444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The functional foods and ingredients market represents a dynamic and rapidly expanding sector within the global food industry, driven by increasing consumer awareness of health and wellness. This market encompasses products that provide health benefits beyond basic nutrition, including foods fortified with vitamins, minerals, probiotics, omega-3 fatty acids, and other bioactive compounds. Consumer demand for products that support immune function, digestive health, heart health, and cognitive performance continues to drive significant growth across multiple product categories.

Market dynamics indicate robust expansion with the sector experiencing a compound annual growth rate (CAGR) of 8.2% during the forecast period. The increasing prevalence of lifestyle-related diseases, aging populations, and growing health consciousness among millennials and Generation Z consumers are primary factors fueling this growth. Functional ingredients such as prebiotics, probiotics, plant sterols, and antioxidants are becoming increasingly integrated into mainstream food products, from dairy and beverages to snacks and supplements.

Regional markets show varying adoption patterns, with North America and Europe leading in terms of product innovation and consumer acceptance, while Asia-Pacific demonstrates the fastest growth potential. The market encompasses diverse product categories including functional beverages, dairy products, bakery items, confectionery, and dietary supplements, each addressing specific health concerns and consumer preferences.

The functional foods and ingredients market refers to the commercial sector focused on developing, manufacturing, and distributing food products that provide health benefits beyond basic nutritional requirements through the addition of bioactive compounds or naturally occurring beneficial substances.

Functional foods are specifically designed to promote optimal health and reduce the risk of disease through enhanced nutritional profiles. These products contain ingredients that have been scientifically proven to provide specific health benefits, such as improving cardiovascular health, supporting immune function, enhancing digestive wellness, or promoting cognitive performance. Key characteristics include the presence of bioactive compounds, proven health claims, and consumer appeal based on wellness benefits.

Functional ingredients represent the active components added to conventional foods to create functional products. These include probiotics for digestive health, omega-3 fatty acids for heart health, antioxidants for cellular protection, and various vitamins and minerals for immune support. The market encompasses both naturally functional foods and those enhanced through fortification or supplementation processes.

Market expansion in the functional foods and ingredients sector reflects a fundamental shift in consumer behavior toward preventive healthcare and wellness-focused nutrition. The industry has evolved from niche health products to mainstream offerings available across multiple retail channels, including supermarkets, specialty stores, and e-commerce platforms. Innovation drivers include advancing food technology, increased research into bioactive compounds, and growing consumer sophistication regarding health and nutrition.

Product diversification continues to accelerate with manufacturers developing targeted solutions for specific health concerns and demographic groups. The market shows particularly strong growth in categories such as functional beverages, which account for 35% of total market share, followed by functional dairy products and dietary supplements. Consumer preferences increasingly favor products with clean labels, natural ingredients, and transparent health claims backed by scientific research.

Competitive landscape features both established food and beverage companies and specialized functional food manufacturers, with significant investment in research and development driving product innovation. The market benefits from favorable regulatory environments in key regions, supporting health claim approvals and product development initiatives. Distribution channels continue to expand, with online sales showing particularly robust growth as consumers seek convenient access to specialized functional products.

Consumer behavior analysis reveals several critical trends shaping the functional foods and ingredients market. The following insights highlight the most significant market developments:

Primary growth drivers in the functional foods and ingredients market stem from multiple interconnected factors that continue to reshape consumer food choices and industry development. The increasing prevalence of lifestyle-related diseases, including obesity, diabetes, and cardiovascular conditions, has created substantial demand for preventive nutrition solutions. Healthcare costs continue rising globally, motivating consumers to invest in functional foods as a proactive approach to health maintenance.

Demographic shifts significantly influence market expansion, particularly the aging global population seeking products that support healthy aging, cognitive function, and mobility. Baby boomers represent a substantial consumer segment with both purchasing power and motivation to maintain health through nutrition. Urbanization trends contribute to increased stress levels and irregular eating patterns, driving demand for convenient functional foods that address specific health concerns.

Scientific advancement in nutritional research continues to identify new bioactive compounds and validate health benefits of existing ingredients. This research foundation supports product development and regulatory approval processes, enabling manufacturers to make credible health claims. Technology improvements in food processing and ingredient delivery systems enhance the stability, bioavailability, and sensory properties of functional foods, making them more appealing to mainstream consumers.

Regulatory support in key markets facilitates market growth through established frameworks for health claims, ingredient approvals, and quality standards. Government initiatives promoting public health and nutrition education further support consumer awareness and adoption of functional foods as part of healthy lifestyle choices.

Cost considerations represent a significant barrier to market expansion, as functional foods typically command premium pricing compared to conventional alternatives. The higher costs associated with specialized ingredients, research and development, and regulatory compliance create pricing challenges that may limit accessibility for price-sensitive consumer segments. Economic uncertainties and fluctuating disposable incomes can impact consumer willingness to pay premiums for functional benefits.

Regulatory complexities across different markets create challenges for manufacturers seeking global distribution. Varying standards for health claims, ingredient approvals, and labeling requirements increase compliance costs and development timelines. Consumer skepticism regarding health claims and marketing messages can limit adoption, particularly when products fail to deliver perceived benefits or when conflicting scientific information creates confusion.

Technical challenges in product development include maintaining ingredient stability, ensuring bioavailability, and achieving acceptable taste profiles while incorporating functional ingredients. Many bioactive compounds are sensitive to processing conditions, storage, and interaction with other food components, requiring sophisticated formulation expertise. Supply chain limitations for specialized ingredients can create availability constraints and price volatility, particularly for novel or exotic functional components.

Market saturation in certain product categories may limit growth opportunities as competition intensifies and differentiation becomes more challenging. The proliferation of functional food products can lead to consumer confusion and decision fatigue, potentially slowing adoption rates for new innovations.

Emerging markets present substantial growth opportunities as rising incomes, urbanization, and health awareness create demand for functional foods in regions such as Asia-Pacific, Latin America, and parts of Africa. These markets offer potential for both established international brands and local manufacturers developing culturally appropriate functional food solutions. Digital health integration creates opportunities for personalized functional foods based on wearable device data, genetic testing, and individual health monitoring.

Plant-based innovation represents a significant opportunity as consumers increasingly seek sustainable and natural functional ingredients. The development of functional foods using plant proteins, adaptogens, and botanical extracts aligns with environmental consciousness and clean eating trends. Microbiome research continues to reveal new opportunities for probiotic and prebiotic products targeting specific health conditions and population groups.

E-commerce expansion enables direct-to-consumer sales models and subscription services for functional foods, allowing manufacturers to build closer relationships with health-conscious consumers. Online platforms facilitate education about product benefits and enable targeted marketing to specific demographic groups. Foodservice integration offers opportunities to incorporate functional ingredients into restaurant meals, institutional food programs, and workplace wellness initiatives.

Collaborative partnerships between food manufacturers, healthcare providers, and technology companies create opportunities for innovative product development and market expansion. These partnerships can leverage complementary expertise in nutrition science, consumer behavior, and distribution channels to accelerate market growth.

Supply and demand dynamics in the functional foods and ingredients market reflect complex interactions between consumer preferences, technological capabilities, and regulatory environments. The market demonstrates strong demand elasticity, with consumers showing willingness to pay premiums for products that deliver proven health benefits. Seasonal variations affect certain product categories, with immune support products experiencing peak demand during cold and flu seasons, while weight management products see increased sales during traditional diet periods.

Innovation cycles drive market dynamics through the continuous introduction of new ingredients, delivery systems, and product formats. The typical product development cycle ranges from 18 to 36 months, requiring substantial investment in research, testing, and regulatory approval processes. Market consolidation trends show larger food companies acquiring specialized functional food manufacturers to expand their health and wellness portfolios.

Price dynamics reflect the premium nature of functional foods, with products typically priced 25-40% higher than conventional alternatives. However, economies of scale and improved manufacturing processes are gradually reducing cost premiums for established functional ingredients. Competitive dynamics intensify as more companies enter the market, leading to increased marketing investments and product differentiation strategies.

Distribution dynamics continue evolving with traditional retail channels expanding functional food sections while online sales grow rapidly. The market benefits from multiple distribution pathways, including health food stores, pharmacies, supermarkets, and direct-to-consumer channels, each serving different consumer segments and purchase occasions.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the functional foods and ingredients market. Primary research includes extensive surveys of consumers, manufacturers, retailers, and industry experts across key geographic markets. Consumer surveys focus on purchasing behavior, brand preferences, health concerns, and willingness to pay for functional benefits, providing crucial insights into market demand drivers.

Industry expert interviews with food scientists, nutritionists, regulatory specialists, and business executives provide qualitative insights into market trends, technological developments, and competitive strategies. These interviews help validate quantitative findings and identify emerging opportunities and challenges. Retail analysis includes store audits, pricing studies, and shelf space allocation assessments across different retail formats and geographic regions.

Secondary research incorporates analysis of industry reports, scientific publications, regulatory documents, and company financial statements to provide comprehensive market context. Patent analysis reveals innovation trends and competitive positioning in ingredient development and product formulation. Trade publication analysis tracks industry news, product launches, and strategic developments affecting market dynamics.

Data validation processes ensure accuracy through triangulation of multiple sources, statistical analysis of survey responses, and expert review of findings. Market sizing and forecasting models incorporate historical trends, demographic projections, and economic indicators to provide reliable growth projections and market opportunity assessments.

North American markets lead in functional food adoption and innovation, with the United States representing the largest single market for functional foods and ingredients. The region benefits from well-established regulatory frameworks, high consumer health awareness, and strong research infrastructure supporting product development. Market penetration reaches approximately 78% of households purchasing at least one functional food product regularly, with particular strength in functional beverages, fortified cereals, and dietary supplements.

European markets demonstrate sophisticated consumer preferences for natural and organic functional foods, with strong demand for probiotic dairy products, functional beverages, and plant-based alternatives. The region’s stringent regulatory environment ensures high product quality but can slow innovation cycles. Germany, France, and the United Kingdom represent the largest markets, while Nordic countries show particularly high adoption rates for functional dairy products.

Asia-Pacific region exhibits the fastest growth potential, driven by rising disposable incomes, urbanization, and increasing health consciousness. China and India represent massive market opportunities, while Japan leads in functional food innovation and consumer acceptance. The region shows strong preference for traditional functional ingredients such as green tea, ginseng, and fermented foods, alongside growing adoption of Western-style functional products.

Latin American markets show emerging potential with growing middle-class populations and increasing awareness of functional foods. Brazil and Mexico lead regional adoption, particularly in functional beverages and fortified foods. Middle East and Africa represent developing markets with potential for growth as economic conditions improve and health awareness increases.

Market leadership in the functional foods and ingredients sector includes both multinational food companies and specialized health-focused manufacturers. The competitive environment features continuous innovation, strategic partnerships, and acquisition activities as companies seek to expand their functional food portfolios and market reach.

Competitive strategies focus on product innovation, scientific research, strategic acquisitions, and expansion into emerging markets. Companies invest heavily in research and development to identify new functional ingredients and develop products addressing specific health concerns. Partnership strategies with research institutions, healthcare providers, and technology companies enable access to cutting-edge science and consumer insights.

Product type segmentation reveals distinct market dynamics across different functional food categories, each addressing specific consumer needs and health concerns. The market demonstrates varying growth rates and consumer adoption patterns across these segments.

By Product Type:

By Functional Ingredient:

By Health Benefit:

Functional beverages represent the largest and fastest-growing segment, driven by consumer preference for convenient, on-the-go health solutions. This category benefits from innovation in flavor profiles, packaging formats, and targeted health benefits. Sports and energy drinks continue expanding beyond traditional athletic markets to include everyday consumers seeking energy and performance benefits. Probiotic beverages show particularly strong growth as consumer awareness of gut health increases.

Functional dairy products maintain strong market position through established consumer acceptance and proven health benefits. Probiotic yogurts lead this segment with continuous innovation in strain selection, flavor varieties, and packaging formats. The category faces challenges from plant-based alternatives but responds with enhanced nutritional profiles and clean label formulations. Functional milk products target specific demographics including children, seniors, and fitness enthusiasts.

Dietary supplements represent a mature but evolving segment with growth driven by personalized nutrition trends and targeted health solutions. The category benefits from e-commerce growth enabling direct-to-consumer sales and subscription models. Gummy vitamins and innovative delivery formats appeal to younger consumers, while traditional capsules and tablets remain popular among health-conscious adults.

Functional bakery products show steady growth through reformulation of traditional products with added health benefits. High-protein breads, fiber-enhanced cereals, and fortified snacks address consumer demand for better-for-you versions of familiar foods. This segment faces challenges in maintaining taste and texture while incorporating functional ingredients.

Manufacturers benefit from premium pricing opportunities and brand differentiation through functional food development. The market enables companies to command higher margins compared to conventional food products while building consumer loyalty through health benefit delivery. Innovation opportunities allow manufacturers to expand into new product categories and target specific consumer segments with tailored solutions.

Retailers gain advantages through higher-margin product categories and increased customer traffic from health-conscious consumers. Functional foods often generate stronger customer loyalty and repeat purchases compared to conventional alternatives. Cross-merchandising opportunities enable retailers to create health and wellness sections that drive incremental sales across multiple categories.

Consumers benefit from convenient access to health-supporting nutrition through everyday food choices. Functional foods provide alternatives to traditional supplements while offering familiar taste experiences enhanced with health benefits. Preventive healthcare approaches through nutrition can potentially reduce long-term healthcare costs and improve quality of life.

Healthcare providers can recommend functional foods as part of comprehensive wellness programs and preventive care strategies. These products provide evidence-based nutritional interventions that complement traditional medical treatments. Ingredient suppliers benefit from growing demand for specialized functional ingredients and opportunities to develop innovative bioactive compounds.

Research institutions gain funding opportunities and industry partnerships for nutrition research and clinical studies validating health benefits. The market supports continued scientific advancement in understanding the relationship between nutrition and health outcomes.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean label movement continues driving product reformulation as consumers demand transparency in ingredient lists and processing methods. Manufacturers respond by replacing artificial additives with natural alternatives and simplifying product formulations while maintaining functional benefits. Organic and non-GMO functional foods gain market share as consumers prioritize natural and sustainable options.

Personalized nutrition emerges as a significant trend with companies developing customized functional foods based on genetic testing, microbiome analysis, and individual health data. This trend enables targeted solutions for specific health concerns and demographic groups. Subscription services and direct-to-consumer models support personalized nutrition delivery and consumer engagement.

Plant-based functionality expands beyond traditional applications as manufacturers incorporate adaptogens, superfoods, and botanical extracts into mainstream products. Mushroom-based ingredients, algae proteins, and plant-derived antioxidants gain popularity among health-conscious consumers seeking natural functional benefits.

Immune support focus intensifies following global health concerns, driving innovation in vitamin C, zinc, elderberry, and probiotic formulations. Products targeting immune system enhancement show sustained growth across multiple categories. Stress management and mental wellness become important functional food targets as consumers seek nutritional solutions for anxiety and cognitive health.

Sustainable packaging and environmental responsibility influence product development and marketing strategies as consumers increasingly consider environmental impact in purchasing decisions. Circular economy principles drive innovation in ingredient sourcing and waste reduction throughout the supply chain.

Strategic acquisitions reshape the competitive landscape as major food companies acquire specialized functional food manufacturers to expand their health and wellness portfolios. Recent transactions demonstrate the industry’s consolidation trend and the value placed on functional food expertise and market access. Partnership agreements between food manufacturers and biotechnology companies accelerate ingredient innovation and product development timelines.

Regulatory approvals for new health claims and functional ingredients expand market opportunities and validate scientific research investments. MarkWide Research analysis indicates that regulatory support continues strengthening in key markets, facilitating product innovation and consumer education efforts. International harmonization of functional food standards progresses slowly but creates opportunities for global product launches.

Technology investments in food processing, ingredient delivery systems, and quality control enhance product development capabilities and manufacturing efficiency. Microencapsulation technologies improve ingredient stability and bioavailability while masking undesirable flavors. Fermentation innovations enable production of novel functional ingredients and improve cost-effectiveness of existing compounds.

Research collaborations between industry and academia advance understanding of nutrition science and support evidence-based product development. Clinical trials validating health benefits of functional foods strengthen marketing claims and consumer confidence. Microbiome research continues revealing new opportunities for probiotic and prebiotic product development.

Market expansion into foodservice channels creates new distribution opportunities as restaurants and institutional food providers incorporate functional ingredients into menu offerings. Workplace wellness programs increasingly include functional foods as part of employee health initiatives.

Investment priorities should focus on research and development capabilities, particularly in areas of ingredient innovation, product formulation, and clinical validation of health benefits. Companies should allocate resources to understanding consumer preferences and developing products that address specific health concerns with proven efficacy. Technology investments in processing equipment and quality control systems will be essential for maintaining product consistency and meeting regulatory requirements.

Market entry strategies for new participants should emphasize differentiation through unique ingredient combinations, targeted health benefits, or innovative delivery formats. Partnership approaches with established food manufacturers, retailers, or healthcare providers can accelerate market access and credibility building. Companies should consider focusing on specific consumer segments or health conditions rather than attempting broad market coverage initially.

Geographic expansion opportunities exist in emerging markets where health awareness is growing and regulatory frameworks are developing. Companies should adapt products to local tastes, cultural preferences, and regulatory requirements while maintaining core functional benefits. E-commerce capabilities will be crucial for reaching health-conscious consumers and enabling direct customer relationships.

Regulatory compliance should be prioritized as a competitive advantage rather than merely a requirement. Companies that excel in navigating regulatory processes and obtaining health claim approvals will gain significant market advantages. Scientific validation through clinical research and peer-reviewed studies will become increasingly important for consumer acceptance and regulatory approval.

Supply chain resilience requires diversification of ingredient sources and development of alternative suppliers for critical functional components. Companies should invest in supplier relationships and consider vertical integration for key ingredients to ensure consistent availability and quality.

Market evolution indicates continued strong growth driven by demographic trends, technological advancement, and increasing consumer sophistication regarding health and nutrition. The functional foods and ingredients market is projected to maintain robust expansion with a compound annual growth rate of 8.2% through the forecast period. Innovation acceleration will be supported by advancing food technology, expanding scientific research, and growing investment in product development.

Consumer trends suggest increasing demand for personalized nutrition solutions, clean label products, and sustainable functional foods. The market will likely see continued premiumization as consumers demonstrate willingness to pay for proven health benefits and superior product quality. Digital integration will enhance consumer education, product customization, and distribution efficiency through online platforms and health monitoring applications.

Technological advancement will enable development of more effective functional ingredients, improved delivery systems, and better integration of health benefits into familiar food products. Biotechnology applications in ingredient production and food processing will create opportunities for novel functional compounds and more cost-effective manufacturing processes. MWR projections indicate that technology-driven innovation will be crucial for maintaining competitive advantages in the evolving market.

Regulatory environment is expected to become more supportive of functional foods as scientific evidence accumulates and public health priorities emphasize preventive nutrition. International harmonization of standards may facilitate global product launches and reduce compliance costs for multinational companies. Healthcare integration will likely increase as medical professionals recognize the role of functional foods in preventive care and chronic disease management.

Market maturation in developed regions will drive companies to seek growth in emerging markets and develop more sophisticated product offerings for health-conscious consumers. The industry will likely see continued consolidation as companies seek scale advantages and complementary capabilities through mergers and acquisitions.

The functional foods and ingredients market represents a dynamic and rapidly expanding sector with substantial growth potential driven by increasing health consciousness, demographic trends, and technological innovation. The market demonstrates resilience and adaptability as manufacturers respond to evolving consumer preferences for natural, effective, and convenient health solutions. Strong fundamentals including scientific validation, regulatory support, and consumer demand create a favorable environment for continued expansion and innovation.

Success factors in this market include investment in research and development, focus on consumer education, and development of products with proven health benefits and superior sensory properties. Companies that excel in ingredient innovation, regulatory compliance, and consumer engagement will be best positioned to capture growth opportunities in both established and emerging markets. Strategic partnerships and technological advancement will be crucial for maintaining competitive advantages and accessing new market segments.

Future growth will be supported by expanding applications of functional ingredients, increasing integration with healthcare systems, and continued consumer adoption of preventive nutrition approaches. The market’s evolution toward personalized nutrition and sustainable production methods creates opportunities for differentiation and premium positioning. MarkWide Research analysis indicates that companies investing in innovation, quality, and consumer trust will be well-positioned to benefit from the substantial growth opportunities in the global functional foods and ingredients market over the coming years.

What is Functional Foods and Ingredients?

Functional foods and ingredients are products that provide health benefits beyond basic nutrition. They include items like probiotics, omega-3 fatty acids, and fortified foods that support wellness and prevent diseases.

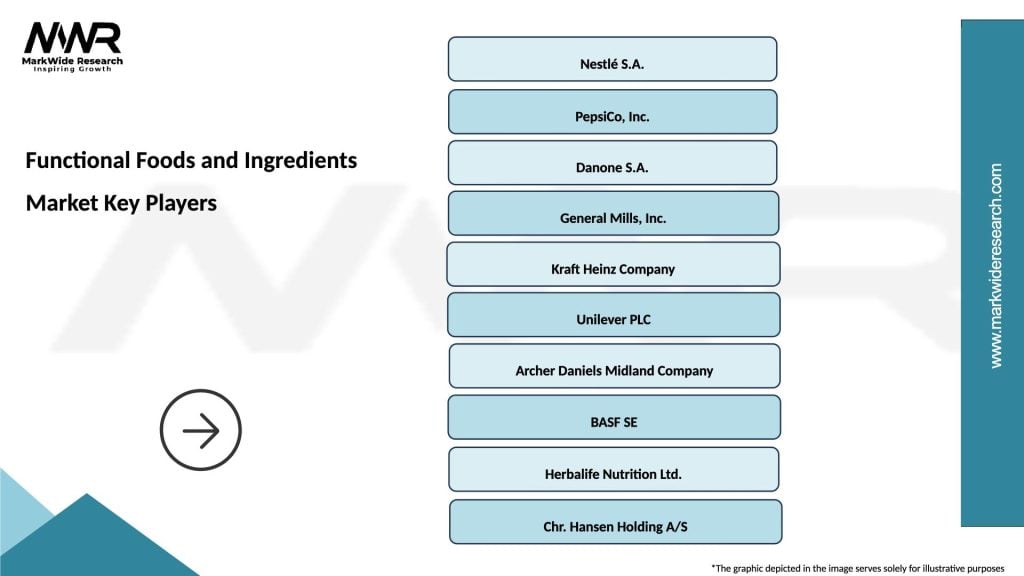

What are the key players in the Functional Foods and Ingredients Market?

Key players in the Functional Foods and Ingredients Market include companies like Nestlé, Danone, and Kraft Heinz, which focus on developing innovative products that cater to health-conscious consumers, among others.

What are the main drivers of growth in the Functional Foods and Ingredients Market?

The growth of the Functional Foods and Ingredients Market is driven by increasing consumer awareness of health and wellness, rising demand for preventive healthcare, and the growing trend of clean label products that emphasize natural ingredients.

What challenges does the Functional Foods and Ingredients Market face?

Challenges in the Functional Foods and Ingredients Market include regulatory hurdles regarding health claims, the complexity of ingredient sourcing, and competition from traditional food products that do not carry health claims.

What opportunities exist in the Functional Foods and Ingredients Market?

Opportunities in the Functional Foods and Ingredients Market include the expansion of plant-based functional foods, innovations in personalized nutrition, and the increasing incorporation of functional ingredients in everyday food products.

What trends are shaping the Functional Foods and Ingredients Market?

Trends in the Functional Foods and Ingredients Market include the rise of functional beverages, the popularity of gut health products, and the growing interest in sustainable sourcing of ingredients that align with consumer values.

Functional Foods and Ingredients Market

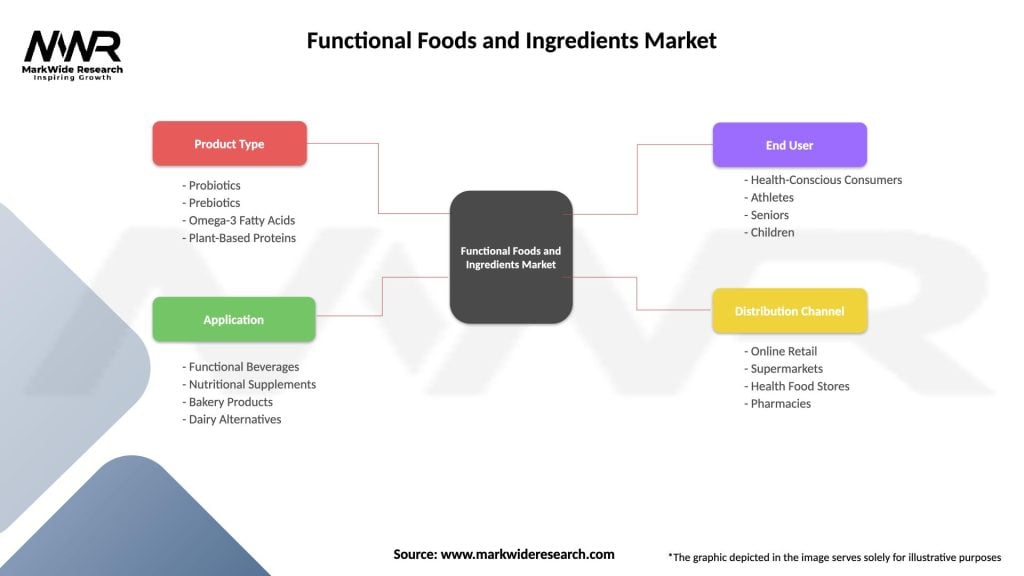

| Segmentation Details | Description |

|---|---|

| Product Type | Probiotics, Prebiotics, Omega-3 Fatty Acids, Plant-Based Proteins |

| Application | Functional Beverages, Nutritional Supplements, Bakery Products, Dairy Alternatives |

| End User | Health-Conscious Consumers, Athletes, Seniors, Children |

| Distribution Channel | Online Retail, Supermarkets, Health Food Stores, Pharmacies |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Functional Foods and Ingredients Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at