444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The GCC desert air coolers market represents a rapidly expanding segment within the region’s cooling solutions industry, driven by the unique climatic conditions and growing demand for energy-efficient cooling alternatives. Desert air coolers, also known as evaporative coolers, have gained significant traction across Gulf Cooperation Council countries due to their cost-effectiveness and environmental benefits compared to traditional air conditioning systems.

Market dynamics in the GCC region are particularly favorable for desert air coolers, with the technology showing remarkable adaptation to the arid climate conditions prevalent across Saudi Arabia, UAE, Qatar, Kuwait, Oman, and Bahrain. The market is experiencing robust growth at a CAGR of 8.2%, reflecting increasing consumer awareness about sustainable cooling solutions and rising energy costs associated with conventional cooling systems.

Regional adoption varies significantly across GCC countries, with Saudi Arabia commanding approximately 35% market share due to its vast geographical area and diverse climatic zones. The UAE follows with 28% market penetration, driven by rapid urbanization and government initiatives promoting energy-efficient technologies. Industrial applications account for nearly 45% of total demand, while residential and commercial sectors represent the remaining market share.

Technological advancements in desert air cooler design have enhanced their effectiveness in extreme heat conditions, with modern units achieving temperature reduction of up to 15-20 degrees Celsius while consuming significantly less energy than traditional air conditioning systems. This efficiency improvement has positioned desert air coolers as viable alternatives for various applications across the GCC region.

The GCC desert air coolers market refers to the commercial ecosystem encompassing the manufacturing, distribution, and sales of evaporative cooling systems specifically designed for the harsh desert climates of Gulf Cooperation Council countries. These cooling systems utilize the natural process of water evaporation to reduce ambient temperatures, making them particularly suitable for arid environments with low humidity levels.

Desert air coolers operate on the principle of evaporative cooling, where hot, dry air passes through water-saturated cooling pads, resulting in cooled air through the evaporation process. This technology is especially effective in desert climates where humidity levels remain consistently low, allowing for optimal evaporation rates and maximum cooling efficiency.

Market scope includes various types of desert air coolers ranging from portable residential units to large-scale industrial cooling systems. The technology encompasses both traditional evaporative coolers and advanced hybrid systems that combine evaporative cooling with other cooling technologies to enhance performance in extreme heat conditions typical of the GCC region.

Strategic positioning of the GCC desert air coolers market reflects a compelling growth trajectory driven by environmental consciousness, energy efficiency requirements, and cost-effectiveness considerations. The market demonstrates strong fundamentals with increasing adoption across residential, commercial, and industrial sectors throughout the Gulf region.

Key growth drivers include rising electricity costs, government sustainability initiatives, and growing awareness of environmental impact associated with traditional cooling systems. The market benefits from favorable climatic conditions that maximize the effectiveness of evaporative cooling technology, particularly during peak summer months when cooling demand reaches its highest levels.

Competitive landscape features both international manufacturers and regional players, with companies focusing on product innovation, energy efficiency improvements, and customization for local market requirements. The market shows strong potential for continued expansion, supported by infrastructure development projects and increasing industrial activities across GCC countries.

Future prospects indicate sustained growth momentum with technological advancements enhancing product performance and expanding application areas. The integration of smart technologies and IoT capabilities is expected to drive next-generation desert air cooler solutions, further strengthening market position in the regional cooling solutions ecosystem.

Market intelligence reveals several critical insights that define the current state and future direction of the GCC desert air coolers market:

Primary growth catalysts propelling the GCC desert air coolers market encompass a diverse range of economic, environmental, and technological factors that create favorable conditions for market expansion.

Energy cost escalation represents the most significant driver, with electricity tariffs increasing across GCC countries as governments reduce energy subsidies. This trend makes energy-efficient cooling solutions increasingly attractive to consumers and businesses seeking to reduce operational expenses while maintaining comfortable indoor environments.

Environmental consciousness is driving demand for sustainable cooling alternatives, particularly as regional governments implement stricter environmental regulations and promote green building standards. Desert air coolers align with these initiatives by offering cooling solutions with minimal environmental impact and reduced carbon emissions.

Industrial expansion across the GCC region creates substantial demand for cost-effective cooling solutions in manufacturing facilities, warehouses, and logistics centers. The growing industrial sector requires efficient cooling systems that can handle large spaces while maintaining operational cost efficiency.

Climate change adaptation strategies increasingly focus on sustainable cooling technologies as temperatures continue to rise across the region. Desert air coolers provide viable solutions for managing extreme heat conditions while reducing dependence on energy-intensive conventional cooling systems.

Technological improvements in desert air cooler design and functionality enhance their appeal to consumers previously hesitant about evaporative cooling technology. Advanced features such as smart controls, improved cooling efficiency, and enhanced durability address traditional concerns about performance and reliability.

Market limitations present certain challenges that may constrain the growth potential of the GCC desert air coolers market, requiring strategic approaches to overcome these barriers.

Humidity sensitivity represents the primary technical limitation, as desert air coolers become less effective in high-humidity conditions. While GCC countries generally maintain low humidity levels, coastal areas and certain seasonal conditions can reduce cooling effectiveness, limiting market penetration in specific geographical zones.

Consumer perception challenges persist regarding the cooling capacity and comfort levels provided by evaporative cooling systems compared to traditional air conditioning. Overcoming these perceptions requires education about proper application scenarios and technological improvements that enhance performance.

Water availability concerns in water-scarce regions may limit adoption, as desert air coolers require continuous water supply for optimal operation. This constraint is particularly relevant in remote areas or regions with limited water infrastructure, potentially restricting market expansion.

Maintenance requirements for cooling pads, water systems, and filters may deter some consumers who prefer low-maintenance cooling solutions. Regular maintenance is essential for optimal performance, which can be perceived as inconvenient compared to sealed air conditioning systems.

Seasonal demand fluctuations create challenges for manufacturers and distributors in managing inventory and production capacity. Peak demand during summer months followed by reduced demand during cooler periods requires careful supply chain management and financial planning.

Emerging opportunities within the GCC desert air coolers market present significant potential for growth and market expansion across various sectors and applications.

Smart technology integration offers substantial opportunities for product differentiation and enhanced functionality. IoT-enabled desert air coolers with remote monitoring, predictive maintenance, and automated controls can command premium pricing while providing superior user experience and operational efficiency.

Industrial cooling applications represent a rapidly expanding opportunity segment, particularly in manufacturing, logistics, and agricultural facilities. Large-scale industrial desert air coolers can provide cost-effective cooling solutions for warehouses, production facilities, and storage areas where traditional air conditioning would be prohibitively expensive.

Hybrid cooling systems that combine evaporative cooling with other technologies present opportunities for enhanced performance in challenging conditions. These systems can address humidity sensitivity concerns while maintaining energy efficiency advantages, expanding the addressable market.

Government infrastructure projects across the GCC region create opportunities for large-scale desert air cooler installations in public buildings, transportation facilities, and community centers. These projects often prioritize energy efficiency and sustainability, favoring evaporative cooling solutions.

Export market potential exists for GCC-based manufacturers to serve other arid regions globally, leveraging expertise developed in desert climate applications. This opportunity can drive economies of scale and support domestic market development through increased production volumes.

Complex interactions between various market forces shape the competitive landscape and growth trajectory of the GCC desert air coolers market, creating dynamic conditions that influence strategic decision-making.

Supply chain dynamics reflect the interplay between international component suppliers, regional manufacturers, and local distributors. The market benefits from established supply chains for cooling components while developing specialized expertise in desert climate applications and customization requirements.

Competitive pressures intensify as both established cooling system manufacturers and specialized evaporative cooling companies compete for market share. This competition drives innovation, improves product quality, and enhances customer service while potentially pressuring profit margins.

Regulatory influences increasingly favor energy-efficient cooling technologies through building codes, energy efficiency standards, and environmental regulations. These regulatory trends create favorable conditions for desert air coolers while potentially constraining traditional air conditioning systems.

Economic cycles affect market demand through their impact on construction activity, industrial investment, and consumer spending. Economic growth periods typically drive increased demand for cooling solutions, while economic downturns may shift preferences toward cost-effective alternatives like desert air coolers.

Technological evolution continues to reshape market dynamics through improvements in cooling efficiency, smart controls, and system integration capabilities. These advances expand application possibilities while potentially disrupting existing market segments and competitive positions.

Comprehensive research approach employed in analyzing the GCC desert air coolers market combines multiple data collection methods and analytical techniques to ensure accuracy and reliability of market insights.

Primary research activities include extensive interviews with industry stakeholders, including manufacturers, distributors, end-users, and industry experts across all GCC countries. These interviews provide firsthand insights into market trends, challenges, and opportunities while validating secondary research findings.

Secondary research encompasses analysis of industry reports, government publications, trade association data, and company financial statements to establish market baselines and identify growth patterns. This research provides historical context and supports trend analysis across different market segments and geographical regions.

Market modeling techniques utilize statistical analysis and forecasting methods to project future market trends and growth scenarios. These models incorporate various economic indicators, demographic trends, and industry-specific factors to generate reliable market projections.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert review, and consistency checks across different data points. This validation approach enhances the reliability of market analysis and supports confident strategic decision-making.

Geographic distribution of the GCC desert air coolers market reveals distinct patterns influenced by climate conditions, economic development, and infrastructure characteristics across member countries.

Saudi Arabia dominates the regional market with approximately 35% market share, driven by its large geographical area, diverse industrial base, and government initiatives promoting energy efficiency. The kingdom’s Vision 2030 sustainability goals support adoption of environmentally friendly cooling technologies, creating favorable conditions for market growth.

United Arab Emirates represents the second-largest market with 28% regional share, benefiting from rapid urbanization, extensive construction activity, and strong industrial development. Dubai and Abu Dhabi lead adoption rates, particularly in commercial and industrial applications where energy efficiency considerations are paramount.

Qatar shows strong growth potential despite its smaller size, with infrastructure development for major events and industrial diversification driving demand for efficient cooling solutions. The country’s focus on sustainability and energy efficiency aligns well with desert air cooler benefits.

Kuwait demonstrates steady market development supported by industrial expansion and growing awareness of energy-efficient cooling alternatives. The country’s extreme summer temperatures create ideal conditions for evaporative cooling technology effectiveness.

Oman and Bahrain represent emerging markets with increasing adoption rates, particularly in industrial and commercial applications. These countries benefit from technology transfer and expertise developed in larger GCC markets while addressing their specific cooling requirements.

Market competition in the GCC desert air coolers sector features a diverse mix of international manufacturers, regional specialists, and local distributors, creating a dynamic competitive environment that drives innovation and market development.

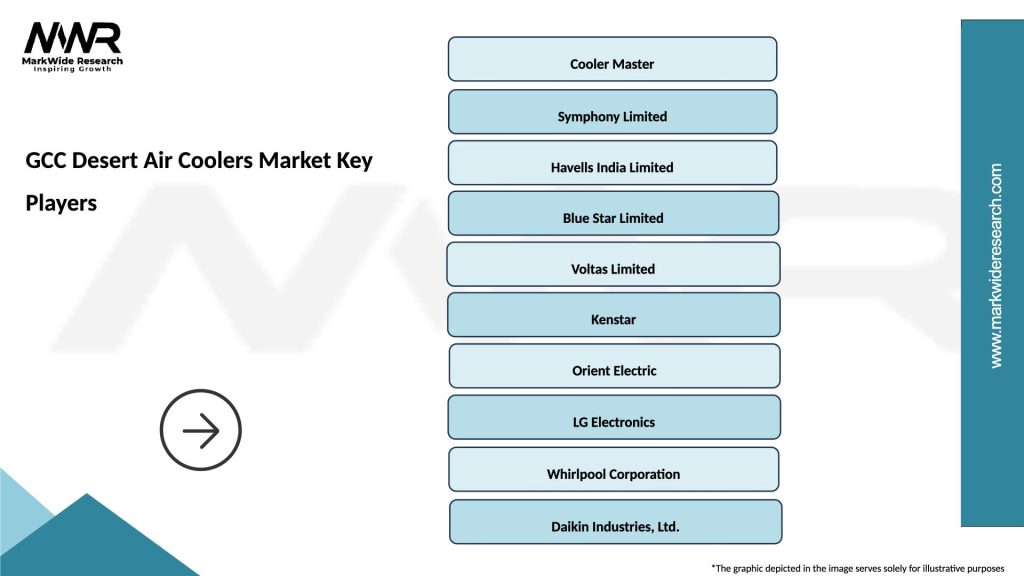

Leading market participants include:

Competitive strategies focus on product innovation, energy efficiency improvements, smart technology integration, and customization for local market requirements. Companies invest in research and development to enhance cooling performance while reducing energy consumption and maintenance requirements.

Market positioning varies among competitors, with some emphasizing premium features and advanced technology while others focus on cost-effectiveness and broad market accessibility. This diversity creates opportunities for different market segments and application requirements.

Market segmentation of the GCC desert air coolers market reveals distinct categories based on various criteria that influence purchasing decisions and application requirements.

By Product Type:

By Application:

By Distribution Channel:

Detailed analysis of market categories reveals specific trends, growth patterns, and opportunities within different segments of the GCC desert air coolers market.

Personal air coolers represent the fastest-growing segment, driven by increasing consumer awareness of energy efficiency and rising electricity costs. These compact units appeal to cost-conscious consumers seeking affordable cooling solutions for small spaces, with sales growing at approximately 12% annually across the region.

Industrial air coolers demonstrate strong demand from the expanding manufacturing and logistics sectors throughout the GCC region. Large-scale facilities require cost-effective cooling solutions that can handle substantial space requirements while maintaining operational efficiency, making industrial desert air coolers increasingly attractive.

Commercial applications show steady growth as businesses seek to reduce operational costs while maintaining comfortable environments for customers and employees. Restaurants, retail stores, and office buildings particularly benefit from the energy efficiency and lower operational costs of desert air coolers.

Smart-enabled coolers emerge as a premium category with advanced features including remote control, programmable timers, and energy monitoring capabilities. According to MarkWide Research analysis, smart desert air coolers command price premiums of 25-30% while offering enhanced user convenience and energy management benefits.

Portable units gain popularity among consumers who value flexibility and mobility in their cooling solutions. These units serve multiple rooms and outdoor applications, appealing to renters and consumers who frequently relocate within the region.

Stakeholder advantages from participating in the GCC desert air coolers market span across manufacturers, distributors, end-users, and supporting service providers, creating value throughout the ecosystem.

For Manufacturers:

For Distributors and Retailers:

For End-Users:

Strategic assessment of the GCC desert air coolers market through SWOT analysis reveals internal capabilities and external factors that influence market development and competitive positioning.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends shaping the GCC desert air coolers market reflect evolving consumer preferences, technological advancements, and changing market dynamics that influence future development directions.

Smart connectivity integration represents a major trend with manufacturers incorporating IoT capabilities, smartphone controls, and energy monitoring features into desert air coolers. These smart features appeal to tech-savvy consumers while providing enhanced convenience and energy management capabilities.

Energy efficiency optimization continues as a primary focus area, with manufacturers developing advanced cooling pad materials, variable speed motors, and improved air circulation designs. These improvements enhance cooling performance while further reducing energy consumption compared to earlier generation products.

Industrial application expansion shows strong momentum as businesses recognize the cost benefits of evaporative cooling for large spaces. Warehouses, manufacturing facilities, and logistics centers increasingly adopt industrial-scale desert air coolers as alternatives to expensive central air conditioning systems.

Hybrid cooling solutions emerge as manufacturers combine evaporative cooling with other technologies to address performance limitations while maintaining energy efficiency benefits. These hybrid systems expand the addressable market by providing effective cooling in challenging conditions.

Sustainability focus drives product development toward environmentally friendly materials, recyclable components, and enhanced energy efficiency. This trend aligns with regional sustainability goals and appeals to environmentally conscious consumers and businesses.

Customization demand increases as different market segments require specific features and capabilities. Manufacturers respond with specialized products for residential, commercial, and industrial applications, each optimized for particular use cases and performance requirements.

Recent developments in the GCC desert air coolers market demonstrate the dynamic nature of the industry and ongoing efforts to enhance product performance, expand market reach, and address evolving customer needs.

Product innovation initiatives focus on improving cooling efficiency through advanced cooling pad materials and enhanced air circulation designs. Manufacturers invest in research and development to optimize performance for extreme desert conditions while reducing water consumption and maintenance requirements.

Smart technology adoption accelerates with leading manufacturers introducing IoT-enabled desert air coolers featuring remote monitoring, predictive maintenance alerts, and energy consumption tracking. These smart features provide competitive differentiation while appealing to technology-oriented consumers.

Distribution network expansion occurs as manufacturers strengthen their presence across GCC countries through partnerships with local distributors, online retail platforms, and specialized cooling equipment retailers. This expansion improves product availability and customer service capabilities.

Industrial market penetration increases through targeted marketing efforts and customized product development for large-scale applications. Manufacturers develop specialized industrial cooling solutions that address the specific requirements of warehouses, manufacturing facilities, and commercial spaces.

Sustainability initiatives gain prominence as manufacturers focus on environmentally friendly materials, energy-efficient designs, and recyclable components. These initiatives align with regional environmental goals while appealing to sustainability-conscious consumers and businesses.

Strategic partnerships develop between manufacturers, technology providers, and regional distributors to enhance market penetration and improve customer service capabilities. These partnerships leverage complementary strengths to accelerate market development and expansion.

Strategic recommendations for market participants in the GCC desert air coolers sector focus on leveraging market opportunities while addressing challenges and competitive pressures.

Technology investment priorities should emphasize smart connectivity features, energy efficiency improvements, and hybrid cooling capabilities. MWR analysis indicates that companies investing in advanced technology features achieve 15-20% higher profit margins compared to those offering basic products.

Market segmentation strategies should target specific applications and customer segments with customized products and marketing approaches. Industrial customers require different features and service levels compared to residential consumers, necessitating tailored value propositions and sales strategies.

Distribution channel optimization should balance online and offline channels while strengthening relationships with specialized retailers and industrial distributors. Multi-channel approaches provide broader market reach while ensuring appropriate customer support for different market segments.

Regional expansion planning should prioritize countries with favorable climatic conditions, growing industrial sectors, and supportive government policies. Saudi Arabia and UAE offer the largest market opportunities, while Qatar and Kuwait present strong growth potential.

Partnership development should focus on technology providers, local distributors, and service organizations that can enhance market penetration and customer satisfaction. Strategic alliances can accelerate market development while reducing investment requirements and market entry risks.

Sustainability positioning should emphasize environmental benefits, energy efficiency, and alignment with regional sustainability goals. This positioning appeals to environmentally conscious consumers while supporting compliance with evolving environmental regulations.

Long-term prospects for the GCC desert air coolers market indicate sustained growth momentum supported by favorable market fundamentals, technological advancement, and increasing adoption across multiple sectors.

Market expansion trajectory suggests continued growth at a CAGR of 8.2% through the forecast period, driven by increasing energy costs, environmental consciousness, and industrial development across the region. This growth rate reflects strong underlying demand and favorable market conditions for evaporative cooling technology.

Technology evolution will likely focus on smart connectivity, energy efficiency optimization, and hybrid cooling solutions that address current limitations while maintaining cost and environmental advantages. Advanced materials and manufacturing techniques will enhance product durability and performance in extreme desert conditions.

Industrial adoption is expected to accelerate as businesses increasingly recognize the cost benefits of evaporative cooling for large spaces. Manufacturing expansion, logistics development, and infrastructure projects across the GCC region will drive demand for industrial-scale desert air coolers.

Regulatory support for energy-efficient cooling technologies will likely strengthen as governments pursue sustainability goals and energy conservation objectives. Building codes and energy efficiency standards may increasingly favor evaporative cooling solutions over traditional air conditioning systems.

Market maturation will bring increased competition, product standardization, and service quality improvements. This maturation process will benefit consumers through better products, competitive pricing, and enhanced customer service while creating challenges for manufacturers to maintain differentiation and profitability.

Export potential may develop as GCC-based manufacturers leverage their desert climate expertise to serve other arid regions globally. This expansion opportunity could drive economies of scale and support continued innovation in desert cooling technology.

Market assessment of the GCC desert air coolers sector reveals a dynamic and growing market with strong fundamentals supporting continued expansion across residential, commercial, and industrial applications. The unique climatic conditions of the Gulf region create optimal operating environments for evaporative cooling technology, while increasing energy costs and environmental consciousness drive adoption of efficient cooling alternatives.

Growth drivers including energy efficiency benefits, cost-effectiveness, and environmental advantages position desert air coolers as compelling alternatives to traditional cooling systems. The market benefits from favorable regulatory trends, industrial expansion, and technological improvements that enhance product performance and appeal to diverse customer segments.

Competitive dynamics feature both established cooling equipment manufacturers and specialized evaporative cooling companies, creating innovation pressure and market development opportunities. Success factors include technology advancement, market segmentation, distribution network strength, and alignment with regional sustainability goals.

Future prospects indicate sustained growth momentum with expanding applications, technological evolution, and increasing market penetration across GCC countries. The GCC desert air coolers market represents a compelling opportunity for manufacturers, distributors, and investors seeking exposure to energy-efficient cooling solutions in one of the world’s most suitable climatic regions for evaporative cooling technology.

What is Desert Air Coolers?

Desert air coolers are devices designed to cool air through the evaporation of water, making them particularly effective in arid climates. They are commonly used in residential and commercial settings to provide a cost-effective cooling solution.

What are the key players in the GCC Desert Air Coolers Market?

Key players in the GCC Desert Air Coolers Market include companies like Symphony Limited, Honeywell International Inc., and Bajaj Electricals Limited, among others. These companies are known for their innovative cooling solutions and extensive distribution networks.

What are the main drivers of the GCC Desert Air Coolers Market?

The main drivers of the GCC Desert Air Coolers Market include the increasing demand for energy-efficient cooling solutions, rising temperatures in the region, and the growing awareness of environmental sustainability. Additionally, the affordability of desert coolers compared to traditional air conditioning systems contributes to their popularity.

What challenges does the GCC Desert Air Coolers Market face?

The GCC Desert Air Coolers Market faces challenges such as high humidity levels in certain areas, which can reduce the effectiveness of evaporative cooling. Additionally, competition from traditional air conditioning systems and the need for regular maintenance can hinder market growth.

What opportunities exist in the GCC Desert Air Coolers Market?

Opportunities in the GCC Desert Air Coolers Market include the potential for technological advancements in cooler design and efficiency, as well as the expansion of the market into new residential and commercial sectors. The increasing focus on sustainable building practices also presents a favorable environment for growth.

What trends are shaping the GCC Desert Air Coolers Market?

Trends shaping the GCC Desert Air Coolers Market include the integration of smart technology for enhanced user control and energy management, as well as a shift towards eco-friendly materials in cooler manufacturing. Additionally, there is a growing preference for portable and compact designs among consumers.

GCC Desert Air Coolers Market

| Segmentation Details | Description |

|---|---|

| Product Type | Portable Coolers, Window Coolers, Split Coolers, Centralized Coolers |

| Technology | Evaporative Cooling, Refrigeration, Thermoelectric, Hybrid Systems |

| End User | Residential, Commercial, Industrial, Hospitality |

| Distribution Channel | Online Retail, Direct Sales, Distributors, Wholesalers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the GCC Desert Air Coolers Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at