444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The gaming in USA market represents one of the most dynamic and rapidly evolving entertainment sectors in the global economy. Digital transformation has fundamentally reshaped how Americans engage with interactive entertainment, creating unprecedented opportunities across mobile gaming, console gaming, PC gaming, and emerging technologies. The market demonstrates remarkable resilience and growth potential, driven by technological innovations, changing consumer preferences, and the increasing mainstream acceptance of gaming culture.

Market penetration in the United States has reached extraordinary levels, with gaming experiencing a 12.3% annual growth rate across multiple platforms and demographics. The sector encompasses diverse gaming experiences ranging from casual mobile applications to sophisticated virtual reality environments, each contributing to the comprehensive gaming ecosystem that defines modern American entertainment consumption patterns.

Consumer engagement patterns reveal that gaming has transcended traditional entertainment boundaries, becoming an integral part of social interaction, professional development, and cultural expression. The market’s expansion reflects broader technological trends including cloud computing, artificial intelligence integration, and the proliferation of high-speed internet connectivity across urban and rural communities nationwide.

The gaming in USA market refers to the comprehensive ecosystem of interactive digital entertainment products, services, and experiences consumed by American audiences across multiple platforms and devices. This market encompasses video games, mobile applications, online gaming platforms, esports competitions, gaming hardware, and associated services that collectively define the interactive entertainment landscape in the United States.

Market definition includes traditional console gaming, personal computer gaming, mobile device gaming, virtual reality experiences, augmented reality applications, and emerging cloud-based gaming services. The sector represents the convergence of technology, entertainment, and social interaction, creating immersive experiences that engage millions of American consumers daily across diverse demographic segments and geographic regions.

Industry scope extends beyond mere entertainment consumption to include professional gaming, content creation, streaming services, gaming journalism, and the broader cultural impact of interactive media on American society. This comprehensive market definition reflects the multifaceted nature of modern gaming and its integration into mainstream American culture and commerce.

Strategic analysis of the gaming in USA market reveals unprecedented growth momentum driven by technological innovation, demographic expansion, and evolving consumer preferences. The market demonstrates exceptional resilience across economic cycles while maintaining consistent expansion patterns that position gaming as a cornerstone of American entertainment consumption.

Key performance indicators highlight the market’s robust foundation, with mobile gaming representing 68% of total gaming engagement among American consumers. The sector benefits from strong infrastructure development, widespread broadband adoption, and increasing smartphone penetration that collectively support sustained market expansion across diverse consumer segments.

Competitive dynamics showcase a mature yet innovative marketplace where established industry leaders compete alongside emerging technology companies and independent developers. The market’s evolution reflects broader digital transformation trends while maintaining unique characteristics that distinguish American gaming preferences from global patterns.

Future trajectory indicates continued expansion supported by emerging technologies, changing work patterns, and the growing acceptance of gaming as a legitimate form of entertainment and social interaction across all age demographics in American society.

Market intelligence reveals several critical insights that define the current state and future direction of gaming in the USA market:

Strategic implications of these insights suggest continued market evolution toward more inclusive, technologically sophisticated, and socially integrated gaming experiences that reflect American cultural values and technological capabilities.

Primary growth drivers propelling the gaming in USA market include technological advancement, demographic shifts, and changing entertainment consumption patterns. Infrastructure development across the United States provides the foundation for sophisticated gaming experiences, with 5G network deployment and fiber optic expansion enabling new gaming possibilities previously constrained by connectivity limitations.

Consumer behavior evolution represents another significant driver, as gaming transitions from niche hobby to mainstream entertainment preference. The normalization of gaming culture, particularly among older demographics, expands the addressable market while creating opportunities for diverse gaming experiences that cater to varied interests and skill levels.

Technological innovation continues driving market expansion through improved graphics capabilities, artificial intelligence integration, and immersive technologies. These advancements create more engaging gaming experiences while reducing barriers to entry for new players and developers entering the market.

Economic factors including increased disposable income, flexible work arrangements, and the growing gig economy contribute to sustained market growth. Americans increasingly view gaming as valuable entertainment investment, supporting premium gaming experiences and subscription-based services that generate recurring revenue streams for industry participants.

Market challenges facing the gaming in USA market include regulatory concerns, content moderation issues, and growing scrutiny regarding gaming addiction and mental health impacts. Legislative pressure at state and federal levels creates uncertainty around loot boxes, in-game purchases, and age-appropriate content, potentially impacting revenue models and market strategies.

Competition intensity presents ongoing challenges as market saturation increases and consumer attention becomes increasingly fragmented across entertainment options. The proliferation of gaming options creates difficulties for individual titles and platforms to maintain user engagement and market share in an increasingly crowded marketplace.

Technical limitations including cybersecurity concerns, platform compatibility issues, and infrastructure constraints in rural areas limit market penetration and growth potential. These challenges require significant investment in security measures and infrastructure development to maintain consumer trust and market expansion.

Economic sensitivity to broader economic conditions affects discretionary spending on gaming products and services. Economic downturns can impact premium gaming purchases while potentially benefiting lower-cost gaming alternatives, creating market volatility and planning challenges for industry participants.

Emerging opportunities in the gaming in USA market include the expansion of cloud gaming services, integration of artificial intelligence technologies, and the development of cross-platform gaming experiences. Cloud gaming represents particularly significant potential, enabling high-quality gaming experiences on devices previously incapable of supporting sophisticated games.

Demographic expansion opportunities exist in underserved market segments including senior citizens, individuals with disabilities, and diverse cultural communities. Targeted game development and marketing strategies can unlock substantial growth potential while promoting inclusivity and accessibility within the gaming ecosystem.

Educational integration presents substantial opportunities as schools, universities, and corporate training programs increasingly recognize gaming’s potential for skill development and knowledge transfer. This trend creates new market segments while legitimizing gaming as a valuable tool for personal and professional development.

Esports growth continues creating opportunities for professional gaming, content creation, and related services. The increasing mainstream acceptance of competitive gaming generates revenue opportunities across broadcasting, sponsorship, merchandise, and live event management sectors.

Dynamic market forces shaping the gaming in USA market include rapid technological change, evolving consumer preferences, and increasing competition from both traditional entertainment and emerging digital platforms. Technology convergence creates new gaming possibilities while disrupting established business models and competitive relationships.

Consumer empowerment through social media, streaming platforms, and user-generated content fundamentally alters the relationship between gaming companies and their audiences. Players increasingly influence game development, marketing strategies, and industry trends through direct feedback and community engagement.

Platform evolution continues reshaping market dynamics as traditional boundaries between console, PC, and mobile gaming blur. Cross-platform compatibility and cloud-based services enable seamless gaming experiences across multiple devices, changing how consumers interact with gaming content and services.

Regulatory environment evolution impacts market dynamics through privacy regulations, content guidelines, and emerging legislation addressing gaming addiction concerns. Industry participants must navigate complex regulatory landscapes while maintaining innovation and growth momentum.

Comprehensive research approach employed in analyzing the gaming in USA market combines quantitative data analysis, qualitative market research, and industry expert insights to provide accurate market assessment. Primary research includes consumer surveys, industry interviews, and market observation studies conducted across diverse geographic regions and demographic segments.

Secondary research incorporates analysis of industry reports, financial statements, regulatory filings, and academic studies to validate primary research findings and provide comprehensive market context. Data triangulation ensures accuracy and reliability of market insights and projections.

Analytical frameworks include market sizing methodologies, competitive analysis models, and trend identification techniques specifically adapted for the dynamic gaming industry. These frameworks account for the unique characteristics of digital entertainment markets and rapid technological change.

Quality assurance measures include peer review processes, data validation protocols, and continuous monitoring of market developments to ensure research accuracy and relevance. Regular methodology updates reflect evolving market conditions and emerging research best practices.

Geographic distribution of gaming in USA market activity reveals significant regional variations influenced by demographics, infrastructure, and cultural factors. West Coast regions including California, Washington, and Oregon demonstrate the highest gaming engagement rates at 78% of the adult population, driven by technology industry presence and cultural acceptance of digital entertainment.

Northeast markets including New York, Massachusetts, and Pennsylvania show strong gaming adoption with particular strength in mobile gaming and esports participation. Urban concentration in these regions supports robust gaming infrastructure and diverse gaming community development.

Southeast regions demonstrate rapid growth in gaming adoption, with states like Texas, Florida, and Georgia experiencing 15.7% annual growth in gaming participation. These markets benefit from younger demographics and increasing broadband infrastructure investment.

Midwest and Mountain regions present mixed gaming adoption patterns, with urban areas showing strong growth while rural regions face infrastructure challenges. However, cloud gaming services increasingly address connectivity limitations, expanding market potential across these geographic areas.

Regional preferences vary significantly, with mobile gaming dominating in urban areas while console and PC gaming maintain stronger presence in suburban and rural markets. These preferences influence marketing strategies and product development priorities for gaming companies targeting specific regional markets.

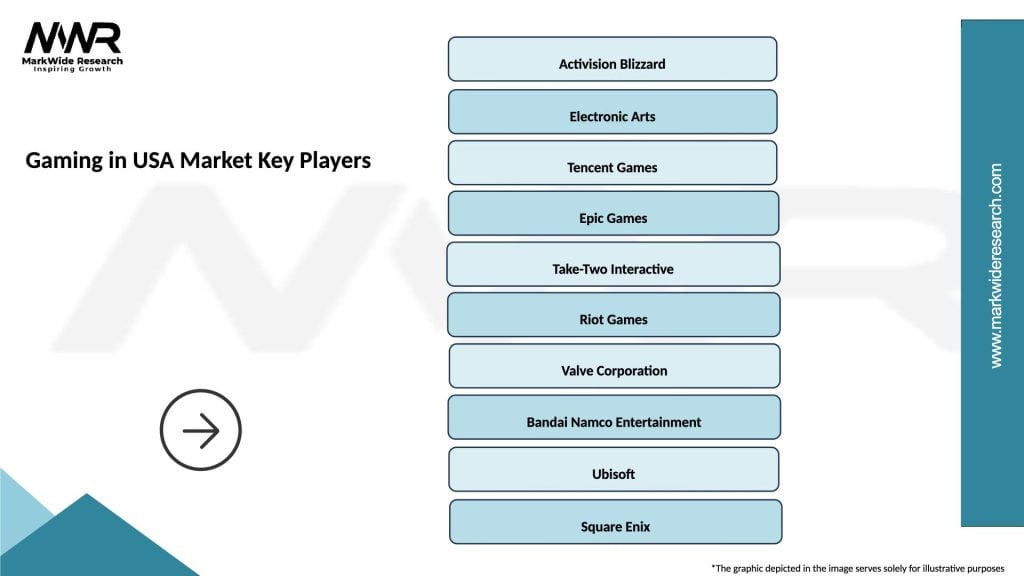

Market leadership in the gaming in USA market is distributed among several major technology companies and specialized gaming organizations. The competitive environment reflects both established industry giants and innovative newcomers disrupting traditional gaming paradigms.

Competitive strategies focus on platform exclusivity, content creation, technology innovation, and community building. Companies increasingly emphasize subscription services, cross-platform compatibility, and social gaming features to maintain competitive advantage.

Market segmentation of the gaming in USA market reveals distinct categories based on platform, genre, demographics, and business models. Platform segmentation includes mobile gaming, console gaming, PC gaming, and emerging cloud-based gaming services, each serving different consumer preferences and use cases.

By Platform:

By Demographics:

Genre segmentation includes action games, role-playing games, strategy games, sports games, puzzle games, and simulation games, each appealing to different consumer interests and engagement patterns.

Mobile gaming category dominates the USA gaming market through accessibility, convenience, and diverse content offerings. Casual gaming within this category attracts broad demographic participation while hardcore mobile games generate substantial revenue through in-app purchases and premium content.

Console gaming category maintains strong position through exclusive content, advanced graphics capabilities, and social gaming features. Premium gaming experiences and franchise properties drive sustained engagement and revenue generation within this traditional gaming segment.

PC gaming category serves enthusiast communities through customizable gaming experiences, modding capabilities, and competitive gaming platforms. This segment demonstrates strong loyalty and high spending patterns among dedicated gaming communities.

Emerging categories including virtual reality gaming, augmented reality experiences, and cloud gaming services represent future growth opportunities. These categories benefit from technological advancement while facing adoption challenges related to cost, complexity, and content availability.

Cross-category trends include increasing integration between gaming categories, with players expecting seamless experiences across multiple platforms and devices. This trend drives development of unified gaming ecosystems and cross-platform compatibility initiatives.

Revenue generation opportunities in the gaming in USA market provide substantial benefits for industry participants through diverse monetization models including premium sales, subscription services, in-app purchases, and advertising revenue. Recurring revenue streams from subscription-based gaming services create predictable income while reducing dependence on individual product launches.

Market expansion benefits enable companies to reach broader audiences through multiple distribution channels and platform strategies. Digital distribution eliminates traditional retail constraints while enabling global reach and reduced distribution costs for gaming content and services.

Innovation advantages allow industry participants to leverage cutting-edge technologies including artificial intelligence, machine learning, and cloud computing to create differentiated gaming experiences. These technological capabilities provide competitive advantages while enabling new gaming paradigms and business models.

Community building benefits enable companies to develop loyal customer bases through social gaming features, user-generated content, and community engagement initiatives. Strong gaming communities provide valuable feedback, organic marketing, and sustained engagement that supports long-term business success.

Data insights generated through gaming platforms provide valuable consumer behavior information that supports product development, marketing optimization, and strategic decision-making across the organization.

Strengths:

Weaknesses:

Opportunities:

Threats:

Cloud gaming adoption represents the most significant trend reshaping the gaming in USA market, enabling high-quality gaming experiences without expensive hardware requirements. Streaming technology advancement reduces barriers to entry while expanding gaming accessibility across diverse consumer segments and geographic regions.

Social gaming integration continues evolving beyond traditional multiplayer experiences to include social media connectivity, content sharing, and community building features. Gaming platforms increasingly function as social networks, enabling players to connect, communicate, and collaborate within gaming environments.

Cross-platform compatibility becomes standard expectation among American gamers, driving development of unified gaming experiences across mobile, console, and PC platforms. This trend reduces platform lock-in while enabling seamless gaming experiences regardless of device preferences.

Artificial intelligence integration enhances gaming experiences through personalized content, adaptive difficulty systems, and intelligent matchmaking. AI technologies improve both game development efficiency and player engagement through sophisticated gaming experiences.

Subscription model adoption grows across gaming platforms as consumers demonstrate willingness to pay for access to gaming libraries rather than individual game purchases. This trend provides predictable revenue streams while reducing consumer commitment barriers to trying new gaming content.

Strategic acquisitions continue reshaping the gaming in USA market as major technology companies acquire gaming studios, platforms, and intellectual property to strengthen competitive positions. MarkWide Research analysis indicates these consolidation trends create both opportunities and challenges for independent developers and smaller gaming companies.

Technology partnerships between gaming companies and cloud service providers enable advanced gaming capabilities while reducing infrastructure investment requirements. These collaborations accelerate innovation while enabling smaller companies to compete with established industry leaders.

Regulatory developments at state and federal levels address gaming addiction concerns, loot box regulations, and age-appropriate content guidelines. Industry participants actively engage with policymakers to shape reasonable regulations that protect consumers while preserving innovation opportunities.

Infrastructure investments in 5G networks, fiber optic connectivity, and edge computing capabilities support advanced gaming experiences while expanding market reach to previously underserved geographic areas. These investments create foundation for future gaming innovation and market expansion.

Educational partnerships between gaming companies and academic institutions create new market opportunities while legitimizing gaming as educational tool. These collaborations support serious gaming development and gamification applications across various industries and educational contexts.

Strategic recommendations for gaming in USA market participants include diversifying platform strategies to reduce dependence on single distribution channels while maximizing market reach. Multi-platform development enables companies to capture value across the gaming ecosystem while reducing business model risks associated with platform changes or competitive pressures.

Investment priorities should focus on emerging technologies including artificial intelligence, cloud computing, and immersive technologies that create competitive advantages and enable innovative gaming experiences. Early adoption of these technologies provides market leadership opportunities while establishing technical capabilities for future growth.

Community engagement strategies become increasingly important as gaming transitions toward social experiences and user-generated content. Companies should invest in community building tools, content creation platforms, and social features that enhance player engagement and retention.

Regulatory compliance preparation requires proactive engagement with evolving gaming regulations while maintaining innovation momentum. Companies should develop compliance frameworks that address current and anticipated regulatory requirements without constraining business model flexibility.

Market expansion opportunities exist in underserved demographic segments and geographic regions through targeted product development and marketing strategies. Companies should conduct thorough market research to identify specific needs and preferences of these emerging market segments.

Long-term projections for the gaming in USA market indicate sustained growth driven by technological innovation, demographic expansion, and increasing cultural acceptance of gaming as mainstream entertainment. MWR forecasts suggest the market will experience 8.9% compound annual growth over the next five years, supported by cloud gaming adoption and mobile gaming expansion.

Technology evolution will continue driving market transformation through virtual reality, augmented reality, and artificial intelligence integration. These technologies will create new gaming categories while enhancing existing gaming experiences, supporting continued market expansion and innovation.

Demographic trends indicate gaming participation will continue expanding across age groups, with particular growth among older demographics and underserved communities. This expansion will drive demand for diverse gaming content and accessible gaming experiences that cater to varied interests and abilities.

Business model evolution toward subscription services, cloud gaming, and social gaming platforms will reshape revenue generation while creating new opportunities for content creators and platform providers. These models will support sustainable growth while improving gaming accessibility and affordability.

Market maturation will bring increased focus on quality, innovation, and consumer satisfaction as competition intensifies and consumer expectations evolve. Successful companies will differentiate through superior gaming experiences, strong community engagement, and innovative technology integration.

The gaming in USA market represents a dynamic and rapidly evolving sector that has fundamentally transformed American entertainment consumption patterns. Through comprehensive analysis of market drivers, competitive dynamics, and emerging trends, it becomes clear that gaming has transcended its traditional boundaries to become an integral component of American culture and commerce.

Market fundamentals remain strong, supported by technological innovation, demographic expansion, and increasing mainstream acceptance of gaming across all age groups. The sector’s resilience during economic challenges, combined with its ability to adapt to changing consumer preferences, positions gaming as a sustainable growth industry with substantial long-term potential.

Strategic opportunities abound for industry participants willing to embrace emerging technologies, expand into underserved market segments, and develop innovative gaming experiences that reflect evolving consumer expectations. Success in this market requires balancing innovation with accessibility, technology advancement with user experience, and growth ambitions with regulatory compliance.

Future success in the gaming in USA market will depend on companies’ ability to navigate complex competitive landscapes while maintaining focus on consumer satisfaction, community building, and technological excellence. The market’s continued evolution promises exciting opportunities for those prepared to adapt and innovate in this dynamic entertainment ecosystem.

What is Gaming in USA?

Gaming in USA refers to the various forms of interactive entertainment, including video games, online gaming, and esports, that are popular among consumers in the United States. This sector encompasses a wide range of platforms, genres, and player demographics.

What are the key companies in the Gaming in USA Market?

Key companies in the Gaming in USA Market include Electronic Arts, Activision Blizzard, and Take-Two Interactive, which are known for their popular game titles and innovative gaming technologies. These companies compete in various segments such as console gaming, mobile gaming, and online multiplayer experiences, among others.

What are the growth factors driving the Gaming in USA Market?

The Gaming in USA Market is driven by factors such as the increasing popularity of mobile gaming, advancements in gaming technology, and the rise of esports. Additionally, the growing acceptance of gaming as a mainstream form of entertainment contributes to its expansion.

What challenges does the Gaming in USA Market face?

The Gaming in USA Market faces challenges such as regulatory scrutiny, concerns over gaming addiction, and competition from alternative forms of entertainment. These factors can impact player engagement and the overall growth of the market.

What opportunities exist in the Gaming in USA Market?

Opportunities in the Gaming in USA Market include the potential for virtual reality and augmented reality gaming experiences, as well as the expansion of cloud gaming services. These innovations can attract new players and enhance user engagement.

What trends are shaping the Gaming in USA Market?

Trends shaping the Gaming in USA Market include the rise of cross-platform gaming, the integration of social features in games, and the increasing focus on diversity and inclusion within gaming narratives. These trends reflect changing consumer preferences and technological advancements.

Gaming in USA Market

| Segmentation Details | Description |

|---|---|

| Product Type | Consoles, PC Games, Mobile Games, Accessories |

| Customer Type | Casual Gamers, Professional Gamers, Streamers, Esports Enthusiasts |

| Distribution Channel | Online Retail, Physical Stores, Subscription Services, Digital Downloads |

| Game Genre | Action, Adventure, Role-Playing, Simulation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Gaming in USA Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at