444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Gap Insurance market is a segment of the insurance industry that provides coverage for the “gap” between the actual cash value of a vehicle and the outstanding balance on a loan or lease. It is primarily designed to protect consumers from financial loss in the event of a total loss or theft of their vehicle. Gap Insurance policies are typically offered by automotive dealerships, lending institutions, and insurance companies.

Meaning

Gap Insurance, also known as Guaranteed Asset Protection Insurance, is a type of coverage that pays the difference, or “gap,” between the amount owed on a vehicle and its actual cash value in the event of a total loss. This type of insurance is particularly relevant for individuals who have purchased a new vehicle or those who are leasing a vehicle. It ensures that they are not left with a significant financial burden if their vehicle is stolen or declared a total loss due to an accident.

Executive Summary

The Gap Insurance market has witnessed significant growth in recent years, driven by the increasing demand for financial protection among vehicle owners. The market is characterized by the presence of various market players, including insurance companies, dealerships, and lending institutions, offering different types of Gap Insurance policies. The market is expected to continue its growth trajectory, fueled by factors such as rising vehicle sales, growing awareness about Gap Insurance, and the increasing need for financial security.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Gap Insurance market operates in a dynamic environment influenced by various factors, including economic conditions, consumer preferences, regulatory changes, and technological advancements. These dynamics shape the market landscape and present both challenges and opportunities for industry participants.

Economic conditions, such as GDP growth, interest rates, and consumer spending, have a significant impact on the demand for Gap Insurance. During economic downturns, consumers may prioritize essential expenses over optional coverage, leading to a temporary decline in the market. Conversely, during periods of economic growth, higher disposable income and increased vehicle sales contribute to market expansion.

Consumer preferences play a vital role in shaping the Gap Insurance market. As consumers become more aware of the potential financial risks associated with vehicle ownership, their demand for Gap Insurance increases. Factors such as peace of mind, financial protection, and the convenience of bundled coverage options influence consumer decisions.

Regulatory changes can have a profound impact on the Gap Insurance market. Government regulations related to insurance practices, consumer protection, and disclosure requirements can shape the market landscape and influence the operations of industry participants. Compliance with regulatory frameworks is essential for market players to ensure legal and ethical business practices.

Technological advancements are revolutionizing the insurance industry, including the Gap Insurance market. The integration of technology in claims processing, policy administration, and customer interactions has improved operational efficiency and customer experience. Advancements in telematics, data analytics, and digital platforms enable insurers to offer personalized coverage options and streamline processes.

The Gap Insurance market is characterized by intense competition among various market players. Insurance companies, automotive dealerships, and lending institutions compete to capture market share by offering competitive pricing, innovative coverage options, and superior customer service. Market players need to differentiate themselves through unique value propositions and strategic partnerships to gain a competitive edge.

Regional Analysis

The Gap Insurance market exhibits regional variations in terms of market size, growth rate, and market dynamics. The market is dominated by developed economies such as North America and Europe, primarily due to higher vehicle ownership rates, consumer awareness, and established insurance markets. These regions have witnessed significant market growth, driven by the factors mentioned earlier.

Emerging economies in Asia-Pacific, Latin America, and the Middle East & Africa present untapped market potential. Rising disposable incomes, urbanization, and increasing vehicle sales in these regions contribute to the market growth. However, limited awareness about Gap Insurance and regulatory challenges hinder the market’s full potential.

North America is one of the largest markets for Gap Insurance, driven by high vehicle ownership rates and a well-established insurance industry. The United States, in particular, accounts for a significant share of the market, supported by a large consumer base and a robust automotive sector.

Europe is another key market for Gap Insurance, with countries like the United Kingdom, Germany, and France witnessing substantial demand. The presence of major automotive manufacturers and a higher awareness level among consumers contribute to market growth in this region.

Asia-Pacific is expected to witness significant market growth due to increasing vehicle sales and improving consumer awareness. China and India, with their large populations and growing middle class, offer lucrative opportunities for Gap Insurance providers. However, market expansion in these regions requires effective distribution channels and tailored marketing strategies to address the unique needs of consumers.

Latin America and the Middle East & Africa are emerging markets with considerable growth potential. Rising disposable incomes, urbanization, and an expanding automotive sector contribute to the demand for Gap Insurance. However, market players need to overcome challenges related to regulatory complexities and limited consumer awareness.

Competitive Landscape

Leading Companies in the Gap Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

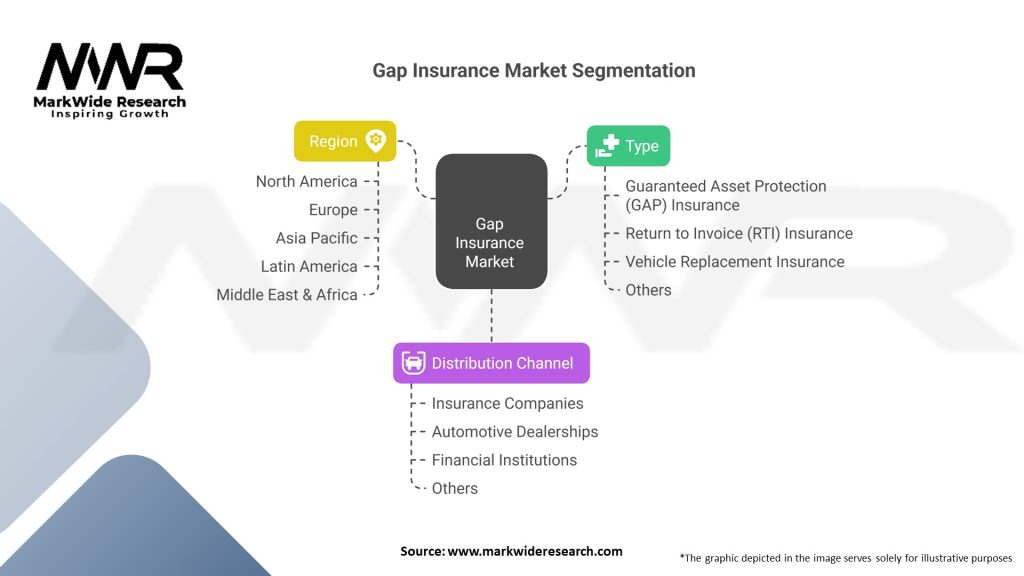

Segmentation

The Gap Insurance market can be segmented based on various factors, including type of coverage, distribution channel, vehicle type, and end-user. These segmentation factors provide insights into the diverse market dynamics and consumer preferences within the Gap Insurance industry.

Type of Coverage:

Distribution Channel:

Vehicle Type:

End-user:

Segmentation provides a comprehensive understanding of the diverse market segments and helps industry participants tailor their offerings to meet specific customer needs. By targeting specific segments and developing customized strategies, market players can enhance their market presence and gain a competitive edge.

Category-wise Insights

The Gap Insurance market encompasses various categories that provide insights into different aspects of the industry.

Market Size and Growth Rate: The market size of the Gap Insurance industry is influenced by factors such as vehicle sales, consumer awareness, and economic conditions. The growth rate of the market indicates the pace of expansion and the potential opportunities available for industry participants.

Key Players and Market Share: Identifying the key players and their market share helps understand the competitive landscape and the relative positioning of each player. Major insurance companies, automotive dealerships, and lending institutions are the key contributors to market share.

Product Portfolio and Coverage Options: Analyzing the product portfolio and coverage options offered by market players provides insights into the diversity and customization available to consumers. Different types of Gap Insurance policies, additional features, and pricing options contribute to the overall attractiveness of offerings.

Distribution Channels: Understanding the distribution channels through which Gap Insurance policies are offered helps evaluate the accessibility and convenience for consumers. Direct sales through insurance companies, collaboration with automotive dealerships, and tie-ups with lending institutions are common distribution channels.

Customer Demographics: Analyzing customer demographics, including age groups, income levels, and vehicle preferences, helps identify target segments and tailor marketing strategies accordingly. Consumer demographics influence the demand for Gap Insurance and the specific needs and preferences of customers.

Analyzing category-wise insights enables market participants to understand the market dynamics and make informed decisions regarding product development, marketing strategies, and customer targeting.

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

A SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis provides an assessment of the Gap Insurance market’s internal strengths and weaknesses, as well as external opportunities and threats.

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the Gap Insurance market. The automotive industry, including vehicle sales and financing, faced challenges due to lockdowns, supply chain disruptions, and economic uncertainties. This, in turn, affected the demand for Gap Insurance.

During the pandemic, vehicle sales experienced a decline globally as consumers prioritized essential expenses and postponed vehicle purchases. The reduced vehicle sales directly impacted the demand for Gap Insurance, as the coverage is typically purchased at the time of vehicle acquisition.

However, as economies recover and vehicle sales rebound, the Gap Insurance market is expected to regain momentum. The increased awareness about financial protection and the importance of insurance may drive the demand for Gap Insurance as consumers seek to safeguard their investments.

Market players have adapted to the changing landscape by leveraging digital platforms, enhancing online distribution channels, and offering innovative coverage options. These strategies help address the evolving needs of customers and ensure business continuity in a post-pandemic environment.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Gap Insurance market is expected to witness steady growth in the coming years. Factors such as increasing vehicle sales, growing awareness about financial protection, and the need for risk mitigation are likely to drive market expansion. Technology will continue to play a crucial role in shaping the market landscape. Insurers will leverage advancements in technology to improve operational efficiency, enhance customer experience, and offer innovative coverage options. The focus on customization and tailored coverage options will intensify as consumers seek personalized insurance solutions. Market players will continue to innovate to meet the evolving needs of customers, offering additional features and flexibility in coverage. The recovery from the Covid-19 pandemic will contribute to market growth as economies stabilize and vehicle sales rebound. The increasing importance of financial security and the rising awareness about Gap Insurance will drive demand among vehicle owners.

Strategic partnerships, collaborations, and expansion into emerging markets will be key strategies for industry participants to capitalize on growth opportunities. Enhancing customer experience and strengthening distribution channels will remain vital for market players to gain a competitive edge.

In conclusion, the Gap Insurance market is witnessing a significant growth driven by the increasing demand for financial protection among vehicle owners. The market is characterized by the presence of various players, including insurance companies, dealerships, and lending institutions, offering different types of Gap Insurance policies. The market is expected to continue its growth trajectory due to factors such as rising vehicle sales, growing awareness about Gap Insurance, and the increasing need for financial security. The market offers several key insights, including growing vehicle sales, increasing awareness, technological advancements, and collaborations with automotive dealerships. These factors contribute to the market’s expansion and present opportunities for industry participants.

What is Gap Insurance?

Gap Insurance is a type of coverage that helps pay the difference between what a car is worth and what the owner owes on their auto loan in the event of a total loss. It is particularly useful for individuals who have financed or leased a vehicle.

What are the key players in the Gap Insurance market?

Key players in the Gap Insurance market include companies like Allstate, Progressive, and Geico, which offer various auto insurance products that may include gap coverage. These companies compete on pricing, customer service, and additional features, among others.

What are the growth factors driving the Gap Insurance market?

The Gap Insurance market is driven by factors such as the increasing number of vehicle leases, rising vehicle prices, and growing consumer awareness about financial protection in case of total loss. Additionally, the expansion of auto financing options contributes to market growth.

What challenges does the Gap Insurance market face?

Challenges in the Gap Insurance market include regulatory scrutiny, consumer misconceptions about the necessity of gap coverage, and competition from alternative insurance products. These factors can impact market penetration and consumer adoption.

What opportunities exist in the Gap Insurance market?

Opportunities in the Gap Insurance market include the potential for product innovation, such as bundling gap insurance with other auto insurance products, and expanding into new demographics, particularly among younger drivers and those leasing vehicles.

What trends are shaping the Gap Insurance market?

Trends in the Gap Insurance market include the increasing integration of technology in policy management and claims processing, as well as a growing emphasis on customer-centric services. Additionally, there is a rise in partnerships between auto dealerships and insurance providers to offer gap coverage at the point of sale.

Gap Insurance Market:

| Segmentation Details | Information |

|---|---|

| Type | Guaranteed Asset Protection (GAP) Insurance, Return to Invoice (RTI) Insurance, Vehicle Replacement Insurance, Others |

| Distribution Channel | Insurance Companies, Automotive Dealerships, Financial Institutions, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Gap Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at