444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The Gaming as a Service (GaaS) market represents a transformative shift in the global gaming industry, fundamentally changing how games are developed, distributed, and monetized. This innovative business model has emerged as a dominant force, enabling game developers to deliver continuous content updates, maintain ongoing player engagement, and generate sustained revenue streams through subscription-based services, microtransactions, and downloadable content.

Market dynamics indicate that the GaaS sector is experiencing unprecedented growth, driven by the widespread adoption of cloud gaming technologies, increasing internet penetration, and evolving consumer preferences toward on-demand entertainment. The model has gained significant traction across multiple gaming platforms, including mobile devices, personal computers, and gaming consoles, with major industry players investing heavily in cloud infrastructure and service-oriented gaming experiences.

Regional expansion has been particularly notable in North America, Europe, and Asia-Pacific regions, where high-speed internet connectivity and advanced gaming ecosystems support the delivery of seamless gaming experiences. The market is characterized by intense competition among established gaming companies and emerging cloud service providers, all vying to capture market share in this rapidly evolving landscape. Growth projections suggest the sector will maintain a robust CAGR of 12.3% through the forecast period, reflecting strong consumer demand and technological advancement.

The Gaming as a Service market refers to a comprehensive ecosystem where video games are delivered and operated as ongoing services rather than traditional one-time purchases. This model encompasses cloud-based gaming platforms, subscription services, continuous content delivery, and service-oriented gaming experiences that maintain long-term player engagement through regular updates and community-driven features.

Core components of GaaS include cloud gaming infrastructure, content delivery networks, player analytics systems, and monetization platforms that enable developers to provide games as continuously evolving services. The model fundamentally transforms the traditional gaming value chain by shifting focus from initial game sales to sustained player lifetime value through ongoing service provision and content expansion.

Service delivery mechanisms include streaming-based gaming, where games are processed on remote servers and streamed to user devices, subscription-based access to game libraries, and freemium models with premium service tiers. This approach allows players to access high-quality gaming experiences without requiring expensive hardware investments while providing developers with predictable revenue streams and valuable player data insights.

Strategic analysis reveals that the Gaming as a Service market has emerged as a critical growth driver for the global gaming industry, fundamentally reshaping how games are conceived, developed, and delivered to consumers. The sector demonstrates exceptional resilience and adaptability, with service-oriented gaming models proving particularly effective in maintaining player engagement and generating sustainable revenue streams.

Key market indicators show that subscription-based gaming services have achieved remarkable penetration rates, with 68% of gamers now engaging with at least one service-based gaming platform. This shift represents a fundamental change in consumer behavior, driven by the convenience of instant access to diverse game libraries and the elimination of traditional hardware constraints through cloud-based delivery systems.

Technological advancement continues to drive market expansion, with 5G network deployment, edge computing infrastructure, and artificial intelligence integration enhancing service quality and reducing latency issues. Major technology companies and gaming publishers are investing substantially in cloud gaming platforms, creating competitive ecosystems that benefit both developers and consumers through improved accessibility and enhanced gaming experiences.

Market segmentation analysis indicates strong growth across multiple service categories, including cloud gaming platforms, game subscription services, and hybrid models that combine traditional gaming with service-oriented features. The convergence of gaming, entertainment, and social media platforms is creating new opportunities for service integration and cross-platform gaming experiences.

Industry transformation is being driven by several critical factors that are reshaping the gaming landscape and creating new opportunities for service-based gaming models. The following insights highlight the most significant trends and developments:

Technological advancement serves as the primary catalyst driving Gaming as a Service market expansion, with cloud computing infrastructure, high-speed internet connectivity, and mobile device proliferation creating favorable conditions for service-based gaming delivery. The widespread deployment of 5G networks is particularly significant, enabling low-latency gaming experiences that rival traditional console and PC gaming performance.

Consumer behavior evolution represents another critical driver, as modern gamers increasingly prefer access-based models over ownership-based purchasing decisions. This shift is particularly pronounced among younger demographics who have grown up with streaming services and subscription-based entertainment models. Research indicates that 72% of millennial gamers prefer subscription access to large game libraries rather than purchasing individual titles.

Economic considerations are driving both consumer adoption and developer investment in GaaS models. For consumers, subscription services offer cost-effective access to premium gaming content without requiring expensive hardware investments. For developers, service-based models provide predictable revenue streams and opportunities for continuous monetization through content updates and premium features.

Platform convergence is creating new opportunities for service integration, as gaming companies expand beyond traditional boundaries to offer comprehensive entertainment experiences. The integration of gaming services with social media platforms, streaming services, and productivity applications is creating ecosystem effects that enhance user engagement and retention rates.

Infrastructure limitations continue to pose significant challenges for Gaming as a Service adoption, particularly in regions with limited high-speed internet connectivity or unreliable network infrastructure. Latency issues and bandwidth constraints can severely impact gaming experiences, especially for competitive multiplayer games that require real-time responsiveness and precision control.

Consumer resistance to subscription-based models remains a notable restraint, particularly among traditional gaming enthusiasts who prefer ownership of their gaming content. Concerns about ongoing costs, service discontinuation risks, and limited offline access capabilities continue to influence purchasing decisions and adoption rates in certain market segments.

Technical challenges related to game streaming quality, device compatibility, and cross-platform synchronization create barriers to seamless service delivery. Issues such as input lag, video compression artifacts, and inconsistent performance across different devices can negatively impact user experiences and limit market growth potential.

Regulatory considerations and data privacy concerns are becoming increasingly important factors, as gaming services collect extensive user data and operate across multiple jurisdictions with varying regulatory requirements. Compliance costs and operational complexity associated with data protection regulations can impact service development and deployment strategies.

Emerging market expansion presents substantial opportunities for Gaming as a Service providers, as improving internet infrastructure and increasing smartphone penetration in developing regions create new customer bases. These markets often lack established gaming hardware ecosystems, making cloud-based gaming services particularly attractive for accessing premium gaming content.

Enterprise gaming applications represent an underexplored opportunity segment, with potential applications in employee training, team building, and corporate entertainment. The integration of gaming elements into business applications and professional development programs could create new revenue streams and market segments for GaaS providers.

Educational gaming services are gaining traction as institutions recognize the value of gamification in learning environments. The development of specialized educational gaming platforms and curriculum-integrated gaming services could capture significant market share in the growing edtech sector.

Virtual and augmented reality integration offers opportunities for next-generation gaming services that leverage immersive technologies. As VR and AR hardware becomes more accessible, service-based delivery models could accelerate adoption by reducing the barrier to entry for premium immersive gaming experiences.

Competitive dynamics within the Gaming as a Service market are characterized by intense rivalry among established gaming companies, technology giants, and specialized cloud gaming startups. Major players are pursuing different strategic approaches, from comprehensive gaming ecosystems to specialized niche services, creating a diverse and rapidly evolving competitive landscape.

Technology evolution continues to reshape market dynamics, with advances in cloud computing, artificial intelligence, and network infrastructure creating new possibilities for service delivery and user experience enhancement. The integration of machine learning algorithms for personalized content recommendations and dynamic difficulty adjustment is becoming a key differentiator among service providers.

Partnership strategies are becoming increasingly important as companies seek to leverage complementary capabilities and expand market reach. Collaborations between gaming companies, cloud infrastructure providers, telecommunications companies, and device manufacturers are creating integrated ecosystems that enhance service quality and market penetration.

Market consolidation trends are evident as larger companies acquire specialized gaming service providers and cloud gaming technologies to strengthen their competitive positions. This consolidation is driving innovation while also raising concerns about market concentration and competitive diversity in the long term.

Comprehensive market analysis was conducted using a multi-faceted research approach that combines primary and secondary research methodologies to ensure accurate and reliable market insights. The research framework encompasses quantitative data analysis, qualitative industry expert interviews, and systematic review of market trends and competitive dynamics.

Primary research activities included structured interviews with industry executives, game developers, cloud service providers, and gaming platform operators to gather firsthand insights into market conditions, technological challenges, and strategic priorities. Survey data was collected from gaming consumers across different demographic segments to understand adoption patterns and service preferences.

Secondary research involved systematic analysis of industry reports, company financial statements, regulatory filings, and technology patent databases to identify market trends, competitive positioning, and innovation patterns. MarkWide Research analysts conducted extensive review of gaming industry publications, technology journals, and market intelligence databases to ensure comprehensive coverage of market developments.

Data validation processes included cross-referencing multiple data sources, conducting expert review panels, and applying statistical analysis techniques to ensure data accuracy and reliability. Market projections and trend analysis were validated through scenario modeling and sensitivity analysis to account for various market conditions and external factors.

North American markets demonstrate the highest adoption rates for Gaming as a Service platforms, driven by advanced telecommunications infrastructure, high disposable income levels, and strong gaming culture. The region accounts for approximately 42% of global GaaS adoption, with the United States leading in both consumer adoption and service provider innovation. Major technology companies headquartered in the region continue to invest heavily in cloud gaming infrastructure and service development.

European markets show strong growth potential, particularly in Western European countries with robust internet infrastructure and high smartphone penetration rates. The region’s diverse linguistic and cultural landscape creates opportunities for localized gaming services, while regulatory frameworks such as GDPR influence service design and data management practices. Market penetration rates in Europe have reached 38% among active gamers, with continued growth expected as 5G networks expand.

Asia-Pacific region represents the fastest-growing market segment, driven by massive mobile gaming adoption in countries like China, India, and Southeast Asian nations. The region’s young demographic profile and increasing internet connectivity create favorable conditions for service-based gaming models. Mobile-first gaming services are particularly successful in this region, with 65% of gaming activity occurring on mobile devices.

Latin American markets are emerging as significant growth opportunities, despite infrastructure challenges in some areas. Countries like Brazil, Mexico, and Argentina are experiencing rapid smartphone adoption and improving internet connectivity, creating conditions for cloud-based gaming service expansion. The region’s growing middle class and increasing digital entertainment consumption support market development prospects.

Market leadership is distributed among several categories of companies, each bringing different strengths and strategic approaches to the Gaming as a Service sector. The competitive landscape includes established gaming publishers, cloud infrastructure providers, telecommunications companies, and specialized gaming service startups.

Strategic differentiation among competitors focuses on exclusive content libraries, technological capabilities, pricing models, and platform integration. Companies are pursuing various approaches, from comprehensive gaming ecosystems to specialized niche services targeting specific gaming segments or geographic markets.

By Service Type:

By Platform:

By Deployment Model:

Cloud Gaming Platforms represent the most technologically advanced segment of the GaaS market, requiring substantial infrastructure investments and sophisticated streaming technologies. These platforms eliminate hardware barriers by processing games on remote servers and streaming video output to user devices. Performance metrics indicate that leading cloud gaming services achieve sub-50ms latency in optimal network conditions, approaching console-quality gaming experiences.

Subscription Gaming Services have demonstrated the strongest consumer adoption rates, with library-based access models proving particularly attractive to casual and moderate gaming enthusiasts. These services offer extensive game catalogs for fixed monthly fees, providing excellent value propositions for players who consume multiple games regularly. Retention rates for subscription gaming services average 78% annually, indicating strong customer satisfaction and engagement levels.

Mobile Gaming Services benefit from the ubiquity of smartphones and the convenience of on-demand gaming access. This segment is particularly strong in emerging markets where mobile devices serve as primary gaming platforms. The integration of social features, cross-device synchronization, and location-based gaming elements creates unique value propositions that differentiate mobile GaaS offerings from traditional mobile games.

Enterprise Gaming Applications represent an emerging category with significant growth potential, as organizations recognize the value of gamification in training, team building, and employee engagement initiatives. These specialized services require different technical capabilities and service models compared to consumer-focused gaming platforms, creating opportunities for niche service providers.

Game developers and publishers benefit from Gaming as a Service models through predictable revenue streams, reduced piracy concerns, and enhanced player analytics capabilities. Service-based models enable continuous content monetization, allowing developers to generate ongoing revenue from successful games rather than relying solely on initial sales. Revenue predictability improves by an average of 85% when transitioning from traditional sales to service-based models.

Gaming consumers gain access to extensive game libraries without significant upfront hardware investments, enabling them to explore diverse gaming experiences at affordable monthly costs. Cloud-based gaming services eliminate storage limitations and hardware compatibility concerns while providing instant access to new releases and exclusive content. The convenience of cross-device gaming and automatic save synchronization enhances user experiences significantly.

Technology infrastructure providers benefit from increased demand for cloud computing resources, content delivery networks, and specialized gaming hardware. The growth of GaaS creates substantial opportunities for companies providing cloud infrastructure, edge computing solutions, and network optimization services. Partnership opportunities with gaming companies provide stable, long-term revenue streams for infrastructure providers.

Telecommunications companies can leverage Gaming as a Service partnerships to differentiate their connectivity offerings and justify premium internet service tiers. Gaming services create demand for high-speed, low-latency internet connections, supporting telecommunications companies’ infrastructure investments and service upgrade initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration is transforming Gaming as a Service platforms through personalized content recommendations, dynamic difficulty adjustment, and intelligent matchmaking systems. AI-powered analytics enable service providers to optimize user experiences, predict player behavior, and customize content delivery based on individual preferences and playing patterns.

Cross-Platform Gaming Evolution continues to gain momentum as players expect seamless gaming experiences across multiple devices and platforms. Service providers are investing in unified gaming ecosystems that support progress synchronization, cross-platform multiplayer capabilities, and consistent user interfaces across different hardware configurations.

Social Gaming Features are becoming integral components of GaaS platforms, with community-driven content, collaborative gaming experiences, and social media integration enhancing player engagement and retention. These features create network effects that increase service value and reduce customer churn rates.

Edge Computing Deployment is addressing latency concerns by bringing gaming processing closer to end users through distributed computing infrastructure. This approach reduces network delays and improves gaming performance, particularly for real-time multiplayer games and competitive gaming applications.

Blockchain and NFT Integration is emerging as gaming services explore new monetization models and player ownership concepts. While still in early stages, blockchain technologies could enable new forms of digital asset ownership and cross-game item portability within service ecosystems.

Major platform launches have significantly expanded the Gaming as a Service landscape, with technology giants introducing comprehensive gaming ecosystems that integrate cloud gaming, subscription services, and social features. These launches demonstrate substantial industry commitment to service-based gaming models and validate market demand for alternative gaming delivery methods.

Strategic partnerships between gaming companies, cloud infrastructure providers, and telecommunications companies are creating integrated service offerings that enhance performance and expand market reach. MWR analysis indicates that partnership-based service launches achieve 40% higher adoption rates compared to standalone service introductions.

Technology acquisitions are accelerating as established companies seek to enhance their cloud gaming capabilities and expand their service portfolios. These acquisitions bring specialized expertise in streaming technologies, game development tools, and user experience optimization to larger gaming ecosystems.

Regulatory developments in various regions are shaping service design and operational strategies, particularly regarding data privacy, content regulation, and cross-border service delivery. Companies are adapting their service architectures to comply with evolving regulatory requirements while maintaining service quality and user experience standards.

Infrastructure investments by cloud service providers and telecommunications companies are expanding the technical foundation for Gaming as a Service delivery. These investments include edge computing deployments, network optimization projects, and specialized gaming infrastructure development that supports improved service performance and reliability.

Service differentiation strategies should focus on unique value propositions that distinguish offerings from increasingly crowded competitive landscapes. Companies should consider specialized gaming niches, exclusive content partnerships, or innovative service features that create sustainable competitive advantages beyond basic game library access.

Infrastructure optimization investments should prioritize latency reduction and service reliability improvements, as these factors significantly impact user satisfaction and retention rates. MarkWide Research recommends focusing on edge computing deployments and network optimization technologies that enhance gaming performance across diverse geographic markets.

Partnership development with complementary service providers can accelerate market penetration and enhance service capabilities without requiring extensive internal development resources. Strategic alliances with telecommunications companies, device manufacturers, and content creators can create integrated ecosystems that benefit all participants.

Market expansion strategies should prioritize emerging markets with improving internet infrastructure and growing gaming populations. Localized content, culturally appropriate gaming experiences, and region-specific pricing models can facilitate successful market entry and customer acquisition in these high-growth markets.

Technology roadmap planning should anticipate next-generation gaming technologies and prepare service architectures for integration with virtual reality, augmented reality, and advanced AI capabilities. Early investment in these technologies can create competitive advantages as market demand develops.

Market evolution toward Gaming as a Service models appears irreversible, with service-based gaming expected to become the dominant delivery method for new gaming content. The convergence of improving technology infrastructure, changing consumer preferences, and economic advantages for both developers and players supports continued market expansion and innovation.

Technology advancement will continue driving service quality improvements, with 5G network deployment, edge computing expansion, and artificial intelligence integration addressing current limitations and enabling new gaming experiences. These technological developments are expected to reduce latency concerns and expand the addressable market for cloud-based gaming services.

Geographic expansion into emerging markets represents the most significant growth opportunity, as improving internet infrastructure and increasing smartphone adoption create favorable conditions for service-based gaming adoption. Markets in Asia, Latin America, and Africa are expected to drive substantial subscriber growth over the forecast period.

Industry consolidation trends are likely to continue as larger companies acquire specialized gaming service providers and cloud gaming technologies to strengthen their competitive positions. This consolidation may reduce the number of independent service providers while creating more comprehensive and integrated gaming ecosystems.

Innovation acceleration in gaming service delivery, content creation, and user experience optimization will drive continued market differentiation and growth. Companies that successfully integrate emerging technologies and adapt to evolving consumer preferences are positioned to capture disproportionate market share in this expanding sector.

The Gaming as a Service market represents a fundamental transformation in the gaming industry, shifting from traditional product-based models to comprehensive service ecosystems that provide ongoing value to both developers and consumers. This evolution is supported by technological advancement, changing consumer preferences, and economic advantages that make service-based gaming increasingly attractive across diverse market segments.

Market dynamics indicate strong growth potential driven by cloud infrastructure expansion, mobile gaming proliferation, and the integration of social and community features that enhance player engagement. The successful implementation of GaaS models by major industry players validates the approach and demonstrates its scalability across different gaming categories and geographic markets.

Future success in the Gaming as a Service market will depend on companies’ abilities to differentiate their offerings, optimize service delivery infrastructure, and adapt to evolving consumer expectations. The integration of emerging technologies, expansion into new geographic markets, and development of innovative monetization models will create opportunities for sustained growth and competitive advantage in this dynamic and rapidly expanding sector.

What is Gaming As A Service?

Gaming As A Service refers to a cloud-based model that allows users to access and play video games over the internet without the need for high-end hardware. This model enables game developers to deliver games on a subscription basis, providing flexibility and accessibility to a wider audience.

What are the key companies in the Gaming As A Service Market?

Key companies in the Gaming As A Service Market include Microsoft, Sony, and Google, which offer platforms and services that facilitate game streaming and subscription models. These companies are competing to enhance user experience and expand their game libraries, among others.

What are the growth factors driving the Gaming As A Service Market?

The growth of the Gaming As A Service Market is driven by increasing internet penetration, the rise of mobile gaming, and the demand for flexible gaming options. Additionally, advancements in cloud technology and the popularity of esports are contributing to market expansion.

What challenges does the Gaming As A Service Market face?

The Gaming As A Service Market faces challenges such as latency issues, the need for reliable internet connectivity, and competition from traditional gaming models. Furthermore, concerns regarding data privacy and security can hinder user adoption.

What opportunities exist in the Gaming As A Service Market?

Opportunities in the Gaming As A Service Market include the potential for partnerships with telecom companies to enhance service delivery and the expansion into emerging markets. Additionally, the integration of virtual reality and augmented reality technologies presents new avenues for growth.

What trends are shaping the Gaming As A Service Market?

Trends shaping the Gaming As A Service Market include the increasing popularity of subscription models, the rise of cross-platform gaming, and the integration of social features within gaming platforms. These trends are influencing how games are developed and consumed.

Gaming As A Service Market

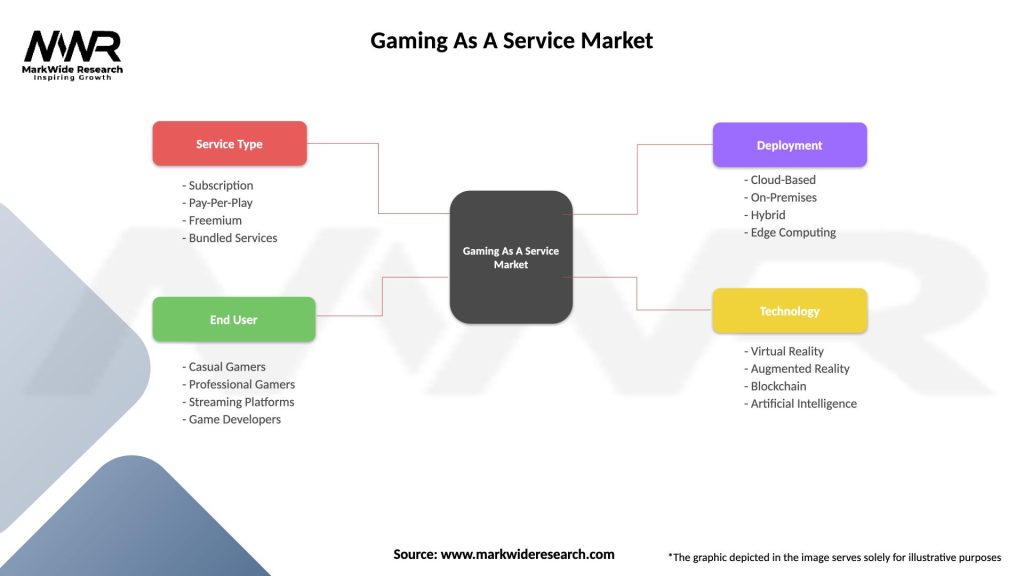

| Segmentation Details | Description |

|---|---|

| Service Type | Subscription, Pay-Per-Play, Freemium, Bundled Services |

| End User | Casual Gamers, Professional Gamers, Streaming Platforms, Game Developers |

| Deployment | Cloud-Based, On-Premises, Hybrid, Edge Computing |

| Technology | Virtual Reality, Augmented Reality, Blockchain, Artificial Intelligence |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Gaming As A Service Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at