444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The GCC cement market has witnessed significant growth in recent years, driven by the booming construction sector in the Gulf Cooperation Council (GCC) countries. Cement, a vital component in construction, plays a crucial role in infrastructure development, residential and commercial buildings, and various other construction projects across the region. This long-form content aims to provide a comprehensive analysis of the GCC cement market, highlighting its meaning, key market insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, key benefits for industry participants and stakeholders, SWOT analysis, market key trends, the impact of Covid-19, key industry developments, analyst suggestions, future outlook, and a concluding summary.

Meaning

Cement, in general, refers to a binding material that, when mixed with water, forms a paste that hardens and binds together other materials like aggregates, sand, and rocks to create a solid structure. In the context of the GCC cement market, it specifically relates to the production, consumption, and trade of cement within the Gulf Cooperation Council countries, namely Saudi Arabia, the United Arab Emirates (UAE), Qatar, Kuwait, Bahrain, and Oman.

Executive Summary

The GCC cement market has experienced substantial growth over the past decade, primarily driven by the region’s rapid urbanization, population growth, and infrastructure development. The increasing demand for residential and commercial spaces, coupled with extensive government investments in mega projects, has fueled the demand for cement across the GCC countries.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The GCC cement market is characterized by intense competition among major players, who strive to capture a significant market share through mergers and acquisitions, capacity expansions, and product innovations. The market is influenced by factors such as raw material availability, transportation costs, government regulations, and changing customer preferences.

Regional Analysis

The GCC cement market exhibits regional variations in terms of production, consumption, and trade. Saudi Arabia has been the largest cement producer and consumer in the region, followed by the UAE and Qatar. Each country has its unique dynamics, influenced by factors like population growth, construction activities, infrastructure projects, and government policies.

Competitive Landscape

Leading Companies in the GCC Cement Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

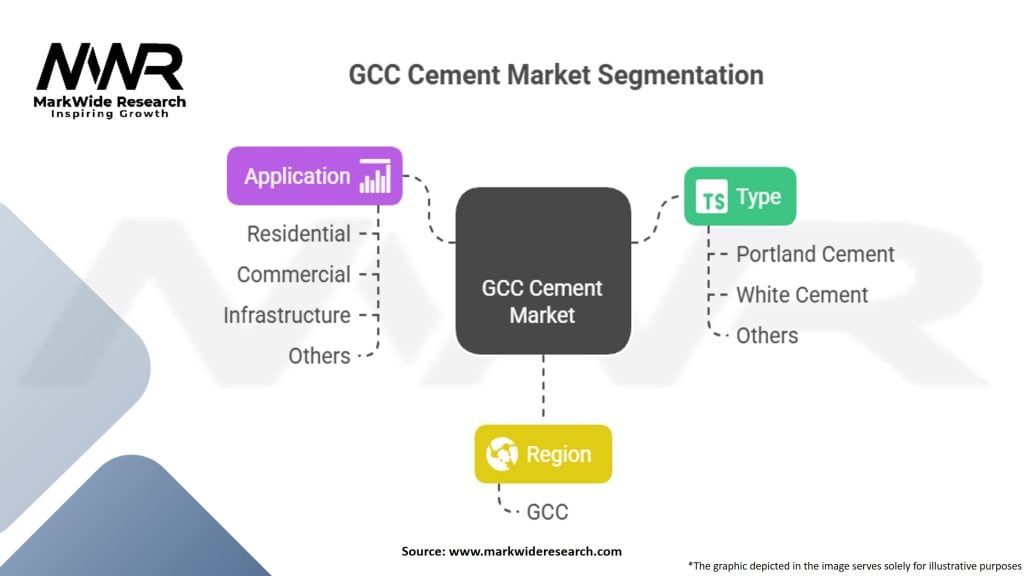

Segmentation

The GCC cement market can be segmented based on product type, application, and end-use industry. The product type segmentation includes Portland cement, blended cement, and specialty cement. Application segmentation covers residential, commercial, and infrastructure sectors. End-use industry segmentation includes construction, oil and gas, and others.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the GCC cement market. Construction activities were temporarily halted or delayed due to lockdown measures and supply chain disruptions. However, governments’ stimulus packages, resumed construction projects, and the gradual recovery of the overall economy have helped the cement market regain momentum.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the GCC cement market remains positive, with sustained growth expected in the coming years. The region’s construction sector is projected to continue expanding, driven by government investments, infrastructure projects, and urbanization. The adoption of sustainable practices, product innovations, and digitalization will play a pivotal role in shaping the industry’s future.

Conclusion

The GCC cement market is witnessing significant growth, propelled by the robust construction sector, government investments, and infrastructure projects. Cement manufacturers, suppliers, contractors, and builders stand to benefit from this growth, provided they embrace sustainability, innovate, and adapt to evolving market trends. Despite challenges posed by environmental concerns and regional instability, the future outlook for the GCC cement market remains promising, with ample opportunities for expansion, export, and technological advancements.

What is the GCC cement?

GCC cement refers to the cement produced in the Gulf Cooperation Council region, which includes countries like Saudi Arabia, the UAE, and Qatar. It is used in various construction applications, including residential, commercial, and infrastructure projects.

Who are the key players in the GCC Cement Market?

Key players in the GCC Cement Market include companies such as Saudi Cement Company, Arabian Cement Company, and Qatar National Cement Company, among others.

What are the main drivers of growth in the GCC Cement Market?

The main drivers of growth in the GCC Cement Market include rapid urbanization, increasing infrastructure development, and government initiatives to boost construction activities across the region.

What challenges does the GCC Cement Market face?

The GCC Cement Market faces challenges such as fluctuating raw material prices, environmental regulations, and competition from alternative building materials, which can impact profitability and market stability.

What opportunities exist in the GCC Cement Market for future growth?

Opportunities in the GCC Cement Market include the growing demand for sustainable construction materials, advancements in cement technology, and the potential for export to neighboring regions.

What trends are shaping the GCC Cement Market?

Trends shaping the GCC Cement Market include the increasing adoption of green cement technologies, the rise of digitalization in production processes, and a focus on reducing carbon emissions in cement manufacturing.

GCC Cement Market:

| Segmentation | Details |

|---|---|

| Type | Portland Cement, White Cement, Others |

| Application | Residential, Commercial, Infrastructure, Others |

| Region | GCC (Gulf Cooperation Council) |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the GCC Cement Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at