444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The gas sweetening chemicals market plays a crucial role in the oil and gas industry, providing solutions for the removal of impurities from natural gas streams. Gas sweetening is the process of removing acidic gases, primarily hydrogen sulfide (H2S) and carbon dioxide (CO2), from natural gas to meet the required specifications for transportation, storage, and utilization. These chemicals help in the purification of natural gas, making it safer for industrial and domestic use.

Meaning

Gas sweetening chemicals refer to a range of chemical substances used in the gas sweetening process to remove unwanted impurities, such as hydrogen sulfide and carbon dioxide, from natural gas. The primary objective is to reduce the concentration of these impurities to acceptable levels to ensure the quality and safety of the gas. These chemicals facilitate the separation and purification of natural gas, making it suitable for various applications.

Executive Summary

The gas sweetening chemicals market is witnessing significant growth due to the rising demand for clean and purified natural gas. Increasing environmental concerns and stringent regulations regarding emissions have necessitated the removal of impurities from natural gas, driving the market for gas sweetening chemicals. The market offers various chemical solutions that efficiently remove hydrogen sulfide and carbon dioxide, ensuring the quality and safety of the gas.

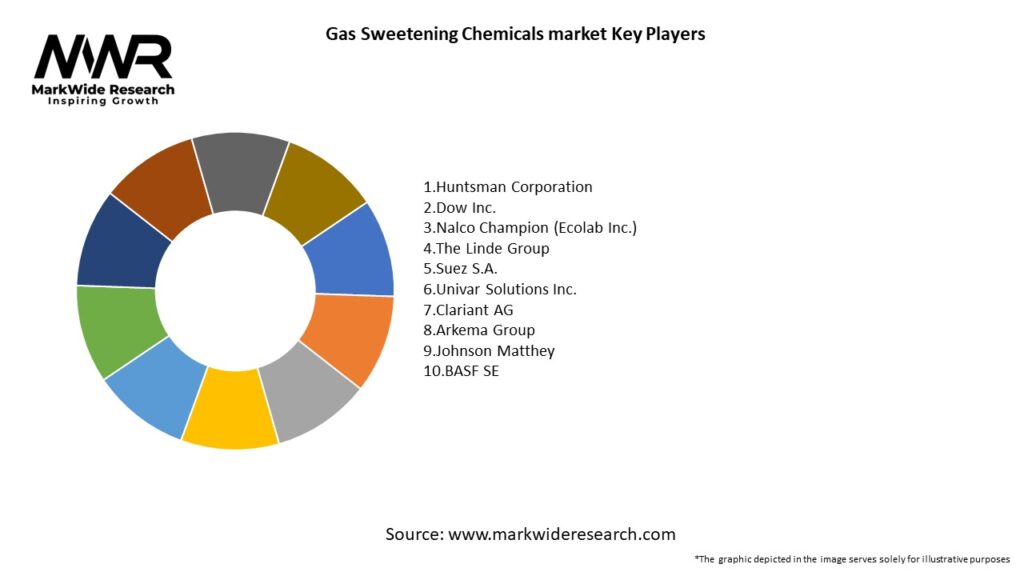

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The gas sweetening chemicals market is driven by the increasing demand for clean and purified natural gas. Stringent environmental regulations and the need to comply with emission standards have propelled the market growth. Technological advancements and the expansion of shale gas exploration have further augmented the market. However, the high cost of gas sweetening chemicals, environmental concerns, and the availability of alternative gas treatment methods pose challenges to the market. Opportunities lie in expanding into emerging economies, the growing demand for LNG, advancements in green gas technologies, and the focus on renewable natural gas. Continued research and development efforts are crucial for the market’s future growth.

Regional Analysis

The gas sweetening chemicals market can be analyzed based on regional segmentation, which provides insights into the market dynamics and trends specific to each region. The following regions are significant players in the gas sweetening chemicals market:

Competitive Landscape

Leading Companies in the Gas Sweetening Chemicals Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

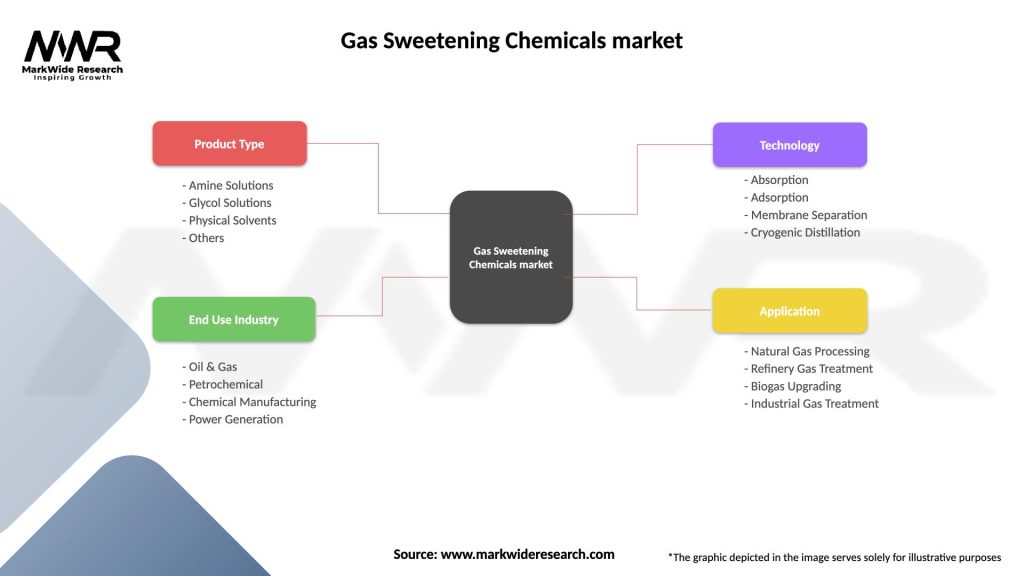

Segmentation

The gas sweetening chemicals market can be segmented based on various factors, including product type, application, and end-use industry. Common segmentation factors include:

Segmentation helps in understanding the specific requirements and preferences of different market segments, enabling companies to tailor their offerings accordingly.

Category-wise Insights

Understanding the different categories of gas sweetening chemicals helps industry participants and stakeholders make informed decisions about the most suitable chemical formulations for their specific needs.

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

A SWOT analysis provides an overview of the strengths, weaknesses, opportunities, and threats associated with the gas sweetening chemicals market:

Analyzing the SWOT factors helps industry participants and stakeholders identify key areas for improvement and leverage opportunities for business growth.

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the gas sweetening chemicals market. The temporary shutdown of industrial activities and reduced energy demand resulted in a decline in natural gas consumption during the initial phases of the pandemic. This led to a decrease in the demand for gas sweetening chemicals.

However, as countries gradually recovered and resumed economic activities, the demand for natural gas rebounded. The increasing focus on cleaner energy sources, such as natural gas, as part of the recovery plans further boosted the demand for gas sweetening chemicals. The market experienced a shift in demand towards solutions that enhance the safety and quality of natural gas.

The pandemic also highlighted the importance of ensuring a reliable and clean energy supply. Governments and industry stakeholders recognized the significance of gas sweetening in improving energy security and reducing environmental impact, leading to sustained market growth.

Key Industry Developments

Analyst Suggestions

Future Outlook

The gas sweetening chemicals market is expected to witness steady growth in the coming years. The increasing demand for clean energy, stringent environmental regulations, and the focus on reducing emissions will drive the market. Technological advancements, such as the development of eco-friendly formulations and the integration of digital technologies, will shape the future of the market. Expanding into emerging economies, capitalizing on LNG and renewable natural gas markets, and investing in research and development will provide growth opportunities for industry participants. Overall, the gas sweetening chemicals market is poised for a positive outlook in the forecast period.

Conclusion

The gas sweetening chemicals market plays a vital role in ensuring the removal of impurities, such as hydrogen sulfide and carbon dioxide, from natural gas streams. The market is driven by the increasing demand for clean and purified natural gas, stringent environmental regulations, and technological advancements. However, challenges such as high costs, environmental concerns, and the availability of alternative methods exist. Expanding into emerging economies, capitalizing on LNG and renewable natural gas markets, and focusing on research and development will unlock growth opportunities. The market is expected to witness steady growth in the future, driven by the global transition towards cleaner energy sources and the need for emissions reduction.

What is Gas Sweetening Chemicals?

Gas Sweetening Chemicals are substances used to remove impurities such as hydrogen sulfide and carbon dioxide from natural gas and other hydrocarbon streams, enhancing the quality and safety of the gas for various applications.

What are the key players in the Gas Sweetening Chemicals market?

Key players in the Gas Sweetening Chemicals market include companies like BASF, Dow Chemical, and Honeywell, which provide a range of chemical solutions for gas processing and purification, among others.

What are the main drivers of the Gas Sweetening Chemicals market?

The main drivers of the Gas Sweetening Chemicals market include the increasing demand for natural gas, stringent environmental regulations, and the need for efficient gas processing technologies in various industries.

What challenges does the Gas Sweetening Chemicals market face?

Challenges in the Gas Sweetening Chemicals market include fluctuating raw material prices, the complexity of gas treatment processes, and competition from alternative technologies that may reduce the need for chemical sweetening.

What opportunities exist in the Gas Sweetening Chemicals market?

Opportunities in the Gas Sweetening Chemicals market include advancements in chemical formulations, the growing focus on sustainable energy solutions, and the expansion of natural gas infrastructure in emerging economies.

What trends are shaping the Gas Sweetening Chemicals market?

Trends shaping the Gas Sweetening Chemicals market include the development of more efficient and environmentally friendly sweetening agents, increased automation in gas processing facilities, and a shift towards integrated gas treatment solutions.

Gas Sweetening Chemicals market

| Segmentation Details | Description |

|---|---|

| Product Type | Amine Solutions, Glycol Solutions, Physical Solvents, Others |

| End Use Industry | Oil & Gas, Petrochemical, Chemical Manufacturing, Power Generation |

| Technology | Absorption, Adsorption, Membrane Separation, Cryogenic Distillation |

| Application | Natural Gas Processing, Refinery Gas Treatment, Biogas Upgrading, Industrial Gas Treatment |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Gas Sweetening Chemicals Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at