444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The fuel gas production and distribution market is a vital sector within the energy industry that plays a significant role in meeting the global demand for various fuel gases. This market encompasses the production, transportation, and distribution of fuel gases such as natural gas, liquefied petroleum gas (LPG), and compressed natural gas (CNG) among others. The fuel gas industry serves a diverse range of sectors, including residential, commercial, industrial, and transportation, making it a crucial component of the global energy landscape.

Meaning

Fuel gas production and distribution involve the extraction, refining, and delivery of various gases used as fuel sources. These gases are essential for powering various applications such as heating, cooking, electricity generation, and fueling vehicles. The process begins with the exploration and extraction of natural gas reserves, followed by purification and transportation through pipelines or in liquefied form. The fuel gases are then distributed through a network of pipelines or via specialized transportation methods to end-users, ensuring a reliable and efficient supply of energy.

Executive Summary

The fuel gas production and distribution market has experienced steady growth in recent years, driven by increasing energy consumption, urbanization, industrialization, and the need for cleaner and more sustainable fuel alternatives. The market’s executive summary provides a concise overview of the key findings, market size, growth rate, and major trends influencing the industry. It highlights the critical aspects that industry participants and stakeholders need to be aware of to make informed decisions and capitalize on emerging opportunities.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Several core insights shape the Fuel Gas Production and Distribution Market:

Growing Global Demand: Increasing global energy needs due to urbanization, industrial growth, and rising standards of living drive demand for fuel gases.

Environmental Considerations: The push towards reducing carbon emissions has positioned natural gas as a cleaner alternative to traditional fossil fuels.

Technological Innovations: Advancements in extraction techniques, such as hydraulic fracturing and horizontal drilling, have boosted production efficiency and resource recovery.

Infrastructure Development: Investments in pipeline networks, LNG terminals, and digital monitoring systems improve distribution efficiency and ensure energy security.

Regulatory and Policy Support: Government incentives, subsidies, and policy reforms aimed at encouraging clean energy use are significant drivers of market expansion.

Integration of Renewable Sources: The rising incorporation of biogas and renewable gas within the conventional fuel gas market is paving the way toward a diversified and sustainable energy mix.

These insights illustrate that the market is driven by a combination of technological progress, environmental imperatives, and economic necessity, making it an essential component of global energy infrastructure.

Market Drivers

The expansion of the Fuel Gas Production and Distribution Market is propelled by several key drivers:

Escalating Energy Demand: Rapid industrialization, urban development, and population growth are dramatically increasing the global demand for energy, thereby elevating the need for efficient fuel gas production and distribution.

Technological Breakthroughs: Innovations in extraction technologies, such as hydraulic fracturing, and improvements in processing techniques have significantly enhanced gas production volumes and reduced production costs.

Environmental Policies: Worldwide efforts to lower carbon emissions and switch to cleaner energy sources are driving policy support and investments in natural gas infrastructure.

Economic Incentives: Government subsidies, tax incentives, and favorable regulatory frameworks are encouraging investments in new production and distribution facilities.

Infrastructure Modernization: Upgrading aging pipeline networks and building new LNG terminals ensure efficient distribution and reduce transmission losses, increasing overall market reliability.

Diversification of Energy Sources: The incorporation of biogas and renewable gas into the fuel mix supports the transition towards more sustainable and diversified energy portfolios.

Rising Export Opportunities: Energy-exporting countries are increasingly leveraging their fuel gas reserves to generate export revenues, further boosting market growth.

Market Restraints

Despite favorable growth drivers, the Fuel Gas Production and Distribution Market faces several challenges:

Regulatory Complexity: The stringent and varying environmental regulations across regions can complicate operations and increase compliance costs.

Infrastructure Challenges: The capital-intensive nature of constructing and maintaining pipelines, LNG terminals, and processing plants can be a significant barrier, particularly in developing markets.

Price Volatility: Fluctuations in global fuel prices and the cost variability of extraction technologies may impact market profitability and investment decisions.

Geopolitical Risks: Political instability and trade disputes in key gas-producing regions can disrupt supply and influence market dynamics.

Environmental Concerns: While natural gas is cleaner than coal and oil, its extraction and distribution can still pose environmental risks, particularly methane leakage, which may affect public perception and regulatory frameworks.

Technological Obsolescence: Rapid advancements require continuous investment in new technologies to remain competitive; failing to adapt could render existing infrastructure outdated.

Competitive Landscape: Intense competition among global producers and the increasing focus on renewable energy sources might result in market share pressures.

Market Opportunities

The Fuel Gas Production and Distribution Market offers several promising opportunities for expansion and innovation:

Expansion in Emerging Economies: Rapid urbanization and industrial growth in regions such as Asia-Pacific, Latin America, and Africa present significant opportunities to expand production and modernize distribution networks.

LNG Market Growth: The increasing global trade of liquefied natural gas and the development of LNG terminals open new markets and facilitate long-distance transport of natural gas.

Digitalization and Smart Technologies: Implementing IoT, big data analytics, and AI-powered monitoring systems in production and distribution can enhance operational efficiency, optimize maintenance, and reduce energy losses.

Renewable Gas Integration: The development and integration of renewable gas (such as biogas and biomethane) into conventional fuel gas systems can contribute to a more sustainable energy mix and meet rising environmental standards.

Public-Private Partnerships: Collaborative initiatives between governments, energy companies, and financial institutions can help fund critical infrastructure projects and support research into advanced extraction and distribution technologies.

Energy Export Opportunities: Countries with abundant natural gas reserves can capitalize on increased demand in international markets, boosting export revenues and stimulating domestic economic growth.

Carbon Credit and Sustainability Incentives: Participation in carbon trading schemes and adherence to environmental sustainability programs can provide additional revenue streams and enhance the financial attractiveness of fuel gas projects.

Market Dynamics

The dynamics of the Fuel Gas Production and Distribution Market are influenced by an interplay of supply-side innovations, demand-side factors, and broader economic, environmental, and regulatory considerations:

Supply Side Factors:

Technological Innovation: Advanced extraction techniques, improved processing technologies, and enhanced digital monitoring are critical to increasing production efficiency and maintaining competitive advantage.

Infrastructure Investment: Upgrading pipeline networks, constructing LNG facilities, and developing advanced distribution systems are essential to ensure secure and efficient gas delivery.

Production Scale: Economies of scale in high-volume production and resource consolidation in key gas fields contribute to cost reductions and improved market stability.

Environmental Technologies: Adoption of advanced emissions controls and leak detection systems is crucial for reducing the environmental footprint of gas production and distribution.

Demand Side Factors:

Global Energy Needs: Expanding industrial activities, increasing residential energy consumption, and the rising demand for electricity generation drive the consumption of fuel gases worldwide.

Consumer Preferences: A growing preference for cleaner energy sources and efficient energy use is pushing the market toward natural and renewable gas alternatives.

Industrial Applications: Sectors such as power generation, chemical processing, and manufacturing rely heavily on fuel gases for operational continuity, ensuring stable long-term demand.

Economic Growth: Economic expansion and increased purchasing power in emerging markets directly contribute to higher energy consumption and demand for advanced distribution networks.

Economic and Regulatory Factors:

Government Policies: Supportive energy policies, subsidies, and tax incentives play a pivotal role in stimulating investments in production and distribution infrastructures.

Environmental Regulations: Strict standards for greenhouse gas emissions and air quality encourage the adoption of cleaner fuel gas technologies and sustainable practices.

Global Trade Dynamics: International trade agreements, export-import policies, and geopolitical considerations significantly influence the distribution and pricing of fuel gases.

Investment in Innovation: Ongoing investment by both public and private sectors in research and development is critical to maintaining technological momentum and market leadership.

Regional Analysis

The Fuel Gas Production and Distribution Market exhibits diverse trends across different regions, influenced by economic development, infrastructure maturity, and regulatory frameworks:

North America:

Robust Production and Consumption: The United States and Canada are major producers and consumers of natural gas, supported by an extensive network of pipelines, LNG terminals, and modern production technologies.

Advanced Infrastructure: High investments in digital monitoring, smart grid technology, and modern distribution systems reinforce market reliability and efficiency.

Regulatory Environment: Favorable policies, safety standards, and environmental regulations support a stable and well-regulated market.

Europe:

Energy Transition Focus: European countries are aggressively transitioning to cleaner energy sources; natural gas plays a pivotal role as a bridge fuel in this transition.

Integrated Market: A well-connected energy market with harmonized regulatory standards facilitates efficient distribution and cross-border trade.

Sustainability Initiatives: Strong emphasis on environmental sustainability and the adoption of renewable gas options are shaping market dynamics.

Asia-Pacific:

Rapid Industrialization: Countries such as China, India, Japan, and South Korea are experiencing explosive growth in industrial activities and urbanization, driving increased demand for fuel gases.

Infrastructure Development: Significant investments in LNG terminals, pipeline construction, and modern processing facilities are propelling market expansion.

Government Support: National strategies and policies aimed at energy security and environmental protection create a conducive environment for market growth.

Latin America:

Resource-Rich Regions: With abundant natural gas reserves, countries like Brazil and Argentina are investing in modern production and distribution infrastructures.

Emerging Economic Growth: Increasing urbanization and industrial development are fueling demand, despite economic and political challenges.

Export Potential: The region offers significant opportunities for natural gas exports, particularly to neighboring markets with growing energy needs.

Middle East and Africa:

Major Production Hubs: The Middle East is a key global hub for natural gas production, supported by substantial reserves and advanced extraction technologies.

Infrastructure Modernization: Ongoing investments in LNG facilities and pipeline networks are modernizing the distribution landscape.

Market Diversification: Efforts to integrate renewable gas sources and improve environmental performance are emerging as critical drivers in these regions.

Competitive Landscape

Leading companies in the Fuel Gas Production and Distribution Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

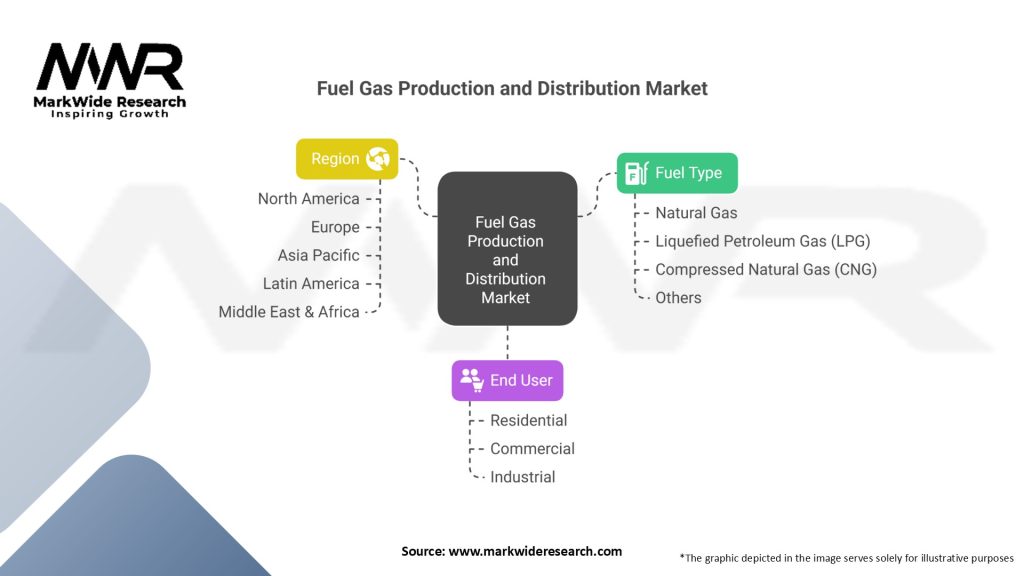

Segmentation

The Fuel Gas Production and Distribution Market can be segmented based on various criteria to provide a detailed view of its structure and dynamics:

By Type of Fuel Gas:

Natural Gas: Conventional gas extracted from underground reservoirs, widely used for power generation, heating, and industrial processes.

Liquefied Natural Gas (LNG): Natural gas that has been cooled to a liquid state for ease of storage and transport, critical for global trade.

Propane and Butane (LPG): Gases used primarily for residential heating, cooking, and light industrial applications.

Biogas and Renewable Gas: Gases produced from organic matter and waste, increasingly integrated into the fuel mix for sustainability.

Other Fuel Gases: Any additional gases used for specific industrial or specialized applications.

By Production Process:

Conventional Gas Extraction: Standard methods of natural gas extraction from reservoirs.

Unconventional Gas Extraction: Techniques like hydraulic fracturing (fracking) and shale gas extraction.

LNG Processing: Facilities focused on liquefaction, storage, and transport of natural gas.

Biogas Production: Processes that generate gas from the anaerobic digestion of organic materials.

By Distribution Channel:

Pipeline Networks: Traditional transport and distribution through fixed pipelines.

LNG Terminals and Floating Storage: Facilities used for exporting and importing LNG.

Commercial and Industrial Supply: Direct supply channels to large-scale industrial users and power plants.

Retail and Residential Supply: Distribution networks for local, small-scale consumers.

By End-User Industry:

Power Generation: Use of natural gas for electricity production.

Industrial Processes: Fuel gas consumption in manufacturing, chemical processing, and other industrial activities.

Residential and Commercial Heating: Usage in heating, cooking, and cooling applications.

Transportation: Fuel for vehicles running on natural gas or LNG.

Other Applications: Specialized sectors such as agriculture, food processing, etc.

By Geography:

North America

Europe

Asia-Pacific

Latin America

Middle East and Africa

Category-wise Insights

Each segment within the Fuel Gas Production and Distribution Market offers unique advantages and addresses specific industry needs:

Natural Gas and LNG: Provide the backbone of modern energy consumption, crucial for both domestic use and global trade.

Unconventional Gas Extraction: Enhances resource recovery from shale and tight gas formations, increasing production volumes.

Biogas and Renewable Gas: Serve as sustainable alternatives, aligning with global decarbonization and environmental goals.

Pipeline Infrastructure: Ensures efficient and secure transportation of fuel gases over vast distances, essential for market stability.

Distribution Channels: Tailored supply networks enable regional and global reach, catering to diverse consumer needs and industrial applications.

Key Benefits for Industry Participants and Stakeholders

The Fuel Gas Production and Distribution Market delivers numerous benefits to various stakeholders:

Energy Security and Reliability: Robust production and distribution networks ensure a continuous and stable supply of energy.

Environmental Advantages: Transitioning to natural and renewable gases reduces greenhouse gas emissions compared to coal and oil, supporting cleaner energy goals.

Economic Growth: Investments in infrastructure and technology contribute to job creation, exports, and overall economic development.

Technological Efficiency: Innovations in extraction, processing, and distribution reduce operational costs and increase yield, enhancing competitiveness.

Global Trade Expansion: The liquefaction and export of natural gas foster international trade, generating additional revenue streams for producing countries.

Sustainable Transition: The integration of renewable gas sources and advanced carbon capture technologies supports the global shift toward sustainable energy.

SWOT Analysis

Strengths:

Established Infrastructure: Extensive pipeline networks, LNG terminals, and production facilities ensure reliable distribution.

Technological Advancements: Ongoing innovation in extraction and processing technologies enhances efficiency and resource recovery.

Environmental Benefits: Use of fuel gas, particularly natural and renewable gas, as a cleaner alternative to other fossil fuels.

Economic Contributions: The market plays a critical role in global energy security and economic growth through diverse revenue streams.

Weaknesses:

High Capital Expenditure: Significant investment is required for building and maintaining production, processing, and distribution infrastructure.

Regulatory Challenges: Complex and varying international regulations can increase compliance costs and delay project implementations.

Market Sensitivity: Price volatility in global fuel markets can impact profitability and long-term planning.

Infrastructure Ageing: In some regions, outdated pipelines and facilities require costly upgrades and modernization efforts.

Opportunities:

Emerging Market Expansion: Rapid industrialization and urbanization in regions like Asia-Pacific, Latin America, and Africa offer significant growth prospects.

LNG Export Growth: Increasing global demand for LNG provides opportunities for expanding liquefaction and export facilities.

Digital and Smart Technologies: Adoption of IoT, AI, and data analytics in production and distribution can optimize operations and reduce losses.

Renewable Integration: Opportunities to incorporate biogas and renewable natural gas into the supply mix support sustainability goals.

Public-Private Partnerships: Collaborative funding models can drive infrastructure developments and reduce financial risks.

Threats:

Geopolitical Instability: Political tensions and trade disputes can disrupt production and international trade of fuel gas.

Environmental Concerns: Methane leakage and other environmental impacts can harm public perception and lead to stricter regulations.

Competitive Pressures: Increasing competition from other energy sources, including renewables like solar and wind, may impact market share.

Economic Downturns: Global economic uncertainty can lead to reduced energy consumption and delay investments in new infrastructure.

Market Key Trends

Several key trends are shaping the future of the Fuel Gas Production and Distribution Market:

Energy Transition: There is a global shift toward cleaner energy sources, with natural gas seen as a transitional fuel bridging fossil fuels and renewable energy.

Digital Transformation: The integration of smart technologies, including IoT, AI, and big data analytics, is revolutionizing production and distribution efficiency.

LNG Market Expansion: The development of LNG infrastructure and technology is facilitating global trade, making natural gas more accessible across continents.

Sustainability Initiatives: Increasing emphasis on environmental sustainability is driving investments in renewable natural gas and carbon capture solutions.

Technological Integration: Emerging technologies such as blockchain for supply chain transparency and automated monitoring for predictive maintenance are being adopted to enhance operational resilience.

Public-Private Partnerships: Collaborative initiatives between governments and the private sector are crucial for financing large infrastructure projects and modernizing outdated systems.

Covid-19 Impact

The Covid-19 pandemic had a mixed but ultimately transformative impact on the Fuel Gas Production and Distribution Market:

Temporary Demand Fluctuations: Lockdowns and reduced industrial activity temporarily lowered energy consumption in some regions; however, residential demand increased.

Accelerated Digital Adoption: Disruptions in supply chains and operations spurred the rapid adoption of digital monitoring and automation technologies.

Supply Chain Resilience: The need to stabilize supply chains led to investments in more robust, diversified sourcing and logistics strategies.

Economic Stimulus: Government stimulus packages and increased fiscal spending in many countries helped sustain capital investment in energy infrastructure.

Long-Term Confidence: Despite short-term disruptions, the pandemic underscored the critical importance of secure and resilient energy systems, reinforcing long-term market growth prospects.

Key Industry Developments

Recent industry developments in the Fuel Gas Production and Distribution Market include:

Infrastructure Upgrades: Major investments in pipeline modernization, LNG terminal expansions, and new processing plants are underway to enhance capacity and efficiency.

Technological Collaborations: Strategic partnerships between energy companies, technology firms, and research institutions are driving the adoption of smart monitoring systems and digital platforms.

Regulatory Reforms: Governments worldwide are updating policies to support a cleaner energy transition, including incentives for natural gas and renewable gas projects.

Market Consolidation: Mergers and acquisitions among leading companies are streamlining operations, improving economies of scale, and strengthening market positions.

Expansion into New Markets: Increased exploration and development activities in emerging regions are broadening the global footprint of fuel gas production.

Renewable Gas Integration: Innovations in biogas production and upgrading technologies are expanding the role of renewable natural gas in the overall supply mix.

Analyst Suggestions

Industry analysts recommend several strategies for stakeholders in the Fuel Gas Production and Distribution Market:

Invest in Digital Technologies: Enhance operational efficiency by adopting IoT, AI, and predictive analytics for real-time monitoring, maintenance, and optimization of production and distribution networks.

Focus on Sustainability: Integrate renewable gas sources and carbon capture technologies to meet environmental standards and support the global energy transition.

Expand Infrastructure Investments: Prioritize upgrading legacy systems and constructing new pipeline and LNG facilities to meet growing global demand.

Strengthen Global Supply Chains: Develop diversified and resilient supply chain strategies to mitigate risks associated with geopolitical tensions and economic fluctuations.

Foster Strategic Partnerships: Collaborate with governments, financial institutions, and technology providers to secure funding and accelerate infrastructure projects.

Target Emerging Markets: Expand market presence in high-growth regions such as Asia-Pacific, Latin America, and Africa through tailored investment and local partnerships.

Monitor Regulatory Developments: Maintain proactive engagement with regulatory bodies to ensure compliance and capitalize on favorable policy initiatives.

Future Outlook

The future of the Fuel Gas Production and Distribution Market is robust, with long-term growth driven by continuing technological advancements, environmental imperatives, and global energy demand:

Sustained Market Growth: As global energy needs expand and countries strive for energy security, demand for fuel gases will increase, supporting strong market growth.

Technological Innovations: Continued breakthroughs in extraction, processing, and digital distribution will drive cost efficiency, improved performance, and enhanced competitiveness.

Expansion of LNG and Renewable Gas: The growth of LNG trade and renewable natural gas integration will diversify the supply mix and bolster international trade.

Infrastructure Modernization: Upgraded pipelines, state-of-the-art processing facilities, and robust distribution networks will ensure reliable energy delivery and reduce transmission losses.

Environmental and Policy Support: Favorable government policies and global initiatives to reduce carbon emissions will further promote the use of natural gas as a cleaner energy source.

Strategic Consolidation: Ongoing mergers, acquisitions, and strategic partnerships will streamline operations and foster innovation, ensuring the market remains agile in a competitive global landscape.

Global Resilience: Enhanced supply chain management and investment in digital technologies will increase the resilience of fuel gas distribution networks amid global economic and geopolitical uncertainties.

Conclusion

The Fuel Gas Production and Distribution Market is a cornerstone of the global energy sector, underpinning economic growth, industrial development, and environmental sustainability. As the world transitions towards cleaner energy solutions, natural gas—along with LNG, LPG, and renewable gas options—emerges as a critical component of a diversified and secure energy portfolio.

In conclusion, the fuel gas production and distribution market plays a crucial role in meeting global energy demands. With a focus on cleaner and more sustainable fuel sources, the market presents significant growth opportunities. By understanding market dynamics, leveraging key trends, and embracing technological advancements, industry participants can position themselves for success in this dynamic and evolving industry. However, careful consideration of market drivers, restraints, and regional variations is essential for informed decision-making and long-term growth in the fuel gas production and distribution market.

What is fuel gas production and distribution?

Fuel gas production and distribution refers to the processes involved in generating gas fuels, such as natural gas, and delivering them to end-users. This includes extraction, processing, and transportation through pipelines to various sectors like residential, commercial, and industrial applications.

What are the key companies in the Fuel Gas Production and Distribution Market?

Key companies in the Fuel Gas Production and Distribution Market include ExxonMobil, Chevron, and Gazprom, among others. These companies play significant roles in the exploration, production, and distribution of fuel gas globally.

What are the main drivers of the Fuel Gas Production and Distribution Market?

The main drivers of the Fuel Gas Production and Distribution Market include the increasing demand for cleaner energy sources, the growth of industrial activities, and advancements in extraction technologies. These factors contribute to a rising need for efficient gas production and distribution systems.

What challenges does the Fuel Gas Production and Distribution Market face?

The Fuel Gas Production and Distribution Market faces challenges such as regulatory compliance, environmental concerns, and fluctuating market prices. These issues can impact operational efficiency and profitability for companies in the sector.

What opportunities exist in the Fuel Gas Production and Distribution Market?

Opportunities in the Fuel Gas Production and Distribution Market include the expansion of infrastructure in emerging economies, the integration of renewable energy sources, and the development of advanced technologies for gas processing. These factors can enhance market growth and sustainability.

What trends are shaping the Fuel Gas Production and Distribution Market?

Trends shaping the Fuel Gas Production and Distribution Market include the increasing adoption of digital technologies, the focus on reducing carbon emissions, and the rise of decentralized energy systems. These trends are influencing how gas is produced, distributed, and consumed.

Fuel Gas Production and Distribution Market

| Segmentation Details | Information |

|---|---|

| Fuel Type | Natural Gas, Liquefied Petroleum Gas (LPG), Compressed Natural Gas (CNG), Others |

| End User | Residential, Commercial, Industrial |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Fuel Gas Production and Distribution Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at