444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The global fruits and vegetables pieces and powder market represents a rapidly expanding segment within the food processing industry, driven by increasing consumer demand for convenient, nutritious, and shelf-stable food products. This market encompasses dehydrated fruit pieces, vegetable chunks, fruit powders, and vegetable powders that serve as essential ingredients in various food applications including bakery products, confectionery, beverages, snacks, and nutritional supplements.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 6.8% over the forecast period. The transformation of fresh produce into processed pieces and powders addresses critical challenges in food preservation, transportation, and year-round availability while maintaining nutritional value and extending shelf life.

Consumer preferences are increasingly shifting toward natural, organic, and minimally processed food ingredients, positioning fruits and vegetables pieces and powder as attractive alternatives to artificial flavoring agents and synthetic additives. The market benefits from growing health consciousness, rising demand for functional foods, and expanding applications across multiple food industry segments.

Technological advancements in processing techniques, including freeze-drying, spray-drying, and vacuum dehydration, have significantly improved product quality, nutritional retention, and flavor preservation. These innovations enable manufacturers to offer premium products that meet stringent quality standards while maintaining cost-effectiveness in production and distribution.

The fruits and vegetables pieces and powder market refers to the commercial sector involved in processing fresh fruits and vegetables into dehydrated pieces, chunks, flakes, and fine powders for use as ingredients in food manufacturing, retail products, and industrial applications. This market encompasses various processing technologies that remove moisture content while preserving nutritional value, flavor, and color characteristics of the original produce.

Product categories within this market include fruit pieces such as dried apple chunks, banana flakes, and strawberry pieces, alongside vegetable components like dehydrated carrot pieces, onion flakes, and bell pepper chunks. Powder forms include fruit powders derived from berries, citrus fruits, and tropical fruits, as well as vegetable powders from leafy greens, root vegetables, and herbs.

Processing methodologies involve sophisticated dehydration techniques that maintain the integrity of vitamins, minerals, and bioactive compounds while achieving the desired texture, particle size, and moisture content. The market serves diverse end-use industries including food and beverage manufacturing, nutraceuticals, cosmetics, and animal feed production.

Market expansion in the fruits and vegetables pieces and powder sector is characterized by increasing adoption across multiple food industry applications, driven by consumer demand for natural ingredients and clean-label products. The market demonstrates strong growth momentum with significant opportunities in emerging economies and developing food processing infrastructure.

Key growth drivers include rising health awareness, with 73% of consumers actively seeking products with natural fruit and vegetable ingredients. The convenience food sector represents a major demand source, as manufacturers incorporate these ingredients to enhance nutritional profiles while maintaining extended shelf life and ease of handling.

Regional dynamics show North America and Europe leading in market maturity and premium product segments, while Asia-Pacific exhibits the fastest growth rates due to expanding food processing industries and increasing disposable incomes. The market benefits from technological innovations that improve processing efficiency and product quality.

Competitive landscape features a mix of large multinational corporations and specialized regional processors, with companies focusing on organic certification, sustainable sourcing, and value-added product development. Strategic partnerships between processors and agricultural producers are becoming increasingly important for ensuring consistent supply and quality standards.

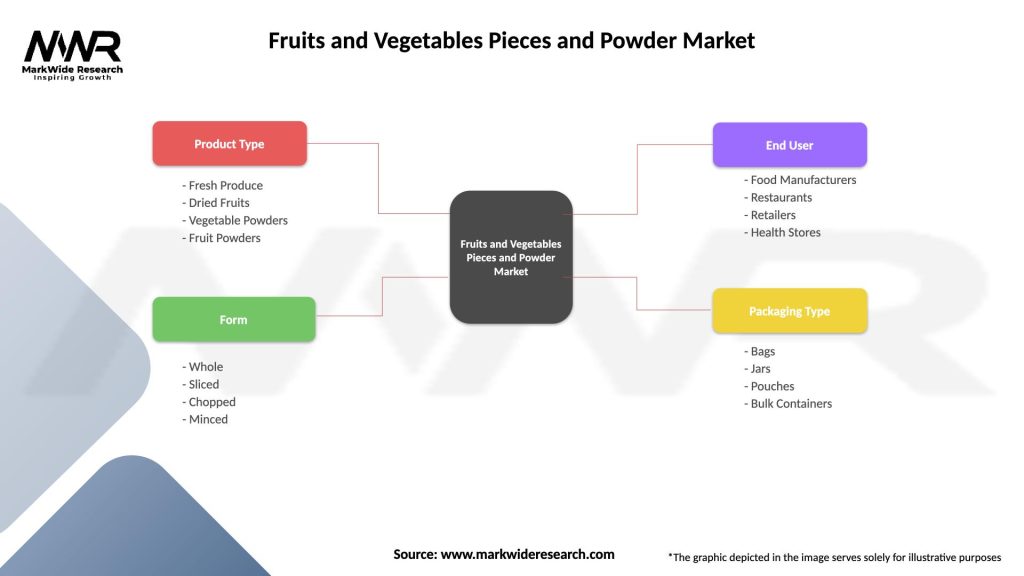

Market segmentation reveals distinct patterns in product preferences and application areas that drive strategic decision-making for industry participants:

Consumer behavior analysis indicates growing preference for transparency in sourcing and processing methods, with manufacturers responding through enhanced traceability systems and detailed product information. The market benefits from increasing incorporation of fruits and vegetables pieces and powder in home cooking and artisanal food preparation.

Health and wellness trends serve as the primary catalyst for market expansion, with consumers increasingly recognizing the nutritional benefits of incorporating natural fruit and vegetable ingredients into their diets. The growing awareness of the connection between diet and health outcomes drives demand for products that offer convenient access to essential vitamins, minerals, and antioxidants.

Convenience factor represents another significant driver, as fruits and vegetables pieces and powder provide year-round availability of seasonal produce while eliminating preparation time and reducing food waste. Food manufacturers leverage these ingredients to create products that meet consumer demands for both nutrition and convenience without compromising on taste or quality.

Clean label movement continues to influence purchasing decisions, with consumers actively seeking products free from artificial colors, flavors, and preservatives. Fruits and vegetables pieces and powder align perfectly with this trend, offering natural alternatives that enhance both nutritional value and sensory appeal in finished products.

Technological innovations in processing equipment and techniques enable manufacturers to produce higher quality products with improved nutritional retention and extended shelf life. Advanced dehydration methods preserve the natural characteristics of fruits and vegetables while achieving the functional properties required for various food applications.

Global food security concerns drive interest in processed forms of fruits and vegetables that can be stored for extended periods without refrigeration, transported efficiently across long distances, and utilized in regions with limited access to fresh produce. This factor particularly influences demand in developing markets and emergency food supply applications.

Raw material price volatility presents ongoing challenges for market participants, as fluctuations in fresh fruit and vegetable prices directly impact production costs and profit margins. Seasonal variations, weather-related crop failures, and global supply chain disruptions can significantly affect the availability and cost of quality raw materials.

Processing complexity and high capital investment requirements for advanced dehydration equipment create barriers to entry for smaller companies and limit expansion opportunities in emerging markets. The need for specialized knowledge in processing techniques and quality control systems adds to operational complexity and costs.

Quality consistency challenges arise from the natural variability in fresh produce characteristics, including sugar content, moisture levels, and flavor profiles. Maintaining consistent product quality across different batches and seasons requires sophisticated processing controls and extensive quality assurance programs.

Regulatory compliance requirements vary significantly across different markets and continue to evolve, particularly regarding organic certification, food safety standards, and labeling requirements. Companies must invest substantial resources in maintaining compliance across multiple jurisdictions while adapting to changing regulations.

Competition from alternatives includes synthetic flavoring agents, artificial colors, and other processed ingredients that may offer cost advantages or specific functional properties. Some applications may favor these alternatives due to standardized characteristics and lower costs, limiting market penetration opportunities.

Emerging market expansion presents substantial growth opportunities as developing economies experience rising disposable incomes, urbanization, and growing food processing industries. Countries in Asia-Pacific, Latin America, and Africa show increasing demand for processed food ingredients and present attractive markets for expansion.

Product innovation opportunities include development of specialized blends, functional ingredient combinations, and customized particle sizes to meet specific application requirements. The integration of superfruits, exotic vegetables, and nutrient-dense ingredients offers potential for premium product development and market differentiation.

Sustainable processing initiatives create opportunities for companies to develop environmentally friendly production methods, reduce waste, and appeal to environmentally conscious consumers. Investments in renewable energy, water conservation, and circular economy principles can provide competitive advantages and access to sustainability-focused market segments.

E-commerce and direct-to-consumer channels offer new distribution opportunities, particularly for specialty and organic products. Online platforms enable smaller producers to reach global markets while providing consumers with access to diverse product offerings and detailed product information.

Functional food applications represent a growing opportunity as consumers seek foods that provide specific health benefits beyond basic nutrition. Fruits and vegetables pieces and powder can be formulated to deliver targeted nutrients, antioxidants, and bioactive compounds for specific health outcomes.

Supply chain integration continues to evolve as companies seek greater control over raw material quality and availability. Vertical integration strategies, including direct relationships with farmers and investment in processing facilities, enable better quality control and cost management while ensuring consistent supply.

Technology adoption accelerates across the industry, with companies investing in advanced processing equipment, automation systems, and quality control technologies. These investments improve production efficiency, reduce labor costs, and enhance product consistency while enabling the development of new product formats and applications.

Consumer education efforts by industry participants help build awareness of the benefits and applications of fruits and vegetables pieces and powder. Educational initiatives target both end consumers and food industry professionals, promoting understanding of nutritional benefits, usage applications, and quality characteristics.

Regulatory landscape evolution influences market dynamics through changing food safety requirements, organic certification standards, and labeling regulations. Companies must adapt their operations and product development strategies to comply with evolving regulatory frameworks while maintaining competitive positioning.

Sustainability initiatives gain importance as stakeholders across the supply chain prioritize environmental responsibility. Companies implement sustainable sourcing practices, reduce packaging waste, and optimize processing efficiency to meet sustainability goals while appealing to environmentally conscious consumers.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market intelligence. Primary research involves direct engagement with industry participants, including manufacturers, suppliers, distributors, and end-users, through structured interviews, surveys, and focus group discussions.

Secondary research encompasses extensive analysis of industry reports, company financial statements, trade publications, and regulatory filings to gather quantitative data and market trends. This approach provides historical context and enables trend analysis across multiple time periods and geographic regions.

Data validation processes include cross-referencing information from multiple sources, conducting expert interviews, and utilizing statistical analysis techniques to ensure data accuracy and reliability. Market sizing calculations employ bottom-up and top-down approaches to validate findings and provide confidence intervals.

Industry expert consultations provide qualitative insights into market dynamics, competitive positioning, and future trends. These discussions with experienced professionals offer valuable perspectives on market challenges, opportunities, and strategic considerations that complement quantitative analysis.

Market segmentation analysis utilizes advanced analytical techniques to identify distinct market segments, assess their relative importance, and understand the factors driving growth in each segment. This analysis enables targeted insights and strategic recommendations for different market participants.

North America maintains a leading position in the fruits and vegetables pieces and powder market, characterized by mature food processing industries, high consumer awareness of health benefits, and strong demand for premium and organic products. The region benefits from advanced processing technologies and well-established distribution networks that support market growth.

United States market dynamics show strong demand across multiple application areas, with the bakery and confectionery sectors representing major consumption areas. Consumer preferences for clean-label products and natural ingredients drive continued market expansion, while regulatory support for organic and natural food products creates favorable market conditions.

European markets demonstrate sophisticated consumer preferences and stringent quality standards that favor premium product segments. Countries such as Germany, France, and the United Kingdom show strong demand for organic and sustainably sourced fruits and vegetables pieces and powder, with European organic segment growing at 11% annually.

Asia-Pacific region exhibits the fastest growth rates, driven by expanding food processing industries, rising disposable incomes, and increasing urbanization. China and India represent major growth markets, with developing food manufacturing sectors creating substantial demand for processed fruit and vegetable ingredients.

Latin America presents emerging opportunities, particularly in countries with strong agricultural sectors that can support local processing industries. Brazil and Mexico show increasing domestic demand while also serving as potential export platforms for global markets.

Middle East and Africa markets demonstrate growing interest in processed food ingredients, driven by urbanization and changing dietary patterns. These regions present long-term growth opportunities as food processing infrastructure develops and consumer preferences evolve toward convenience products.

Market structure features a diverse competitive environment with established multinational corporations, regional specialists, and emerging companies competing across different market segments and geographic regions. Competition focuses on product quality, innovation, pricing, and customer service capabilities.

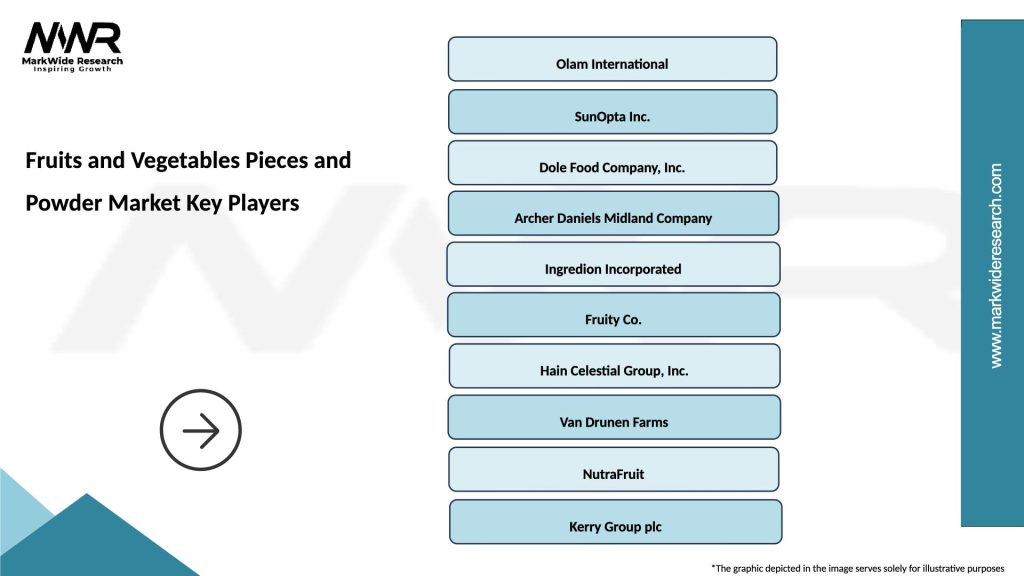

Leading market participants include:

Competitive strategies emphasize product innovation, quality differentiation, and customer relationship development. Companies invest in research and development to create new product formats, improve processing efficiency, and develop application-specific solutions that meet evolving customer needs.

Strategic partnerships between processors and agricultural suppliers become increasingly important for ensuring consistent raw material quality and supply security. These relationships enable better planning, quality control, and cost management while supporting sustainable sourcing initiatives.

By Product Type:

By Processing Method:

By Application:

By Distribution Channel:

Fruit Pieces Category dominates market demand due to versatile applications across bakery, confectionery, and snack food sectors. Apple pieces represent the largest segment within this category, followed by berry pieces and tropical fruit varieties. Consumer preference for visible fruit inclusions in products drives continued growth in this segment.

Processing technology preferences vary by product category and application requirements. Freeze-drying gains popularity for premium applications requiring maximum nutritional retention and superior rehydration properties, while spray-drying remains cost-effective for powder applications with good solubility requirements.

Vegetable Pieces Market shows steady growth driven by increasing incorporation in savory applications, soup mixes, and ready-to-eat meals. Onion and garlic pieces represent major volume segments, while specialty vegetables and herbs command premium pricing for gourmet and ethnic food applications.

Powder Segments demonstrate strong growth potential, particularly in beverage applications and nutritional supplements. Fruit powders benefit from clean-label trends and natural coloring applications, while vegetable powders gain traction in functional food formulations and protein supplement enhancement.

Organic Categories across all product types show accelerated growth rates as consumers prioritize organic certification and sustainable sourcing. Premium pricing for organic products supports improved profit margins while meeting growing consumer demand for certified organic ingredients.

Application-specific developments include customized particle sizes, moisture content specifications, and functional property enhancements tailored to specific end-use requirements. These specialized products command higher prices while providing enhanced performance characteristics for targeted applications.

Manufacturers benefit from incorporating fruits and vegetables pieces and powder through enhanced product differentiation, improved nutritional profiles, and alignment with consumer preferences for natural ingredients. These ingredients enable clean-label formulations while providing consistent quality and extended shelf life compared to fresh alternatives.

Cost advantages include reduced transportation and storage costs due to lower weight and volume compared to fresh produce, elimination of seasonal price fluctuations through strategic procurement, and reduced waste through extended shelf life and consistent quality characteristics.

Retailers gain advantages through products with longer shelf life, reduced refrigeration requirements, and appeal to health-conscious consumers seeking natural ingredients. The convenience factor and year-round availability support consistent product availability and customer satisfaction.

Consumers benefit from convenient access to fruit and vegetable nutrition, consistent product quality regardless of season, and enhanced food safety through controlled processing environments. The concentration of nutrients in processed forms can provide higher nutritional density compared to fresh alternatives in some applications.

Agricultural producers benefit from value-added processing opportunities that reduce post-harvest losses, provide stable demand for produce that may not meet fresh market standards, and create additional revenue streams through processing partnerships.

Food service operators gain operational efficiencies through reduced preparation time, consistent portion control, and simplified inventory management while maintaining nutritional quality and customer appeal in menu offerings.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean Label Movement continues to drive market growth as consumers increasingly scrutinize ingredient lists and seek products with recognizable, natural components. This trend favors fruits and vegetables pieces and powder over synthetic alternatives, creating opportunities for market expansion across multiple application areas.

Functional Food Integration represents a significant trend as manufacturers incorporate fruits and vegetables pieces and powder to enhance the nutritional profiles of conventional products. This approach enables the development of functional foods that provide specific health benefits while maintaining familiar taste and texture characteristics.

Sustainable Sourcing Practices gain importance as companies respond to consumer environmental concerns and corporate sustainability goals. Initiatives include direct farmer partnerships, organic certification, and waste reduction programs that appeal to environmentally conscious consumers and business customers.

Premium Product Development focuses on exotic fruits, superfruit ingredients, and specialty processing techniques that command higher prices while meeting consumer demand for unique and health-promoting ingredients. These premium segments show strong growth potential despite higher price points.

Customization and Co-packing services expand as manufacturers seek specialized solutions for specific applications. Custom blends, particle size specifications, and private label manufacturing enable companies to differentiate their products while leveraging specialized processing expertise.

Technology Integration includes automation, quality control systems, and traceability solutions that improve processing efficiency and product consistency. According to MarkWide Research analysis, companies investing in advanced processing technologies show 22% better operational efficiency compared to traditional operations.

Processing Innovation continues to advance with new dehydration technologies that improve nutritional retention, reduce processing time, and enhance product quality. Recent developments include hybrid processing methods that combine multiple dehydration techniques to optimize specific product characteristics.

Capacity Expansion Projects by major industry participants indicate strong confidence in market growth prospects. Companies are investing in new processing facilities, equipment upgrades, and geographic expansion to meet growing demand and improve market positioning.

Strategic Acquisitions and partnerships reshape the competitive landscape as companies seek to expand product portfolios, enter new markets, and gain access to specialized processing capabilities. These transactions often focus on organic producers, specialty processors, and companies with strong customer relationships.

Certification Programs expand beyond organic to include fair trade, non-GMO, and sustainability certifications that appeal to conscious consumers and meet corporate sourcing requirements. These certifications often command premium pricing while providing market differentiation opportunities.

Research and Development Initiatives focus on new product formats, enhanced nutritional profiles, and improved functional properties. Companies collaborate with research institutions and technology providers to develop innovative processing methods and product applications.

Supply Chain Integration efforts include direct farmer partnerships, contract farming arrangements, and vertical integration strategies that provide better control over raw material quality and availability while supporting sustainable sourcing goals.

Market Entry Strategies should focus on differentiation through quality, specialty products, or specific application expertise rather than competing solely on price. New entrants should consider niche markets, regional specialization, or unique processing capabilities to establish competitive positioning.

Investment Priorities should emphasize processing technology upgrades, quality control systems, and supply chain integration to improve operational efficiency and product consistency. Companies should also consider organic certification and sustainability initiatives to access premium market segments.

Product Development Focus should align with consumer trends toward functional foods, clean-label products, and premium natural ingredients. MWR research indicates that companies with strong innovation capabilities achieve 28% higher revenue growth compared to those focusing primarily on commodity products.

Geographic Expansion opportunities exist in emerging markets with developing food processing industries, particularly in Asia-Pacific and Latin America. Companies should consider local partnerships, joint ventures, or acquisition strategies to enter these markets effectively.

Sustainability Integration should become a core business strategy rather than an add-on initiative, as environmental considerations increasingly influence purchasing decisions across both consumer and business markets. Companies should develop comprehensive sustainability programs that address sourcing, processing, and packaging.

Customer Relationship Management should emphasize technical support, application development assistance, and customized solutions that create value beyond basic product supply. Strong customer relationships provide competitive advantages and support premium pricing strategies.

Market growth prospects remain positive driven by continued consumer preference for natural ingredients, expanding food processing industries in emerging markets, and ongoing innovation in processing technologies. The market is expected to maintain steady growth rates with opportunities for accelerated expansion in premium and specialty segments.

Technology evolution will continue to improve processing efficiency, nutritional retention, and product quality while reducing costs and environmental impact. Emerging technologies such as microwave-assisted dehydration and pulsed electric field processing may create new opportunities for product development and market differentiation.

Consumer trends toward health consciousness, convenience, and sustainability will continue to support market growth while creating opportunities for premium products and specialized applications. The integration of fruits and vegetables pieces and powder in functional foods and nutraceuticals presents significant long-term growth potential.

Regulatory environment is expected to become more supportive of natural ingredients while potentially creating additional requirements for organic certification, sustainability reporting, and supply chain transparency. Companies that proactively address these requirements will be better positioned for future success.

Global market integration will continue as trade barriers decrease and supply chains become more sophisticated. This integration creates opportunities for specialized producers to access global markets while enabling cost optimization through strategic sourcing and production location decisions.

Innovation opportunities include development of new product formats, enhanced functional properties, and application-specific solutions that meet evolving customer needs. According to MarkWide Research projections, the market shows potential for sustained growth rates above 6% annually through the forecast period, driven by these innovation initiatives and expanding applications.

The fruits and vegetables pieces and powder market represents a dynamic and growing segment within the global food ingredients industry, characterized by strong consumer demand for natural, nutritious, and convenient food products. Market growth is supported by multiple favorable trends including health consciousness, clean-label preferences, and expanding food processing industries in emerging economies.

Key success factors for market participants include investment in advanced processing technologies, development of strong supplier relationships, focus on quality and consistency, and alignment with consumer preferences for natural and sustainable products. Companies that successfully navigate these requirements while maintaining cost competitiveness will be well-positioned for long-term success.

Future opportunities exist across multiple dimensions including geographic expansion, product innovation, application development, and sustainability initiatives. The market’s fundamental drivers remain strong, with continued growth expected across all major product categories and geographic regions.

Strategic considerations for industry participants should emphasize differentiation through quality and innovation rather than price competition alone, while building capabilities in areas such as organic certification, sustainable sourcing, and customer technical support. The market rewards companies that can deliver consistent quality, innovative solutions, and responsive customer service while maintaining competitive pricing structures.

What is Fruits and Vegetables Pieces and Powder?

Fruits and Vegetables Pieces and Powder refer to processed forms of fruits and vegetables that are either cut into pieces or ground into powder. These products are commonly used in food processing, culinary applications, and nutritional supplements.

Who are the key players in the Fruits and Vegetables Pieces and Powder Market?

Key players in the Fruits and Vegetables Pieces and Powder Market include companies like Dole Food Company, SunOpta, and Olam International, which are known for their extensive product ranges and global distribution networks, among others.

What are the main drivers of growth in the Fruits and Vegetables Pieces and Powder Market?

The growth of the Fruits and Vegetables Pieces and Powder Market is driven by increasing consumer demand for healthy and convenient food options, the rise in plant-based diets, and the expansion of the food processing industry.

What challenges does the Fruits and Vegetables Pieces and Powder Market face?

Challenges in the Fruits and Vegetables Pieces and Powder Market include issues related to supply chain disruptions, fluctuating raw material prices, and the need for stringent quality control measures to ensure product safety.

What opportunities exist in the Fruits and Vegetables Pieces and Powder Market?

Opportunities in the Fruits and Vegetables Pieces and Powder Market include the growing trend of clean label products, innovations in processing technologies, and the increasing popularity of functional foods that incorporate these ingredients.

What trends are shaping the Fruits and Vegetables Pieces and Powder Market?

Trends in the Fruits and Vegetables Pieces and Powder Market include a shift towards organic and non-GMO products, the use of advanced drying techniques to preserve nutrients, and the rising popularity of fruit and vegetable powders in health supplements and smoothies.

Fruits and Vegetables Pieces and Powder Market

| Segmentation Details | Description |

|---|---|

| Product Type | Fresh Produce, Dried Fruits, Vegetable Powders, Fruit Powders |

| Form | Whole, Sliced, Chopped, Minced |

| End User | Food Manufacturers, Restaurants, Retailers, Health Stores |

| Packaging Type | Bags, Jars, Pouches, Bulk Containers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Fruits and Vegetables Pieces and Powder Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at