444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The GCC and Africa ICT market represents one of the most dynamic and rapidly evolving technology landscapes globally, characterized by unprecedented digital transformation initiatives and substantial infrastructure investments. This comprehensive market encompasses information and communication technology solutions across the Gulf Cooperation Council countries and the African continent, driving innovation in telecommunications, cloud computing, artificial intelligence, and digital services. Market dynamics indicate robust growth trajectories, with the region experiencing accelerated adoption of emerging technologies and digital solutions across various sectors including healthcare, education, banking, and government services.

Regional governments are implementing ambitious digitization strategies, with the UAE’s Vision 2071, Saudi Arabia’s Vision 2030, and various African digital transformation initiatives leading the charge. The market demonstrates significant growth potential with telecommunications infrastructure expansion, 5G network deployments, and increasing smartphone penetration rates driving demand for advanced ICT solutions. Investment patterns show substantial capital allocation toward smart city projects, e-government initiatives, and digital payment systems, reflecting the region’s commitment to technological advancement.

Technology adoption rates vary significantly across different countries within the GCC and Africa, with Gulf states typically leading in infrastructure development while African nations show remarkable mobile-first innovation and leapfrogging traditional technology phases. The market benefits from young demographics, with over 60% of the population under 30 years old, creating substantial demand for digital services and mobile applications.

The GCC and Africa ICT market refers to the comprehensive ecosystem of information and communication technology products, services, and solutions deployed across the Gulf Cooperation Council member states and African countries. This market encompasses telecommunications infrastructure, software development, cloud computing services, cybersecurity solutions, digital transformation services, and emerging technologies including artificial intelligence, Internet of Things, and blockchain applications.

Market scope includes both hardware and software components, ranging from network equipment and data centers to enterprise software solutions and mobile applications. The definition extends to encompass digital services such as e-commerce platforms, fintech solutions, health tech applications, and educational technology platforms that serve the diverse needs of businesses, governments, and consumers across the region.

Geographic coverage spans the six GCC member states (UAE, Saudi Arabia, Kuwait, Qatar, Bahrain, and Oman) alongside the 54 African countries, creating a vast and diverse market with varying levels of technological maturity and infrastructure development. This market represents the convergence of traditional telecommunications with modern digital technologies, enabling comprehensive digital transformation across multiple industry verticals.

Strategic analysis reveals that the GCC and Africa ICT market is experiencing unprecedented growth driven by government digitization initiatives, increasing internet penetration, and rising demand for cloud-based solutions. The market demonstrates strong fundamentals with telecommunications infrastructure investments, 5G network rollouts, and expanding fiber optic connectivity creating robust foundations for advanced technology adoption.

Key growth drivers include the region’s young population, increasing smartphone adoption rates exceeding 75% in GCC countries, and growing digital literacy levels. African markets show particular strength in mobile money solutions and fintech innovation, while GCC countries lead in smart city implementations and government digital services. Investment flows continue to strengthen the market, with sovereign wealth funds and international technology companies establishing significant regional presence.

Market segmentation reveals telecommunications services maintaining the largest share, followed by software and IT services, with emerging technologies like artificial intelligence and IoT showing the highest growth rates. The competitive landscape features both international technology giants and regional players, creating a dynamic ecosystem that fosters innovation and technological advancement across diverse industry sectors.

Digital transformation initiatives across the GCC and Africa are reshaping traditional business models and creating new opportunities for ICT solution providers. The market demonstrates several critical insights that define its current trajectory and future potential:

Government initiatives serve as primary catalysts for ICT market expansion across the GCC and Africa, with national digital strategies creating substantial demand for technology solutions and infrastructure development. Vision 2030 in Saudi Arabia, UAE’s digital government strategy, and various African digital transformation programs are driving systematic technology adoption across public and private sectors.

Demographic advantages significantly contribute to market growth, with the region’s young population demonstrating high technology adoption rates and digital service consumption. The median age below 30 years in most countries creates a tech-savvy consumer base that drives demand for innovative digital solutions, mobile applications, and online services.

Infrastructure investments continue to expand market opportunities, with substantial capital allocation toward telecommunications networks, data centers, and fiber optic connectivity. 5G network deployments are accelerating across GCC countries, while African nations are rapidly expanding 4G coverage and improving internet connectivity infrastructure.

Economic diversification efforts in oil-dependent economies are creating new opportunities for ICT solutions, as governments and businesses seek technology-enabled alternatives to traditional revenue sources. Digital economy initiatives are fostering innovation ecosystems and encouraging technology entrepreneurship across the region.

Infrastructure limitations in certain African regions continue to challenge ICT market expansion, with inadequate power supply, limited internet connectivity, and insufficient telecommunications infrastructure constraining technology adoption in rural and remote areas. Digital divide issues persist between urban and rural populations, affecting market penetration rates for advanced ICT solutions.

Regulatory complexities across different countries create challenges for technology companies seeking regional expansion, with varying data protection laws, telecommunications regulations, and digital service requirements complicating market entry strategies. Compliance costs associated with multiple regulatory frameworks can limit smaller technology providers’ ability to operate across diverse markets.

Skills shortages in specialized technology areas constrain market growth, with limited availability of qualified professionals in areas such as cybersecurity, artificial intelligence, and advanced data analytics. Educational gaps between technology advancement and workforce capabilities create bottlenecks for ICT solution implementation and maintenance.

Economic volatility in certain regions affects technology investment decisions, with currency fluctuations and economic uncertainty influencing enterprise spending on ICT solutions and infrastructure upgrades. Budget constraints in some African countries limit government technology investments and public sector digitization initiatives.

Emerging technologies present substantial opportunities for market expansion, with artificial intelligence, machine learning, and Internet of Things applications showing significant potential across various industry sectors. Smart city projects across the region create opportunities for integrated technology solutions that combine multiple ICT components for urban management and citizen services.

Digital financial services represent one of the most promising opportunity areas, particularly in African markets where traditional banking infrastructure is limited. Mobile money solutions and digital payment platforms show exceptional growth potential, with several countries achieving mobile money transaction rates exceeding 40% of GDP.

E-commerce expansion creates opportunities for supporting ICT infrastructure, including payment processing systems, logistics technology, and customer relationship management solutions. Cross-border trade digitization initiatives offer opportunities for technology providers specializing in trade facilitation and supply chain management solutions.

Healthcare digitization presents significant opportunities, with telemedicine platforms, electronic health records, and medical device connectivity solutions addressing healthcare access challenges across the region. Educational technology solutions also show strong potential, particularly in addressing educational access and quality improvement initiatives.

Competitive dynamics in the GCC and Africa ICT market are characterized by intense competition between international technology giants and emerging regional players, creating a vibrant ecosystem that drives innovation and service improvement. Market consolidation trends are evident in certain segments, while other areas show increasing fragmentation as new entrants introduce specialized solutions.

Technology convergence is reshaping market boundaries, with traditional telecommunications companies expanding into cloud services, software providers offering infrastructure solutions, and new entrants disrupting established business models. Partnership strategies are becoming increasingly important, with companies forming strategic alliances to deliver comprehensive solutions and expand market reach.

Customer expectations are evolving rapidly, with businesses and consumers demanding integrated solutions, improved user experiences, and enhanced security features. Service delivery models are shifting toward subscription-based offerings and managed services, reflecting changing customer preferences and technology consumption patterns.

Innovation cycles are accelerating, with new technologies and solutions entering the market at unprecedented rates. Digital transformation requirements are driving demand for comprehensive ICT solutions that integrate multiple technologies and provide end-to-end digital capabilities for organizations across various sectors.

Comprehensive research approach employed for this market analysis combines primary and secondary research methodologies to provide accurate and actionable insights into the GCC and Africa ICT market landscape. Primary research includes extensive interviews with industry executives, technology vendors, government officials, and end-users across different countries and market segments.

Secondary research encompasses analysis of government publications, industry reports, company financial statements, and regulatory documents from across the GCC and African markets. Data validation processes ensure accuracy and reliability of market information through cross-referencing multiple sources and expert verification.

Market sizing methodologies utilize both top-down and bottom-up approaches, incorporating government statistics, industry association data, and company-specific information to develop comprehensive market assessments. Forecasting models consider historical trends, current market dynamics, and future growth drivers to project market development trajectories.

Regional analysis methodology accounts for significant variations in market maturity, regulatory environments, and economic conditions across different countries within the GCC and Africa. Segmentation analysis provides detailed insights into specific technology categories, application areas, and customer segments to support strategic decision-making.

GCC countries demonstrate the highest ICT market maturity levels, with the UAE and Saudi Arabia leading in technology adoption and infrastructure development. UAE market shows particular strength in smart city implementations and digital government services, with Dubai and Abu Dhabi serving as regional technology hubs. The country maintains internet penetration rates exceeding 95% and demonstrates strong adoption of emerging technologies.

Saudi Arabia represents the largest GCC ICT market, driven by Vision 2030 initiatives and substantial government investments in digital transformation projects. NEOM project and other mega-developments are creating significant opportunities for advanced ICT solutions and smart city technologies. The kingdom shows rapid growth in e-commerce and digital payment adoption.

African markets display diverse characteristics, with South Africa, Nigeria, Kenya, and Egypt leading in ICT adoption and innovation. Nigeria demonstrates exceptional growth in fintech solutions and mobile services, while Kenya leads globally in mobile money innovation with M-Pesa and similar platforms achieving remarkable success rates.

North African countries including Egypt and Morocco show strong growth in telecommunications infrastructure and digital services adoption. East African markets demonstrate particular strength in mobile-first solutions and innovative technology applications that address local market needs and challenges.

Market leadership in the GCC and Africa ICT sector is distributed among several categories of players, including global technology giants, regional telecommunications operators, and emerging technology companies. Competitive positioning varies significantly across different market segments and geographic regions.

International technology companies maintaining strong regional presence include:

Regional telecommunications operators play crucial roles in market development:

Technology segmentation reveals distinct market categories with varying growth rates and adoption patterns across the GCC and Africa ICT market. Telecommunications services maintain the largest market share, encompassing mobile services, fixed-line communications, and internet connectivity solutions.

By Technology Category:

By Application Sector:

Telecommunications infrastructure continues to represent the foundation of the ICT market, with ongoing investments in 5G networks, fiber optic expansion, and network modernization projects. Mobile services dominate telecommunications revenue, particularly in African markets where mobile-first strategies have proven highly successful.

Cloud computing adoption is accelerating rapidly across both GCC and African markets, with businesses increasingly migrating to cloud-based solutions for improved scalability and cost efficiency. Hybrid cloud deployments are becoming more common as organizations balance security requirements with operational flexibility needs.

Cybersecurity solutions show exceptional growth potential as organizations become more aware of cyber threats and regulatory compliance requirements. Managed security services are gaining traction, particularly among small and medium enterprises that lack internal cybersecurity expertise.

Artificial intelligence applications are expanding beyond traditional use cases, with implementations in customer service, predictive analytics, and process automation showing strong adoption rates. Machine learning solutions are being integrated into various business applications to improve operational efficiency and decision-making capabilities.

Internet of Things deployments are increasing across smart city projects, industrial applications, and consumer devices. Connected device ecosystems are creating new opportunities for data analytics and automated service delivery across multiple industry sectors.

Technology vendors benefit from expanding market opportunities driven by digital transformation initiatives and government investments in ICT infrastructure. Revenue diversification opportunities exist across multiple technology categories and application sectors, reducing dependence on single market segments.

Telecommunications operators can leverage existing infrastructure investments to expand into adjacent markets including cloud services, cybersecurity, and digital applications. Service portfolio expansion enables operators to increase customer lifetime value and reduce competitive pressure from pure-play technology providers.

Government entities benefit from improved service delivery capabilities, enhanced citizen engagement, and operational efficiency gains through ICT solution adoption. Digital government initiatives enable cost reduction, transparency improvement, and better resource allocation across public sector operations.

Enterprise customers gain access to advanced technology capabilities that improve operational efficiency, customer experience, and competitive positioning. Digital transformation enables businesses to adapt to changing market conditions and customer expectations more effectively.

Investors and stakeholders benefit from market growth opportunities and the potential for substantial returns on technology investments. Market expansion creates opportunities for both financial returns and positive social impact through improved technology access and digital inclusion initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-first strategies are becoming standard across organizations in the GCC and Africa, with businesses prioritizing digital channels and online service delivery. Customer experience optimization through technology is driving investment in user interface design, mobile applications, and omnichannel service platforms.

Artificial intelligence integration is expanding beyond pilot projects into production deployments, with organizations implementing AI solutions for customer service, predictive maintenance, and business process automation. Machine learning applications are becoming more sophisticated and industry-specific.

Sustainability focus is influencing ICT purchasing decisions, with organizations seeking energy-efficient technology solutions and environmentally responsible service providers. Green technology initiatives are creating opportunities for sustainable ICT solutions and carbon footprint reduction services.

Edge computing adoption is increasing as organizations seek to reduce latency and improve application performance for real-time applications. Distributed computing architectures are becoming more common, particularly in IoT and smart city implementations.

Cybersecurity-by-design approaches are becoming standard practice, with security considerations integrated into technology solution development from initial design phases. Zero-trust security models are gaining adoption across enterprise and government sectors.

Major infrastructure investments continue to reshape the regional ICT landscape, with several significant developments impacting market dynamics. Data center expansion projects by major cloud providers are improving service availability and reducing latency for regional customers.

5G network rollouts are accelerating across GCC countries, with commercial services launching in multiple markets and creating opportunities for advanced mobile applications and IoT deployments. Network infrastructure modernization projects are improving connectivity and enabling new service categories.

Government digital initiatives continue to expand, with new e-government platforms launching across multiple countries and creating substantial opportunities for technology solution providers. Digital identity programs are being implemented to support comprehensive digital service delivery.

Fintech innovation is accelerating, with new mobile money platforms, digital banking services, and cryptocurrency initiatives launching across the region. Regulatory sandboxes are enabling fintech companies to test innovative solutions in controlled environments.

Smart city projects are progressing from planning to implementation phases, with integrated technology solutions being deployed for traffic management, utility optimization, and citizen services. Public-private partnerships are facilitating large-scale smart city implementations across multiple countries.

MarkWide Research analysis indicates that companies seeking success in the GCC and Africa ICT market should prioritize local partnership strategies and adapt solutions to address specific regional requirements. Market entry strategies should consider the diverse regulatory environments and varying levels of infrastructure maturity across different countries.

Investment priorities should focus on mobile-first solutions, particularly in African markets where mobile technology adoption exceeds traditional computing platforms. Solution development should emphasize user experience optimization and local language support to maximize market penetration and customer adoption.

Partnership strategies with local telecommunications operators and system integrators can provide valuable market access and customer relationship advantages. Channel development should include both direct sales and partner-based distribution models to maximize market coverage and customer reach.

Technology focus areas should include cybersecurity, cloud computing, and artificial intelligence solutions, which show the strongest growth potential across both GCC and African markets. Vertical specialization in government, financial services, and healthcare sectors can provide competitive advantages and higher margins.

Talent development initiatives should be prioritized to address skills shortages and build local technical capabilities. Training programs and certification initiatives can support market development while building customer loyalty and solution adoption rates.

Long-term market prospects for the GCC and Africa ICT sector remain highly positive, with continued government support, demographic advantages, and infrastructure investments creating sustainable growth foundations. Digital transformation initiatives are expected to accelerate, driven by changing business models and customer expectations.

Technology evolution will continue to create new market opportunities, with emerging technologies like quantum computing, advanced robotics, and augmented reality beginning to show commercial potential. Integration trends will drive demand for comprehensive technology platforms that combine multiple solution categories.

Market maturation in GCC countries will create opportunities for more sophisticated technology solutions and services, while African markets will continue to demonstrate innovation in mobile-first and leapfrog technology implementations. Cross-border collaboration between GCC and African markets is expected to increase, creating regional technology ecosystems.

Investment flows are projected to remain strong, with both government and private sector funding supporting continued market expansion. MWR projections indicate that the market will maintain robust growth rates, with emerging technology segments showing the highest expansion potential over the forecast period.

Regulatory evolution will continue to shape market development, with governments implementing policies that support digital transformation while addressing security and privacy concerns. Standards harmonization across the region may facilitate market integration and cross-border technology service delivery.

The GCC and Africa ICT market represents one of the most dynamic and promising technology markets globally, characterized by strong government support, favorable demographics, and substantial infrastructure investments. Market fundamentals remain robust, with digital transformation initiatives driving sustained demand for comprehensive ICT solutions across multiple industry sectors.

Growth opportunities span across traditional telecommunications services and emerging technology categories, with particular strength in mobile-first solutions, cloud computing, and artificial intelligence applications. The market’s diversity creates opportunities for both specialized solution providers and comprehensive technology platforms that address multiple customer requirements.

Strategic success in this market requires understanding of local requirements, regulatory environments, and customer preferences across different countries and regions. Companies that invest in local partnerships, talent development, and solution customization are positioned to capture the substantial opportunities available in this rapidly expanding market ecosystem.

What is GCC And Africa ICT?

GCC And Africa ICT refers to the information and communication technology landscape within the Gulf Cooperation Council and African regions, encompassing various technologies, services, and applications that facilitate communication and information exchange.

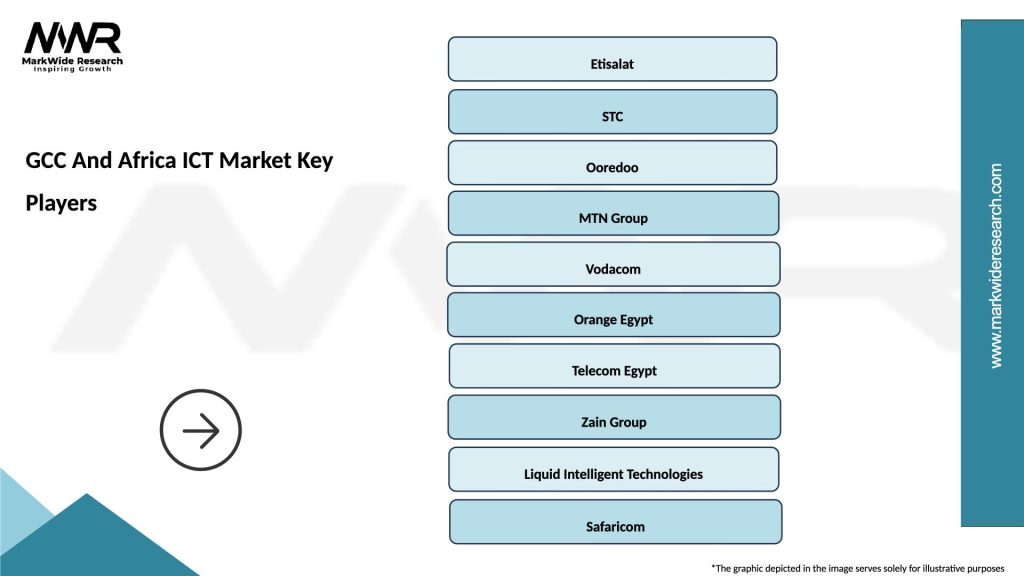

What are the key players in the GCC And Africa ICT Market?

Key players in the GCC And Africa ICT Market include companies like MTN Group, Orange, Etisalat, and Vodafone, which provide a range of telecommunications and digital services, among others.

What are the main drivers of growth in the GCC And Africa ICT Market?

The main drivers of growth in the GCC And Africa ICT Market include increasing internet penetration, the rise of mobile technology, and the growing demand for digital services across various sectors such as education, healthcare, and finance.

What challenges does the GCC And Africa ICT Market face?

Challenges in the GCC And Africa ICT Market include regulatory hurdles, infrastructure limitations, and cybersecurity threats that can hinder the growth and adoption of ICT solutions.

What opportunities exist in the GCC And Africa ICT Market?

Opportunities in the GCC And Africa ICT Market include the expansion of e-commerce, the adoption of cloud computing, and the potential for smart city initiatives that leverage technology for urban development.

What trends are shaping the GCC And Africa ICT Market?

Trends shaping the GCC And Africa ICT Market include the increasing focus on artificial intelligence, the growth of fintech solutions, and the rise of remote work technologies that are transforming how businesses operate.

GCC And Africa ICT Market

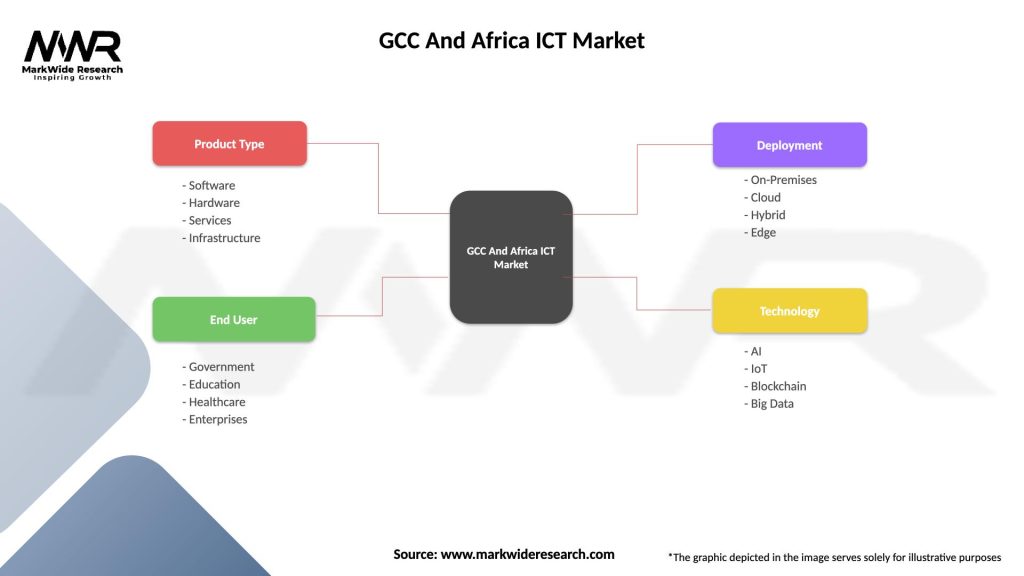

| Segmentation Details | Description |

|---|---|

| Product Type | Software, Hardware, Services, Infrastructure |

| End User | Government, Education, Healthcare, Enterprises |

| Deployment | On-Premises, Cloud, Hybrid, Edge |

| Technology | AI, IoT, Blockchain, Big Data |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the GCC And Africa ICT Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at