444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The GCC compound feed market represents a dynamic and rapidly evolving sector within the Gulf Cooperation Council region’s agricultural landscape. This market encompasses the production, distribution, and consumption of nutritionally balanced feed formulations designed to optimize livestock performance across various animal categories. The region’s compound feed industry has experienced remarkable transformation, driven by increasing demand for high-quality animal protein, modernization of farming practices, and growing awareness of animal nutrition science.

Market dynamics in the GCC region reflect a sophisticated understanding of livestock nutritional requirements, with compound feed manufacturers developing specialized formulations for poultry, cattle, sheep, goats, and aquaculture species. The market demonstrates strong growth momentum, with industry analysts projecting a compound annual growth rate of 6.2% through the forecast period. This growth trajectory is supported by rising meat consumption patterns, expanding commercial farming operations, and increasing adoption of scientific feeding practices across the region.

Regional characteristics of the GCC compound feed market include heavy reliance on imported raw materials, advanced feed processing technologies, and stringent quality control measures. The market benefits from substantial government support for food security initiatives, modern infrastructure development, and favorable regulatory frameworks that encourage agricultural sector growth. Key market participants have established sophisticated supply chain networks to ensure consistent feed quality and availability across diverse geographical locations.

The GCC compound feed market refers to the comprehensive ecosystem of nutritionally formulated animal feed products manufactured, distributed, and consumed within the Gulf Cooperation Council member states, including Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Bahrain, and Oman. These compound feeds represent scientifically balanced combinations of various ingredients including grains, protein meals, vitamins, minerals, and additives designed to meet specific nutritional requirements of different livestock species and production stages.

Compound feed formulations in the GCC market are characterized by their precision in meeting animal dietary needs while optimizing feed conversion efficiency, growth rates, and overall animal health. The market encompasses various feed types including starter feeds, grower feeds, finisher feeds, and specialized formulations for breeding animals. Modern compound feed production in the region incorporates advanced technologies such as pelleting, extrusion, and micro-ingredient dosing systems to ensure consistent quality and nutritional value.

Market significance extends beyond simple feed production to encompass food security, agricultural sustainability, and economic development objectives across GCC nations. The compound feed industry serves as a critical link between raw material imports and domestic livestock production, supporting the region’s goals of achieving greater self-sufficiency in animal protein production while maintaining high standards of food safety and quality.

Strategic positioning of the GCC compound feed market reflects the region’s commitment to developing a robust and sustainable livestock sector capable of meeting growing domestic demand for animal protein products. The market has evolved from basic feed mixing operations to sophisticated manufacturing facilities employing cutting-edge technology and scientific formulation approaches. Current market trends indicate strong momentum toward premium feed products, specialized nutrition solutions, and environmentally sustainable production practices.

Key market drivers include rapidly expanding poultry and aquaculture sectors, increasing consumer preference for high-quality meat products, and growing adoption of intensive farming practices. The market benefits from substantial investments in feed manufacturing infrastructure, with feed production capacity increasing by 8.5% annually across the region. Government initiatives supporting food security and agricultural development have created favorable conditions for market expansion and technological advancement.

Competitive landscape features a mix of international feed companies, regional manufacturers, and specialized nutrition providers offering diverse product portfolios. Market leaders focus on innovation, quality assurance, and customer service excellence to maintain competitive advantages. The industry demonstrates strong collaboration between feed manufacturers, livestock producers, and research institutions to develop optimized nutrition solutions for regional farming conditions.

Market intelligence reveals several critical insights shaping the GCC compound feed industry’s development trajectory and competitive dynamics:

Population growth across GCC countries serves as a fundamental driver for compound feed market expansion, with increasing urbanization and rising disposable incomes driving higher consumption of animal protein products. The region’s demographic trends indicate sustained demand growth for meat, dairy, and seafood products, directly translating into increased feed requirements for livestock and aquaculture operations.

Government initiatives supporting food security and agricultural self-sufficiency have created substantial momentum for compound feed market development. National food security strategies emphasize domestic livestock production capabilities, leading to significant investments in feed manufacturing infrastructure, research and development programs, and farmer education initiatives. These policy frameworks provide long-term stability and growth opportunities for feed industry participants.

Technological advancement in feed formulation and production processes has revolutionized the industry’s efficiency and product quality standards. Modern feed mills incorporate precision nutrition concepts, automated quality control systems, and data-driven optimization approaches that enhance feed performance while reducing production costs. The adoption of digital technologies in feed management has improved traceability, inventory management, and customer service capabilities.

Commercial farming expansion represents another significant driver, with increasing numbers of livestock producers adopting intensive production systems that require high-quality compound feeds. The shift from traditional extensive farming to modern commercial operations has created substantial demand for specialized feed products designed to optimize animal performance, health, and productivity under controlled production environments.

Raw material price volatility poses significant challenges for compound feed manufacturers, with fluctuating costs of key ingredients such as corn, soybean meal, and wheat affecting profit margins and pricing strategies. Global commodity market dynamics, weather-related supply disruptions, and geopolitical factors contribute to price instability that complicates long-term planning and contract negotiations within the feed industry.

Import dependency creates vulnerability to supply chain disruptions and currency fluctuations that can impact feed availability and pricing. The region’s heavy reliance on imported feed ingredients exposes manufacturers to international market volatilities, transportation challenges, and regulatory changes in exporting countries. This dependency also limits the industry’s ability to respond quickly to sudden demand changes or supply shortages.

Regulatory compliance requirements continue to evolve, creating ongoing challenges for feed manufacturers to maintain adherence to food safety, environmental, and animal welfare standards. Increasing regulatory complexity requires substantial investments in quality assurance systems, documentation processes, and staff training programs. Compliance costs can be particularly burdensome for smaller feed manufacturers with limited resources.

Environmental concerns related to livestock production and feed manufacturing have led to stricter regulations and public scrutiny of industry practices. Issues such as water usage, waste management, and carbon emissions require ongoing attention and investment in sustainable production technologies. These environmental considerations may limit expansion opportunities and increase operational costs for feed manufacturers.

Aquaculture development presents exceptional growth opportunities for compound feed manufacturers, with regional governments promoting fish farming as a sustainable protein source. The expanding aquaculture sector requires specialized feed formulations that differ significantly from traditional livestock feeds, creating opportunities for innovation and market differentiation. Growing consumer demand for seafood products supports continued investment in aquaculture feed development.

Organic and natural feed products represent emerging market segments with significant growth potential, driven by increasing consumer awareness of food quality and production methods. Premium feed formulations incorporating organic ingredients, probiotics, and natural additives command higher margins while meeting evolving market demands for sustainable and health-conscious animal production practices.

Technology integration offers numerous opportunities for operational efficiency improvements and service enhancement. Digital platforms for feed management, precision nutrition software, and automated feeding systems create value-added services that strengthen customer relationships while improving feed utilization efficiency. Investment in research and development capabilities can lead to breakthrough innovations in feed formulation and production technologies.

Regional expansion within GCC countries and neighboring markets provides growth opportunities for established feed manufacturers. Developing distribution networks, strategic partnerships, and local production facilities can capture market share in underserved areas while reducing transportation costs and improving customer service levels.

Supply chain integration has become increasingly important in the GCC compound feed market, with successful companies developing comprehensive strategies that encompass raw material sourcing, production optimization, and distribution efficiency. Vertical integration approaches allow feed manufacturers to better control quality, costs, and supply reliability while providing enhanced value propositions to customers. Strategic partnerships with ingredient suppliers and livestock producers create mutually beneficial relationships that strengthen market positions.

Innovation cycles in feed formulation continue to accelerate, driven by advancing nutritional science, ingredient technology, and production methods. Research and development investments focus on improving feed conversion efficiency, animal health outcomes, and environmental sustainability. Collaboration between feed manufacturers, academic institutions, and technology providers facilitates knowledge transfer and accelerates innovation adoption across the industry.

Customer relationship management has evolved beyond traditional sales approaches to encompass comprehensive technical support, nutritional consulting, and performance monitoring services. Feed companies increasingly position themselves as partners in livestock production success, providing expertise and solutions that extend beyond feed supply. This service-oriented approach creates competitive differentiation and customer loyalty in an increasingly competitive market environment.

Market consolidation trends reflect the industry’s maturation, with larger companies acquiring smaller operations to achieve economies of scale and expand market coverage. Consolidation activities enable improved operational efficiency, enhanced research capabilities, and stronger negotiating power with suppliers and customers. However, this trend also creates opportunities for specialized niche players to serve specific market segments with customized solutions.

Comprehensive market analysis for the GCC compound feed market employs multiple research methodologies to ensure accuracy, reliability, and depth of insights. Primary research activities include extensive interviews with industry executives, feed manufacturers, livestock producers, and regulatory officials across all GCC member states. These interviews provide firsthand perspectives on market trends, challenges, opportunities, and competitive dynamics that shape industry development.

Secondary research encompasses detailed analysis of government publications, industry reports, trade association data, and academic research papers related to compound feed production, livestock farming, and agricultural development in the GCC region. This research foundation provides historical context, statistical validation, and comparative analysis capabilities that enhance overall market understanding.

Data validation processes involve cross-referencing information from multiple sources, conducting follow-up interviews to clarify findings, and employing statistical analysis techniques to identify trends and patterns. Market sizing and forecasting methodologies incorporate both top-down and bottom-up approaches to ensure comprehensive coverage and accuracy. MarkWide Research analytical frameworks provide structured approaches to market evaluation and competitive assessment.

Industry expert consultation includes engagement with nutritionists, veterinarians, agricultural economists, and technology specialists who provide specialized knowledge and insights into technical aspects of compound feed production and utilization. These expert perspectives enhance the research quality and provide valuable context for market analysis and future projections.

Saudi Arabia dominates the GCC compound feed market, representing approximately 42% of regional consumption due to its large livestock population and extensive commercial farming operations. The kingdom’s Vision 2030 initiative emphasizes agricultural development and food security, creating favorable conditions for feed industry growth. Major feed manufacturing facilities in Saudi Arabia serve both domestic and export markets, benefiting from economies of scale and advanced production technologies.

United Arab Emirates accounts for 28% of regional market share, with Dubai and Abu Dhabi serving as important distribution hubs for feed products throughout the region. The UAE’s strategic location, modern infrastructure, and business-friendly environment attract international feed companies seeking regional market access. The country’s focus on aquaculture development and premium livestock production drives demand for specialized feed formulations.

Qatar and Kuwait together represent 18% of the GCC compound feed market, with both countries investing heavily in food security initiatives and domestic agricultural capabilities. Qatar’s National Food Security Programme and Kuwait’s agricultural development projects create substantial opportunities for feed manufacturers. These markets demonstrate strong demand for high-quality feed products supporting intensive livestock production systems.

Bahrain and Oman comprise the remaining 12% of regional market share, with both countries focusing on sustainable agricultural development and aquaculture expansion. Oman’s coastal location provides advantages for fish farming development, while Bahrain’s strategic position supports regional distribution activities. These smaller markets offer opportunities for specialized feed products and customized nutrition solutions.

Market leadership in the GCC compound feed sector is characterized by a diverse mix of international corporations, regional manufacturers, and specialized nutrition companies. The competitive environment emphasizes quality, innovation, and customer service excellence as key differentiating factors.

Competitive strategies focus on product innovation, quality assurance, technical support, and supply chain reliability. Leading companies invest substantially in research and development, customer education programs, and digital technologies that enhance service delivery and operational efficiency.

By Animal Type:

By Feed Form:

By Distribution Channel:

Poultry feed category demonstrates the strongest market performance, driven by expanding broiler production and increasing egg consumption across GCC countries. Modern poultry operations require sophisticated feed formulations that optimize growth rates, feed conversion efficiency, and meat quality. Innovation in poultry nutrition focuses on reducing antibiotic usage, improving gut health, and enhancing product differentiation through specialized feeding programs.

Ruminant feed segment benefits from growing dairy production and increasing demand for high-quality beef products. Feed formulations for dairy cattle emphasize milk production optimization, while beef cattle feeds focus on growth performance and meat quality enhancement. The segment faces challenges from fluctuating forage availability and increasing feed costs, driving demand for more efficient nutrition solutions.

Aquaculture feed category represents the fastest-growing segment, supported by government initiatives promoting fish farming as a sustainable protein source. Specialized formulations for different fish species require precise nutrition profiles and high-quality ingredients to achieve optimal growth and feed conversion ratios. The segment benefits from increasing consumer demand for seafood products and expanding commercial aquaculture operations.

Premium feed products across all categories demonstrate strong growth potential, with livestock producers increasingly recognizing the value of high-quality nutrition in achieving production objectives. Premium formulations incorporate advanced ingredients, specialized additives, and customized nutrition profiles that command higher margins while delivering superior performance results.

Feed manufacturers benefit from expanding market opportunities, technological advancement possibilities, and growing demand for specialized nutrition solutions. The market provides platforms for innovation, product differentiation, and value-added service development that enhance competitive positioning and profitability. Strategic partnerships and vertical integration opportunities create additional growth avenues and operational efficiencies.

Livestock producers gain access to advanced nutrition solutions that optimize animal performance, reduce production costs, and improve product quality. Modern compound feeds provide consistent nutrition profiles, convenient handling characteristics, and technical support services that enhance farming efficiency and profitability. Quality assurance programs and traceability systems provide confidence in feed safety and regulatory compliance.

Consumers benefit from improved food quality, safety, and availability resulting from optimized livestock nutrition programs. High-quality compound feeds contribute to better animal health, reduced antibiotic usage, and enhanced nutritional content of animal protein products. Sustainable feed production practices support environmental stewardship and long-term food security objectives.

Government stakeholders achieve food security objectives, economic development goals, and agricultural sector modernization through a robust compound feed industry. The sector contributes to employment creation, technology transfer, and rural development while supporting national strategies for agricultural self-sufficiency and export competitiveness.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration has emerged as a dominant trend, with feed manufacturers increasingly focusing on environmentally responsible production practices, alternative protein sources, and circular economy principles. Companies are investing in renewable energy systems, waste reduction programs, and sustainable ingredient sourcing strategies that align with global environmental objectives and consumer expectations.

Precision nutrition approaches are revolutionizing feed formulation practices, with advanced analytical techniques and data-driven optimization methods enabling more precise matching of feed compositions to animal requirements. This trend supports improved feed efficiency, reduced environmental impact, and enhanced animal performance while optimizing production costs and resource utilization.

Digital transformation continues to reshape industry operations, with feed manufacturers adopting automated production systems, digital quality control platforms, and customer relationship management technologies. Mobile applications, online ordering systems, and data analytics platforms enhance operational efficiency and customer service capabilities while providing valuable insights for business optimization.

Functional feed additives represent a growing trend, with increasing incorporation of probiotics, prebiotics, enzymes, and other bioactive compounds that support animal health and performance beyond basic nutrition. These specialized ingredients address specific production challenges while reducing reliance on antibiotics and other pharmaceutical interventions in livestock production systems.

Infrastructure investments across the GCC region have significantly expanded feed manufacturing capacity and technological capabilities. Major feed companies have established state-of-the-art production facilities incorporating advanced automation, quality control systems, and environmental management technologies. These investments support market growth while improving operational efficiency and product quality standards.

Strategic partnerships between international feed companies and regional players have accelerated technology transfer, market access, and capability development. Joint ventures and licensing agreements enable knowledge sharing, resource optimization, and market expansion while providing local expertise and distribution networks for international participants.

Research and development initiatives have intensified, with increased collaboration between feed manufacturers, academic institutions, and government research organizations. These programs focus on developing region-specific feed formulations, improving ingredient utilization efficiency, and addressing local production challenges through innovative nutrition solutions.

Regulatory harmonization efforts across GCC countries are creating more consistent standards and requirements for feed quality, safety, and labeling. These developments facilitate trade, reduce compliance complexity, and support market integration while maintaining high standards for animal nutrition and food safety.

Market positioning strategies should emphasize differentiation through quality, innovation, and customer service excellence rather than competing solely on price. Companies should invest in developing specialized expertise, advanced formulation capabilities, and comprehensive technical support services that create value for customers while building competitive advantages. MarkWide Research analysis indicates that successful companies focus on building long-term customer relationships through consistent performance and reliable service delivery.

Supply chain optimization represents a critical success factor, with companies needing to develop robust sourcing strategies, inventory management systems, and distribution networks that ensure consistent product availability and quality. Strategic partnerships with ingredient suppliers, logistics providers, and technology companies can enhance operational efficiency while reducing costs and risks.

Innovation investment should prioritize areas with the highest potential for market differentiation and customer value creation. Research and development programs should focus on sustainable ingredients, functional additives, precision nutrition technologies, and digital platforms that address evolving market needs and regulatory requirements.

Geographic expansion strategies should consider market entry approaches that leverage existing capabilities while addressing local market requirements and competitive dynamics. Companies should evaluate partnership opportunities, acquisition possibilities, and organic growth strategies that provide sustainable competitive advantages in target markets.

Long-term growth prospects for the GCC compound feed market remain highly positive, supported by favorable demographic trends, government policy support, and continuing modernization of livestock production systems. The market is expected to maintain robust growth momentum, with projected annual expansion of 6.8% over the next decade. This growth trajectory reflects sustained demand for animal protein products, increasing adoption of commercial farming practices, and ongoing investments in agricultural infrastructure.

Technology evolution will continue to reshape industry operations, with artificial intelligence, automation, and precision nutrition technologies becoming increasingly important competitive factors. Companies that successfully integrate these technologies into their operations and service offerings will achieve significant advantages in efficiency, quality, and customer satisfaction. Digital platforms will become essential tools for customer engagement, supply chain management, and business optimization.

Sustainability requirements will intensify, with increasing emphasis on environmental stewardship, resource efficiency, and circular economy principles. Feed manufacturers will need to develop comprehensive sustainability strategies that address climate change concerns, resource conservation, and waste reduction while maintaining economic viability and competitive positioning.

Market consolidation trends are expected to continue, with larger companies acquiring smaller operations to achieve scale advantages and expand market coverage. However, opportunities will remain for specialized companies that focus on niche markets, innovative products, or superior customer service. The industry structure will likely evolve toward a combination of large integrated players and specialized niche providers serving specific market segments.

The GCC compound feed market represents a dynamic and rapidly evolving industry with substantial growth potential and significant opportunities for market participants. Strong demographic trends, government support for agricultural development, and increasing demand for high-quality animal protein products create favorable conditions for sustained market expansion. The industry’s evolution toward more sophisticated nutrition solutions, sustainable production practices, and technology-enabled operations positions it well for long-term success.

Strategic success in this market requires companies to balance multiple priorities including quality excellence, innovation capabilities, operational efficiency, and customer service leadership. Organizations that can effectively navigate the challenges of raw material volatility, regulatory compliance, and competitive pressures while capitalizing on growth opportunities in aquaculture, premium products, and regional expansion will achieve sustainable competitive advantages.

Future market development will be characterized by continued technological advancement, increasing sustainability requirements, and evolving customer expectations for specialized nutrition solutions. Companies that invest in research and development, embrace digital transformation, and develop comprehensive sustainability strategies will be best positioned to capitalize on emerging opportunities and maintain market leadership positions in the evolving GCC compound feed landscape.

What is Compound Feed?

Compound feed refers to a mixture of various feed ingredients formulated to meet the nutritional needs of livestock and poultry. It is designed to enhance growth, reproduction, and overall health in animals.

What are the key players in the GCC Compound Feed Market?

Key players in the GCC Compound Feed Market include Al Ain Feed Mill, Al Dahra Agriculture, and Gulf Feed. These companies are involved in the production and distribution of high-quality compound feed for various livestock.

What are the main drivers of the GCC Compound Feed Market?

The main drivers of the GCC Compound Feed Market include the increasing demand for meat and dairy products, the growth of the livestock industry, and advancements in feed formulation technologies. These factors contribute to the rising consumption of compound feed in the region.

What challenges does the GCC Compound Feed Market face?

The GCC Compound Feed Market faces challenges such as fluctuating raw material prices, regulatory compliance issues, and competition from alternative feed sources. These factors can impact the profitability and sustainability of feed manufacturers.

What opportunities exist in the GCC Compound Feed Market?

Opportunities in the GCC Compound Feed Market include the growing trend towards organic and sustainable feed options, innovations in feed additives, and the expansion of aquaculture. These trends can lead to new product development and market growth.

What trends are shaping the GCC Compound Feed Market?

Trends shaping the GCC Compound Feed Market include the increasing focus on animal health and nutrition, the adoption of technology in feed production, and the rise of customized feed solutions. These trends are driving changes in consumer preferences and industry practices.

GCC Compound Feed Market

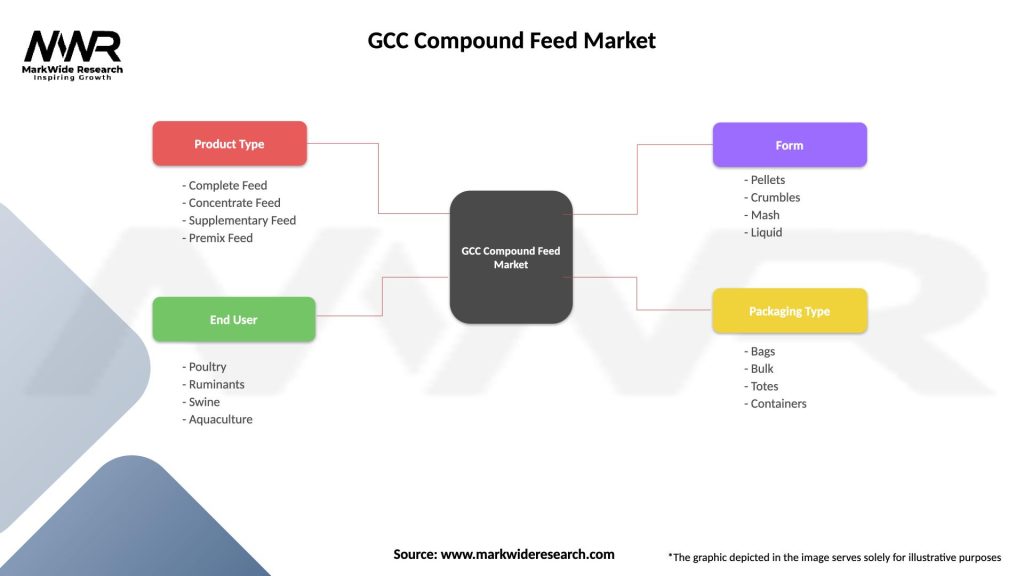

| Segmentation Details | Description |

|---|---|

| Product Type | Complete Feed, Concentrate Feed, Supplementary Feed, Premix Feed |

| End User | Poultry, Ruminants, Swine, Aquaculture |

| Form | Pellets, Crumbles, Mash, Liquid |

| Packaging Type | Bags, Bulk, Totes, Containers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the GCC Compound Feed Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at