444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The fungicide market is a significant segment of the global agricultural industry, playing a crucial role in protecting crops from fungal diseases. Fungicides are chemical substances designed to kill or inhibit the growth of fungi, thereby safeguarding plants from infections that can lead to yield loss and economic damage. The demand for fungicides has been steadily increasing due to the growing need for enhanced crop productivity and quality, particularly in the face of climate change and the expansion of agricultural practices. This article provides an in-depth analysis of the fungicide market, including its meaning, executive summary, key market insights, market drivers, market restraints, market opportunities, market dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, key benefits for industry participants and stakeholders, SWOT analysis, market key trends, the impact of Covid-19, key industry developments, analyst suggestions, future outlook, and a conclusion.

Meaning

Fungicides are chemical compounds used to control or eliminate fungal pathogens that can harm crops, leading to reduced yields and compromised quality. These compounds are applied to plants through various methods, such as spraying, dusting, or seed treatment, to prevent or treat fungal infections. Fungicides work by inhibiting the growth and reproduction of fungi or by destroying them outright. They are an essential tool in modern agriculture, helping farmers protect their crops from diseases caused by fungal pathogens.

Executive Summary

The fungicide market is witnessing significant growth due to the increasing demand for high-quality and disease-free crops. Farmers across the globe are adopting fungicides as a preventive measure to safeguard their crops from fungal infections. The market is characterized by the presence of numerous key players offering a wide range of fungicide products. Key factors driving market growth include the need for improved crop productivity, rising concerns over food security, and the growing importance of disease management in agriculture. However, the market also faces challenges such as stringent regulations on pesticide use, environmental concerns, and resistance development in fungal populations. Despite these challenges, the fungicide market presents ample opportunities for manufacturers and stakeholders to innovate and develop sustainable solutions for crop protection.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

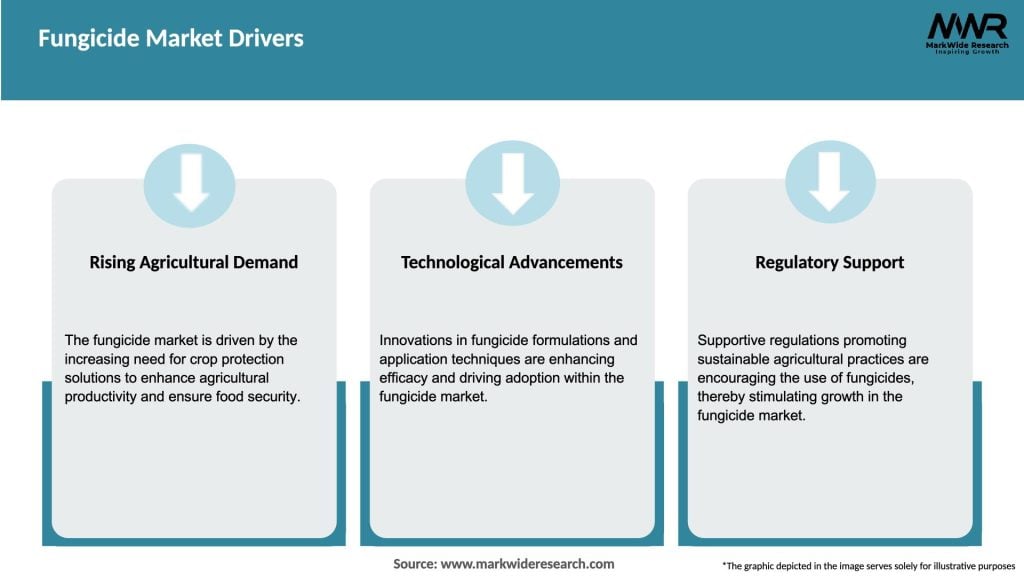

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The fungicide market is dynamic and influenced by various factors such as technological advancements, regulatory landscape, consumer preferences, and market competition. The market is characterized by intense competition, with key players focusing on research and development to launch novel fungicide products. The emergence of digital farming technologies, precision agriculture, and integrated pest management practices is reshaping the fungicide market. Additionally, the increasing emphasis on sustainable agriculture and the development of eco-friendly fungicides are driving market dynamics. The market is also witnessing significant consolidation through mergers and acquisitions, enabling companies to expand their product portfolios and geographical presence.

Regional Analysis

The fungicide market is geographically segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. North America and Europe dominate the global market, owing to the presence of well-established agricultural sectors and high adoption rates of fungicides. The Asia-Pacific region is witnessing rapid growth due to the expansion of farming activities, rising food demand, and increasing awareness about crop protection. Latin America is a significant market, driven by extensive agriculture in countries like Brazil and Argentina. The Middle East and Africa region is witnessing steady growth, with increasing investments in agriculture and efforts to enhance food security. Each region has its own unique market dynamics, regulatory framework, and crop-specific disease challenges, influencing the demand for fungicides.

Competitive Landscape

Leading Companies in the Fungicide Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

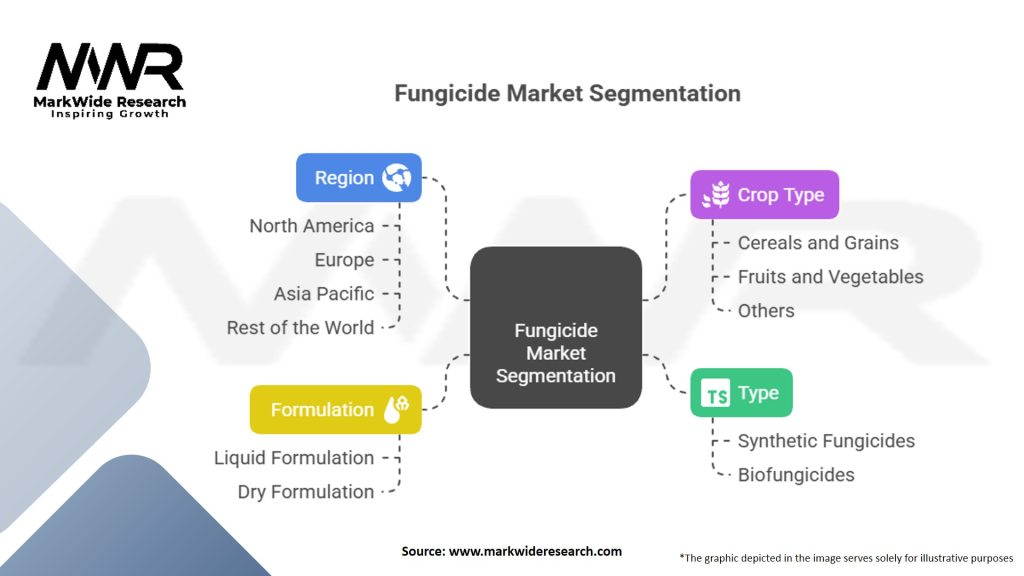

Segmentation

The fungicide market can be segmented based on product type, crop type, formulation, mode of action, and application method. Product types include synthetic fungicides and biofungicides. Crop types encompass cereals and grains, fruits and vegetables, oilseeds and pulses, and others. Formulations include liquid, powder, and granular formulations. Mode of action refers to the mechanism by which fungicides control fungal pathogens, such as contact fungicides, systemic fungicides, and translaminar fungicides. Application methods include foliar spraying, seed treatment, soil treatment, and post-harvest treatment. These segmentation parameters allow for a comprehensive understanding of the fungicide market and cater to the diverse needs of farmers and crop-specific disease management.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The fungicide market offers several key benefits for industry participants and stakeholders:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a mixed impact on the fungicide market. On one hand, the agricultural sector has been deemed essential, ensuring continued demand for fungicides to protect crops and maintain food supply chains. However, disruptions in global trade, logistics, and supply chains have affected the availability and distribution of fungicides. Lockdown measures, labor shortages, and reduced access to inputs have posed challenges for farmers in applying fungicides timely and effectively. Moreover, the economic impact of the pandemic has influenced farmers’ purchasing power, leading to a shift towards cost-effective fungicide solutions. The long-term impact of the pandemic on the fungicide market will depend on the pace of recovery, government policies, and changing consumer behavior.

Key Industry Developments

Analyst Suggestions

Future Outlook

The fungicide market is expected to witness steady growth in the coming years. Factors such as population growth, climate change, and the need for enhanced crop productivity will continue to drive the demand for fungicides. However, there will be increasing emphasis on sustainability, environmental responsibility, and the development of eco-friendly alternatives. Biofungicides and integrated pest management practices are likely to gain prominence. Technological advancements, such as precision agriculture and digital farming technologies, will shape the future of fungicide application. Collaboration, research and development, and market diversification will be key strategies for fungicide manufacturers to stay competitive and meet the evolving needs of farmers and consumers.

Conclusion

The fungicide market plays a vital role in ensuring crop protection, disease management, and food security. The market is driven by the need for enhanced crop productivity, rising awareness about disease prevention, and technological advancements in agriculture. However, challenges such as stringent regulations, environmental concerns, and resistance development need to be addressed. The future of the fungicide market lies in sustainable and eco-friendly solutions, precision agriculture technologies, and collaboration among industry players. The ongoing Covid-19 pandemic has impacted the market, but the agricultural sector’s essential nature has sustained demand. Overall, the fungicide market presents significant opportunities for manufacturers, stakeholders, and farmers to safeguard crops, improve yields, and contribute to sustainable agriculture.

What is a fungicide?

A fungicide is a type of pesticide specifically designed to kill or inhibit the growth of fungi that can harm plants. These chemicals are widely used in agriculture to protect crops from fungal diseases, ensuring better yield and quality.

What are the key companies in the Fungicide Market?

Key companies in the Fungicide Market include BASF, Syngenta, Bayer, and Corteva Agriscience, among others.

What are the main drivers of growth in the Fungicide Market?

The main drivers of growth in the Fungicide Market include the increasing demand for high-quality crops, the rise in agricultural practices, and the need for effective disease management in various crops such as fruits, vegetables, and cereals.

What challenges does the Fungicide Market face?

The Fungicide Market faces challenges such as the development of resistance among fungal pathogens, regulatory pressures regarding chemical usage, and environmental concerns related to pesticide application.

What opportunities exist in the Fungicide Market?

Opportunities in the Fungicide Market include the development of bio-based fungicides, advancements in formulation technologies, and the increasing adoption of integrated pest management practices among farmers.

What trends are shaping the Fungicide Market?

Trends shaping the Fungicide Market include the growing emphasis on sustainable agriculture, the rise of precision farming techniques, and the increasing research into novel fungicidal compounds and their applications.

Fungicide Market

| Segmentation | Details in the Segmentation |

|---|---|

| Type | Synthetic Fungicides, Biofungicides |

| Crop Type | Cereals and Grains, Fruits and Vegetables, Others |

| Formulation | Liquid Formulation, Dry Formulation |

| Region | North America, Europe, Asia Pacific, Rest of the World |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Fungicide Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at