerging opportunities for businesses seeking to expand beyond traditional printing services. The convergence of digital printing and additive manufacturing technologies opens new market segments and revenue streams for forward-thinking companies.

Smart packaging solutions incorporating digital printing with IoT technologies and interactive elements represent high-growth opportunities. The increasing demand for intelligent packaging in retail, pharmaceuticals, and consumer goods creates substantial market potential for innovative digital printing applications.

Cross-border expansion opportunities exist for established GCC digital printing companies to leverage regional expertise and relationships for expansion into adjacent markets in Africa, Asia, and other Middle Eastern countries.

Supply chain evolution within the GCC digital printing market reflects broader regional economic transformation trends. Local manufacturing capabilities are expanding, reducing dependence on imported equipment and consumables while improving supply chain resilience and cost competitiveness.

Customer behavior patterns demonstrate increasing sophistication and demand for comprehensive printing solutions. Businesses across the region are seeking integrated service providers capable of handling complex projects from design through fulfillment, driving consolidation and service expansion within the market.

Technology integration trends show accelerating adoption of cloud-based printing solutions, workflow automation, and data analytics capabilities. These technological developments are improving operational efficiency by approximately 35% across major market segments while enabling new service offerings and business models.

Competitive dynamics are intensifying as international printing technology providers establish regional operations and local companies invest in advanced capabilities. This competition is driving innovation, improving service quality, and creating more favorable pricing conditions for end-users.

Regulatory environment developments, including environmental standards and quality certifications, are shaping market evolution and creating opportunities for companies that proactively address compliance requirements and sustainability concerns.

Comprehensive market analysis methodology employed for this research encompasses multiple data collection and validation approaches to ensure accuracy and reliability of findings. Primary research activities include extensive interviews with industry executives, technology providers, and end-users across all GCC member states to gather firsthand insights into market conditions and trends.

Secondary research components involve systematic analysis of industry publications, government reports, trade association data, and company financial statements to establish market baselines and validate primary research findings. This multi-source approach ensures comprehensive coverage of market dynamics and emerging trends.

Data validation processes include cross-referencing information from multiple sources, conducting follow-up interviews to clarify findings, and utilizing statistical analysis techniques to identify patterns and correlations within the collected data. Quality assurance measures ensure research accuracy and reliability.

Market segmentation analysis utilizes both top-down and bottom-up approaches to accurately assess market size, growth rates, and competitive positioning across different technology categories, application segments, and geographic regions within the GCC market.

Forecasting methodology incorporates econometric modeling, trend analysis, and scenario planning to develop realistic market projections that account for various economic, technological, and regulatory factors affecting the GCC digital printing market.

United Arab Emirates maintains market leadership position with approximately 35% of regional digital printing activity, driven by Dubai’s status as a global business hub and Abu Dhabi’s economic diversification initiatives. The country’s advanced infrastructure, international connectivity, and business-friendly environment support robust digital printing market growth across commercial, packaging, and specialty applications.

Saudi Arabia represents the largest growth opportunity within the GCC region, accounting for 28% of current market activity with substantial expansion potential driven by Vision 2030 economic transformation programs. Government investments in manufacturing, tourism, and technology sectors are creating significant demand for digital printing solutions across various applications.

Qatar demonstrates strong market fundamentals with 15% regional market share, supported by ongoing infrastructure development and preparation for major international events. The country’s focus on knowledge economy development and technology adoption creates favorable conditions for digital printing market expansion.

Kuwait shows steady market growth with 12% of regional activity, driven by government modernization initiatives and private sector development programs. The country’s strategic location and established business networks support digital printing market development across various industry sectors.

Bahrain and Oman collectively represent 10% of regional market activity but demonstrate strong growth potential driven by economic diversification efforts and increasing technology adoption across business sectors. Both countries are investing in digital infrastructure and innovation capabilities that support digital printing market expansion.

Market leadership within the GCC digital printing sector is characterized by a mix of international technology providers and regional service companies that have established strong market positions through strategic investments and comprehensive service offerings.

Competitive strategies focus on technology innovation, service expansion, and strategic partnerships to capture growing market opportunities and establish sustainable competitive advantages within the dynamic GCC digital printing market.

By Technology:

By Application:

By End-User:

Commercial Printing Segment continues to represent the largest market category, driven by consistent demand for marketing materials, corporate communications, and business documentation. Digital technology adoption in this segment has reached 72% penetration rate across the GCC region, with particular strength in short-run and variable data printing applications.

Packaging Applications demonstrate the highest growth rates within the digital printing market, fueled by e-commerce expansion and consumer demand for customized packaging solutions. This segment benefits from digital printing’s ability to handle variable designs, small batch sizes, and quick turnaround times that traditional packaging printing cannot efficiently provide.

Textile Printing Category shows substantial growth potential as fashion and home décor industries increasingly adopt digital printing technologies. The ability to produce complex designs, handle small production runs, and reduce inventory requirements makes digital textile printing particularly attractive to regional manufacturers and designers.

Industrial Applications represent an emerging high-growth category, including product marking, labeling, and traceability applications across manufacturing industries. The region’s expanding industrial base creates substantial opportunities for specialized digital printing solutions that support production processes and regulatory compliance requirements.

Wide-format Printing serves signage, graphics, and display applications with strong demand from retail, hospitality, and event industries throughout the GCC region. This category benefits from the region’s active tourism and business event sectors that require high-quality visual communication solutions.

Technology Providers benefit from substantial market opportunities driven by regional economic diversification and digital transformation initiatives. The GCC market offers attractive growth prospects with relatively limited competition in specialized applications and strong demand for advanced printing technologies.

Service Providers can leverage digital printing technologies to offer enhanced capabilities, improved turnaround times, and expanded service offerings that create competitive advantages and higher profit margins. The ability to handle customization and variable data printing opens new revenue streams and market opportunities.

End-User Businesses gain significant operational advantages through digital printing adoption, including reduced inventory requirements, faster time-to-market, and enhanced customization capabilities. These benefits translate into improved customer satisfaction and competitive positioning within their respective markets.

Supply Chain Partners including consumable suppliers, maintenance providers, and software developers benefit from growing market demand and opportunities for specialized service offerings. The expanding digital printing ecosystem creates multiple touchpoints for value-added services and long-term business relationships.

Regional Economy benefits from digital printing market growth through job creation, technology transfer, and enhanced manufacturing capabilities that support broader economic diversification objectives. The sector contributes to reducing dependence on traditional industries while building knowledge-based economic activities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration represents a dominant trend across the GCC digital printing market, with businesses increasingly prioritizing environmentally-friendly printing solutions. This includes adoption of eco-solvent inks, recyclable substrates, and energy-efficient printing equipment that align with regional sustainability initiatives and corporate environmental responsibility programs.

Automation and AI Implementation are transforming digital printing operations through intelligent workflow management, predictive maintenance, and quality control systems. These technologies improve operational efficiency by approximately 40% in production environments while reducing waste and enhancing print quality consistency.

Cloud-Based Solutions are gaining traction as businesses seek flexible, scalable printing capabilities that support remote work and distributed operations. Cloud printing platforms enable centralized management, improved security, and enhanced collaboration across multiple locations and business units.

Hybrid Printing Approaches combining digital and traditional printing methods are becoming more common as businesses optimize cost-effectiveness and quality across different application requirements. This trend allows companies to leverage the strengths of both technologies while minimizing individual limitations.

Personalization and Customization continue driving market evolution as consumer preferences shift toward unique, customized products across various applications. Variable data printing capabilities enable mass customization that was previously impossible with traditional printing methods.

Industry 4.0 Integration is connecting digital printing systems with broader manufacturing and business processes through IoT connectivity, data analytics, and automated workflow management. This integration improves overall operational efficiency and enables new service models and business opportunities.

Technology Partnerships between international printing equipment manufacturers and regional service providers are expanding market capabilities and improving local support infrastructure. These collaborations enhance technology transfer, training programs, and service quality across the GCC digital printing market.

Government Initiatives supporting digital transformation and manufacturing development are creating favorable conditions for digital printing market expansion. Programs including Saudi Arabia’s Vision 2030 and UAE’s Industry 4.0 strategy provide incentives and support for technology adoption and business development.

Infrastructure Investments in technology parks, innovation centers, and manufacturing facilities are improving the business environment for digital printing companies. These developments include specialized facilities, training centers, and research capabilities that support market growth and development.

Acquisition Activities within the regional market are consolidating capabilities and expanding service offerings as companies seek to build comprehensive solutions and capture growing market opportunities. Strategic acquisitions enable rapid capability expansion and market penetration.

Innovation Centers and research facilities established by major technology providers are advancing digital printing capabilities and developing solutions specifically tailored to regional market requirements and applications.

MarkWide Research analysis indicates that companies seeking success in the GCC digital printing market should prioritize comprehensive service offerings that extend beyond basic printing capabilities to include design, fulfillment, and logistics services. This integrated approach creates stronger customer relationships and higher profit margins while differentiating providers in an increasingly competitive market.

Investment in workforce development represents a critical success factor, with companies needing to establish training programs and partnerships with educational institutions to address skill shortages. Organizations that proactively develop technical capabilities will gain significant competitive advantages in equipment operation, maintenance, and customer support.

Sustainability initiatives should be integrated into business strategies from the outset, as environmental considerations are becoming increasingly important in purchasing decisions. Companies that demonstrate leadership in sustainable printing practices will capture growing market segments focused on environmental responsibility.

Technology partnerships with international providers can accelerate capability development and market penetration while reducing investment risks. Strategic alliances enable access to advanced technologies, training resources, and global best practices that enhance competitive positioning.

Market specialization in specific applications or industry verticals can create sustainable competitive advantages and premium pricing opportunities. Companies that develop deep expertise in packaging, textiles, or industrial applications can establish market leadership positions and build long-term customer relationships.

Long-term market prospects for the GCC digital printing sector remain highly positive, supported by continued economic diversification, technological advancement, and growing demand for customized printing solutions. MWR projects sustained growth across all major market segments, with particular strength in packaging, textile, and industrial applications.

Technology evolution will continue driving market transformation through improvements in print quality, speed, and substrate compatibility. Emerging technologies including 3D printing integration, smart packaging solutions, and advanced automation capabilities will create new market opportunities and revenue streams for forward-thinking companies.

Regional integration initiatives and cross-border trade facilitation will expand market opportunities beyond individual GCC member states, enabling companies to leverage regional expertise for broader market penetration and growth. This integration will create economies of scale and enhanced competitive positioning.

Sustainability requirements will increasingly influence market development, with companies that proactively address environmental concerns gaining competitive advantages. The integration of circular economy principles and sustainable practices will become essential for long-term market success.

Market maturation will lead to increased specialization and service differentiation as companies seek to establish unique value propositions and sustainable competitive advantages. This evolution will create opportunities for niche players while rewarding companies that invest in comprehensive capabilities and customer relationships.

The GCC digital printing market represents a dynamic and rapidly evolving sector with substantial growth opportunities driven by regional economic transformation, technological advancement, and changing consumer preferences. Market fundamentals remain strong across all major segments, with particular strength in packaging, commercial printing, and emerging industrial applications.

Strategic success factors include comprehensive service offerings, workforce development, sustainability integration, and technology partnerships that enable companies to capture growing market opportunities while building sustainable competitive advantages. The region’s unique position as a global business hub, combined with government support for digital transformation initiatives, creates favorable conditions for continued market expansion.

Future market evolution will be characterized by increased automation, sustainability focus, and service integration as companies seek to differentiate offerings and capture premium market segments. Organizations that proactively address these trends while investing in advanced capabilities and customer relationships will be best positioned for long-term success in the dynamic GCC digital printing market.

What is Digital Printing?

Digital printing refers to the process of printing digital images directly onto various media substrates. It is widely used in applications such as packaging, textiles, and promotional materials.

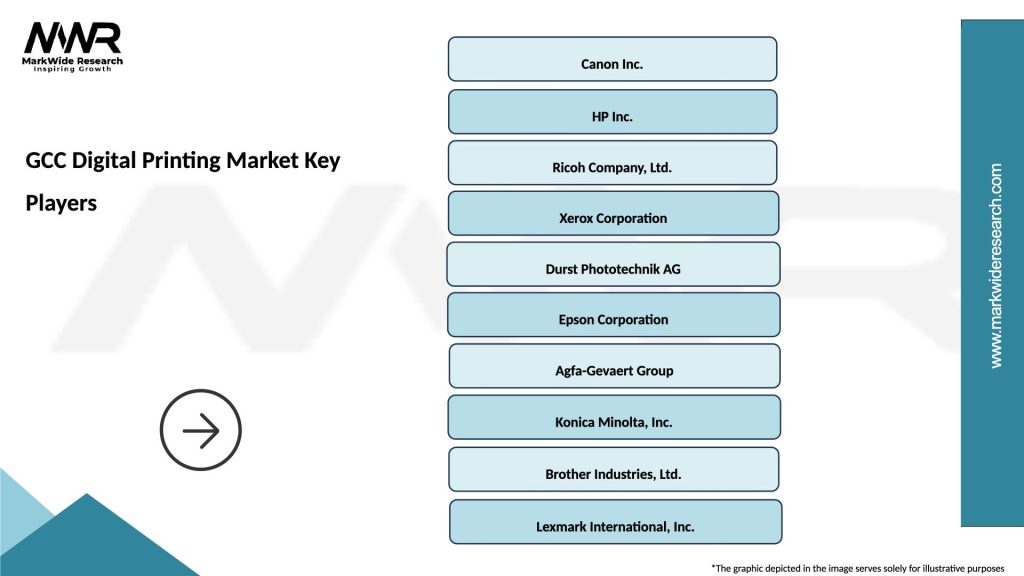

What are the key players in the GCC Digital Printing Market?

Key players in the GCC Digital Printing Market include HP Inc., Canon Inc., and Epson, among others. These companies are known for their innovative printing technologies and solutions tailored to various industries.

What are the main drivers of growth in the GCC Digital Printing Market?

The main drivers of growth in the GCC Digital Printing Market include the increasing demand for customized printing solutions, advancements in printing technology, and the rise of e-commerce, which requires efficient packaging solutions.

What challenges does the GCC Digital Printing Market face?

The GCC Digital Printing Market faces challenges such as high initial investment costs and competition from traditional printing methods. Additionally, the need for skilled labor to operate advanced printing equipment can be a barrier.

What opportunities exist in the GCC Digital Printing Market?

Opportunities in the GCC Digital Printing Market include the growing trend of sustainable printing practices and the expansion of digital textile printing. These trends are driven by consumer preferences for eco-friendly products and personalized designs.

What trends are shaping the GCC Digital Printing Market?

Trends shaping the GCC Digital Printing Market include the adoption of automation and smart technologies in printing processes, as well as the increasing use of digital printing in packaging and labels. These innovations are enhancing efficiency and reducing waste.

GCC Digital Printing Market

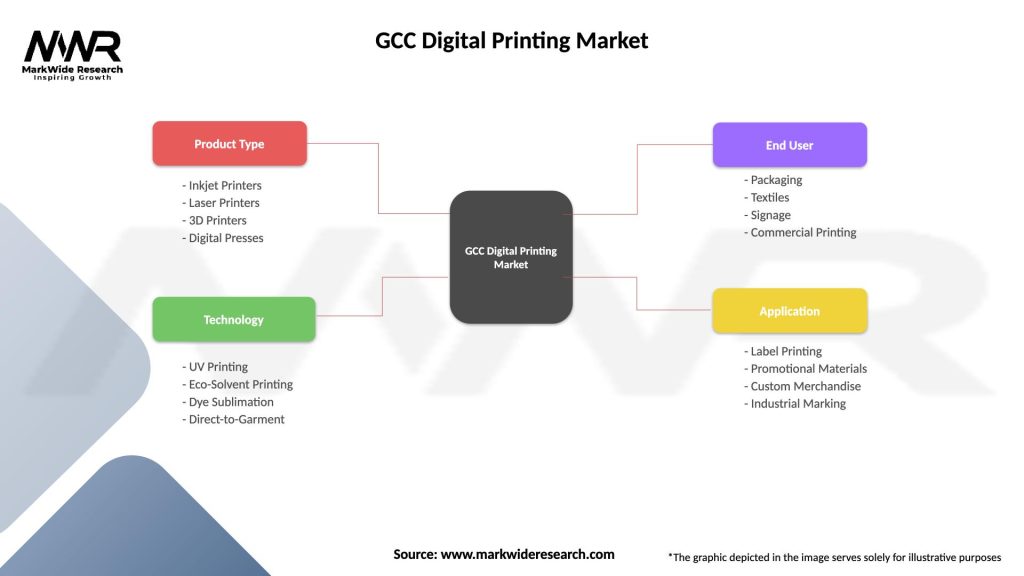

| Segmentation Details | Description |

|---|---|

| Product Type | Inkjet Printers, Laser Printers, 3D Printers, Digital Presses |

| Technology | UV Printing, Eco-Solvent Printing, Dye Sublimation, Direct-to-Garment |

| End User | Packaging, Textiles, Signage, Commercial Printing |

| Application | Label Printing, Promotional Materials, Custom Merchandise, Industrial Marking |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the GCC Digital Printing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at