444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The GCC construction machinery rental market represents a dynamic and rapidly evolving sector that has become integral to the region’s ambitious infrastructure development plans. This market encompasses the rental and leasing of heavy construction equipment, including excavators, cranes, bulldozers, loaders, and specialized machinery across the Gulf Cooperation Council countries. Market dynamics indicate robust growth driven by mega-projects, urbanization initiatives, and the region’s strategic shift toward diversified economies beyond oil dependency.

Regional infrastructure investments have positioned the GCC as a global hub for construction activity, with countries like the UAE, Saudi Arabia, and Qatar leading massive development programs. The rental model has gained significant traction as construction companies seek to optimize capital expenditure while maintaining access to cutting-edge equipment. Equipment utilization rates have improved substantially, with rental penetration reaching approximately 35% of total construction equipment usage across major GCC markets.

Technological advancement within the rental sector has transformed traditional equipment leasing into sophisticated service offerings that include maintenance, operator training, and digital fleet management solutions. The market demonstrates strong resilience and adaptability, particularly as construction projects become increasingly complex and time-sensitive. Sustainability initiatives are also driving demand for newer, more efficient equipment available through rental channels, supporting the region’s environmental goals while meeting construction demands.

The GCC construction machinery rental market refers to the comprehensive ecosystem of equipment leasing services that provide construction companies, contractors, and project developers with temporary access to heavy machinery and specialized construction equipment across Gulf Cooperation Council member states. This market encompasses short-term rentals, long-term leasing arrangements, and full-service equipment solutions that include maintenance, operation, and technical support services.

Equipment categories within this market span earthmoving machinery, material handling equipment, concrete and road construction machinery, lifting and access equipment, and specialized tools for various construction applications. The rental model enables construction companies to access state-of-the-art equipment without significant capital investment, providing flexibility to scale operations according to project requirements and market conditions.

Service integration has evolved beyond simple equipment provision to include comprehensive solutions such as operator training, preventive maintenance, emergency repair services, and digital fleet management systems. This transformation reflects the market’s maturation and the increasing sophistication of construction projects across the GCC region, where efficiency and reliability are paramount to project success.

Strategic market positioning of the GCC construction machinery rental sector reflects the region’s commitment to infrastructure development and economic diversification. The market has experienced substantial expansion, driven by government-led mega-projects, private sector construction activities, and the increasing adoption of rental models by construction companies seeking operational flexibility and cost optimization.

Key growth drivers include the region’s Vision 2030 initiatives, World Cup infrastructure projects, and ongoing urban development programs that require substantial construction equipment deployment. The rental model has proven particularly attractive to international contractors entering GCC markets, as it provides immediate access to equipment without the complexities of importation and long-term asset management. Market penetration rates vary across GCC countries, with the UAE and Saudi Arabia leading adoption at approximately 40% and 38% respectively.

Technological integration has become a defining characteristic of leading rental companies, with IoT-enabled equipment monitoring, predictive maintenance systems, and digital booking platforms enhancing service delivery. The market demonstrates strong fundamentals with consistent demand patterns, though it remains sensitive to oil price fluctuations and government spending cycles that influence construction activity levels across the region.

Market segmentation analysis reveals distinct patterns in equipment demand and rental preferences across different construction sectors and geographic regions within the GCC. The following insights highlight critical market characteristics:

Government infrastructure initiatives serve as the primary catalyst for construction machinery rental market expansion across the GCC region. National vision programs, including Saudi Arabia’s Vision 2030 and UAE’s Vision 2071, have allocated substantial resources to infrastructure development, creating sustained demand for construction equipment. These initiatives encompass transportation networks, smart city developments, renewable energy projects, and tourism infrastructure that require diverse machinery solutions.

Economic diversification strategies implemented across GCC countries have stimulated private sector construction activity, particularly in commercial real estate, industrial facilities, and mixed-use developments. The shift away from oil-dependent economies has encouraged investment in manufacturing, logistics, and service sectors, each requiring specialized construction support. Private sector construction spending has increased by approximately 25% over the past three years, directly benefiting rental equipment providers.

Cost optimization pressures faced by construction companies have accelerated adoption of rental models over equipment ownership. Rising equipment costs, maintenance complexities, and project-specific requirements make rental arrangements increasingly attractive. Construction companies can access latest technology equipment without depreciation concerns while maintaining operational flexibility to scale resources according to project phases and market conditions.

Technological advancement in construction equipment has created demand for specialized machinery that may not justify purchase for individual projects. Advanced equipment featuring GPS guidance, automated controls, and enhanced safety systems are readily available through rental channels, enabling construction companies to leverage cutting-edge technology without substantial capital investment.

Economic volatility associated with oil price fluctuations continues to impact construction activity levels across the GCC region, creating uncertainty for rental equipment providers. Government spending on infrastructure projects often correlates with oil revenues, leading to project delays or cancellations during periods of reduced oil income. This cyclical nature creates challenges for rental companies in maintaining optimal fleet utilization and revenue stability.

High capital requirements for establishing and maintaining modern equipment fleets present significant barriers to entry for new market participants. The need for substantial initial investment in equipment procurement, maintenance facilities, and skilled personnel limits market competition and can result in higher rental rates for customers. Additionally, rapid technological advancement requires continuous fleet updates to remain competitive.

Skilled operator shortages across the construction industry impact the rental market’s ability to provide comprehensive equipment solutions. The complexity of modern construction machinery requires specialized training and certification, yet the region faces ongoing challenges in developing adequate skilled labor pools. This constraint affects both equipment utilization efficiency and service quality delivery.

Regulatory compliance complexities vary across GCC countries, creating operational challenges for regional rental companies. Different safety standards, environmental regulations, and equipment certification requirements necessitate significant administrative resources and can limit cross-border equipment deployment efficiency. Import regulations and customs procedures also impact fleet management flexibility.

Digital transformation initiatives present substantial opportunities for rental companies to differentiate services and improve operational efficiency. Implementation of IoT sensors, predictive maintenance systems, and mobile booking platforms can enhance customer experience while reducing operational costs. MarkWide Research analysis indicates that companies investing in digital solutions experience approximately 20% higher customer retention rates compared to traditional operators.

Sustainable construction trends create demand for environmentally friendly equipment solutions, including electric and hybrid machinery. As GCC countries pursue carbon neutrality goals, construction projects increasingly require low-emission equipment options. Rental companies investing in green technology fleets can capture premium market segments while supporting regional sustainability objectives.

Specialized equipment segments offer growth opportunities in niche markets such as renewable energy construction, advanced manufacturing facilities, and smart infrastructure projects. These sectors require specialized machinery that may not justify purchase for individual contractors, creating ideal rental market conditions. The complexity and cost of specialized equipment make rental arrangements particularly attractive for project-specific applications.

Regional expansion potential exists for established rental companies to extend operations across GCC borders, serving multinational construction projects and capturing economies of scale. Cross-border operations can improve fleet utilization while providing customers with consistent service quality across multiple project locations. Strategic partnerships and joint ventures can facilitate market entry while sharing regulatory compliance burdens.

Supply and demand equilibrium in the GCC construction machinery rental market reflects the interplay between infrastructure investment cycles and equipment availability. During peak construction periods, equipment demand can exceed supply capacity, leading to higher rental rates and extended booking lead times. Conversely, economic downturns can result in excess capacity and competitive pricing pressures that challenge rental company profitability.

Competitive intensity has increased as international rental companies establish regional operations alongside established local providers. This competition drives service innovation and pricing optimization while expanding equipment availability for customers. Market consolidation trends are emerging as larger companies acquire smaller operators to achieve economies of scale and expand geographic coverage.

Customer relationship evolution has shifted from transactional equipment provision to strategic partnership arrangements. Construction companies increasingly seek rental providers capable of supporting entire project lifecycles with integrated equipment solutions, maintenance services, and technical expertise. This evolution requires rental companies to develop comprehensive service capabilities and industry-specific knowledge.

Technology integration continues reshaping market dynamics through equipment connectivity, data analytics, and automated fleet management systems. These technological advances enable predictive maintenance, optimize equipment utilization, and provide customers with real-time equipment performance data. Companies successfully implementing technology solutions gain competitive advantages through improved service reliability and operational efficiency.

Comprehensive market analysis for the GCC construction machinery rental sector employs multiple research methodologies to ensure data accuracy and insight reliability. Primary research activities include structured interviews with industry executives, rental company operators, construction contractors, and equipment manufacturers across all GCC member states. These interviews provide qualitative insights into market trends, challenges, and growth opportunities from diverse stakeholder perspectives.

Secondary research components encompass analysis of government infrastructure spending data, construction project databases, equipment import statistics, and industry association reports. Financial analysis of publicly traded rental companies provides insights into market performance metrics, profitability trends, and investment patterns. Regulatory documentation review ensures understanding of compliance requirements and policy impacts across different GCC jurisdictions.

Market sizing methodologies utilize bottom-up and top-down approaches to validate market scope and growth projections. Equipment fleet analysis, rental rate surveys, and utilization studies provide quantitative foundations for market assessment. Cross-referencing multiple data sources ensures reliability and identifies potential discrepancies requiring further investigation.

Trend analysis techniques incorporate historical data review, current market observation, and forward-looking scenario modeling. Industry expert consultations and technology assessment studies inform future market trajectory predictions. Regular market monitoring and data updates ensure research findings remain current and relevant for strategic decision-making purposes.

United Arab Emirates leads the GCC construction machinery rental market with the most mature and diversified rental ecosystem. Dubai and Abu Dhabi serve as regional hubs for international rental companies, benefiting from advanced infrastructure, business-friendly regulations, and consistent construction activity. The UAE market demonstrates the highest rental penetration rates, with approximately 42% of construction equipment accessed through rental arrangements. Major projects including Expo 2020 legacy developments and ongoing smart city initiatives sustain equipment demand.

Saudi Arabia represents the largest growth opportunity within the GCC rental market, driven by Vision 2030 mega-projects and economic diversification initiatives. NEOM, Red Sea Project, and Qiddiya developments require substantial equipment deployment, creating opportunities for both local and international rental providers. The Saudi market shows increasing sophistication in equipment requirements, with growing demand for specialized machinery and comprehensive service packages.

Qatar maintains steady rental market activity supported by ongoing infrastructure development and World Cup legacy projects. The market demonstrates preference for high-quality equipment and full-service rental arrangements, reflecting the country’s focus on project excellence and timeline adherence. Equipment utilization rates in Qatar average approximately 78%, indicating efficient market dynamics and strong demand fundamentals.

Kuwait, Oman, and Bahrain represent emerging opportunities within the regional rental market, each with distinct characteristics and growth drivers. Kuwait’s infrastructure modernization programs create equipment demand, while Oman’s tourism and industrial diversification projects require specialized machinery solutions. Bahrain’s compact market focuses on urban development and industrial expansion, favoring flexible rental arrangements over equipment ownership.

Market leadership in the GCC construction machinery rental sector is characterized by a mix of international companies, regional operators, and specialized local providers. The competitive environment continues evolving as companies expand service offerings and geographic coverage to capture market opportunities.

Competitive differentiation increasingly focuses on service quality, technology integration, and comprehensive solution provision rather than equipment availability alone. Leading companies invest in digital platforms, predictive maintenance systems, and skilled workforce development to maintain competitive advantages in an evolving market landscape.

Equipment type segmentation reveals distinct market dynamics across different machinery categories within the GCC construction rental market. Each segment demonstrates unique demand patterns, rental duration preferences, and pricing structures that reflect specific construction application requirements.

By Equipment Type:

By Application Sector:

Heavy earthmoving equipment dominates rental volume and revenue generation across the GCC market, with excavators and bulldozers experiencing consistently high utilization rates. This category benefits from diverse application potential across infrastructure, building, and industrial construction projects. Average rental duration for heavy earthmoving equipment extends approximately 4.5 months per contract, reflecting project complexity and equipment integration requirements.

Lifting and material handling equipment represents a high-value rental segment characterized by specialized applications and safety-critical operations. Tower cranes and mobile cranes command premium rental rates due to operational complexity and skilled operator requirements. This category demonstrates strong growth potential as construction projects increase in scale and complexity across the region.

Specialized construction equipment including concrete pumps, road construction machinery, and access platforms shows increasing demand as projects require specific technical capabilities. These equipment categories often justify rental over purchase due to project-specific applications and high capital costs. Rental companies investing in specialized equipment portfolios can capture premium market segments with limited competition.

Technology-enhanced equipment featuring GPS guidance, automated controls, and connectivity systems represents the fastest-growing rental category. Construction companies increasingly demand advanced equipment capabilities to improve productivity and meet project specifications. MWR data indicates that technology-enhanced equipment commands rental premiums of approximately 15-25% over standard equipment, reflecting value perception and competitive advantages.

Construction companies benefit significantly from rental arrangements through reduced capital expenditure requirements and improved cash flow management. Equipment rental eliminates depreciation concerns while providing access to latest technology machinery without substantial upfront investment. Operational flexibility enables construction companies to scale equipment resources according to project phases and market conditions, optimizing resource utilization and project profitability.

Project developers gain advantages through rental models that transfer equipment-related risks to specialized providers while ensuring access to reliable, well-maintained machinery. Rental arrangements often include maintenance services, reducing project management complexity and potential delays. The ability to access specialized equipment for specific project phases without long-term commitments supports efficient project execution and cost control.

Equipment manufacturers benefit from rental market growth through increased equipment sales to rental companies and extended product lifecycle management. Rental channels provide manufacturers with market feedback, usage data, and opportunities for product development based on real-world applications. Strong rental markets support equipment residual values and create secondary market opportunities for older equipment.

Financial institutions find rental companies attractive investment opportunities due to asset-backed business models and predictable cash flow patterns. Equipment rental provides diversification opportunities within construction sector exposure while offering relatively stable returns. The growth of rental markets creates financing opportunities for fleet expansion and technology upgrades across the industry.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital platform adoption has accelerated across the GCC construction machinery rental market, with leading companies implementing comprehensive digital solutions for equipment booking, fleet management, and customer service. Mobile applications and web-based platforms enable real-time equipment availability checking, instant booking confirmation, and digital documentation management. These platforms improve customer convenience while reducing administrative costs and operational complexity for rental providers.

Predictive maintenance integration utilizing IoT sensors and data analytics has become a competitive differentiator for premium rental companies. Equipment monitoring systems provide real-time performance data, enabling proactive maintenance scheduling and reducing unexpected downtime. This technology trend improves equipment reliability while optimizing maintenance costs and extending equipment lifecycle, benefiting both rental companies and customers.

Sustainability focus drives increasing demand for fuel-efficient and low-emission construction equipment across environmentally conscious projects. Electric and hybrid machinery options are expanding within rental fleets, supporting regional carbon reduction goals while meeting customer requirements for sustainable construction practices. Green equipment adoption has increased by approximately 30% annually among premium construction projects.

Comprehensive service packages have evolved beyond equipment provision to include operator training, maintenance services, and technical support. This trend reflects customer preference for single-source solutions that reduce project management complexity while ensuring equipment performance and safety compliance. Integrated service delivery creates stronger customer relationships and recurring revenue opportunities for rental providers.

Strategic partnerships between international equipment manufacturers and regional rental companies have strengthened market capabilities and expanded service offerings. These collaborations provide rental companies with preferential equipment access, technical support, and training programs while offering manufacturers direct market insights and customer feedback. Recent partnerships have focused on technology integration and sustainable equipment solutions.

Fleet modernization initiatives across major rental companies have accelerated equipment replacement cycles to incorporate latest technology features and environmental compliance standards. Companies are investing substantially in Tier 4 compliant engines, GPS guidance systems, and connectivity features that improve equipment performance and customer value proposition. These investments reflect long-term market confidence and competitive positioning strategies.

Cross-border expansion activities have increased as regional rental companies establish operations across multiple GCC countries to serve multinational construction projects. This expansion trend creates economies of scale while providing customers with consistent service quality across different project locations. Regulatory harmonization efforts across GCC countries support this expansion trend.

Technology startup integration has emerged as established rental companies partner with or acquire technology companies specializing in construction equipment management, digital platforms, and data analytics. These integrations accelerate digital transformation while bringing innovative solutions to traditional rental operations. MarkWide Research analysis indicates that companies with strong technology integration report 22% higher customer satisfaction scores compared to traditional operators.

Investment prioritization should focus on technology integration and fleet modernization to maintain competitive positioning in an evolving market landscape. Rental companies should evaluate digital platform capabilities, predictive maintenance systems, and customer interface improvements as essential investments for long-term success. Technology adoption creates operational efficiencies while enhancing customer experience and retention rates.

Geographic diversification across GCC countries can reduce market risk while capturing growth opportunities in emerging markets. Companies should consider strategic partnerships or joint ventures to enter new markets while sharing regulatory compliance burdens and local market knowledge. Cross-border operations improve fleet utilization and provide customers with regional service consistency.

Service portfolio expansion beyond equipment rental to include comprehensive project support services creates competitive advantages and revenue diversification. Companies should evaluate opportunities in operator training, maintenance services, and technical consulting that leverage existing capabilities while addressing customer needs. Integrated service delivery strengthens customer relationships and improves contract retention rates.

Sustainability initiatives including green equipment procurement and environmental compliance programs position companies favorably for future market requirements. Investment in electric and hybrid equipment options supports regional environmental goals while capturing premium market segments. Early adoption of sustainable practices creates competitive advantages as environmental regulations strengthen across the region.

Market expansion prospects remain positive for the GCC construction machinery rental sector, supported by continued infrastructure investment and economic diversification initiatives across the region. Government commitment to Vision 2030 programs and ongoing mega-project development creates sustained equipment demand through the forecast period. Market growth projections indicate expansion at approximately 6.8% annually over the next five years, driven by both public and private sector construction activity.

Technology transformation will continue reshaping the rental industry through advanced equipment features, digital platform capabilities, and data-driven service optimization. Autonomous equipment operation, artificial intelligence integration, and enhanced connectivity features will become standard expectations rather than premium offerings. Companies successfully implementing technology solutions will capture increasing market share while improving operational efficiency.

Sustainability requirements will intensify as GCC countries pursue carbon neutrality goals and implement stricter environmental regulations. Demand for electric and hybrid construction equipment will accelerate, requiring rental companies to invest in green technology fleets. This transition creates opportunities for early adopters while potentially challenging companies with traditional equipment portfolios.

Market consolidation trends may accelerate as companies seek economies of scale and expanded service capabilities through mergers and acquisitions. Larger, well-capitalized companies with comprehensive service offerings and technology capabilities will likely gain competitive advantages over smaller, traditional operators. Strategic partnerships and joint ventures will provide alternative approaches to market expansion and capability development.

The GCC construction machinery rental market demonstrates robust fundamentals and strong growth prospects driven by sustained infrastructure investment and economic diversification initiatives across the region. Market maturation has created sophisticated rental ecosystems that provide comprehensive equipment solutions supporting complex construction projects and demanding timeline requirements. Technology integration and service innovation continue differentiating leading companies while improving customer value propositions.

Strategic opportunities exist for rental companies willing to invest in digital transformation, sustainable equipment solutions, and comprehensive service capabilities. The evolution from transactional equipment provision to strategic partnership arrangements creates competitive advantages for companies developing integrated service offerings. Geographic expansion across GCC countries provides growth opportunities while improving operational efficiency through economies of scale.

Market challenges including economic volatility, regulatory complexity, and intense competition require strategic planning and operational excellence to navigate successfully. Companies with strong financial positions, technology capabilities, and customer relationships are best positioned to capitalize on growth opportunities while managing market risks. The rental model’s inherent flexibility provides advantages during economic uncertainty while supporting construction industry efficiency and project success across the dynamic GCC construction landscape.

What is Construction Machinery Rental?

Construction Machinery Rental refers to the leasing of heavy equipment and machinery used in construction projects, such as excavators, bulldozers, and cranes. This service allows companies to access necessary equipment without the high costs of purchasing and maintaining it.

What are the key players in the GCC Construction Machinery Rental Market?

Key players in the GCC Construction Machinery Rental Market include companies like Al-Futtaim Engineering, United Equipment Rental, and Al-Bahar, which provide a range of construction machinery for various projects, among others.

What are the main drivers of the GCC Construction Machinery Rental Market?

The main drivers of the GCC Construction Machinery Rental Market include the rapid growth of infrastructure projects, increased urbanization, and the rising demand for cost-effective construction solutions. These factors contribute to a higher reliance on rental services for heavy machinery.

What challenges does the GCC Construction Machinery Rental Market face?

Challenges in the GCC Construction Machinery Rental Market include fluctuating demand due to economic conditions, competition from local and international players, and the need for regular maintenance and servicing of rental equipment. These factors can impact profitability and operational efficiency.

What opportunities exist in the GCC Construction Machinery Rental Market?

Opportunities in the GCC Construction Machinery Rental Market include the expansion of renewable energy projects, increased investment in smart city initiatives, and the growing trend of outsourcing equipment needs. These trends can lead to a higher demand for rental services.

What trends are shaping the GCC Construction Machinery Rental Market?

Trends shaping the GCC Construction Machinery Rental Market include the adoption of advanced technologies such as telematics for equipment monitoring, a shift towards sustainable construction practices, and the increasing use of modular construction techniques. These innovations are enhancing efficiency and reducing environmental impact.

GCC Construction Machinery Rental Market

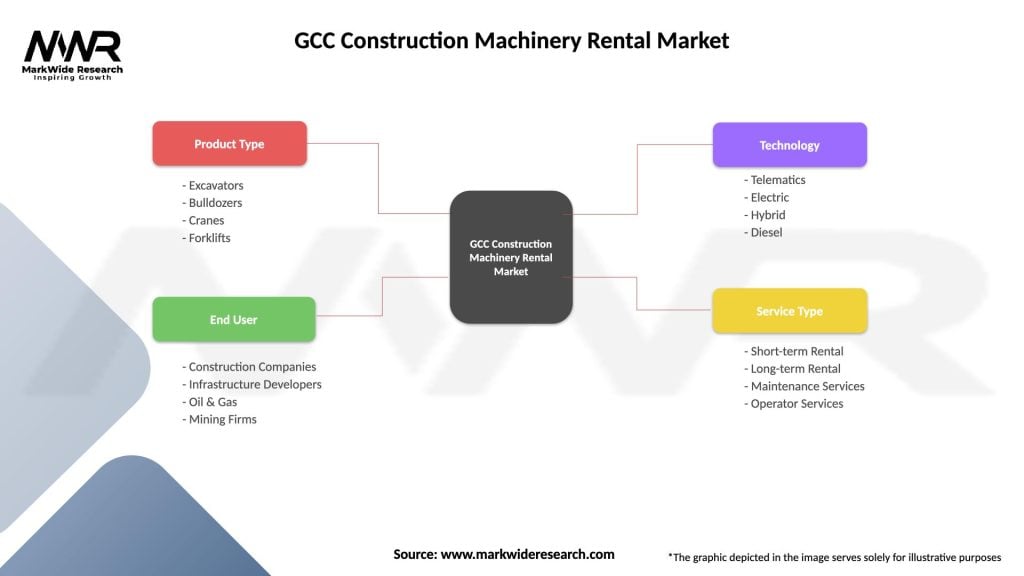

| Segmentation Details | Description |

|---|---|

| Product Type | Excavators, Bulldozers, Cranes, Forklifts |

| End User | Construction Companies, Infrastructure Developers, Oil & Gas, Mining Firms |

| Technology | Telematics, Electric, Hybrid, Diesel |

| Service Type | Short-term Rental, Long-term Rental, Maintenance Services, Operator Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the GCC Construction Machinery Rental Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at