444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The gas turbine MRO (Maintenance, Repair, and Overhaul) market refers to the industry involved in the maintenance, repair, and overhaul activities for gas turbines. Gas turbines are widely used in various applications, including power generation, oil and gas, aviation, and industrial sectors. These turbines play a crucial role in providing reliable and efficient power generation and mechanical drive solutions.

Meaning

Gas turbine MRO entails a comprehensive range of services required to maintain and optimize the performance of gas turbines. It includes routine inspections, repairs, component replacements, performance enhancements, and other maintenance activities. MRO services are vital for ensuring the longevity, efficiency, and safe operation of gas turbines throughout their operational life.

Executive Summary

The gas turbine MRO market has witnessed significant growth in recent years. The increasing demand for energy, coupled with aging gas turbine infrastructure, has led to a surge in the need for maintenance and repair services. Additionally, advancements in technology and the emergence of predictive maintenance solutions have further fueled market growth. However, the COVID-19 pandemic has presented challenges, affecting the market to some extent.

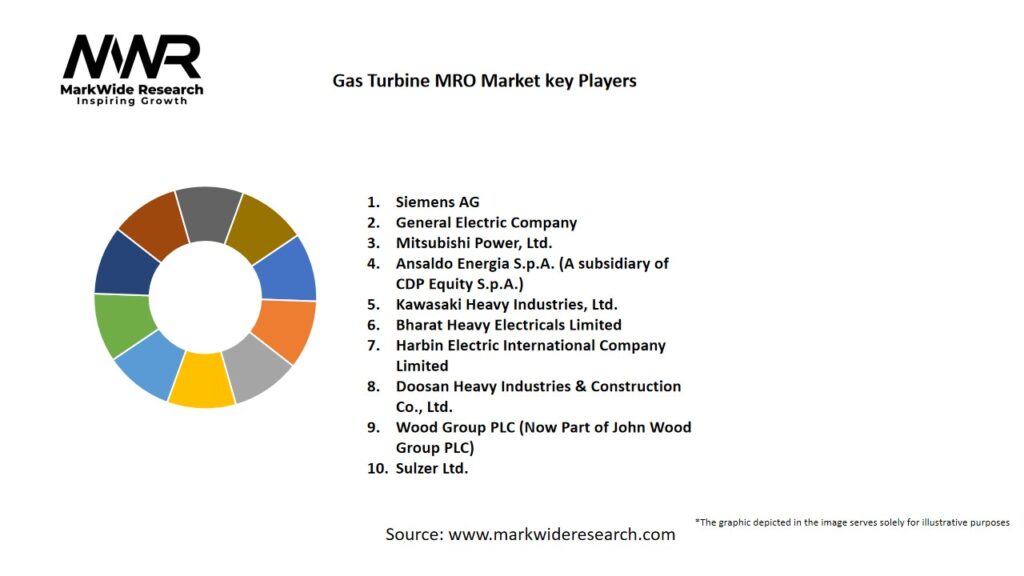

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

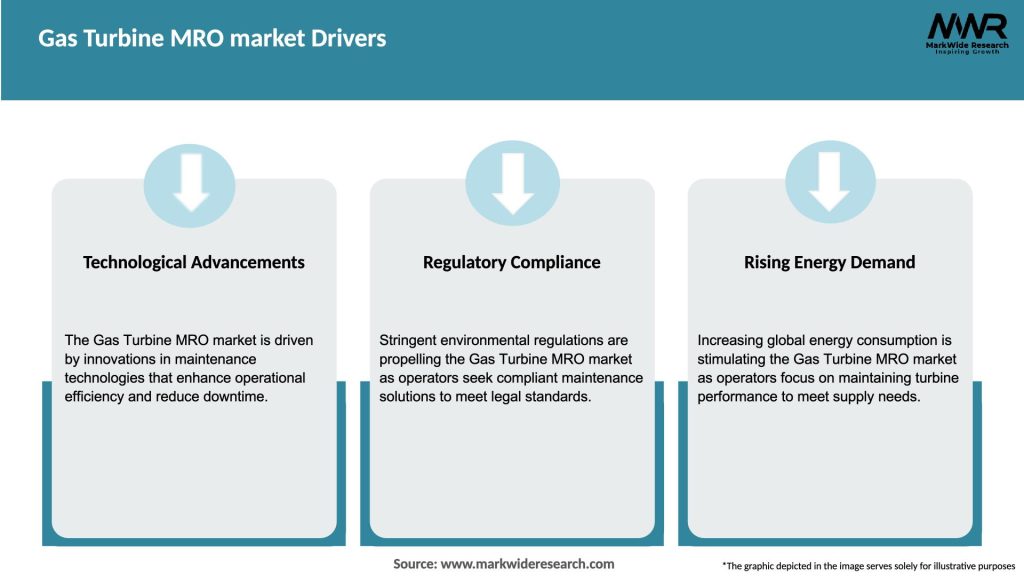

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The gas turbine MRO market is influenced by various dynamics, including technological advancements, regulatory policies, market competition, and customer preferences. The industry continually evolves to meet the changing requirements of end-users and address emerging challenges.

Regional Analysis

The gas turbine MRO market exhibits regional variations due to differences in energy demands, regulatory frameworks, and industrial activities. Major regions contributing to the market include North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

In North America, the mature gas turbine infrastructure and increasing emphasis on enhancing operational efficiency drive the demand for MRO services. Europe focuses on the modernization of existing gas turbine installations and strict emission regulations, boosting the market growth. The Asia Pacific region, led by countries like China and India, experiences robust growth due to rapid industrialization and expanding power generation capacities.

Competitive Landscape

Leading Companies in the Gas Turbine MRO Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

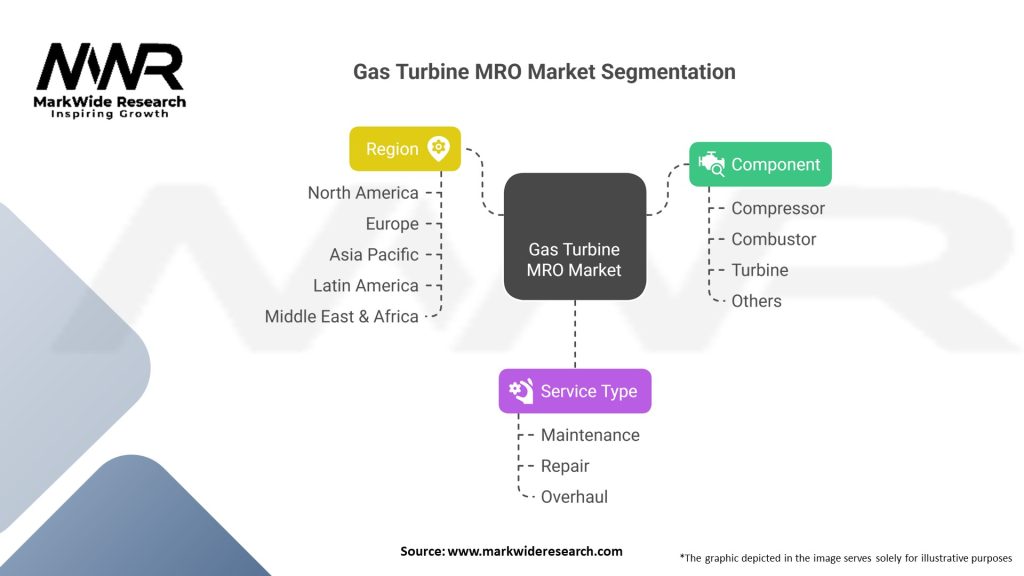

Segmentation

The gas turbine MRO market can be segmented based on various factors, including service type, turbine type, end-user industry, and geography.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a mixed impact on the gas turbine MRO market. On one hand, the global economic slowdown and project delays affected the demand for MRO services. The uncertainty and financial constraints faced by various industries led to deferred maintenance activities. On the other hand, the pandemic highlighted the importance of resilient and reliable power generation, emphasizing the need for gas turbine maintenance and repair services.

Key Industry Developments

Analyst Suggestions

Future Outlook

The gas turbine MRO market is expected to witness steady growth in the coming years. The increasing energy demand, aging gas turbine infrastructure, and focus on operational efficiency are the key drivers contributing to market expansion. The integration of digital solutions, the adoption of predictive maintenance practices, and the expansion in emerging markets present significant growth opportunities. However, market players need to address challenges related to high costs, technological advancements, and the impact of external factors such as the COVID-19 pandemic.

Conclusion

The gas turbine MRO market plays a crucial role in maintaining the performance, reliability, and longevity of gas turbines. The industry continues to evolve, driven by advancements in technology, increasing energy demands, and regulatory requirements. Gas turbine MRO services offer numerous benefits, including improved efficiency, extended operational life, and compliance with environmental regulations. To thrive in this competitive landscape, industry participants should embrace digitalization, invest in workforce skills, and explore collaborations with OEMs. Despite the challenges posed by the COVID-19 pandemic and economic uncertainties, the gas turbine MRO market holds promising growth opportunities in the future.

What is Gas Turbine MRO?

Gas Turbine MRO refers to the maintenance, repair, and overhaul services for gas turbines, which are critical components in power generation and aviation. These services ensure the efficient operation and longevity of gas turbines by addressing wear and tear, performance issues, and compliance with safety standards.

Who are the key players in the Gas Turbine MRO market?

Key players in the Gas Turbine MRO market include General Electric, Siemens, and Rolls-Royce, which provide comprehensive maintenance solutions and innovative technologies for gas turbines. These companies focus on enhancing operational efficiency and reducing downtime, among others.

What are the main drivers of the Gas Turbine MRO market?

The main drivers of the Gas Turbine MRO market include the increasing demand for energy, the need for efficient power generation, and the growing focus on reducing operational costs. Additionally, advancements in technology and the push for sustainability are also contributing to market growth.

What challenges does the Gas Turbine MRO market face?

The Gas Turbine MRO market faces challenges such as the high cost of maintenance services, the complexity of turbine systems, and the need for skilled labor. Additionally, regulatory compliance and the rapid pace of technological change can pose significant hurdles.

What opportunities exist in the Gas Turbine MRO market?

Opportunities in the Gas Turbine MRO market include the expansion of renewable energy sources, which require hybrid systems, and the increasing adoption of digital technologies for predictive maintenance. Furthermore, emerging markets present new avenues for growth and service expansion.

What trends are shaping the Gas Turbine MRO market?

Trends shaping the Gas Turbine MRO market include the integration of IoT and AI for enhanced monitoring and predictive maintenance, as well as a shift towards more sustainable practices. Additionally, there is a growing emphasis on retrofitting existing turbines to improve efficiency and reduce emissions.

Gas Turbine MRO Market:

| Segmentation Details | Information |

|---|---|

| Component | Compressor, Combustor, Turbine, Others |

| Service Type | Maintenance, Repair, Overhaul |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Gas Turbine MRO Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at