444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The gadget insurance market has witnessed significant growth in recent years due to the increasing reliance on electronic devices and the rising demand for protection against potential risks and damages. Gadget insurance offers coverage for a wide range of electronic devices, including smartphones, laptops, tablets, cameras, and wearable gadgets. This comprehensive insurance coverage provides peace of mind to consumers by safeguarding their valuable gadgets against theft, accidental damage, loss, and malfunction.

Meaning

Gadget insurance, also known as electronic device insurance or tech insurance, is a type of insurance policy that provides coverage for electronic devices against various risks and perils. It offers financial protection to consumers by compensating for the repair or replacement costs incurred due to accidental damages, theft, loss, or mechanical breakdowns. Gadget insurance policies are designed to address the specific needs of gadget owners and provide them with peace of mind in case of any unforeseen events.

Executive Summary

The gadget insurance market has witnessed substantial growth in recent years, driven by the increasing penetration of smartphones and other electronic devices globally. The market is fueled by the growing awareness among consumers regarding the need for gadget protection and the rising incidence of accidental damages and thefts. Insurance providers are constantly innovating their policies to offer comprehensive coverage and competitive pricing, attracting a larger customer base. The market is also influenced by advancements in technology and the increasing adoption of high-end gadgets.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The gadget insurance market operates in a dynamic environment influenced by various factors such as technological advancements, changing consumer preferences, regulatory developments, and competitive landscape. Understanding the market dynamics is essential for insurance providers to stay competitive and adapt to evolving trends and customer expectations.

Regional Analysis

The gadget insurance market exhibits regional variations in terms of market size, growth potential, consumer behavior, and regulatory frameworks. The market is dominated by developed regions, including North America and Europe, due to the high penetration of electronic devices and well-established insurance infrastructures. However, emerging economies in Asia Pacific, such as China and India, are witnessing significant growth due to the increasing adoption of smartphones and rising disposable incomes.

Competitive Landscape

Leading Companies in the Gadget Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

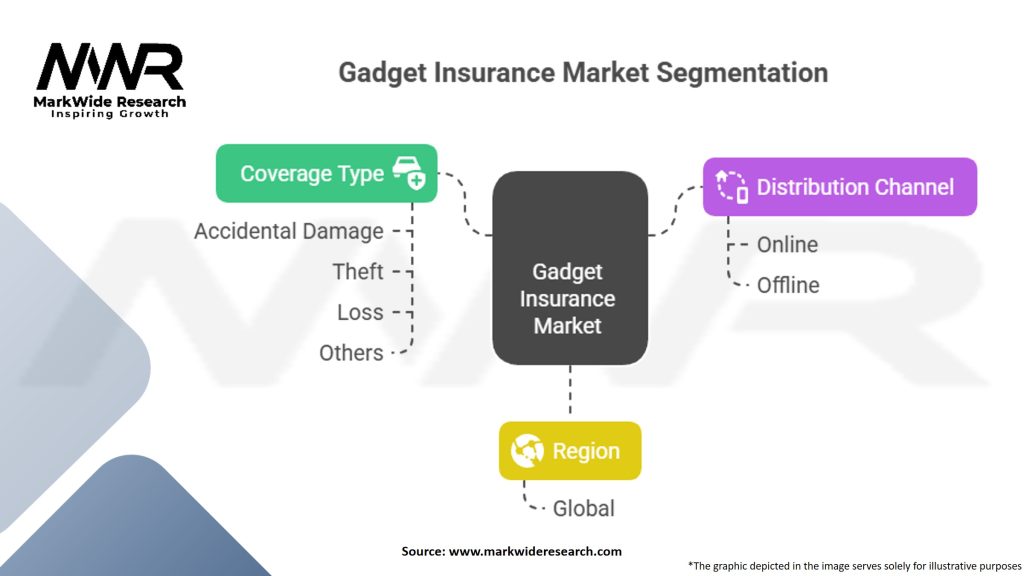

Segmentation

The gadget insurance market can be segmented based on several factors, including:

Category-wise Insights

Smartphones: Smartphones account for the largest share in the gadget insurance market due to their high market penetration and value. The increasing price of high-end smartphones and the vulnerability of screens to accidental damages make smartphone insurance policies highly sought after.

Laptops and Tablets: Laptops and tablets are widely used for personal and professional purposes. The portability of these devices increases their exposure to accidental damages and thefts, creating a significant market for gadget insurance.

Cameras: Cameras, including digital cameras and DSLRs, are popular among photography enthusiasts and professionals. Gadget insurance for cameras offers coverage against damages, thefts, and breakdowns, ensuring peace of mind for photographers.

Wearable Gadgets: The growing popularity of wearable gadgets, such as smartwatches, fitness trackers, and augmented reality devices, has created a niche market for gadget insurance. These devices are prone to damages and loss, making insurance coverage essential for users.

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a mixed impact on the gadget insurance market. On one hand, the increased reliance on electronic devices for remote work, education, and entertainment has driven the demand for gadget insurance. On the other hand, economic uncertainties and reduced consumer spending power have influenced purchasing decisions, leading to some slowdown in the market growth. However, as the global situation stabilizes and economies recover, the market is expected to regain momentum.

Key Industry Developments

Analyst Suggestions

Future Outlook

The gadget insurance market is expected to witness steady growth in the coming years. Factors such as increasing gadget ownership, rising awareness about gadget protection, and technological advancements will drive market expansion. Emerging markets, especially in Asia Pacific, hold significant growth potential. Insurance providers need to focus on innovation, customization, and strategic partnerships to stay competitive in this evolving landscape.

Conclusion

The gadget insurance market is experiencing significant growth, driven by the increasing ownership of electronic devices and the need for financial protection against potential risks and damages. Insurance providers are offering comprehensive coverage options, customizable policies, and value-added services to cater to the specific needs of gadget owners. Collaborations with device manufacturers and retailers, along with advancements in technology, are shaping the market dynamics. Despite challenges, the future outlook for the gadget insurance market remains positive, with opportunities for expansion and innovation.

What is Gadget Insurance?

Gadget insurance is a type of coverage designed to protect electronic devices such as smartphones, tablets, laptops, and other gadgets from damage, theft, or loss. This insurance helps consumers mitigate the financial risks associated with repairing or replacing their devices.

What are the key players in the Gadget Insurance Market?

Key players in the Gadget Insurance Market include companies like Asurion, SquareTrade, and Worth Ave Group, which offer various insurance plans tailored for electronic devices. These companies provide coverage options that cater to different consumer needs and preferences, among others.

What are the growth factors driving the Gadget Insurance Market?

The Gadget Insurance Market is driven by the increasing reliance on electronic devices, rising consumer awareness about device protection, and the growing trend of online shopping for insurance products. Additionally, the proliferation of high-value gadgets has led to a greater demand for comprehensive insurance solutions.

What challenges does the Gadget Insurance Market face?

Challenges in the Gadget Insurance Market include high competition among providers, the complexity of claims processes, and consumer skepticism regarding the value of insurance. These factors can hinder market growth and affect customer satisfaction.

What opportunities exist in the Gadget Insurance Market?

Opportunities in the Gadget Insurance Market include the potential for innovative coverage options, partnerships with retailers for bundled insurance plans, and the expansion of services to include emerging technologies like smart home devices. These trends can enhance customer engagement and market reach.

What trends are shaping the Gadget Insurance Market?

Trends in the Gadget Insurance Market include the rise of on-demand insurance models, increased customization of policies, and the integration of technology for streamlined claims processing. These innovations are making insurance more accessible and user-friendly for consumers.

Gadget Insurance Market

| Segmentation Details | Information |

|---|---|

| Coverage Type | Accidental Damage, Theft, Loss, Others |

| Distribution Channel | Online, Offline |

| Region | Global |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Gadget Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at