444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Game Asset Trading Platform market is a dynamic and rapidly growing sector within the gaming industry, providing a platform for buying, selling, and trading digital assets such as in-game items, virtual currency, skins, and other digital collectibles. This market has gained significant traction due to the rise of online gaming, esports, and the increasing demand for unique and customizable gaming experiences. Game asset trading platforms cater to a diverse audience of gamers, collectors, investors, and developers, creating a vibrant ecosystem for digital asset exchange.

Meaning

A Game Asset Trading Platform refers to an online marketplace or platform where users can buy, sell, trade, and exchange digital assets related to video games. These assets can include in-game items, virtual currency, character skins, weapons, cosmetic upgrades, and other digital collectibles. Game asset trading platforms provide a convenient and secure environment for gamers to monetize their gaming experience, unlock new content, and engage in virtual economies within games.

Executive Summary

The Game Asset Trading Platform market is experiencing rapid growth driven by the increasing popularity of online gaming, the emergence of blockchain technology for asset ownership verification, and the demand for digital collectibles among gamers. Key players in this market offer user-friendly interfaces, secure transactions, and a wide range of digital assets to cater to diverse gaming communities. However, challenges such as regulatory concerns, fraud prevention, and platform security remain significant considerations for market participants.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Game Asset Trading Platform market operates in a dynamic environment shaped by technological advancements, regulatory changes, user behavior trends, and market competition. Innovations such as blockchain integration, NFT adoption, and community-driven economies drive market growth, while challenges related to security, regulation, and user trust require strategic solutions and industry collaboration.

Regional Analysis

The Game Asset Trading Platform market exhibits regional variations influenced by factors such as gaming culture, regulatory landscape, technological infrastructure, and market maturity. Key regions contributing to market growth include:

Competitive Landscape

Leading Companies in the Game Asset Trading Platform Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

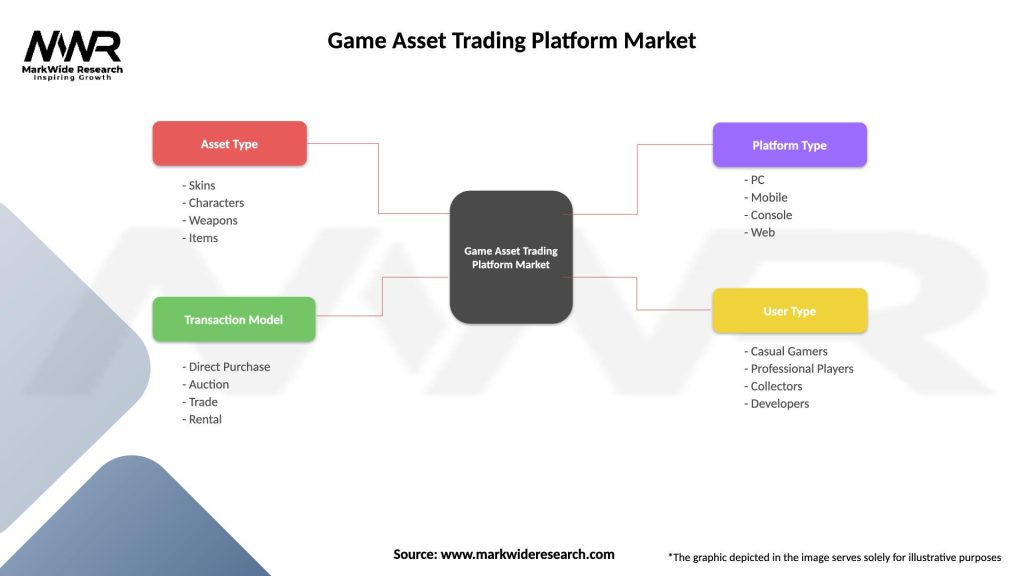

The Game Asset Trading Platform market can be segmented based on:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a mixed impact on the Game Asset Trading Platform market. While it led to increased gaming activity and digital asset transactions as people spent more time at home, it also posed challenges such as supply chain disruptions, server capacity issues, and economic uncertainties affecting user spending and engagement.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Game Asset Trading Platform market is poised for continued growth and innovation, driven by the convergence of gaming, blockchain technology, and digital asset ownership. Opportunities in emerging technologies, cross-platform integration, decentralized finance, and virtual economies will shape the future of asset trading platforms, offering new possibilities for gamers, investors, developers, and platform providers.

Conclusion

The Game Asset Trading Platform market represents a dynamic and evolving sector within the gaming industry, offering opportunities for monetization, user engagement, and asset ownership. Despite challenges such as regulatory uncertainties and security risks, the market is driven by technological advancements, market trends, and user demand for digital assets. Strategic initiatives focusing on innovation, security, compliance, and community engagement will be key to unlocking the full potential of game asset trading platforms and shaping the future of digital asset economies in gaming.

What is a Game Asset Trading Platform?

A Game Asset Trading Platform is a digital marketplace where users can buy, sell, and trade in-game assets such as skins, characters, and virtual currencies. These platforms facilitate transactions between players and often include features like auctions and direct sales.

What are the key players in the Game Asset Trading Platform Market?

Key players in the Game Asset Trading Platform Market include companies like OpenSea, Enjin, and Rarible, which provide platforms for trading digital assets. These companies are known for their user-friendly interfaces and robust security measures, among others.

What are the growth factors driving the Game Asset Trading Platform Market?

The Game Asset Trading Platform Market is driven by the increasing popularity of online gaming, the rise of blockchain technology, and the growing demand for virtual goods. Additionally, the expansion of esports and gaming communities contributes to market growth.

What challenges does the Game Asset Trading Platform Market face?

Challenges in the Game Asset Trading Platform Market include regulatory uncertainties, security concerns regarding asset ownership, and the volatility of digital currencies. These factors can hinder user trust and market stability.

What future opportunities exist in the Game Asset Trading Platform Market?

Future opportunities in the Game Asset Trading Platform Market include the integration of augmented reality and virtual reality technologies, which can enhance user experiences. Additionally, partnerships with game developers can lead to exclusive asset offerings.

What trends are shaping the Game Asset Trading Platform Market?

Trends in the Game Asset Trading Platform Market include the increasing use of non-fungible tokens (NFTs) for unique in-game items and the rise of decentralized finance (DeFi) applications. These trends are transforming how players interact with digital assets.

Game Asset Trading Platform Market

| Segmentation Details | Description |

|---|---|

| Asset Type | Skins, Characters, Weapons, Items |

| Transaction Model | Direct Purchase, Auction, Trade, Rental |

| Platform Type | PC, Mobile, Console, Web |

| User Type | Casual Gamers, Professional Players, Collectors, Developers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Game Asset Trading Platform Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at