444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The GaAs (Gallium Arsenide) wafer and epiwafer market comprises advanced semiconductor materials crucial for high-frequency and optoelectronic applications. GaAs wafers are substrates used in the production of various electronic devices such as RF (Radio Frequency) amplifiers, microwave circuits, and photonic devices due to their superior electrical properties. Epiwafers are epitaxial layers grown on GaAs wafers, enhancing functionality for specialized applications in telecommunications, aerospace, and consumer electronics.

Meaning

GaAs wafers are crystalline substrates made from gallium arsenide, known for their high electron mobility, thermal stability, and reliability in high-frequency applications. These wafers serve as fundamental materials for manufacturing RF and microwave devices, LEDs, and solar cells, offering advantages over traditional silicon in specific performance metrics critical for advanced electronic systems.

Executive Summary

The GaAs wafer and epiwafer market is witnessing robust growth driven by expanding applications in 5G networks, satellite communications, and high-speed data transmission. Key market players are focusing on technological advancements, production scalability, and strategic partnerships to capitalize on increasing demand for high-performance semiconductor materials. With ongoing innovations and rising adoption in telecommunications and aerospace sectors, the market presents opportunities for sustained growth and market expansion.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Dynamics

The GaAs wafer and epiwafer market dynamics are shaped by technological advancements, market demand shifts, competitive strategies, and regulatory frameworks:

Market Drivers

Several factors are driving the growth of the GaAs wafer and epiwafer market:

Market Restraints

Despite its growth prospects, the GaAs wafer and epiwafer market faces several challenges:

Market Opportunities

The GaAs wafer and epiwafer market presents opportunities for growth and innovation:

Market Dynamics

Regional Analysis

Competitive Landscape

Leading Companies in the GaAs Wafer and Epiwafer Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

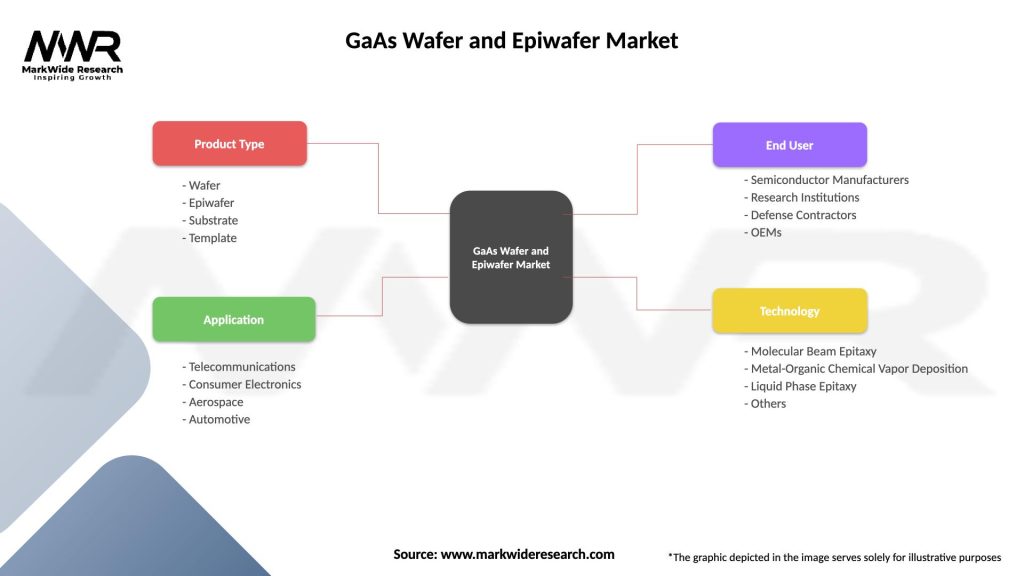

Segmentation

The GaAs wafer and epiwafer market can be segmented based on several criteria:

Category-wise Insights

Each category of GaAs wafer and epiwafer offers specific advantages and applications within the market:

Key Benefits for Industry Participants and Stakeholders

Industry participants benefit from the GaAs wafer and epiwafer market in several ways:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Key trends shaping the GaAs wafer and epiwafer market include:

Covid-19 Impact

The Covid-19 pandemic has influenced the GaAs wafer and epiwafer market in several ways:

Key Industry Developments

Recent industry developments in the GaAs wafer and epiwafer market include:

Analyst Suggestions

Based on market trends and developments, analysts suggest the following strategies for industry participants:

Future Outlook

The future outlook for the GaAs wafer and epiwafer market is promising, driven by technological advancements, expanding applications in telecommunications and aerospace sectors, and growing demand for high-frequency semiconductor solutions. As industry players innovate, collaborate, and invest in next-generation technologies, the market is poised for sustained growth, market expansion, and competitive differentiation in the global semiconductor industry.

Conclusion

In conclusion, the GaAs wafer and epiwafer market represents a critical segment within the semiconductor industry, characterized by technological sophistication, application diversity, and market opportunities. Despite challenges such as cost constraints, supply chain dependencies, and regulatory compliance, the market offers significant growth potential driven by increasing demand for high-performance RF components, photonic devices, and optoelectronic solutions. By focusing on innovation, strategic partnerships, market expansion strategies, and sustainability initiatives, industry participants can navigate market dynamics, capitalize on emerging trends, and position themselves for long-term success in the GaAs semiconductor market.

What is GaAs Wafer and Epiwafer?

GaAs Wafer and Epiwafer refer to semiconductor materials made from Gallium Arsenide, used primarily in high-frequency and optoelectronic applications. These wafers are essential in the production of devices such as LEDs, solar cells, and high-speed transistors.

What are the key companies in the GaAs Wafer and Epiwafer Market?

Key companies in the GaAs Wafer and Epiwafer Market include IQE plc, AXT Inc., and Sumitomo Electric Industries. These companies are known for their advancements in semiconductor technology and production capabilities, among others.

What are the growth factors driving the GaAs Wafer and Epiwafer Market?

The GaAs Wafer and Epiwafer Market is driven by the increasing demand for high-performance electronic devices, the growth of the telecommunications sector, and advancements in solar energy technologies. These factors contribute to the rising adoption of GaAs-based components in various applications.

What challenges does the GaAs Wafer and Epiwafer Market face?

Challenges in the GaAs Wafer and Epiwafer Market include the high production costs associated with GaAs materials and competition from silicon-based technologies. Additionally, the limited availability of raw materials can hinder market growth.

What opportunities exist in the GaAs Wafer and Epiwafer Market?

Opportunities in the GaAs Wafer and Epiwafer Market include the growing demand for 5G technology, which requires high-frequency components, and the expansion of the electric vehicle market that utilizes GaAs in power electronics. These trends are expected to drive innovation and investment in the sector.

What trends are shaping the GaAs Wafer and Epiwafer Market?

Trends in the GaAs Wafer and Epiwafer Market include the increasing integration of GaAs in consumer electronics and the development of advanced manufacturing techniques. Additionally, there is a growing focus on sustainability and reducing the environmental impact of semiconductor production.

GaAs Wafer and Epiwafer Market

| Segmentation Details | Description |

|---|---|

| Product Type | Wafer, Epiwafer, Substrate, Template |

| Application | Telecommunications, Consumer Electronics, Aerospace, Automotive |

| End User | Semiconductor Manufacturers, Research Institutions, Defense Contractors, OEMs |

| Technology | Molecular Beam Epitaxy, Metal-Organic Chemical Vapor Deposition, Liquid Phase Epitaxy, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the GaAs Wafer and Epiwafer Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at