444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The GCC (Gulf Cooperation Council) Construction Equipment/Machinery Rental Market is witnessing significant growth in recent years. The construction industry in the GCC region has experienced substantial development, driving the demand for construction equipment and machinery rental services. Construction equipment and machinery rental refer to the practice of leasing or renting heavy machinery and equipment required for construction projects, such as excavators, cranes, loaders, bulldozers, and other specialized equipment.

Meaning

GCC Construction Equipment/Machinery Rental Market refers to the market for renting or leasing heavy construction equipment and machinery in the Gulf Cooperation Council region. It encompasses the demand and supply dynamics of rental services for construction machinery, including excavators, cranes, loaders, bulldozers, and other specialized equipment used in construction projects across the GCC countries.

Executive Summary

The GCC Construction Equipment/Machinery Rental Market has witnessed significant growth in recent years, driven by the booming construction industry in the region. Rental services for construction equipment and machinery offer various benefits to industry participants, including cost savings, flexibility, and access to advanced machinery without the need for large upfront investments. This report provides key insights into the market dynamics, drivers, restraints, opportunities, regional analysis, competitive landscape, segmentation, and future outlook of the GCC Construction Equipment/Machinery Rental Market.

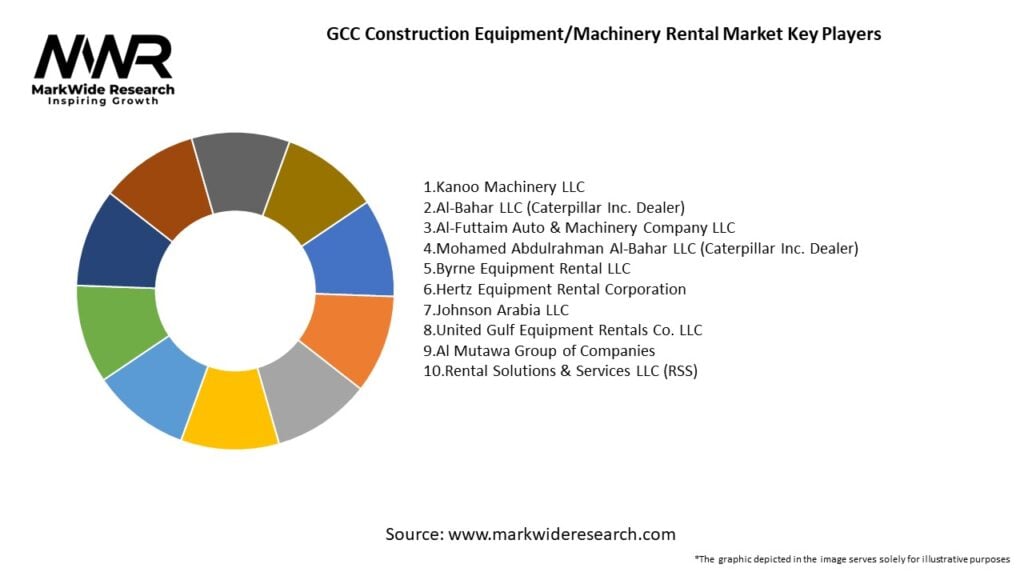

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The GCC Construction Equipment/Machinery Rental Market operates in a dynamic environment influenced by several factors. The market dynamics are driven by the growth of the construction industry, technological advancements, government initiatives, economic conditions, and customer preferences. These factors shape the demand and supply dynamics of rental services for construction equipment and machinery in the GCC region.

Regional Analysis

The GCC Construction Equipment/Machinery Rental Market is analyzed across the Gulf Cooperation Council countries, including Saudi Arabia, the United Arab Emirates, Bahrain, Qatar, Kuwait, and Oman. These countries have witnessed rapid infrastructure development and construction activities, creating substantial demand for construction equipment and machinery rental services.

In Saudi Arabia, the largest construction market in the region, major infrastructure projects, such as Neom and the Riyadh Metro, have fueled the demand for rental services. The United Arab Emirates, with its ambitious projects like Expo 2020 Dubai and the construction of new airports, offers significant opportunities for the rental market. Bahrain, Qatar, Kuwait, and Oman are also witnessing rapid construction growth, driven by government initiatives and diversification efforts.

Competitive Landscape

Leading Companies in the GCC Construction Equipment/Machinery Rental Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The GCC Construction Equipment/Machinery Rental Market can be segmented based on equipment type, end-user industry, and rental duration.

Based on equipment type, the market can be segmented into:

Based on the end-user industry, the market can be segmented into:

Based on rental duration, the market can be segmented into:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The GCC Construction Equipment/Machinery Rental Market offers several benefits to industry participants and stakeholders:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The GCC Construction Equipment/Machinery Rental Market was not immune to the impact of the COVID-19 pandemic. The construction industry witnessed disruptions due to lockdowns, labor shortages, supply chain disruptions, and project delays. However, the market showed resilience and adapted to the changing circumstances. Rental companies implemented safety protocols, increased sanitation measures, and adopted contactless rental processes to ensure business continuity. As economies recover and construction activities resume, the market is expected to regain momentum.

Key Industry Developments

Analyst Suggestions

Future Outlook

The GCC Construction Equipment/Machinery Rental Market is expected to witness sustained growth in the coming years. The construction industry’s expansion, government initiatives, and technological advancements will continue to drive the demand for rental services. Rental companies that adapt to emerging technologies, provide excellent customer experiences, offer sustainable options, and forge strategic partnerships are likely to thrive in the competitive market landscape.

Conclusion

The GCC Construction Equipment/Machinery Rental Market is experiencing significant growth, driven by the flourishing construction industry in the region. Rental services for construction equipment and machinery provide cost savings, flexibility, and access to advanced equipment, making them an attractive option for industry participants. Technological advancements, government initiatives, and emerging opportunities in SMEs and sustainable practices contribute to the market’s positive outlook. Rental companies that leverage technology, enhance customer experience, expand their rental fleets, and embrace sustainability are well-positioned for success in the GCC Construction Equipment/Machinery Rental Market.

What is Construction Equipment/Machinery Rental?

Construction Equipment/Machinery Rental refers to the practice of renting heavy machinery and equipment used in construction projects, such as excavators, bulldozers, and cranes, rather than purchasing them outright.

What are the key players in the GCC Construction Equipment/Machinery Rental Market?

Key players in the GCC Construction Equipment/Machinery Rental Market include companies like Al-Futtaim Engineering, United Equipment Rental, and Al-Bahar, among others.

What are the main drivers of the GCC Construction Equipment/Machinery Rental Market?

The main drivers of the GCC Construction Equipment/Machinery Rental Market include the rapid growth of infrastructure projects, increasing urbanization, and the rising demand for cost-effective construction solutions.

What challenges does the GCC Construction Equipment/Machinery Rental Market face?

Challenges in the GCC Construction Equipment/Machinery Rental Market include fluctuating demand due to economic conditions, high maintenance costs of equipment, and competition from local and international rental companies.

What opportunities exist in the GCC Construction Equipment/Machinery Rental Market?

Opportunities in the GCC Construction Equipment/Machinery Rental Market include the expansion of renewable energy projects, increased investment in smart city initiatives, and the growing trend of outsourcing equipment needs by construction firms.

What trends are shaping the GCC Construction Equipment/Machinery Rental Market?

Trends shaping the GCC Construction Equipment/Machinery Rental Market include the adoption of advanced technologies like telematics for equipment monitoring, a shift towards sustainable equipment options, and the increasing use of digital platforms for rental transactions.

GCC Construction Equipment/Machinery Rental Market

| Segmentation Details | Description |

|---|---|

| Product Type | Excavators, Bulldozers, Cranes, Forklifts |

| End User | Construction, Mining, Oil & Gas, Infrastructure |

| Technology | Telematics, Electric, Hydraulic, Pneumatic |

| Service Type | Short-term Rental, Long-term Rental, Lease, Maintenance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the GCC Construction Equipment/Machinery Rental Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at