444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The GCC construction market represents one of the most dynamic and rapidly evolving sectors in the Middle East, encompassing comprehensive infrastructure development, commercial projects, and residential construction across the Gulf Cooperation Council countries. Market dynamics indicate sustained growth driven by ambitious national vision programs, mega-project developments, and increasing urbanization across Saudi Arabia, UAE, Qatar, Kuwait, Oman, and Bahrain. The regional construction landscape demonstrates remarkable resilience with projected growth rates of 6.2% CAGR through the forecast period, supported by substantial government investments in infrastructure modernization and economic diversification initiatives.

Construction activities across the GCC region showcase unprecedented scale and sophistication, with major developments in smart cities, transportation networks, and sustainable building technologies. The market benefits from strategic geographical positioning, abundant energy resources, and progressive regulatory frameworks that encourage foreign investment and technological innovation. Regional governments continue prioritizing construction sector development as a cornerstone of economic transformation, with infrastructure spending representing approximately 45% of total construction investments across member countries.

Technological advancement and sustainability initiatives are reshaping traditional construction methodologies, with increasing adoption of Building Information Modeling (BIM), prefabricated construction techniques, and green building standards. The integration of digital technologies and smart construction solutions positions the GCC construction market at the forefront of global industry innovation, attracting international expertise and establishing new benchmarks for project delivery excellence.

The GCC construction market refers to the comprehensive ecosystem of building, infrastructure development, and construction-related activities across the six Gulf Cooperation Council member states, encompassing residential, commercial, industrial, and infrastructure projects that drive regional economic development and urbanization.

Construction market dynamics within the GCC context involve complex interactions between government policy initiatives, private sector investments, international partnerships, and technological innovations that collectively shape the built environment across the region. This market encompasses traditional construction methodologies alongside cutting-edge technologies, sustainable building practices, and mega-project developments that define the region’s architectural and infrastructure landscape.

Market participants include local and international construction companies, engineering consultancies, material suppliers, technology providers, and financial institutions that collaborate to deliver projects ranging from individual residential units to massive infrastructure networks spanning multiple countries. The market’s significance extends beyond immediate construction activities to encompass long-term economic diversification strategies, job creation initiatives, and sustainable development goals that align with national vision programs across GCC member states.

Strategic market positioning establishes the GCC construction sector as a regional powerhouse driving economic transformation through ambitious infrastructure projects, sustainable development initiatives, and technological innovation adoption. The market demonstrates exceptional growth potential with construction sector contribution representing approximately 12% of regional GDP, supported by substantial government commitments to infrastructure modernization and private sector engagement in mega-project developments.

Key market drivers include national vision program implementations, population growth necessitating expanded housing and infrastructure, tourism sector development requiring world-class facilities, and economic diversification strategies reducing dependence on hydrocarbon revenues. The construction market benefits from favorable regulatory environments, strategic international partnerships, and increasing focus on sustainability standards that attract global expertise and investment capital.

Competitive landscape features a dynamic mix of established regional contractors, international construction giants, and specialized technology providers collaborating on projects of unprecedented scale and complexity. Market consolidation trends indicate increasing emphasis on integrated project delivery capabilities, digital technology adoption, and sustainable construction practices that meet evolving client expectations and regulatory requirements.

Future market trajectory points toward continued expansion driven by ongoing mega-project developments, smart city initiatives, and infrastructure modernization programs that position the GCC region as a global construction innovation hub. The market’s evolution reflects broader economic transformation goals while maintaining focus on sustainable development principles and technological advancement integration.

Market intelligence reveals several critical insights shaping the GCC construction landscape and influencing strategic decision-making across industry stakeholders:

National vision programs across GCC countries serve as primary catalysts for construction market expansion, with comprehensive development strategies requiring massive infrastructure investments, urban development projects, and economic diversification initiatives. These ambitious programs encompass transportation networks, smart city developments, tourism infrastructure, and industrial complexes that collectively drive sustained construction activity across the region.

Population growth dynamics create substantial demand for residential construction, educational facilities, healthcare infrastructure, and supporting commercial developments. Rapid urbanization trends necessitate comprehensive city planning, utility infrastructure expansion, and transportation system development that provide consistent construction market opportunities across multiple project categories and geographic locations.

Economic diversification strategies drive construction demand through industrial development projects, technology parks, financial districts, and specialized economic zones designed to reduce hydrocarbon dependency. These initiatives require sophisticated infrastructure development, advanced building technologies, and integrated project delivery approaches that showcase regional construction capabilities and attract international investment.

Tourism sector expansion generates significant construction opportunities through hospitality projects, entertainment facilities, cultural developments, and supporting infrastructure that position GCC countries as premier global destinations. Tourism infrastructure investments demonstrate consistent growth with projects incorporating cutting-edge design, sustainable technologies, and world-class amenities that meet international visitor expectations.

Technological advancement integration drives construction market evolution through smart building systems, digital infrastructure requirements, and automated construction processes that improve project efficiency and long-term operational performance. The emphasis on technology adoption creates opportunities for specialized contractors, system integrators, and technology providers while establishing new industry standards and best practices.

Economic volatility associated with hydrocarbon price fluctuations creates periodic challenges for construction market stability, affecting government spending capacity, private investment decisions, and project financing availability. Market participants must navigate economic cycles while maintaining operational efficiency and strategic positioning for recovery periods and growth phases.

Skilled workforce limitations present ongoing challenges for construction market expansion, particularly in specialized technical areas, project management, and advanced technology implementation. The reliance on expatriate workers creates additional complexity regarding visa regulations, workforce stability, and knowledge transfer requirements that impact project delivery timelines and costs.

Material supply chain dependencies expose the construction market to global commodity price variations, shipping disruptions, and quality control challenges that affect project budgets and schedules. Regional material production capacity limitations necessitate substantial imports, creating vulnerability to international market conditions and logistics constraints.

Regulatory complexity across different GCC jurisdictions creates challenges for regional contractors and international companies seeking to operate across multiple markets. Varying building codes, approval processes, and compliance requirements necessitate specialized expertise and can impact project delivery efficiency and cost structures.

Environmental considerations increasingly influence construction project planning and execution, with sustainability requirements, environmental impact assessments, and climate adaptation measures adding complexity to traditional construction processes. These factors require specialized expertise, advanced materials, and innovative construction techniques that may increase project costs and timelines.

Smart city development initiatives present substantial opportunities for construction companies specializing in integrated technology solutions, sustainable building practices, and innovative urban planning approaches. These projects require comprehensive expertise in digital infrastructure, IoT integration, and advanced building systems that create new market segments and revenue streams for qualified contractors and technology providers.

Renewable energy infrastructure development offers significant construction opportunities through solar power projects, wind energy installations, and supporting grid infrastructure that align with regional sustainability goals. The transition toward renewable energy sources creates demand for specialized construction capabilities, advanced materials, and integrated project delivery approaches that combine traditional construction with cutting-edge technology implementation.

Transportation network expansion provides extensive construction opportunities through railway projects, airport developments, port facilities, and highway infrastructure that enhance regional connectivity and economic integration. These mega-projects require sophisticated construction capabilities, international expertise, and long-term project management skills that offer substantial revenue potential for qualified market participants.

Healthcare infrastructure modernization creates opportunities for specialized medical facility construction, advanced hospital systems, and integrated healthcare campuses that meet growing population needs and medical tourism objectives. The emphasis on world-class healthcare facilities requires expertise in complex building systems, specialized equipment integration, and stringent quality standards that command premium pricing and long-term relationships.

Industrial development projects offer construction opportunities through manufacturing facilities, logistics centers, petrochemical complexes, and technology parks that support economic diversification goals. These projects require specialized industrial construction expertise, advanced safety systems, and integrated utility infrastructure that create opportunities for experienced contractors and engineering firms.

Competitive dynamics within the GCC construction market reflect increasing sophistication in project delivery capabilities, technology adoption, and international partnership development. Market leaders demonstrate competitive advantages through integrated service offerings, digital technology implementation, and sustainable construction practices that meet evolving client expectations and regulatory requirements.

Supply chain evolution shows increasing emphasis on regional material production, advanced logistics systems, and quality assurance processes that reduce dependency on international suppliers while maintaining construction quality standards. Local content requirements in major projects encourage regional supplier development and create opportunities for domestic construction material producers and service providers.

Technology integration trends accelerate across all construction market segments, with Building Information Modeling, project management software, and automated construction equipment becoming standard requirements for major projects. The digital transformation of construction processes improves project efficiency, reduces costs, and enhances quality control while creating new skill requirements and business opportunities.

Sustainability imperatives increasingly influence construction market dynamics through green building requirements, energy efficiency standards, and environmental impact considerations that reshape traditional construction approaches. Sustainable construction practices demonstrate adoption rates exceeding 40% in premium commercial developments, creating competitive advantages for companies with proven environmental expertise and certification capabilities.

Financial market integration evolves through innovative project financing mechanisms, public-private partnerships, and international investment participation that expand funding sources and risk-sharing arrangements. These developments enable larger project scales, improved financial structures, and enhanced market access for qualified construction companies and development partners.

Comprehensive market analysis employs multiple research methodologies to ensure accurate, reliable, and actionable insights for construction industry stakeholders. The research approach combines quantitative data analysis, qualitative market assessment, and expert consultation to provide holistic understanding of market dynamics, competitive positioning, and future growth opportunities across the GCC construction landscape.

Primary research activities include extensive interviews with construction company executives, government officials, project developers, and industry experts across all GCC member countries. These discussions provide firsthand insights into market challenges, growth opportunities, regulatory developments, and strategic priorities that shape construction market evolution and competitive dynamics.

Secondary research analysis encompasses comprehensive review of government publications, industry reports, project databases, and regulatory documentation that provide quantitative market data, policy insights, and trend analysis. This research foundation ensures accuracy in market sizing, growth projections, and competitive landscape assessment while identifying emerging opportunities and potential market constraints.

Market validation processes involve cross-referencing multiple data sources, expert consultation, and statistical analysis to ensure research findings accuracy and reliability. The validation methodology includes peer review, data triangulation, and sensitivity analysis that enhance research credibility and provide confidence in strategic recommendations and market projections.

Analytical frameworks incorporate advanced statistical modeling, trend analysis, and scenario planning that enable comprehensive market assessment and future outlook development. These methodologies support strategic decision-making through robust data analysis, risk assessment, and opportunity identification that meet the complex information needs of construction industry stakeholders.

Saudi Arabia dominates the GCC construction market with approximately 45% regional market share, driven by Vision 2030 implementation, NEOM development, and comprehensive infrastructure modernization programs. The kingdom’s construction sector benefits from substantial government investment, mega-project development, and increasing private sector participation that create extensive opportunities across residential, commercial, and infrastructure segments.

United Arab Emirates maintains strong construction market position with estimated 25% regional share, supported by Dubai’s continued development, Abu Dhabi’s economic diversification initiatives, and Expo legacy projects. The UAE construction market demonstrates particular strength in luxury developments, tourism infrastructure, and smart city initiatives that attract international investment and expertise.

Qatar represents significant construction market presence with approximately 15% regional share, benefiting from World Cup infrastructure legacy, National Vision 2030 implementation, and ongoing diversification projects. The country’s construction sector emphasizes sustainability, advanced technology integration, and world-class infrastructure development that positions Qatar as a regional innovation leader.

Kuwait shows steady construction market growth with estimated 8% regional share, driven by national development plan implementation, infrastructure modernization, and residential sector expansion. The construction market benefits from government investment programs, private sector engagement, and increasing focus on sustainable development practices that create diverse project opportunities.

Oman and Bahrain collectively represent approximately 7% regional market share, with construction activities focused on tourism infrastructure, industrial development, and urban modernization projects. Both countries emphasize sustainable construction practices, technology adoption, and regional connectivity projects that enhance their strategic positioning within the broader GCC construction landscape.

Market leadership in the GCC construction sector features a dynamic combination of established regional contractors, international construction giants, and specialized service providers that compete across multiple project categories and geographic markets. The competitive environment emphasizes integrated project delivery capabilities, technological innovation, and sustainable construction practices that meet evolving client expectations and regulatory requirements.

Leading regional contractors demonstrate competitive advantages through local market knowledge, government relationships, and proven project delivery capabilities across diverse construction segments:

International construction companies bring global expertise, advanced technologies, and specialized capabilities to major GCC projects:

Competitive strategies increasingly emphasize digital technology adoption, sustainability certification, and integrated service offerings that provide comprehensive project solutions from design through completion and maintenance. Market leaders invest substantially in workforce development, technology platforms, and strategic partnerships that enhance competitive positioning and market access capabilities.

By Construction Type: The GCC construction market demonstrates diverse segmentation across multiple construction categories that reflect regional development priorities and economic diversification strategies.

By Technology Integration: Construction market segmentation increasingly reflects technology adoption levels and digital integration capabilities.

By Project Scale: Market segmentation reflects varying project sizes and complexity levels that require different capabilities and resources.

Infrastructure Construction represents the largest and most dynamic segment of the GCC construction market, driven by national vision program implementations and regional connectivity initiatives. This category encompasses transportation networks, utility systems, telecommunications infrastructure, and public facilities that form the foundation for economic development and urbanization across member countries.

Transportation infrastructure projects demonstrate particular strength with railway developments, airport expansions, port facilities, and highway networks receiving substantial investment allocation. According to MarkWide Research analysis, transportation construction shows consistent growth with project values increasing by approximately 15% annually across major GCC markets, reflecting government priorities for regional connectivity and economic integration.

Commercial construction maintains robust growth through office developments, retail centers, hospitality projects, and mixed-use complexes that support economic diversification and tourism sector expansion. The commercial segment benefits from increasing private sector investment, international business expansion, and growing consumer markets that drive demand for world-class commercial facilities and supporting infrastructure.

Residential construction addresses population growth, urbanization trends, and housing affordability challenges through diverse project types ranging from luxury developments to affordable housing initiatives. Government housing programs, private sector developments, and integrated community projects create substantial construction opportunities while addressing social and economic development objectives.

Industrial construction supports economic diversification through manufacturing facilities, logistics centers, technology parks, and specialized industrial complexes. This segment requires advanced construction capabilities, specialized equipment, and stringent safety standards that create opportunities for experienced contractors with proven industrial expertise and international certification capabilities.

Construction companies benefit from substantial project opportunities, long-term revenue visibility, and market expansion potential through participation in the dynamic GCC construction market. The regional emphasis on mega-project development, infrastructure modernization, and sustainable construction practices creates competitive advantages for companies with proven capabilities, advanced technologies, and strategic market positioning.

Technology providers gain access to rapidly growing markets for construction technology solutions, digital platforms, and automated systems that enhance project efficiency and quality. The increasing adoption of Building Information Modeling, IoT sensors, project management software, and sustainable construction technologies creates substantial revenue opportunities for qualified technology companies and system integrators.

Material suppliers benefit from consistent demand growth, regional content requirements, and opportunities for local production facility development that reduce import dependency while serving expanding construction markets. The emphasis on quality materials, sustainable products, and advanced construction solutions creates competitive advantages for suppliers with proven capabilities and regional market presence.

Financial institutions access diverse project financing opportunities through construction loans, project bonds, public-private partnerships, and innovative financing mechanisms that support regional development objectives. The construction market’s growth trajectory and government backing provide attractive risk-adjusted returns while contributing to economic diversification and infrastructure development goals.

Government entities achieve strategic development objectives through construction sector growth that creates employment opportunities, enhances infrastructure capabilities, and supports economic diversification initiatives. The construction market’s contribution to GDP growth, job creation, and technology transfer aligns with national vision programs and long-term development strategies across GCC member countries.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation acceleration represents the most significant trend reshaping the GCC construction market, with widespread adoption of Building Information Modeling, project management platforms, and automated construction equipment. Digital technology implementation shows growth rates exceeding 30% annually across major construction projects, driven by efficiency requirements, quality improvement objectives, and competitive differentiation strategies.

Sustainability integration emerges as a fundamental trend influencing construction practices, material selection, and project design across all market segments. Green building certifications, renewable energy integration, and environmental performance optimization become standard requirements for premium developments, creating competitive advantages for companies with proven sustainable construction expertise and certification capabilities.

Modular construction adoption gains momentum through prefabricated building systems, factory-produced components, and accelerated construction methodologies that reduce project timelines and improve quality control. This trend particularly benefits residential and commercial construction segments where standardization opportunities exist and speed-to-market provides competitive advantages.

Smart city integration influences construction project planning and execution through IoT sensor networks, automated building systems, and integrated urban infrastructure that supports comprehensive city management and optimization. Construction companies increasingly require capabilities in digital infrastructure, system integration, and smart building technologies to participate in major urban development projects.

Regional collaboration strengthens through cross-border infrastructure projects, standardized construction practices, and integrated supply chain development that enhance efficiency and reduce costs. This trend creates opportunities for construction companies with multi-country capabilities and expertise in regional connectivity projects and standardized delivery methodologies.

Mega-project launches continue reshaping the construction landscape with announcements of transformational developments including NEOM in Saudi Arabia, Dubai 2040 Urban Master Plan implementation, and Qatar National Vision 2030 infrastructure projects. These developments create substantial construction opportunities while establishing new benchmarks for project scale, technology integration, and sustainable development practices.

Technology partnerships between construction companies and technology providers accelerate digital transformation through strategic alliances, joint ventures, and collaborative development programs. Recent partnerships focus on artificial intelligence integration, robotics implementation, and advanced project management systems that enhance construction efficiency and quality while reducing costs and timelines.

Sustainability certifications gain prominence with increasing numbers of construction projects pursuing LEED, BREEAM, and regional green building standards that demonstrate environmental performance and operational efficiency. MWR data indicates that sustainable construction project certifications increased by 42% over the past two years, reflecting market demand and regulatory requirements for environmental responsibility.

Workforce development initiatives expand through government programs, industry partnerships, and educational institution collaborations that address skilled labor shortages and technology adoption requirements. These initiatives focus on technical training, digital skills development, and construction management capabilities that support market growth and competitiveness enhancement.

Financial innovation introduces new project financing mechanisms including green bonds, infrastructure funds, and innovative public-private partnership structures that expand funding sources and risk-sharing arrangements. These developments enable larger project scales, improved financial structures, and enhanced market access for qualified construction companies and development partners.

Strategic positioning recommendations emphasize the importance of technology adoption, sustainability certification, and integrated service capability development for construction companies seeking competitive advantages in the evolving GCC market. Companies should prioritize digital platform implementation, workforce skill development, and strategic partnership formation that enhance project delivery capabilities and market differentiation.

Market entry strategies for international construction companies should focus on local partnership development, regulatory compliance expertise, and regional market knowledge acquisition that facilitate successful market penetration and project acquisition. Understanding cultural nuances, government procurement processes, and local business practices becomes critical for sustainable market success and growth.

Investment priorities should emphasize technology infrastructure, workforce development, and sustainability capability enhancement that position companies for long-term market participation and growth. Construction companies benefit from investments in digital platforms, automated equipment, and environmental certification programs that meet evolving client expectations and regulatory requirements.

Risk management approaches must address economic volatility, supply chain disruptions, and regulatory changes through diversified market exposure, flexible operational structures, and comprehensive contingency planning. Companies should develop robust risk assessment frameworks, financial hedging strategies, and operational flexibility that enable successful navigation of market uncertainties and economic cycles.

Growth strategies should leverage regional development trends, technology integration opportunities, and sustainability market demands through targeted capability development and strategic market positioning. Success requires balanced approaches combining organic growth initiatives, strategic acquisitions, and partnership development that enhance market presence and competitive capabilities.

Long-term market trajectory indicates sustained growth driven by ongoing national vision program implementations, infrastructure modernization requirements, and economic diversification initiatives across GCC member countries. The construction market benefits from substantial government commitments, increasing private sector participation, and growing international investment that create consistent project opportunities and revenue growth potential.

Technology evolution will fundamentally transform construction practices through artificial intelligence integration, robotics adoption, and advanced automation systems that improve efficiency, quality, and safety while reducing costs and environmental impact. Construction technology adoption rates are projected to reach 75% of major projects within the next five years, creating competitive requirements for digital capability development and system integration expertise.

Sustainability imperatives will become standard requirements rather than competitive differentiators, with environmental performance, renewable energy integration, and circular economy principles embedded in all construction project planning and execution. This evolution creates opportunities for companies with proven sustainable construction capabilities while establishing new market entry barriers for traditional contractors.

Regional integration will accelerate through cross-border infrastructure projects, standardized construction practices, and integrated supply chain development that enhance efficiency and create economies of scale. Construction companies with multi-country capabilities and regional expertise will benefit from increased project opportunities and competitive advantages in integrated development initiatives.

Market consolidation trends may emerge as smaller contractors seek partnerships or acquisition opportunities to compete effectively in increasingly sophisticated and technology-intensive construction markets. This evolution could create opportunities for strategic acquisitions, joint ventures, and partnership development that enhance market presence and capability portfolios for established market participants.

The GCC construction market represents one of the most dynamic and opportunity-rich construction environments globally, driven by ambitious national development programs, substantial government investments, and comprehensive economic diversification strategies. Market fundamentals remain strong with consistent growth drivers including population expansion, urbanization trends, infrastructure modernization requirements, and increasing focus on sustainable development practices that create extensive opportunities across all construction segments.

Technological transformation and sustainability integration are reshaping traditional construction approaches, creating competitive advantages for companies that successfully adopt digital platforms, automated systems, and environmental best practices. The market’s evolution toward smart construction solutions, prefabricated building systems, and integrated project delivery methodologies establishes new industry standards while creating opportunities for innovation and differentiation.

Strategic success in the GCC construction market requires comprehensive understanding of regional dynamics, government priorities, and evolving client expectations combined with proven capabilities in technology integration, sustainable construction, and complex project delivery. Companies that effectively balance local market knowledge with international expertise while maintaining focus on quality, efficiency, and environmental responsibility will achieve sustainable competitive advantages and long-term growth in this dynamic and expanding market environment.

What is GCC Construction?

GCC Construction refers to the building and infrastructure development activities within the Gulf Cooperation Council countries, which include various sectors such as residential, commercial, and industrial construction.

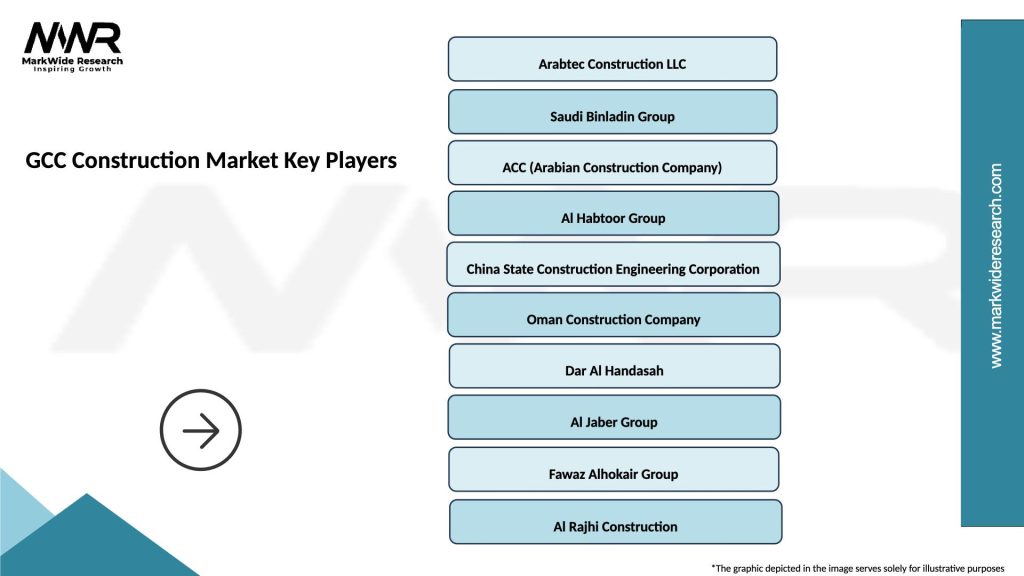

What are the key players in the GCC Construction Market?

Key players in the GCC Construction Market include companies like Arabtec Construction, Saudi Binladin Group, and ACC (Arabian Construction Company), among others.

What are the main drivers of growth in the GCC Construction Market?

The main drivers of growth in the GCC Construction Market include urbanization, government investments in infrastructure, and the hosting of international events that require extensive construction projects.

What challenges does the GCC Construction Market face?

The GCC Construction Market faces challenges such as fluctuating material costs, labor shortages, and regulatory hurdles that can impact project timelines and budgets.

What opportunities exist in the GCC Construction Market?

Opportunities in the GCC Construction Market include the rise of smart city projects, sustainable building practices, and increased demand for affordable housing solutions.

What trends are shaping the GCC Construction Market?

Trends shaping the GCC Construction Market include the adoption of advanced construction technologies, a focus on sustainability, and the integration of digital tools for project management.

GCC Construction Market

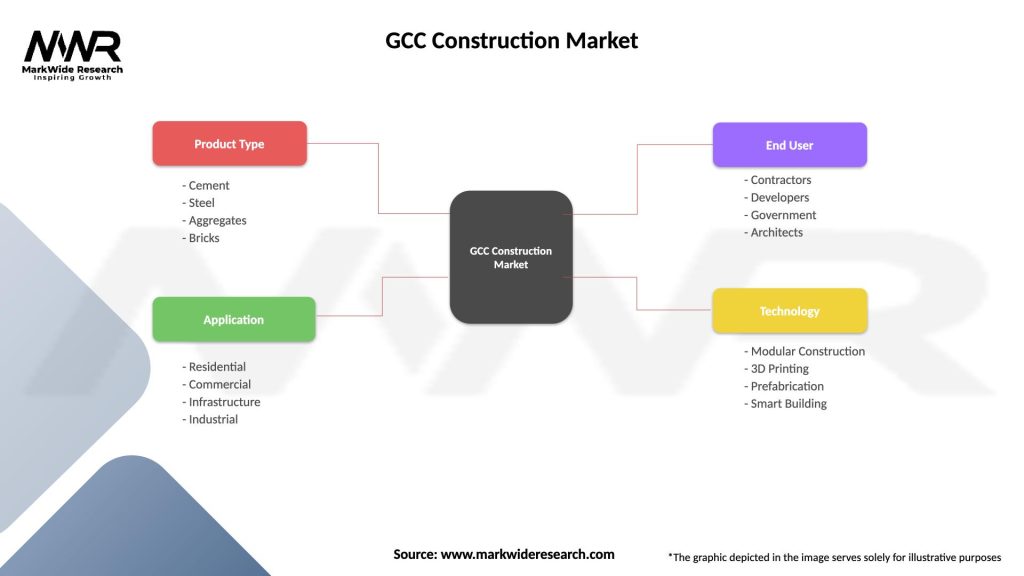

| Segmentation Details | Description |

|---|---|

| Product Type | Cement, Steel, Aggregates, Bricks |

| Application | Residential, Commercial, Infrastructure, Industrial |

| End User | Contractors, Developers, Government, Architects |

| Technology | Modular Construction, 3D Printing, Prefabrication, Smart Building |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the GCC Construction Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at